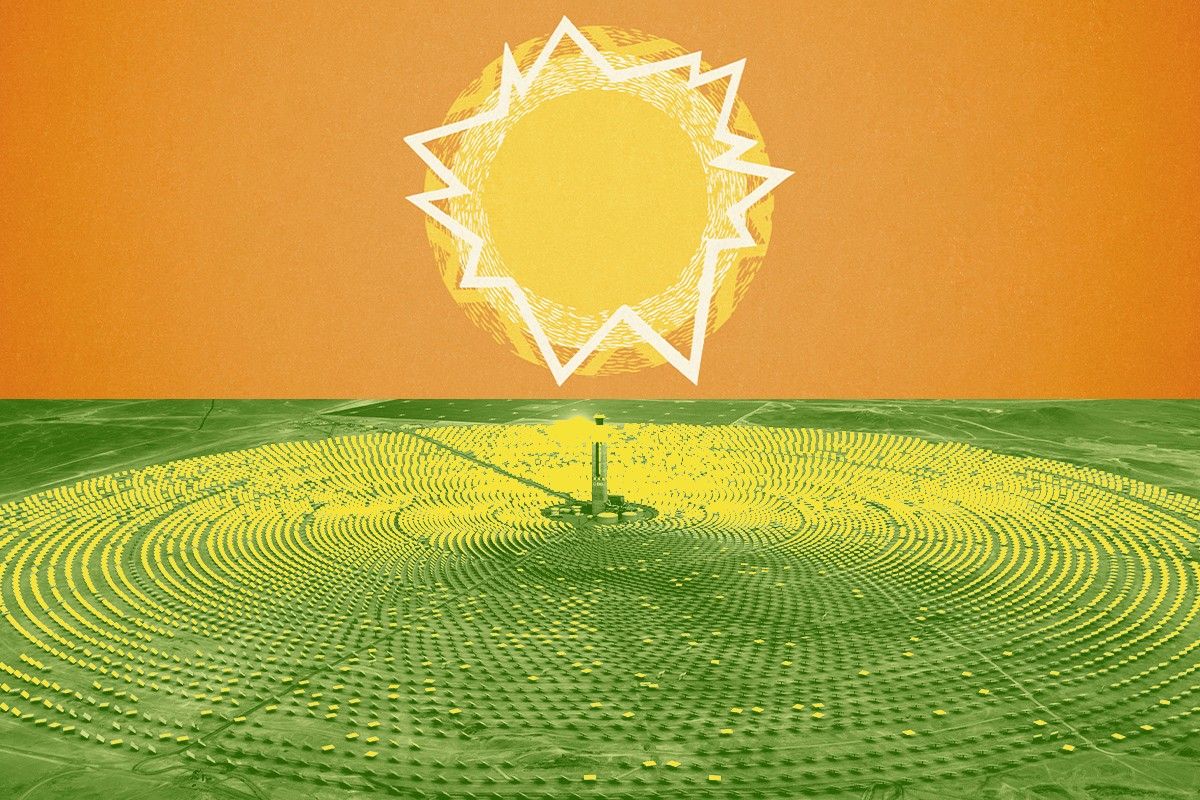

Hundreds of thousands of mirrors blanket the desert of the American West, strategically angled to catch the sun and bounce its intense heat back to a central point in the sky. Despite their monumental size and futuristic look, these projects are far more under-the-radar-than the acres of solar panels cropping up in communities around the country, simply because there are so few of them.

The technology is called concentrating solar power, and it’s not particularly popular. Of the thousands of big solar projects operating in the U.S. today, less than a dozen use it.

Concentrating solar power lags for many reasons: It remains much more expensive than installations that use solar panels, it can take up a lot of land, and it can fry birds that fly too close (a narrative that’s shadowed the industry and an issue it says it’s working to alleviate). Yet the government still has big aspirations for the technology.

To meet its climate goals and avert the catastrophe that comes with significant warming, the world must roll out renewable energy sources with unprecedented speed. But while the construction of solar and wind energy is surging, renewables still face two disadvantages that fossil fuels don't: They produce electricity under certain conditions, like when the wind is blowing or the sun is shining. And there’s not a lot of research on them powering heavy industry, like cement and steel production.

That’s where concentrating solar power has an advantage. It has two big benefits that have long kept boosters invested in its success. First, concentrating solar power is usually constructed with built-in storage that's cheaper than large-scale batteries, so it can solve the intermittency challenges faced by other kinds of solar power. Plus, CSP can get super-hot — potentially hot enough for industrial processes like making cement. Taken together, those qualities allow the projects to function more like fossil fuel plants than fields of solar panels.

A few other carbon-free technologies — like nuclear power — are capable of doing much the same thing. The question is which technologies will be able to scale.

“We have goals of decarbonizing the entire energy sector, not just electricity, but the industrial sector as well, by 2050,” said Matthew Bauer, program manager for the concentrating solar-thermal power team at the Department of Energy’s Solar Technologies Office. “We think CSP is one of the most promising technologies to do that.”

In February, the Department of Energy broke ground in New Mexico on a project they see as a focal point for the future of CSP. It’s a bet that the technology can compete, despite past skepticism.

Concentrating solar plants can be built in different ways, but they’re basically engineered to bounce sun off mirrors to beam sunlight at a device called a receiver, which then heats up whatever medium is inside it. The heat can power a turbine or an engine to produce electricity. The higher the heat, the more electricity is produced and the lower the cost of producing it.

The CSP installation in New Mexico will look a lot like past projects, with a field of mirrors pointing towards a tall tower. But one element makes it particularly unique: big boxes of sand-like particles. When it’s completed next year, it will be the first known CSP project of its kind to use solid particles like sand or ceramics to transfer heat, according to Jeremy Sment, a mechanical engineer leading the team designing the project at Sandia National Laboratories.

For years, scientists sought a material that would get hot enough to improve CSP’s efficiency and costs. Past commercial CSP projects have topped out around 550 degrees Celsius. For this new project, which the Department of Energy calls “generation three,” the team is hoping to exceed 700 degrees C, and has tested the particles above 1000 degrees C, the temperature of volcanic magma.

Past projects have used oil and molten salt to absorb the sun’s heat and store it. But at blistering temperatures these materials decompose or are corrosive. In 2021, the Department of Energy decided particles were the most promising route to reach the super-hot temperatures required for efficient CSP. The team building the project considered using numerous types of particles, including red and white sand from Riyadh in Saudia Arabia and a titanium-based mineral called ilmenite. They settled on a manufactured particle from a Texas-based company, Carbo Ceramics. To build the project they need 120,000 kilograms of the stuff.

Engineers at Sandia are now working on the project’s other components. At the receiver, particles will fall like a curtain through a beam of sunlight. After they’re blasted with heat, gravity will carry them down the 175-foot tower, slowed down by obstacles that create a chute similar to a children’s marble run. They’ll offload thermal energy to “supercritical carbon dioxide” — CO2 in a fluid state — which could then power a turbine. For industrial applications, the system would be designed to allow particles to exchange heat with air or steam to heat a furnace or kiln. To store heat energy for later, the particles can be stowed in insulated steel bins within the tower until that heat is needed hours later.

The team expects construction to wrap up next year, with results for this phase of the project ready at the end of 2025. The project needs to show it can reach super-high temperatures, produce electricity using the supercritical CO2, and that it can store heat for hours, allowing the energy to be used when the sun isn’t shining.

By the Department of Energy’s technology pilot standards, the 1 megawatt project is big, but it's much smaller than most solar projects built to supply power to electric utilities and tiny compared to past CSP projects.

This could help tackle another of CSP's challenges: Projects have been uneconomic unless they’re huge. They require big plots of land and lots of money to get started. One of the most well-known CSP projects in the U.S., the 110-megawatt Crescent Dunes, cost $1 billion and covers more than 1,600 acres in Nevada. “Nothing short of a home run is deployable — I can’t just put a solar tower on my rooftop,” said Sment.

Projects that use solar panels can be as small as the footprint of a home. Overall, they’re much easier to finance and build. That’s led to more projects, which creates efficiencies and lower costs. The DOE hopes its tests will show promise for smaller, easier to deploy CSP projects.

“That’s been one of the challenges, in my opinion, that’s faced CSP historically. The projects tended to be very large, one of a kind,” said Steve Schell, chief scientist at Heliogen, a Bill Gates-backed CSP startup that’s working on a different pilot with the Department of Energy.

Heliogen went public at the end of 2021 with a valuation of $2 billion. To overcome hesitancy about the price tags usually associated with CSP, the company is targeting modular projects focused on producing green hydrogen and industrial heat, aiming to replace the fossil fuels that usually power processes like cement-making.

For companies, the CSP business has historically been tough. Some U.S. CSP startups have gone out of business, or shifted their sights to projects abroad. Despite its splashy IPO, Heliogen’s shares are worth less than 25 cents today, down from over $15 at the end of 2021. In its most recent quarterly financial report, the company downgraded its expected 2022 revenue by $8- $11 million as it works to finalize deals with customers.

Bauer at the DOE thinks the government can make technologies like CSP less risky by investing in research that takes a longer view than the one afforded by markets. And as the grid needs more large-scale storage, the value for CSP may change.

Even if CSP never becomes a significant source of generation on the grid, supporters like Shannon Yee, an associate professor of mechanical engineering at the Georgia Institute of Technology who has worked with DOE on solar technologies for years, say it could still find other potential applications in manufacturing, water treatment, or sanitation.

“We always seem to be so focused on generating electricity that we don't look at these other needs where concentrated solar may actually provide greater benefit,” said Yee. “Everything really needs sources of energy and heat. How do we do that better?”

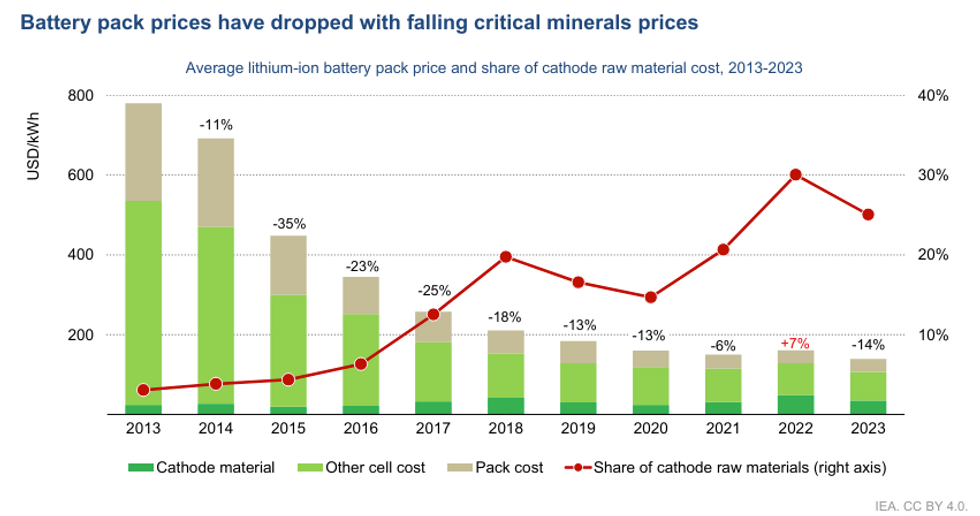

IEA

IEA