Reactor realism includes keeping existing plants running, so notch this as yet more progress: Diablo Canyon, the last nuclear station left in California, just cleared the final state permitting hurdle to staying open until 2030, and possibly longer. The Central Coast Water Board voted unanimously on Thursday to give the state’s last nuclear plant a discharge permit and water quality certification. In a post on LinkedIn, Paris Ortiz-Wines, a pro-nuclear campaigner who helped pass a 2022 law that averted the planned 2025 closure of Diablo Canyon, said “70% of public comments were in full support — from Central Valley agricultural associations, the local Chamber of Commerce, Dignity Health, the IBEW union, district supervisors, marine meteorologists, and local pro-nuclear organizations.” Starting in 2021, she said, she attended every hearing on the bill that saved the plant. “Back then, I knew every single pro-nuclear voice testifying,” she wrote. “Now? I’m meeting new ones every hearing.”

2. Trump’s solar siege may be coming to an end

It was the best of times, it was the worst of times. It was a year of record solar deployments, it was a year of canceled solar megaprojects, choked-off permits, and desperate industry pleas to Congress for help. But the solar industry’s political clouds may be parting. The Department of the Interior is reviewing at least 20 commercial-scale projects that E&E News reported had “languished in the permitting pipeline” since Trump returned to office. “That includes a package of six utility-scale projects given the green light Friday by Interior Secretary Doug Burgum to resume active reviews, such as the massive Esmeralda Energy Center in Nevada,” the newswire reported, citing three anonymous career officials at the agency.

Heatmap’s Jael Holzman broke the news that the project, also known as Esmeralda 7, had been canceled in October. At the time, NextEra, one of the project’s developers, told her that it was “committed to pursuing our project’s comprehensive environmental analysis by working closely with the Bureau of Land Management.” That persistence has apparently paid off. In a post on X linking to the article, Morgan Lyons, the senior spokesperson at the Solar Energy Industries Association, called the change “quite a tone shift” with the eyes emoji. GOP voters overwhelmingly support solar power, a recent poll commissioned by the panel manufacturer First Solar found. The MAGA coalition has some increasingly prominent fans. As I have covered in the newsletter, Katie Miller, the right-wing influencer and wife of Trump consigliere Stephen Miller, has become a vocal proponent of competing with China on solar and batteries.

Get Heatmap AM directly in your inbox every morning:

3. America’s only active rare earths miner is opening a Texas factory

MP Materials operates the only active rare earths mine in the United States at California’s Mountain Pass. Now the company, of which the federal government became the largest shareholder in a landmark deal Trump brokered earlier this year, is planning a move downstream in the rare earths pipeline. As part of its partnership with the Department of Defense, MP Materials plans to invest more than $1 billion into a manufacturing campus in Northlake, Texas, dedicated to making the rare earth magnets needed for modern military hardware and electric vehicles. Dubbed 10X, the campus is expected to come online in 2028, according to The Wall Street Journal.

Sign up to receive Heatmap AM in your inbox every morning:

4. New York’s climate law will cost upstaters twice as much as city people

New York’s rural-urban divide already maps onto energy politics as tensions mount between the places with enough land to build solar and wind farms and the metropolis with rising demand for power from those panels and turbines. Keeping the state’s landmark climate law in place and requiring New York to generate the vast majority of its power from renewables by 2040 may only widen the split. That’s the obvious takeaway from data from the New York State Energy Research and Development Authority. In a memo sent Thursday to Governor Kathy Hochul on the “likely costs of” complying with the law as it stands, NYSERDA warned that the statute will increase the cost of heating oil and natural gas. Upstate households that depend on fossil fuels could face hikes “in excess of $4,000 a year,” while New York City residents would see annual costs spike by $2,300. “Only a portion of these costs could be offset by current policy design,” read the memo, a copy of which City & State reporter Rebecca C. Lewis posted on X.

5. Support for data centers is nosediving

Last fall, this publication’s energy intelligence unit Heatmap Pro commissioned a nationwide survey asking thousands of American voters: “Would you support or oppose a data center being built near where you live?” Net support came out to +2%, with 44% in support and 42% opposed. Earlier this month, the pollster Embold Research ran the exact same question by another 2,091 registered voters across the country. The shift in the results, which I wrote about here, is staggering. This time just 28% said they would support or strongly support a data center that houses “servers that power the internet, apps, and artificial intelligence” in their neighborhood, while 52% said they would oppose or strongly oppose it. That’s a net support of -24% — a 26-point drop in just a few months.

Among the more interesting results was the fact that the biggest partisan gap was between rural and urban Republicans, with the latter showing greater support than any other faction. When I asked Emmet Penney at the right-leaning Foundation for American Innovation to make sense of that for me, he said data centers stoke a “fear of bigness” in a way that compares to past public attitudes on nuclear power.

THE KICKER

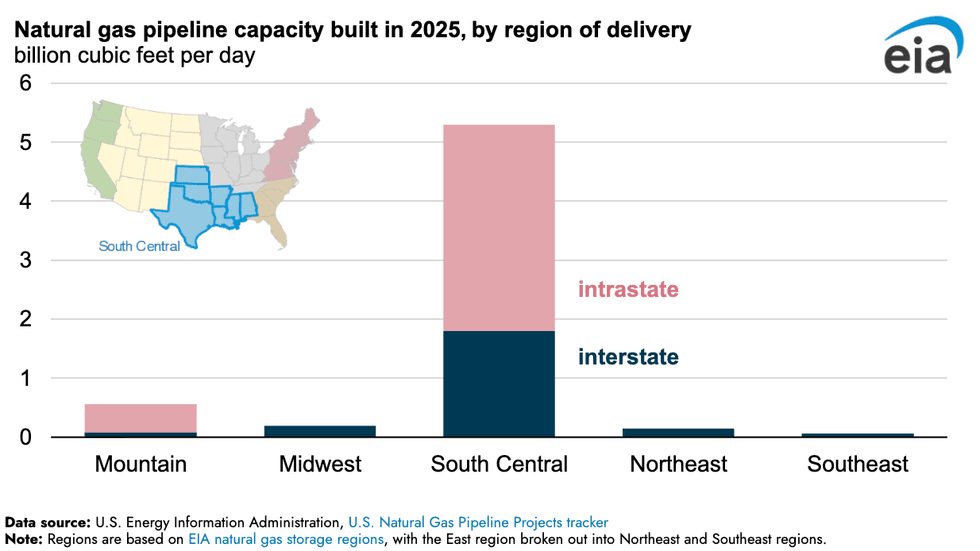

A Gulf coast pipeline boom.EIA

A Gulf coast pipeline boom.EIA

Gas pipeline construction absolutely boomed last year in one specific region of the U.S. Spanning Texas, Oklahoma, Kansas, Arkansas, Louisiana, Mississippi, and Alabama, the so-called South Central bloc saw a dramatic spike in intrastate natural gas pipelines, more than all other regions combined, per new Energy Information Administration data. It’s no mystery as to why. The buildout of liquified natural gas export terminals along the Gulf coast needs conduits to carry fuel from the fracking fields as far west as the Texas Permian.

Smoke billows from a missile strike in Tehran. Fatemeh Bahrami/Anadolu via Getty Images

Smoke billows from a missile strike in Tehran. Fatemeh Bahrami/Anadolu via Getty Images

A Gulf coast pipeline boom.EIA

A Gulf coast pipeline boom.EIA