Electric Vehicles

Who Would Want to Kill the New Chevy Bolt?

A test drive provided tantalizing evidence that a great, cheap EV is possible for the U.S.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

A test drive provided tantalizing evidence that a great, cheap EV is possible for the U.S.

On Qatari aluminum, floating offshore wind, and Taiwanese nuclear

This week is light on the funding, heavy on the deals.

On the solar siege, New York’s climate law, and radioactive data center

Current conditions: A rain storm set to dump 2 inches of rain across Alabama, Tennessee, Georgia, and the Carolinas will quench drought-parched woodlands, tempering mounting wildfire risk • The soil on New Zealand’s North Island is facing what the national forecast called a “significant moisture deficit” after a prolonged drought • Temperatures in Odessa, Texas, are as much as 20 degrees Fahrenheit hotter than average.

For all its willingness to share in the hype around as-yet-unbuilt small modular reactors and microreactors, the Trump administration has long endorsed what I like to call reactor realism. By that, I mean it embraces the need to keep building more of the same kind of large-scale pressurized water reactors we know how to construct and operate while supporting the development and deployment of new technologies. In his flurry of executive orders on nuclear power last May, President Donald Trump directed the Department of Energy to “prioritize work with the nuclear energy industry to facilitate” 5 gigawatts of power uprates to existing reactors “and have 10 new large reactors with complete designs under construction by 2030.” The record $26 billion loan the agency’s in-house lender — the Loan Programs Office, recently renamed the Office of Energy Dominance Financing — gave to Southern Company this week to cover uprates will fulfill the first part of the order. Now the second part is getting real. In a scoop on Thursday, Heatmap’s Robinson Meyer reported that the Energy Department has started taking meetings with utilities and developers of what he said “would almost certainly be AP1000s, a third-generation reactor produced by Westinghouse capable of producing up to 1.1 gigawatts of electricity per unit.”

Reactor realism includes keeping existing plants running, so notch this as yet more progress: Diablo Canyon, the last nuclear station left in California, just cleared the final state permitting hurdle to staying open until 2030, and possibly longer. The Central Coast Water Board voted unanimously on Thursday to give the state’s last nuclear plant a discharge permit and water quality certification. In a post on LinkedIn, Paris Ortiz-Wines, a pro-nuclear campaigner who helped pass a 2022 law that averted the planned 2025 closure of Diablo Canyon, said “70% of public comments were in full support — from Central Valley agricultural associations, the local Chamber of Commerce, Dignity Health, the IBEW union, district supervisors, marine meteorologists, and local pro-nuclear organizations.” Starting in 2021, she said, she attended every hearing on the bill that saved the plant. “Back then, I knew every single pro-nuclear voice testifying,” she wrote. “Now? I’m meeting new ones every hearing.”

It was the best of times, it was the worst of times. It was a year of record solar deployments, it was a year of canceled solar megaprojects, choked-off permits, and desperate industry pleas to Congress for help. But the solar industry’s political clouds may be parting. The Department of the Interior is reviewing at least 20 commercial-scale projects that E&E News reported had “languished in the permitting pipeline” since Trump returned to office. “That includes a package of six utility-scale projects given the green light Friday by Interior Secretary Doug Burgum to resume active reviews, such as the massive Esmeralda Energy Center in Nevada,” the newswire reported, citing three anonymous career officials at the agency.

Heatmap’s Jael Holzman broke the news that the project, also known as Esmeralda 7, had been canceled in October. At the time, NextEra, one of the project’s developers, told her that it was “committed to pursuing our project’s comprehensive environmental analysis by working closely with the Bureau of Land Management.” That persistence has apparently paid off. In a post on X linking to the article, Morgan Lyons, the senior spokesperson at the Solar Energy Industries Association, called the change “quite a tone shift” with the eyes emoji. GOP voters overwhelmingly support solar power, a recent poll commissioned by the panel manufacturer First Solar found. The MAGA coalition has some increasingly prominent fans. As I have covered in the newsletter, Katie Miller, the right-wing influencer and wife of Trump consigliere Stephen Miller, has become a vocal proponent of competing with China on solar and batteries.

Get Heatmap AM directly in your inbox every morning:

MP Materials operates the only active rare earths mine in the United States at California’s Mountain Pass. Now the company, of which the federal government became the largest shareholder in a landmark deal Trump brokered earlier this year, is planning a move downstream in the rare earths pipeline. As part of its partnership with the Department of Defense, MP Materials plans to invest more than $1 billion into a manufacturing campus in Northlake, Texas, dedicated to making the rare earth magnets needed for modern military hardware and electric vehicles. Dubbed 10X, the campus is expected to come online in 2028, according to The Wall Street Journal.

Sign up to receive Heatmap AM in your inbox every morning:

New York’s rural-urban divide already maps onto energy politics as tensions mount between the places with enough land to build solar and wind farms and the metropolis with rising demand for power from those panels and turbines. Keeping the state’s landmark climate law in place and requiring New York to generate the vast majority of its power from renewables by 2040 may only widen the split. That’s the obvious takeaway from data from the New York State Energy Research and Development Authority. In a memo sent Thursday to Governor Kathy Hochul on the “likely costs of” complying with the law as it stands, NYSERDA warned that the statute will increase the cost of heating oil and natural gas. Upstate households that depend on fossil fuels could face hikes “in excess of $4,000 a year,” while New York City residents would see annual costs spike by $2,300. “Only a portion of these costs could be offset by current policy design,” read the memo, a copy of which City & State reporter Rebecca C. Lewis posted on X.

Last fall, this publication’s energy intelligence unit Heatmap Pro commissioned a nationwide survey asking thousands of American voters: “Would you support or oppose a data center being built near where you live?” Net support came out to +2%, with 44% in support and 42% opposed. Earlier this month, the pollster Embold Research ran the exact same question by another 2,091 registered voters across the country. The shift in the results, which I wrote about here, is staggering. This time just 28% said they would support or strongly support a data center that houses “servers that power the internet, apps, and artificial intelligence” in their neighborhood, while 52% said they would oppose or strongly oppose it. That’s a net support of -24% — a 26-point drop in just a few months.

Among the more interesting results was the fact that the biggest partisan gap was between rural and urban Republicans, with the latter showing greater support than any other faction. When I asked Emmet Penney at the right-leaning Foundation for American Innovation to make sense of that for me, he said data centers stoke a “fear of bigness” in a way that compares to past public attitudes on nuclear power.

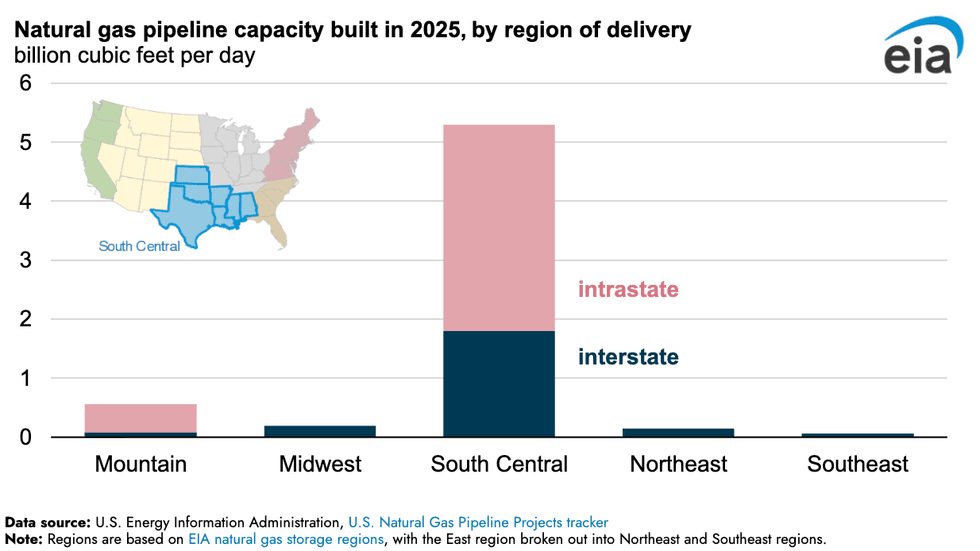

Gas pipeline construction absolutely boomed last year in one specific region of the U.S. Spanning Texas, Oklahoma, Kansas, Arkansas, Louisiana, Mississippi, and Alabama, the so-called South Central bloc saw a dramatic spike in intrastate natural gas pipelines, more than all other regions combined, per new Energy Information Administration data. It’s no mystery as to why. The buildout of liquified natural gas export terminals along the Gulf coast needs conduits to carry fuel from the fracking fields as far west as the Texas Permian.

On Cybertruck deaths, Texas wind waste, and American aluminum

Current conditions: Yet more snow is dusting New York City with at least an inch fallen already, though that’s set to turn into rain later in the morning • Authorities in Saudi Arabia issued a red alert over a major sandstorm blasting broad swaths of the desert nation • Heavy snow blanketed Romania, halting transportation and taking down power lines.

In his State of the Union address Tuesday night, President Donald Trump unveiled what he called the new “ratepayer protection pledge.” Under the effort, the White House will tell “major tech companies that they have the obligation to provide for their own power needs.” By mandating the bring-your-own-generation approach, the Trump administration is endorsing a push that’s been ongoing for months. The North American Electric Reliability Corporation, the U.S. grid watchdog, called for data centers to build their own generators. An industry-backed proposal in the nation’s largest power grid would do something similar. “This is a unique strategy,” Trump said. “We have an old grid that could never handle the [amount] of electricity that’s needed.” With tech companies constructing new power plants, Trump said, towns should welcome data center projects that could end up lowering electricity rates by inviting more power onto the local grid.

The political blowback to data centers is gaining strength. It is, as my colleague Jael Holzman wrote recently, “swallowing American politics.” On the right, Senator Josh Hawley, the populist Republican from Missouri, introduced legislation this month to restrict data center construction. On the left, Senator Bernie Sanders, the democratic socialist from Vermont, reiterated his proposal this week to halt all data center projects. In the center, Pennsylvania Governor Josh Shapiro, a Democrat with unusually strong support among his state’s GOP voters, recently outlined plans for a more “selective” approach to data centers, as I reported in this newsletter.

Trump isn’t the only Republican pushing back against the data center blowback. On Tuesday, Mississippi Governor Tate Reeves delivered an impassioned defense of his state’s data center buildout. “I understand individuals who would rather not have any industrial project in their backyard. We all choose where to live, whether it’s urban, suburban, agrarian, or industrial. I do not understand the impulse to prevent our country from advancing technologically — except as civilizational suicide,” Reeves wrote in a post on X. “I don’t want to go gently. I love this country, and want her to rise. That’s why Mississippi has become the home of the world’s most impressive supercomputers. We are committed to America and American power. We know that being the hub of the world’s most awesome technology will inevitably bring prosperity and authority to our state. There is nobody better than Mississippians to wield it.”

Replying to Sanders’ proposal, Reeves said he’s “tempted to sit back and let other states fritter away the generational chance to build. To laugh at their short-sightedness. But the best path for all of us would be to see America dominate.”

Sign up to receive Heatmap AM in your inbox every morning:

The subcompact Ford Pinto gained infamy in the 1970s for its tendency to explode when the gas tank ruptured in a crash. The Ford Motor Company sold just under 3.2 million Pintos. By the official death toll, 27 people died as a result of fires from the vehicles exploding. Tesla has sold more than 34,000 Cybertrucks; already, five people have died in fire fatalities.

That, according to a calculation by the automotive blog Fuel Arc, means the Tesla Cybertruck has 14.52 deaths per 100,000 units, compared to the Ford Pinto’s 0.85 deaths. “The Cybertruck is far more dangerous (by volume) than the historic poster child for corporate greed and grossly antagonistic design,” Fuel Arc’s Kay Leadfoot wrote. “I look forward to the Cybertruck being governmentally crash-tested by the NHTSA, which it has not been thus far. Until then, I can’t recommend sitting in one.” That is, however, based on the lower death toll figure for the Pinto. Back in 1977, Mother Jones published a blockbuster cover story under the headline “Pinto Madness” claiming that the number of deaths could be as high as 900.

Texas accused the recycling company Global Fiberglass Solutions of illegally dumping thousands of wind turbine blades near the central town of Sweetgrass. The company allegedly hired several subcontractors to break down, transport and recycle the blades, but failed to properly dispose of the waste and instead created what Windpower Monthly called a “stockpile” of more than 3,000 blades across two sites in the town. Attorney General Ken Paxton, a Republican candidate for U.S. Senate, seized on a Trumpian critique of the energy source, saying the dumps damage “beautiful Texas land and threaten surrounding communities.”

Off the Atlantic Coast, meanwhile, Orsted is at a transitional moment for two of its offshore wind projects. The Danish developer just brought the vessel Wind Scylla to port after completing the installation of turbines at its Revolution Wind project in New England. The boat is headed to New York next to start installing the first wind turbine at Sunrise Wind, according to OffshoreWIND.biz.

Last month, I told you that Century Aluminum inked a deal with Emirates Global Aluminum to build the first smelter in the U.S. in half a century in Oklahoma. On Tuesday, the U.S. Aluminum Company, a local firm in the state, joined the project, signing an agreement to “explore the development of an aluminum fabrication plant near the new smelter.” If completed, the project — already dubbed Oklahoma Primary Aluminum — would roughly double U.S. primary production of the metal.

The Biden administration had placed what Heatmap’s Matthew Zeitlin called “a big bet on aluminum” back in 2024. By spring of last year, our colleague Katie Brigham was chronicling the confusion over how Trump’s tariffs on aluminum would work. With the recent Supreme Court ruling upending Trump’s trade policies, that one may remain a headscratcher for a little while longer.

Another day, another landmark energy investment from Google. This time, the tech giant has made a deal with the long-duration energy storage startup Form Energy to deploy what Katie wrote “would be the largest battery in the world by energy capacity: an iron-air system capable of delivering 300 megawatts of power at once while storage 30 gigawatt-hours of energy, enabling continuous discharge for 100 hours straight.” The project will power a data center in Minnesota. “For all of 2025, I believe the installed capacity [added to the grid] in the entire U.S. was 57 gigawatt-hours. And in one project, we’re going to install 30 gigawatt-hours,” Form CEO Mateo Jaramillo told Katie. “What it highlights is, once you get to the 100-hour duration, you can really stop thinking about energy to some extent. “