Iran and its neighbors on the Persian Gulf are some of the largest oil and gas producers in the world and the country has long threatened to disrupt oil exports as an act of self-defense or retaliation from attack.

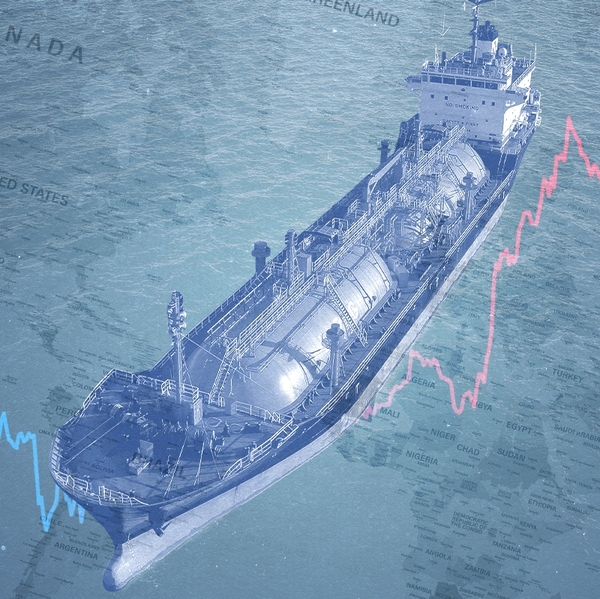

That may be already happening. According to data from Bloomberg, some oil tankers are pausing or turning around outside the vital Strait of Hormuz, a narrow, deep channel between Iran and Oman that connects the Persian Gulf to the Arabian Sea and thus to global markets in and bordering the Indian Ocean.

The strait has been “effectively closed,” according to a report from Tasnim, a semi-official news agency linked to the Iran Revolutionary Guard Corps. British naval officials also said they had “received multiple reports” of broadcasts that “have claimed that the Strait of Hormuz (SoH) has been closed.” And a European Union naval official told Reuters that the Iranian Revolutionary Guard had been broadcasting “no ship is allowed to pass the Strait of Hormuz” to ships in the area. Some tankers are still navigating the strait, according to marine tracking data from Kpler.

But it’s questionable whether Iran can actually maintain any attempted closure of the strait, whether by laying mines or directly threatening and attacking ships.

So far, U.S. attacks are “targeting, fairly heavily, naval assets and assets that are close to the Gulf,” Greg Brew, an analyst at the Eurasia Group, told me, which “suggests that they are trying to degrade Iran’s ability to disrupt energy traffic through the Strait of Hormuz.”

The U.S. is “trying to reduce the risks of Iranian effort to close the strait as part of this operation, rather than waiting to see if the Iranians escalate in that direction. The Iranians have responded by claiming that the strait has been closed. The problem for them now, though, is that they’ll have to enforce that threat.”

Closing the strait was a “tail risk” that had been roiling the oil market in the lead-up to Trump’s decision to launch the attack, Rory Johnston, petroleum analyst and author of Commodity Context, told me.

Global oil prices had gotten skittish over the past weeks, with the Brent crude benchmark getting as low at $66.30 per barrel in early February and getting near $73 per barrel on Friday. Brent prices approached $80 per barrel last June during the 12 Day War between Iran and Israel.

While the market could likely weather disruption to Iran’s own exports, jumpy behavior in the market was due to pricing in an enhanced risk of a region-wide calamity. Options traders especially were “attempting to hedge that enormous tail risk,” Johnston said, and “that was really moving the market.”

And even if the strait is not directly closed off by the Iranian military, ships may find it financially onerous to attempt the passage. “Insurers told ship owners on Saturday they would cancel policies and raise coverage prices for vessels travelling through the Gulf and Strait of Hormuz after the U.S. and Israel attacked Iran,” the Financial Times reported Saturday.

Another risk to the region’s oil sector is that Iran could retaliate by striking oil production and exporting infrastructure in neighboring countries, Johnston told me. “Right next door, you’ve got Iraq, you’ve got Saudi Arabia, and you’ve got the Emirates and others who collectively are more like 20 million barrels per day. And that is obviously a much bigger deal,” Johnston said, comparing their production to Iran’s own oil industry.

Of course, Iran is still a major exporter despite U.S. sanctions; in the days running up to the U.S. attack, it was shipping out around 3 million barrels per day from Kharg Island in the Strait of Hormuz, according to data from Bloomberg, almost triple its exports from equivalent dates in January and nearly its entire daily production.

Iran’s exports “had actually surged immediately ahead of what’s gone down over the past 24 hours,” Johnston told me. “In the past couple days, you’d seen a large surge of tankers departing Kharg Island, and the inventories on Kharg Island being drawn down, which is kind of what you would do if you expected that your exports were about to get disrupted.”

To the extent Iranian oil exports are cut off, that could be a big deal for China, which has become the number one destination for Middle East oil shipments. Beijing has been building up stockpiles of oil, likely preparing for the risk that sanctioned exporters like Iran and Venezuela would go off the market, as well as wider risks to exports from the Middle East.

“China is highly concerned over the military strikes against Iran,” the Chinese foreign ministry wrote on X. “China calls for an immediate stop of the military actions, no further escalation of the tense situation, resumption of dialogue and negotiation, and efforts to uphold peace and stability in the Middle East.”

Last year, China began to substantially increase its stockpiling of oil, going from 84,000 barrels per day to 430,000 barrels per day, some 83% of the growth of its imports, according to data and estimates from Rystad Energy and Erica Downs, a senior research scholar at the Columbia University Center on Global Energy Policy.

While the U.S. is now far less reliant on oil exports from the Middle East, oil and gas is still a global market. If Middle Eastern oil and gas exports are disrupted, that will likely increase the price of energy — whether it’s gasoline, electricity, or even home heating — as American energy producers can sell their barrels and BTUs at higher prices globally.

Smoke billows from a missile strike in Tehran. Fatemeh Bahrami/Anadolu via Getty Images

Smoke billows from a missile strike in Tehran. Fatemeh Bahrami/Anadolu via Getty Images