Lifestyle

The Quest to Ban the Best Raincoats in the World

Why Patagonia, REI, and just about every other gear retailer are going PFAS-free.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

Why Patagonia, REI, and just about every other gear retailer are going PFAS-free.

Current conditions: Springlike weather is bringing rain from Texas to Michigan • A Saharan dust storm known as a calima is headed for Europe, threatening “blood rain” as far north as Luxembourg • The Greenlandic capital of Nuuk is poised for days of snow, but with limited accumulation.

The aerial assault the United States and Israel launched on Iran this past weekend is already sending oil prices upward. By Sunday evening, the price for West Texas Intermediate crude, the benchmark for the oil drilled in the U.S., had risen 2.78% to just over $67 per barrel. Brent crude, the benchmark typically used to measure Europe’s production, 2.87% to nearly $73 per barrel. Murban crude, the benchmark set out of Abu Dhabi, surged by more than 4% to north of $74. By rendering the Strait of Hormuz — the waterway between the United Arab Emirates and Iran through which 15% of global oil flows and which tapers to just 20 miles wide at its narrowest point — impassable, the conflict could send prices per barrel as high as $100 or more, the consultancy Wood Mackenzie warned Sunday night. “The key question is when do vessels re-establish export flows,” Alan Gelder, Wood Mackenzie’s senior vice president of refining, chemicals and oil markets, said in a statement. “No doubt, tanker rates and insurance will increase dramatically, but these costs would only be a small part of the oil price impact associated with a curtailment of oil flows if they last for more than a few days.”

The rise in prices began weeks ago as the biggest U.S. troop buildup in the Middle East since 2003 seemed to presage war. The market isn’t just reflecting a fear of an unpredictable and prolonged halt to tanker traffic through the Strait. Insurers are threatening to cancel policies on vessels that dare to pass the waterway right now, the Financial Times reported. Iranian attacks on buildings and infrastructure belonging to America’s Arab allies across the Persian Gulf suggests the rest of the region’s oil production could face damage. “Right next door, you’ve got Iraq, you’ve got Saudi Arabia, and you’ve got the Emirates and others who collectively are more like 20 million barrels per day. And that is obviously a much bigger deal,” Rory Johnston, petroleum analyst and author of Commodity Context, told Heatmap’s Matthew Zeitlin.

A North Dakota judge finalized a $345 million judgement against Greenpeace USA on Friday, ordering the American chapter of the famed activist group to pay out the damages from its protests against the construction of the Dakota Access Pipeline. The ruling came after judge James Gion decided in October to slash almost half the $667 million that a jury awarded developer Energy Transfer Partners a year ago. The Dallas-based company called the ruling an “important step in this legal process of holding Greenpeace accountable for its unlawful and damaging actions against us.” In its own statement, Greenpeace said, “this is not the end of the case — or Greenpeace USA.” Rather, the group said it will request a new trial and, if necessary, “appeal the decision to the North Dakota Supreme Court.” The organization, which has since its founding in 1971 embarked on audacious acts of protest to raise awareness about environmental destruction, cast its fight against the ruling as a battle to protect Americans’ First Amendment rights. “In the years since the Standing Rock protests, anti-protest laws have spread across the U.S. and the world. Two of the most important components of change and progress throughout human history — free speech and peaceful protest – have never been more endangered,” Greenpeace said in the statement. “We must defend those rights. Our future depends on it.”

Last year, the International Seabed Authority, a little known United Nations agency based in Jamaica, debated how to establish rules for giving private companies permits to collect mineral-rich nodules off the deep ocean floor in waters far from any country’s maritime borders. Under outside pressure from the U.S., which is not a signatory to the ISA and has vowed under the Trump administration to go it alone on deep-sea mining, countries failed to reach an agreement. When the body reconvenes this week in the capital city of Kingston, the head of the ISA is determined to finalize a plan. In an interview with The New York Times, ISA chief Leticia Caravalho promised to broker a deal this year, lest an area in international waters become what she called the Wild West. “The world agreed 30 years ago that this is an area that belongs to all of us, and we should go there collectively,” she said. Banning mining outright, as some countries (and groups such as Greenpeace) have called for, would only take money away from scientific research and delay setting strict environmental protections, she said. “Being able to make the rules before activity starts is unique in human history,” she said.

Sign up to receive Heatmap AM in your inbox every morning:

The 220-megawatt ACES Delta green hydrogen project in Utah is by far the largest in the U.S. Now it’s ready to launch. As of last week, all 40 of the electrolyzers at the facility were installed and fully operational, supplier HydrogenPro told the trade publication Hydrogen Insight. It’s a critical milestone for a sector facing mounting challenges as the federal tax credit known as 45V begins its earlier phase out next year and the Trump administration yanks funding for the two regional hubs meant to hasten deployment of green hydrogen technology. Not every project is panning out as well. In New York, the developer Plug Power announced plans to abandon a 120-megawatt plant and sell the land to a data center company.

There’s a lot going on in hydrogen, including entirely new colors added to the rainbow scheme that describes how the fuel is made. If you want a quick 101 guide, this episode of Heatmap's Shift Key podcast is a good place to start.

At this stage in the new nuclear race, the company that looks likely to deploy the first small modular reactor in North America is GE Vernova Hitachi Nuclear Energy, the U.S.-Japanese joint venture building its debut BWRX-300 at the Darlington nuclear plant in Ontario, Canada. The developer is set to build another one of the third-generation, 300-megawatt reactors at the Tennessee Valley Authority soon after, and, as I reported for Heatmap, received major funding from the Department of Energy last year to pull it off. Until now, five European countries have been considering buying their own BWRX-300s: Czechia, Estonia, Finland, Poland, and Sweden. Now add a sixth. Lithuania just signed onto a memorandum of understanding in Washington promising to assess the potential to deploy the reactor, according to World Nuclear News.

There is a bright spot for clean energy in the Middle East. In Iraq, the first 250-megawatt section of what’s designed to be a 1-gigawatt solar farm is expected to enter operation in the next few days after the facility’s transmission connection powered on for the first time. Located in the Basra region, site of some of the bloodiest battles of the Iraq war, the project is a joint venture between the French giant TotalEnergies, which has a 45% stake; the Basrah Oil Company, which commands 30% of the solar farm; and QatarEnergy, with 25%, according to Renewables Now.

On the solar siege, New York’s climate law, and radioactive data center

Current conditions: A rain storm set to dump 2 inches of rain across Alabama, Tennessee, Georgia, and the Carolinas will quench drought-parched woodlands, tempering mounting wildfire risk • The soil on New Zealand’s North Island is facing what the national forecast called a “significant moisture deficit” after a prolonged drought • Temperatures in Odessa, Texas, are as much as 20 degrees Fahrenheit hotter than average.

For all its willingness to share in the hype around as-yet-unbuilt small modular reactors and microreactors, the Trump administration has long endorsed what I like to call reactor realism. By that, I mean it embraces the need to keep building more of the same kind of large-scale pressurized water reactors we know how to construct and operate while supporting the development and deployment of new technologies. In his flurry of executive orders on nuclear power last May, President Donald Trump directed the Department of Energy to “prioritize work with the nuclear energy industry to facilitate” 5 gigawatts of power uprates to existing reactors “and have 10 new large reactors with complete designs under construction by 2030.” The record $26 billion loan the agency’s in-house lender — the Loan Programs Office, recently renamed the Office of Energy Dominance Financing — gave to Southern Company this week to cover uprates will fulfill the first part of the order. Now the second part is getting real. In a scoop on Thursday, Heatmap’s Robinson Meyer reported that the Energy Department has started taking meetings with utilities and developers of what he said “would almost certainly be AP1000s, a third-generation reactor produced by Westinghouse capable of producing up to 1.1 gigawatts of electricity per unit.”

Reactor realism includes keeping existing plants running, so notch this as yet more progress: Diablo Canyon, the last nuclear station left in California, just cleared the final state permitting hurdle to staying open until 2030, and possibly longer. The Central Coast Water Board voted unanimously on Thursday to give the state’s last nuclear plant a discharge permit and water quality certification. In a post on LinkedIn, Paris Ortiz-Wines, a pro-nuclear campaigner who helped pass a 2022 law that averted the planned 2025 closure of Diablo Canyon, said “70% of public comments were in full support — from Central Valley agricultural associations, the local Chamber of Commerce, Dignity Health, the IBEW union, district supervisors, marine meteorologists, and local pro-nuclear organizations.” Starting in 2021, she said, she attended every hearing on the bill that saved the plant. “Back then, I knew every single pro-nuclear voice testifying,” she wrote. “Now? I’m meeting new ones every hearing.”

It was the best of times, it was the worst of times. It was a year of record solar deployments, it was a year of canceled solar megaprojects, choked-off permits, and desperate industry pleas to Congress for help. But the solar industry’s political clouds may be parting. The Department of the Interior is reviewing at least 20 commercial-scale projects that E&E News reported had “languished in the permitting pipeline” since Trump returned to office. “That includes a package of six utility-scale projects given the green light Friday by Interior Secretary Doug Burgum to resume active reviews, such as the massive Esmeralda Energy Center in Nevada,” the newswire reported, citing three anonymous career officials at the agency.

Heatmap’s Jael Holzman broke the news that the project, also known as Esmeralda 7, had been canceled in October. At the time, NextEra, one of the project’s developers, told her that it was “committed to pursuing our project’s comprehensive environmental analysis by working closely with the Bureau of Land Management.” That persistence has apparently paid off. In a post on X linking to the article, Morgan Lyons, the senior spokesperson at the Solar Energy Industries Association, called the change “quite a tone shift” with the eyes emoji. GOP voters overwhelmingly support solar power, a recent poll commissioned by the panel manufacturer First Solar found. The MAGA coalition has some increasingly prominent fans. As I have covered in the newsletter, Katie Miller, the right-wing influencer and wife of Trump consigliere Stephen Miller, has become a vocal proponent of competing with China on solar and batteries.

Get Heatmap AM directly in your inbox every morning:

MP Materials operates the only active rare earths mine in the United States at California’s Mountain Pass. Now the company, of which the federal government became the largest shareholder in a landmark deal Trump brokered earlier this year, is planning a move downstream in the rare earths pipeline. As part of its partnership with the Department of Defense, MP Materials plans to invest more than $1 billion into a manufacturing campus in Northlake, Texas, dedicated to making the rare earth magnets needed for modern military hardware and electric vehicles. Dubbed 10X, the campus is expected to come online in 2028, according to The Wall Street Journal.

Sign up to receive Heatmap AM in your inbox every morning:

New York’s rural-urban divide already maps onto energy politics as tensions mount between the places with enough land to build solar and wind farms and the metropolis with rising demand for power from those panels and turbines. Keeping the state’s landmark climate law in place and requiring New York to generate the vast majority of its power from renewables by 2040 may only widen the split. That’s the obvious takeaway from data from the New York State Energy Research and Development Authority. In a memo sent Thursday to Governor Kathy Hochul on the “likely costs of” complying with the law as it stands, NYSERDA warned that the statute will increase the cost of heating oil and natural gas. Upstate households that depend on fossil fuels could face hikes “in excess of $4,000 a year,” while New York City residents would see annual costs spike by $2,300. “Only a portion of these costs could be offset by current policy design,” read the memo, a copy of which City & State reporter Rebecca C. Lewis posted on X.

Last fall, this publication’s energy intelligence unit Heatmap Pro commissioned a nationwide survey asking thousands of American voters: “Would you support or oppose a data center being built near where you live?” Net support came out to +2%, with 44% in support and 42% opposed. Earlier this month, the pollster Embold Research ran the exact same question by another 2,091 registered voters across the country. The shift in the results, which I wrote about here, is staggering. This time just 28% said they would support or strongly support a data center that houses “servers that power the internet, apps, and artificial intelligence” in their neighborhood, while 52% said they would oppose or strongly oppose it. That’s a net support of -24% — a 26-point drop in just a few months.

Among the more interesting results was the fact that the biggest partisan gap was between rural and urban Republicans, with the latter showing greater support than any other faction. When I asked Emmet Penney at the right-leaning Foundation for American Innovation to make sense of that for me, he said data centers stoke a “fear of bigness” in a way that compares to past public attitudes on nuclear power.

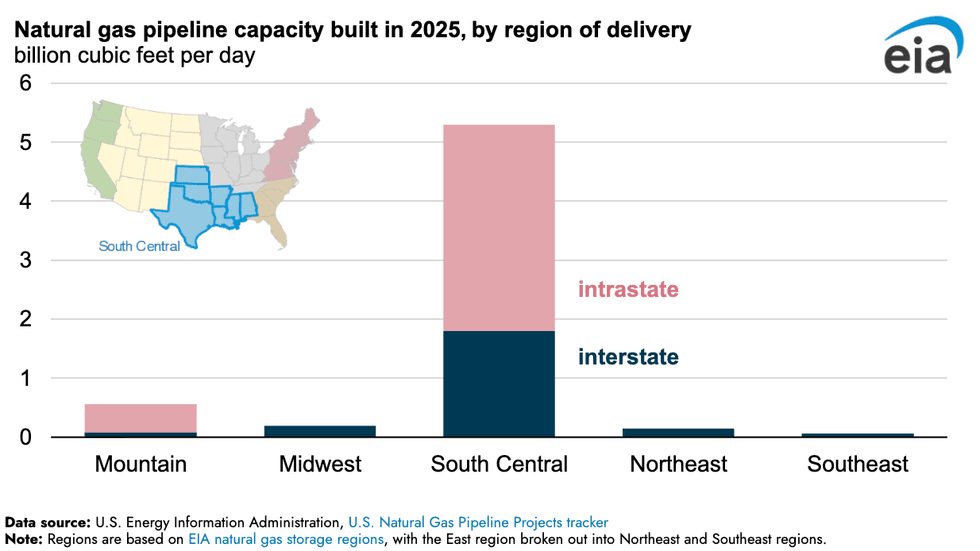

Gas pipeline construction absolutely boomed last year in one specific region of the U.S. Spanning Texas, Oklahoma, Kansas, Arkansas, Louisiana, Mississippi, and Alabama, the so-called South Central bloc saw a dramatic spike in intrastate natural gas pipelines, more than all other regions combined, per new Energy Information Administration data. It’s no mystery as to why. The buildout of liquified natural gas export terminals along the Gulf coast needs conduits to carry fuel from the fracking fields as far west as the Texas Permian.