You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

And four more things we learned from Tesla’s Q1 earnings call.

Tesla doesn’t want to talk about its cars — or at least, not about the cars that have steering wheels and human drivers.

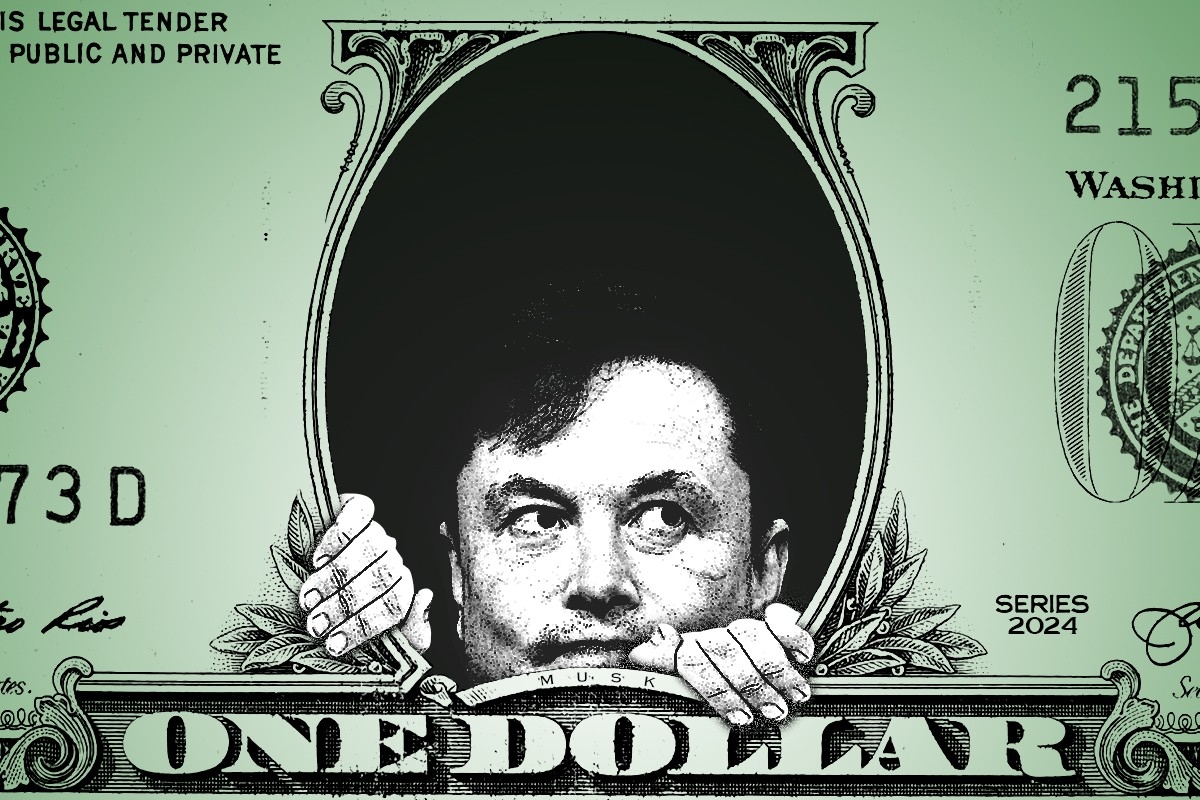

Despite weeks of reports about Tesla’s manufacturing and sales woes — price cuts, recalls, and whether a new, cheaper model would ever come to fruition — CEO Elon Musk and other Tesla executives devoted their quarterly earnings call largely to the company's autonomous driving software. Musk promised that the long-awaited program would revolutionize the auto industry (“We’re putting the actual ‘auto’ in automobile,” as he put it) and lead to the “biggest asset appreciation in history” as existing Tesla vehicles got progressively better self-driving capabilities.

In other Tesla news, car sales are falling, and a new, cheaper vehicle will not be constructed on an all-new platform and manufacturing line, which would instead by reserved for a from-the-ground-up autonomous vehicle.

Here are five big takeaways from the company's earnings and conference call.

The company reported that its “total automotive revenues” came in at $17.4 billion in the first quarter, down 13% from a year ago. Its overall revenues of $21.3 billion, meanwhile, were down 9% from a year ago. The earnings announcement included a number of explanations for the slowdown, which was even worse than Wall Street analysts had expected.

Among the reasons Tesla cited for the disappointing results were arson at its Berlin factory, the obstruction to Red Sea shipping due to Houthi attacks from Yemen, plus a global slowdown in electric vehicle sales “as many carmakers prioritize hybrids over EVs.” The combined effects of these unfortunate events led the company to undertake a well-publicized series of price cuts and other sweeteners for buyers, which dug further into Tesla’s bottom line. Tesla’s chief financial officer, Vaibhav Taneja, said that the company’s free cash flow was negative more than $2 billion, largely due to a “mismatch” between its manufacturing and actual sales, which led to a buildup of car inventory.

The bad news was largely expected — the company’s shares had fallen 40% so far this year leading up to the first quarter earnings, and the past few weeks have featured a steady drumbeat of bad news from the automaker, including layoffs and a major recall. The company’s profits of $1.1 billion were down by more than 50%, short of Wall Street’s expectations — and yet still, Tesla shares were up more than 10% in after-hours trading following the shareholder update and earnings call.

The strange thing about Tesla is that it makes the overwhelming majority of its money from selling cars, but has become the world’s most valuable car company thanks to investors thinking that it’s more of an artificial intelligence company. It’s not uncommon for Tesla CEO Elon Musk and his executives to start talking about their Full Self-Driving technology and autonomous driving goals when the company’s existing business has hit a rough patch, and today was no exception.

Tesla’s value per share was about 33 times its earnings per share by the end of trading on Monday, comparable to how investors evaluate software companies that they expect to grow quickly and expand profitability in the future. Car companies, on the other hand, tend to have much lower valuations compared to their earnings — Ford’s multiple is 12, for instance, and GM’s is 6.

Musk addressed this gap directly on the company’s earnings call. He said that Tesla “should be thought of as an AI/robotics company,” and that “if you value Tesla as an auto company, that’s the wrong framework.” To emphasize just how much the company is pivoting around its self-driving technology, Musk said that “if somebody believes Tesla is not going to solve autonomy they should not be an investor in the company.”

One reason investors value Tesla so differently relative to its peers is that they do, actually, expect the company will make a lot of money using artificial intelligence. No doubt with that in mind, executives made sure to let everyone know that its artificial intelligence spending was immense: The company’s free cash flow may have been negative more than $2 billion, but $1 billion of that was in spending on AI infrastructure. The company also said that it had “increased AI training compute by more than 130%” in the first quarter.

“The future is not only electric, but also autonomous,” the company’s investor update said. “We believe scaled autonomy is only possible with data from millions of vehicles and an immense AI training cluster. We have, and continue to expand, both.”

Musk described the company’s FSD 12 self-driving software as “profound” and said that “it’s only a matter of time before we exceed the reliability of humans, and not much time at that.”

The biggest open question about Tesla is what would happen with its long-promised Model 2, a sub-$30,000 EV that would, in theory, have mass appeal. Reuters reported that the project had been cancelled and that Tesla was instead devoting its resources to another long-promised project, a self-driving ride-hailing vehicle called the “robotaxi.”

Musk tweeted that Reuters was “lying” but never directly denied the report or identified what was wrong with it, instead saying that the robotaxi would be unveiled in August. He later followed up to say that “going balls to the wall for autonomy is a blindingly obvious move. Everything else is like variations on a horse carriage.”

Before the call, Wall Street analysts were begging for a confirmation that newer, cheaper models besides a robotaxi were coming.

“If Tesla does not come out with a Model 2 the next 12 to 18 months, the second growth wave will not come,” Wedbush Securities analyst Dan Ives wrote in a note last week. “Musk needs to recommit to the Model 2 strategy ALONG with robotaxis but it CANNOT be solely replaced by autonomy.”

Anyone who expected to get their answers on today’s call, though, was likely kidding themselves.

Tesla announced today it had updated its planned vehicle line-up to “accelerate the launch of new models ahead of our previously communicated start of production in the second half of 2025,” and that “these new vehicles, including more affordable models, will utilize aspects of the next generation platform as well as aspects of our current platforms.” Musk added on the company’s earnings call that a new model would not be “contingent on any new factory or massive new production line.”

Some analysts attributed the share pricing popping after hours to this line, although it’s unclear just how new this new car would be.

Tesla’s shareholder update indicated that any new, cheaper vehicle would not necessarily be entirely new nor unlock massive new savings through an all-new production process. “This update may result in achieving less cost reduction than previously expected but enables us to prudently grow our vehicle volumes in a more capex efficient manner during uncertain times,” the update said.

Of the robotaxi, meanwhile, the company said it will “continue to pursue a revolutionary ‘unboxed’ manufacturing strategy,” indicating that just the ride-hailing vehicle would be built entirely on a new platform.

Musk also discussed how a robotaxi network could work, saying that it would be a combination of Tesla-operated robotaxis and owners putting their own cars into the ride-hailing fleet. When asked directly about its schedule for a $25,000 car, Musk quickly pivoted to discussing autonomy, saying that when Teslas are able to self-drive without supervision, it will be “the biggest asset appreciation in history,” as existing Teslas became self-driving.

When asked whether any new vehicles would “tweaks” or “new models,” Musk dodged the question, saying that they had said everything they had planned to say on the new cars.

One bright spot on the company’s numbers was the growth in its sales of energy systems, which are tilting more and more toward the company’s battery offerings.

Tesla said it deployed just over 4 gigawatts of energy storage in the first quarter of the year, and that its energy revenue was up 7% from a year ago. Profits from the business more than doubled.

Tesla’s energy business is growing faster than its car business, and Musk said it will continue to grow “significantly faster than the car business” going forward.

Revenues from “services and others,” which includes the company’s charging network, was up by a quarter, as more and more other electric vehicle manufacturers adopt Tesla’s charging standard.

Another speculative Tesla project is Optimus, which the company describes as a “general purpose, bi-pedal, humanoid robot capable of performing tasks that are unsafe, repetitive or boring.” Like many robotics projects, the most the public has seen of Optimus has been intriguing video content, but Musk said that it was doing “factory tasks in the lab” and that it would be in “limited production” in a factory doing “useful tasks” by the end of this year. External sales could begin “by the end of next year,” Musk said.

But as with any new Tesla project, these dates may be aspirational. Musk described them as “just guesses,” but also said that Optimus could “be more valuable than everything else combined.”

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

The battery recycling company announced a $425 million Series E round after pivoting to power data centers.

Amidst a two year-long slump in lithium prices, the Nevada-based battery recycling company Redwood Materials announced last summer that it had begun a new venture focused on grid-scale energy storage. Today, it’s clear just how much that bet has paid off.

The company announced a $425 million round of Series E funding for the new venture, known as Redwood Energy. That came from some big names in artificial intelligence, including Google and Nvidia’s venture capital arm, NVentures. This marks the final close of the funding round, increasing the total from $350 million announced in October.

Redwood Energy adapts the company’s original mission — breaking down spent batteries to recover, refine, and resell critical minerals — to suit the data center revolution. Instead of merely extracting battery materials, the company can now also repurpose electric vehicle batteries that still have some life left in them as energy storage solutions for AI data centers, allowing Redwood to get value from the battery throughout its lifecycle.

“Regardless of where lithium prices are, if we can put [a lithium-ion battery] in a large-scale energy storage system, it can have a lot more value before we break it down into critical materials,” Claire McConnell, Redwood’s new VP of business development for energy storage, told me.

Over the past 12 to 18 months, she explained that the company had started to receive more and more used electric vehicle battery packs “in better condition than we initially anticipated.” Given the substantial electricity load growth underway, McConnell said the company saw it as “perfect moment” to “develop something that could be really unique for that market.”

At the time of Redwood Energy’s launch last June, the company announced that it had stockpiled over a gigawatt-hour of used EV batteries, with an additional 5 gigawatt-hours expected over the following year. Its first microgrid pilot is already live and generating revenue in Sparks, Nevada, operating in partnership with the data center owner and operator Crusoe Energy. That project is off-grid, supplying solar-generated electricity directly to Crusoe’s data center. Future projects could be grid-connected though, storing energy when prices are low and dispatching it when there are spikes in demand.

The company also isn’t limiting itself to used battery packs, McConnell told me. Plenty of manufacturers, she said, are sitting on a surplus of new batteries that they’re willing to offload to Redwood. The potential reasons for that glut are easy to see: already-slower-than-expected EV adoption compounded by Trump’s rollback of incentives has left many automakers with lower than projected EV sales. And even in the best of times, automakers routinely retool their product lines, which could leave them with excess inventory from an older model.

While McConnell wouldn’t reveal what percent of packs are new, she did tell me they make up a “pretty meaningful percentage of our inventory right now,” pointing to a recently announced partnership with General Motors meant to accelerate deployment of both new and used battery packs for energy storage.

While Redwood isn’t abandoning its battery recycling roots, this shift in priorities toward data center energy storage comes after a tough few years for the battery recycling sector overall. By last June, lithium prices had fallen precipitously from their record highs in 2022, making mineral recycling far less competitive. Then came Trump’s cuts to consumer electric vehicle incentives, further weakening demand. On top of that, the rise of lithium-iron phosphate batteries — which now dominate the battery storage sector and are increasingly common in EVs — have reduced the need for nickel and cobalt in particular, as they’re not a part of this cheaper battery chemistry.

All this helped create the conditions for the bankruptcy of one of Redwood’s main competitors, Li-Cycle, in May 2025. The company went public via a SPAC merger in 2021, aiming to commercialize its proprietary technique for shredding whole lithium-ion battery packs at once. But it ultimately couldn’t secure the funds to finish building out its recycling hub in Rochester, New York, and it was acquired by the commodities trading and mining company Glencore last summer.

“We started really early, and in a way we started Redwood almost too early,” JB Straubel, Redwood’s founder and Tesla’s co-founder, told TechCrunch last summer. He was alluding to the fact that in 2017, when Redwood was founded, there just weren’t that many aging EVs on the road — nor are there yet today. So while an influx of used EV batteries is eventually expected, slower than anticipated EV adoption means there just may not be enough supply yet to sustain a company like Redwood on that business model alone.

In the meantime, Redwood has also worked to recycle and refine critical minerals from battery manufacturing scrap and used lithium-ion from consumer electronics. Partnerships with automakers such as Toyota, Volkswagen, and General Motors, as well as global battery manufacturer Panasonic, have helped bolster both its EV battery recycling business and new storage endeavor. The goal of building a domestic supply chain for battery materials such as lithium, nickel, cobalt, and copper also remains as bipartisan as ever, meaning Redwood certainly isn’t dropping the recycling and refining arm of its business, even as it shifts focus toward energy storage.

For instance, it’s also still working on the buildout of a recycling and battery component production facility in Charleston, South Carolina. While three years ago the company announced that this plant would eventually produce over 100 gigawatt-hours of cathode and anode battery components annually, operations on this front appear to be delayed. When Redwood announced that recycling and refining operations had begun in Charleston late last year, it made no mention of when battery component production would start up.

It’s possible that this could be taking a backburner to the company’s big plans to expand its storage business. While the initial Crusoe facility offers 63 megawatt-hours of battery energy storage, McConnell told me that Redwood is now working on projects “in the hundreds of megawatt-hours, looking to gigawatt-hour scale” that it hopes to announce soon.

The market potential is larger than any of us might realize. Over the next five or so years, McConnell said, “We expect that repurposed electric vehicle battery packs could make up 50% of the energy storage market.”

Fossil fuel companies colluded to stifle competition from clean energy, the state argues.

A new kind of climate lawsuit just dropped.

Last week the state of Michigan joined the parade of governments at all levels suing fossil fuel companies for climate change-related damages. But it’s testing a decidedly different strategy: Rather than allege that Big Oil deceived the public about the dangers of its products, Michigan is bringing an antitrust case, arguing that the industry worked as a cartel to stifle competition from non-fossil fuel resources.

Starting in the 1980s, the complaint says, ExxonMobil, Chevron, Shell, BP, and their trade association, the American Petroleum Institute, conspired “to delay the transition from fossil fuels to renewable energy” and “unlawfully colluded to reduce innovation” in Michigan’s transportation and energy markets. This, it alleges, is a key driver of Michigan’s (and the country’s) present-day struggles with energy affordability. If the companies had not suppressed renewable energy and electric vehicles, the argument goes, these technologies would have become competitive sooner and resulted in lower transportation and energy costs.

The framing may enable Michigan to sidestep some of the challenges other climate lawsuits have faced. Ten states have attempted to hold Big Oil accountable for climate impacts, mostly by arguing that the industry concealed the harms their products would cause. One suit filed by the City of New York has been dismissed, and many others have been delayed due to arguments over whether the proceedings belong in state or federal court, and haven’t yet gotten to the substance of the claims. Michigan’s tactic “maybe speeds up getting to the merits of the case,” Margaret Barry, a climate litigation fellow at Columbia University’s Sabin Center for Climate Change Law, told me, “because those jurisdictional issues aren’t going to be part of the court’s review.”

The fossil fuel industry’s primary defense in these suits has been that cities and states cannot fault oil companies for greenhouse gas emissions because regulating those emissions is the job of the federal government, per the Clean Air Act. Making the case about competition may “avoid arguments about whether this lawsuit is really about regulation,” Rachel Rothschild, an assistant professor of law at the University of Michigan, told me.

The biggest hurdle Michigan will face is proving the existence of a coordinated plot. Geoffrey Kozen, a partner at the law firm Robins Kaplan who works on antitrust cases, told me that companies in these kinds of suits tend to argue that they were simply reacting independently to the same market pressures and responding as any rational market actor would.

There are two main ways for a plaintiff to overcome that kind of argument, Kozen explained. In rare cases, there is a smoking gun — a memo that all of the parties signed saying they were going to act together, for example. More often, attorneys attempt to demonstrate a combination of “parallel conduct,” i.e., showing that all of the parties did the same thing, and “plus factors,” or layers of evidence that make it more likely that there was some kind of underlying agreement.

According to Michigan’s lawsuit, the collusion story in this case goes like this. In 1979, the American Petroleum Institute started a group called the CO2 and Climate Task Force. By that time, Exxon had come to understand that fossil fuel consumption was warming the planet and would cause devastation costing trillions of dollars. The company’s scientists had concluded that cleaner alternatives to fossil fuels would have to make up an increasing amount of the world’s energy if such effects were to be avoided.

“A self-interested and law-abiding rational firm would have used this insight to innovate and compete in the energy market by offering superior and cheaper energy products to consumers,” the complaint says. Michigan alleges that instead, Exxon shared its findings with the other companies in the task force and conspired with them to suppress clean alternatives to fossil fuels. They worked together to “synchronize assessments of climate risks, monitor each other’s scientific and industry outlooks, align their responses to competitive threats, and coordinate their efforts to suppress technologies likely to displace gasoline or other fossil fuels through collusion rather than competition,” according to the complaint.

Michigan’s lawyers point to evidence showing that the named companies shut down internal research programs, withheld products from the market, and used their control of patents to stifle progress away from fossil fuels. The companies were all early leaders in developing clean technologies — with innovations in rechargeable batteries, hybrid cars, and solar panels — but began to sabotage or abandon those efforts after the formation of the task force, the lawsuit alleges.

The case will likely turn on whether the judge finds it credible that these actions would have been against the companies’ self-interest had they not known their peers would be doing the same thing, Kozen told me.

“The actions differ between defendants. They are over a wide range of time periods. And so the question is, is that pursuant to an actual agreement? Or is it pursuant to a bunch of oil executives who are all thinking in similar ways?” he said. “I think that’s going to be the number one point where success or failure is probably going to tip.”

Another challenge for Michigan will be to prove what the world would have looked like had this collusion not taken place. In the parlance of antitrust, this is known as the “but-for world.” Without the Big Oil conspiracy, the lawsuit says, electric vehicles would be “a common sight in every neighborhood,” there would be ubiquitous “reliable and fast chargers,” and renewable energy would be “supplied at scale.” It argues that economic models show that Michigan’s energy prices would also have been significantly lower. While such arguments are common in antitrust cases, it’s a lot more difficult to quantify the effects of stifled innovation than something more straightforward like price fixing.

The companies, of course, reject Michigan’s narrative. A spokeswoman for Exxon told the New York Times it was “yet another legally incoherent effort to regulate by lawsuit.”

If the state can gather enough plausible evidence of harm, however, it may be able to get past the companies’ inevitable motion to dismiss the case and on to discovery. While the case is built on heaps of internal emails and leaked memos that have been made public over the years through congressional investigations, who knows how much of the story has yet to be revealed.

“It’s, in my experience, almost impossible, if someone is actually a member of a cartel, to hide all the evidence,” said Kozen. “Whatever it is, it always comes out.”

Current conditions: Temperatures as low as 30 degrees Fahrenheit below average are expected to persist for at least another week throughout the Northeast, including in New York City • Midsummer heat is driving temperatures up near 100 degrees in Paraguay • Antarctica is facing intense katabatic winds that pull cold air from high altitudes to lower ones.

The United States has, once again, exited the Paris Agreement, the first global carbon-cutting pact to include the world’s two top emitters. President Donald Trump initiated the withdrawal on his first day back in office last year — unlike the last time Trump quit the Paris accords, after a prolonged will-he-won’t-he game in 2017. That process took three years to complete, allowing newly installed President Joe Biden to rejoin in 2021 after just a brief lapse. This time, the process took only a year to wrap up, meaning the U.S. will remain outside the pact for years at least. “Trump is making unilateral decisions to remove the United States from any meaningful global climate action,” Katie Harris, the vice president of federal affairs at the union-affiliated BlueGreen Alliance, said in a statement. “His personal vendetta against clean energy and climate action will hurt workers and our environment.” Now, as Heatmap’s Katie Brigham wrote last year, at “all Paris-related meetings (which comprise much of the conference), the U.S. would have to attend as an ‘observer’ with no decision-making power, the same category as lobbyists.”

America has not yet completed its withdrawal from the United Nations Framework Convention on Climate Change, the overarching group through which the Paris Agreement was negotiated, which Trump initiated this month. That won’t be final until next year. That Trump is even planning to quit the body shows how much more aggressive the administration’s approach to climate policy is this time around. Trump remained within the UNFCCC during his first term, preferring to stay engaged in negotiations even after quitting the Paris Agreement.

Just weeks after a federal judge struck down the Trump administration’s stop work order on the Revolution Wind project off Rhode Island’s shores, another federal judge has overturned the order halting construction on the Vineyard Wind project off Massachusetts. That, as Heatmap’s Emily Pontecorvo wrote last night, “makes four offshore wind farms that have now won preliminary injunctions against Trump’s freeze on the industry.” Besides Revolution Wind, Dominion Energy’s Coastal Virginia offshore wind project and Equinor’s Empire Wind plant off Long Island have each prevailed in their challenges to the administration’s blanket order to abandon construction on dubious national security grounds.

Meanwhile, the White House is potentially starving another major infrastructure project of funding. The Gateway rail project to build a new tunnel under the Hudson River between New Jersey and New York City could run out of money and halt construction by the end of next week, the project manager warned Tuesday. Washington had promised billions to get the project done, but the money stopped flowing in October during the government shutdown. Officials at the Department of Transportation said the funding would remain suspended until, as The New York Times reported, the project’s contracts could be reviewed for compliance with new rules about businesses owned by women and minorities.

Sign up to receive Heatmap AM in your inbox every morning:

A new transmission line connecting New England’s power-starved and gas-addicted grid to Quebec’s carbon-free hydroelectric system just came online this month. But electricity abruptly stopped flowing onto the New England Clean Energy Connect as the Canadian province’s state-owned utility, Hydro-Quebec, withheld power to meet skyrocketing demand at home amid the Arctic chill. Power plant owners in New England and New York, where Hydro-Quebec is building another line down the Hudson River to connect to New York City, complained that deals with the utility focused on maintaining supplies during the summer, when air conditioning traditionally surges power to peak demand. Hydro-Quebec restored power to the line on Monday.

The storm represented a force majeure event. If it hadn’t, the utility would have needed to pay penalties. But the incident is sure to fuel more criticism from power plant owners, most of which are fossil fueled, who oppose increased competition from the Quebecois. “I hate to say it, but a lot of the issues and concerns that we have been talking about for years have played out this weekend,” Dan Dolan — who leads the New England Power Generators Association, a trade group representing power plant owners — told E&E News. “This is a very expensive contract for a product that predominantly comes in non-stressed periods in the winter,” he said.

Europe has signed what the European Commission president Urusula von der Leyen called “the mother of all deals” with India, “a free trade zone of 2 billion people.” As part of the deal, the world’s second-largest market and the most populous nation plan to ramp up exports of steel, plastics, chemicals, and pharmaceuticals. But don’t expect Brussels to give New Delhi a break on its growing share of the global emissions. The EU’s carbon border adjustment mechanism — the first major tariff in the world based on the carbon intensity of imports — just took effect this month, and will remain intact for Indian goods, Reuters reported.

The Department of the Interior has ordered staff at the National Park Service to remove or edit signs and other informational materials in at least 17 parks out West to scrub mentions of climate change or hardship inflicted by settlers on Native Americans. The effort comes as part of what The Washington Post called a renewed push to implement Trump’s executive order on “restoring truth and sanity to American history.” Park staff have interpreted those orders, the newspaper reported, to mean eliminating any reference to historic racism, sexism, LGBTQ rights, and climate change. Just last week, officials removed an exhibit at Independence National Historical Park on George Washington’s ownership of slaves.

Tesla is going trucking. The electric automaker inked a deal Tuesday with Pilot Travel Centers, the nation’s largest operator of highway pit stops, to install Tesla’s Semi Chargers for heavy-duty electric vehicle charging. The stations are set to be built at select Pilot locations along Interstate 5, Interstate 10, and several other major corridors where heavy-duty charging is highest. The first sites are scheduled to open this summer.