You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

The United Auto Workers’ contract with the Big Three automakers is almost up. Its replacement is going to be hotly contested.

One of the dirty little secrets of the electric vehicle boom is that many of its workers are paid less and enjoy fewer benefits than those who manufacture the nation’s gas guzzlers. But if unions have their way, that won’t be the case for long.

On September 14, the United Auto Workers' contract with the Big Three automakers — GM, Ford, and Stellantis — will expire. Negotiations for a new agreement are set to begin in July, and electric vehicle jobs will be a defining issue with potential to put the 380,000-member union on strike this fall. The union’s leadership team held a town hall late last month where they laid out the stakes.

“To be clear, I and the UAW leadership support this transition, but it must be a just transition,” said vice president of the union Mike Booth. “These must not only be union jobs, but they must be jobs that maintain the wages, benefits, and safety standards that generations of UAW members have fought for.”

So far, the industry has been trending in the opposite direction. Booth pointed to the Ultium battery cell manufacturing plant in Lordstown, Ohio, which is a joint venture between GM and LG. Workers there currently start at $16.50 per hour, and can work their way up to $20 per hour after seven years. That’s well below the $32 per hour that union workers made at a nearby GM assembly plant that closed in 2019. “Meanwhile the company is receiving billions in government subsidies. This is not a just transition, and this is not an acceptable standard to set,” said Booth.

The Big Three are facing pressure to keep EV costs down amid inflation, materials scarcity, and increasing competition from international automakers — particularly from China. They also must contend with the fact that workers for other preeminent players in the nascent industry — Tesla and Rivian — aren’t unionized, although movements are cropping up to change that. While Elon Musk argues Tesla pays its workers more than their unionized counterparts, his company has been accused of serious labor violations and the National Labor Relations Board has ruled it illegally fired a worker involved in labor organizing.

The upcoming negotiations are a bellwether for many on the left's belief that the transition to clean energy can and should “create millions of good, high-wage jobs.” But as Booth’s remark suggests, union members aren’t just frustrated with the automakers, but with Biden. His signature climate policy, the Inflation Reduction Act, has begun fueling the growth of a domestic electric vehicle manufacturing industry with billions of dollars in incentives and little support for organized labor.

According to a database of clean manufacturing announcements maintained by Jack Conness, a policy analyst at the nonprofit Energy Innovation, companies have announced upwards of $70 billion in investments in U.S. battery and electric vehicle manufacturing since the law was passed.

The IRA has been hailed by labor advocates for including wage and apprenticeship requirements for many of its subsidies. But those provisions are geared at construction jobs, not manufacturing jobs. For example, while automakers must pay prevailing wages and hire apprentices to build their battery factories in order to qualify for the full “Advanced Energy Project Credit,” they do not have to make similar commitments to the workers who will actually make the batteries.

The only relevant labor requirements for those workers came in federal guidance on the tax credit for the manufacturing of clean energy parts that was published last month. It noted that the Internal Revenue Service would only consider projects recommended by the Department of Energy. That agency must base its endorsements on a set of criteria that includes having a “clear and appropriately robust plan” to engage with labor unions.

These kinds of provisions, like requiring developers to put their plans for workforce and community engagement in their applications, may help give unions a leg up. David Madland, a senior fellow at the Center for American Progress, a liberal D.C. policy think tank, pointed to the recent unionization of the Blue Bird electric school bus factory in rural Georgia. The company received funding from the EPA that required it to be “committed to remain neutral in any organizing campaign.”

“The Biden administration is doing a lot to ensure the jobs created by industrial policy are good jobs,” Madland told me in an email. “But more work needs to be done.”

Recently-elected insurgent president of the UAW Shawn Fain sent a memo to the union’s 380,000 members in early May warning that the shift to EVs was “at serious risk of becoming a race to the bottom.” He stated that the union would not endorse Biden for re-election until he does more to support labor standards in the transition.

It’s not yet clear whether the transition to EVs will result in a net loss or gain of manufacturing jobs. Industry studies have noted that electric vehicles have fewer parts, and will therefore require fewer workers, than internal combustion engine vehicles. Ford CEO Jim Farley made waves in November when he said the job required 40% less labor, a statistic that echoes a similar warning by the UAW back in 2020

But some researchers and analysts have contested the idea. Carnegie Mellon engineers analyzed production data from leading automotive manufacturers and found that although EVs have fewer parts, their components collectively require more labor-hours than conventional vehicle parts. But the researchers note that despite this, the shift to electric vehicles could still lead to job losses in certain regions depending on where companies choose to locate new battery factories.

While the IRA has seemingly given automakers enough incentives not to move these facilities abroad, many of them are building their plants in southern states where organized labor has always struggled to gain a foothold.

Outside analysts predict the negotiations will break down and lead to a strike. Four years ago, when the union went on strike against GM for 40 days during the last round of negotiations, it cost the company $3.6 billion. Workers lost nearly $1 billion in wages.

UAW leadership began to prepare its members for that possibility during its town hall last month.

“I want to be clear on this, and I know this might sound crazy, but the choice of whether or not we go on strike is up to the Big Three,” said UAW Secretary-Treasurer Margaret Mock. “We are clear about what we want.”

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

And more on the week’s biggest conflicts around renewable energy projects.

1. Jackson County, Kansas – A judge has rejected a Hail Mary lawsuit to kill a single solar farm over it benefiting from the Inflation Reduction Act, siding with arguments from a somewhat unexpected source — the Trump administration’s Justice Department — which argued that projects qualifying for tax credits do not require federal environmental reviews.

2. Portage County, Wisconsin – The largest solar project in the Badger State is now one step closer to construction after settling with environmentalists concerned about impacts to the Greater Prairie Chicken, an imperiled bird species beloved in wildlife conservation circles.

3. Imperial County, California – The board of directors for the agriculture-saturated Imperial Irrigation District in southern California has approved a resolution opposing solar projects on farmland.

4. New England – Offshore wind opponents are starting to win big in state negotiations with developers, as officials once committed to the energy sources delay final decisions on maintaining contracts.

5. Barren County, Kentucky – Remember the National Park fighting the solar farm? We may see a resolution to that conflict later this month.

6. Washington County, Arkansas – It seems that RES’ efforts to build a wind farm here are leading the county to face calls for a blanket moratorium.

7. Westchester County, New York – Yet another resort town in New York may be saying “no” to battery storage over fire risks.

Solar and wind projects are getting swept up in the blowback to data center construction, presenting a risk to renewable energy companies who are hoping to ride the rise of AI in an otherwise difficult moment for the industry.

The American data center boom is going to demand an enormous amount of electricity and renewables developers believe much of it will come from solar and wind. But while these types of energy generation may be more easily constructed than, say, a fossil power plant, it doesn’t necessarily mean a connection to a data center will make a renewable project more popular. Not to mention data centers in rural areas face complaints that overlap with prominent arguments against solar and wind – like noise and impacts to water and farmland – which is leading to unfavorable outcomes for renewable energy developers more broadly when a community turns against a data center.

“This is something that we’re just starting to see,” said Matthew Eisenson, a senior fellow with the Renewable Energy Legal Defense Initiative at the Columbia University Sabin Center for Climate Change Law. “It’s one thing for environmentalists to support wind and solar projects if the idea is that those projects will eventually replace coal power plants. But it’s another thing if those projects are purely being built to meet incremental demand from data centers.”

We’ve started to see evidence of this backlash in certain resort towns fearful of a new tech industry presence and the conflicts over transmission lines in Maryland. But it is most prominent in Virginia, ground zero for American hyperscaler data centers. As we’ve previously discussed in The Fight, rural Virginia is increasingly one of the hardest places to get approval for a solar farm in the U.S., and while there are many reasons the industry is facing issues there, a significant one is the state’s data center boom.

I spent weeks digging into the example of Mecklenburg County, where the local Board of Supervisors in May indefinitely banned new solar projects and is rejecting those that were in the middle of permitting when the decision came down. It’s also the site of a growing data center footprint. Microsoft, which already had a base of operations in the county’s town of Boydton, is in the process of building a giant data center hub with three buildings and an enormous amount of energy demand. It’s this sudden buildup of tech industry infrastructure that is by all appearances driving a backlash to renewable energy in the county, a place that already had a pre-existing high opposition risk in the Heatmap Pro database.

It’s not just data centers causing the ban in Mecklenburg, but it’s worth paying attention to how the fight over Big Tech and solar has overlapped in the county, where Sierra Club’s Virginia Chapter has worked locally to fight data center growth with a grassroots citizens group, Friends of the Meherrin River, that was a key supporter of the solar moratorium, too.

In a conversation with me this week, Tim Cywinski, communications director for the state’s Sierra Club chapter, told me municipal leaders like those in Mecklenburg are starting to group together renewables and data centers because, simply put, rural communities enter into conversations with these outsider business segments with a heavy dose of skepticism. This distrust can then be compounded when errors are made, such as when one utility-scale solar farm – Geenex’s Grasshopper project – apparently polluted a nearby creek after soil erosion issues during construction, a problem project operator Dominion Energy later acknowledged and has continued to be a pain point for renewables developers in the county.

“I don’t think the planning that has been presented to rural America has been adequate enough,” the Richmond-based advocate said. “Has solar kind of messed up in a lot of areas in rural America? Yeah, and that’s given those communities an excuse to roll them in with a lot of other bad stuff.”

Cywinski – who describes himself as “not your typical environmentalist” – says the data center space has done a worse job at community engagement than renewables developers in Virginia, and that the opposition against data center projects in places like Chesapeake and Fauquier is more intense, widespread, and popular than the opposition to renewables he’s seeing play out across the Commonwealth.

But, he added, he doesn’t believe the fight against data centers is “mutually exclusive” from conflicts over solar. “I’m not going to tout the gospel of solar while I’m trying to fight a data center for these people because it’s about listening to them, hearing their concerns, and then not telling them what to say but trying to help them elevate their perspective and their concerns,” Cywinski said.

As someone who spends a lot of time speaking with communities resisting solar and trying to best understand their concerns, I agree with Cywinksi: the conflict over data centers speaks to the heart of the rural vs. renewables divide, and it offers a warning shot to anyone thinking AI will help make solar and wind more popular.

The One Big Beautiful Bill Act is one signature away from becoming law and drastically changing the economics of renewables development in the U.S. That doesn’t mean decarbonization is over, experts told Heatmap, but it certainly doesn’t help.

What do we do now?

That’s the question people across the climate change and clean energy communities are asking themselves now that Congress has passed the One Big Beautiful Bill Act, which would slash most of the tax credits and subsidies for clean energy established under the Inflation Reduction Act.

Preliminary data from Princeton University’s REPEAT Project (led by Heatmap contributor Jesse Jenkins) forecasts that said bill will have a dramatic effect on the deployment of clean energy in the U.S., including reducing new solar and wind capacity additions by almost over 40 gigawatts over the next five years, and by about 300 gigawatts over the next 10. That would be enough to power 150 of Meta’s largest planned data centers by 2035.

But clean energy development will hardly grind to a halt. While much of the bill’s implementation is in question, the bill as written allows for several more years of tax credit eligibility for wind and solar projects and another year to qualify for them by starting construction. Nuclear, geothermal, and batteries can claim tax credits into the 2030s.

Shares in NextEra, which has one of the largest clean energy development businesses, have risen slightly this year and are down just 6% since the 2024 election. Shares in First Solar, the American solar manufacturer, are up substantially Thursday from a day prior and are about flat for the year, which may be a sign of investors’ belief that buyer demand for solar panels will persist — or optimism that the OBBBA’s punishing foreign entity of concern requirements will drive developers into the company’s arms.

Partisan reversals are hardly new to climate policy. The first Trump administration gleefully pulled the rug from under the Obama administration’s power plant emissions rules, and the second has been thorough so far in its assault on Biden’s attempt to replace them, along with tailpipe emissions standards and mileage standards for vehicles, and of course, the IRA.

Even so, there are ways the U.S. can reduce the volatility for businesses that are caught in the undertow. “Over the past 10 to 20 years, climate advocates have focused very heavily on D.C. as the driver of climate action and, to a lesser extent, California as a back-stop,” Hannah Safford, who was director for transportation and resilience in the Biden White House and is now associate director of climate and environment at the Federation of American Scientists, told Heatmap. “Pursuing a top down approach — some of that has worked, a lot of it hasn’t.”

In today’s environment, especially, where recognition of the need for action on climate change is so politically one-sided, it “makes sense for subnational, non-regulatory forces and market forces to drive progress,” Safford said. As an example, she pointed to the fall in emissions from the power sector since the late 2000s, despite no power plant emissions rule ever actually being in force.

“That tells you something about the capacity to deliver progress on outcomes you want,” she said.

Still, industry groups worry that after the wild swing between the 2022 IRA and the 2025 OBBA, the U.S. has done permanent damage to its reputation as a business-friendly environment. Since continued swings at the federal level may be inevitable, building back that trust and creating certainty is “about finding ballasts,” Harry Godfrey, the managing director for Advanced Energy United’s federal priorities team, told Heatmap.

The first ballast groups like AEU will be looking to shore up is state policy. “States have to step up and take a leadership role,” he said, particularly in the areas that were gutted by Trump’s tax bill — residential energy efficiency and electrification, transportation and electric vehicles, and transmission.

State support could come in the form of tax credits, but that’s not the only tool that would create more certainty for businesses — considering the budget cuts states will face as a result of Trump’s tax bill, it also might not be an option. But a lot can be accomplished through legislative action, executive action, regulatory reform, and utility ratemaking, Godfrey said. He cited new virtual power plant pilot programs in Virginia and Colorado, which will require further regulatory work to “to get that market right.”

A lot of work can be done within states, as well, to make their deployment of clean energy more efficient and faster. Tyler Norris, a fellow at Duke University's Nicholas School of the Environment, pointed to Texas’ “connect and manage” model for connecting renewables to the grid, which allows projects to come online much more quickly than in the rest of the country. That’s because the state’s electricity market, ERCOT, does a much more limited study of what grid upgrades are needed to connect a project to the grid, and is generally more tolerant of curtailing generation (i.e. not letting power get to the grid at certain times) than other markets.

“As Texas continues to outpace other markets in generator and load interconnections, even in the absence of renewable tax credits, it seems increasingly plausible that developers and policymakers may conclude that deeper reform is needed to the non-ERCOT electricity markets,” Norris told Heatmap in an email.

At the federal level, there’s still a chance for, yes, bipartisan permitting reform, which could accelerate the buildout of all kinds of energy projects by shortening their development timelines and helping bring down costs, Xan Fishman, senior managing director of the energy program at the Bipartisan Policy Center, told Heatmap. “Whether you care about energy and costs and affordability and reliability or you care about emissions, the next priority should be permitting reform,” he said.

And Godfrey hasn’t given up on tax credits as a viable tool at the federal level, either. “If you told me in mid-November what this bill would look like today, while I’d still be like, Ugh, that hurts, and that hurts, and that hurts, I would say I would have expected more rollbacks. I would have expected deeper cuts,” he told Heatmap. Ultimately, many of the Inflation Reduction Act’s tax credits will stick around in some form, although we’ve yet to see how hard the new foreign sourcing requirements will hit prospective projects.

While many observers ruefully predicted that the letter-writing moderate Republicans in the House and Senate would fold and support whatever their respective majorities came up with — which they did, with the sole exception of Pennsylvania Republican Brian Fitzpatrick — the bill also evolved over time with input from those in the GOP who are not openly hostile to the clean energy industry.

“You are already seeing people take real risk on the Republican side pushing for clean energy,” Safford said, pointing to Alaska Republican Senator Lisa Murkowski, who opposed the new excise tax on wind and solar added to the Senate bill, which earned her vote after it was removed.

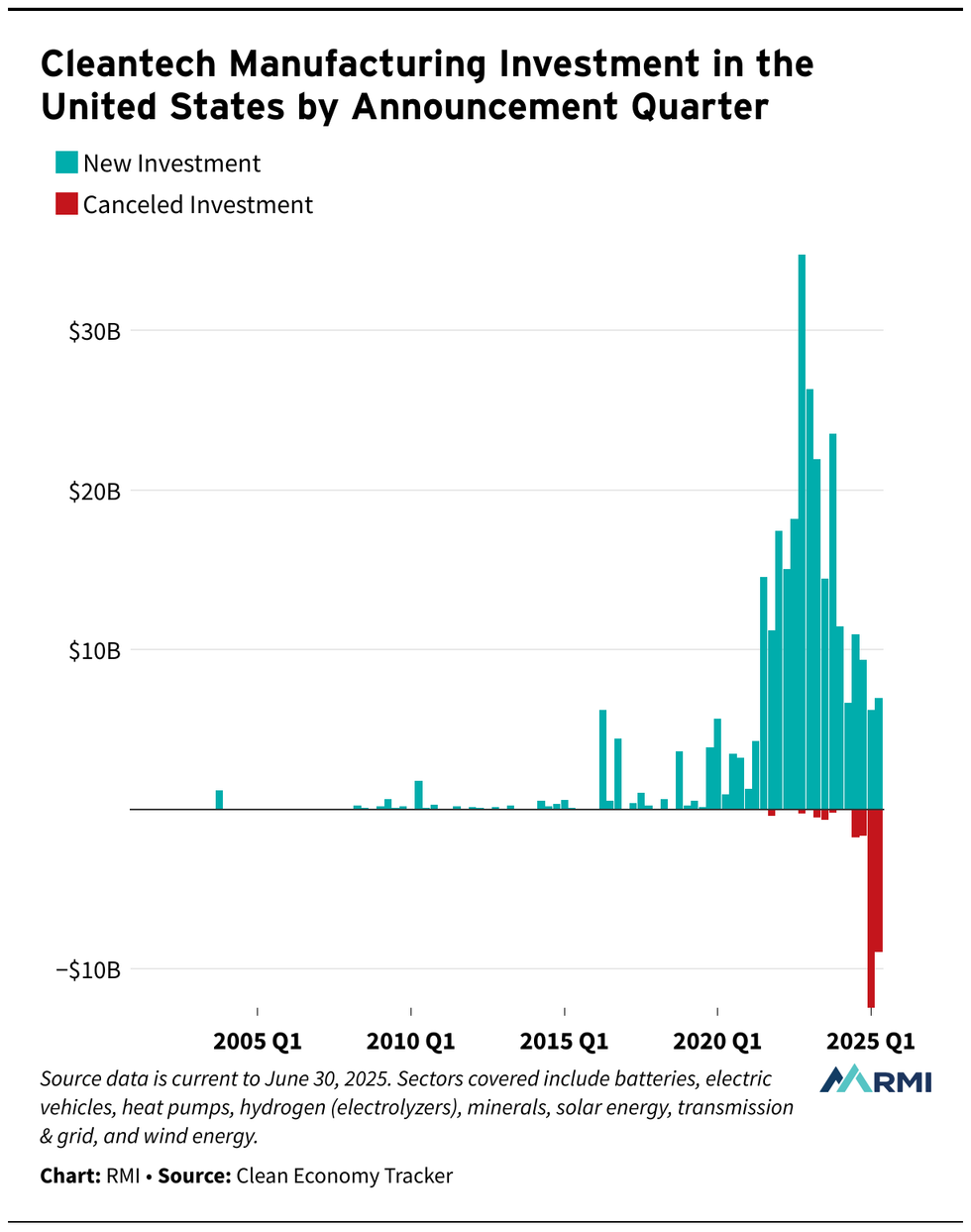

Some damage has already been done, however. Canceled clean energy investments adds up to $23 billion so far this year, compared to just $3 billion in all of 2024, according to the decarbonization think tank RMI. And that’s before OBBBA hits Trump’s desk.

The start-and-stop nature of the Inflation Reduction Act may lead some companies, states, local government and nonprofits to become leery of engaging with a big federal government climate policy again.

“People are going to be nervous about it for sure,” Safford said. “The climate policy of the future has to be polycentric. Even if you have the political opportunity to make a big swing again, people will be pretty gun shy. You will need to pursue a polycentric approach.”

But to Godfrey, all the back and forth over the tax credits, plus the fact that Republicans stood up to defend them in the 11th hour, indicates that there is a broader bipartisan consensus emerging around using them as a tool for certain energy and domestic manufacturing goals. A future administration should think about refinements that will create more enduring policy but not set out in a totally new direction, he said.

Albert Gore, the executive director of the Zero Emissions Transportation Association, was similarly optimistic that tax credits or similar incentives could work again in the future — especially as more people gain experience with electric vehicles, batteries, and other advanced clean energy technologies in their daily lives. “The question is, how do you generate sufficient political will to implement that and defend it?” he told Heatmap. “And that depends on how big of an economic impact does it have, and what does it mean to the American people?”

Ultimately, Fishman said, the subsidy on-off switch is the risk that comes with doing major policy on a strictly partisan basis.

“There was a lot of value in these 10-year timelines [for tax credits in the IRA] in terms of business certainty, instead of one- or two- year extensions,” Fishman told Heatmap. “The downside that came with that is that it became affiliated with one party. It was seen as a partisan effort, and it took something that was bipartisan and put a partisan sheen on it.”

The fight for tax credits may also not be over yet. Before passage of the IRA, tax credits for wind and solar were often extended in a herky-jerky bipartisan fashion, where Democrats who supported clean energy in general and Republicans who supported it in their districts could team up to extend them.

“You can see a world where we have more action on clean energy tax credits to enhance, extend and expand them in a future congress,” Fishman told Heatmap. “The starting point for Republican leadership, it seemed, was completely eliminating the tax credits in this bill. That’s not what they ended up doing.”