You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

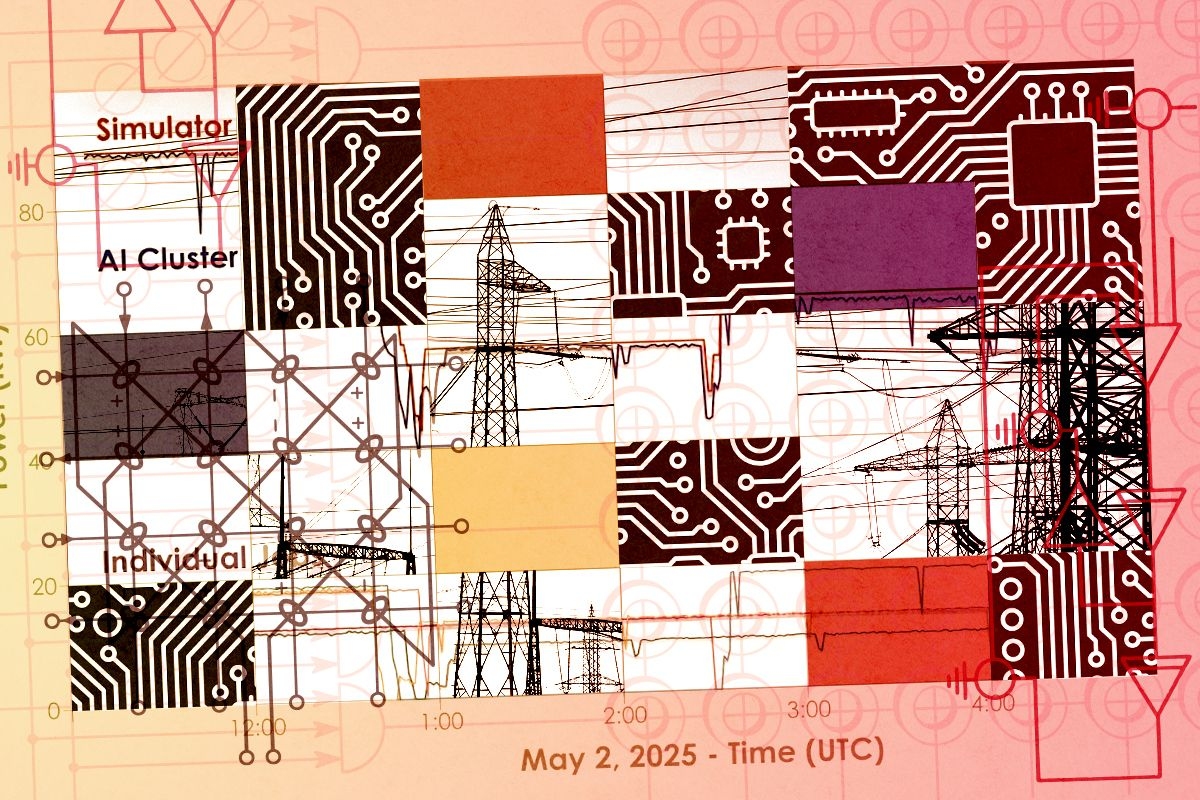

Or at least the team at Emerald AI is going to try.

Everyone’s worried about the ravenous energy needs of AI data centers, which the International Energy Agency projects will help catalyze nearly 4% growth in global electricity demand this year and next, hitting the U.S. power sector particularly hard. On Monday, the Department of Energy released a report adding fuel to that fire, warning that blackouts in the U.S. could become 100 times more common by 2030 in large part due to data centers for AI.

The report stirred controversy among clean energy advocates, who cast doubt on that topline number and thus the paper’s justification for a significant fossil fuel buildout. But no matter how the AI revolution is powered, there’s widespread agreement that it’s going to require major infrastructure development of some form or another.

Not so fast, says Emerald AI, which emerged from stealth last week with $24.5 million in seed funding led by Radical Ventures along with a slew of other big name backers, including Nvidia’s venture arm as well as former Secretary of State John Kerry, Google’s chief scientist Jeff Dean, and Kleiner Perkins chair John Doerr. The startup, founded and led by Orsted’s former chief strategy and innovation officer Varun Sivaram, was built to turn data centers from “grid liabilities into flexible assets” by slowing, pausing, or redirecting AI workloads during times of peak energy demand.

Research shows this type of data center load flexibility could unleash nearly 100 gigawatts of grid capacity — the equivalent of four or five Project Stargates and enough to power about 83 million U.S. homes for a year. Such adjustments, Sivaram told me, would be necessary for only about 0.5% of a data center’s total operating time, a fragment so tiny that he says it renders any resulting training or operating performance dips for AI models essentially negligible.

As impressive as that hypothetical potential is, whether a software product can actually reduce the pressures facing the grid is a high stakes question. The U.S. urgently needs enough energy to serve that data center growth, both to ensure its economic competitiveness and to keep electricity bills affordable for Americans. If an algorithm could help alleviate even some of the urgency of an unprecedented buildout of power plants and transmission infrastructure, well, that’d be a big deal.

While Emerald AI will by no means negate the need to expand and upgrade our energy system, Sivaram told me, the software alone “materially changes the build out needs to meet massive demand expansion,” he said. “It unleashes energy abundance using our existing system.”

Grand as that sounds, the fundamental idea is nothing new. It’s the same concept as a virtual power plant, which coordinates distributed energy resources such as rooftop solar panels, smart thermostats, and electric vehicles to ramp energy supply either up or down in accordance with the grid’s needs.

Adoption of VPPs has lagged far behind their technical potential, however. That’s due to a whole host of policy, regulatory, and market barriers such as a lack of state and utility-level rules around payment structures, insufficient participation incentives for customers and utilities, and limited access to wholesale electricity markets. These programs also depend on widespread customer opt-in to make a real impact on the grid.

“It’s really hard to aggregate enough Nest thermostats to make any kind of dent,”” Sivaram told me. Data centers are different, he said, simply because “they’re enormous, they’re a small city.” They’re also, by nature, virtually controllable and often already interconnected if they’re owned by the same company. Sivaram thinks the potential of flexible data center loads is so promising and the assets themselves so valuable that governments and utilities will opt to organize “bespoke arrangements for data centers to provide their services.”

Sivaram told me he’s also optimistic that utilities will offer data center operators with flexible loads the option to skip the ever-growing interconnection queue, helping hyperscalers get online and turn a profit more quickly.

The potential to jump the queue is not something that utilities have formally advertised as an option, however, although there appears to be growing interest in the idea. An incentive like this will be core to making Emerald AI’s business case work, transmission advocate and president of Grid Strategies Rob Gramlich told me.

Data center developers are spending billions every year on the semiconductor chips powering their AI models, so the typical demand response value proposition — earn a small sum by turning off appliances when the grid is strained — doesn’t apply here. “There’s just not anywhere near enough money in that for a hyperscaler to say, Oh yeah, I’m gonna not run my Nvidia chips for a while to make $200 a megawatt hour. That’s peanuts compared to the bazillions [they] just spent,” Gramlich explained.

For Emerald AI to make a real dent in energy supply and blunt the need for an immediate and enormous grid buildout, a significant number of data center operators will have to adopt the platform. That’s where the partnership with Nvidia comes in handy, Sivaram told me, as the startup is “working with them on the reference architecture” for future AI data centers. “The goal is for all [data centers] to be potentially flexible in the future because there will be a standard reference design,” Sivaram said.

Whether or not data centers will go all in on Nvidia’s design remains to be seen, of course. Hyperscalers have not typically thought of data centers as a flexible asset. Right now, Gramlich said, most are still in the mindset that they need to be operating all 8,760 hours of the year to reach their performance targets.

“Two or three years ago, when we first noticed the surge in AI-driven demand, I talked to every hyperscaler about how flexible they thought they could be, because it seemed intuitive that machine learning might be more flexible than search and streaming,” Gramlich told me. By and large, the response was that while these companies might be interested in exploring flexibility “potentially, maybe, someday,” they were mostly focused on their mandate to get huge amounts of gigawatts online, with little time to explore new data center models.

“Even the ones that are talking about flexibility now, in terms of what they’re actually doing in the market today, they all are demanding 8,760 [hours of operation per year],” Gramlich told me.

Emerald AI is well aware that its business depends on proving to hyperscalers that a degree of flexibility won’t materially impact their operations. Last week, the startup released the results of a pilot demonstration that it ran at an Oracle data center in Phoenix, which proved it was able to reduce power consumption by 25% for three hours during a period of grid stress while still “assuring acceptable customer performance for AI workloads.”

It achieved this by categorizing specific AI tasks — think everything from model training and fine tuning to conversations with chatbots — from high to low priority, indicating the degree to which operations could be slowed while still meeting Oracle’s performance targets. Now, Emerald AI is planning additional, larger-scale demonstrations to showcase its capacity to handle more complex scenarios, such as responding to unexpected grid emergencies.

As transmission planners and hyperscalers alike wait to see more proof validating Emerald AI’s vision of the future, Sivaram is careful to note that his company is not advocating for a halt to energy system expansion. In an increasingly electrified economy, expanding and upgrading the grid will be essential — even if every data center in the world has a flexible load profile.

’We should be building a nationwide transmission system. We should be building out generation. We should be doing grid modernization with grid enhancing technologies,” Sivaram told me. “We just don’t need to overdo it. We don’t need the particularly massive projections that you’re seeing that are going to cause your grandmother’s electricity rates to spike. We can avoid that.”

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Whether any of them will hold up in court is now the big question.

Environmental lawyers are in for years of déjà vu as the Trump administration relitigates questions that many believed were settled by the Supreme Court nearly 20 years ago.

On Thursday, Trump rescinded the “endangerment finding,” the Environmental Protection Agency’s 2009 determination that greenhouse gas emissions from vehicles threaten Americans’ public health and welfare and should be regulated. In the short term, the move repeals existing vehicle emissions standards and prevents future administrations from replacing them. In the longer term, what matters is whether any of the administration’s justifications hold up in court.

In its final rule, the EPA abandoned its attempt to back the move using a bespoke climate science report published by the Department of Energy last year. The report was created by a working group assembled in secret by the department and made up of five scientists who have a track record of pushing back on mainstream climate science. Not only was the report widely refuted by scientists, but the assembly of the working group itself broke federal law, a judge ruled in late January.

“The science is clear that climate change is creating a risk for the public and public health, and so I think it’s significant that they realized that it creates a legal risk if they were to try to assert otherwise,” Carrie Jenks, the executive director of Harvard’s Environmental and Energy Law Program, told me.

Instead, the EPA came up with three arguments to justify its decision, each of which will no doubt have to be defended in court. The agency claims that each of them can stand alone, but that they also reinforce each other. Whether that proves to be true, of course, has yet to be determined.

Here’s what they are:

Congress never specifically told the EPA to regulate greenhouse gas emissions. If it did, maybe we would have accomplished more on climate change by now.

What happened instead was that in 1999, a coalition of environmental and solar energy groups asked the EPA to regulate emissions from cars, arguing that greenhouse gases should be considered pollutants under the federal Clean Air Act. In 2007, in a case called Massachusetts v. EPA, the Supreme Court agreed with the second part. That led the EPA to consider whether these gases posed enough of a danger to public health to warrant regulation. In 2009, it concluded they did — that’s what’s known as the endangerment finding. After reaching that finding, the EPA went ahead and developed standards to limit emissions from vehicles. It later followed that up with rules for power plants and oil and gas operations.

Now Trump’s EPA is arguing that this three-step progression — categorizing greenhouse gases as pollutants under the Clean Air Act, making a scientific finding that they endanger public health, and setting regulations — was all wrong. Instead, the agency now believes, it’s necessary to consider all three at once.

Using the EPA’s logic, the argument comes out something like this: If we consider that U.S. cars are a small sliver of global emissions, and that limiting those emissions will not materially change the trajectory of global warming or the impacts of climate change on Americans, then we must conclude that Congress did not intend for greenhouse gases to be regulated when it enacted the Clean Air Act.

“They are trying to merge it all together and say, because we can’t do that last thing in a way that we think is reasonable, we can’t do the first thing,” Jenks said.

The agency is not explicitly asking for Massachusetts v. EPA to be overturned, Jenks said. But if its current argument wins in court, that would be the effective outcome, preventing future administrations from issuing greenhouse gas standards unless Congress passed a law explicitly telling it to do so. While it's rare for the Supreme Court to reverse course, none of the five justices who were in the majority on that case remain, and the makeup of the court is now far more conservative than in 2007.

The EPA also asserted that the “major questions doctrine,” a legal principle that says federal agencies cannot set policies of major economic and political significance without explicit direction from Congress, means the EPA cannot “decide the Nation’s policy response to global climate change concerns.”

The Supreme Court has used the major questions doctrine to overturn EPA’s regulations in the past, most notably in West Virginia v. EPA, which ruled that President Obama’s Clean Power Plan failed this constitutional test. But that case was not about EPA’s authority to regulate greenhouse gases, the court solely struck down the particular approach the EPA took to those regulations. Nevertheless, the EPA now argues that any climate regulation at all would be a violation.

The EPA’s final argument is about the “futility” of vehicle emissions standards. It echoes a portion of the first justification, arguing that the point alone is enough of a reason to revoke the endangerment finding absent any other reason.

The endangerment finding had “severed the consideration of endangerment from the consideration of contribution” of emissions, the agency wrote. The Clean Air Act “instructs the EPA to regulate in furtherance of public health and welfare, not to reduce emissions regardless [of] whether such reductions have any material health and welfare impact.”

Funnily enough, to reach this conclusion, the agency had to use climate models developed by past administrations, including the EPA’s Optimization Model for reducing Emissions of GHGs from Automobiles, as well as some developed by outside scientists, such as the Finite amplitude Impulse Response climate emulator model — though it did so begrudgingly.

The agency “recognizes that there is still significant dispute regarding climate science and modeling,” it wrote. “However, the EPA is utilizing the climate modeling provided within this section to help illustrate” that zero-ing out emissions from vehicles “would not materially address the health and welfare dangers attributed to global climate change concerns in the Endangerment Finding.”

I have yet to hear back from outside experts about the EPA’s modeling here, so I can’t say what assumptions the agency made to reach this conclusion or estimate how well it will hold up to scrutiny. We’ll be talking to more legal scholars and scientists in the coming days as they digest the rule and dig into which of these arguments — if any — has a chance to prevail.

The state is poised to join a chorus of states with BYO energy policies.

With the backlash to data center development growing around the country, some states are launching a preemptive strike to shield residents from higher energy costs and environmental impacts.

A bill wending through the Washington State legislature would require data centers to pick up the tab for all of the costs associated with connecting them to the grid. It echoes laws passed in Oregon and Minnesota last year, and others currently under consideration in Florida, Georgia, Illinois, and Delaware.

Several of these bills, including Washington’s, also seek to protect state climate goals by ensuring that new or expanded data centers are powered by newly built, zero-emissions power plants. It’s a strategy that energy wonks have started referring to as BYONCE — bring your own new clean energy. Almost all of the bills also demand more transparency from data center companies about their energy and water use.

This list of state bills is by no means exhaustive. Governors in New York and Pennsylvania have declared their intent to enact similar policies this year. At least six states, including New York and Georgia, are also considering total moratoria on new data centers while regulators study the potential impacts of a computing boom.

“Potential” is a key word here. One of the main risks lawmakers are trying to circumvent is that utilities might pour money into new infrastructure to power data centers that are never built, built somewhere else, or don’t need as much energy as they initially thought.

“There’s a risk that there’s a lot of speculation driving the AI data center boom,” Emily Moore, the senior director of the climate and energy program at the nonprofit Sightline Institute, told me. “If the load growth projections — which really are projections at this point — don’t materialize, ratepayers could be stuck holding the bag for grid investments that utilities have made to serve data centers.”

Washington State, despite being in the top 10 states for data center concentration, has not exactly been a hotbed of opposition to the industry. According to Heatmap Pro data, there are no moratoria or restrictive ordinances on data centers in the state. Rural communities in Eastern Washington have also benefited enormously from hosting data centers from the earlier tech boom, using the tax revenue to fund schools, hospitals, municipal buildings, and recreation centers.

Still, concern has started to bubble up. A ProPublica report in 2024 suggested that data centers were slowing the state’s clean energy progress. It also described a contentious 2023 utility commission meeting in Grant County, which has the highest concentration of data centers in the state, where farmers and tech workers fought over rising energy costs.

But as with elsewhere in the country, it’s the eye-popping growth forecasts that are scaring people the most. Last year, the Northwest Power and Conservation Council, a group that oversees electricity planning in the region, estimated that data centers and chip fabricators could add somewhere between 1,400 megawatts and 4,500 megawatts of demand by 2030. That’s similar to saying that between one and four cities the size of Seattle will hook up to the region’s grid in the next four years.

In the face of such intimidating demand growth, Washington Governor Bob Ferguson convened a Data Center Working Group last year — made up of state officials as well as advisors from electric utilities, environmental groups, labor, and industry — to help the state formulate a game plan. After meeting for six months, the group published a report in December finding that among other things, the data center boom will challenge the state’s efforts to decarbonize its energy systems.

A supplemental opinion provided by the Washington Department of Ecology also noted that multiple data center developers had submitted proposals to use fossil fuels as their main source of power. While the state’s clean energy law requires all electricity to be carbon neutral by 2030, “very few data center developers are proposing to use clean energy to meet their energy needs over the next five years,” the department said.

The report’s top three recommendations — to maintain the integrity of Washington’s climate laws, strengthen ratepayer protections, and incentivize load flexibility and best practices for energy efficiency — are all incorporated into the bill now under discussion in the legislature. The full list was not approved by unanimous vote, however, and many of the dissenting voices are now opposing the data center bill in the legislature or asking for significant revisions.

Dan Diorio, the vice president of state policy for the Data Center Coalition, an industry trade group, warned lawmakers during a hearing on the bill that it would “significantly impact the competitiveness and viability of the Washington market,” putting jobs and tax revenue at risk. He argued that the bill inappropriately singles out data centers, when arguably any new facility with significant energy demand poses the same risks and infrastructure challenges. The onshoring of manufacturing facilities, hydrogen production, and the electrification of vehicles, buildings, and industry will have similar impacts. “It does not create a long-term durable policy to protect ratepayers from current and future sources of load growth,” he said.

Another point of contention is whether a top-down mandate from the state is necessary when utility regulators already have the authority to address the risks of growing energy demand through the ratemaking process.

Indeed, regulators all over the country are already working on it. The Smart Electric Power Alliance, a clean energy research and education nonprofit, has been tracking the special rate structures and rules that U.S. utilities have established for data centers, cryptocurrency mining facilities, and other customers with high-density energy needs, many of which are designed to protect other ratepayers from cost shifts. Its database, which was last updated in November, says that 36 such agreements have been approved by state utility regulators, mostly in the past three years, and that another 29 are proposed or pending.

Diario of the Data Center Coalition cited this trend as evidence that the Washington bill was unnecessary. “The data center industry has been an active party in many of those proceedings,” he told me in an email, and “remains committed to paying its full cost of service for the energy it uses.” (The Data Center Coalition opposed a recent utility decision in Ohio that will require data centers to pay for a minimum of 85% of their monthly energy forecast, even if they end up using less.)

One of the data center industry’s favorite counterarguments against the fear of rising electricity is that new large loads actually exert downward pressure on rates by spreading out fixed costs. Jeff Dennis, who is the executive director of the Electricity Customer Alliance and has worked for both the Department of Energy and the Federal Energy Regulatory Commission, told me this is something he worries about — that these potential benefits could be forfeited if data centers are isolated into their own ratemaking class. But, he said, we’re only in “version 1.5 or 2.0” when it comes to special rate structures for big energy users, known as large load tariffs.

“I think they’re going to continue to evolve as everybody learns more about how to integrate large loads, and as the large load customers themselves evolve in their operations,” he said.

The Washington bill passed the Appropriations Committee on Monday and now heads to the Rules Committee for review. A companion bill is moving through the state senate.

Plus more of the week’s top fights in renewable energy.

1. Kent County, Michigan — Yet another Michigan municipality has banned data centers — for the second time in just a few months.

2. Pima County, Arizona — Opposition groups submitted twice the required number of signatures in a petition to put a rezoning proposal for a $3.6 billion data center project on the ballot in November.

3. Columbus, Ohio — A bill proposed in the Ohio Senate could severely restrict renewables throughout the state.

4. Converse and Niobrara Counties, Wyoming — The Wyoming State Board of Land Commissioners last week rescinded the leases for two wind projects in Wyoming after a district court judge ruled against their approval in December.