You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

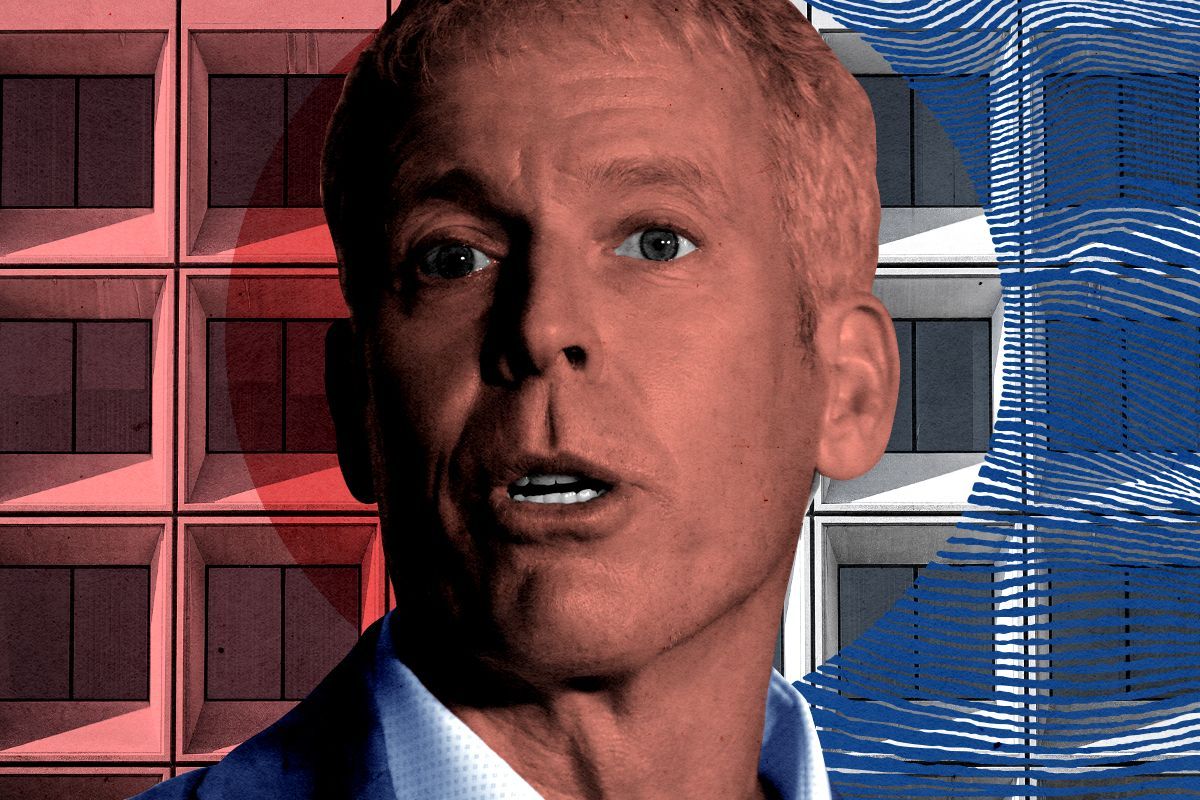

His intellectual influences include longtime climate action skeptics — and Bill Gates’ favorite author.

Donald Trump’s nominee for Secretary of Energy, Chris Wright, is a nerd — and he’ll tell you about it. “I’m Chris Wright, and my short bio is, I started out as a science geek, I transitioned to a tech nerd, and then I’ve been an energy entrepreneur my whole life,” he told energy journalist Robert Bryce on the Power Hungry podcast in 2020. “In addition to an energy nerd, I’ve been a climate nerd for quite some time,” he said in a talk hosted by Veriten, the energy consulting firm in 2023.

This is a far cry from Trump’s first Energy Secretary, the former Texas Governor Rick Perry, who famously failed to remember on the Republican primary debate stage the third of the three agencies he sought to eliminate (it was the Department of Energy) and who reportedly didn’t know that the Energy Department’s responsibilities — and budget — then lay heavily with maintaining the country’s nuclear stockpile.

But Wright’s extensive energy experience — studying nuclear fusion at the Massachusetts Institute of Technology and working early in his career on solar and geothermal engineering (his company, Liberty Energy, the fracking powerhouse he founded in 2011, has invested in the next-generation geothermal company Fervo, and Wright sits on the board of the nuclear company Oklo) — has not won him any plaudits from environmental groups or Democrats who focus on climate change. After Trump announced his nomination, the Sierra Club called Wright a “climate denier who has profited off of polluting our communities and endangering our health and future.” Illinois Rep. Sean Casten, one of the House’s most vocal proponents of climate action, also called Wright a “climate denier who prioritizes the wants of energy producers over the needs of American consumers.”

Few Republicans — and certainly few high-level Trump appointees — are as conversant in climate and energy data as Wright. That may make him an even more effective advocate for Trump’s “energy dominance” strategy, built around increased production of fossil fuels and, almost certainly, fewer subsidies for clean energy and electrification.

Typically when a person gains some notoriety by coming out against immediate, large-scale climate action and restrictions on fossil fuel extraction, climate advocates try to link that person to the fossil fuel industry and its long history of deliberate and knowing climate denial. Wright’s associations, however, are perfectly straightforward: Liberty Energy fracks oil and gas in the United States and Canada on behalf of large oil companies. He thinks the company’s contribution to the good of the world consists of its producing more hydrocarbons — full stop.

Get the best of Heatmap in your inbox daily.

Wright calls this philosophy “energy sobriety,” fully conceding that climate change is real while also diminishing the urgency of mounting a response. In seemingly countless speeches, interviews, and legislative testimonies, as well as in Liberty Energy’s annual “Bettering Human Lives” report — its version of an environmental, social, and governance review — Wright is perfectly comfortable acknowledging climate change while also patiently assaulting many key pillars of climate policy as it’s practiced in the United States, Europe, and other countries in the developed world seeking to sharply reduce greenhouse gas emissions.

While Wright’s written and spoken record adds up to tens of thousands of words and hours of talks, it can be distilled into a few core ideas: Energy consumption makes people better off; energy access, especially in the developing world, is a greater global challenge than climate change; and existing alternatives to hydrocarbons are not capable of replacing the status quo energy system, which still overwhelmingly relies on fossil fuels, with little prospect of a rapid transition.

He cites a wide range of thinkers, including members of a group of scholars — including the Danish political scientist Bjorn Lomborg (whose book, False Alarm, is “fantastic,” Wright said in a Liberty talk), University of Colorado science policy scholar Roger Pielke, Jr. (“a real intellectual”), and the Canadian energy scholar and historian Vaclav Smil (“the greatest energy scholar of my lifetime by far”) — who share elements of this deflationary view of climate change.

Lomborg and Pielke have long been bêtes noires of the climate movement, mostly as the subjects of years of furious back and forth in every form of media for the past two-plus decades. (Though in Pielke’s case, there was also an investigation in 2015 over alleged conflicts of interest led by House Democrat Raul Grijalva, who is retiring from Congress this year.) Lomborg has for decades argued that climate change ranks relatively low on global challenges compared to, say, global public health, while Pielke contends that many climate change policy advocates overstate what the Intergovernmental Panel on Climate Change actually says about the connection between climate change and extreme weather, a point that has made him the object of intense criticism for going on 15 years.

Smil, meanwhile, is deeply skeptical of any effort to wean the world from fossil fuels considering their role in the production of steel, cement, plastics, and fertilizers — the materials that he describes as essential to the modern world. Smil also counts among his fans Bill Gates (“Vaclav Smil is my favorite author”), who is also one of the biggest funders and promoters of climate action through his research and investment group Breakthrough Energy and funding for companies like TerraPower, which is currently building the country’s first next-generation nuclear facility in Wyoming.

Pielke called both Wright and Doug Burgum, Trump’s nominee for Secretary of the Interior and the designated head of a planned National Energy Council “super competent. They know energy, and that’s a fantastic starting point,” he told me.

“There is polarization of the climate debate, and the idea that fossil fuels are evil and the fossil industry are arch-villains — that’s part of the framing from the progressive left about how climate wars are to be fought,” Pielke said. “I’m not particularly wedded to that sort of Manichean evil vs. good framing of the debate.”

But the differences are real. Wright strongly contests much of what is the mainstream of climate policy. While he acknowledges that increased concentrations of carbon dioxide cause higher temperature, he says it’s “actually sort of slow-moving in our lifetimes” and a “relatively modest phenomenon that’s just been wildly abused for political reasons,” he said in a talk to the conservative policy group American Legislative Exchange Council.

While the Department of Energy has only limited authority over energy policy, per se, especially the permitting and public lands issues that typically concern fossil fuel companies, Wright does have some levers he can pull. He will likely act quickly to approve more export facilities for liquified natural gas, though the Energy Department’s recently released study of LNG’s long-term effects — particularly on domestic energy prices — may complicate that somewhat. Beyond that, he will inherit a massive energy research portfolio through the national labs, putting him in charge of developing the energy technology that he says are currently insufficient to replace oil and gas.

“I’ve worked on alternatives. I’d love it if fusion energy arrives,” Wright said in an interview with the conservative website Power Line. “I love energy technology, and I think there’s good things going on, but it’s now become political.”

He believes that reaching net zero greenhouse gas emissions by 2050 is “neither achievable nor humane,” he wrote in the foreword to the 2024 edition of “Bettering Human Lives.” He also disagrees with the idea of subsidizing the world’s predominant forms of alternative energy, solar and wind.

“Wind and solar are never going to be dominant sources of energy in the world,” Wright told Bryce on the 2020 podcast. The “main impact” of subsidies for wind and solar, Wright said in another 2023 podcast episode with Bryce, “is just to make our electricity grids less reliable and electricity prices more expensive, and to do nothing for the demand for oil and very little for the demand for natural gas.”

“Oil and gas make the world go round,” he added. “[People] want higher quality of lives. That’s what drives the demand for oil and gas.”

Bryce, a persistent critic of green energy policies, told me in an email that he thinks Wright is “the right person for the DOE. He’s not apologetic about being an energy humanist. Regardless of what anyone thinks about climate change, it is obvious that we are going to need a lot more energy in the future, and the majority of that new supply will come from hydrocarbons.”

While Wright’s arguments certainly have wide purchase among his peers in the energy industry executive corps, he nevertheless stands out from the rest for his willingness to express them. In contrast to the stance taken by large, multinational energy companies, which are willing at least to pay lip service to carbon reduction goals and have, at times, embraced branding and marketing strategies to make them seem like something other than oil and gas companies (e.g. ExxonMobil’s algae-based fuel initiative and BP’s notorious “Beyond Petroleum” campaign), Wright and his company see their contribution to a better world as their work extracting oil and gas.

Other executives “don’t want to deal with the criticism that will come with taking a higher-profile stance,” Bryce told me. “They don’t have time or the inclination. It takes a lot of time, courage, and conviction to engage with the media, get on the speaking circuit, and do so in a thoughtful way.”

Wright’s emphasis on the energy poverty faced by poor countries could potentially serve as a diplomatic bridge to the developing world, especially in Africa, where some observers think there’s space for the United States to start funding natural gas development through the International Development Finance Corporation. For Wright, expanding energy production — and specifically fossil fuel development — is crucial to providing cheap energy to the developing world. He mentions in almost every talk the billions of people who use wood, dung, or other biofuels on open fires to cook indoors, causing 3 million premature deaths per year.

“The biggest problem today is a third of humanity doesn’t have hydrocarbons,” Wright told Bryce in 2023. In a 2023 speech to the American Conservation Coalition, a conservative environmental group, he described strictures against financing fossil fuel development as “not just ignorant or bad policy” but “immoral.” His solution: distributing propane stoves as widely as possible, in part through his Bettering Human Lives Foundation.

Here might be the greatest challenge for advocates of climate action: Even if most of the world’s leaders have accepted the reality of anthropogenic climate change, much of the world, especially outside North America and Europe, is still eagerly increasing its use of fossil fuels. In the United States, coal plant shutdowns are being pushed out further and natural gas investment may soon pick up again to power new demand for electricity. Globally, coal use is set to grow over the next few years. That’s thanks in large part to demand from China, the world’s largest emitter and second-largest cumulative emitter behind the United States, defying predictions that demand there was near peaking. The biggest new source of oil demand is India, a country with a per-capita gross domestic product less than 1/30th of the United States.

And so the greatest danger to aggressive action to lower global emissions may not be Chris Wright and his “sober” ideas at the helm of the Department of Energy. It may be that much of the world agrees with him.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

If the Senate reconciliation bill gets enacted as written, you’ve got about 92 days left to seal the deal.

If you were thinking about buying or leasing an electric vehicle at some point, you should probably get on it like, right now. Because while it is not guaranteed that the House will approve the budget reconciliation bill that cleared the Senate Tuesday, it is highly likely. Assuming the bill as it’s currently written becomes law, EV tax credits will be gone as of October 1.

The Senate bill guts the subsidies for consumer purchases of electric vehicles, a longstanding goal of the Trump administration. Specifically, it would scrap the 30D tax credit by September 30 of this year, a harsher cut-off than the version of the bill that passed the House, which would have axed the credit by the end of 2025 except for automakers that had sold fewer than 200,000 electric vehicles. The credit as it exists now is worth up to $7,500 for cars with an MSRP below $55,000 (and trucks and sports utility vehicles under $80,000), and, under the Inflation Reduction Act, would have lasted through the end of 2032. The Senate bill also axes the $4,000 used EV tax credit at the end of September.

“Long story short, the credits under the current legislation are only going to be on the books through the end of September,” Corey Cantor, the research director of the Zero Emission Transportation Association, told me. “Now is definitely a good time, if you’re interested in an EV, to look at the market.”

The Senate applied the same strict timeline to credits for clean commercial vehicles, both new and used. For home EV chargers, the tax credit will now expire at the end of June next year.

While EVs were on the road well before the 2022 passage of the Inflation Reduction Act, what the new tax credit did was help build out a truly domestic electric vehicle market, Cantor said. “You have a bunch of refreshed EV models from major automakers,” Cantor told me, including “more affordable models in different segments, and many of them qualify for the credit.”

These include cars produceddomestically by Kia,Hyundai, and Chevrolet. But of course, the biggest winner from the credit is Tesla, whose Model Y was the best-selling car in the world in 2023.

Tesla shares were down over 5.5% in Tuesday afternoon trading, though not just because of Congress. JPMorgan also released an analyst report Monday arguing that the decline in sales seen in the first quarter would accelerate in the second quarter. President Trump, with whom Tesla CEO Elon Musk had an extremely public falling out last month, suggested on social media Monday night that the government efficiency department Musk himself formerly led should “take a good, hard, look” at the subsidies Musk receives across his many businesses. Trump also said that he would “take a look” at Musk’s United States citizenship in response to reporters’ questions about it.

Cantor told me that he expects a surge of consumer attention to the EV market if the bill passes in its current form. “You’ve seen more customers pull their purchase ahead” when subsidies cut-offs are imminent, he said.

But overall, the end of the subsidy is likely to reduce EV sales from their previously expected levels.

Harvard researchers have estimated that the termination of the EV tax credit “would cut the EV share of new vehicle sales in 2030 by 6.0 percentage points,” from 48% of new sales by 2030 to 42%. Combined with other Trump initiatives such as terminating the National Electric Vehicle Infrastructure program for publicly funded chargers (currently being litigated) and eliminating California’s waiver under the Clean Air Act that allowed it to set tighter vehicle emissions standards, the share of new car sales that are electric could fall to 32% in 2030.

But not all government support for electric vehicles will end by October 1, even if the bill gets the president’s signature in its current form.

“It’s important for consumers to know there are many states that offer subsidies, such as New York, and Colorado,” Cantor told me. That also goes for California, New Jersey, Nevada, and New Mexico. You can find the full list here.

Editor’s note: This story has been edited to include a higher cost limit for trucks and SUVs.

Excise tax is out, foreign sourcing rules are in.

After more than three days of stops and starts on the Senate floor, Congress’ upper chamber finally passed its version of Trump’s One Big Beautiful Bill Act Tuesday morning, sending the tax package back to the House in hopes of delivering it to Trump by the July 4 holiday, as promised.

An amendment brought by Senators Joni Ernst and Chuck Grassley of Iowa and Lisa Murkowski of Alaska that would have more gradually phased down the tax credits for wind and solar rather than abruptly cutting them off was never brought to the floor. Instead, Murkowski struck a deal with the Senate leadership designed to secure her vote that accomplished some of her other priorities, including funding for rural hospitals, while also killing an excise tax on renewables that had only just been stuffed into the bill over the weekend.

The new tax on wind and solar would have driven up development costs by as much as 20% — a prospect that industry groups said would “kill” investment altogether. But even without the tax, the Senate’s bill would gum up the works for clean energy projects across the spectrum due to new phase-out schedules for tax credits and fast-approaching deadlines to meet complex foreign sourcing rules. While more projects will likely be built under this version than the previous one, the basic outcomes haven’t changed: higher energy costs, project delays, lost jobs, and ceding leadership in artificial intelligence and manufacturing to China.

"This bill will hit Americans hard, terminating credits that have helped families lower their energy and transportation costs, shrinking demand for American-made advanced energy technologies, and squeezing new domestic energy production at a time of rising demand and prices,” Heather O’Neill, the CEO and president of the trade group Advanced Energy United, said in a statement Tuesday. “The advanced energy industry will endure, but the downstream effects of these rollbacks and punitive policies will be felt by American families and businesses for years to come.”

Here’s what’s in the final Senate bill.

The final Senate bill bifurcates the previously technology-neutral tax credits for clean electricity into two categories with entirely different rules and timelines — wind and solar versus everything else.

Tax credits for wind and solar farms would end abruptly with no phase-out period, but the bill includes a significant safe harbor for projects that are already under construction or close to breaking ground. As long as a project starts construction within 12 months of the bill’s passage, it will be able to claim the tax credits as originally laid out in the Inflation Reduction Act. All other projects must be “placed in service,” i.e. begin operating, by the start of 2028 to qualify.

That means if Trump signs the bill into law on July 4, wind and solar developers will have until July 4 of 2026 to “start construction.” Otherwise, they will have less than a year and a half to bring their projects online and still qualify for the credits.

Meanwhile, all other sources of zero-emissions electricity, including batteries, advanced nuclear, geothermal, and hydropower, will be able to continue claiming the tax credits for nearly a decade. The credits would start phasing down for projects that start construction in 2034 and terminate in 2036.

While there are some potential wins in the bill for clean energy development, many of the safe harbored projects will still be subject to complex foreign sourcing rules that may prove too much of a burden to meet.

The bill requires that any zero-emissions electricity or advanced manufacturing project that starts construction after December of this year abide by strict new “foreign entities of concern,” or FEOC rules in order to be eligible for tax credits. The rules penalize companies for having financial or material connections to people or businesses that are “owned by, controlled by, or subject to the jurisdiction or direction of” any of four countries — Russia, Iran, North Korea, and most importantly for clean energy technology, China.

As with the text that came out of the Senate Finance committee, the text in the final bill would phase in supply chain restrictions, requiring project developers and manufacturers to use fewer and fewer Chinese-sourced inputs over time. For clean electricity projects starting construction next year, 40% of the value of the materials used in the project must be free of ties to a FEOC. By 2030, the threshold would rise to 60%. Energy storage facilities are subject to a more aggressive timeline and would be required to prove that 55% of the project materials are non-FEOC in 2026, rising to 75% by 2030. Each covered advanced manufacturing technology gets its own specific FEOC benchmarks.

Unlike the text from the Finance Committee, however, the final text includes a clear exception for developers who already have procurement contracts in place prior to the bill’s enactment. If a solar developer has already signed a contract to get its cells from a Chinese company, for example, it could exempt that cost from the calculation. That would make it easier for companies further along in the development process to comply with the eligibility rules.

That said, these materials sourcing rules come on top of strict ownership and licensing rules likely to block more than 100 existing and planned solar and battery factories with partial Chinese ownership or licensing deals with Chinese firms from receiving the tax credits, per a BloombergNEF analysis I reported on previously.

Once again, the details of how any of this will work — and whether it will, in fact, be “workable” — will depend heavily on guidance written by the Treasury department. That not only gives the Trump administration significant discretion over the rules, it also assumes that the nTreasury department, which is now severely understaffed after Trump’s efficiency department cleaned house earlier this year, will actually have the bandwidth to write them. Without Treasury guidance, developers may not have the cost certainty they need to continue moving forward on projects.

Up until today, the Senate and House looked poised to destroy the business model for companies like Sunrun that lease rooftop solar installations to homeowners and businesses by cutting them off from the investment tax credit, which can bring down the cost of a solar array by as much as 70%. The final Senate bill, however, got rid of this provision and replaced it with a much more narrow version.

Now, the only “leasing” schemes that are barred from claiming tax credits are those for solar water heaters and small wind installations. Companies that lease solar panels, batteries, fuel cells, and geothermal heating equipment are still eligible. SunRun’s stock jumped nearly 10% on Tuesday.

Other than the new FEOC rules, which will have truly existential consequences for a great many projects, there aren’t many changes to the advanced manufacturing tax credit, or 45X, than in previous versions of the bill. The OBBBA would create a new phase-out schedule for critical mineral producers claiming the tax credit that begins in 2031. Previously, critical minerals were set to be eligible indefinitely. It would also terminate the credit for wind energy components early, in 2028.

One significant change from the Senate Finance text is that the bill would allow vertically integrated companies to stack the tax credit for multiple components.

But perhaps the biggest change, which was introduced last weekend, is a twisted new definition of “critical mineral” that allows metallurgical coal — the type of coal used in steelmaking — to qualify for the tax credit. As my colleague Matthew Zeitlin wrote, most of the metallurgical coal the U.S. produces is exported, meaning this subsidy will mostly help other countries produce cheaper steel.

It looks like the hydrogen industry’s intense lobbying efforts finally paid off: The final Senate bill is the first text we’ve seen since this process began in May that would extend the lifespan of the tax credit for clean hydrogen production. Now, projects that begin construction before January 1, 2028 will still qualify for the credit. This is shorter than the Inflation Reduction Act’s 2033 cut-off, but much longer than the end-of-year cliff earlier versions of the bill would have imposed.

The tax credits for electric vehicles and energy efficiency building improvements would end almost immediately. Consumers will have to purchase or lease a new or used EV before September 30, 2025, in order to benefit. There would be a slightly longer lead time to get an EV charger installed, but that credit (30C) would expire on June 30, 2026.

Meanwhile, energy efficiency upgrades such as installing a heat pump or better-insulated windows and doors would have to be completed by the end of this year in order to qualify. Same goes for self-financed rooftop solar. The tax credit for newly built energy efficiency homes would expire on June 30, 2026.

The bill would make similar changes to the carbon sequestration (45Q) and clean fuels (45Z) tax credits as previous versions, boosting the credit amount for carbon capture projects that do enhanced oil recovery, and extending the clean fuels credit to corn ethanol producers.

The House Rules Committee met on Tuesday afternoon shortly after the Senate vote to deliberate on whether to send it to the House floor, and is still debating as of press time. As of this writing, Rules members Ralph Norman and Chip Roy have said they’ll vote against it.

On sparring in the Senate, NEPA rules, and taxing first-class flyers

Current conditions: A hurricane warning is in effect for Mexico as the Category 1 storm Flossie approaches • More than 50,000 people have been forced to flee wildfires raging in Turkey • Heavy rain caused flash floods and landslides near a mountain resort in northern Italy during peak tourist season.

Senate lawmakers’ vote-a-rama on the GOP tax and budget megabill dragged into Monday night and continues Tuesday. Republicans only have three votes to lose if they want to get the bill through the chamber and send it to the House. Already Senators Thom Tillis and Rand Paul are expected to vote against it, and there are a few more holdouts for whom clean energy appears to be one sticking point. Senator Lisa Murkowski of Alaska, for example, has put forward an amendment (together with Iowa Senators Joni Ernst and Chuck Grassley) that would eliminate the new renewables excise tax, and phase out tax credits for solar and wind gradually (by 2028) rather than immediately, as proposed in the original bill. “I don’t want us to backslide on the clean energy credits,” Murkowski told reporters Monday. E&E News reported that the amendment could be considered on a simple majority threshold. (As an aside: If you’re wondering why wind and solar need tax credits if they’re so cheap, as clean energy advocates often emphasize, Heatmap’s Emily Pontecorvo has a nice explainer worth reading.)

At the same time, Utah’s Senator John Curtis has proposed an amendment that tweaks the new excise tax to make it more “flexible.” The amendments are “setting up a major intra-party fight,” Politicoreported, adding that “fiscal hawks on both sides of the Capitol are warning they will oppose the bill if the phase-outs of Inflation Reduction Act provisions are watered down.” Senators have already defeated amendments proposed by Democrats Jeanne Shaheen of New Hampshire and John Hickenlooper of Colorado to defend clean energy and residential solar tax credits, respectively. The session has broken the previous record for most votes in a vote-a-rama, set in 2008, with no end in sight.

The Department of Energy on Monday rolled back most of its regulations relating to the National Environmental Policy Act, or NEPA, and published a new set of guidance procedures in their place. The longstanding NEPA law requires that the government study the environmental impacts of its actions, and in the case of the DOE, this meant things like permitting and public lands management. In a press release outlining the changes, the agency said it was “fixing the broken permitting process and delivering on President Trump’s pledge to unleash American energy dominance and accelerate critical energy infrastructure.” Secretary of Energy Chris Wright said the agency was cutting red tape to end permitting paralysis. “Build, baby, build!” he said.

Nearly 300 employees of the Environmental Protection Agency signed a letter addressed to EPA head Lee Zeldin declaring their dissent toward the Trump administration’s policies. The letter accuses the administration of:

“Going forward, you have the opportunity to correct course,” the letter states. “Should you choose to do so, we stand ready to support your efforts to fulfill EPA’s mission.” It’s signed by more than 420 people, 270 being EPA workers. Many of them asked to sign anonymously. In a statement to The New York Times, EPA spokesperson Carolyn Horlan said “the Trump EPA will continue to work with states, tribes and communities to advance the agency’s core mission of protecting human health and the environment and administrator Zeldin’s Powering the Great American Comeback Initiative, which includes providing clean air, land and water for EVERY American.”

At the fourth International Conference on Financing for Development taking place in Spain this week, a group of eight countries including France and Spain announced they’re banding together in an effort to tax first- and business-class flyers as well as private jets to raise money for climate mitigation and sustainable development. “The aim is to help improve green taxation and foster international solidarity by promoting more progressive and harmonised tax systems,” the office of Spanish Prime Minister Pedro Sanchez said in a statement. Other countries in the coalition include Kenya, Barbados, Somalia, Benin, Sierra Leone, and Antigua & Barbuda. The group said it will “work towards COP30 on a better contribution of the aviation sector to fair transitions and resilience.” Wopke Hoekstra, who heads up the European Commission for Climate, called for other countries to join the group in the lead-up to COP30 in November.

In case you missed it: Google announced on Monday that it intends to buy fusion energy from nuclear startup Commonwealth Fusion Systems. Of course, CFS will have to crack commercial-scale fusion first (minor detail!), but as The Wall Street Journal noted, the news is significant because it is “the first direct deal between a customer and a fusion energy company.” Google will buy 200 megawatts of energy supplied by CFS’s ARC plant in Virginia. “It’s a pretty big signal to the market that fusion’s coming,” CFS CEO Bob Mumgaard told the Journal. “It’s desirable, and that people are gonna work together to make it happen.” Google’s head of advanced energy Michael Terrell echoed that sentiment, saying the company hopes this move will “prove out and scale a promising pathway toward commercial fusion power.” CFS, which is backed by Bill Gates’ Breakthrough Energy Ventures, aims to produce commercial fusion energy in the 2030s.

All the public property owned by Britain’s King Charles earned a net profit of £1.15 billion ($1.58 billion) last year. The biggest source of income? Offshore wind leases.