This article is exclusively

for Heatmap Plus subscribers.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

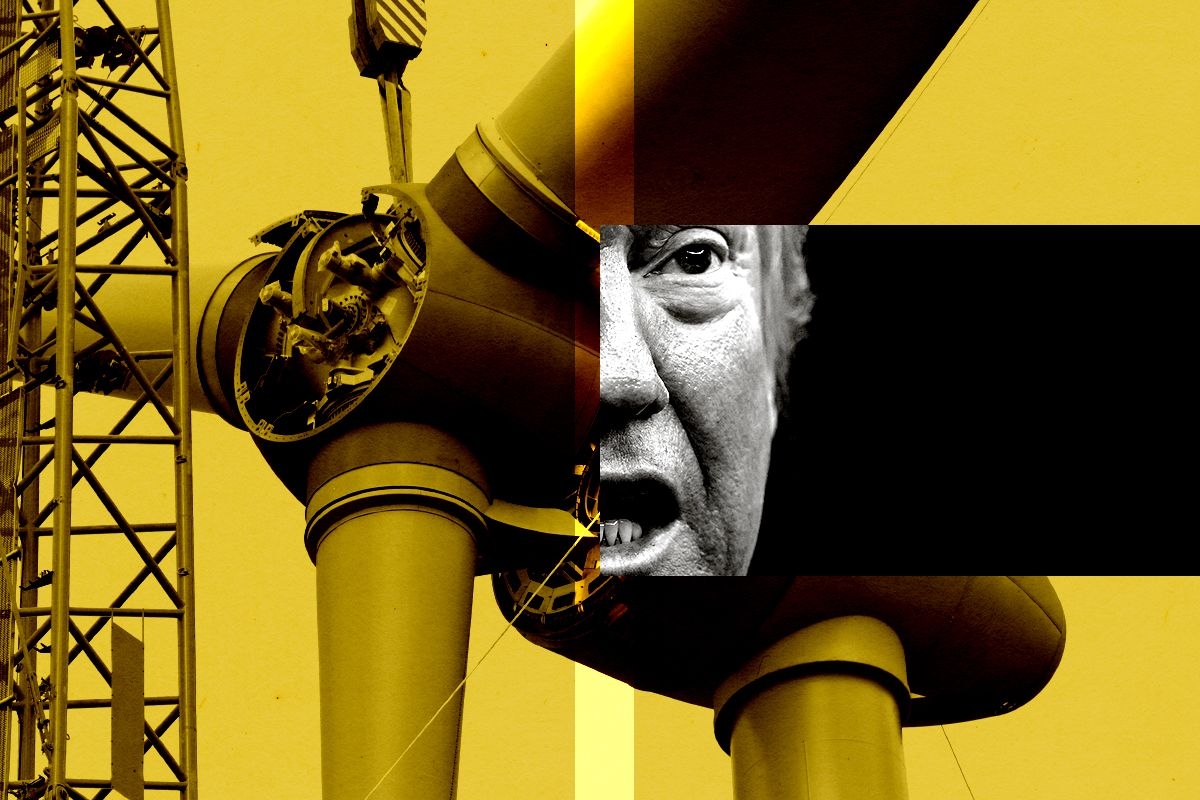

Six months in, federal agencies are still refusing to grant crucial permits to wind developers.

Federal agencies are still refusing to process permit applications for onshore wind energy facilities nearly six months into the Trump administration, putting billions in energy infrastructure investments at risk.

On Trump’s first day in office, he issued two executive orders threatening the wind energy industry – one halting solar and wind approvals for 60 days and another commanding agencies to “not issue new or renewed approvals, rights of way, permits, leases or loans” for all wind projects until the completion of a new governmental review of the entire industry. As we were first to report, the solar pause was lifted in March and multiple solar projects have since been approved by the Bureau of Land Management. In addition, I learned in March that at least some transmission for wind farms sited on private lands may have a shot at getting federal permits, so it was unclear if some arms of the government might let wind projects proceed.

However, I have learned that the wind industry’s worst fears are indeed coming to pass. The Fish and Wildlife Service, which is responsible for approving any activity impacting endangered birds, and the U.S. Army Corps of Engineers, tasked with greenlighting construction in federal wetlands, have simply stopped processing wind project permit applications after Trump’s orders – and the freeze appears immovable, unless something changes.

According to filings submitted to federal court Monday under penalty of perjury by Alliance for Clean Energy New York, at least three wind projects in the Empire State – Terra-Gen’s Prattsburgh Wind, Invenergy’s Canisteo Wind, and Apex’s Heritage Wind – have been unable to get the Army Corps or Fish and Wildlife Service to continue processing their permitting applications. In the filings, ACE NY states that land-based wind projects “cannot simply be put on a shelf for a few years until such time as the federal government may choose to resume permit review and issuance,” because “land leases expire, local permits and agreements expire, and as a result, the project must be terminated.”

While ACE NY’s filings discuss only these projects in New York, they describe the impacts as indicative of the national industry’s experience, and ACE NY’s executive director Marguerite Wells told me it is her understanding “that this is happening nationwide.”

“I can confirm that developers have conveyed to me that [the] Army Corps has stopped processing their applications specifically citing the wind ban,” Wells wrote in an email. “As I have understood it, the initial freeze covered both wind and solar projects, but the freeze was lifted for solar projects and not for wind projects.”

Lots of attention has been paid to Trump’s attacks on offshore wind, because those projects are sited entirely in federal waters. But while wind projects sited on private lands can hypothetically escape a federal review and keep sailing on through to operation, wind turbines are just so large in size that it’s hard to imagine that bird protection laws can’t apply to most of them. And that doesn’t account for wetlands, which seem to be now bedeviling multiple wind developers.

This means there’s an enormous economic risk in a six-month permitting pause, beyond impacts to future energy generation. The ACE NY filings state the impacts to New York alone represent more than $2 billion in capital investments, just in the land-based wind project pipeline, and there’s significant reason to believe other states are also experiencing similar risks. In a legal filing submitted by Democratic states challenging the executive order targeting wind, attorneys general listed at least three wind projects in Arizona – RWE’s Forged Ethic, AES’s West Camp, and Repsol’s Lava Run – as examples that may require approval from the federal government under the Bald and Golden Eagle Protection Act. As I’ve previously written, this is the same law that bird conservation advocates in Wyoming want Trump to use to reject wind proposals in their state, too.

The Fish and Wildlife Service and Army Corps of Engineers declined to comment after this story’s publication due to litigation on the matter. I also reached out to the developers involved in these projects to inquire about their commitments to these projects in light of the permitting pause. We’ll let you know if we hear back from them.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

NineDot Energy’s nine-fiigure bet on New York City is a huge sign from the marketplace.

Battery storage is moving full steam ahead in the Big Apple under new Mayor Zohran Mamdani.

NineDot Energy, the city’s largest battery storage developer, just raised more than $430 million in debt financing for 28 projects across the metro area, bringing the company’s overall project pipeline to more than 60 battery storage facilities across every borough except Manhattan. It’s a huge sign from the marketplace that investors remain confident the flashpoints in recent years over individual battery projects in New York City may fail to halt development overall. In an interview with me on Tuesday, NineDot CEO David Arfin said as much. “The last administration, the Adams administration, was very supportive of the transition to clean energy. We expect the Mamdani administration to be similar.”

It’s a big deal given that a year ago, the Moss Landing battery fire in California sparked a wave of fresh battery restrictions at the local level. We’ve been able to track at least seven battery storage fights in the boroughs so far, but we wouldn’t be surprised if the number was even higher. In other words, risk remains evident all over the place.

Asked where the fears over battery storage are heading, Arfin said it's “really hard to tell.”

“As we create more facts on the ground and have more operating batteries in New York, people will gain confidence or have less fear over how these systems operate and the positive nature of them,” he told me. “Infrastructure projects will introduce concern and reasonably so – people should know what’s going on there, what has been done to protect public safety. We share that concern. So I think the future is very bright for being able to build the cleaner infrastructure of the future, but it's not a straightforward path.”

In terms of new policy threats for development, local lawmakers are trying to create new setback requirements and bond rules. Sam Pirozzolo, a Staten Island area assemblyman, has been one of the local politicians most vocally opposed to battery storage without new regulations in place, citing how close projects can be to residences, because it's all happening in a city.

“If I was the CEO of NineDot I would probably be doing the same thing they’re doing now, and that is making sure my company is profitable,” Pirozzolo told me, explaining that in private conversations with the company, he’s made it clear his stance is that Staten Islanders “take the liability and no profit – you’re going to give money to the city of New York but not Staten Island.”

But onlookers also view the NineDot debt financing as a vote of confidence and believe the Mamdani administration may be better able to tackle the various little bouts of hysterics happening today over battery storage. Former mayor Eric Adams did have the City of Yes policy, which allowed for streamlined permitting. However, he didn’t use his pulpit to assuage battery fears. The hope is that the new mayor will use his ample charisma to deftly dispatch these flares.

“I’d be shocked if the administration wasn’t supportive,” said Jonathan Cohen, policy director for NY SEIA, stating Mamdani “has proven to be one of the most effective messengers in New York City politics in a long time and I think his success shows that for at least the majority of folks who turned out in the election, he is a trusted voice. It is an exercise that he has the tools to make this argument.”

City Hall couldn’t be reached for comment on this story. But it’s worth noting the likeliest pathway to any fresh action will come from the city council, then upwards. Hearings on potential legislation around battery storage siting only began late last year. In those hearings, it appears policymakers are erring on the side of safety instead of blanket restrictions.

The week’s most notable updates on conflicts around renewable energy and data centers.

1. Wasco County, Oregon – They used to fight the Rajneeshees, and now they’re fighting a solar farm.

2. Worcester County, Maryland – The legal fight over the primary Maryland offshore wind project just turned in an incredibly ugly direction for offshore projects generally.

3. Manitowoc County, Wisconsin – Towns are starting to pressure counties to ban data centers, galvanizing support for wider moratoria in a fashion similar to what we’ve seen with solar and wind power.

4. Pinal County, Arizona – This county’s commission rejected a 8,122-acre solar farm unanimously this week, only months after the same officials approved multiple data centers.

.

A conversation with Adib Nasle, CEO of Xendee Corporation

Today’s Q&A is with Adib Nasle, CEO of Xendee Corporation. Xendee is a microgrid software company that advises large power users on how best to distribute energy over small-scale localized power projects. It’s been working with a lot with data centers as of late, trying to provide algorithmic solutions to alleviate some of the electricity pressures involved with such projects.

I wanted to speak with Nasle because I’ve wondered whether there are other ways to reduce data center impacts on local communities besides BYO power. Specifically, I wanted to know whether a more flexible and dynamic approach to balancing large loads on the grid could help reckon with the cost concerns driving opposition to data centers.

Our conversation is abridged and edited slightly for clarity.

So first of all, tell me about your company.

We’re a software company focused on addressing the end-to-end needs of power systems – microgrids. It’s focused on building the economic case for bringing your own power while operating these systems to make sure they’re delivering the benefits that were promised. It’s to make sure the power gap is filled as quickly as possible for the data center, while at the same time bringing the flexibility any business case needs to be able to expand, understand, and adopt technologies while taking advantage of grid opportunities, as well. It speaks to multiple stakeholders: technical stakeholders, financial stakeholders, policy stakeholders, and the owner and operator of a data center.

At what point do you enter the project planning process?

From the very beginning. There’s a site. It needs power. Maybe there is no power available, or the power available from the grid is very limited. How do we fill that gap in a way that has a business case tied to it? Whatever objective the customer has is what we serve, whether it’s cost savings or supply chain issues around lead times, and then the resiliency or emissions goals an organization has as well.

It’s about dealing with the gap between what you need to run your chips and what the utility can give you today. These data center things almost always have back-up systems and are familiar with putting power on site. It must now be continuous. We helped them design that.

With our algorithm, you tell it what the site is, what the load requirements are, and what the technologies you’re interested in are. It designs the optimal power system. What do we need? How much money is it going to take and how long?

The algorithm helps deliver on those cost savings, deliverables, and so forth. It’s a decision support system to get to a solution very, very quickly and with a high level of confidence.

How does a microgrid reduce impacts to the surrounding community?

The data center obviously wants to power as quickly and cheaply as possible. That’s the objective of that facility. At the same time, when you start bringing generation assets in, there are a few things that’ll impact the local community. Usually we have carbon monoxide systems in our homes and it warns us, right? Emissions from these assets become important and there’s a need to introduce technologies in a way that introduces that power gap and the air quality need. Our software helps address the emissions component and the cost component. And there are technologies that are silent. Batteries, technology components that are noise compliant.

From a policy perspective and a fairness perspective, a microgrid – on-site power plant you can put right next to the data center – helps unburden the local grid at a cost of upgrades that has no value to ratepayers other than just meeting the needs of one big customer. That one big customer can produce and store their own power and ratepayers don’t see a massive increase in their costs. It solves a few problems.

What are data centers most focused on right now when it comes to energy use, and how do you help?

I think they’re very focused on the timeframe and how quickly they can get that power gap filled, those permits in.

At the end of the day the conversation is about the utility’s relationship with the community as opposed to the data center’s relationship with the utility. Everything’s being driven by timelines and those timelines are inherently leaning towards on-site power solutions and microgrids.

More and more of these data center operators and owners are going off-grid. They’ll plug into the grid with what’s available but they’re not going to wait.

Do you feel like using a microgrid makes people more supportive of a data center?

Whether the microgrid is serving a hospital or a campus or a data center, it’s an energy system. From a community perspective, if it’s designed carefully and they’re addressing the environmental impact, the microgrid can actually provide shock absorbers to the system. It can be a localized generation source that can bring strength and stability to that local, regional grid when it needs help. This ability to take yourself out of the equation as a big load and run autonomously to heal itself or stabilize from whatever shock it's dealing with, that’s a big benefit to the local community.