You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

On funding frustrations, stronger hurricane winds, and a lithium deal

Current conditions: A severe heat wave warning has been issued for most of Australia • Schools are closed across parts of Great Britain due to snow and ice from Storm Bert • The atmospheric river pummeling Northern California will reach peak intensity today.

A new draft text for climate finance was released in the early hours at COP29 today. While the document has been significantly cut down from 25 pages to 10, it contains little of substance. The most important detail – how much money developed countries will contribute annually to helping developing countries adapt to climate change – remains undecided, and placeholders have been added to the text where a dollar amount should be: “[X] trillion of dollars annually” and “[X] billion per year.” Negotiators are dismayed. “We came here to talk about money,” Mohamed Adow, director of the thinktank Power Shift Africa, told The Associated Press. “The way you measure money is with numbers. We need a check, but all we have right now is a blank piece of paper.”

Ocean heat due to human-caused climate change is making Atlantic hurricane winds stronger, according to a new study published in the journal Environmental Research: Climate. Between 2019 and 2023, maximum hurricane wind speeds increased by 18 mph on average. In most cases, the increase was enough to bump a storm into a higher category and bring about more destruction. Eight storms saw wind speeds jump by 25 mph or more; three intensified by two storm categories as a result. So far in 2024, all of the 11 named storms have been made stronger because of climate change. Hurricane Milton’s wind speeds were 24 mph stronger. “We had two Category 5 storms here in 2024,” said Daniel Gilford, a climate scientist at Climate Central and lead author on the study. “Our analysis shows that we would have had zero Category 5 storms without human-caused climate change.”

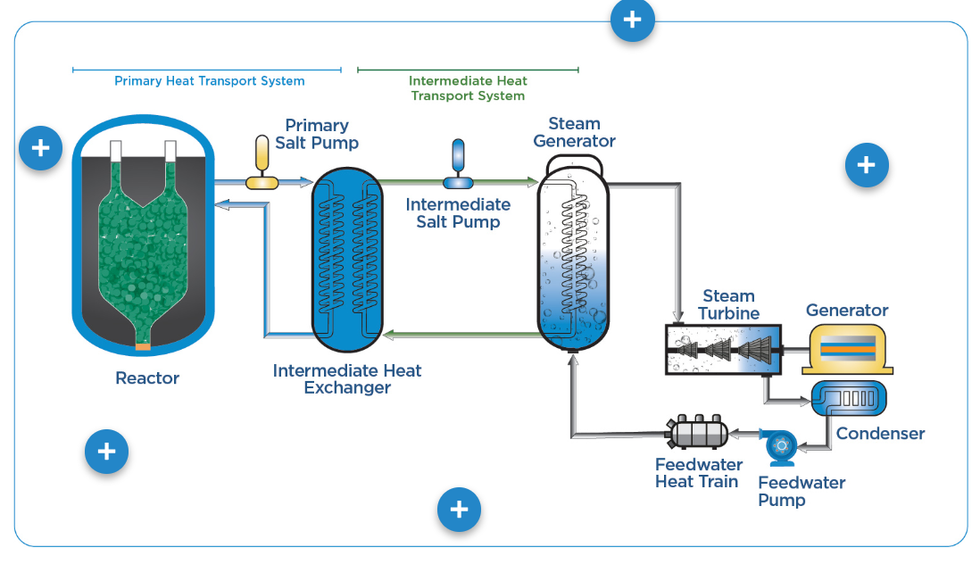

The U.S. Nuclear Regulatory Commission granted Kairos Power permission to build its first electricity-producing plant, the Hermes 2 Demonstration Plant, in Oak Ridge, Tennessee. Kairos’ high-temperature nuclear reactors are cooled by fluoride salt, rather than water. The company began construction on its first demonstration reactor back in July, and the new plant will “build on learnings” from that project. In a news release, Kairos said the project was reviewed and approved in just over one year.

“The Commission’s approval of the Hermes 2 construction permits marks an important step toward delivering clean electricity from advanced reactors to support decarbonization,” said Mike Laufer, Kairos CEO and co-founder. “We are proud to lead the industry in advanced reactor licensing and look forward to continued collaboration with the NRC as we chart a path forward with future applications.” Kairos signed an agreement with Google in October to deploy small modular reactors that will provide 500 megawatts of power to the tech company’s data centers by 2035.

In case you missed it: ExxonMobil signed a deal this week to supply 100,000 tons of lithium from its Arkansas extraction project to LG Chem’s large EV battery plant in Tennessee. The partnership “could strengthen the U.S. critical mineral supply chain and be a game-changer for EV manufacturers,” Electrek reported. Once completed, LG Chem’s plant is expected to be the largest of its kind in the U.S., producing 60,000 tons of cathode material annually. The move by ExxonMobil is “part of a broader effort among U.S. oil companies to diversify their oil- and gas-focused portfolios,” as E&E News explained.

Georgia Power recently disclosed that its projected load growth for the next decade from “economic development projects” has gone up by over 12,000 megawatts, to 36,500 megawatts. Just for 2028 to 2029, the pipeline has more than tripled, from 6,000 megawatts to 19,990 megawatts, destined for so-called “large load” projects like new data centers and factories. To give you an idea of just how much power Georgia businesses will demand over the next decade, the two new recently booted up nuclear reactors at Vogtle each have a capacity of around 1,000 megawatts. Of the listed projects that may come online, five will require 1,000 megawatts or more. “The culprit is largely data centers,” wrote Heatmap’s Matthew Zeitlin. “About 3,330 megawatts’ worth of data centers have broken ground in Georgia, and just over 4,100 megawatts are pending construction, vastly outstripping commitments made by industrial customers.”

Indonesia, the fifth largest generator of coal power in the world, plans to retire its coal power plants within the next 15 years to curb climate change, the nation’s President Prabowo Subianto said at the G20 summit in Brazil.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

There has been no new nuclear construction in the U.S. since Vogtle, but the workers are still plenty busy.

The Trump administration wants to have 10 new large nuclear reactors under construction by 2030 — an ambitious goal under any circumstances. It looks downright zany, though, when you consider that the workforce that should be driving steel into the ground, pouring concrete, and laying down wires for nuclear plants is instead building and linking up data centers.

This isn’t how it was supposed to be. Thousands of people, from construction laborers to pipefitters to electricians, worked on the two new reactors at the Plant Vogtle in Georgia, which were intended to be the start of a sequence of projects, erecting new Westinghouse AP1000 reactors across Georgia and South Carolina. Instead, years of delays and cost overruns resulted in two long-delayed reactors 35 miles southeast of Augusta, Georgia — and nothing else.

“We had challenges as we were building a new supply chain for a new technology and then workforce,” John Williams, an executive at Southern Nuclear Operating Company, which owns over 45% of Plant Vogtle, said in a webinar hosted by the environmental group Resources for the Future in October.

“It had been 30 years since we had built a new nuclear plant from scratch in the United States. Our workforce didn’t have that muscle memory that they have in other parts of the world, where they have been building on a more regular frequency.”

That workforce “hasn’t been building nuclear plants” since heavy construction stopped at Vogtle in 2023, he noted — but they have been busy “building data centers and car manufacturing in Georgia.”

Williams said that it would take another “six to 10” AP1000 projects for costs to come down far enough to make nuclear construction routine. “If we were currently building the next AP1000s, we would be farther down that road,” he said. “But we’ve stopped again.”

J.R. Richardson, business manager and financial secretary of the International Brotherhood of Electric Workers Local 1579, based in Augusta, Georgia, told me his union “had 2,000 electricians on that job,” referring to Vogtle. “So now we have a skill set with electricians that did that project. If you wait 20 or 30 years, that skill set is not going to be there anymore.”

Richardson pointed to the potential revitalization of the failed V.C. Summer nuclear project in South Carolina, saying that his union had already been reached out to about it starting up again. Until then, he said, he had 350 electricians working on a Meta data center project between Augusta and Atlanta.

“They’re all basically the same,” he told me of the data center projects. “They’re like cookie cutter homes, but it’s on a bigger scale.”

To be clear, though the segue from nuclear construction to data center construction may hold back the nuclear industry, it has been great for workers, especially unionized electrical and construction workers.

“If an IBEW electrician says they're going hungry, something’s wrong with them,” Richardson said.

Meta’s Northwest Louisiana data center project will require 700 or 800 electricians sitewide, Richardson told me. He estimated that of the IBEW’s 875,000 members, about a tenth were working on data centers, and about 30% of his local were on a single data center job.

When I asked him whether that workforce could be reassembled for future nuclear plants, he said that the “majority” of the workforce likes working on nuclear projects, even if they’re currently doing data center work. “A lot of IBEW electricians look at the longevity of the job,” Richardson told me — and nuclear plants famously take a long, long time to build.

America isn’t building any new nuclear power plants right now (though it will soon if Rick Perry gets his way), but the question of how to balance a workforce between energy construction and data center projects is a pressing one across the country.

It’s not just nuclear developers that have to think about data centers when it comes to recruiting workers — it’s renewables developers, as well.

“We don’t see people leaving the workforce,” said Adam Sokolski, director of regulatory and economic affairs at EDF Renewables North America. “We do see some competition.”

He pointed specifically to Ohio, where he said, “You have a strong concentration of solar happening at the same time as a strong concentration of data center work and manufacturing expansion. There’s something in the water there.”

Sokolski told me that for EDF’s renewable projects, in order to secure workers, he and the company have to “communicate real early where we know we’re going to do a project and start talking to labor in those areas. We’re trying to give them a market signal as a way to say, We’re going to be here in two years.”

Solar and data center projects have lots of overlapping personnel needs, Sokolski said. There are operating engineers “working excavators and bulldozers and graders” or pounding posts into place. And then, of course, there are electricians, who Sokolski said were “a big, big piece of the puzzle — everything from picking up the solar panel off from the pallet to installing it on the racking system, wiring it together to the substations, the inverters to the communication systems, ultimately up to the high voltage step-up transformers and onto the grid.”

On the other hand, explained Kevin Pranis, marketing manager of the Great Lakes regional organizing committee of the Laborers’ International Union of North America, a data center is like a “fancy, very nice warehouse.” This means that when a data center project starts up, “you basically have pretty much all building trades” working on it. “You’ve got site and civil work, and you’re doing a big concrete foundation, and then you’re erecting iron and putting a building around it.”

Data centers also have more mechanical systems than the average building, “so you have more electricians and more plumbers and pipefitters” on site, as well.

Individual projects may face competition for workers, but Pranis framed the larger issue differently: Renewable energy projects are often built to support data centers. “If we get a data center, that means we probably also get a wind or solar project, and batteries,” he said.

While the data center boom is putting upward pressure on labor demand, Pranis told me that in some parts of the country, like the Upper Midwest, it’s helping to compensate for a slump in commercial real estate, which is one of the bread and butter industries for his construction union.

Data centers, Pranis said, aren’t the best projects for his members to work on. They really like doing manufacturing work. But, he added, it’s “a nice large load and it’s a nice big building, and there’s some number of good jobs.”

A conversation with Dustin Mulvaney of San Jose State University

This week’s conversation is a follow up with Dustin Mulvaney, a professor of environmental studies at San Jose State University. As you may recall we spoke with Mulvaney in the immediate aftermath of the Moss Landing battery fire disaster, which occurred near his university’s campus. Mulvaney told us the blaze created a true-blue PR crisis for the energy storage industry in California and predicted it would cause a wave of local moratoria on development. Eight months after our conversation, it’s clear as day how right he was. So I wanted to check back in with him to see how the state’s development landscape looks now and what the future may hold with the Moss Landing dust settled.

Help my readers get a state of play – where are we now in terms of the post-Moss Landing resistance landscape?

A couple things are going on. Monterey Bay is surrounded by Monterey County and Santa Cruz County and both are considering ordinances around battery storage. That’s different than a ban – important. You can have an ordinance that helps facilitate storage. Some people here are very focused on climate change issues and the grid, because here in Santa Cruz County we’re at a terminal point where there really is no renewable energy, so we have to have battery storage. And like, in Santa Cruz County the ordinance would be for unincorporated areas – I’m not sure how materially that would impact things. There’s one storage project in Watsonville near Moss Landing, and the ordinance wouldn’t even impact that. Even in Monterey County, the idea is to issue a moratorium and again, that’s in unincorporated areas, too.

It’s important to say how important battery storage is going to be for the coastal areas. That’s where you see the opposition, but all of our renewables are trapped in southern California and we have a bottleneck that moves power up and down the state. If California doesn’t get offshore wind or wind from Wyoming into the northern part of the state, we’re relying on batteries to get that part of the grid decarbonized.

In the areas of California where batteries are being opposed, who is supporting them and fighting against the protests? I mean, aside from the developers and an occasional climate activist.

The state has been strongly supporting the industry. Lawmakers in the state have been really behind energy storage and keeping things headed in that direction of more deployment. Other than that, I think you’re right to point out there’s not local advocates saying, “We need more battery storage.” It tends to come from Sacramento. I’m not sure you’d see local folks in energy siting usually, but I think it’s also because we are still actually deploying battery storage in some areas of the state. If we were having even more trouble, maybe we’d have more advocacy for development in response.

Has the Moss Landing incident impacted renewable energy development in California? I’ve seen some references to fears about that incident crop up in fights over solar in Imperial County, for example, which I know has been coveted for development.

Everywhere there’s batteries, people are pointing at Moss Landing and asking how people will deal with fires. I don’t know how powerful the arguments are in California, but I see it in almost every single renewable project that has a battery.

Okay, then what do you think the next phase of this is? Are we just going to be trapped in a battery fire fear cycle, or do you think this backlash will evolve?

We’re starting to see it play out here with the state opt-in process where developers can seek state approval to build without local approval. As this situation after Moss Landing has played out, more battery developers have wound up in the opt-in process. So what we’ll see is more battery developers try to get permission from the state as opposed to local officials.

There are some trade-offs with that. But there are benefits in having more resources to help make the decisions. The state will have more expertise in emergency response, for example, whereas every local jurisdiction has to educate themselves. But no matter what I think they’ll be pursuing the opt-in process – there’s nothing local governments can really do to stop them with that.

Part of what we’re seeing though is, you have to have a community benefit agreement in place for the project to advance under the California Environmental Quality Act. The state has been pretty strict about that, and that’s the one thing local folks could still do – influence whether a developer can get a community benefits agreement with representatives on the ground. That’s the one strategy local folks who want to push back on a battery could use, block those agreements. Other than that, I think some counties here in California may not have much resistance. They need the revenue and see these as economic opportunities.

I can’t help but hear optimism in your tone of voice here. It seems like in spite of the disaster, development is still moving forward. Do you think California is doing a better or worse job than other states at deploying battery storage and handling the trade offs?

Oh, better. I think the opt-in process looks like a nice balance between taking local authority away over things and the better decision-making that can be brought in. The state creating that program is one way to help encourage renewables and avoid a backlash, honestly, while staying on track with its decarbonization goals.

The week’s most important fights around renewable energy.

1. Nantucket, Massachusetts – A federal court for the first time has granted the Trump administration legal permission to rescind permits given to renewable energy projects.

2. Harvey County, Kansas – The sleeper election result of 2025 happened in the town of Halstead, Kansas, where voters backed a moratorium on battery storage.

3. Cheboygan County, Michigan – A group of landowners is waging a new legal challenge against Michigan’s permitting primacy law, which gives renewables developers a shot at circumventing local restrictions.

4. Klamath County, Oregon – It’s not all bad news today, as this rural Oregon county blessed a very large solar project with permits.

5. Muscatine County, Iowa – To quote DJ Khaled, another one: This county is also advancing a solar farm, eliding a handful of upset neighbors.