You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

It’s been just over a week since one of the 350-foot-long blades of a wind turbine off the Massachusetts coast unexpectedly broke off, sending hunks of fiberglass and foam into the waters below. As of Wednesday morning, cleanup crews were still actively removing debris from the water and beaches and working to locate additional pieces of the blade.

The blade failure quickly became a crisis for residents of Nantucket, where debris soon began washing up on the island’s busy beaches. It is also a PR nightmare for the nascent U.S. offshore wind industry, which is already on the defensive against community opposition and rampant misinformation about its environmental risks and benefits.

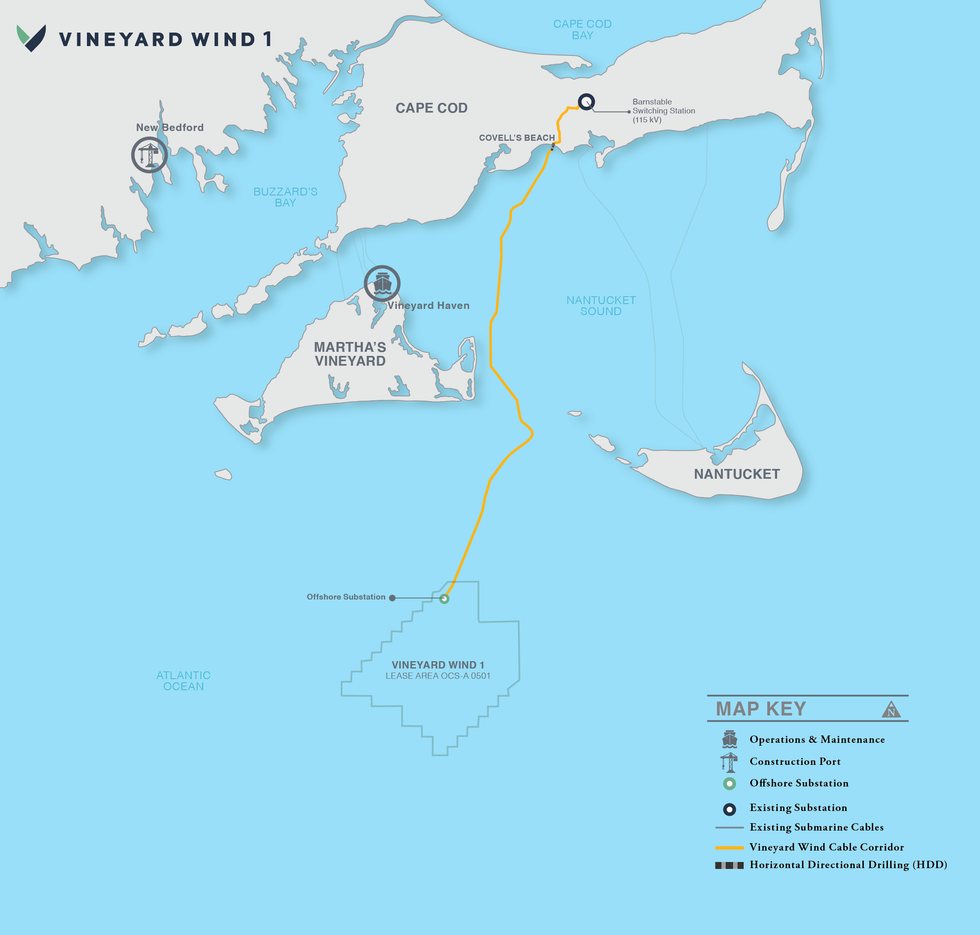

The broken turbine is part of Vineyard Wind 1, which is being developed by Avangrid and Copenhagen Infrastructure Partners. The project was still under construction when the breakage occurred, but it was already the largest operating offshore wind farm in the US, with ten turbines sending power to the New England Grid as of June. The plan is to bring another 52 online, which will produce enough electricity to power more than 400,000 homes. Now both installation and power generation have been paused while federal investigators look into the incident.

There’s still a lot we don’t know about why this happened, what the health and safety risks are, and what it means for this promising clean energy solution going forward. But here’s everything we’ve learned so far.

Vineyard Wind

On the evening of Saturday, July 13, Vineyard Wind received an alert that there was a problem with one of its turbines. The equipment contains a “delicate sensoring system,” CEO Klaus Moeller told the Nantucket Select Board during a public meeting last week. Though he did not describe what the alert said, he added that “one of the blades was broken and folded over.” Later at the meeting, a spokesperson for GE Vernova, which manufactured and installed the turbines, said that “blade vibrations” had been detected. About a third of the blade, or roughly 120 feet, fell into the water.

Two days later, Vineyard Wind contacted the town manager in Nantucket to explain that modeling showed the potential for debris from the blade to travel toward the island. Sure enough, fiberglass shards and other scraps began washing up on shore the next day, and all beaches on the island’s south shore were quickly closed to the public.

On Thursday morning, another large portion of the damaged blade detached and fell into the ocean. Monitoring and recovery crews continued to find debris throughout the area over the weekend. The beaches have since reopened, but visitors have been advised to wear shoes and leave their pets at home as cleanup continues.

During GE’s second quarter earnings call on July 24, GE Vernova CEO Scott Strazik and Vice President of Investor Relations Michael Lapides said the company had identified a “material deviation” as the cause of the accident, and that the company is continuing to work on a "root cause analysis" to get to the bottom of how said deviation happened in the first place.

The turbine was one of GE’s Haliade-X 13-megawatt turbines, which are manufactured in Gaspé, Canada, and it was still undergoing post-installation testing by GE when the failure occurred — that is, it was not among those sending power to the New England grid. This was actually the second issue the company has had at this particular turbine site. One of the original blades destined for the site was damaged during the installation process, and the one that broke last week was a replacement, Craig Gilvard, Vineyard Wind’s communications director, told the New Bedford Light.

By Vineyard Wind’s account at the meeting last week, the accident triggered an automatic shut down of the system and activated the company’s emergency response plan, which included immediately notifying the U.S. Coast Guard, the federal Bureau of Safety and Environmental Enforcement, and regional emergency response committees.

Moeller, the CEO, said during the meeting that the company worked with the Coast Guard to immediately establish a 500 meter “safety zone” around the turbine and to send out notices to mariners. According to the Coast Guard’s notice log, however, the safety zone went into effect three days later. In response to my questions, the Coast Guard confirmed that the zone was established around 8pm that night and announced to mariners over radio broadcast.

Two days after the turbine broke, on Monday, Vineyard Wind contacted the National Oceanic and Atmospheric Administration for aid in modeling where the turbine debris would travel in the water. The agency estimated pieces would likely make landfall in Nantucket that day. Vineyard Wind put out a press release about the accident and subsequently contacted the Nantucket town manager. At the Nantucket Select Board meeting last week, Moeller said the company followed regulatory protocols but that there was “really no excuse” for how long it took to inform the public, and said, “we want to move much quicker and make sure that we learn from this.”

The Interior Department’s Bureau of Safety and Environmental Enforcement has ordered the company to cease all power production and installation activities until it can determine whether this was an isolated incident or affects other turbines.

By Tuesday, Vineyard Wind said it had deployed two small teams to Nantucket in addition to hiring a local contractor to remove debris on the island. The company later said it would “increase its local team to more than 50 employees and contractors dedicated to beach clean-up and debris recovery efforts.”

GE Vernova is responsible for recovering offshore debris and has not published any public statements about the effort. In response to a list of questions, a GE Vernova spokesperson said, “We continue to work around the clock to enhance mitigation efforts in collaboration with Vineyard Wind and all relevant state, local and federal authorities. We are working with urgency to complete our root cause analysis of this event.”

There have been no reported injuries as a result of the accident.

Vineyard Wind and GE Vernova have stressed that the debris are “not toxic.” At the Select Board meeting, GE’s executive fleet engineering director Renjith Viripullan said that the blade is made of fiberglass, foam, and balsa wood. It is bonded together using a “bond paste,” he said, and likened the blade construction to that of a boat. “That's the correlation we need to think about,” he said.

One of the board members asked if there was any risk of PFAS contamination as a result of the accident. Viripullan said he would need to “take that question back” and follow up with the answer later. (This was one of the questions I asked GE, but the company did not respond to it.)

That being said, the debris poses some dangers. Photos of cleanup crews posted to the Harbormaster’s Facebook page show workers wearing white hazmat suits. Vineyard Wind said “members of the public should avoid handling debris as the fiber-glass pieces can be sharp and lead to cuts if handled without proper gloves.”

Though members of the public raised concerns at the meeting and to the press that fiberglass fragments in the ocean threaten marine life and public health, it is not yet clear how serious the risks are, and several efforts are underway to further assess them. Vineyard Wind is developing a water quality testing plan for the island and setting up a process for people to file claims. GE hired a design and engineering firm to conduct an environmental assessment, which it will present at a Nantucket Select Board meeting later this week. The Massachusetts Department of Environmental Protection has requested information from the companies about the makeup of the debris to evaluate risks, and the Department of Fish and Game is monitoring for impacts to the local ecosystem.

As of last Wednesday morning, Vineyard Wind had collected “approximately 17 cubic yards of debris, enough to fill more than six truckloads, and several larger pieces that washed ashore.” It is not yet known what fraction of the turbine that fell off has been recovered. Vineyard Wind did not respond to a request for the latest numbers in time for publication, but I’ll update this piece if I get a response.

Yes. In May, a blade on the same model of turbine, the GE Haliade-X, sustained damage at a wind farm being installed off the coast of England called Dogger Bank. At the Nantucket Select Board meeting, a spokesperson for GE said the Dogger Bank incident was “an installation issue specific to the installation of that blade” and that “we don’t think there’s a connection between that installation issue and what we saw here.” Executives emphasized this point during the earnings call and chalked up the Dogger Bank incident to “an installation error out at sea.”

Several blades have also broken off another GE turbine model dubbed the Cypress at wind farms in Germany and Sweden. After the most recent incident in Germany last October, the company used similar language, telling reporters that it was working to “determine the root cause.”

A “company source with knowledge of the investigations” into the various incidents recently told CNN that “there were different root causes for the damage, including transportation, handling, and manufacturing deviations.”

GE Vernova’s stock price fell nearly 10% last Wednesday.

The backlash was swift. Nantucket residents immediately wrote to Nantucket’s Select Board to ask the town to stop the construction of any additional offshore wind turbines. “I know it's not oil, but it's sharp and maybe toxic in other ways,” Select Board member Dawn Holgate told company executives at the meeting last week. “We're also facing an exponential risk if this were to continue because many more windmills are planned to be built out there and there's been a lot of concern about that throughout the community.”

The Select Board plans to meet in private on Tuesday night to discuss “potential litigation by the town against Vineyard Wind relative to recovery costs.”

“We expect Vineyard Wind will be responsible for all costs and associated remediation efforts incurred by the town in response to the incident,” Elizabeth Gibson, the Nantucket town manager said during the meeting last week.

The Aquinnah Wampanoag tribe is also calling for a moratorium on offshore wind development and raised concerns about the presence of fiberglass fragments in the water.

On social media, anti-wind groups throughout the northeast took up the story as evidence that offshore wind is “not green, not clean.” Republican state representatives in Massachusetts cited the incident as a reason for opposing legislation to expedite clean energy permitting last week. Fox News sought comment from internet personality and founder of Barstool Sports David Portnoy, who owns a home on Nantucket and said the island had been “ruined by negligence.” The Texas Public Policy Foundation, a nonprofit funded by oil companies and which is backing a lawsuit against Vineyard Wind, cited the incident as evidence that the project is harming local fishermen. The First Circuit Court of Appeals is set to hear oral arguments on the case this Thursday.

Meanwhile, environmental groups supportive of offshore wind tried to do damage control for the industry. “Now we must all work to ensure that the failure of a single turbine blade does not adversely impact the emergence of offshore wind as a critical solution for reducing dependence on fossil fuels and addressing the climate crisis,” the Sierra Club’s senior advisor for offshore wind, Nancy Pyne, wrote in a statement. “Wind power is one of the safest forms of energy generation.”

This story was last updated July 24 at 3:15 p.m. The current version contains new information and corrects the location where the turbine blades are produced. With assistance from Jael Holzman.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

The sale of Ravenswood Generating Station closed at the end of January.

New York City’s largest fossil fuel-fired power plant has changed hands. The Ravenswood Generating Station, which provides more than 20% of the city’s generation capacity, was sold by its former parent company LS Power to NRG, an energy company headquartered in Texas that owns power plants throughout the country.

It’s not yet clear what this means for “Renewable Ravenswood,” the former owner’s widely-publicized plans to convert the site into a clean energy hub. Prior to the sale, those plans were hanging by a thread. NRG did not respond to detailed questions about whether it will abandon or advance that vision.

“Ravenswood has been an important part of powering New York City for decades, and we recognize how much the facility matters to the surrounding community and the region,” a spokesperson for the company told me in an email. “We’ve begun engaging with community stakeholders and look forward to continuing those conversations in the months ahead. Our leadership team is carefully reviewing all relevant information and is taking a thoughtful, measured approach to any future decisions.”

Ravenswood is made up of four generating units: a natural gas combined cycle plant built in 2004, and three steam generators built in the 1960s that run mostly on natural gas, though sometimes also on oil. The plant is responsible for a sizable chunk of the city’s climate footprint. In 2023, the most recent year for which data is available, the plant emitted nearly 1.3 million metric tons of CO2, or about 8% of the city’s emissions from electricity production.

The Renewable Ravenswood concept was largely celebrated by the surrounding community, which includes two of the largest public housing projects in the country and suffers from disproportionately high rates of chronic respiratory diseases like asthma. The plan, which a local subsidiary of LS Power called Rise Light and Power proposed in 2022, entailed replacing the plant’s three 1960s steam generators with a combination of offshore wind, batteries, and renewable energy delivered from upstate New York via new power lines.

By last year, however, the plan was increasingly looking like a distant dream. Its centerpiece was a proposed offshore wind farm called Attentive Energy, but the project has been on ice since 2024, with little chance of moving forward under the Trump administration. This past November, New York regulators rejected a proposed transmission line that would have connected Ravenswood to a hypothetical future offshore wind development, primarily because there was no longer any such development in progress. Earlier this week, state energy regulators delivered yet another blow to potential offshore wind development when they decided not to solicit offers from for new projects to enter the state’s energy market.

Battery development has also had a rocky few years in New York State, which has affected Ravenswood’s transition. Rise Light and Power initially proposed building a 316-megawatt battery project on the site in 2019, but it has yet to break ground. The former CEO, Clint Plummer, previously told me that the company was waiting on New York State regulators to open up their anticipated battery solicitation, which would enable the project to bid into the New York energy market, before building the project. That solicitation opened last July, but it’s unclear whether the company submitted a bid. NRG did not respond to a question about this.

NRG first announced its plans to buy a fleet of natural gas plants — 18 in total — from LS Power in May 2025. Ravenswood was not mentioned in the press release or investor materials, however. “We're acquiring these assets at a significant discount to new build cost, at an attractive valuation, and at the strategically opportune time to be adding high-quality, difficult-to-replicate resources into our portfolio as the sector enters into a period of sustained demand growth,” NRG’s CEO Lawrence Coben told investors at the time.

The purchase was subject to regulatory approval and officially closed a few weeks ago, on January 30. Documents filed with the Securities and Exchange Commission confirm that Ravenswood was part of the deal. Documents filed with the New York Public Service Commission describe the terms in more detail, but they do not mention the proposed transition of the site to a clean energy hub.

Local officials, community groups, and tenant associations were deeply involved in fleshing out the Renewable Ravenswood vision. The Queens Borough President worked with the former owner on a multiyear report called “Reimagine Ravenswood,” released last summer, based on extensive engagement with the community, including public workshops, focus groups, interviews with local leaders, and a community survey. The report is evidence of high hopes the community has for the site’s transition, describing the potential to create jobs, expand public space, and generally increase investment in the neighborhood.

I reached out to many of the local elected officials and community groups that have publicly supported Renewable Ravenswood to ask if they were aware of the sale and whether NRG had made any commitments in regard to the transition plan. Just one responded. State Senator Kristen Gonzalez’s office told me they were aware of the sale, but declined to comment further.

Heron Power and DG Matrix each score big funding rounds, plus news for heat pumps and sustainable fashion.

While industries with major administrative tailwinds such as nuclear and geothermal have been hogging the funding headlines lately, this week brings some variety with news featuring the unassuming but ever-powerful transformer. Two solid-state transformer startups just announced back-to-back funding rounds, promising to bring greater efficiency and smarter services to the grid and data centers alike. Throw in capital supporting heat pump adoption and a new fund for sustainable fashion, and it looks like a week for celebrating some of the quieter climate tech solutions.

Transformers are the silent workhorses of the energy transition. These often-underappreciated devices step up voltage for long-distance electricity transmission and step it back down so that it can be safely delivered to homes and businesses. As electrification accelerates and data centers race to come online, demand for transformers has surged — more than doubling since 2019 — creating a supply crunch in the U.S. that’s slowing the deployment of clean energy projects.

Against this backdrop, startup Heron Power just raised a $140 million Series B round co-led by Andreessen Horowitz and Breakthrough Energy Ventures to build next-generation solid state transformers. The company said its tech will be able to replace or consolidate much of today’s bulky transformer infrastructure, enabling electricity to move more efficiently between low-voltage technologies like solar, batteries, and data centers and medium-voltage grids. Heron’s transformers also promise greater control than conventional equipment, using power electronics and software to actively manage electricity flows, whereas traditional transformers are largely passive devices designed to change voltage.

This new funding will allow Heron to build a U.S.manufacturing facility designed to produce around 40 gigawatts of transformer equipment annually; it expects to begin production there next year. This latest raise follows quickly on the heels of its $38 million Series A round last May, reflecting hunger among customers for more efficient and quicker to deploy grid infrastructure solutions. Early announced customers include the clean energy developer Intersect Power and the data center developer Crusoe.

It’s a good time to be a transformer startup. DG Matrix, which also develops solid-state transformers, closed a $60 million Series A this week, led by Engine Ventures. The company plans to use the funding to scale its manufacturing and supply chain as it looks to supply data centers with its power-conversion systems.

Solid-state transformers — which use semiconductors to convert and control electricity — have been in the research and development phase for decades. Now they’re finally reaching the stage of technical maturity needed for commercial deployment, driving a surge in activity across the industry. DG Matrix’s emphasis is on creating flexible power conversion solutions, marketing its product as the world’s first “multi-port” solid-state transformer capable of managing and balancing electricity from multiple different sources at once.

“This Series A marks our transition from breakthrough technology to scaled infrastructure deployment,” Haroon Inam, DG Matrix’s CEO, said in a statement. “We are working with hyperscalers, energy companies, and industrial customers across North America and globally, with multiple gigawatt-class datacenters in the pipeline.” According to TechCrunch, data centers make up roughly 90% of DG Matrix’s current customer base, as its transformers can significantly reduce the space data centers require for power conversion.

Zero Homes, a digital platform and marketplace that helps homeowners manage the heat pump installation process, just announced a $16.8 million Series A round led by climate tech investor Prelude Ventures. The company’s free smartphone app lets customers create a “digital twin” of their home — a virtual model that mirrors the real-world version, built from photos, videos, and utility data. This allows homeowners to get quotes, purchase, and plan for their HVAC upgrade without the need for a traditional in-person inspection. The company says this will cut overall project costs by 20% on average.

Zero works with a network of vetted independent installers across the U.S., with active projects in California, Colorado, Massachusetts, Minnesota, and Illinois. As the startup plans for national expansion, it’s already gained traction with some local governments, partnering with Chicago on its Green Homes initiative and netting $745,000 from Colorado’s Office of Economic Development to grow its operations in Denver.

Climactic, an early-stage climate tech VC, launched a new hybrid fund called Material Scale, aimed at helping sustainable materials and apparel startups navigate the so-called “valley of death” — the gap between early-stage funding and the later-stage capital needed to commercialize. As Climactic’s cofounder Josh Fesler explained on LinkedIn, the fund is designed to cover the extra costs involved with sustainable production, bridging the gap between the market price of conventional materials and the higher price of sustainable materials.

Structured as a “hybrid debt-equity platform,” the fund allows Climactic’s investors to either take a traditional equity stake in materials startups or provide them with capital in the form of loans. TechCrunch reports that the fund’s initial investments will come from an $11 million special purpose vehicle, a separate entity created to fund a small set of initial investments that sits outside Material Scale’s main investing pool.

The fashion industry accounts for roughly 10% of global emissions. “These days there are many alt materials startups that have moved through science and structural risk, have venture funding, credible supply chains and most importantly can achieve market price and positive gross margins just with scale,” Fesler wrote in his LinkedIn post. “They just need the capital to grow into their rightful commercial place.”

Clean energy stocks were up after the court ruled that the president lacked legal authority to impose the trade barriers.

The Supreme Court struck down several of Donald Trump’s tariffs — the “fentanyl” tariffs on Canada, Mexico, and China and the worldwide “reciprocal” tariffs ostensibly designed to cure the trade deficit — on Friday morning, ruling that they are illegal under the International Emergency Economic Powers Act.

The actual details of refunding tariffs will have to be addressed by lower courts. Meanwhile, the White House has previewed plans to quickly reimpose tariffs under other, better-established authorities.

The tariffs have weighed heavily on clean energy manufacturers, with several companies’ share prices falling dramatically in the wake of the initial announcements in April and tariff discussion dominating subsequent earnings calls. Now there’s been a sigh of relief, although many analysts expected the Court to be extremely skeptical of the Trump administration’s legal arguments for the tariffs.

The iShares Global Clean Energy ETF was up almost 1%, and shares in the solar manufacturer First Solar and the inverter company Enphase were up over 5% and 3%, respectively.

First Solar initially seemed like a winner of the trade barriers, however the company said during its first quarter earnings call last year that the high tariff rate and uncertainty about future policy negatively affected investments it had made in Asia for the U.S. market. Enphase, the inverter and battery company, reported that its gross margins included five percentage points of negative impact from reciprocal tariffs.

Trump unveiled the reciprocal tariffs on April 2, a.k.a. “liberation day,” and they have dominated decisionmaking and investor sentiment for clean energy companies. Despite extensive efforts to build an American supply chain, many U.S. clean energy companies — especially if they deal with batteries or solar — are still often dependent on imports, especially from Asia and specifically China.

In an April earnings call, Tesla’s chief financial officer said that the impact of tariffs on the company’s energy business would be “outsized.” The turbine manufacturer GE Vernova predicted hundreds of millions of dollars of new costs.

Companies scrambled and accelerated their efforts to source products and supplies from the United States, or at least anywhere other than China.

Even though the tariffs were quickly dialed back following a brutal market reaction, costs that were still being felt through the end of last year. Tesla said during its January earnings call that it expected margins to shrink in its energy business due to “policy uncertainty” and the “cost of tariffs.”