You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

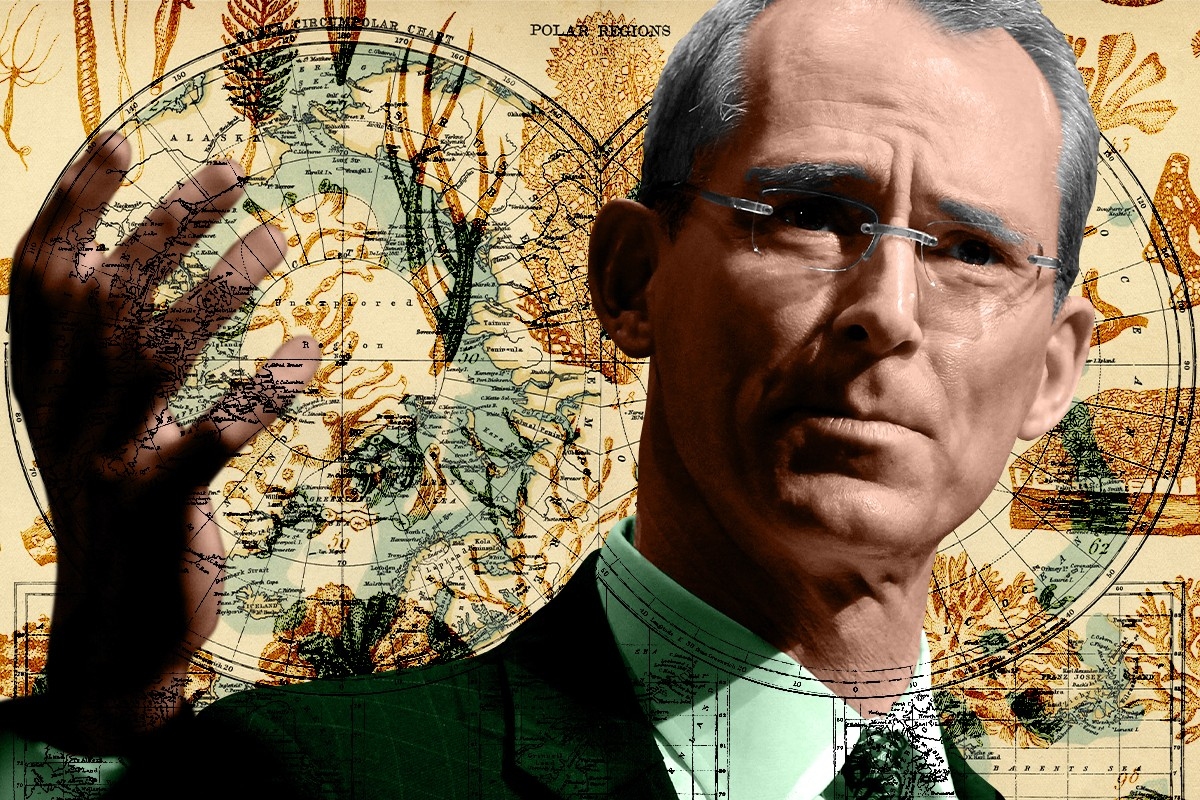

A conversation with former congressman Bob Inglis.

Bob Inglis was snorkeling in Australia’s Great Barrier reef in 2008 when he had what he called “an epiphany.’’

The then-Republican congressman from a very conservative district in South Carolina had scoffed at climate change throughout his two terms in the House, but his certainty had begun to give way four years earlier when his son told him, upon turning 18, that he needed to “clean up his act on the environment.’’

The comment stung. Inglis was still thinking about it in 2008 during a congressional trip to Antarctica, where he saw researchers extract ice cores that showed steadily rising levels of carbon dioxide since the Industrial Age began. His belief that climate change was a hoax began to weaken.

It was on another fact-finding trip that Inglis toured the Great Barrier Reef. Alongside the Australian oceanographer Scott Heron, he saw that the once-colorful reef was being bleached and killed by warmer, more acidic waters. It was visible proof of the destructive power of climate change.

Heron, a fellow Christian, talked about the need to save the reef and the planet with such passion, Inglis said, that “I could see that he was worshipping God in what he was showing me. My metamorphosis was complete. I decided that I was ready to act.’’

The next year, Inglis co-sponsored legislation to impose a tax on carbon emissions. That “heresy’’ did not go over well in his district, and he was crushed in the 2010 primary, 71% to 29%. (The bill, meanwhile, never made it out of committee.) “I knew that I was making the right choice,’’ he said. “It’s a choice that I’d make again.’’

His newfound commitment to addressing climate change led him to launch a nonprofit group, RepublicEn, devoted to bringing conservatives into the climate conversation. Today, Inglis tours the country, doing about 100 events a year at conservative groups such as College Republicans, Rotary Clubs, hunting and fishing clubs, and local GOP organizations.

The following interview has been edited for length and clarity.

You’ve talked about how, as a Republican congressman, you refused to accept climate change because the issue was associated with Al Gore, a Democrat. Do you think that what political scientists call “negative partisanship’’ is a major reason why conservatives still resist action on climate change?

Yes, it is. That’s why we need credible messengers who can speak the language of the tribe and who can make the tribe believe that conservative ideas can add something to this conversation. Conservatives have an undeserved inferiority complex on climate and energy. We understand the concepts of negative externalities and market distortion and accountability. Free enterprise — accountable free enterprise — can fix climate change.

You are referring to the libertarian concept of negative externalities, actions that negatively affect other people. Can you explain how it relates to carbon emissions?

When you burn fossil fuels, you’re basically dumping trash into the sky. You don’t pay a tipping fee for putting carbon waste into the atmosphere and contributing to climate change, so there is an implicit subsidy for burning these fuels and belching carbon — in fact, it’s the granddaddy of all energy subsidies.

Take that subsidy away and everything changes. Virtually all coal would be quickly replaced with natural gas and wind and solar and other methods. If you use a tax to set the real price of carbon, the free market will figure out cheaper and better ways to produce electricity. Things will start happening faster. You’ll see more development of hydrogen and better batteries that don’t use lithium to store the energy created by solar and wind. Climate change is an economic problem. Just fix the economics and innovation will happen. That’s the language of conservatism, and it’s how I talk to conservatives about it.

Why do you believe a carbon tax is the best way to bring Republicans aboard?

It is still the most obvious way to solve climate change, and the most efficient. This is an idea that goes back to Milton Friedman in the 1980s, when he said, instead of trying to regulate polluters, tax pollution. Make them pay for their negative externalities. You tax the trash they dump into the sky, just the way we impose a cost for dumping trash on land. It has to be a substantial tax, and it has to be steadily rising to increase incentives to find other forms of energy that don’t turn the sky into a dump for emissions. If you do that, you don’t need tax incentives for solar and wind — the rising cost of fossil fuels will provide all the incentives they need. But you also need to make this tax apply to other nations and the goods they import into the U.S.

How do you do that?

You can put a tax on the carbon produced in goods imported from China. Sen. Bill Cassidy [R-Louisiana] recently proposed a foreign pollution tax like the carbon border adjustment mechanism the European Union has already adopted. We very much welcome this idea because it’s a way of making the transition away from fossil fuels worldwide. Many Republicans say it’s not fair if the U.S. lowers emissions while China can do what it wants. The beauty of a foreign pollution fee is that it addresses this problem in an efficient way. It creates economic incentives for China to reduce its own emissions.

A carbon tax has been talked about for a long time but has gone nowhere in Congress. Do you see any evidence that it’s more politically palatable today?

I think a carbon tax is like the rescue of the banks after the financial crisis in 2008. Until the banks collapsed, bailing out the U.S. financial system seemed impossible. But when the consequences of not doing it became clear, the bailout went from impossible to inevitable without passing through probable.

Several catalyzing events could propel the carbon tax forward. The most likely is the momentum created by the European border adjustment mechanism, which is really a carbon tariff. Companies in the U.S. who deal with Europe are going to be calling their members of Congress and Senators and saying, wouldn’t you really rather collect that revenue for carbon emissions here at home through a carbon tax rather than sending the money to Europe? At some point, the light will go on at the U.S. Capitol — wow, the Europeans are getting a lot of revenue with a tariff on carbon, and we could do that, too. We could do that to China. We could say, the stuff you are selling here, you have to pay a carbon tariff.

Another momentum-maker is our federal debt. If interest rates stay high, interest will really start eating more and more of the federal budget. I have always said that a carbon tax should be revenue neutral, but given what’s happening to the deficit, it could also provide that revenue. Necessity may force Congress to turn to what used to seem impossible.

Could extreme weather provide another incentive?

Yes, there could be some catalyzing climate event that really focuses the mind. I don’t know what it will be. During the civil rights movement, when Americans saw segregated cities turn the police dogs and fire hoses on protestors, it really turned the tide on Jim Crow. We’ve had so much extreme weather that people are getting desensitized to it, but there still might be a catastrophic event that changes people’s priorities.

This year, we’ve already seen some of the most extreme weather and weather-related disasters in recent human history — massive wildfires that darkened skies across the country, relentless heat waves, fierce storms, and destructive flooding. Do you see evidence that this is registering with conservatives?

A lot of people won’t change their minds because of what a scientist says. But experience is different. Experience is a harsh teacher. You can’t argue with the thermometer. You can’t argue with the yardstick showing that sea is rising. You can’t argue with the water coming into your home. In 2010, when I was getting tossed out of Congress, there was a lot of aggressive disbelief in climate change. People told me, I don’t believe in climate change, and you shouldn’t, either.

Right now, it’s quite different. Conservatives say to me, sure, you can switch to clean energy here, but what difference does it make if you don’t get the rest of the world in on this? Why should we do this alone? That’s when I talk about negative externalities and a carbon tax, and imposing a carbon tariff on China and other countries. That changes their perspective.

Get one great climate story in your inbox every day:

What do you say to The Wall Street Journal conservatives who concede that climate change is occurring but insist that it’s less disruptive and cheaper to invest in adaptation to a hotter, more extreme climate?

Adaptation is a defeatist argument. Good luck building a seawall in Miami-Dade, for example. As sea levels rise, the water there is coming up into streets through the porous bedrock under that area. In South Carolina, go to coastal areas and you’ll see the big stands of pine trees dying because of salt water intrusion. In Montana, the forests are now filled with dead and dying trees because bark beetles that used to die in the winter now survive and go on attacking the trees year-round.

Adaptation won’t work in many places where people are going to lose what they love. It won’t work in New England when maple trees no longer produce maple sap for syrup because the winters are too warm. It won’t work at ski resorts that no longer have snow. When you stop arguing and pay attention to what you’re losing, you start saying, wow, how do we fix this?

Polls show there is still a big partisan divide on climate change. Do you think that can change?

The problem is no longer a lack of information. People can see what is happening. The problem is a lack of validation, and it’s a lack of hope. We need validation from conservative leaders that climate change is obviously real, and that we obviously need to do something about it. And we need to show conservatives that the free enterprise system can provide solutions once we get the true cost of carbon right.

If you keep telling people about all the terrible things happening and that we’re all hosed, it’s depressing. It makes people say, I don’t want to work with you. But if you can come to conservatives and say, we can light the world with new energy sources, and we can have more energy and more freedom and more manufacturing and more jobs — we can have a better world if we act on this. We can have true energy independence, so we don’t need to depend on energy from authoritarian regimes who chop journalists up into pieces. I’d like to be free of those people. I’d like to able to say to the Saudis, we don’t need your oil. Why don’t you see if you can drink that stuff?

The current Republican presidential field is not validating that climate change needs to be addressed.

In the first debate Nikki Haley did say climate change is real, but immediately pivoted to talking about how China and India have to lower their emissions, too. That’s a step forward, but it’s not enough. In 2018, when Republicans lost the House, it dawned on then-Majority Leader Kevin McCarthy and some other Republicans that you can’t win suburban swing districts with a retro position on climate change. So McCarthy convened a special Republican conference on climate, and the takeaway was, we need to get with it.

Polling data shows a majority of young conservatives and young evangelicals want action on climate change, and if you want to win in 2024, 2028, and 2032, you need to have a plan that you can talk about. But then Trump decided to run again, and he’s doubling down on climate disputation, and everyone in the party is afraid of the Death Angel. Trump can’t get anyone elected, but if he comes after you, he can get you killed in a primary.

But even if Trump wins, he will be a lame duck by 2026, and then the party is going to ask, where do we go next? My prediction at that point is that Republicans will be tired of reruns of the Trump show and will want a fresh approach that can win over young voters and suburban voters. And if he loses in 2024, that’s when you’ll have the reevaluation.

You’ve said of climate change, “We’re all in this together.’’ That sounds progressive — maybe even vaguely socialistic. Does that message resonate with conservatives who are suspicious of collective action?

[Laughs.] Maybe I should examine that statement more closely. But as a person of faith, I think it is just obvious we are literally in this fight together.

I think you can summon all Americans to a higher cause. I think if we can assure conservatives, I’m not trying to cancel you, and you have ideas to contribute to this discussion about the power of economic incentives, free enterprise, and innovation. You have to make conservatives feel that they have something important to contribute.

You have to make them feel they have something to gain from the solutions. If you the United States makes a bold move on carbon taxes and tells China and other nations, you have to pay a carbon tariff on the stuff you export to us, then it becomes an international effort to curtail emissions. Then conservatives start saying, we’re really talking about realistic and fair solutions. That’s when you can say, we need to take action because we do not want to lose this amazingly beautiful planet. That’s when you can say to them, we’re really all in this together.

Read more about Republicans and climate change:

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

The Trump administration’s rollback of coal plant emissions standards means that mercury is on the menu again.

It started with the cats. In the seaside town of Minamata, on the west coast of the most southerly of Japan’s main islands, Kyushu, the cats seemed to have gone mad — convulsing, twirling, drooling, and even jumping into the ocean in what looked like suicides. Locals started referring to “dancing cat fever.” Then the symptoms began to appear in their newborns and children.

Now, nearly 70 years later, Minimata is a cautionary tale of industrial greed and its consequences. Dancing cat fever and “Minamata disease” were both the outward effects of severe mercury poisoning, caused by a local chemical company dumping methylmercury waste into the local bay. Between the first recognized case in 1956 and 2001, more than 2,200 people were recognized as victims of the pollution, which entered the population through their seafood-heavy diets. Mercury is a bioaccumulator, meaning it builds up in the tissues of organisms as it moves up the food chain from contaminated water to shellfish to small fish to apex predators: Tuna. Cats. People.

In 2013, 140 countries, including the U.S., joined the Minamata Convention, pledging to learn from the mistakes of the past and to control the release of mercury into the environment. That included, explicitly, mercury in emissions from “coal-fired power plants.” Last month, however, the U.S. Environmental Protection Agency retreated from the convention by abandoning the 2024 Mercury and Air Toxics Standards, which had reduced allowable mercury pollution from coal-fired plants by as much as 90%. Nearly all of the 219 operating coal-fired plants in the U.S. already meet the previous, looser standard, set in 2012; Trump’s EPA has argued that returning to the older rules will save Americans $670 million in regulatory compliance costs by 2037.

The rollback — while not a surprise from an administration that has long fetishized coal — came as a source of immense frustration to scientists, biologists, and activists who’ve dedicated their careers to highlighting the dangers of environmental contaminants. Nearly all human exposure to methylmercury in the United States comes from eating seafood, according to the EPA, and it’s well-documented that adding more mercury to the atmosphere will increase levels in fish, even those caught far from fenceline communities.

“Mercury is an extremely toxic metal,” Nicholas Fisher, an expert in marine pollution at Stony Brook University, told me. “It’s probably among the most toxic of all the metals, and it’s been known for centuries.” In his opinion, it’s unthinkable that there is still any question of mercury regulations making Americans safer.

Gabriel Filippelli, the executive director of the Indiana University Environmental Resilience Institute, concurred. “Mercury is not a trivial pollutant,” he told me. “Elevated mercury levels cost millions of IQ points across the country.” The EPA rollback “actually costs people brain power.”

When coal burns in a power plant, it releases mercury into the air, where it can travel great distances and eventually end up in the water. “There is no such thing as a local mercury problem,” Filippelli said. He recalled a 2011 study that looked at Indianapolis Power & Light, a former coal plant that has since transitioned to natural gas, in which his team found “a huge plume of mercury in solids downwind” of the plant, as well as in nearby rivers that were “transporting it tens of kilometers away into places where people fish and eat what they catch.”

Earthworms and small aquatic organisms convert mercury in soils and runoff into methylmercury, a highly toxic form that presents the most danger to people, children, and the fetuses of pregnant women as it moves up the food chain. Though about 70% of mercury deposited in the United States comes from outside the country — China, for example, is the second-greatest source of mercury in the Great Lakes Basin after the U.S., per the National Oceanic and Atmospheric Administration — that still leaves a significant chunk of pollution under the EPA’s control.

There is, in theory, another line of defense beyond the EPA. For recreational fishers, of whom there are nearly 60 million in the country each year, state-level advisories on which waterways are safe to fish in based on tests of methylmercury concentrations in the fish help guide decisions about what is safe to eat. Oregon, for example, advises that people not eat more than one “resident fish,” such as bass, walleye, and carp, caught from the Columbia River per week — and not eat any other seafood during that time, either. Forty-nine states have some such advisories in place; the only state that doesn’t, coal-friendly Wyoming, has refused to test its fish. One also imagines that safe waterways will start to become more limited if the coal-powered plants the Trump administration is propping up forgo the expensive equipment necessary to scrub their emissions of heavy metals.

“It’s not something where you’re going to see a dramatic change overnight,” Tasha Stoiber, a senior scientist with the Environmental Working Group, a research and advocacy nonprofit that focuses on toxic chemicals, told me. “But depending on the water body that you’re fishing in, you want to seek out state advisories.”

For people who prefer to buy their fish at the store, the Food and Drug Administration sets limits on the amount of mercury allowed in commercial seafood. But Kevin McCay, the chief operations officer at the seafood company Safe Catch, told me the FDA’s limit of 1 part per million for methylmercury is outrageously high compared with limits in the European Union and Japan. “It has to be glowing red before the FDA is actually going to do anything,” he said. (Watchdog groups have likewise warned that the hemorrhaging of civil servants from the FDA will have downstream consequences for food safety.)

McCay also told me that he “certainly” expects mercury levels in the fish to rise due to the EPA’s decision. Unlike other canned tuna companies that test batches of fish, Safe Catch drills a small test hole in every fish it buys to ensure the mercury content is well below the FDA’s limits. (Fish that are lower on the food chain, like salmon, are the safest choices, while fish at the top of the food chain, like tuna, sharks, and swordfish, are the worst.)

The obsessive oversight gives the company a front-seat view of where and how methylmercury is working its way up the food chain, and McCay worries his company could face more limited sourcing options in the coming years if policies remain friendly to coal. (An independent investigation by Consumer Reports in 2023 found that even fish sourced by an ultra-cautious company like Safe Catch contain some level of mercury. “There’s probably no actual safe amount,” McCay told me, recommending that customers should eat a diverse range of seafood to limit exposure.)

Even people who don’t eat fish should be concerned, though. That’s because, as Filippelli told me, “a lot of [contaminated] fish meal is being incorporated into pet food.”

There are no regulatory standards for mercury in pet foods. But avoiding mercury is not as simple as bypassing the tuna-flavored kibble, Sarrah M. Dunham-Cheatham, who authored a 2019 study on mercury in pet food, told me. Even many brands that don’t list fish among their ingredients contain fish meal that is high in mercury, she said.

Different species also have different sensitivities to mercury, with chimpanzees and cats being among the most sensitive. “I don’t want to be alarmist or scare people,” Dunham-Cheatham said. But because of the issues with labeling pet food, there isn’t much to be done to limit mercury intake in your pets — that is, short of dealing with the emissions on local and planetary scales. “We’re expecting there to be more emissions to the atmosphere, more deposition to aquatic environments, and therefore more mercury accumulated into proteins that will go into making the pet foods,” she said.

To Fisher, the Stony Brook professor, the Trump administration’s decision to walk back mercury restrictions makes no sense at all. The Ancient Romans understood the dangers of mercury; the dancing cats of Minamata are now seven decades behind us. “Why should we make the underlying assumption that the mercury is innocent until proven guilty?” he said.

On Qatari aluminum, floating offshore wind, and Taiwanese nuclear

Current conditions: Upstate New York and New England are facing another 2 inches of snow • A heat wave in India is sending temperatures in Gujarat beyond 100 degrees Fahrenheit • Record-breaking rain is causing flash flooding in South Australia, New South Wales, and Victoria.

The war with Iran is shocking oil and natural gas prices as the Strait of Hormuz effectively closes and Americans start paying more at the pump. “So despite the stock market overall being down, clean energy companies’ shares are soaring, right?” Heatmap’s Matthew Zeitlin wrote yesterday. “Wrong. First Solar: down over 1% on the day. Enphase: down over 3%. Sunrun: down almost 8%; Tesla: down around 2.5%.” What’s behind the slump? Matthew identified three reasons. First, there was a general selloff in the market. Second, supply chain disruptions could lead to inflation, which might lead to higher interest rates, or at the very least slow the planned cycle of cuts. Third, governments may end up trying “to mitigate spiking fuel prices by subsidizing fossil fuels and locking in supply contracts to reinforce their countries’ energy supplies,” meaning renewables “may thereby lose out on investment that might more logically flow their way.”

The U.S. liquified natural gas industry is certainly looking at boom times. U.S. developers signed sale and purchase agreements for 40 million tons per year in 2025 from planned export facilities, according to new Department of Energy data the Energy Information Administration posted. That’s the highest volume since 2022, when Russia’s invasion of Ukraine sent demand for American LNG soaring. That conflict, too, is still having its effects on global fossil fuel supplies. A Russian-flagged LNG tanker is on fire in the Mediterranean Sea as the result of a drone strike by Ukraine, The Independent reported Wednesday.

It’s not just fossil fuels. Qatari smelter Qatalum started shutting down on Tuesday as 50% shareholder Norsk Hydro issued a force majeure notice to customers. “The decision to shut down was made after the company’s gas supplier informed it of a forthcoming suspension of its gas supply,” the company said in a statement to Mining.com. QatarEnergy — which owns 51% of Qatalum’s other shareholder, Qatar Aluminum Manufacturing Co. — had previously suspended production after halting output of natural gas due to Iranian drone attacks.

Sign up to receive Heatmap AM in your inbox every morning:

Panel manufacturer Silfab Solar paused production at its South Carolina factory in Fort Mill after a chemical spill triggered a regulatory investigation. The plant accidentally spilled approximately 300 gallons of a water solution containing less than 0.3% potassium hydroxide. Experts told WCNC, the Charlotte-area NBC News affiliate, that the volume of the caustic chemical that spilled will be harmless. But the state Department of Environmental Services “asked Silfab to cease receipt of additional chemicals at their facility until an investigation is complete.” Such accidents risk political backlash at a time of heightened public health anxiety over clean energy technologies. As Heatmap’s Jael Holzman wrote last summer, the Moss Landing battery factory fire sparked a nationwide backlash.

Two-thirds of offshore wind potential is located at sites where the water is too deep for traditional turbine platforms. But the first wind farm with floating platforms only came into operation nine years ago. The largest so far, located in Norway’s stretch of the North Sea, is just under 100 megawatts. So, if completed, Spanish developer Ocean Winds’ in the United Kingdom would be by far the largest plant. The company took a step forward on the 1.5-gigawatt project when the company signed the lease agreement this week, according to OffshoreWIND.biz.

In Denmark, meanwhile, right-wing politicians are campaigning against the country’s offshore wind giant, Orsted. The country’s conservative Liberal party campaigned on divesting from the company, which claims the Danish government as its largest shareholder, back in 2022. Now, Bloomberg reported, the party is once against renewing its calls to exit Orsted after this year’s election.

Facing surging electricity demand and mounting threats of blackouts from Chinese attacks on energy imports, Taiwan is taking yet another step toward reversing its nuclear phaseout. Nearly a year after the island nation’s last reactor shut down, Taiwanese Premier Cho Jung-tai, a member of the ruling Democratic Progressive Party that has long opposed atomic energy, announced new proposals to allow the state-owned Taiwan Power Company to submit plans to restart at least two of the country’s three shuttered nuclear stations. (A fourth plant, called Lungmen, was nearly completed in the late 2010s before the DPP government canceled its construction.) The government report also said Taiwan may consider building new nuclear technologies, such as small modular reactors or fusion plants.

In June 2023, thousands of lightning strikes in heat wave-baked Quebec sparked more than 120 wildfires that ultimately scorched nearly 7,000 acres of parched forests. Lightning, in fact, starts almost 60% of wildfires. Now a Vancouver-based weather modification startup called Skyward Wildfire says it can prevent catastrophic blazes by stopping lightning strikes through cloud seeding. MIT Technology Review found some good reasons to doubt the company’s claims. But experts said preventing wildfires is cheaper than putting them out, so it may have some merit.

The attacks on Iran have not redounded to renewables’ benefit. Here are three reasons why.

The fragility of the global fossil fuel complex has been put on full display. The Strait of Hormuz has been effectively closed, causing a shock to oil and natural gas prices, putting fuel supplies from Incheon to Karachi at risk. American drivers are already paying more at the pump, despite the United States’s much-vaunted energy independence. Never has the case for a transition to renewable energy been more urgent, clear, and necessary.

So despite the stock market overall being down, clean energy companies’ shares are soaring, right?

Wrong.

First Solar: down over 1% on the day. Enphase: down over 3%. Sunrun: down almost 8%; Tesla: down around 2.5%.

Why the slump? There are a few big reasons:

Several analysts described the market action today as “risk-off,” where traders sell almost anything to raise cash. Even safe haven assets like U.S. Treasuries sold off earlier today while the U.S. dollar strengthened.

“A lot of things that worked well recently, they’re taking a big beating,” Gautam Jain, a senior research scholar at the Columbia University Center on Global Energy Policy, told me. “It’s mostly risk aversion.”

Several trackers of clean energy stocks, including the S&P Global Clean Energy Transition Index (down 3% today) or the iShares Global Clean Energy ETF (down over 3%) have actually outperformed the broader market so far this year, making them potentially attractive to sell off for cash.

And some clean energy stocks are just volatile and tend to magnify broader market movements. The iShares Global Clean Energy ETF has a beta — a measure of how a stock’s movements compare with the overall market — higher than 1, which means it has tended to move more than the market up or down.

Then there’s the actual news. After President Trump announced Tuesday afternoon that the United States Development Finance Corporation would be insuring maritime trade “for a very reasonable price,” and that “if necessary” the U.S. would escort ships through the Strait of Hormuz, the overall market picked up slightly and oil prices dropped.

It’s often said that what makes renewables so special is that they don’t rely on fuel. The sun or the wind can’t be trapped in a Middle Eastern strait because insurers refuse to cover the boats it arrives on.

But what renewables do need is cash. The overwhelming share of the lifetime expense of a renewable project is upfront capital expenditure, not ongoing operational expenditures like fuel. This makes renewables very sensitive to interest rates because they rely on borrowed money to get built. If snarled supply chains translate to higher inflation, that could send interest rates higher, or at the very least delay expected interest rate cuts from central banks.

Sustained inflation due to high energy prices “likely pushes interest rate cuts out,” Jain told me, which means higher costs for renewables projects.

While in the long run it may make sense to respond to an oil or natural gas supply shock by diversifying your energy supply into renewables, political leaders often opt to try to maintain stability, even if it’s very expensive.

“The moment you start thinking about energy security, renewables jump up as a priority,” Jain said. “Most countries realize how important it is to be independent of the global supply chain. In the long term it works in favor of renewables. The problem is the short term.”

In the short term, governments often try to mitigate spiking fuel prices by subsidizing fossil fuels and locking in supply contracts to reinforce their countries’ energy supplies. Renewables may thereby lose out on investment that might more logically flow their way.

The other issue is that the same fractured supply chain that drives up oil and gas prices also affects renewables, which are still often dependent on imports for components. “Freight costs go up,” Jain said. “That impacts clean energy industry more.”

As for the Strait of Hormuz, Trump said the Navy would start escorting ships “as soon as possible.”