You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

On striking down the California waiver, the tax bill, and BYD

Current conditions: Showers and thunderstorms in the South and cool weather in the Northeast will make Memorial Day weekend “more reminiscent of late March than late May” • At least four people are dead and 50,000 stranded in New South Wales, Australia, due to torrential rainfall that is expected to ease Friday evening • Evacuation orders are in place around Oracle, Arizona, to the north of Tucson, due to the growing Cody Fire.

It’s official: After weeks of speculation and run-up, the Senate voted 51 to 44 on Thursday to overturn California’s waiver from the Clean Air Act to set stricter-than-federal emissions limits on cars and trucks. The vote was along party lines, with the exception of Michigan Democrat Elissa Slotkin, who joined Republicans in passing the disapproval resolution under the Congressional Review Act. California required companies to stop selling new gas vehicles by 2035, which Republicans had criticized as an “electric vehicle mandate” due to the size of the state and its influence over the automotive market.

The Senate’s parliamentarian and the Government Accountability Office had determined that the Senate could not use the CRA to prevent California from setting stricter emissions standards, as it has done since 1967, because the waiver is not a federal rule and therefore not subject to a simple 50-vote threshold repeal vote. To get around the technicality, Republicans voted Wednesday night on what Rhode Island Democratic Senator Sheldon Whitehouse called the “double nuclear option” — essentially declaring they were “within their rights to skirt a filibuster and muscle through measures to deny” California its unique emissions-setting authority, The New York Times writes. But that also means the door is now open “to challenges against all sorts of other federal program waivers — without having to worry about the Senate filibuster,” Capitol Hill correspondent Jamie Dupree wrote in his newsletter Thursday, adding, “it certainly is a substantial change in the precedents of the Senate. And now it’s the new regular order.” California Governor Gavin Newsom called the vote “illegal” and vowed to “fight this unconstitutional attack on California in court.”

We’re continuing to track the repercussions of the House reconciliation bill that passed early Thursday morning, including its “full-frontal assault on the residential solar business model,” in the words of my colleague Matthew Zeitlin. Though an earlier draft of the bill shortened the availability of the Residential Clean Energy Credit, 25D, for people who purchased home solar systems from 2034 to expiring at the end of this year, Matthew explains that the new language says no credit “shall be allowed under this section for any investment during the taxable year” if the entity claiming the tax credit “rents or leases such property to a third party during such taxable year” and “the lessee would qualify for a credit under section 25D with respect to such property if the lessee owned such property.” That’s “how you kill a business model in legislative text,” Matthew continues. The repercussions were immediate: By midday, shares of Sunrun were already down $37.5%, an erasure of almost $1 billion.

For the first time, BYD has outsold Tesla in Europe. In April, the Chinese automaker sold 7,231 electric vehicles, up 169% from the year prior, while Tesla sold 7,165 EVs, down 49% in the same period, Bloomberg reports based on market research by Jato Dynamics.

As we covered in AM earlier this month, the first quarter of 2025 was the second-best month ever for BEV sales in the European Union, despite “the name Tesla [becoming] toxic for so many, limiting its appeal,” Clean Technica wrote at the time. But while BYD marked a milestone in beating the American automaker, it remained in the 10th spot overall for electric vehicle sales, with Volkswagen the clear winner for the month with 23,514 sales. But BYD is “about to reinforce its EV lineup in Europe with the Dolphin Surf, a fully electric hatchback that will sell for” around $22,700 in Germany until the end of June, Bloomberg writes.

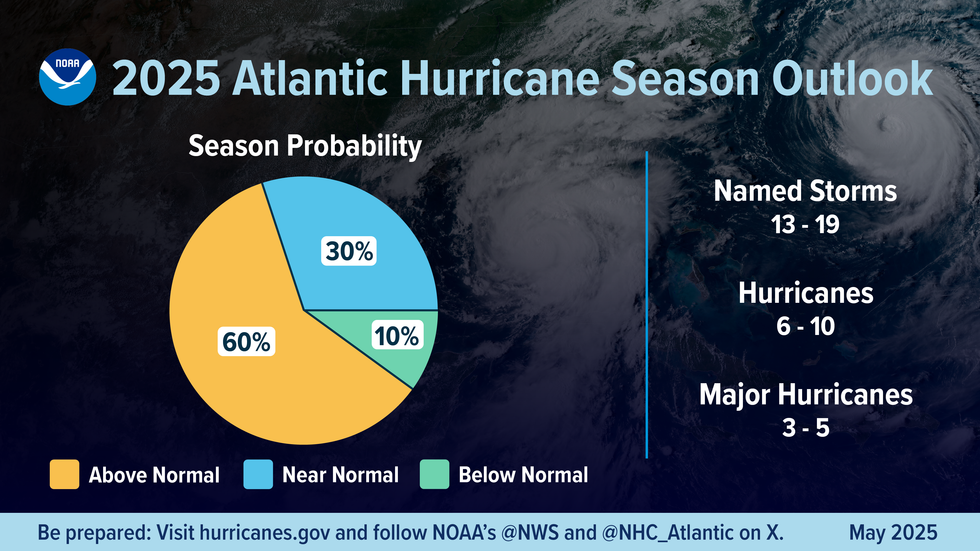

The National Oceanic and Atmospheric Administration released its forecast for the 2025 Atlantic hurricane season, with a higher estimated upper limit for named storms than earlier predictions from private forecasters. According to NOAA, we can expect between 13 and 19 named storms this year, of which six to 10 could become hurricanes and three to five could develop into major Category 3 or higher hurricanes. That puts the season on track to be more active than the average Atlantic hurricane season, when 14 named storms, seven hurricanes, and three major hurricanes can be expected.

Private forecasters also rely on NOAA data to inform their predictions, but arrived at slightly different conclusions. Colorado State University’s Department of Atmospheric Sciences forecasts 17 named storms for 2025, while AccuWeather predicts 13 to 18 named storms. Though the Atlantic has cooled slightly from its historic highs last year, it is still warmer than usual — part of what is spurring the above-average estimates for the season. Still, as I’ve reported, there are lingering concerns about the reliability of NOAA’s data in future years as the agency hemorrhages the personnel who repair the sensors that monitor sea temperatures or run quality control on the data.

Microsoft announced its commitment to purchase nearly 623,000 metric tons of low-carbon cement from the startup Sublime Systems on Thursday. The contract, which runs over a six- to nine-year period, is intended to “reduce emissions — both at Microsoft and globally,” Jeff Leeper, the vice president of global datacenter construction at Microsoft, said in a press release about the deal. The company aims to use the cement on its construction projects “when geographically possible,” including incorporating it in data centers, office buildings, and other infrastructure. The companies declined to share how much the deal was worth, Bloomberg writes.

My colleague Emily Pontecorvo profiled Sublime earlier this year, noting that cement is a significant source of carbon emissions — 8% of the global total — due to a chemical reaction with limestone kilns required for production. But Sublime has “developed a new way to make reactive lime that does not require limestone,” Emily explains. “Instead of heating up rocks in a kiln, they drive the chemical process with electric currents. This enables the company to avoid limestone and use a variety of other raw materials that do not contain carbon to produce lime.” The company is working to construct its first 30,000-ton commercial plant, which is expected to be completed in 2027.

Pakistan imported 22 gigawatts of solar panels in 2024, more than the entire country of Canada. “That’s not a typo or a spreadsheet rounding error. That’s the kind of number that turns heads at IEA meetings and makes policy analysts double-check their databases,” Clean Technica writes.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

A conversation on FEMA, ICE, and why local disaster response still needs federal support with the National Low-Income Housing Coalition’s Noah Patton.

Congress left for recess last week without reaching an agreement to fund the Department of Homeland Security, the parent agency of, among other offices, Customs and Border Protection, Immigration and Customs Enforcement, and somewhat incongruously, the Federal Emergency Management Agency. Democrats and Republicans remain leagues apart on their primary sticking point, ending the deadly and inhumane uses of force and detention against U.S. citizens and migrant communities. That also leaves FEMA without money for payroll and non-emergency programs.

The situation at the disaster response agency was already precarious — the office has had three acting administrators in less than a year; cut thousands of staff with another 10,000 on the chopping block; and has blocked and delayed funding to its local partners, including pausing the issuance of its Emergency Management Performance Grants, which are used for staffing, training, and equipping state-, city-, and tribal-level teams, pending updated population statistics post deportations.

Even so, FEMA remains technically capable of fulfilling its congressionally mandated duties due to an estimated $7 billion that remains in its Disaster Relief Fund. Still, the shutdown has placed renewed scrutiny on DHS Secretary Kristi Noem’s oversight of the agency. It has also elevated existing questions about what FEMA is doing alongside CBP and ICE in the first place.

To learn more about how the effects of the shutdown are trickling down through FEMA’s local operations, I spoke with Noah Patton, the director of disaster recovery at the National Low-Income Housing Coalition, which has publicly condemned the use of FEMA funding as a “political bargaining chip to allow ICE and CBP to continue their ongoing and imminent threats to the areas where they operate.”

When asked for comment, a FEMA spokesperson directed me to a DHS press release titled “Another Democrat Government Shutdown Dramatically Hurts America’s National Security.”

The conversation below has been edited for length and clarity.

Why is the DHS shutdown an issue you care about as a low-income housing organization? What are the stakes?

How the country responds to and recovers from disasters is inextricably linked to the issue of affordable housing. Often, households with the lowest incomes are in areas with the highest risk of disaster impacts. Our system has a lot of cracks in it. If you don’t have a rainy day fund for such things; if you’re someone who is not fully insured; if you have non-permanent employment — when disasters occur, you’re going to be hit the hardest. At the same time, you’ll receive the least assistance.

That not only exacerbates existing economic issues but also reduces the affordable housing stock available to the lowest-income households, as units are physically removed from the market when they’re destroyed or damaged by disasters.

What disasters are we talking about specifically at the moment? Are reimbursements for, say, the recent winter storms impacted by the shutdown?

Typically, when the [Disaster Relief Fund] is low, FEMA will implement critical needs funding. It pauses reimbursements for non-specific disaster-response projects and reallocates funds to preserve operational capacity for direct disaster response. That hasn’t happened yet because the DRF has sufficient funds. On the administrative end, reimbursements will be processed as we go along.

Is there anything you’re concerned about in the short term with regard to the DHS shutdown? Or has NLIHC pushed for the depoliticization of FEMA funding because of the cascading effects for the people you advocate for?

FEMA is okay as of right now. The need to stop ICE and CBP and the violence in communities across the country is taking precedence. We appreciate Congress’ interest in ensuring FEMA is adequately funded, but the DHS appropriations bill is not the only vehicle for providing FEMA funding. That’s why we’ve been pushing for a disaster-specific supplemental spending bill. That bill could also have longer-term assistance under HUD for places like Alaska [following Typhoon Halong], Los Angeles [following the January 2025 wildfires], and St. Louis [following the May 2025 tornado].

Maybe you’ve already answered my next question: How has NLIHC been navigating the tension between condemning ICE and CBP, while at the same time pushing for FEMA funding?

We have been big supporters of the House’s FEMA Act: the Fixing Emergency Management for Americans Act. It’s a bill that would remove FEMA from DHS, reestablish it as an independent agency as it was prior to 2003, and implement reforms to expand access to federal assistance for households with the lowest incomes after disasters. We’ve been supporters of that bill since it came out.

I’d also say, in the short term, I don’t see a huge amount of impact on the disaster response and recovery systems. It’s worth pausing on that, given everything going on with ICE and CBP.

What else is on your minds right now at NLIHC?

Much of the work we’re doing stems from the rapid, forced decentralization of the federal government’s emergency management capability — because emergency response and recovery now falls to the states. But many states lack robust disaster response and recovery programs. The state of Oklahoma, for example — I think their Emergency Management Office is 90% federally funded.

The administration’s pull-back of state-level emergency management performance grants and the coordination FEMA was providing on that will get the ball rolling; as we’ve seen in other disasters, the ball ends at households with the lowest incomes being the most impacted. We’re trying to head that off by coordinating advocates at the state and local levels to work with their local governments and facilitate more robust conversations on emergency management and related programs. A good example of that would be what we’re seeing in Washington State after the flooding from the atmospheric rivers. They have not received a disaster declaration from FEMA, so they’re not receiving federal assistance, but people are experiencing homelessness due to those floods. We’re working with folks there to craft programs that ensure that, in the absence of federal assistance, some form of aid continues.

For many years, the federal government was heavily involved in emergency management and served as the main coordinator. They were the source of the vast, vast, vast majority of funding. Now we’re looking toward a world where that’s less true, and where state-level mechanisms will be all the more important. Even if the FEMA Act is passed, it encourages state-level systems to emerge for responding to and recovering from disasters. We’re adding a focus to that state-level work that we didn’t necessarily need before.

The Trump administration has justified its defunding of FEMA by saying, “Well, disaster response is local, so this should be the responsibility of the states.” But like you were saying, places like Oklahoma get all their support from the federal government to begin with.

They always say, “Disaster response is local” because operationally, it needs to be. You’re not going to have a FEMA guy parachute in and start telling the local firefighters and cops what to do; that’s best handled by the folks who are on the ground and are familiar with their communities.

But it’s wrong to say, “If all disaster response is local, then why are we even involved?” FEMA provides the coordination and additional resources that are pivotal. Federal resources are allocated to local officials to respond to the disaster. The salaries of all those local emergency managers — at least, a high percentage of them — that money comes from the feds.

If the shutdown continues much longer, would that be another impact: local emergency managers not receiving their salaries?

The grant-making fight is separate. The administration is trying to slow down the flow of [emergency management preparedness grants] to state governments. Several states have filed high-profile lawsuits to obtain the grants that the federal government arbitrarily paused. Regardless of any shutdown, that will still be an issue.

On Georgia’s utility regulator, copper prices, and greening Mardi Gras

Current conditions: Multiple wildfires are raging on Oklahoma’s panhandle border with Texas • New York City and its suburbs are under a weather advisory over dense fog this morning • Ahmedabad, the largest city in the northwest Indian state of Gujarat, is facing temperatures as much as 4 degrees Celsius higher than historical averages this week.

The United States could still withdraw from the International Energy Agency if the Paris-based watchdog, considered one of the leading sources of global data and forecasts on energy demand, continues to promote and plan for “ridiculous” net-zero scenarios by 2050. That’s what Secretary of Energy Chris Wright said on stage Tuesday at a conference in the French capital. Noting that the IEA was founded in the wake of the oil embargoes that accompanied the 1973 Yom Kippur War, the Trump administration wants the organization to refocus on issues of energy security and poverty, Wright said. He cited a recent effort to promote clean cooking fuels for the 2 billion people who still lack regular access to energy — more than 2 million of whom are estimated to die each year from exposure to fumes from igniting wood, crop residue, or dung indoors — as evidence that the IEA was shifting in Washington’s direction. But, Wright said, “We’re definitely not satisfied. We’re not there yet.” Wright described decarbonization policies as “politicians’ dreams about greater control” through driving “up the price of energy so high that the demand for energy” plummets. “To me, that’s inhuman,” Wright said. “It’s immoral. It’s totally unrealistic. It’s not going to happen. And if so much of the data reporting agencies are on these sort of left-wing big government fantasies, that just distorts” the IEA’s mission.

Wright didn’t, however, just come to Paris to chastise the Europeans. Prompted by a remark from Jean-Luc Palayer, the top U.S. executive of French uranium giant Orano, Wright called the company “fantastic” and praised plans to build new enrichment facilities and bring waste reprocessing to America. While the French, Russians, and Japanese have long recycled spent nuclear waste into fresh fuel, the U.S. briefly but “foolishly” banned commercial reprocessing in the 1970s, Wright said, and never got an industry going again. As a result, all the spent fuel from the past seven decades of nuclear energy production is sitting on site in swimming pools or dry cask storage. “We want to have a nuclear renaissance. We have got to get serious about this stuff. So we will start reprocessing, likely in partnership with Orano,” Wright said. Designating Yucca Mountain as the first U.S. permanent repository for nuclear waste set the project in Nevada up for failure in the early 2000s, Wright added. “In the United States, we’ve tried to find a permanent repository for waste and we’ve had, I think, the wrong approach,” he noted. The Trump administration, he said, was “doing it differently” by inviting states to submit proposals for federally backed campuses to host nuclear enrichment and waste reprocessing facilities. Still, reprocessing leaves behind a small amount of waste that needs to be buried, so, Wright said, “we’re going to develop multiple long-term repositories.”

The Trump administration could tweak tariffs on metals and other materials, U.S. Trade Representative Jamieson Greer said Tuesday. During an appearance on CNBC’s “Squawk Box,” Greer said he’d heard from companies who claimed they needed to hire more workers to navigate the tariffs. “You may want to sometimes adjust the way some of the tariffs are for compliance purposes,” he said. “We’re not trying to have people deal with so much beancounting that they’re not running their company correctly.” Still, he said, the U.S. is “shipping more steel than ever,” and has, as I reported in a newsletter last month, the first new aluminum smelter in the works in half a century. “So clearly those [tariffs] are going in the right direction and they’re going to stay in place.”

Sign up to receive Heatmap AM in your inbox every morning:

California Governor Gavin Newsom, widely seen as a frontrunner for the Democratic presidential nod in two years, is already staking out an alternative energy approach to Trump. During a stop in London on his tour of Europe, Newsom this week signed onto a new pact with British Energy Secretary Ed Miliband, pledging to work together with the United Kingdom on deploying more clean energy technologies such as offshore wind in the nation’s most populous state. One of the biggest winners of the deal, according to Politico, is Octopus Energy, the biggest British energy supplier, which is looking to enter the California market. But the agreement also sets the stage for more joint atmospheric research between California and the U.K. “California is the best place in America to invest in a clean economy because we set clear goals and we deliver,” Newsom said. “Today, we deepened our partnership with the United Kingdom on climate action and welcomed nearly a billion dollars in clean tech investment from Octopus Energy.”

France, meanwhile, is realigning its energy plan for the next nine years in a way the Trump administration will like. The draft version of the plan released last year called for 90 gigawatts of installed solar capacity by 2035. But the latest plan published last week reduced the target to a range of 55 to 80 gigawatts. Onshore wind falls to 35 to 40 gigawatts from 40 to 45 gigawatts. Offshore wind drops to 15 gigawatts from 18 gigawatts. Instead, Renewables Now reported, the country is betting on a nuclear revival.

When Democrats unseated two Republicans on Georgia’s five-member Public Service Commission, the upsets signaled a change to the state’s utility regulator so big one expert described it to Heatmap’s Emily Pontecorvo at the time as “seismic.” Now one of the three remaining Republicans on the body is stepping aside in this year’s election. In a lengthy post on X, Tricia Pridemore said she would end her eight-year tenure on the commission by opting out of reelection. “I have consistently championed common-sense, America First policies that prioritize energy independence, grid reliability, and practical solutions over partisan rhetoric,” wrote Pridemore, who both championed the nuclear expansion at Georgia Power’s Plant Vogtle and pushed for more natural gas generation. “These efforts have laid the foundation for job creation, national security, and opportunity across our state. By emphasizing results over rhetoric, we have positioned Georgia as a leader in affordability, reliability, and forward-thinking energy planning.”

BHP, the world’s most valuable mining company, reported a nearly 30% spike in net profits for the first half of this year thanks to soaring demand for copper. The Australian giant’s chief executive, Mike Henry, said the earnings marked a “milestone” as copper contributed the largest share of its profit for the first time, accounting for 51% of income before interest, tax, depreciation, and amortization. The company also signed a $4.3 billion deal with Canada’s Wheaton Precious Metals to supply silver from its Antamina mine in Peru in a deal the Financial Times called “the largest of its kind for so-called precious metals streaming, where miners make deals to sell gold or silver that is a byproduct of their main business.”

The mining companies the Trump administration is investing in, on the other hand, may have less rosy news for the market. Back in October, I told you that the U.S. was taking a stake in Trilogy Metals after approving its request to build a mining road in a remote corner of Alaska that’s largely untouched by industry. On Tuesday, the company reported a net loss of $42 million. The loss largely stemmed from what Mining.com called “the treatment of the proposed U.S. government’s investment as a derivative financial instrument” under standard American accounting rules. The accounting impact, however, had no effect on the cash the company had on hand and “is expected to resolve once applicable conditions are met.”

“It’s an environmental catastrophe.” That’s how Brett Davis, the head of a nonprofit that advocates for less pollution at Mardi Gras, referred to the waste the carnival generates each year in New Orleans. Data the city’s sanitation department gave The New York Times showed that the weekslong party produced an average of 1,123 tons of waste per year for the last decade. Reusing the plastic beads that became popular in the 1970s when manufacturing moved overseas and made cheap goods widely accessible just amounts to “recirculating toxic plastic junk no one wants,” Davis told the newspaper. Instead, he’s sold more than $1 million in more sustainable alternative items to throw during the parade, including jambalaya mix, native flower start kits, and plant-based glitter.

Batteries can only get so small so fast. But there’s more than one way to get weight out of an electric car.

Batteries are the bugaboo. We know that. Electric cars are, at some level, just giant batteries on wheels, and building those big units cheaply enough is the key to making EVs truly cost-competitive with fossil fuel-burning trucks and cars and SUVs.

But that isn’t the end of the story. As automakers struggle to lower the cost to build their vehicles amid a turbulent time for EVs in America, they’re looking for any way to shave off a little expense. The target of late? Plain old wires.

Last month, when General Motors had to brace its investors for billions in losses related to curtailing its EV efforts and shifting factories back to combustion, it outlined cost-saving measures meant to get things moving in the right direction. While much of the focus was on using battery chemistries like lithium ion phosphate, otherwise known as LFP, that are cheaper to build, CEO Mary Barra noted that the engineers on every one of the company’s EVs were working “to take out costs beyond the battery,” of which cutting wiring will be a part.

They are not alone in this obsession. Coming into a do-or-die year with the arrival of the R2 SUV, Rivian said it had figured out how to cut two miles of wires out of the design, a coup that also cuts 44 pounds from the vehicle’s weight (this is still a 5,000-pound EV, but every bit counts). Ford has become obsessed with figuring out smarter and cheaper ways for its money-hemorrhaging EV division to build cars; the company admitted, after tearing down a Tesla Model 3 to look inside, that its Mustang Mach-E EV had a mile of extra and possibly unnecessary wiring compared to its rival.

A bunch of wires sounds like an awfully mundane concern for cars so sophisticated. But while every foot adds cost and weight, the obsession with stripping out wiring is about something deeper — the broad move to redefine how cars are designed and built.

It so happens that the age of the electric vehicle is also the age of the software-defined car. Although automobiles were born as purely mechanical devices, code has been creeping in for decades, and software is needed to manage the computerized fuel injection systems and on-board diagnostic systems that explain why your Check Engine light is illuminated. Tesla took this idea to extremes when it routed the driver’s entire user interface through a giant central touchscreen. This was the car built like a phone, enabling software updates and new features to be rolled out years after someone bought the car.

As Tesla ruled the EV industry in the 2010s, the smartphone-on-wheels philosophy spread. But it requires a lot of computing infrastructure to run a car on software, which adds complexity and weight. That’s why carmakers have spent so much time in the past couple of years talking about wires. Their challenge (among many) is to simplify an EV’s production without sacrificing any of its capability.

Consider what Rivian is attempting to do with the R2. As InsideEVs explains, electric cars have exploded in their need for electronic control units, the embedded computing brains that control various systems. Some models now need more than 100 to manage all the software-defined components. Rivian managed to sink the number to just seven, and thus shave even more cost off the R2, through a “zonal” scheme where the ECUs control all the systems located in their particular region of the vehicle.

Compared to an older, centralized system that connects all the components via long wires, the savings are remarkable. As Rivian chief executive RJ Scaringe posted on X: “The R2 harness improves massively over the R1 Gen 2 harness. Building on the backbone of our network architecture and zonal ECUs, we focused on ease of install in the plant and overall simplification through integrated design — less wires, less clips and far fewer splices!”

Legacy automakers, meanwhile, are racing to catch up. Even those that have built decent-selling quality EVs to date have not come close to matching the software sophistication of Tesla and Rivian. But they have begun to see the light — not just about fancy iPads in the cockpit, but also about how the software-defined vehicle can help them to run their factories in a simpler and cheaper way.

How those companies approach the software-defined car will define them in the years to come. By 2028, GM hopes to have finished its next-gen software platform that “will unite every major system from propulsion to infotainment and safety on a single, high-speed compute core,” according to Barra. The hope is that this approach not only cuts down on wiring and simplifies manufacturing, but also makes Chevys and Cadillacs more easily updatable and better-equipped for the self-driving future.

In that sense, it’s not about the wires. It’s about all the trends that have come to dominate electric vehicles — affordability, functionality, and autonomy — colliding head-on.