You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

On adaptation funding, plastic pollution, and LNG

Current conditions: A California wildfire burned some 400 acres near the site of the Hell’s Kitchen Lithium Extraction Project • Storm Bert in the U.K. killed at least five people and triggered 150 flood warnings • Many parts of the U.S. could see their coldest weather of the season on Thanksgiving and Black Friday.

The UN COP29 climate summit came to a close Sunday – two days behind schedule – after delegates reached a deal on a sum for a new climate finance goal. Developed countries pledged to give at least $300 billion annually by 2035 to help poorer countries adapt to climate change and transition away from fossil fuels. That’s up from the previous goal, set in 2009, of $100 billion, but well below the $1 trillion economists say will be needed. That a deal was reached at all was seen as a success after two weeks of stalemate. But many from developing nations found it insufficient. Here are some reactions:

Beyond the climate finance deal, the summit did not result in a clear plan for how countries will transition away from fossil fuels, as pledged at last year’s COP28, nor details on tripling renewable energy capacity.

As one UN summit winds down, another begins. This week delegates from 175 countries will gather in Busan, South Korea, with a goal of cementing a global treaty on reducing plastic pollution. Some nations want to tackle the problem by curbing plastic production, while others – especially petrostates and representatives from the chemicals industry – want to focus on ways to reuse and recycle plastics. Researchers say that without a treaty, plastic pollution will double by 2050. Already the world produces half a billion tons of the stuff every year, and most of that ends up being dumped. A few months ago, the U.S. signalled it would back a treaty to curb production, but experts think Donald Trump’s election win makes such a move less likely.

This fifth round of talks on an international plastics treaty is meant to be the last. Most plastic is made from fossil fuels. The International Energy Agency estimated that this year one-fifth of the world’s oil will go toward industrial and chemical sectors. As the energy transition ramps up, major oil and gas producers see the plastics market as a “plan B.” Indeed, the Financial Times reported today that “the biggest takeover deal in Europe so far this year” – oil company Adnoc’s €15 billion ($15.7 billion) purchase of German polymers producer Covestro – is being driven by a projected growth in demand for plastics.

Get Heatmap AM directly in your inbox every morning:

One to watch for this week: The Department of Energy’s analysis on the environmental and economic impacts of natural gas exports could be released in the next few days, E&E News reported. It’s likely to conclude that U.S. LNG shipments are worse for the climate than coal in some countries where those shipments wind up, and that they drive up domestic prices. “The assumption is that a good time to release such a report would be the Friday after Thanksgiving,” one energy lobbyist told the outlet.

Tesla’s massive EV production plant in Austin, Texas, spewed environmental toxins into the surrounding air and water for months back in 2022, according to an investigation by The Wall Street Journal. The hazards were not addressed even after managers were made aware of them, and employees felt pressured by CEO Elon Musk to put production goals ahead of regulatory compliance. “Across his business empire, Musk’s companies show a pattern of breaking environmental rules again and again, federal and state government filings and documents show,” the Journal said. It noted that as co-head of the new “Department of Government Efficiency” under the Trump administration, Musk is likely to try to cut environmental regulations that apply to his own companies.

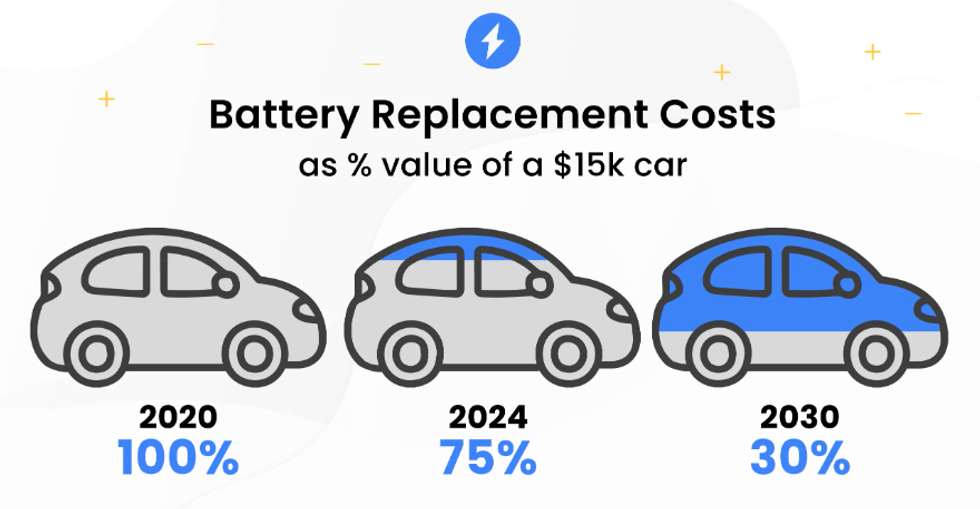

A recent report finds that the cost of replacing an EV battery pack will soon be lower than the cost of replacing an internal combustion engine. The analysis comes from Recurrent, a startup focused on helping buyers understand battery health in used EVs. (As CNBC explained earlier this year, “Recurrent aims to do for electric vehicle batteries what odometers do for fuel-powered cars: show the wear and tear on the battery and its future value.”) While it’s unlikely that an EV driver would need to replace a battery, this possibility remains a nagging concern, especially among those who might consider buying a used EV. The report found that, as the price of lithium-ion batteries falls, so will the cost of replacing them. By 2030, the cost will be at parity with that of replacing an ICE, and at the same time, used batteries could be sold on. “The takeaway? It will no longer be the case that a 10+ year old EV is worthless,” the report said. “It will be very feasible for someone to buy an inexpensive EV and replace the battery pack for a few thousand dollars.”

The toxic pollution that shrouds India’s north costs the country’s economy $95 billion each year, or about 3% of GDP.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

One of the buzziest climate tech companies in our Insiders Survey is pushing past the “missing middle.”

One of the buzziest climate tech companies of the past year is proving that a mature, hitherto moribund technology — conventional geothermal — still has untapped potential. After a breakthrough year of major discoveries, Zanskar has raised a $115 million Series C round to propel what’s set to be an investment-heavy 2026, as the startup plans to break ground on multiple geothermal power plants in the Western U.S.

“With this funding, we have a six power plant execution plan ahead of us in the next three, four years,” Diego D’Sola, Zanskar’s head of finance, told me. This, he estimates, will generate over $100 million of revenue by the end of the decade, and “unlock a multi-gigawatt pipeline behind that.”

The size of the round puts a number to climate world’s enthusiasm for Zanskar. In Heatmap’s Insider’s Survey, experts identified Zanskar as one of the most promising climate tech startups in operation today.

Zanskar relies on its suite of artificial intelligence tools to locate previously overlooked conventional geothermal resources — that is, naturally occurring reservoirs of hot water and steam. Trained on a combination of exclusive subsurface datasets, modern satellite and remote sensing imagery, and fresh inputs from Zanksar’s own field team, the company’s AI models can pinpoint the most promising sites for exploration and even guide exactly what angle and direction to drill a well from.

Early last year, Zanskar announced that it had successfully revitalized an underperforming geothermal power plant in New Mexico by drilling a new pumped well nearby, which has since become the most productive well of this type in the U.S. That was followed by the identification of a large geothermal resource in northern Nevada, where exploratory wells had been drilled for decades but no development had ever occurred. Just last month, the company revealed a major discovery in western Nevada — a so-called “blind” geothermal system with no visible surface activity such as geysers or hot springs, and no history of exploratory drilling.

“This is a site nobody had ever had on the radar, no prior exploration,” Carl Hoiland, Zanskar’s CEO, told me of this latest discovery, dubbed “Big Blind.” He described it as a tipping point for the industry, which had investors saying, “Okay, this is starting to look more like a trend than just an anomaly.”

Spring Lane Capital led Zanskar’s latest round, which also included Obvious Ventures, Union Square Ventures, and Lowercarbon Capital, among others. Spring Lane aims to fill the oft-bemoaned “missing middle” of climate finance — the stage at which a startup has matured beyond early-stage venture backing but is still considered too risky for more traditional infrastructure investors.

Zanskar now finds itself squarely in that position, needing to finance not just the drills, turbines, and generators for its geothermal plants, but also the requisite permitting and grid interconnection costs. D’Sola told me that he expects the company to close its first project financing this quarter, explaining that its ambitious plans require “north of $600 million in total capital expenditures, the vast majority of which will come from non-dilutive sources or project level financing.”

Unsurprisingly, the company anticipates that data centers will be some of its first customers, with hyperscalers likely working through utilities to secure the clean energy attributes of Zanskar’s grid-connected power. And while the West Coast isn’t the primary locus of today’s data center buildout, Hoiland thinks Zanskar’s clean, firm, low-cost power will help draw the industry toward geothermally rich states such as Utah and Nevada, where it’s focused.

“We see a scenario where the western U.S. is going to have some of the cheapest carbon-free energy, maybe anywhere in the world, but certainly in the United States.” Hoiland told me.

Just how cheap are we talking? Using the levelized cost of energy — which averages the lifetime cost of building and operating a power plant per unit of electricity generated — Zanskar plans to deliver electricity under $45 per megawatt-hour by the end of this decade. For context, the Biden administration set that same cost target for next-generation geothermal systems such as those being pursued by startups like Fervo Energy and Eavor — but projected it wouldn’t be reached 2035.

At this price point, conventional geothermal would be cheaper than natural gas, too. The LCOE for a new combined-cycle natural gas plant in the U.S. typically ranges from $48 to $107 per megawatt-hour.

That opens up a world of possibilities, Hoiland said, with the startup’s’s most optimistic estimates showing that conventional geothermal could potentially supply all future increases in electricity demand. “But really what we’re trying to meet is that firm, carbon-free baseload requirement, which by some estimates needs to be 10% to 30% of the total mix,” Hoiland said. “We have high confidence the resource can meet all of that.”

On New Jersey’s rate freeze, ‘global water bankruptcy,’ and Japan’s nuclear restarts

Current conditions: A major winter storm stretching across a dozen states, from Texas to Delaware, and could hit by midweek • The edge of the Sahara Desert in North Africa is experiencing sandstorms kicked up by colder air heading southward • The Philippines is bracing for a tropical cyclone heading toward northern Luzon.

Mikie Sherrill wasted no time in fulfilling the key pledge that animated her campaign for governor of New Jersey. At her inauguration Tuesday, the Democrat signed a series of executive orders aimed at constraining electricity bills and expanding energy production in the state. One order authorized state utility regulators to freeze rate hikes. Another directed the New Jersey Board of Public Utilities “to open solicitations for new solar and storage power generation, to modernize gas and nuclear generation so we can lower utility costs over the long term.” Now, as Heatmap’s Matthew Zeitlin put it, “all that’s left is the follow-through,” which could prove “trickier than it sounds” due to “strict deadlines to claim tax credits for renewable energy development looming.”

Last month, the environmental news site Public Domain broke a big story: Karen Budd-Falen, the No. 3 official at the Department of the Interior, has extensive financial ties to the controversial Thacker Pass lithium mine in northern Nevada that the Trump administration is pushing to fast track. Now The New York Times is reporting that House Democrats are urging the Interior Department’s inspector general to open an investigation into the multimillion-dollar relationship Budd-Falen’s husband has with the mine’s developer. Frank Falen, her husband, sold water from a family ranch in northern Nevada to the subsidiary of Lithium Americas for $3.5 million in 2019, but the bulk of the money from the sale depended on permit approval for the project. Budd-Falen did not reveal the financial arrangement on any of her four financial disclosures submitted to the federal government when she worked for the Interior Department during President Donald Trump’s first term from 2018 to 2021.

House Republicans, meanwhile, are planning to vote this week to undo Biden-era restrictions on mining near more than a million acres of Minnesota wilderness. “Mining is huge in Minnesota. And all mining helps the school trust fund in Minnesota as well. So it benefits all schools in the state,” Representative Pete Stauber, a Minnesota Republican and the chair of the Natural Resources Subcommittee on Energy and Mineral Resources, said of the rule-killing bill he sponsored. While the vote is expected to draw blowback from environmentalists, E&E News noted that it could also agitate proceduralists who oppose the GOP’s continued “use of the rule-busting Congressional Review Act for actions that have not been traditionally seen as rules.” Still, the move is likely to fuel the dealmaking boom for critical minerals. As Heatmap’s Katie Brigham wrote in September, “everybody wants to invest” in startups promising to mine and refine the metals over which China has a near monopoly.

Sign up to receive Heatmap AM in your inbox every morning:

A new United Nations report declares that the world has entered an era of “global water bankruptcy,” putting billions of people at risk. In an interview with The Guardian, Kaveh Madani, the report’s lead author, said that while not every basin and country is directly at risk, trade and migration are set to face calamity from water shortages. Upward of 75% of people live in countries classified as water insecure or critically water insecure, and 2 billion people live on land that is sinking as groundwater aquifers collapse. “This report tells an uncomfortable truth: Many critical water systems are already bankrupt,” Madani said. “It’s extremely urgent [because] no one knows exactly when the whole system would collapse.”

The Democratic Republic of the Congo has given the U.S. government a vetted list of mining and processing projects open to American investment. The shortlist, which Mining.com said was delivered to U.S. officials last week, includes manganese, gold, and cassiterite licenses; a copper-cobalt project and a germanium-processing venture; four gold permits; a lithium license; and mines producing cobalt, gold, and tungsten. The potential deals are an outgrowth of the peace agreement Trump brokered between the DRC and Rwanda-backed rebels, and could offer Washington a foothold in a mineral-rich country whose resources China has long dominated. But establishing an American presence in an unstable African country is a risky investment. As I reported for Heatmap back in October, the Denver-based Energy Fuels’ $2 billion mining project in Madagascar was suddenly thrown into chaos when the island nation’s protests resulted in a coup, though the company has said recently it’s still moving forward.

The Tokyo Electric Power Company is delaying the restart of the Kashiwazaki Kariwa nuclear power station in western Japan after an alarm malfunction. The alarm system for the control rods that keep the fission reaction in check failed to sound during a test operation on Tuesday, Tepco said. The world’s largest nuclear plant had been scheduled to restart one of its seven reactors on Tuesday. Fuel loading for the reactor, known as Unit 6, was completed in June. It’s unclear when the restart will now take place.

The delay marks a setback for Prime Minister Sanae Takaichi, who has made restarting the reactors idled after the 2011 Fukushima disaster and expanding the nuclear industry a top priority, as I told you in October. But as I wrote last month in an exclusive about Japan’s would-be national small modular reactor champion, the country has a number of potential avenues to regain its nuclear prowess beyond just reviving its existing fleet.

As a fourth-generation New Yorker, I’m qualified to say something controversial: I love, and often even prefer, Montreal-style bagels. They’re smaller, more efficient, and don’t deliver the same carbohydrate bomb to my gut. Now the best-known Montreal-style bagel place in the five boroughs has found a way to use the energy needed to make their hand-rolled, wood-fired bagels more efficiently, too. Black Seed Bagels’ catering kitchen in northern Brooklyn is now part of a battery pilot program run by David Energy, a New York-based retail energy provider. The startup supplied suitcase-sized batteries for free last August, allowing Black Seed to disconnect from ConEdison’s grid during hours when electricity rates are particularly high. “We’re in the game of nickels and dimes,” Noah Bernamoff, Black Seed’s co-owner, told Canary Media. “So we’re always happy to save the money.” Wise words.

Rob talks through Rhodium Groups’s latest emissions report with climate and energy director Ben King.

America’s estimated greenhouse gas emissions rose by 2.4% last year — which is a big deal since they had been steady or falling in 2023 and 2024. More ominously, U.S. emissions grew faster than our gross domestic product last year, suggesting that the economy got less efficient from a climate pollution perspective.

Is this Trump’s fault? The AI boom’s? Or was it a weird fluke? In this week’s Shift Key episode, Rob talks to Ben King, a climate and energy director at the Rhodium Group, about why U.S. emissions grew and what it says about the underlying structure of the American economy. They talk about the power grid, the natural gas system, and whether industry is going to overtake other emissions drivers as once thought.

Shift Key is hosted by Robinson Meyer, the founding executive editor of Heatmap, and Jesse Jenkins, a professor of energy systems engineering at Princeton University. Jesse is off this week.

Subscribe to “Shift Key” and find this episode on Apple Podcasts, Spotify, Amazon, or wherever you get your podcasts.

You can also add the show’s RSS feed to your podcast app to follow us directly.

Here is an excerpt from our conversation:

Robinson Meyer: At the same time there’s been rising total electrification of the vehicle fleet, there’s also been rising hybrid and plug-in hybrid sales. Do we have a sense of how that breakdown is happening, in terms of reduced carbon intensity of the transportation sector and the light duty fleet?

Ben King: It’s a good question. We haven’t disaggregated the … When I say electric vehicles, I’m talking broadly about both full battery electric, and then plug-in hybrids. And then, I think we say this in paper, but I think there was pretty robust growth for gasoline hybrids as which, you know, relative to just a pure gas car, is better from an emissions perspective.

Meyer: Well, it’s funny because if you care about decarbonization and getting to net zero as soon as possible, you could have to poo poo hybrids. But if you’re actually involved in the game to just keep as much emissions out of the sky as possible, and you’re looking to net those 2% declines every year, hybrids are pretty important because they are basically a drop-in replacement to gasoline car use that burns less gasoline.

King: The other interesting thing that gasoline hybrids does for the sector is it finds interesting unanticipated uses for all this battery manufacturing capacity that we’ve built in the U.S., or that we stand to build. Our forecast for pure EVs — so battery electrics, plug-in hybrids — looks a little worse in the out years because of the tax credits going away, because of the EPA tailpipe regulations going away at the same time that the anticipated demand pull from those policies, plus the advanced manufacturing tax credit — the 45X tax credit — has really been wildly successful in standing up a battery manufacturing industry here in the U.S.

If you want that capacity to be around, one thing that you could do with those batteries is put them into hybrids, right? You might have to retool the line a little bit to accommodate different sizes and stuff, build the expertise, build the workforce, etc., such that when the floodgates open again for electric vehicle adoption, for instance, we’ve got substantial battery manufacturing capacity here domestically.

Mentioned:

Rhodium Group: Preliminary US Greenhouse Gas Emissions Estimates for 2025

Rob on Rhodium’s 2023 emissions report

And here’s Rhodium’s 2024 emissions report

This episode of Shift Key is sponsored by …

Heatmap Pro brings all of our research, reporting, and insights down to the local level. The software platform tracks all local opposition to clean energy and data centers, forecasts community sentiment, and guides data-driven engagement campaigns. Book a demo today to see the premier intelligence platform for project permitting and community engagement.

Music for Shift Key is by Adam Kromelow.