You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

Implementing the new rules could mean reshaping the entire U.S. energy system.

The most generous, lucrative, and all-around lavish subsidy in President Joe Biden’s climate law, the Inflation Reduction Act, is the new tax credit for clean hydrogen production. Under the policy, a company can get a bounty of up to $3 for each kilogram of hydrogen made with clean electricity that it produces and sells. There are few legal limits to what a company can earn.

So it figures, then, that this subsidy has been the subject of maybe the most acrimonious, dramatic, hair-tearing fight over the law so far, one that saw snoozy lobbyists and power plant operators take out Spotify spots and full-page New York Times ads in order to make their point.

On Friday, the first phase of that battle ended — and the side supported by most environmental groups claimed a provisional victory. The Biden administration proposed strict rules governing the tax credit, designed to ensure that only zero-carbon electricity meeting rigorous standards can be used to make subsidized hydrogen. The rules, which some industry groups allege could stunt the field in its infancy, will have far-reaching consequences not only for hydrogen itself, but for how America’s power grid prepares for an age of abundant, zero-carbon electricity. It will create a system for organizing clean electricity that could soon determine how companies, consumers, and the federal government buy and sell that electricity — even when it has nothing to do with hydrogen.

But all of that is in the future. Now, to get the highest value of the tax credit, companies must — like other subsidies in the law — demonstrate that they paid a prevailing wage and took advantage of local apprenticeship programs.

They also must demonstrate that they used clean, zero-carbon electricity to power their electrolyzers, the energy-hungry machines that pull hydrogen out of water or other molecules. And defining clean electricity has proven to be an enormous challenge. However the Biden administration chose to define it, someone was going to be left out — or let in.

Consider just one hypothetical. Pretend you own a fancy new electrolyzer. If you buy power for it from a wind farm that’s already hooked up to the grid, then another power plant will have to replace the electrons that you’re now using. That marginal electricity will probably have to come from a coal or natural gas power plant, meaning that it will need to burn extra fuel, meaning it will release extra carbon pollution. Does that mean that the electricity that you bought is actually clean? And if not, do you still get the tax credit?

Earlier this year, climate groups proposed that any clean electricity used to make hydrogen had to meet three requirements: It had to come from a truly new source of power on the grid; it had to generate power at the same time that it was used; and it had to be produced on essentially the same grid where it was used. The Biden administration largely adopted those requirements in Friday’s proposal. On a briefing call with reporters ahead of the rule's release, Deputy Secretary of the Treasury Wally Adeyemo was effusive about the new rule’s benefits. “We’ve developed a structure that will drive innovation and create good-paying jobs in this emerging industry while strengthening our energy security and reducing emissions in hard-to-transition sectors of the economy,” he said.

Not everyone feels that way. Senator Joe Manchin, who provided a key vote for the IRA, told Bloomberg that the draft is “horrible” and promised that “we are fighting it.”

“It doesn’t do anything the bill does. They basically made it 10 times more stringent for hydrogen,” he said. The trade group for the nuclear industry has also expressed its “disappointment,” arguing, more or less correctly, that the proposal “effectively eliminates all existing clean energy from qualifying” for the credit.

But debate about the proposal has not quite run on green vs. industry lines. Air Products, the world’s largest hydrogen producer, has backed the administration’s approach, as have half a dozen other hydrogen companies. So has Synergetic, a hydrogen developer that recently left the trade group the American Clean Power Association to protest its laxer stance. “Consumer groups are behind these rules, and environmental justice has also come out to express support,” Rachel Fakhry, a policy director at the Natural Resource Defense Council, told me.

The excessive focus on the hydrogen tax credit has been, in one sense, surprising. If you care most about cutting carbon pollution in the near-term, the hydrogen tax credit is unlikely to be the most important part of the IRA. Other policies — such as the clean electricity tax credit, which could add vast amounts of new wind and solar to the grid, or new subsidies for electric vehicles — will likely reduce greenhouse gas pollution by far more in the next decade.

But a clean hydrogen industry could soon be crucial to the climate fight. Hydrogen could eventually be used to fuel medium- and heavy-duty trucks, which are responsible for roughly a quarter of the country’s transportation emissions.

It could also decarbonize the production of steel, chemicals, and fertilizer, all of which require fossil fuels today. These are a looming climate problem: By the middle of this decade, heavy industry will pollute the climate more than any other sector of the American economy, according to the Rhodium Group, an independent research firm.

Yet this does not explain why the hydrogen tax credit attracted so much attention. It became a big fight, in short, because it stood the biggest chance of backfiring. Because the tax credit is so generous, incentivizing hydrogen companies to use more and more power, it risked gobbling up too much electricity and distorting the country’s power markets. In the disaster-movie scenario, the tax credit could wind up like the federal government’s ethanol subsidies, which have cost billions while doing nothing to help the climate.

The hydrogen tax credit “has been the most challenging piece of policy that we’ve had to contend with,” John Podesta, the White House adviser in charge of implementing the IRA, told me on the sidelines of COP28 in Dubai earlier this month.

He described the administration as balancing between two extremes. On the one hand, overly strict rules could cause companies to invest more in so-called “blue hydrogen,” which is produced by separating natural gas and capturing the resulting carbon. Yet overly loose rules could cause emissions to balloon and power prices to soar.

“We could kind of blow it in either direction, I think,” he said.

This hasn’t always been seen as a problem. Since the IRA passed last year, the clean hydrogen tax credit has stood out for its extreme generosity, which goes far beyond what is contemplated by other tax credits in the law.

Once the Treasury Department decides that a hydrogen project qualifies for the tax credit, for instance, then that project can receive credits for the next 10 years. For five of those years, it can even get that money as a direct payment from the government, rather than as a tax cut. What’s more, projects can qualify for the tax credit as long as they begin construction by 2033. That means the tax credit will still be used well into the 2040s, even if Congress does not extend it.

Almost no other policy in the law spends federal dollars so lavishly or directly. Manchin, who negotiated the final text of the IRA with Senate Majority Leader Chuck Schumer, has long championed the hydrogen industry and seen it as a way to use fossil-fuel assets, such as pipelines, in the energy transition.

Soon after the IRA passed, however, climate advocates realized that this generosity could pose risks to the rest of the law. In the summer of 2022, Wilson Ricks, an engineering Ph.D. student at Princeton, was interning for the Department of Energy, studying how to measure the climate impact of hydrogen produced by electrolysis.

Ricks had already concluded that the “lifecycle” of the electricity used to make hydrogen mattered: If electricity from a nuclear power plant was sent to an electrolyzer instead of the power grid, thereby forcing a natural-gas plant to turn on and send power to the grid instead, then so-called “clean hydrogen” could actually result in more climate pollution than the traditional approach of using natural gas to make hydrogen.

Then the IRA passed, and “potentially hundreds of billions of dollars hinged on that question,” he told me. In January, Ricks and his colleagues at Princeton’s ZERO Lab published a study urging the Biden administration to adopt stringent guidelines for the tax credit. Without hourly matching, they concluded, the subsidy could wreak havoc in the country’s electricity markets.

Ricks wasn’t the only expert suddenly worried about what a giant new hydrogen subsidy could do to electricity markets. Nearly a year earlier, Taylor Sloane, an energy developer for the utility and power company AES, virtually predicted the hydrogen fight in a Medium post.

“The reason it matters that we get these rules right is that we don’t want to have an environmental backlash against green hydrogen in a few years demonstrating how it actually increases emissions,” he wrote. “Getting the rules right from the start will ensure more stable long-term growth of green hydrogen.”

Ultimately, the administration decided that nearly all clean electricity used to produce hydrogen must meet three requirements — largely inherited from the climate groups’ proposals. They also mirror hydrogen regulations already adopted in the European Union.

First, the electricity must come from a relatively new source of zero-carbon power, such as a wind or nuclear plant: You can’t use electrons that once would have powered homes or cars to power an electrolyzer.

Second, the electricity must be produced at roughly the same time that it is used to make hydrogen: You can’t buy cheap solar power at noon and claim that you’re using it to make hydrogen at midnight.

Finally, the electricity must have been made on the same power grid that the electrolyzer itself is using: You can’t buy wind power in Iowa and claim that you’re using it to make hydrogen in Massachusetts.

Today, no power company in the country has a way of certifying that its electricity meets all three requirements of the new hydrogen rule — and none has any way of selling it, either. So the rules also require local power grids to set up and sell “energy attribute certificates,” or EACs, which certify that a given kilowatt-hour of electricity was produced on a certain grid, at a certain time, and using a certain source of clean energy.

Utilities and grid managers have until 2028 to launch this new system; until then, hydrogen companies can keep using the existing system of renewable energy credits, or RECs, which certify only that zero-carbon electricity was generated during a certain year.

Although this new system of EACs may sound like so much bureaucratic legerdemain, it could eventually become more important than the hydrogen tax credit itself, because it could all but reshape how the country’s electricity systems work.

Right now, even though the availability of clean energy rises and falls throughout the day — solar panels make more power at noon than at midnight, for instance — there is no way to buy or sell claims to that power. By creating a systematic way to describe and sell an hour of clean electricity, EACs could actually create a market for 24/7 clean electricity.

The existence of that system could alter corporate sustainability pledges, climate-friendly government orders, and even how companies measure their own progress toward meeting their Paris Agreement goals. Even though hundreds of American companies say that they buy their electricity from zero-carbon sources, only Google, Microsoft, and a few other companies have committed to buying 24/7 clean electricity.

“I know the administration faced absurd amounts of pressure given how lucrative this is,” Ricks told me. “But it seems like they pretty much held firm and went with the science.”

That said, the proposal kicks two issues down the road. It asks companies whether it should allow any exceptions to the general rule requiring that clean electricity come from clean sources. Some nuclear power plant operators, for instance, have argued that electricity from a nuclear plant should count toward the credit if the plant would otherwise be slated to shut down.

That decision could shape other administration priorities. Two of the government’s seven proposed “hydrogen hubs,” new industrial facilities funded by the bipartisan infrastructure law, are planning to use nuclear power to generate clean hydrogen. Under the current rules, these hubs may not qualify for the generous hydrogen tax credit, even though they could still earn billions in other subsidies.

The proposal also asks for advice about how to count so-called renewable natural gas, which is captured methane released from cows or landfills. Some environmentalists worry that the rules for this technology, if poorly drafted, could allow companies to engage in aggressive carbon accounting that does not align with reality. But so far, the Biden administration seems to have little appetite for that approach.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Boosters say that the energy demand from data centers make VPPs a necessary tool, but big challenges still remain.

The story of electricity in the modern economy is one of large, centralized generation sources — fossil-fuel power plants, solar farms, nuclear reactors, and the like. But devices in our homes, yards, and driveways — from smart thermostats to electric vehicles and air-source heat pumps — can also act as mini-power plants or adjust a home’s energy usage in real time. Link thousands of these resources together to respond to spikes in energy demand or shift electricity load to off-peak hours, and you’ve got what the industry calls a virtual power plant, or VPP.

The theoretical potential of VPPs to maximize the use of existing energy infrastructure — thereby reducing the need to build additional poles, wires, and power plants — has long been recognized. But there are significant coordination challenges between equipment manufacturers, software platforms, and grid operators that have made them both impractical and impracticable. Electricity markets weren’t designed for individual consumers to function as localized power producers. The VPP model also often conflicts with utility incentives that favor infrastructure investments. And some say it would be simpler and more equitable for utilities to build their own battery storage systems to serve the grid directly.

Now, however, many experts say that VPPs’ time to shine is nigh. Homeowners are increasingly pairing rooftop solar with home batteries, installing electric heat pumps, and buying EVs — effectively large batteries on wheels. At the same time, the ongoing data center buildout has pushed electricity demand growth upward for the first time in decades, leaving the industry hungry for new sources of cheap, clean, and quickly deployable power.

“VPPs have been waiting for a crisis and cash to scale and meet the moment. And now we have both,” Mark Dyson, a managing director at RMI, a clean energy think tank, told me. “We have a load growth crisis, and we have a class of customers who have a very high willingness to pay for power as quickly as possible.” Those customers are the data center hyperscalers, of course, who are impatient to circumvent the lengthy grid interconnection queue in any way possible, potentially even by subsidizing VPP programs themselves.

Jigar Shah, former director of the Department of Energy’s Loan Programs Office under President Biden, is a major VPP booster, calling their scale-up “the fastest and most cost-effective way to support electrification” in a 2024 DOE release announcing a partnership to integrate VPPs onto the electric grid. While VPPs today provide roughly 37.5 gigawatts of flexible capacity, Shah’s goal was to scale that to between 80 and 160 gigawatts by 2030. That’s equivalent to around 7% to 13% of the U.S.’s current utility-scale electricity generating capacity.

Utilities are infamously slow to adopt new technologies. But Apoorv Bhargava, CEO and co-founder of the utility-focused VPP software platform WeaveGrid, told me that he’s “felt a sea change in how aware utilities are that, building my way out is not going to happen; burning my way out is not going to happen.” That’s led, he explained, to an industry-wide recognition that “we need to get much better at flexing resources — whether that’s consumer resources, whether that’s utility-sited resources, whether that’s hyperscalers even. We’ve got to flex.”

Actual VPP capacity appears to have grown more slowly over the past few years than the enthusiasm surrounding the resource’s potential. According to renewable energy consultancy WoodMackenzie, while the number of new VPP programs, offtakers, and company deployments each grew over 33% last year, capacity grew by a more modest 13.7%. Ben Hertz-Shargel, who leads a WoodMac research team focused on distributed energy resources, attributed this slower growth to utility pilot programs that cap VPP participation, rules that limit financial incentives by restricting how VPP capacity is credited, and other market barriers that make it difficult for customers to engage.

Dyson similarly said he sees “friction on the utility side, on the regulatory side, to align the incentive programs with real needs.” These points of friction include requirements for all participating devices to communicate real-time performance data — even for minor, easily modeled metrics such as a smart thermostat’s output — as well as utilities’ hesitancy to share household-level metering data with third parties, even when it’s necessary to enroll in a VPP program. Figuring out new norms for utilities and state regulations is “the nut that we have to crack,” he said.

One of the more befuddling aspects of the whole VPP ecosystem, however, can be just trying to parse out what services a VPP program can actually provide. The term VPP can refer to anything from decades-old demand response programs that have customers manually shutting off appliances during periods of grid stress to aspirational, fully integrated systems that continually and automatically respond to the grid’s needs.

“When a customer like a utility says, I want to do a VPP, nobody knows what they’re talking about. And when a regulator says we should enable VPPs, nobody knows what services they’re selling,” Bhargava told me.

In an effort to help clarify things, the software company EnergyHub developed what it calls the VPP Maturity Model, which defines five levels of maturity. Level 0 represents basic demand response. A utility might call up an industrial customer and tell them to reduce their load, or use price signals to encourage households to cut down on electricity use in the evening. Level 1 incorporates smart devices that can send data back to the utility, while at Level 2, VPPs can more precisely ramp load up or down over a period of hours with better monitoring, forecasting, and some partial autonomy — this is where most advanced VPPs are at today.

Moving into Levels 3 and 4 involves more automation, the ability to handle extended grid events, and ultimately full integration with the utility and grid-operator’s systems to provide 24/7 value. The ultimate goal, according to EnergyHub’s model, is for VPPs to operate indistinguishably from conventional power plants, eventually surpassing them in capabilities.

But some question whether imitating such a fundamentally different resource should actually be the end game.

“What we don’t need is a bunch of virtual power plants that are overconstrained to act just like gas plants,” Dyson told me. By trying to engineer “a new technology to behave like an old technology,” he said, grid operators risk overlooking the unique value VPPs can provide — particularly on the distribution grid, which delivers electricity directly to homes and businesses. Here, VPPs can help manage voltage regulation or work to avoid overloads on lines with many distributed resources, such as solar panels — things traditional power plants can’t do because they’re not connected to these local lines.

Still others are frankly dubious of the value of large-scale VPP programs in the first place. “The benefits of virtual power plants, they look really tantalizing on paper,” Ryan Hanna, a research scientist at UC San Diego’s Center for Energy Research told me. “Ultimately, they’re providing electric services to the electric power grid that the power grid needs. But other resources could equally provide those.”

Why not, he posited, just incentivize or require utilities to incorporate battery storage systems at either the transmission or distribution levels into their long-term plans for meeting demand? Large-scale batteries would also help utilities maximize the value of their existing assets and capture many of the other benefits VPPs promise. Plus, they would do it at a “larger size, and therefore a lower unit cost,” Hanna told me.

Many VPP companies would certainly dispute the cost argument, and also note that with grid interconnection queues stretching on for years, VPPs offer a way to deploy aggregated resources far more quickly than building out and connecting new, centralized assets.

But another advantage of Hanna’s utility-led approach, he said, is that the benefits would be shared equally — all customers would see similar savings on their electricity bills as grid-scale batteries mitigate the need for expensive new infrastructure, the cost of which is typically passed on to ratepayers. VPPs, on the other hand, deliver an outsize benefit to the customers incentivized to participate by dint of their neighborhood’s specific needs, and with the cash on hand to invest in resources such as a home battery or an EV.

This echoes a familiar equity argument made about rooftop solar: that the financial benefits accrue only to households that can afford the upfront investment, while the cost of maintaining shared grid infrastructure falls more heavily on non-participants. Except in the case of VPPs, non-participants also stand to benefit — just less — if the programs succeed in driving down system costs and improving grid reliability.

“I may pay Customer A and Customer B may sit on the sidelines,” Matthew Plante, co-founder and president of the VPP operator Voltus, told me. “Customer A gets a direct payment, but customer B’s rates go down. And so everyone benefits, even if not directly.” On the flip side, if the VPP didn’t exist, that would be a lose-lose for all customers.

Plante is certainly not opposed to the idea of utilities building grid-scale batteries themselves, though. Neither he nor anyone else can afford to be picky about the way new capacity comes online right now, he said. “I think we all want to say, what is quickest and most efficient and most economical? And let’s choose that solution. Sometimes it’s got to be both.”

For its part, Voltus is betting that its pathway to scale runs through its recently announced partnership with the U.S. division of Octopus Energy, the U.K.’s largest energy supplier, which provides software to utilities to coordinate distributed energy resources and enroll customers in VPP programs. Together, they plan to build portfolios of flexible capacity for utilities and wholesale electricity markets, areas where Octopus has extensive experience. “So that gives us market access in a much quicker way,” Plante told me.”

At this moment, there’s no customer more motivated than a data center to bring large volumes of clean energy online as quickly as possible, in whatever way possible. Because while data enters themselves can theoretically act as flexible loads, ramping up and down in response to grid conditions, operators would probably rather pay others to be flexible instead.

“Does a data center company ever want to say, okay, I won’t run my training model for a couple hours on the hottest day of the year? They don’t, because it’s worth a lot of money to run that training model 24/7,” Dyson told me. “Instead, the opportunity here is to use the money that generates to pay other people to flex their load, or pay other people to adopt batteries or other resources that can help create headroom on the system.”

Both Plante of Voltus and Bhargava of WeaveGrid confirmed that hyperscalers are excited by the idea of subsidizing VPP programs in one form or another. That could look like providing capital to help customers in a data center’s service territory buy residential batteries or contracts that guarantee a return for VPP aggregators like Voltus. “I think they recognize in us an ability to get capacity unlocked quickly,” Plante told me.

Yet another knot in this whole equation, however, is that even given hyperscalers’ enthusiasm and the maturation of VPP technology, most utilities still lack a natural incentive to support this resource. That’s because investor-owned utilities — which serve approximately 70% of U.S. electricity customers — earn profits primarily by building infrastructure such as power plants and transmission lines, receiving a guaranteed rate of return on that capital investment. Successful VPPs, on the other hand, reduce a utility’s need to build new assets.

The industry is well aware of this fundamental disconnect, though some contend that current load growth ought to quell this concern. Utilities will still need to build significant new infrastructure to meet the moment, Bhargava told me, and are now under intense pressure to expand the grid’s capacity in other ways, as well.

“They cannot build fast enough. There’s not enough copper, there’s not enough transformers, there’s not enough people,” Bhargava explained. VPPs, he expects, will allow utilities to better prioritize infrastructure upgrades that stand to be most impactful, such as building a substation near a data center instead of in a suburb that could be adequately served by distributed resources.

The real question he sees now is, “How do we make our flexibility as good as copper? How do we make people trust in it as much as they would trust in upgrading the system?”

On the real copper gap, Illinois’ atomic mojo, and offshore headwinds

Current conditions: The deadliest avalanche in modern California history killed at least eight skiers near Lake Tahoe • Strong winds are raising the wildfire risk across vast swaths of the northern Plains, from Montana to the Dakotas, and the Southwest, especially New Mexico, Texas, and Oklahoma • Nairobi is bracing for days more of rain as the Kenyan capital battles severe flooding.

Last week, the Environmental Protection Agency repealed the “endangerment finding” that undergirds all federal greenhouse gas regulations, effectively eliminating the justification for curbs on carbon dioxide from tailpipes or smokestacks. That was great news for the nation’s shrinking fleet of coal-fired power plants. Now there’s even more help on the way from the Trump administration. The agency plans to curb rules on how much hazard pollutants, including mercury, coal plants are allowed to emit, The New York Times reported Wednesday, citing leaked internal documents. Senior EPA officials are reportedly expected to announce the regulatory change during a trip to Louisville, Kentucky on Friday. While coal plant owners will no doubt welcome less restrictive regulations, the effort may not do much to keep some of the nation’s dirtiest stations running. Despite the Trump administration’s orders to keep coal generators open past retirement, as Heatmap’s Matthew Zeitlin wrote in November, the plants keep breaking down.

At the same time, the blowback to the so-called climate killshot the EPA took by rescinding the endangerment finding has just begun. Environmental groups just filed a lawsuit challenging the agency’s interpretation of the Clean Air Act to cover only the effects of regional pollution, not global emissions, according to Landmark, a newsletter tracking climate litigation.

Copper prices — as readers of this newsletter are surely well aware — are booming as demand for the metal needed for virtually every electrical application skyrockets. Just last month, Amazon inked a deal with Rio Tinto to buy America’s first new copper output for its data center buildout. But new research from a leading mineral supply chain analyst suggests the U.S. can meet 145% of its annual demand using raw copper from overseas and domestic mines and from scrap. By contrast, China — the world’s largest consumer — can source just 40% of its copper that way. What the U.S. lacks, according to Benchmark Mineral Intelligence, is the downstream processing capacity to turn raw copper into the copper cathode manufacturers need. “The U.S. is producing more copper than it uses, and is far more self-reliant than China in terms of raw materials,” Benchmark analyst Albert Mackenzie told the Financial Times. The research calls into question the Trump administration’s mineral policy, which includes stockpiling copper from jointly-owned ventures in the Democratic Republic of the Congo and domestically. “Stockpiling metal ores doesn’t help if you don’t have midstream processing,” Stephen Empedocles, chief executive of US lobbying firm Clark Street Associates, told the newspaper.

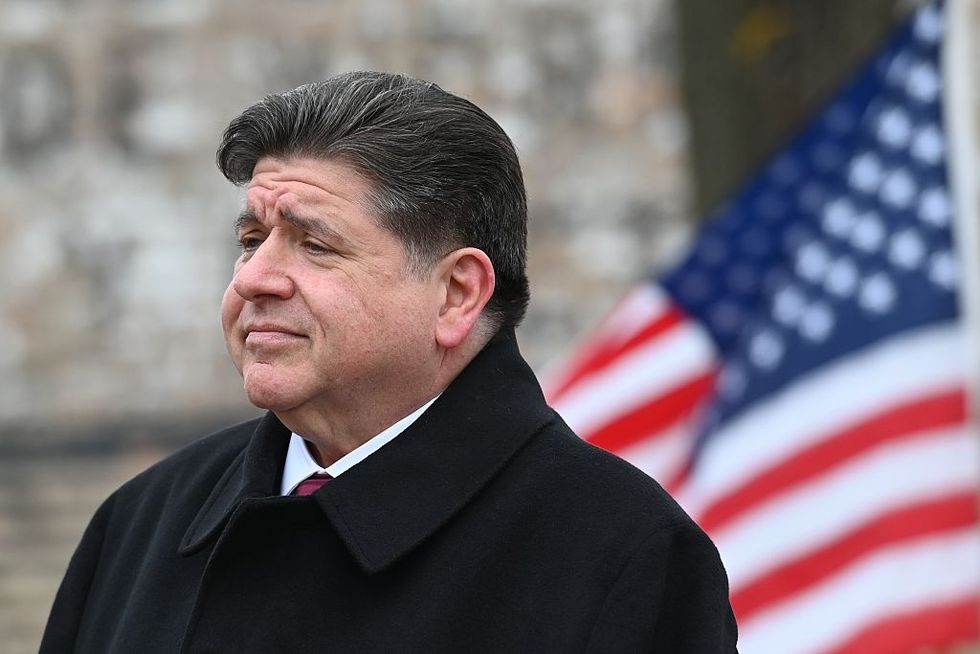

Illinois generates more of its power from nuclear energy than any other state. Yet for years the state has banned construction of new reactors. Governor JB Pritzker, a Democrat, partially lifted the prohibition in 2023, allowing for development of as-yet-nonexistent small modular reactors. With excitement about deploying large reactors with time-tested designs now building, Pritzker last month signed legislation fully repealing the ban. In his state of the state address on Wednesday, the governor listed the expansion of atomic energy among his administration’s top priorities. “Illinois is already No. 1 in clean nuclear energy production,” he said. “That is a leadership mantle that we must hold onto.” Shortly afterward, he issued an executive order directing state agencies to help speed up siting and construction of new reactors. Asked what he thought of the governor’s move, Emmet Penney, a native Chicagoan and nuclear expert at the right-leaning Foundation for American Innovation, told me the state’s nuclear lead is “an advantage that Pritzker wisely wants to maintain.” He pointed out that the policy change seems to be copying New York Governor Kathy Hochul’s playbook. “The governor’s nuclear leadership in the Land of Lincoln — first repealing the moratorium and now this Hochul-inspired executive order — signal that the nuclear renaissance is a new bipartisan commitment.”

The U.S. is even taking an interest in building nuclear reactors in the nation that, until 1946, was the nascent American empire’s largest overseas territory. The Philippines built an American-made nuclear reactor in the 1980s, but abandoned the single-reactor project on the Bataan peninsula after the Chernobyl accident and the fall of the Ferdinand Marcos dictatorship that considered the plant a key state project. For years now, there’s been a growing push in Manila to meet the country’s soaring electricity needs by restarting work on the plant or building new reactors. But Washington has largely ignored those efforts, even as the Russians, Canadians, and Koreans eyed taking on the project. Now the Trump administration is lending its hand for deploying small modular reactors. The U.S. Trade and Development Agency just announced funding to help the utility MGEN conduct a technical review of U.S. SMR designs, NucNet reported Wednesday.

Sign up to receive Heatmap AM in your inbox every morning:

Despite the American government’s crusade against the sector, Europe is going all in on offshore wind. For a glimpse of what an industry not thrust into legal turmoil by the federal government looks like, consider that just on Wednesday the homepage of the trade publication OffshoreWIND.biz featured stories about major advancements on at least three projects totaling nearly 5 gigawatts:

That’s not to say everything is — forgive me — breezy for the industry. Germany currently gives renewables priority when connecting to the grid, but a new draft law would give grid operators more discretion when it comes to offshore wind, according to a leaked document seen by Windpower Monthly.

American clean energy manufacturing is in retreat as the Trump administration’s attacks on consumer incentives have forced companies to reorient their strategies. But there is at least one company setting up its factories in the U.S. The sodium-ion battery startup Syntropic Power announced plans to build 2 gigawatts of storage projects in 2026. While the North Carolina-based company “does not reveal where it manufactures its battery systems,” Solar Power World reported, it “does say” it’s establishing manufacturing capacity in the U.S. “We’re making this move now because the U.S. market needs storage that can be deployed with confidence, supported by certification, insurance acceptance, and a secure domestic supply chain,” said Phillip Martin, Syntropic’s chief executive.

For years now, U.S. manufacturers have touted sodium-ion batteries as the next big thing, given that the minerals needed to store energy are more abundant and don’t afford China the same supply-chain advantage that lithium-ion packs do. But as my colleague Katie Brigham covered last April, it’s been difficult building a business around dethroning lithium. New entrants are trying proprietary chemistries to avoid the mistakes other companies made, as Katie wrote in October when the startup Alsym launched a new stationary battery product.

Last spring, Heron Power, the next-generation transformer manufacturer led by a former Tesla executive, raised $38 million in a Series A round. Weeks later, Spain’s entire grid collapsed from voltage fluctuations spurred by a shortage of thermal power and not enough inverters to handle the country’s vast output of solar power — the exact kind of problem Heron Power’s equipment is meant to solve. That real-life evidence, coupled with the general boom in electrical equipment, has clearly helped the sales pitch. On Wednesday, the company closed a $140 million Series B round co-led by the venture giants Andreessen Horowitz and Breakthrough Energy Ventures. “We need new, more capable solutions to keep pace with accelerating energy demand and the rapid growth of gigascale compute,” Drew Baglino, Heron’s founder and chief executive, said in a statement. “Too much of today’s electrical infrastructure is passive, clunky equipment designed decades ago. At Heron we are manifesting an alternative future, where modern power electronics enable projects to come online faster, the grid to operate more reliably, and scale affordably.”

A senior scholar at Columbia University’s Center on Global Energy Policy on what Trump has lost by dismantling Biden’s energy resilience strategy.

A fossil fuel superpower cannot sustain deep emissions reductions if doing so drives up costs for vulnerable consumers, undercuts strategic domestic industries, or threatens the survival of communities that depend on fossil fuel production. That makes America’s climate problem an economic problem.

Or at least that was the theory behind Biden-era climate policy. The agenda embedded in major legislation — including the Infrastructure Investment and Jobs Act and the Inflation Reduction Act — combined direct emissions-reduction tools like clean energy tax credits with a broader set of policies aimed at reshaping the U.S. economy to support long-term decarbonization. At a minimum, this mix of emissions-reducing and transformation-inducing policies promised a valuable test of political economy: whether sustained investments in both clean energy industries and in the most vulnerable households and communities could help build the economic and institutional foundations for a faster and less disruptive energy transition.

Sweeping policy reversals have cut these efforts short. Abandoning the strategy makes the U.S. economy less resilient to the decline of fossil fuels. It also risks sowing distrust among communities and firms that were poised to benefit, complicating future efforts to recommit to the economic policies needed to sustain an energy transition.

This agenda rested on the idea that sustaining decarbonization would require structural changes across the economy, not just cleaner sources of energy. First, in a country that derives substantial economic and geopolitical power from carbon-intensive industries, a durable energy transition would require the United States to become a clean energy superpower in its own right. Only then could the domestic economy plausibly gain, rather than lose, from a shift away from fossil fuels.

Second, with millions of households struggling to afford basic energy services and fossil fuels often providing relatively cheap energy, climate policy would need to ensure that clean energy deployment reduces household energy burdens rather than exacerbates them.

Third, policies would need to strengthen the economic resilience of communities that rely heavily on fossil fuel industries so the energy transition does not translate into shrinking tax bases, school closures, and lost economic opportunity in places that have powered the country for generations.

This strategy to reshape the economy for the energy transition has largely been dismantled under President Trump.

My recent research examines federal support for fossil fuel-reliant communities, assessing President Biden’s stated goal of “revitalizing the economies of coal, oil, gas, and power plant communities.” Federal spending data provides little evidence that these at-risk communities have been effectively targeted. One reason is timing: While legislation authorized unprecedented support, actual disbursements lagged far behind those commitments.

Many of the key policies — including $4 billion in manufacturing tax credits reserved for communities affected by coal closures — took years to move from statutory language to implementation guidance and final project selection. As a result, aside from certain pandemic-era programs, fossil fuel-reliant communities had received limited support by the time Trump took office last year.

Since then, the Trump administration and Congress have canceled projects intended to benefit fossil fuel-reliant regions, including carbon capture and clean hydrogen demonstrations, and discontinued programs designed to help communities access and implement federal funding.

Other elements of the strategy to reduce the country’s vulnerability to fossil fuel decline have fared even worse under the Trump administration. Programs intended to help households access and afford clean energy — most notably the $27 billion Greenhouse Gas Reduction Fund — were effectively canceled last year, including attempts to claw back previously awarded funds. More broadly, the rollback of IRA programs with an explicit equity or justice focus leaves lower-income households more exposed to the economic disruptions that can accompany an energy transition.

By contrast, subsidies and grant programs aimed at strengthening the country’s energy manufacturing base have largely survived, including tax credits supporting domestic production of batteries, solar components, and other key technologies. Even so, the investment environment has weakened. Automakers have scaled back planned U.S. battery manufacturing expansions. Clean Investment Monitor data shows annual clean energy manufacturing investments on pace to decline in 2025, after rising sharply from 2022 to 2024. Whatever one believed about the potential to build globally competitive domestic supply chains for the technologies that will power clean energy systems, those prospects have dimmed amid slowing investment and the Trump administration’s prioritization of fossil fuels.

Perhaps these outcomes were unavoidable. Building a strong domestic solar industry was always uncertain, and place-based economic development programs have a mixed track record even under favorable conditions. Still, the Biden-era approach reflected a coherent theory of climate politics that warranted a real-world test.

Over the past year, debates in climate policy circles have centered on whether clean energy progress can continue under less supportive federal policies, with plausible cases made on both sides. The fate of Biden’s broader economic strategy to sustain the energy transition, however, is less ambiguous. The underlying dependence of the United States on fossil fuels across industries, households, and many local communities remains largely unchanged.