Somewhat ironically, Alaskans themselves don’t typically view things that way. Though no fewer than four utility board elections and the Anchorage mayoral race this spring will help to shape the energy future of the Railbelt, the electrical grid that runs from Fairbanks through Anchorage and out to the Kenai Peninsula and serves 70% of the state’s population, locals are debating the stakes in terms of cost.

“Literally nobody who is pitching renewables [on the campaign trail] is pitching them as a solution to climate change,” Nathaniel Herz, an independent Anchorage-based reporter who covers energy, environment, and government issues in the state for his newsletter Northern Journal, told me. Rather, the selling point is that wind, solar, and tidal power could be the way out of an urgent gas shortage.

The energy crisis touched off in earnest last May when the region’s largest natural gas producer, Hilcorp, informed the four Railbelt utilities that it doesn’t have access to enough deliverable gas in Cook Inlet to guarantee new contracts going forward. Though a gas shortage in the aging basin was a long time coming, the urgency of the situation still came as a shock; the Railbelt utilities get about 80% of their energy from natural gas. Demand could outpace supply as soon as 2027, the state has warned.

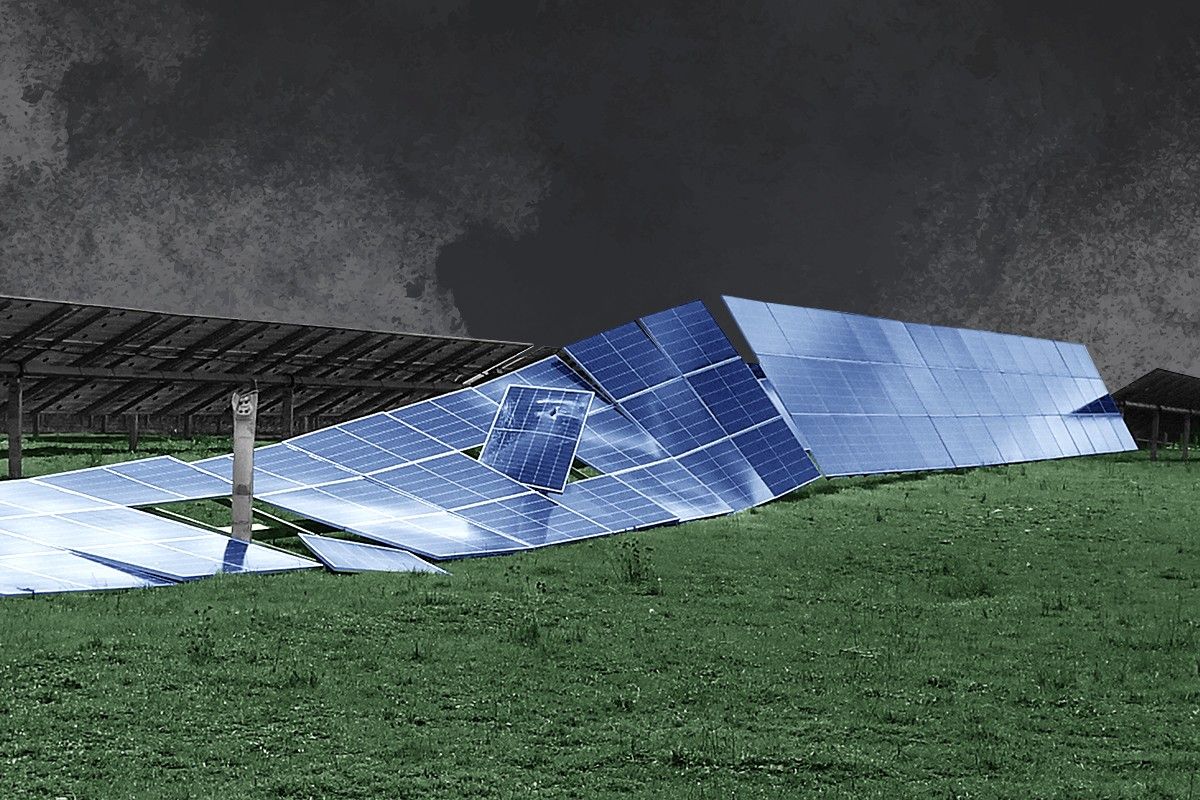

Billy J. Roberts, NREL, for DOE

Billy J. Roberts, NREL, for DOE

Homer Electric Association was the first utility to face the consequences, with a contract that expired this year. As a stopgap, it signed a one-year contract with Enstar, the local private gas utility that gets 90% of its supply from Hilcorp (and also supplies gas for heating homes and businesses) at a higher price. The rest of the Railbelt co-ops’ contracts are set to expire by 2028.

Proposed solutions to the crisis range from new drilling in Cook Inlet — which is risky, expensive, and laden with permitting hurdles, making it unappealing to investors — to building an 800-mile, $43 billion pipeline from the oil-rich North Slope. More realistically, the Railbelt seems headed toward importing liquified natural gas from British Columbia, at least in the short term.

That option is “really unpalatable to many Alaskans,” Satchel Pondolfino, the lower Kenai Peninsula organizer for Cook Inletkeeper, a Homer-based environmental non-profit, told me. “We’re an energy state: It’s inconceivable for a lot of people that we have to bring in fuel from other places.”

It’s also expensive. Importing LNG could result in 50% higher costs for the utilities. That, in turn, would mean up to a 15% hike in consumers’ already-steep utility bills, and likely “even more than that for heating bills,” as Herz has reported — no small thing in a place where it is dark and cold for half the year. One independent analysis Herz cites found that the 80% renewable portfolio standard proposed by the state’s Republican Governor Mike Dunleavy would save $6.7 billion in fuel costs over the next 35 years compared to an estimated $3.2 billion investment in the projects. The National Renewable Energy Laboratory’s latest assessment likewise found that a large clean-energy build-out would be “more affordable than relying on imported natural gas.”

Critically, then, the spring elections in Alaska will help decide both what the long-term solution will be and how quickly it should be implemented. The Anchorage mayoral runoff set for this coming Tuesday — a choice between incumbent Dave Bronson, a self-described “center-right kind of guy” who favors new Cook Inlet drilling, and Suzanne LaFrance, a Lead Locally-endorsed climate candidate pushing for a renewable mix — is perhaps the marquee race, albeit one with a more limited say over the future energy mix.

“Utilities have control over specifically where they get their energy from, and the legislature has a lot of control over how we tax different energy producers,” Jenny-Marie Stryker, the political director at The Alaska Center, the state’s largest conservation advocacy organization, told me. But while there is not “one turnkey thing that we’re looking for the mayor to do,” Stryker added, it’s instead the “many, many steps” LaFrance has promised to follow in the city’s climate action plan that would mark an improvement over Bronson. (LaFrance’s campaign did not respond to Heatmap’s request for comment.)

Bronson, who was elected during the pandemic when Alaskans were bristling against perceived government overreach, ignored his predecessor’s climate action plan and established the Southcentral Mayors’ Energy Coalition to address the Railbelt energy crisis — a move Stryker told me was a “pretty big waste of time,” since it’s something the 11-mayor group has “no control over.” Bronson defended his decision to me in an emailed statement, arguing that any climate action plan is by necessity secondary to addressing Southcentral Alaska’s immediate energy concerns.

“It is easy to say, ‘Let’s build a massive solar plant, let’s invest in tidal energy, let’s investigate geothermal,’” he wrote. “However, there are grid transmission upgrades that need to be made” before that can be a reality. Additionally, while the assumption is that building out new renewables is “easy,” the “permitting process alone can take 2-3 years, and in some cases, 5-6 years,” he stressed. (New LNG import terminals, meanwhile, might not be online until 2030.)

Herz, the reporter, told me earlier that renewable project developers “would be looking at capital expenditures that were 80% to 90% higher than they would be to develop utility-scale renewable projects in the Lower 48.” In an oil state, there is also an “inherent skepticism about some of the renewable technology and economic viability that you might not find elsewhere in the United States because there aren’t really big utility-scale projects that have been built here.” The ones that are on the board — including a possible and intriguing tidal energy project — fall more firmly into the purview of the local co-ops.

The utility board elections, then, have a more immediate hand in shaping the Railbelt’s future energy mix. Two of those elections have already taken place: for the board of the Matanushka Electric Association, where both climate candidates lost (albeit one by just 41 of 3,246 votes), and for the Homer Electric Association, where a climate candidate was re-elected and a challenger lost, maintaining the board’s ideological status quo. Chugach Electric Association, which represents Anchorage and is the largest provider in the state, will go next, with voting ongoing and ending May 17. That board is currently held by a pro-renewable majority that has advanced utility-scale wind and solar projects, with pro-gas challengers vying to take back control.

Finally, Fairbanks’ Golden Valley Electric Association ballots are due June 4, with Gary Newman, a pro-renewable Democrat, attempting to hold off Harmony Tomaszewski, who helped block a local climate action plan last year. Fairbanks has been hit especially hard by the energy crisis, burning coal and diesel to compensate for LNG shortfalls and polluting its air. A rate hike of about $29 more per month for households has also brought unusually high levels of public interest to the co-op election.

While “on paper” the current GVEA board is “pretty conservative,” Eleanor Gagnon, the energy justice organizer with the Fairbanks Climate Action Coalition, told me, its annual meeting in April featured a lot of talk about diversifying its energy portfolio — a conversationtalk that would have been shocking even a few years ago. “They really seem to have come to the realization that more renewables are necessary because of these rate hikes, and because the rate hikes are due to the instability of natural gas sources,” she said.

I’ve spoken with organizers before about how policies with positive climate benefits are often economic issues at heart — ones that sometimes override environmental motivations — and that seems especially true in Alaska. “The urgency of Cook Inlet gas not meeting our demands by 2027 — folks are throwing climate out the window,” Pondolfino, the Cook Inletkeeper organizer, said. “They’re like, ‘We just need energy security and we need to be able to afford it.’”

The math shows that having a diversified renewable mix would be better economically than importing expensive LNG. That doesn’t mean it will be an easy transition, or a quick one, but it gives activists and advocates a clear goal to keep working toward on every ballot.

“Most people in the Lower 48 do not have any way to voice their opinion about the direction their utility should move in, or to vote for representatives,” Pondolfino said. “It is a privilege to vote in elections that have a really direct impact on people’s lives and their ability to afford to live here.”

Billy J. Roberts, NREL, for DOE

Billy J. Roberts, NREL, for DOE

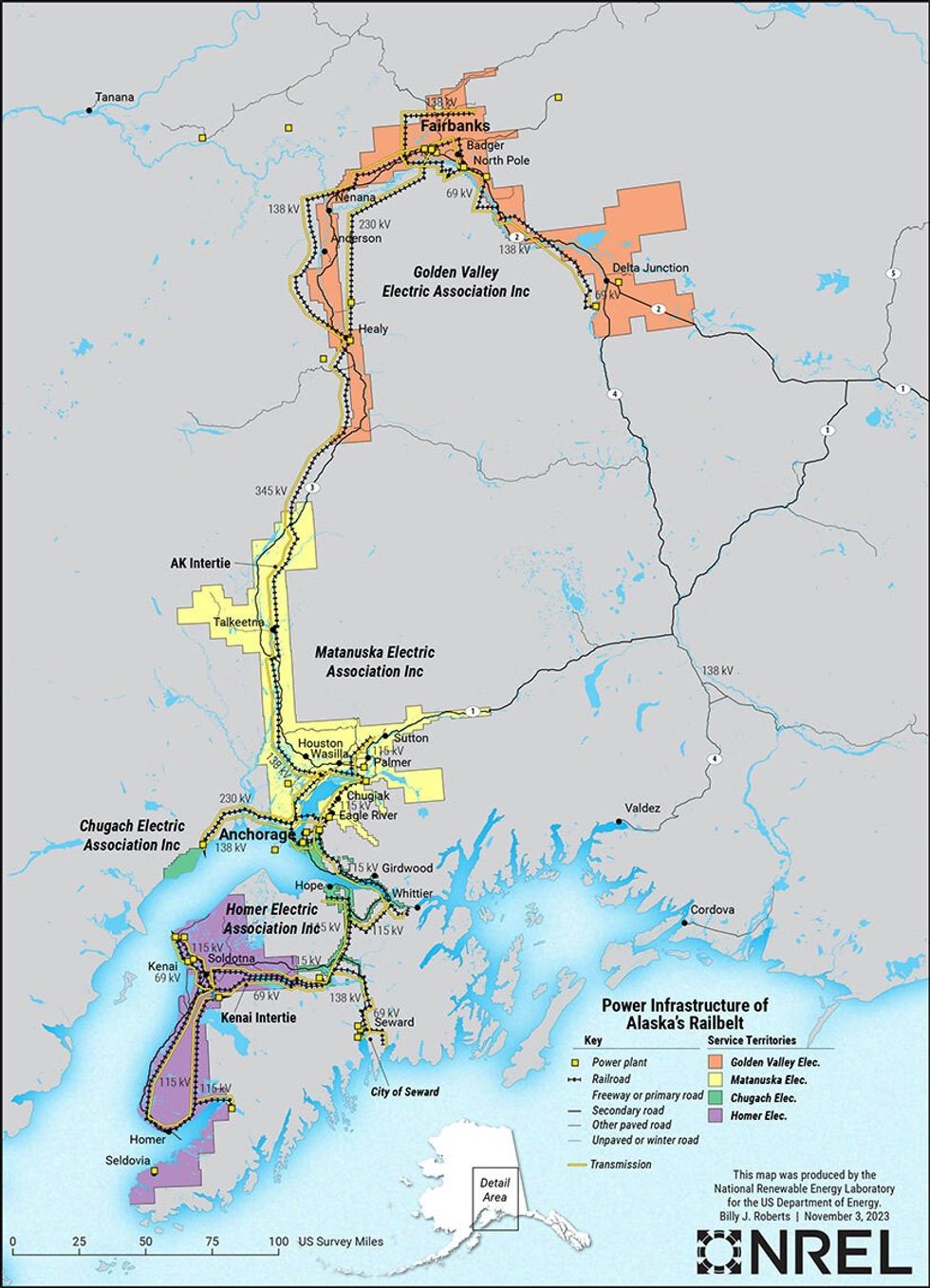

Ember

Ember

Sonnenkraft

Sonnenkraft