You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

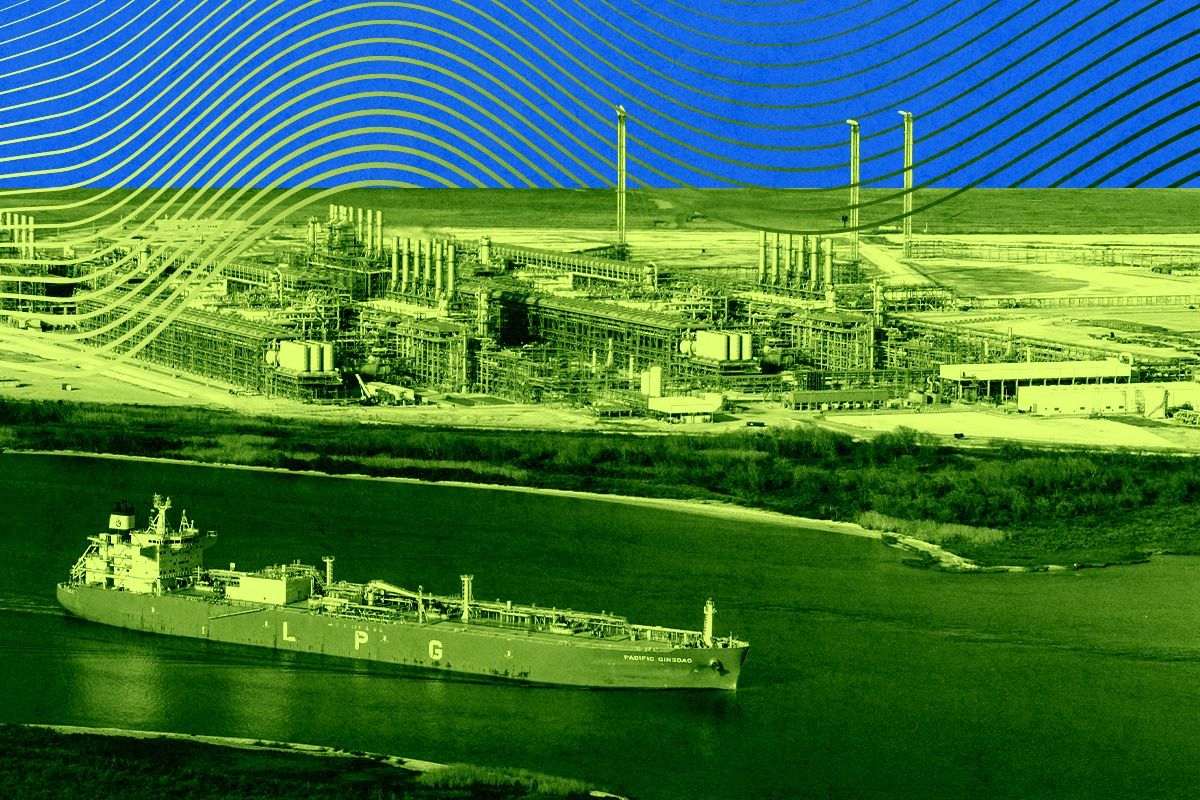

Some producers were already renegotiating contracts due to rising costs. Then came “Liberation Day.”

Expanding U.S. liquified natural gas exports has been a key priority for Trump and part of his strategy to “unleash U.S. energy dominance.” But his tariffs could make it harder for projects that are still early in their development to succeed.

After taking office, Trump swiftly reversed the Biden administration’s slow-walking of permits for LNG export terminals and issued key approvals for two big new projects in Louisiana, Calcasieu Pass 2 and Commonwealth LNG. They add to a pipeline of roughly eight other projects that have received key federal approvals but have not yet reached a final investment decision, according to data from the Energy Information Administration.

Cost inflation was a concern for these projects prior to this week’s tariffs, said Ben Cahill, the director of energy markets and policy at the University of Texas at Austin’s Center for Energy and Environmental Systems Analysis. The previously announced 25% tariffs on steel and aluminum were already set to make building these projects more expensive, Cahill told me in an email.

Anne-Sophie Corbeau, a research scholar focused on natural gas at Columbia University’s Center on Global Energy Policy, noted that U.S. liquified natural gas companies were already trying to renegotiate contracts with buyers due to rising costs. “For the moment U.S. LNG is still interesting,” she said in an email, “but if costs increase too much, maybe people will start to wonder.”

The effect of the new round of global tariffs on these projects is much harder for experts to predict, and is changing by the day. Some countries may choose to increase their U.S. LNG imports to try to close their trade deficits and appease Trump. Morningstar analysts issued a note on Thursday predicting a favorable market for Venture Global, the developer behind Calcasieu Pass 2, as it’s looking for buyers, and “could offer the quick and easy victory both Trump and foreign leaders want.”

But the tariffs (not to mention the uncertainty about how long they’ll last) could also turn off potential buyers from signing long-term contracts with the U.S. They may begin to look elsewhere, or impose retaliatory tariffs, as China has already done.

China imposed 15% retaliatory tariffs on U.S. LNG back in February, in response to Trump’s first round of tariffs. Not a single tanker of U.S. LNG has gone to the country since then. Now the country has retaliated to this week’s escalation with an additional 34% tariff on U.S. goods.

That may sound bad for America’s LNG industry, but China is a relatively small buyer right now — only about 5% of U.S. exports went to China last year. That number is set to rise rapidly over the next few years, however, as Chinese companies have signed a number of long-term contracts with U.S. LNG projects that are about to come online. “In a few years from now, assuming nothing has changed and the volumes are growing, that will become more and more complicated,” Corbeau said. “That is very likely to force Chinese buyers to look elsewhere for new LNG contracts. I would bet that the Chinese companies will try to get out of the contracts with the U.S. LNG projects that have not taken [final investment decision] yet.”

Erica Downs, a senior research scholar focused on China at the Center on Global Energy Policy also noted that U.S. LNG developers may have been counting on additional financing for new projects coming from China. “I suspect that what's happening now with the trade war is going to mean that you're not going to see Chinese companies enthusiastic about investing in U.S. LNG projects — although who knows if the Trump administration even wants that,” she told me.

Nearly half of U.S. LNG exports went to Europe last year, and a third went to Asian countries. The biggest buyer was the Netherlands, followed by France, Japan, and South Korea. The U.K. and India were also major customers.

Leading up to this week, European leaders had suggested they were willing to buy more U.S. LNG if it would help avoid being slapped with tariffs by Trump. Clearly, that willingness to buy didn’t pay off. As Politicoreported, EU diplomats struggled even to begin talks with the Trump administration to work out a deal. They still could, but Corbeau pointed out in a LinkedIn post Friday morning that it would be tough for the EU — or any other country — to make up their trade deficit with the U.S. simply by boosting LNG imports.

It’s also unclear what leverage these leaders have, as EU governments mostly don’t have a financial stake in their energy companies and can’t tell them from whom to buy fuel. European utilities “may not be so keen to bow to political whims and contract U.S. LNG, or any LNG for that matter,” Corbeau wrote in a recent blog post. Gas consumption in the block is on track to decline, and upcoming environmental regulations on imported gas could rule out U.S. sourcing if Trump also makes good on his plans to repeal U.S. methane pollution regulations. “The EU needs U.S. LNG for the moment, but they may choose not to increase their exposure,” Corbeau told me.

Other countries may simply become wary of increasing their reliance on U.S. energy. “Nobody wants to have to rely on the trade relationship with Trump if this is how he's going to treat his trading partners,” Elan Sykes, the director of energy and climate policy at the Progressive Policy Institute told me. “The environmental and energy security considerations used to both favor the U.S.,” said Sykes. “Now one of them is somewhat unclear, and the president is actively destroying our country's export market value proposition.”

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

The foreign entities of concern rules in the One Big Beautiful Bill would place gigantic new burdens on developers.

Trump campaigned on cutting red tape for energy development. At the start of his second term, he signed an executive order titled, “Unleashing Prosperity Through Deregulation,” promising to kill 10 regulations for each new one he enacted.

The order deems federal regulations an “ever-expanding morass” that “imposes massive costs on the lives of millions of Americans, creates a substantial restraint on our economic growth and ability to build and innovate, and hampers our global competitiveness.” It goes on to say that these regulations “are often difficult for the average person or business to understand,” that they are so complicated that they ultimately increase the cost of compliance, as well as the risks of non-compliance.

Reading this now, the passage echoes the comments I’ve heard from industry groups and tax law experts describing the incredibly complex foreign entities of concern rules that Congress — with the full-throated backing of the Trump administration — is about to impose on clean energy projects and manufacturers. Under the One Big Beautiful Bill Act, wind and solar, as well as utility-scale energy storage, geothermal, nuclear, and all kinds of manufacturing projects will have to abide by restrictions on their Chinese material inputs and contractual or financial ties with Chinese entities in order to qualify for tax credits.

“Foreign entity of concern” is a U.S. government term referring to entities that are “owned by, controlled by, or subject to the jurisdiction or direction of” any of four countries — Russia, Iran, North Korea, and most importantly for clean energy technology, China.

Trump’s tax bill requires companies to meet increasingly strict limits on the amount of material from China they use in their projects and products. A battery factory starting production next year, for example, would have to ensure that 60% of the value of the materials that make up its products have no connection to China. By 2030, the threshold would rise to 85%. The bill lays out similar benchmarks and timelines for clean electricity projects, as well as other kinds of manufacturing.

But how companies should calculate these percentages is not self-evident. The bill also forbids companies from collecting the tax credits if they have business relationships with “specified foreign entities” or “foreign-influenced entities,” terms with complicated definitions that will likely require guidance from the Treasury for companies to be sure they pass the test.

Regulatory uncertainty could stifle development until further guidance is released, but how long that takes will depend on if and when the Trump administration prioritizes getting it done. The One Big Beautiful Bill Act contains a lot of other new tax-related provisions that were central to the Trump campaign, including a tax exemption for tips, which are likely much higher on the department’s to-do list.

Tax credit implementation was a top priority for the Biden administration, and even with much higher staffing levels than the department currently has, it took the Treasury 18 months to publish initial guidance on foreign entities of concern rules for the Inflation Reduction Act’s electric vehicle tax credit. “These things are so unbelievably complicated,” Rachel McCleery, a former senior advisor at the Treasury under Biden, told me.

McCleery questioned whether larger, publicly-owned companies would be able to proceed with major investments in things like battery manufacturing plants until that guidance is out. She gave the example of a company planning to pump out 100,000 batteries per year and claim the per-kilowatt-hour advanced manufacturing tax credit. “That’s going to look like a pretty big number in claims, so you have to be able to confidently and assuredly tell your shareholder, Yep, we’re good, we qualify, and that requires a certification” by a tax counsel, she said. To McCleery, there’s an open question as to whether any tax counsel “would even provide a tax opinion for publicly-traded companies to claim credits of this size without guidance.”

John Cornwell, the director of policy at the Good Energy Collective, which conducts research and advocacy for nuclear power, echoed McCleery’s concerns. “Without very clear guidelines from the Treasury and IRS, until those guidelines are in place, that is going to restrict financing and investment,” Cornwell told me.

Understanding what the law requires will be the first challenge. But following it will involve tracking down supply chain data that may not exist, finding alternative suppliers that may not be able to fill the demand, and establishing extensive documentation of the origins of components sourced through webs of suppliers, sub-suppliers, and materials processors.

The Good Energy Institute put out an issue brief this week describing the myriad hurdles nuclear developers will face in trying to adhere to the tax credit rules. Nuclear plants contain thousands of components, and documenting the origin of everything from “steam generators to smaller items like specialized fasteners, gaskets, and electronic components will introduce substantial and costly administrative burdens,” it says. Additionally the critical minerals used in nuclear projects “often pass through multiple processing stages across different countries before final assembly,” and there are no established industry standards for supply chain documentation.

Beyond the documentation headache, even just finding the materials could be an issue. China dominates the market for specialized nuclear-grade materials manufacturing and precision component fabrication, the report says, and alternative suppliers are likely to charge premiums. Establishing new supply chains will take years, but Trump’s bill will begin enforcing the sourcing rules in 2026. The rules will prove even more difficult for companies trying to build first-of-a-kind advanced nuclear projects, as those rely on more highly specialized supply chains dominated by China.

These challenges may be surmountable, but that will depend, again, on what the Treasury decides, and when. The Department’s guidance could limit the types of components companies have to account for and simplify the documentation process, or it could not. But while companies wait for certainty, they may also be racking up interest. “The longer there are delays, that can have a substantial risk of project success,” Cornwell said.

And companies don’t have forever. Each of the credits comes with a phase-out schedule. Wind manufacturers can only claim the credits until 2028. Other manufacturers have until 2030. Credits for clean power projects will start to phase down in 2034. “Given the fact that a lot of these credits start lapsing in the next few years, there’s a very good chance that, because guidance has not yet come out, you’re actually looking at a much smaller time frame than than what is listed in the bill,” Skip Estes, the government affairs director for Securing America’s Energy Future, or SAFE, told me.

Another issue SAFE has raised is that the way these rules are set up, the foreign sourcing requirements will get more expensive and difficult to comply with as the value of the tax credits goes down. “Our concern is that that’s going to encourage companies to forego the credit altogether and just continue buying from the lowest common denominator, which is typically a Chinese state-owned or -influenced monopoly,” Estes said.

McCleery had another prediction — the regulations will be so burdensome that companies will simply set up shop elsewhere. “I think every industry will certainly be rethinking their future U.S. investments, right? They’ll go overseas, they’ll go to Canada, which dumped a ton of carrots and sticks into industry after we passed the IRA,” she said.

“The irony is that Republicans have historically been the party of deregulation, creating business friendly environments. This is completely opposite, right?”

On the budget debate, MethaneSAT’s untimely demise, and Nvidia

Current conditions: The northwestern U.S. faces “above average significant wildfire potential” for July • A month’s worth of rain fell over just 12 hours in China’s Hubei province, forcing evacuations • The top floor of the Eiffel Tower is closed today due to extreme heat.

The Senate finally passed its version of Trump’s One Big Beautiful Bill Act Tuesday morning, sending the tax package back to the House in hopes of delivering it to Trump by the July 4 holiday. The excise tax on renewables that had been stuffed into the bill over the weekend was removed after Senator Lisa Murkowski of Alaska struck a deal with the Senate leadership designed to secure her vote. In her piece examining exactly what’s in the bill, Heatmap’s Emily Pontecorvo explains that even without the excise tax, the bill would “gum up the works for clean energy projects across the spectrum due to new phase-out schedules for tax credits and fast-approaching deadlines to meet complex foreign sourcing rules.” Debate on the legislation begins on the House floor today. House Speaker Mike Johnson has said he doesn’t like the legislation, and a handful of other Republicans have already signaled they won’t vote for it.

The Environmental Protection Agency this week sent the White House a proposal that is expected to severely weaken the federal government’s ability to rein in planet-warming pollution. Details of the proposal, titled “Greenhouse Gas Endangerment Finding and Motor Vehicle Reconsideration,” aren’t clear yet, but EPA Administrator Lee Zeldin has reportedly been urging the Trump administration to repeal the 2009 “endangerment finding,” which explicitly identified greenhouse gases as a public health threat and gave the EPA the authority to regulate them. Striking down that finding would “free EPA from the legal obligation to regulate climate pollution from most sources, including power plants, cars and trucks, and virtually any other source,” wrote Alex Guillén at Politico. The title of the proposal suggests it aims to roll back EPA tailpipe emissions standards, as well.

Get Heatmap AM directly in your inbox every morning:

So long, MethaneSAT, we hardly knew ye. The Environmental Defense Fund said Tuesday that it had lost contact with its $88 million methane-detecting satellite, and that the spacecraft was “likely not recoverable.” The team is still trying to figure out exactly what happened. MethaneSAT launched into orbit last March and was collecting data about methane pollution from global fossil fuel infrastructure. “Thanks to MethaneSAT, we have gained critical insight about the distribution and volume of methane being released from oil and gas production areas,” EDF said. “We have also developed an unprecedented capability to interpret the measurements from space and translate them into volumes of methane released. This capacity will be valuable to other missions.“ The good news is that MethaneSAT was far from the only methane-tracking satellite in orbit.

Nvidia is backing a D.C.-based startup called Emerald AI that “enables AI data centers to flexibly adjust their power consumption from the electricity grid on demand.” Its goal is to make the grid more reliable while still meeting the growing energy demands of AI computing. The startup emerged from stealth this week with a $24.5 million seed round led by Radical Ventures and including funding from Nvidia. Emerald AI’s platform “acts as a smart mediator between the grid and a data center,” Nvidia explains. A field test of the software during a grid stress event in Phoenix, Arizona, demonstrated a 25% reduction in the energy consumption of AI workloads over three hours. “Renewable energy, which is intermittent and variable, is easier to add to a grid if that grid has lots of shock absorbers that can shift with changes in power supply,” said Ayse Coskun, Emerald AI’s chief scientist and a professor at Boston University. “Data centers can become some of those shock absorbers.”

In case you missed it: California Governor Gavin Newsom on Monday rolled back the state’s landmark Environmental Quality Act. The law, which had been in place since 1970, required environmental reviews for construction projects and had become a target for those looking to alleviate the state’s housing crisis. The change “means most urban developers will no longer have to study, predict, and mitigate the ways that new housing might affect local traffic, air pollution, flora and fauna, noise levels, groundwater quality, and objects of historic or archeological significance,” explainedCal Matters. On the other hand, it could also mean that much-needed housing projects get approved more quickly.

Tesla is expected to report its Q2 deliveries today, and analysts are projecting a year-over-year drop somewhere from 11% to 13%.

Jesse teaches Rob the basics of energy, power, and what it all has to do with the grid.

What is the difference between energy and power? How does the power grid work? And what’s the difference between a megawatt and a megawatt-hour?

On this week’s episode, we answer those questions and many, many more. This is the start of a new series: Shift Key Summer School. It’s a series of introductory “lecture conversations” meant to cover the basics of energy and the power grid for listeners of every experience level and background. In less than an hour, we try to get you up to speed on how to think about energy, power, horsepower, volts, amps, and what uses (approximately) 1 watt-hour, 1 kilowatt-hour, 1 megawatt-hour, and 1 gigawatt-hour.

Shift Key is hosted by Jesse Jenkins, a professor of energy systems engineering at Princeton University, and Robinson Meyer, Heatmap’s executive editor.

Subscribe to “Shift Key” and find this episode on Apple Podcasts, Spotify, Amazon, YouTube, or wherever you get your podcasts.

You can also add the show’s RSS feed to your podcast app to follow us directly.

Here is an excerpt from our conversation:

Jesse Jenkins: Let’s start with the joule. The joule is the SI unit for both work and energy. And the basic definition of energy is the ability to do work — not work in a job, but like work in the physics sense, meaning we are moving or displacing an object around. So a joule is defined as 1 newton-meter, among other things. It has an electrical equivalent, too. A newton is a unit of force, and force is accelerating a mass, from basic physics, over some distance in this case. So 1 meter of distance.

So we can break that down further, right? And we can describe the newton as 1 kilogram accelerated at 1 meter per second, squared. And then the work part is over a distance of one meter. So that kind of gives us a sense of something you feel. A kilogram, right, that’s 2.2 pounds. I don’t know, it’s like … I’m trying to think of something in my life that weighs a kilogram. Rob, can you think of something? A couple pounds of food, I guess. A liter of water weighs a kilogram by definition, as well. So if you’ve got like a liter bottle of soda, there’s your kilogram.

Then I want to move it over a meter. So I have a distance I’m displacing it. And then the question is, how fast do I want to do that? How quickly do I want to accelerate that movement? And that’s the acceleration part. And so from there, you kind of get a physical sense of this. If something requires more energy, if I’m moving more mass around, or if I’m moving that mass over a longer distance — 1 meter versus 100 meters versus a kilometer, right? — or if I want to accelerate that mass faster over that distance, so zero to 60 in three seconds versus zero to 60 in 10 seconds in your car, that’s going to take more energy.

Robinson Meyer: I am looking up what weighs … Oh, here we go: A 13-inch MacBook Air weighs about, a little more than a kilogram.

Jenkins: So your laptop. If you want to throw your laptop over a meter, accelerating at a pace of 1 meter per second, squared …

Meyer: That’s about a joule.

Jenkins: … that’s about a joule.

Mentioned:

This episode of Shift Key is sponsored by …

The Yale Center for Business and the Environment’s online clean energy programs equip you with tangible skills and powerful networks—and you can continue working while learning. In just five hours a week, propel your career and make a difference.

Music for Shift Key is by Adam Kromelow.