You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

The long-delayed risk disclosure regulation is almost here.

A new era of transparency for corporate sustainability is coming — finally. After two years of deliberation, the Securities and Exchange Commission is expected to issue a final rule requiring public companies to make climate-related disclosures to investors. The decision could come as soon as next week.

The rule considers two categories of climate-related information relevant to investors: greenhouse gas emissions and exposure to climate-related risks like extreme weather or future regulations. While many companies voluntarily disclose this kind of information in other ways, the rules will both require and standardize climate-based reporting as a core part of a company’s fiduciary duty.

From almost the moment it appeared, the proposal has been the center of a lobbying firestorm. Some of the rule’s opponents write it off as part of an activist agenda — an indirect route to economy-wide carbon regulations. “The host of new requirements in this Proposed Rule are motivated by a small number of environmental activists who seek to steer the economy away from fossil fuels,” wrote twelve Republican attorneys general in a letter to the SEC responding to the proposal. The U.S. Chamber of Commerce, meanwhile, vowed to fight back against “unlawful and excessive government overreach.” (At a Chamber-sponsored event last October, SEC Chair Gary Gensler joked, “Wait, are you already suing us? I just walked in.”)

Certainly there are environmentalists who do see the rule as a tool to undermine the oil and gas industry. But proponents primarily make the case that the stakes are less about the atmosphere and more about protecting investors and the entirety of the financial system.

While we’re still waiting on the final rule — which was originally expected in the fall of 2022 and has been repeatedly delayed — here’s a catch-up on what we know so far.

At a basic level, the SEC makes rules saying what companies have to disclose and how so that investors can make well-informed decisions. The two types of information this particular rule covers — climate-related risks and greenhouse gas emissions — are distinct, but related.

The former is pretty straightforward. From the growing number of billion-dollar weather- and climate-related disasters in the United States to the ongoing exodus of insurance companies from fire and flood-prone areas to trade delays in the drought-stricken Panama Canal, it’s clear that climate change poses a substantial financial risk to businesses. It makes sense that investors would want to know how exposed a company’s warehouses or data centers or trucking routes are to wildfires and floods.

But why should investors care about a company’s emissions? Because they are an indicator of another type of risk.

“A shareholder is not necessarily concerned with whether a company is ‘on target’ with any climate commitment,” Boston University law professor Madison Condon writes, “but rather in assessing how exposed an asset may be to changes in global or local climate policy, energy prices, or shifts in consumer and investor sentiments.”

These changes are already in motion around the world, and are generally accelerating. Companies that aren’t preparing could be disadvantaged, or alternatively, could miss lucrative opportunities. Steven Rothstein, a managing director at the nonprofit Ceres, gave the example of the steel industry. If you think that, in the next several years, customers are going to ask for low-emission steel — which some already are doing — or that there might be a regulatory cost put on steel-related emissions, then a company with lower emissions will be better positioned to grow, while a company with higher emissions might have to spend a bunch of money to retrofit its factories.

Part of the SEC’s rationale for the rule is the proliferation of investor-led initiatives calling for government-mandated climate risk disclosure. “These initiatives demonstrate that investors are using information about climate risks now as part of their investment selection process and are seeking more informative disclosures about those risks,” the Commission wrote in its proposal. (Oil giant Exxon filed suit against the sponsors of one such proposal in January, having lost patience with proposals it said were “calculated to diminish the company’s existing business.”)

After the draft rule was released in March 2022, the SEC was bombarded by thousands of comments from investors, academics, NGOs, politicians, trade associations, and companies. One analysis of those comments by legal researchers found that investors were the most supportive group, with more than 80% in favor of the rule.

The most contentious aspect of the proposal invited criticism even from parties that were generally supportive of the rule. The SEC had taken a strong stance on emissions reporting, asking companies to disclose emissions indirectly related to their business, known as“scope 3” emissions. That means a company like Amazon wouldn’t just have to report the emissions from its warehouses and delivery trucks, but also an estimate of the emissions associated with producing and using all the products it sells. A company like Ford wouldn’t just have to report the emissions from its factories, but also from the production of the raw materials it uses, as well as from all the gasoline burned in the cars it sells.

Those in support of scope 3 reporting point to the fact that for many companies, including the two I just named, the number would vastly exceed their direct emissions.

In a legal review of why scope 3 emissions reporting matters, Condon warned that without it, companies could begin outsourcing their most emissions-intensive processes to third parties in order to appear greener than they actually are. She also argued that leaving out scope 3 obscures climate risks. She gave the example of electric vehicles, which can involve higher emissions during production than conventional cars but result in much lower emissions over their lifecycle. “When excluding Scope 3, an EV manufacturer is penalized, even though from the perspective of considering transition risk and climate impact, this makes little sense,” she wrote.

But companies and their trade associations threw every excuse at the idea of a scope 3 requirement: It would cost too much to gather the data; the data on supply chain emissions is unreliable and impossible to verify; since companies don’t directly produce these emissions, they aren’t relevant; etc.

And by all accounts, they won. The SEC is expected to drop requirements to report scope 3 emissions in the final rule.

However, that’s unlikely to satisfy opponents, many of whom, like the Republican attorneys generals who wrote letters to the Commission, say the SEC doesn’t have the legal authority to require climate-related disclosures at all. If there’s one thing that critics and supporters agree on, it’s that the rule, whatever it says, is going to be challenged in court.

A lot of companies are going to have to report their scope 3 emissions anyway. The European Union’s Corporate Sustainability Reporting Directive includes scope 3 and is expected to cover more than 50,000 companies, with some starting to report as soon as this year; U.S.-based businesses on EU-regulated exchanges, or with subsidiaries or parent companies in Europe, will be expected to comply. A similar rule voted into law in California last year also requires scope 3 emissions disclosures and covers any company doing business in the state — whether private or public — giving it broader reach than the SEC. However, Governor Gavin Newsom did not include any funding for the law in his budget proposal this year, creating concern that it will be delayed.

Danny Cullenward, a climate economist and legal expert, said the fate of the California regulations are important in light of the likely Supreme Court challenge to the SEC rule. “It's a lot harder to mount comparably broad challenges to state laws on this front,” he told me.

Despite the SEC’s narrow focus on protecting investors, the mandatory disclosure of corporate emissions and climate risks would have widespread effects — even some that regular people might feel. Suddenly, consumers would have better tools to compare the relative sustainability of different companies and products. Activists would have more documentation to hold companies accountable for greenwashing or failing to live up to their public climate commitments.

The rule is also set to spark an explosion in the businesses of corporate emissions accounting and climate risk analysis. Most companies don’t have the staff or expertise to track their emissions, and thus will have to turn either to specialized climate-specific firms like Watershed or all-purpose corporate accountants like Deloitte to manage the disclosure process for them. Similarly, analytics giants like Moodys and S&P Global will also be called upon to feed company data into climate models and spit out risk reports.

Both exercises come with inherent challenges and uncertainties. Climate risk researchers have warned that rating services keep their methodologies in a black box, making it hard to know whether they are using climate models appropriately. “The misuse of climate models risks a range of issues, including maladaptation and heightened vulnerability of business to climate change, an overconfidence in assessments of risk, material misstatement of risk in financial reports, and the creation of greenwash,” wrote the authors of a 2021 article in the journal Nature Climate Change.

“When you ask, ‘What is my exposure to future climate risks?,’ you're asking for a projection of future climate states and probabilities of different future climate outcomes and extreme weather events. There's an enormous amount of scientific uncertainty and complexity in getting to that,” Cullenward told me.

But while neither emissions accounting nor climate risk assessment may be perfectly up to the task yet, Cullenward argued that’s all the more reason for the SEC to get these rules in place.

“If you don't ask people to disclose what's going on, it's just sticking your head in the sand,” he said. “No one will ever know how to do it perfectly, getting out of the gate. To me that is not a reason to stop or to slow down, that is a reason to get started.”

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

New research out today shows a 10-fold increase in smoke mortality related to climate change from the 1960s to the 2010.

If you are one of the more than 2 billion people on Earth who have inhaled wildfire smoke, then you know firsthand that it is nasty stuff. It makes your eyes sting and your throat sore and raw; breathe in smoke for long enough, and you might get a headache or start to wheeze. Maybe you’ll have an asthma attack and end up in the emergency room. Or maybe, in the days or weeks afterward, you’ll suffer from a stroke or heart attack that you wouldn’t have had otherwise.

Researchers are increasingly convinced that the tiny, inhalable particulate matter in wildfire smoke, known as PM2.5, contributes to thousands of excess deaths annually in the United States alone. But is it fair to link those deaths directly to climate change?

A new study published Monday in Nature Climate Change suggests that for a growing number of cases, the answer should be yes. Chae Yeon Park, a climate risk modeling researcher at Japan’s National Institute for Environmental Studies, looked with her colleagues at three fire-vegetation models to understand how hazardous emissions changed from 1960 to 2019, compared to a hypothetical control model that excluded historical climate change data. They found that while fewer than 669 deaths in the 1960s could be attributed to climate change globally, that number ballooned to 12,566 in the 2010s — roughly a 20-fold increase. The proportion of all global PM2.5 deaths attributable to climate change jumped 10-fold over the same period, from 1.2% in the 1960s to 12.8% in the 2010s.

“It’s a timely and meaningful study that informs the public and the government about the dangers of wildfire smoke and how climate change is contributing to that,” Yiqun Ma, who researches the intersection of climate change, air pollution, and human health at the Yale School of Medicine, and who was not involved in the Nature study, told me.

The study found the highest climate change-attributable fire mortality values in South America, Australia, and Europe, where increases in heat and decreases in humidity were also the greatest. In the southern hemisphere of South America, for example, the authors wrote that fire mortalities attributable to climate change increased from a model average of 35% to 71% between the 1960s and 2010s, “coinciding with decreased relative humidity,” which dries out fire fuels. For the same reason, an increase in relative humidity lowered fire mortality in other regions, such as South Asia. North America exhibited a less dramatic leap in climate-related smoke mortalities, with climate change’s contribution around 3.6% in the 1960s, “with a notable rise in the 2010s” to 18.8%, Park told me in an email.

While that’s alarming all on its own, Ma told me there was a possibility that Park’s findings might actually be too conservative. “They assume PM2.5 from wildfire sources and from other sources” — like from cars or power plants — “have the same toxicity,” she explained. “But in fact, in recent studies, people have found PM2.5 from fire sources can be more toxic than those from an urban background.” Another reason Ma suspected the study’s numbers might be an underestimate was because the researchers focused on only six diseases that have known links to PM2.5 exposure: chronic obstructive pulmonary disease, lung cancer, coronary heart disease, type 2 diabetes, stroke, and lower respiratory infection. “According to our previous findings [at the Yale School of Medicine], other diseases can also be influenced by wildfire smoke, such as mental disorders, depression, and anxiety, and they did not consider that part,” she told me.

Minghao Qiu, an assistant professor at Stony Brook University and one of the country’s leading researchers on wildfire smoke exposure and climate change, generally agreed with Park’s findings, but cautioned that there is “a lot of uncertainty in the underlying numbers” in part because, intrinsically, wildfire smoke exposure is such a complicated thing to try to put firm numbers to. “It’s so difficult to model how climate influences wildfire because wildfire is such an idiosyncratic process and it’s so random, ” he told me, adding, “In general, models are not great in terms of capturing wildfire.”

Despite their few reservations, both Qiu and Ma emphasized the importance of studies like Park’s. “There are no really good solutions” to reduce wildfire PM2.5 exposure. You can’t just “put a filter on a stack” as you (sort of) can with power plant emissions, Qiu pointed out.

Even prescribed fires, often touted as an important wildfire mitigation technique, still produce smoke. Park’s team acknowledged that a whole suite of options would be needed to minimize future wildfire deaths, ranging from fire-resilient forest and urban planning to PM2.5 treatment advances in hospitals. And, of course, there is addressing the root cause of the increased mortality to begin with: our warming climate.

“To respond to these long-term changes,” Park told me, “it is crucial to gradually modify our system.”

On the COP16 biodiversity summit, Big Oil’s big plan, and sea level rise

Current conditions: Record rainfall triggered flooding in Roswell, New Mexico, that killed at least two people • Storm Ashley unleashed 80 mph winds across parts of the U.K. • A wildfire that broke out near Oakland, California, on Friday is now 85% contained.

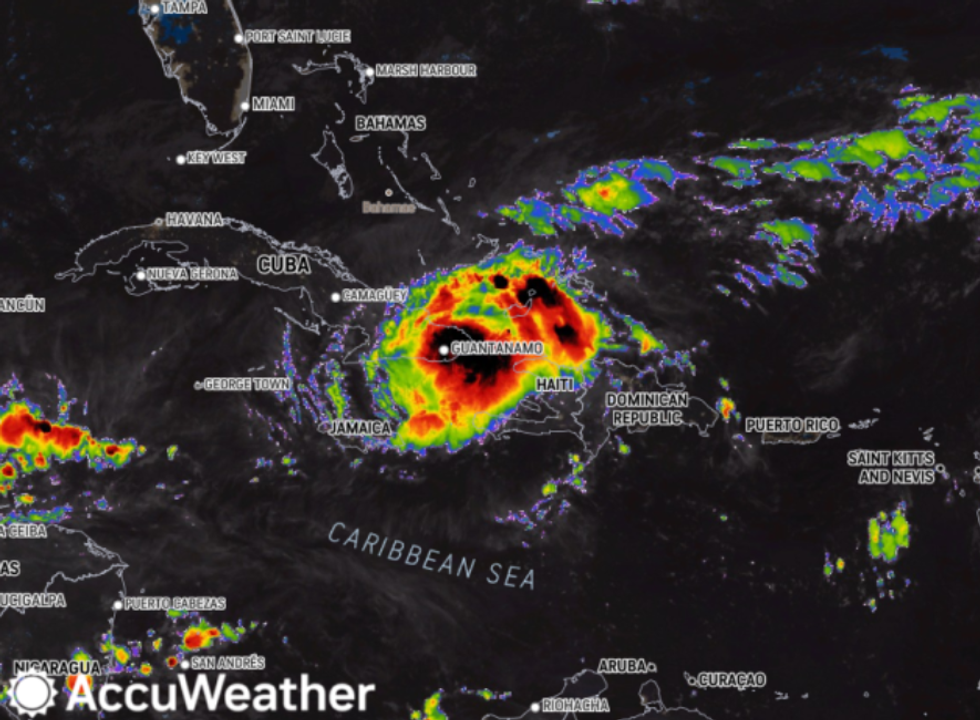

Forecasters hadn’t expected Hurricane Oscar to develop into a hurricane at all, let alone in just 12 hours. But it did. The Category 1 storm made landfall in Cuba on Sunday, hours after passing over the Bahamas, bringing intense rain and strong winds. Up to a foot of rainfall was expected. Oscar struck while Cuba was struggling to recover from a large blackout that has left millions without power for four days. A second system, Tropical Storm Nadine, made landfall in Belize on Saturday with 60 mph winds and then quickly weakened. Both Oscar and Nadine developed in the Atlantic on the same day.

The COP16 biodiversity summit starts today in Cali, Colombia. Diplomats from 190 countries will try to come up with a plan to halt global biodiversity loss, aiming to protect 30% of land and sea areas and restore 30% of degraded ecosystems by 2030. Discussions will revolve around how to monitor nature degradation, hold countries accountable for their protection pledges, and pay for biodiversity efforts. There will also be a big push to get many more countries to publish national biodiversity strategies. “This COP is a test of how serious countries are about upholding their international commitments to stop the rapid loss of biodiversity,” said Crystal Davis, Global Director of Food, Land, and Water at the World Resources Institute. “The world has no shot at doing so without richer countries providing more financial support to developing countries — which contain most of the world’s biodiversity.”

A prominent group of oil and gas producers has developed a plan to roll back environmental rules put in place by President Biden, The Washington Post reported. The paper got its hands on confidential documents from the American Exploration and Production Council (AXPC), which represents some 30 producers. The documents include draft executive orders promoting fossil fuel production for a newly-elected President Trump to sign if he takes the White House in November, as well as a roadmap for dismantling many policies aimed at getting oil and gas producers to disclose and curb emissions. AXPC’s members, including ExxonMobil, ConocoPhillips, and Hess, account for about half of the oil and gas produced in the U.S., the Post reported.

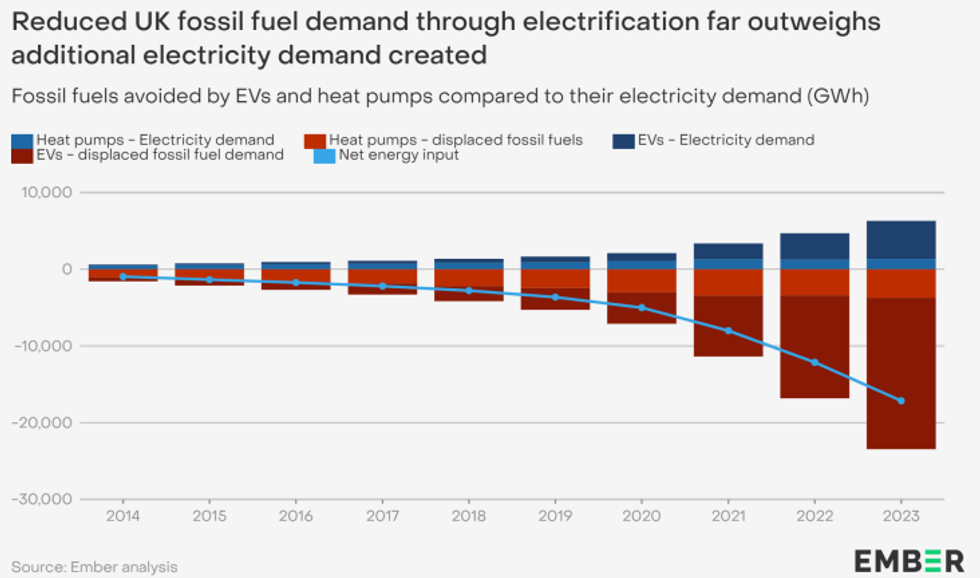

A new report from the energy think tank Ember looks at how the uptake of electric vehicles and heat pumps in the U.K. is affecting oil and gas consumption. It found that last year the country had 1.5 million EVs on the road, and 430,000 residential heat pumps in homes, and the reduction in fossil fuel use due to the growth of these technologies was equivalent to 14 million barrels of oil, or about what the U.K. imports over a two-week span. This reduction effect will be even stronger as more and more EVs and heat pumps are powered by clean energy. The report also found that even though power demand is expected to rise, efficiency gains from electrification and decarbonization will make up for this, leading to an overall decline in energy use and fossil fuel consumption.

The world’s sea levels are projected to rise by more than 6 inches on average over the next 30 years if current trends continue, according to a new study published in the journal Nature. “Such rates would represent an evolving challenge for adaptation efforts,” the authors wrote. By examining satellite data, the researchers found that sea levels have risen by about .4 inches since 1993, and that they’re rising faster now than they were then. In 1993 the seas were rising by about .08 inches per year, and last year they were rising at .17 inches per year. These are averages, of course, and some areas are seeing much more extreme changes. For example, areas around Miami, Florida, have already seen sea levels rise by 6 inches over the last 31 years.

“As the climate crisis grows more urgent, restoring faith in government will be more important than ever.” –Paul Waldman writing for Heatmap about the profound implications of America becoming a low-trust society.

That means big, bad things for disaster relief — and for climate policy in general.

When Hurricanes Helene and Milton swept through the Southeast, small-government conservatives demanded fast and effective government service, in the form of relief operations organized by the Federal Emergency Management Agency. Yet even as the agency was scrambling to meet the need, it found itself targeted by far-right militias, who prevented it from doing its job because they had been led by cynical politicians to believe it wasn't doing its job.

It’s almost a law of nature, or at least of politics, that when government does its job, few people notice — only when it screws up does everyone pay attention. While this is nothing new in itself, it has increasingly profound implications for the future of government-driven climate action. While that action comes in many forms and can be sold to the public in many ways, it depends on people having faith that when government steps in — whether to create new regulations, invest in new technologies, or provide benefits for climate-friendly choices — it knows what it’s doing and can accomplish its goals.

As the climate crisis grows more urgent, restoring faith in government will be more important than ever. Unfortunately, simply doing the right things — like responding competently to disasters — won’t be enough to convince people that the next climate initiative will do what it’s supposed to.

The number of people expressing faith in government today is nearly as low as it has been in the half-century pollsters have been asking the question. That trust has bounced up and down a bit — it rose after September 11, then fell again during the disastrous Iraq War — but for the last decade and half, only around 20% of Americans say they trust the government most of the time.

It’s partisan, of course: People express more trust when their party controls the White House. And the decline of trust reaches beyond the government. Faith in most of the key institutions of American life — business, education, religion, news media — has fallen in recent decades, sometimes for good reason. The net result is a public skeptical that those in authority have the ability to solve complex problems.

Changing that perspective is extraordinarily difficult, often because of the nature of good and bad news: The former usually happens slowly and invisibly, while the latter often happens dramatically and all at once.

Take the program created in the Energy Department under George W. Bush to provide loans to innovative energy technologies. If most Americans had heard of it, it was because of one company: Solyndra, a manufacturer of innovative but overly expensive solar panels. Undercut by a decline in prices of traditional panels, the company went under, and its $535 million loan was never repaid. Republicans made Solyndra’s failure into a major controversy, claiming that the program showed that government investment in green technology was corrupt, ineffective, and wasteful.

What few people heard about was that the loan program overall not only turned a profit at the time (and for what it’s worth, it still does), it also provided help to many successful companies, even if a few failed — as any venture capital investor could tell you is inevitable. The successes included Tesla, which used its federal loan to ramp up production of the sedans that would turn it from a niche manufacturer of electric roadsters into what it is today. Needless to say, Elon Musk does not advertise the fact that his success was built on government help.

More recently, the hurricane response has shown how partisan polarization can be used to undermine trust in government — especially when Donald Trump is involved. Trump took the opportunity of the hurricanes to accuse the federal government of being both political and partisan, delivering help only to those areas that vote for Democrats. Soon after, he promised to do precisely what he falsely accused the Biden administration of doing, saying that if he is president again, he will withhold disaster aid from California unless Gov. Gavin Newsom changes the state’s water policies to be more to Trump’s liking. “And we’ll say, Gavin, if you don’t do it, we’re not giving any of that fire money that we send you all the time for all the fire, forest fires that you have,” Trump said. And in fact, in his first term Trump did try to withhold disaster aid from blue states.

What sounds like hypocrisy is actually something much more pernicious. As he often does, Trump is arguing not that he is clean and his opponents are dirty, but that everyone is dirty, and it’s just a question of whether government is in the hands of our team or their team. When he says he’ll “drain the swamp,” he’s telling people both that government is corrupt, and the answer is merely to change who gets the spoils. If you believe him, you’ll have no trust in government whatsoever, even if you might think he’ll use it in a way you’ll approve of.

We’ve seen again and again that people want government to perform well and get angry when it doesn’t, but they don’t reward competence when it happens. Which is why making sure systems operate properly and problems are solved is necessary but not sufficient to win back trust. Government’s advocates — especially those who are counting on it to undertake ambitious climate action both now and in the future — need not only to deliver, they have to get better at, for lack of a better word, propaganda. Policy success is not its own advertisement. And despite his ample policy achievements, Joe Biden has not been a charismatic and effective messenger — on the role of government, or much else.

Ronald Reagan used to say that the most frightening words in the English language were “I’m from the government and I’m here to help”; the oft-repeated quip was at the center of his incredibly successful effort to delegitimize government in the eyes of voters. To reverse the decline of trust so people will believe that government has the knowledge and ability to tackle climate change, the public needs to be reminded — often and repeatedly — of what government does well.

Touting past and present successes on climate — and disaster relief, and so many other ways the government solves problems every day — is essential to building support for future climate initiatives. Those successes are all around, it’s just that most people never hear about them or take them for granted. But promoting government as an engine of positive change should be as high a priority for climate advocates, including those who hold public office, as discrediting government was for Reagan and is for Trump.