The Biden administration will be holding the first ever auction for the right to develop offshore wind farms in the Gulf of Mexico on Tuesday. The sale represents a hopeful, historic shift for the region, where the economy has long been defined by oil and gas.

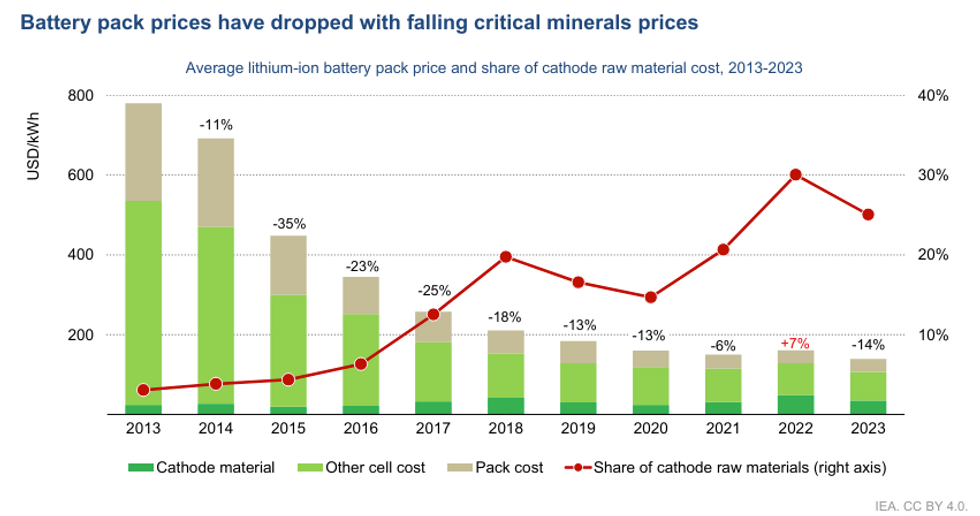

But wind energy is not a sure bet in the Gulf — at least not yet. Slower winds and frequent hurricanes will raise costs and require new turbine designs. Low power prices in the area and a lack of supportive policy make for an uncertain market. These hurdles mount on top of what is already a tumultuous time for the industry. Costs for offshore wind farms on the East Coast have soared due to high interest rates, inflation, and supply chain constraints.

“The business case in the Gulf of Mexico for offshore wind is very vague, and very uncertain,” Chelsea Jean-Michel, a wind analyst at BloombergNEF, told me. “It doesn't really make a lot of sense.”

The Bureau of Ocean Energy Management has put up three areas for sale in the Gulf, which it estimates will produce about 3.7 gigawatts of energy once developed, or enough to power nearly 1.3 million homes. Two of the areas are 30 to 40 miles off the coast of Galveston, Texas, while the third is closer to Lake Charles, Louisiana, just over 40 miles offshore.

Analysts expect Tuesday’s auction to be uncompetitive and the leases to sell for low prices that bake in uncertainty. Sixteen wind developers have signed up to participate, including legacy oil companies Shell, TotalEnergies (formerly known as Total), and Equinor, as well as renewable-focused companies that have offshore projects in the Northeast, like Invenergy, and newcomers, like energyRe. But they may not all end up putting in bids. More than 40 entities were registered to bid on offshore leases in California last December, but only seven ultimately took part in the auction.

The federal government has been studying offshore wind development in the Gulf of Mexico for years. In 2020, National Renewable Energy Lab scientists published an assessment of different types of energy resources that could go in the Gulf, including wave energy and ocean-based solar panels. The authors found that offshore wind had the most potential, by far, but would face numerous challenges, and likely be more expensive than offshore wind energy in the Northeast.

For one, engineers need to design turbines that can safely and economically produce energy in the Gulf’s unique weather conditions. Most of the time, the Gulf has lower wind speeds than the coasts, but other times, it has hurricane-force gales. The report called this “a challenging design optimization problem” and says that a new class of turbines will be needed. I spoke to Walter Musiel, one of the authors, who said that this was doable, and that turbines have since been installed in typhoon-prone areas in Asia that will provide some helpful data. The challenge, he said, will be building a supply chain for turbines with bigger rotors, and figuring out how intense future hurricanes could be in order to design blades that are strong enough.

The Gulf also has advantages that the report said could offset some of these expenses. Smaller waves and shallower water could lower capital costs for installation and maintenance. The report also cited “lower labor costs” in the region. However, workers there are currently fighting to ensure jobs in offshore wind depart from the low-wage, unsafe, exploitative conditions that pervade the local construction and offshore oil industries.

Another big advantage, though, is the maturity of the area’s offshore oil industry. “Despite low winds, the Gulf of Mexico is uniquely positioned,” wrote David Foulon, the managing director for offshore wind at TotalEnergies, in comments to BOEM, “thanks to its unequaled history of offshore expertise, established industrial supply chain, strength of workforce base, and maritime assets’ pool that can drive the growth of offshore wind in the U.S. to new heights and spread around the world thereafter.”

Justin Williams, the vice president of communications at the National Ocean Industries Association, told me Gulf Coast companies have already brought their expertise to offshore wind construction in the Northeast. “Take the Block Island Wind Farm offshore Rhode Island,” he said. “Gulf Island Fabrication built the steel jackets for its foundations and Montco Offshore provided heavy lift vessels to move the equipment on site.”

The National Renewable Energy Lab study took these benefits into account. But it still found that offshore wind energy would be pricier in the Gulf of Mexico than elsewhere. While the lab expects the average cost of offshore wind to land at $63 per megawatt-hour by 2030, it estimated that Gulf wind would cost in the range of $73 to $91 per megawatt-hour by that date. That could make it harder for Gulf wind projects to compete in local energy markets, which have lower power prices than the Northeast.

The region also lacks the policy support found in the Northeast. Massachusetts plans to contract 5,700 megawatts by 2027, New York has a goal of 9,000 megawatts by 2035, and New Jersey recently increased its goal to 11,000 megawatts by 2040. These policies gave developers a level of certainty that there would be a buyer for the electricity generated. Although Louisiana has a Climate Action Plan that recommends the state procure 5,000 megawatts of offshore wind energy by 2035, it’s not legally binding and no utilities have included offshore wind in their resource plans yet.

“They’re the only state down there that has expressed any interest,” Samantha Woodworth, a senior research analyst for North America wind at Wood Mackenzie, told me in an email. “Unless there are state-driven procurement targets or unless the project can produce power at significantly lower cost than what has bid elsewhere in the U.S. and somehow balance that with sufficient project returns, [offshore wind] projects down there are likely to be uneconomic.”

In public comments submitted to BOEM, the American Clean Power Association, the leading industry group for offshore wind, also warned that the leases would not provide developers with the certainty needed to establish a local workforce or supply chain. It urged the agency to either increase the number of leases or establish a regular leasing schedule. But this is the only such sale the agency has announced to date.

However, when I reached out to American Clean Power to ask how its members were approaching this uncertain environment, the group echoed Total’s optimism about the strengths of the local workforce and supply chain. “The region is eager to get into the offshore wind game, and developers understand both the challenges and opportunities that exist in building in the Gulf Coast,” spokesperson Phil Sgro said by email.

Jenny Netherton, a senior program manager at the Southeastern Wind Coalition, which is made up of nonprofits and energy companies, told me that there’s a lot of room for innovation and to try “different routes to market.” For example, developers could forgo the energy market altogether and sell their electricity directly to industrial clients, such as incoming green hydrogen production facilities. Louisiana currently produces 30% of the country’s hydrogen through a polluting process using natural gas. But the federal government has billions of dollars in grants and subsidies available to develop new facilities that produce it with renewable electricity.

If turbines do go up in the Gulf, it may not be until 2034-2035, according to BloombergNEF. This means that communities who are looking forward to the clean energy and economic benefits of a new offshore wind industry could end up waiting a lot longer than they might have hoped.

Local environmental justice groups are already frustrated that the BOEM did not include an incentive for developers to create community benefits in the lease terms. The lease terms for the recent offshore wind sale in California gave companies up to a 10% discount on their purchase if they pledged to spend a comparable amount on community benefits, such as hiring commitments, job training, or economic contributions. If fulfilled, nearly $53 million will go toward these agreements in California.

“It was disappointing to see,” said Jackson Voss, climate policy coordinator for the Louisiana-based Alliance for Affordable Energy. “I don't think that it makes very much sense for different regions of the country to receive different benefits, especially considering the Biden administration’s commitment to environmental justice.”

The Gulf lease terms have a similar provision but it is limited to investments in local workforce training, supply chains, and a fisheries fund that will be used to compensate fishermen for potential losses. A spokesperson for BOEM told me the agency determined it would be too challenging to implement community benefits agreements in the Gulf equitably “due to the number and variety of community groups.”

Overall, the challenges facing Gulf offshore wind are representative of a theme that runs through renewable energy development. As much as the costs for technologies like wind and solar have plunged, what works in one place may not work in another. The cost of offshore wind in the Gulf may never match the cost of offshore wind in the Atlantic. But as Netherton said, there’s still a lot of room for innovation.

Read more about wind power:

Why Offshore Wind Is Suddenly in Trouble

IEA

IEA