You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

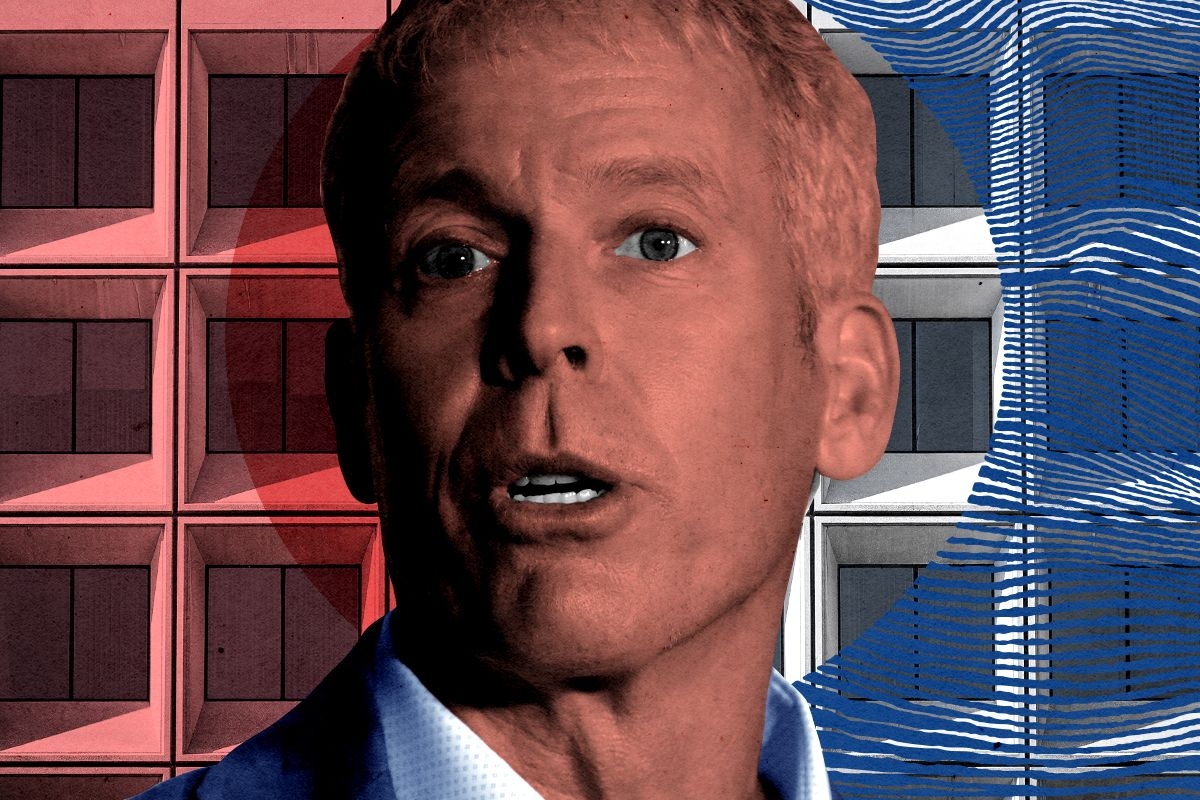

His intellectual influences include longtime climate action skeptics — and Bill Gates’ favorite author.

Donald Trump’s nominee for Secretary of Energy, Chris Wright, is a nerd — and he’ll tell you about it. “I’m Chris Wright, and my short bio is, I started out as a science geek, I transitioned to a tech nerd, and then I’ve been an energy entrepreneur my whole life,” he told energy journalist Robert Bryce on the Power Hungry podcast in 2020. “In addition to an energy nerd, I’ve been a climate nerd for quite some time,” he said in a talk hosted by Veriten, the energy consulting firm in 2023.

This is a far cry from Trump’s first Energy Secretary, the former Texas Governor Rick Perry, who famously failed to remember on the Republican primary debate stage the third of the three agencies he sought to eliminate (it was the Department of Energy) and who reportedly didn’t know that the Energy Department’s responsibilities — and budget — then lay heavily with maintaining the country’s nuclear stockpile.

But Wright’s extensive energy experience — studying nuclear fusion at the Massachusetts Institute of Technology and working early in his career on solar and geothermal engineering (his company, Liberty Energy, the fracking powerhouse he founded in 2011, has invested in the next-generation geothermal company Fervo, and Wright sits on the board of the nuclear company Oklo) — has not won him any plaudits from environmental groups or Democrats who focus on climate change. After Trump announced his nomination, the Sierra Club called Wright a “climate denier who has profited off of polluting our communities and endangering our health and future.” Illinois Rep. Sean Casten, one of the House’s most vocal proponents of climate action, also called Wright a “climate denier who prioritizes the wants of energy producers over the needs of American consumers.”

Few Republicans — and certainly few high-level Trump appointees — are as conversant in climate and energy data as Wright. That may make him an even more effective advocate for Trump’s “energy dominance” strategy, built around increased production of fossil fuels and, almost certainly, fewer subsidies for clean energy and electrification.

Typically when a person gains some notoriety by coming out against immediate, large-scale climate action and restrictions on fossil fuel extraction, climate advocates try to link that person to the fossil fuel industry and its long history of deliberate and knowing climate denial. Wright’s associations, however, are perfectly straightforward: Liberty Energy fracks oil and gas in the United States and Canada on behalf of large oil companies. He thinks the company’s contribution to the good of the world consists of its producing more hydrocarbons — full stop.

Get the best of Heatmap in your inbox daily.

Wright calls this philosophy “energy sobriety,” fully conceding that climate change is real while also diminishing the urgency of mounting a response. In seemingly countless speeches, interviews, and legislative testimonies, as well as in Liberty Energy’s annual “Bettering Human Lives” report — its version of an environmental, social, and governance review — Wright is perfectly comfortable acknowledging climate change while also patiently assaulting many key pillars of climate policy as it’s practiced in the United States, Europe, and other countries in the developed world seeking to sharply reduce greenhouse gas emissions.

While Wright’s written and spoken record adds up to tens of thousands of words and hours of talks, it can be distilled into a few core ideas: Energy consumption makes people better off; energy access, especially in the developing world, is a greater global challenge than climate change; and existing alternatives to hydrocarbons are not capable of replacing the status quo energy system, which still overwhelmingly relies on fossil fuels, with little prospect of a rapid transition.

He cites a wide range of thinkers, including members of a group of scholars — including the Danish political scientist Bjorn Lomborg (whose book, False Alarm, is “fantastic,” Wright said in a Liberty talk), University of Colorado science policy scholar Roger Pielke, Jr. (“a real intellectual”), and the Canadian energy scholar and historian Vaclav Smil (“the greatest energy scholar of my lifetime by far”) — who share elements of this deflationary view of climate change.

Lomborg and Pielke have long been bêtes noires of the climate movement, mostly as the subjects of years of furious back and forth in every form of media for the past two-plus decades. (Though in Pielke’s case, there was also an investigation in 2015 over alleged conflicts of interest led by House Democrat Raul Grijalva, who is retiring from Congress this year.) Lomborg has for decades argued that climate change ranks relatively low on global challenges compared to, say, global public health, while Pielke contends that many climate change policy advocates overstate what the Intergovernmental Panel on Climate Change actually says about the connection between climate change and extreme weather, a point that has made him the object of intense criticism for going on 15 years.

Smil, meanwhile, is deeply skeptical of any effort to wean the world from fossil fuels considering their role in the production of steel, cement, plastics, and fertilizers — the materials that he describes as essential to the modern world. Smil also counts among his fans Bill Gates (“Vaclav Smil is my favorite author”), who is also one of the biggest funders and promoters of climate action through his research and investment group Breakthrough Energy and funding for companies like TerraPower, which is currently building the country’s first next-generation nuclear facility in Wyoming.

Pielke called both Wright and Doug Burgum, Trump’s nominee for Secretary of the Interior and the designated head of a planned National Energy Council “super competent. They know energy, and that’s a fantastic starting point,” he told me.

“There is polarization of the climate debate, and the idea that fossil fuels are evil and the fossil industry are arch-villains — that’s part of the framing from the progressive left about how climate wars are to be fought,” Pielke said. “I’m not particularly wedded to that sort of Manichean evil vs. good framing of the debate.”

But the differences are real. Wright strongly contests much of what is the mainstream of climate policy. While he acknowledges that increased concentrations of carbon dioxide cause higher temperature, he says it’s “actually sort of slow-moving in our lifetimes” and a “relatively modest phenomenon that’s just been wildly abused for political reasons,” he said in a talk to the conservative policy group American Legislative Exchange Council.

While the Department of Energy has only limited authority over energy policy, per se, especially the permitting and public lands issues that typically concern fossil fuel companies, Wright does have some levers he can pull. He will likely act quickly to approve more export facilities for liquified natural gas, though the Energy Department’s recently released study of LNG’s long-term effects — particularly on domestic energy prices — may complicate that somewhat. Beyond that, he will inherit a massive energy research portfolio through the national labs, putting him in charge of developing the energy technology that he says are currently insufficient to replace oil and gas.

“I’ve worked on alternatives. I’d love it if fusion energy arrives,” Wright said in an interview with the conservative website Power Line. “I love energy technology, and I think there’s good things going on, but it’s now become political.”

He believes that reaching net zero greenhouse gas emissions by 2050 is “neither achievable nor humane,” he wrote in the foreword to the 2024 edition of “Bettering Human Lives.” He also disagrees with the idea of subsidizing the world’s predominant forms of alternative energy, solar and wind.

“Wind and solar are never going to be dominant sources of energy in the world,” Wright told Bryce on the 2020 podcast. The “main impact” of subsidies for wind and solar, Wright said in another 2023 podcast episode with Bryce, “is just to make our electricity grids less reliable and electricity prices more expensive, and to do nothing for the demand for oil and very little for the demand for natural gas.”

“Oil and gas make the world go round,” he added. “[People] want higher quality of lives. That’s what drives the demand for oil and gas.”

Bryce, a persistent critic of green energy policies, told me in an email that he thinks Wright is “the right person for the DOE. He’s not apologetic about being an energy humanist. Regardless of what anyone thinks about climate change, it is obvious that we are going to need a lot more energy in the future, and the majority of that new supply will come from hydrocarbons.”

While Wright’s arguments certainly have wide purchase among his peers in the energy industry executive corps, he nevertheless stands out from the rest for his willingness to express them. In contrast to the stance taken by large, multinational energy companies, which are willing at least to pay lip service to carbon reduction goals and have, at times, embraced branding and marketing strategies to make them seem like something other than oil and gas companies (e.g. ExxonMobil’s algae-based fuel initiative and BP’s notorious “Beyond Petroleum” campaign), Wright and his company see their contribution to a better world as their work extracting oil and gas.

Other executives “don’t want to deal with the criticism that will come with taking a higher-profile stance,” Bryce told me. “They don’t have time or the inclination. It takes a lot of time, courage, and conviction to engage with the media, get on the speaking circuit, and do so in a thoughtful way.”

Wright’s emphasis on the energy poverty faced by poor countries could potentially serve as a diplomatic bridge to the developing world, especially in Africa, where some observers think there’s space for the United States to start funding natural gas development through the International Development Finance Corporation. For Wright, expanding energy production — and specifically fossil fuel development — is crucial to providing cheap energy to the developing world. He mentions in almost every talk the billions of people who use wood, dung, or other biofuels on open fires to cook indoors, causing 3 million premature deaths per year.

“The biggest problem today is a third of humanity doesn’t have hydrocarbons,” Wright told Bryce in 2023. In a 2023 speech to the American Conservation Coalition, a conservative environmental group, he described strictures against financing fossil fuel development as “not just ignorant or bad policy” but “immoral.” His solution: distributing propane stoves as widely as possible, in part through his Bettering Human Lives Foundation.

Here might be the greatest challenge for advocates of climate action: Even if most of the world’s leaders have accepted the reality of anthropogenic climate change, much of the world, especially outside North America and Europe, is still eagerly increasing its use of fossil fuels. In the United States, coal plant shutdowns are being pushed out further and natural gas investment may soon pick up again to power new demand for electricity. Globally, coal use is set to grow over the next few years. That’s thanks in large part to demand from China, the world’s largest emitter and second-largest cumulative emitter behind the United States, defying predictions that demand there was near peaking. The biggest new source of oil demand is India, a country with a per-capita gross domestic product less than 1/30th of the United States.

And so the greatest danger to aggressive action to lower global emissions may not be Chris Wright and his “sober” ideas at the helm of the Department of Energy. It may be that much of the world agrees with him.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

It starts — but doesn’t end — with the Strait of Hormuz.

For the second time in a year, the United States and Israel have launched a major aerial assault on Iran. Strikes were reported across the country early Saturday, targeting Iranian leadership and military infrastructure. In retaliation, Iran has launched attacks on Israel and Gulf nations allied with the U.S., with several of the targets appearing to be American military installations. “The United States military is undertaking a massive and ongoing operation,” President Trump said in a video posted to Truth Social explaining his rationale for launching the war.

While the conflict has quickly metastasized across the region, it has the potential to affect the entire world by disrupting the production and shipment of oil and natural gas.

Iran and its neighbors on the Persian Gulf are some of the largest oil and gas producers in the world and the country has long threatened to disrupt oil exports as an act of self-defense or retaliation from attack.

That may be already happening. According to data from Bloomberg, some oil tankers are pausing or turning around outside the vital Strait of Hormuz, a narrow, deep channel between Iran and Oman that connects the Persian Gulf to the Arabian Sea and thus to global markets in and bordering the Indian Ocean.

The strait has been “effectively closed,” according to a report from Tasnim, a semi-official news agency linked to the Iran Revolutionary Guard Corps. British naval officials also said they had “received multiple reports” of broadcasts that “have claimed that the Strait of Hormuz (SoH) has been closed.” And a European Union naval official told Reuters that the Iranian Revolutionary Guard had been broadcasting “no ship is allowed to pass the Strait of Hormuz” to ships in the area. Some tankers are still navigating the strait, according to marine tracking data from Kpler.

But it’s questionable whether Iran can actually maintain any attempted closure of the strait, whether by laying mines or directly threatening and attacking ships.

So far, U.S. attacks are “targeting, fairly heavily, naval assets and assets that are close to the Gulf,” Greg Brew, an analyst at the Eurasia Group, told me, which “suggests that they are trying to degrade Iran’s ability to disrupt energy traffic through the Strait of Hormuz.”

The U.S. is “trying to reduce the risks of Iranian effort to close the strait as part of this operation, rather than waiting to see if the Iranians escalate in that direction. The Iranians have responded by claiming that the strait has been closed. The problem for them now, though, is that they’ll have to enforce that threat.”

Closing the strait was a “tail risk” that had been roiling the oil market in the lead-up to Trump’s decision to launch the attack, Rory Johnston, petroleum analyst and author of Commodity Context, told me.

Global oil prices had gotten skittish over the past weeks, with the Brent crude benchmark getting as low at $66.30 per barrel in early February and getting near $73 per barrel on Friday. Brent prices approached $80 per barrel last June during the 12 Day War between Iran and Israel.

While the market could likely weather disruption to Iran’s own exports, jumpy behavior in the market was due to pricing in an enhanced risk of a region-wide calamity. Options traders especially were “attempting to hedge that enormous tail risk,” Johnston said, and “that was really moving the market.”

And even if the strait is not directly closed off by the Iranian military, ships may find it financially onerous to attempt the passage. “Insurers told ship owners on Saturday they would cancel policies and raise coverage prices for vessels travelling through the Gulf and Strait of Hormuz after the U.S. and Israel attacked Iran,” the Financial Times reported Saturday.

Another risk to the region’s oil sector is that Iran could retaliate by striking oil production and exporting infrastructure in neighboring countries, Johnston told me. “Right next door, you’ve got Iraq, you’ve got Saudi Arabia, and you’ve got the Emirates and others who collectively are more like 20 million barrels per day. And that is obviously a much bigger deal,” Johnston said, comparing their production to Iran’s own oil industry.

Of course, Iran is still a major exporter despite U.S. sanctions; in the days running up to the U.S. attack, it was shipping out around 3 million barrels per day from Kharg Island in the Strait of Hormuz, according to data from Bloomberg, almost triple its exports from equivalent dates in January and nearly its entire daily production.

Iran’s exports “had actually surged immediately ahead of what’s gone down over the past 24 hours,” Johnston told me. “In the past couple days, you’d seen a large surge of tankers departing Kharg Island, and the inventories on Kharg Island being drawn down, which is kind of what you would do if you expected that your exports were about to get disrupted.”

To the extent Iranian oil exports are cut off, that could be a big deal for China, which has become the number one destination for Middle East oil shipments. Beijing has been building up stockpiles of oil, likely preparing for the risk that sanctioned exporters like Iran and Venezuela would go off the market, as well as wider risks to exports from the Middle East.

“China is highly concerned over the military strikes against Iran,” the Chinese foreign ministry wrote on X. “China calls for an immediate stop of the military actions, no further escalation of the tense situation, resumption of dialogue and negotiation, and efforts to uphold peace and stability in the Middle East.”

Last year, China began to substantially increase its stockpiling of oil, going from 84,000 barrels per day to 430,000 barrels per day, some 83% of the growth of its imports, according to data and estimates from Rystad Energy and Erica Downs, a senior research scholar at the Columbia University Center on Global Energy Policy.

While the U.S. is now far less reliant on oil exports from the Middle East, oil and gas is still a global market. If Middle Eastern oil and gas exports are disrupted, that will likely increase the price of energy — whether it’s gasoline, electricity, or even home heating — as American energy producers can sell their barrels and BTUs at higher prices globally.

It’s either reassure investors now or reassure voters later.

Investor-owned utilities are a funny type of company. On the one hand, they answer to their shareholders, who expect growing returns and steady dividends. But those returns are the outcome of an explicitly political process — negotiations with state regulators who approve the utilities’ requests to raise rates and to make investments, on which utilities earn a rate of return that also must be approved by regulators.

Utilities have been requesting a lot of rate increases — some $31 billion in 2025, according to the energy policy group PowerLines, more than double the amount requested the year before. At the same time, those rate increases have helped push electricity prices up over 6% in the last year, while overall prices rose just 2.4%.

Unsurprisingly, people have noticed, and unsurprisingly, politicians have responded. (After all, voters are most likely to blame electric utilities and state governments for rising electricity prices, Heatmap polling has found.) Democrat Mikie Sherrill, for instance, won the New Jersey governorship on the back of her proposal to freeze rates in the state, which has seen some of the country’s largest rate increases.

This puts utilities in an awkward position. They need to boast about earnings growth to their shareholders while also convincing Wall Street that they can avoid becoming punching bags in state capitols.

Make no mistake, the past year has been good for these companies and their shareholders. Utilities in the S&P 500 outperformed the market as a whole, and had largely good news to tell investors in the past few weeks as they reported their fourth quarter and full-year earnings. Still, many utility executives spent quite a bit of time on their most recent earnings calls talking about how committed they are to affordability.

When Exelon — which owns several utilities in PJM Interconnection, the country’s largest grid and ground zero for upset over the influx data centers and rising rates — trumpeted its growing rate base, CEO Calvin Butler argued that this “steady performance is a direct result of a continued focus on affordability.”

But, a Wells Fargo analyst cautioned, there is a growing number of “affordability things out there,” as they put it, “whether you are looking at Maryland, New Jersey, Pennsylvania, Delaware.” To name just one, Pennsylvania Governor Josh Shapiro said in a speech earlier this month that investor-owned utilities “make billions of dollars every year … with too little public accountability or transparency.” Pennsylvania’s Exelon-owned utility, PECO, won approval at the end of 2024 to hike rates by 10%.

When asked specifically about its regulatory strategy in Pennsylvania and when it intended to file a new rate case, Butler said that, “with affordability front and center in all of our jurisdictions, we lean into that first,” but cautioned that “we also recognize that we have to maintain a reliable and resilient grid.” In other words, Exelon knows that it’s under the microscope from the public.

Butler went on to neatly lay out the dilemma for utilities: “Everything centers on affordability and maintaining a reliable system,” he said. Or to put it slightly differently: Rate increases are justified by bolstering reliability, but they’re often opposed by the public because of how they impact affordability.

Of the large investor-owned utilities, it was probably Duke Energy, which owns electrical utilities in the Carolinas, Florida, Kentucky, Indiana, and Ohio, that had to most carefully navigate the politics of higher rates, assuring Wall Street over and over how committed it was to affordability. “We will never waver on our commitment to value and affordability,” Duke chief executive Harry Sideris said on the company’s February 10 earnings call.

In November, Duke requested a $1.7 billion revenue increase over the course of 2027 and 2028 for two North Carolina utilities, Duke Energy Carolinas and Duke Energy Progress — a 15% hike. The typical residential customer Duke Energy Carolinas customer would see $17.22 added onto their monthly bill in 2027, while Duke Energy Progress ratepayers would be responsible for $23.11 more, with smaller increases in 2028.

These rate cases come “amid acute affordability scrutiny, making regulatory outcomes the decisive variable for the earnings trajectory,” Julien Dumoulin-Smith, an analyst at Jefferies, wrote in a note to clients. In other words, in order to continue to grow earnings, Duke needs to convince regulators and a skeptical public that the rate increases are necessary.

“Our customers remain our top priority, and we will never waver on our commitment to value and affordability,” Sideris told investors. “We continue to challenge ourselves to find new ways to deliver affordable energy for our customers.”

All in all, “affordability” and “affordable” came up 15 times on the call. A year earlier, they came up just three times.

When asked by a Jefferies analyst about how Duke could hit its forecasted earnings growth through 2029, Sideris zeroed in on the regulatory side: “We are very confident in our regulatory outcomes,” he said.

At the same time, Duke told investors that it planned to increase its five-year capital spending plan to $103 billion — “the largest fully regulated capital plan in the industry,” Sideris said.

As far as utilities are concerned, with their multiyear planning and spending cycles, we are only at the beginning of the affordability story.

“The 2026 utility narrative is shifting from ‘capex growth at all costs’ to ‘capex growth with a customer permission slip,’” Dumoulin-Smith wrote in a separate note on Thursday. “We believe it is no longer enough for utilities to say they care about affordability; regulators and investors are demanding proof of proactive behavior.”

If they can’t come up with answers that satisfy their investors, ultimately they’ll have to answer to the voters. Last fall, two Republican utility regulators in Georgia lost their reelection bids by huge margins thanks in part to a backlash over years of rate increases they’d approved.

“Especially as the November 2026 elections approach, utilities that fail to demonstrate concrete mitigants face political and reputational risk and may warrant a credibility discount in valuations, in our view,” Dumoulin wrote.

At the same time, utilities are dealing with increased demand for electricity, which almost necessarily means making more investments to better serve that new load, which can in the short turn translate to higher prices. While large technology companies and the White House are making public commitments to shield existing customers from higher costs, utility rates are determined in rate cases, not in press releases.

“As the issue of rising utility bills has become a greater economic and political concern, investors are paying attention,” Charles Hua, the founder and executive director of PowerLines, told me. “Rising utility bills are impacting the investor landscape just as they have reshaped the political landscape.”

Plus more of the week’s top fights in data centers and clean energy.

1. Osage County, Kansas – A wind project years in the making is dead — finally.

2. Franklin County, Missouri – Hundreds of Franklin County residents showed up to a public meeting this week to hear about a $16 billion data center proposed in Pacific, Missouri, only for the city’s planning commission to announce that the issue had been tabled because the developer still hadn’t finalized its funding agreement.

3. Hood County, Texas – Officials in this Texas County voted for the second time this month to reject a moratorium on data centers, citing the risk of litigation.

4. Nantucket County, Massachusetts – On the bright side, one of the nation’s most beleaguered wind projects appears ready to be completed any day now.