You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

More than $760 million from the Inflation Reduction Act’s Green and Resilient Retrofit Program is still caught in legal limbo — but no one seems to have noticed.

When a federal judge put an injunction on the Trump administration’s efforts to freeze Inflation Reduction Act funding back in April, many grantees were able to pick up their clean energy projects where they left off. But not everyone.

Some 100 low-income housing providers that won more than $760 million in grants and loans from the IRA’s Green and Resilient Retrofit Program to make critical safety and energy upgrades to their buildings are still in limbo. The U.S. Department of Housing and Urban Development will not respond to their questions about if or when projects can move forward, and also fired all of the third-party contractors that had been hired to implement the program.

While these developers are certainly not the only ones locked in a bureaucratic standstill — a lawsuit aiming to unlock money from the Greenhouse Gas Reduction Fund is still wending through the courts, and many states are waiting to hear whether they’ll ever get funding for their home energy retrofit rebate programs — their plight has so far been overlooked, raising the risk that the money could quietly disappear.

The Green and Resilient Retrofit Program addressed a known funding gap for affordable housing preservation. Low-income housing providers operate on tight margins and often struggle to pay for regular maintenance, let alone to make upgrades to their buildings. On top of that, many of the buildings that receive other subsidies from HUD are barred from taking on debt for improvements.

“So what do you do if your building is now 40 years old and it needs upgrades?” Juliana Bilowich, the senior director of housing operations and policy for Leading Age, a nonprofit focused on affordable senior housing, said to me. “There are some housing communities that haven’t had air conditioning for years because the HUD budget won’t support it, or it’s broken and it needs to be upgraded, but there’s no funding they can get to do that.”

That was the case for The Towers, a 20-story senior living center in New Haven, Connecticut, except the building was nearly 60 years old. While its individual apartments have air conditioning, there’s no HVAC system serving the hallways where residents have to wait for the elevator. “The summertime is horrible,” Gus Keach-Longo, the president and CEO of The Towers, told me.

While the building has made cosmetic improvements over the years, it hasn’t done major efficiency or structural work outside of installing LED lightbulbs, Keach-Longo told me. A recent assessment of the building scored it at a 7 out of 100 for energy efficiency. In addition to an HVAC solution, the building needed a new roof and windows.

The Green and Resilient Retrofit Program looked like it could be a lifeline for Towers residents. For one, it was uniquely flexible. The funds could be used for a wide range of projects, as long as they reduced the building’s emissions, improved its energy or water efficiency, or made it more resilient to flooding, extreme heat, or other weather-related hazards.

Billowich called the program a “linchpin” for buildings that didn’t have the ability to go to the bank and get a loan. “This was the way that housing communities were going to be able to continue operating.” Applicants planned to insulate their pipes so they didn’t burst during a cold front, or replace their windows to save money on energy and protect residents from wildfire smoke. The funds could also be leveraged to raise additional money for other kinds of repairs. The resulting energy savings could then be put toward expanding services for residents.

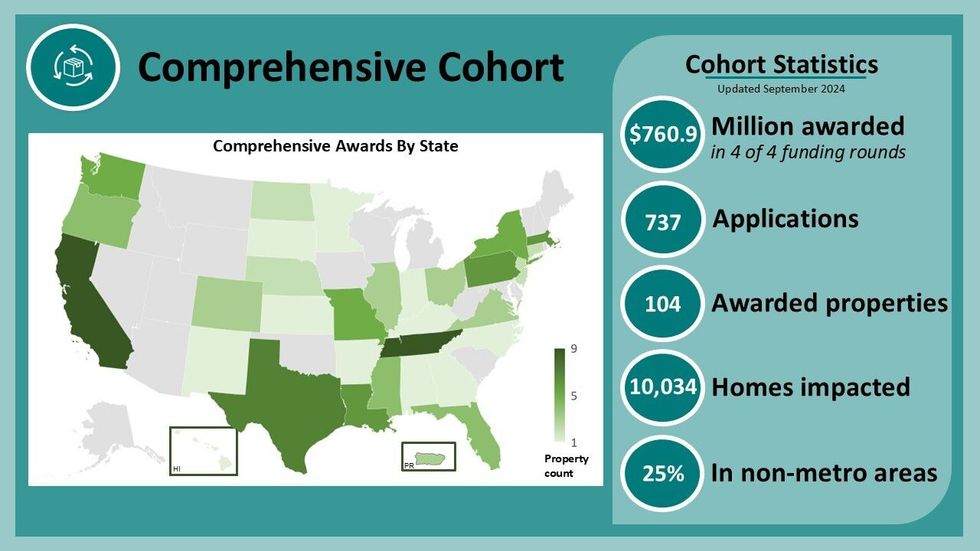

The $1 billion program was divided into three streams of funding. A building owner could get up to $750,000 per property under the “Elements” stream to supplement existing retrofit plans with green upgrades like solar panels. The “Leading Edge” stream supplied up to $10 million for more involved projects and required the building to ultimately meet a green certification, such as Passive House or LEED. The “Comprehensive” stream was designed to facilitate more complicated, full-building retrofits that required significant technical assistance to plan. Grantees could get up to $80,000 per unit, or $20 million total, but they would have to work with HUD-employed contractors that would scope out and oversee the project.

The Towers applied for a Comprehensive grant and was one of just a few properties to win the full $20 million. But since signing a contract for the award last July, Keach-Longo said his team has “heard almost nothing.” They were supposed to be assigned a Multifamily Assessment Contractor, or MAC, the term for the HUD-employed contractor that would oversee the project, but the Biden administration never got to it. When the Trump administration came in, it halted the program as part of the larger IRA funding freeze. On February 12, HUD terminated its contracts with all five of the companies it had selected to serve as MACs, including big consulting firms like Deloitte and Ernst and Young. HUD did not respond to emailed questions for this story.

Margaret Salazar, the CEO of REACH Community Development in Oregon, has also been “stuck in a holding pattern” regarding her organization’s two Comprehensive awards. “We want to do right by what we’ve communicated with residents that we are making these repairs. We want to involve them in the process. And now we’re hanging out there without any path forward,” she told me.

When the funding freeze first went into effect in March, an affordable housing operator in the Boston area called the Codman Square Neighborhood Development Corporation, which had won an Elements grant, joined a lawsuit filed by five other nonprofits that challenged Trump’s pause. In April, the district court judge overseeing the case issued a preliminary injunction barring HUD and other agencies from maintaining any program-wide freezes.

The agency complied, in part. HUD sent a letter to awardees notifying them of the injunction and resumed processing reimbursements for Elements and Leading Edge grants. Ron Budynas, the chief operating officer for an affordable senior housing provider called Wesley Living, which won 10 separate awards from the program, told me he’s been able to proceed with his three Elements projects. He’s already completed one, upgrading an apartment complex in Lexington, Tennessee, with high efficiency heat pumps, and is now working on the others, installing solar and battery backup systems at two other properties in Tennessee.

His remaining seven are Comprehensive projects, however, and are “a whole different story,” he said. “Every time I’ve written to the [Green and Resilient Retrofit Program] staff, the only answer I get back from them on the Comprehensive grants is ’we’re still waiting for direction from headquarters.’”

Budynas was much further along than Keach-Longo at The Towers by the time Trump came into office. He said he was already working with a MAC and had completed a capital needs assessment on five of the properties; the next step was to scope out the work. He told me he contacted HUD after the court’s injunction and asked whether his team could put together the scope for one project to move it forward, but the agency told him no, since the program rules say that the MAC has to do it — even though it had fired all of the MACs.

Then the reconciliation bill that Congress passed earlier this month rescinded $138 million from the program — money set aside for administrative costs and technical assistance, i.e. to pay for the MACs. “How do we go forward if the MAC has to do the scope and they don’t have any money to pay the MAC?” Budynas said. Six of the seven Wesley Living properties that won Comprehensive awards receive HUD subsidies that preclude them from using other types of financing, “so there’s no way for us to update those properties if the Comprehensive doesn’t go forward,” he said.

It’s unclear whether any of this will be addressed in the lawsuit, since the only plaintiff in the case that challenged HUD — Codman Square — has been able to progress with its Elements award. I reached out to Democracy Forward, the nonprofit legal organization that is representing the plaintiffs, but it declined to comment.

Beth Neitzel, a partner at the law firm Foley Hoag, which is not involved in the case, told me this might be an unfortunate gray area for the Comprehensive award winners. She said the lawyers could argue that HUD is violating the terms of the injunction, but the government could respond that no one in the case is being injured by its actions.

“I don’t know if that will carry the day. It seems pretty clear they are violating the terms of the preliminary injunction by not unfreezing that fund,” Neitzel said. “But there is that potential wrinkle that they will argue that’s not an issue here because nobody here has standing to challenge that.” As a matter of law, she added, it’s irrelevant that HUD fired the contractors overseeing the program since the program itself was congressionally mandated.

Meanwhile the grantees wait, and the consequences of the delay stack up. Salazar, of REACH in Oregon, told me the organization missed out on an opportunity to get additional funding from the Portland Housing Bureau because it hadn’t been able to scope out the project with its MAC.

“This isn’t just money on the line. This is the future of these affordable housing communities,” Bilowich said. “That is a blue issue, that’s a red issue, that’s everybody’s issue. And so we need a solution, and this was the most efficient and cost-effective solution that everybody had come up with.”

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

NineDot Energy’s nine-fiigure bet on New York City is a huge sign from the marketplace.

Battery storage is moving full steam ahead in the Big Apple under new Mayor Zohran Mamdani.

NineDot Energy, the city’s largest battery storage developer, just raised more than $430 million in debt financing for 28 projects across the metro area, bringing the company’s overall project pipeline to more than 60 battery storage facilities across every borough except Manhattan. It’s a huge sign from the marketplace that investors remain confident the flashpoints in recent years over individual battery projects in New York City may fail to halt development overall. In an interview with me on Tuesday, NineDot CEO David Arfin said as much. “The last administration, the Adams administration, was very supportive of the transition to clean energy. We expect the Mamdani administration to be similar.”

It’s a big deal given that a year ago, the Moss Landing battery fire in California sparked a wave of fresh battery restrictions at the local level. We’ve been able to track at least seven battery storage fights in the boroughs so far, but we wouldn’t be surprised if the number was even higher. In other words, risk remains evident all over the place.

Asked where the fears over battery storage are heading, Arfin said it's “really hard to tell.”

“As we create more facts on the ground and have more operating batteries in New York, people will gain confidence or have less fear over how these systems operate and the positive nature of them,” he told me. “Infrastructure projects will introduce concern and reasonably so – people should know what’s going on there, what has been done to protect public safety. We share that concern. So I think the future is very bright for being able to build the cleaner infrastructure of the future, but it's not a straightforward path.”

In terms of new policy threats for development, local lawmakers are trying to create new setback requirements and bond rules. Sam Pirozzolo, a Staten Island area assemblyman, has been one of the local politicians most vocally opposed to battery storage without new regulations in place, citing how close projects can be to residences, because it's all happening in a city.

“If I was the CEO of NineDot I would probably be doing the same thing they’re doing now, and that is making sure my company is profitable,” Pirozzolo told me, explaining that in private conversations with the company, he’s made it clear his stance is that Staten Islanders “take the liability and no profit – you’re going to give money to the city of New York but not Staten Island.”

But onlookers also view the NineDot debt financing as a vote of confidence and believe the Mamdani administration may be better able to tackle the various little bouts of hysterics happening today over battery storage. Former mayor Eric Adams did have the City of Yes policy, which allowed for streamlined permitting. However, he didn’t use his pulpit to assuage battery fears. The hope is that the new mayor will use his ample charisma to deftly dispatch these flares.

“I’d be shocked if the administration wasn’t supportive,” said Jonathan Cohen, policy director for NY SEIA, stating Mamdani “has proven to be one of the most effective messengers in New York City politics in a long time and I think his success shows that for at least the majority of folks who turned out in the election, he is a trusted voice. It is an exercise that he has the tools to make this argument.”

City Hall couldn’t be reached for comment on this story. But it’s worth noting the likeliest pathway to any fresh action will come from the city council, then upwards. Hearings on potential legislation around battery storage siting only began late last year. In those hearings, it appears policymakers are erring on the side of safety instead of blanket restrictions.

The week’s most notable updates on conflicts around renewable energy and data centers.

1. Wasco County, Oregon – They used to fight the Rajneeshees, and now they’re fighting a solar farm.

2. Worcester County, Maryland – The legal fight over the primary Maryland offshore wind project just turned in an incredibly ugly direction for offshore projects generally.

3. Manitowoc County, Wisconsin – Towns are starting to pressure counties to ban data centers, galvanizing support for wider moratoria in a fashion similar to what we’ve seen with solar and wind power.

4. Pinal County, Arizona – This county’s commission rejected a 8,122-acre solar farm unanimously this week, only months after the same officials approved multiple data centers.

.

A conversation with Adib Nasle, CEO of Xendee Corporation

Today’s Q&A is with Adib Nasle, CEO of Xendee Corporation. Xendee is a microgrid software company that advises large power users on how best to distribute energy over small-scale localized power projects. It’s been working with a lot with data centers as of late, trying to provide algorithmic solutions to alleviate some of the electricity pressures involved with such projects.

I wanted to speak with Nasle because I’ve wondered whether there are other ways to reduce data center impacts on local communities besides BYO power. Specifically, I wanted to know whether a more flexible and dynamic approach to balancing large loads on the grid could help reckon with the cost concerns driving opposition to data centers.

Our conversation is abridged and edited slightly for clarity.

So first of all, tell me about your company.

We’re a software company focused on addressing the end-to-end needs of power systems – microgrids. It’s focused on building the economic case for bringing your own power while operating these systems to make sure they’re delivering the benefits that were promised. It’s to make sure the power gap is filled as quickly as possible for the data center, while at the same time bringing the flexibility any business case needs to be able to expand, understand, and adopt technologies while taking advantage of grid opportunities, as well. It speaks to multiple stakeholders: technical stakeholders, financial stakeholders, policy stakeholders, and the owner and operator of a data center.

At what point do you enter the project planning process?

From the very beginning. There’s a site. It needs power. Maybe there is no power available, or the power available from the grid is very limited. How do we fill that gap in a way that has a business case tied to it? Whatever objective the customer has is what we serve, whether it’s cost savings or supply chain issues around lead times, and then the resiliency or emissions goals an organization has as well.

It’s about dealing with the gap between what you need to run your chips and what the utility can give you today. These data center things almost always have back-up systems and are familiar with putting power on site. It must now be continuous. We helped them design that.

With our algorithm, you tell it what the site is, what the load requirements are, and what the technologies you’re interested in are. It designs the optimal power system. What do we need? How much money is it going to take and how long?

The algorithm helps deliver on those cost savings, deliverables, and so forth. It’s a decision support system to get to a solution very, very quickly and with a high level of confidence.

How does a microgrid reduce impacts to the surrounding community?

The data center obviously wants to power as quickly and cheaply as possible. That’s the objective of that facility. At the same time, when you start bringing generation assets in, there are a few things that’ll impact the local community. Usually we have carbon monoxide systems in our homes and it warns us, right? Emissions from these assets become important and there’s a need to introduce technologies in a way that introduces that power gap and the air quality need. Our software helps address the emissions component and the cost component. And there are technologies that are silent. Batteries, technology components that are noise compliant.

From a policy perspective and a fairness perspective, a microgrid – on-site power plant you can put right next to the data center – helps unburden the local grid at a cost of upgrades that has no value to ratepayers other than just meeting the needs of one big customer. That one big customer can produce and store their own power and ratepayers don’t see a massive increase in their costs. It solves a few problems.

What are data centers most focused on right now when it comes to energy use, and how do you help?

I think they’re very focused on the timeframe and how quickly they can get that power gap filled, those permits in.

At the end of the day the conversation is about the utility’s relationship with the community as opposed to the data center’s relationship with the utility. Everything’s being driven by timelines and those timelines are inherently leaning towards on-site power solutions and microgrids.

More and more of these data center operators and owners are going off-grid. They’ll plug into the grid with what’s available but they’re not going to wait.

Do you feel like using a microgrid makes people more supportive of a data center?

Whether the microgrid is serving a hospital or a campus or a data center, it’s an energy system. From a community perspective, if it’s designed carefully and they’re addressing the environmental impact, the microgrid can actually provide shock absorbers to the system. It can be a localized generation source that can bring strength and stability to that local, regional grid when it needs help. This ability to take yourself out of the equation as a big load and run autonomously to heal itself or stabilize from whatever shock it's dealing with, that’s a big benefit to the local community.