The Securities and Exchange Commission approved a highly anticipated rule on Wednesday that will require companies to disclose information about their climate-related risks to investors. But the final rule differs dramatically from the proposal the Commission released two years ago, with significantly weaker provisions that leave it up to companies to decide how much information to share.

Perhaps the most dramatic change: Most of the climate-related disclosures the rule covers are now mandatory only if they’re considered “material.” Under the original rule, all public companies would have been required to calculate and report the greenhouse gas emissions they are directly responsible for, known as scope 1 emissions, and the emissions from the electricity they use, known as scope 2 — no exceptions. But under the final rule, companies only have to report this information if they deem it material — i.e. if there is “a substantial likelihood that the disclosure of the omitted fact would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available,” according to a 1976 Supreme Court decision.

Further, only about 40% of domestic public companies will even be required to consider whether their emissions are material. Smaller companies and emerging growth businesses — generally companies with less than $1.2 billion in annual revenues — are exempt.

Part of the impetus for the rule was to standardize climate disclosures. Though many companies already publicly report information about their emissions and climate-related risks, they do so sporadically, using different methodologies, adopting different formats, and publishing across different forums. Steven Rothstein, a managing director at the nonprofit Ceres, once told me it was like a “climate ‘Tower of Babel.’”

The final rule will still create a more formal, consistent, public reporting system for this information. But the picture it provides to investors will be incomplete. “By shifting to a materiality standard, they are leaving a huge gap in the information available to investors and the public,” Kathy Fallon, the director of land and climate at the Clean Air Task Force told me. “That's going to hurt companies and the climate in the long run.”

This wasn’t entirely unexpected. The original proposal ignited a firestorm from Republican attorneys general and business groups accusing the SEC of trying to pass back-door climate regulations, overstepping its role, and saddling companies with burdensome reporting costs. The Commission received more than 20,000 comments on the proposal, more than any rule in its history. As the pressure grew, reports emerged that the Commission planned to remove a requirement that companies tally up and report a third category of their emissions, known as scope 3, which includes those associated with their supply chains and the use of their products. Then last week, Reuters reported that the SEC would also soften the requirements for disclosing scope 1 and 2 emissions by subjecting them to this materiality test.

Before the vote on Wednesday, Erik Gerding, director of the SEC’s division of corporation finance, emphasized that the final rule struck an “appropriate balance” between investor demand for more consistent, comparable, information about climate-related risks, and “the concerns expressed by many companies and commenters about the potential costs of the proposed rules.”

The Commission voted along party lines, with Democratic chair Gary Gensler and commissioners Caroline Crenshaw and Jaime Lizárraga approving the rule, and Republican commissioners Hester Peirce and Mark Uyeda voting against. But no one appeared satisfied.

Peirce argued that companies were already required to inform investors about material risks and trends, including those related to climate change. She accused the staff of having merely “decorated the final rule with materiality ribbons” while still creating an overly prescriptive rule. “The resulting flood of climate related disclosures will overwhelm investors, not inform them,” she said.

Crenshaw said the rule was a “bare minimum” step forward that would “move a haphazard potpourri of public company disclosures into the Commission's well-developed and standardized filing ecosystem.” But she also worried that it would pass the buck to future commissions to ensure investors are getting the information they actually need. “To be crystal clear, this is not the rule I would have written,” she said. “Today's rule is better for investors than no rule at all, and that's why it has my vote. But while it has my vote, it does not have my unencumbered support.”

There is no specific test to determine whether emissions are considered material. But the climate disclosure rule does discuss some examples of when a company’s scope 1 or scope 2 emissions may be material. One is if there is a transition risk associated with those emissions — for example, if a company anticipates that future regulations would increase their costs. Another is if a company has articulated a climate goal, like an ambition to achieve net-zero emissions, to the public. As with other SEC disclosures subject to a material standard, it will be entirely up to these companies to determine whether their emissions are material, and they will not have to share their analysis with investors.

Experts don’t expect this to lead to a total lack of emissions reporting. If a company fails to disclose its emissions, it could open up the business to fines from the SEC or lawsuits from investors if the information is later determined to be, in fact, material. Many companies, prodded by their lawyers, are likely to play it safe and disclose. “It’s hard to make an argument that scope 1 emissions are not material,” Jameson McLennan, a sustainable finance analyst at BloombergNEF, told me.

But there still may be a spectrum. John Tobin, a professor of practice at Cornell University’s business school and a former managing director of sustainability at Credit Suisse, told me that big, white collar companies like banks and tech companies that don’t directly emit much may not see the need to disclose, whereas manufacturing and industrial companies that directly burn fossil fuels to produce their products, absolutely should. That being said, those white collar businesses should still consider their scope 2 emissions material, Tobin said, as they tend to use a substantial amount of electricity and could be at risk of cost increases if regulations change.

Where Tobin thinks the rule really falls short is in lacking requirements to disclose certain kinds of scope 3 emissions — particularly upstream supply chain emissions. Why would an investor care more about the emissions from the electricity Toyota uses than the emissions from the steel it buys? The latter is more likely to pose a significant risk to the company’s business due to carbon regulations. “A lot of the emissions associated with industrial activity have very little to do with electricity,” he told me.

By telling companies they only have to report emissions that are material, the Commission is essentially saying that a company’s emissions are not inherently material to an investor’s understanding of risk. Allowing companies to opt out of emissions reporting “misses the whole point of climate disclosures,” said Fallon. “The whole point is to make available the information that investors want, not just the information that companies want to give.” Investors want to know how exposed a company may be to changes in climate policies, energy prices, or shifts in consumer sentiments.

At the same time, tying the list of required disclosures to a materiality test could be what ultimately preserves the rule when it inevitably ends up in court. Many groups have already threatened to sue the commission if it exceeds its legal authority. These include the National Association of Manufacturers.

“The NAM has been clear that a failure to bring the rule back within the agency’s statutory authority could invite legal action. On the other hand, a balanced, workable rule could obviate the need for litigation,” said the group’s vice president of domestic policy, Charles Crain.

The rule will still likely surface valuable information for investors and others keen to get their hands on more consistent, comparable data about certain companies’ emissions and vulnerability to climate change. But it will also leave huge reporting gaps that dilute the overall utility of that information.

“The fact that the SEC is providing uniform requirements for reporting is still an improvement upon what we had before,” said Fallon. “But the final rule doesn’t go far enough to give investors the information they need to make informed decisions.”

Editor’s note: This story has been updated to reflect the result of the SEC’s vote.

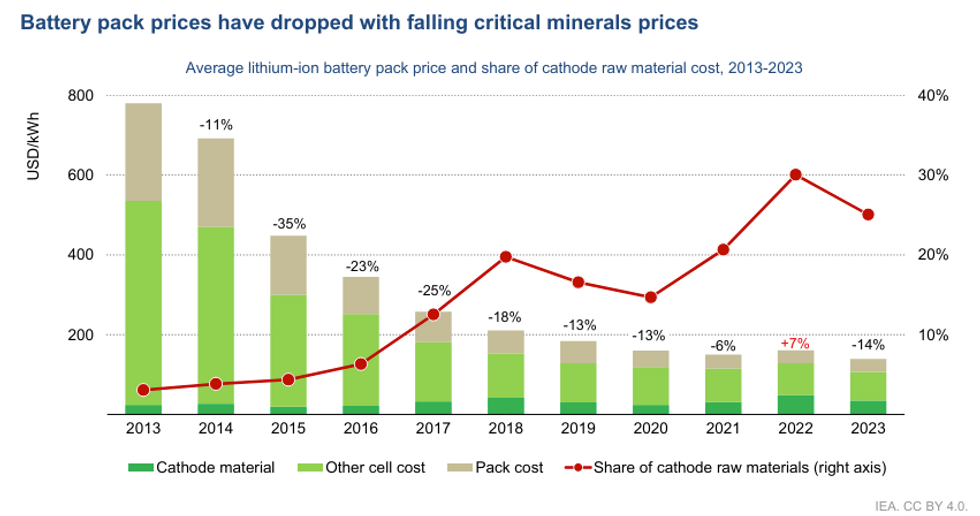

IEA

IEA