You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

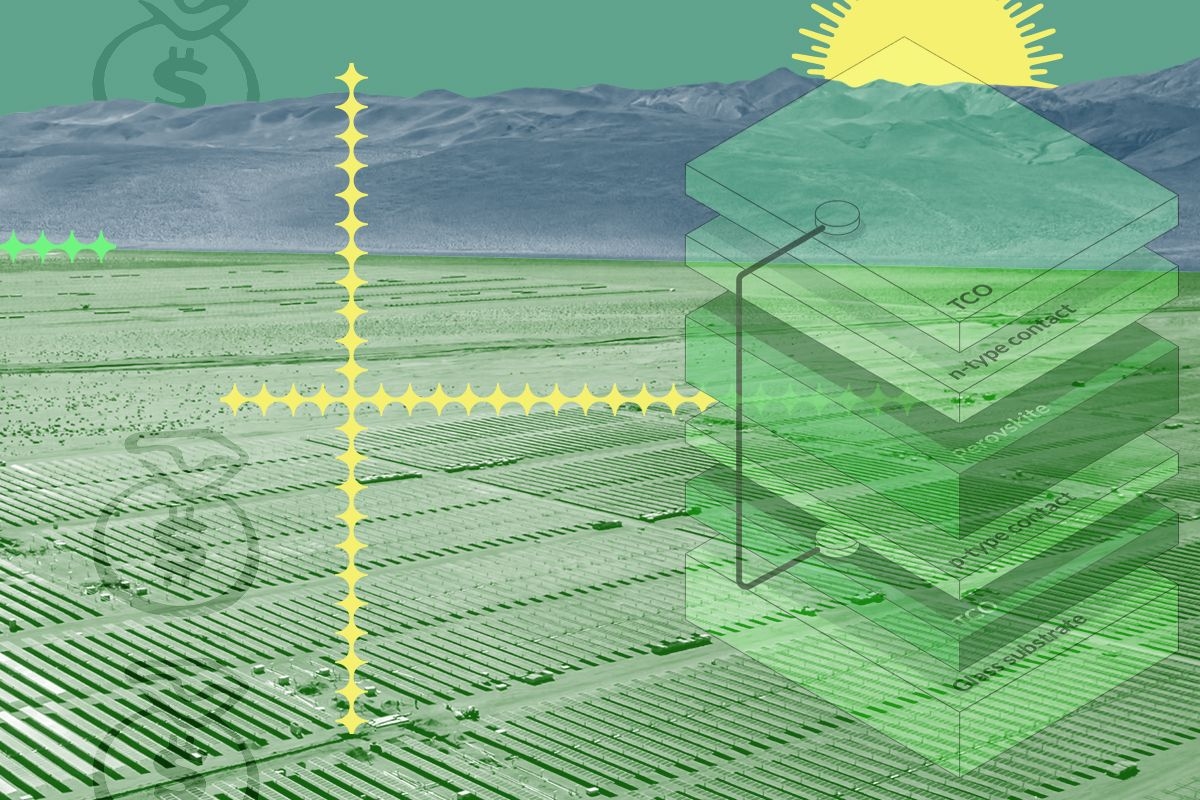

A conversation about perovskite, scale, and “soft costs” with Tandem PV CEO Scott Wharton.

What happens after solar modules get cheap? The relentless cost declines for solar technology driven by mass production and steady innovation — largely in China — has resulted in a commercial ecosystem where pricing is dominated by everything but the solar panels themselves.

In this world, a more efficient panel is not necessarily one that costs less to buy from a supplier, but rather one that can optimize on these “soft costs,” getting more energy out of the given time and money spent on installing the panel. This will come to matter more and more as solar costs inevitably plateau — and especially if Congress decides to eliminate clean energy incentives under the Inflation Reduction Act, which, combined with high tariffs on solar imports from Asia, could take away solar’s cost advantage over new natural gas-fired power.

At least that’s the thesis of Tandem PV, which uses so-called perovskite technology to build solar panels that, the company says, are already more efficient than existing silicon panels, and could become almost twice as efficient as existing panels as the technology improves. Perovskite refers to a group of minerals that share a similar structure and which, when stacked with silicon, can absorb a broad range of light, maximizing the efficiency of converting light to electricity.

I spoke with Tandem PV chief executive Scott Wharton about why he thinks that even in this era of rock bottom costs, greater performance will still win the day. Our conversation has been edited for length and clarity.

Why does it not matter so much that your solar panels are a little more expensive than other ones?

Well, I would say, for the whole history of solar panels, the cost of it was really high. There was this move to get the cost down, reduce the green premium, etc. We’re now in a world where that view is, I would say, antiquated.

And by cost, you mean the cost of the physical module.

The cost of the panel itself, yeah. The reason why is that for utility scale, which is where we’re focused on, only 20% of the cost is the panel. So 80% of the actual cost of a solar deployment — which is what matters, right? The cost of deploying it — labor, land, the balance of systems, the construction loans. It’s typical, I would say, of engineers — everything’s about the commodity. Whereas from my experience, it depends on the total cost. What we’re doing is, we’re saving the cost where it matters: on the labor.

So I guess the argument you’re trying to make is that even if the upfront cost of the panel is higher, the higher efficiency actually does make the kind of physical cost over time go down — and then all the soft costs, I imagine, are basically the same. Or is there any argument why the soft costs would be different, too?

First of all, I’m not sure that we will charge a premium. We want to be the same or cheaper. But even if we did, the point is that most of the cost is in those other things: labor, land, and installation. So if our panel has 30% more power in a single panel — a 28% [efficient] panel is about [third] more [efficient] than a 21% panel — then you need 30% fewer panels.

The other thing I learned recently is that people think that, oh, you just have this huge parcel of land and everything is equal. But a lot of times, when you’re deploying solar, you can’t actually fit everything on one parcel. So there’s a savings from having more density.

There’s also an issue where a lot of the best solar locations are taken, or you don’t have a ton of choice, necessarily, about where you put your panels because co-location matters so much. So it’s even more important to have efficiency in how you use that land.

Where is Tandem PV on the trajectory from lab to mass deployment?

We just announced a $50 million [Series A funding round], and we’re building out the first significant commercial perovskite factory in the United States. Conventional wisdom for manufacturing is, you put it as far away as possible. I think when you’re trying to do something really new, it’s probably the same story: It seems cheaper, but it’s not. Because if it takes you six more months because you’re flying back and forth and people don’t understand each other, then that actually costs you money and time and delay. We’re going to emphasize quality and speed over cost.

If we do this right, then the theory is, we’ve become the next, First Solar — that’s our intention. We want to take back solar leadership from China, which is a bold statement, but I think we’re on the journey. I tell the team, it’s like a bicycle race, where you go slowly, slowly, slowly, and then there’s a point where you need to break out. Well, I think we’ve broken out. Whether we fall flat on our face because we’re exhausted or we jump out ahead, we’ll see what history writes.

Obviously a big story in the solar industry is cost declining so much, and that’s tied to, a very specific technological stack. What do you guys have to do besides demonstrating results to tell the story that a different technology might be necessary?

So number one, there’s a reason why people are interested in perovskites. It’s 200 times thinner than traditional silicon panels — no rare earth minerals or metals, no mining.

What people don’t know about silicon solar is, you’ve got to heat this up to, like, 2,000 degrees Celsius to purify it, and it’s very, very expensive. We’re using the same glass and basically putting on a 1 micron-thick layer of ink. So we’re adding a little bit of cost, but you get a lot more energy for it than what you add.

The second thing is, we’re not actually competing with silicon so much as we’re building on top of it. As silicon technology gets better and cheaper, our product gets better and cheaper. And then the third thing is, see point number one, where we started. If you have a 28% or 30% [efficient] panel — by the way, silicon hits its physics limits at 26%. It can never get better than that. So we’re already better than where silicon is. And as labor and land become more expensive in the United States and around the world, it actually is cheaper to make something that focuses on where all the costs are.

I know you’re not in mass production yet, but are you going out to utility scale developers? Do they want a more efficient panel, or are they just comfortable working with the stuff they normally work with?

It’s both. They like what they have, but their feedback is — especially given all the supply chain risks that are going on around the world — if you can build it, we’ll buy it. We’re basically building something that is the same thing they already have, for a market that we already know. And is there a market for electricity? Yeah, there’s going to be a huge shortage of it with the AI boom. So we feel pretty confident that if we can build this, they will come.

Putting aside public policy issues, what’s to stop one of the big Chinese solar manufacturers from using this technology? People have been talking about it for decades.

It’s like any hard thing. It’s not a secret that people want to have rockets and go to space, it’s just a very, very hard technology. It’s the same thing as, why did Google and Apple win back the mobile phone war from the Japanese and the Germans and others? It’s a leapfrogging thing. I think the market’s up for grabs.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

It’s either reassure investors now or reassure voters later.

Investor-owned utilities are a funny type of company. On the one hand, they answer to their shareholders, who expect growing returns and steady dividends. But those returns are the outcome of an explicitly political process — negotiations with state regulators who approve the utilities’ requests to raise rates and to make investments, on which utilities earn a rate of return that also must be approved by regulators.

Utilities have been requesting a lot of rate increases — some $31 billion in 2025, according to the energy policy group PowerLines, more than double the amount requested the year before. At the same time, those rate increases have helped push electricity prices up over 6% in the last year, while overall prices rose just 2.4%.

Unsurprisingly, people have noticed, and unsurprisingly, politicians have responded. (After all, voters are most likely to blame electric utilities and state governments for rising electricity prices, Heatmap polling has found.) Democrat Mikie Sherrill, for instance, won the New Jersey governorship on the back of her proposal to freeze rates in the state, which has seen some of the country’s largest rate increases.

This puts utilities in an awkward position. They need to boast about earnings growth to their shareholders while also convincing Wall Street that they can avoid becoming punching bags in state capitols.

Make no mistake, the past year has been good for these companies and their shareholders. Utilities in the S&P 500 outperformed the market as a whole, and had largely good news to tell investors in the past few weeks as they reported their fourth quarter and full-year earnings. Still, many utility executives spent quite a bit of time on their most recent earnings calls talking about how committed they are to affordability.

When Exelon — which owns several utilities in PJM Interconnection, the country’s largest grid and ground zero for upset over the influx data centers and rising rates — trumpeted its growing rate base, CEO Calvin Butler argued that this “steady performance is a direct result of a continued focus on affordability.”

But, a Wells Fargo analyst cautioned, there is a growing number of “affordability things out there,” as they put it, “whether you are looking at Maryland, New Jersey, Pennsylvania, Delaware.” To name just one, Pennsylvania Governor Josh Shapiro said in a speech earlier this month that investor-owned utilities “make billions of dollars every year … with too little public accountability or transparency.” Pennsylvania’s Exelon-owned utility, PECO, won approval at the end of 2024 to hike rates by 10%.

When asked specifically about its regulatory strategy in Pennsylvania and when it intended to file a new rate case, Butler said that, “with affordability front and center in all of our jurisdictions, we lean into that first,” but cautioned that “we also recognize that we have to maintain a reliable and resilient grid.” In other words, Exelon knows that it’s under the microscope from the public.

Butler went on to neatly lay out the dilemma for utilities: “Everything centers on affordability and maintaining a reliable system,” he said. Or to put it slightly differently: Rate increases are justified by bolstering reliability, but they’re often opposed by the public because of how they impact affordability.

Of the large investor-owned utilities, it was probably Duke Energy, which owns electrical utilities in the Carolinas, Florida, Kentucky, Indiana, and Ohio, that had to most carefully navigate the politics of higher rates, assuring Wall Street over and over how committed it was to affordability. “We will never waver on our commitment to value and affordability,” Duke chief executive Harry Sideris said on the company’s February 10 earnings call.

In November, Duke requested a $1.7 billion revenue increase over the course of 2027 and 2028 for two North Carolina utilities, Duke Energy Carolinas and Duke Energy Progress — a 15% hike. The typical residential customer Duke Energy Carolinas customer would see $17.22 added onto their monthly bill in 2027, while Duke Energy Progress ratepayers would be responsible for $23.11 more, with smaller increases in 2028.

These rate cases come “amid acute affordability scrutiny, making regulatory outcomes the decisive variable for the earnings trajectory,” Julien Dumoulin-Smith, an analyst at Jefferies, wrote in a note to clients. In other words, in order to continue to grow earnings, Duke needs to convince regulators and a skeptical public that the rate increases are necessary.

“Our customers remain our top priority, and we will never waver on our commitment to value and affordability,” Sideris told investors. “We continue to challenge ourselves to find new ways to deliver affordable energy for our customers.”

All in all, “affordability” and “affordable” came up 15 times on the call. A year earlier, they came up just three times.

When asked by a Jefferies analyst about how Duke could hit its forecasted earnings growth through 2029, Sideris zeroed in on the regulatory side: “We are very confident in our regulatory outcomes,” he said.

At the same time, Duke told investors that it planned to increase its five-year capital spending plan to $103 billion — “the largest fully regulated capital plan in the industry,” Sideris said.

As far as utilities are concerned, with their multiyear planning and spending cycles, we are only at the beginning of the affordability story.

“The 2026 utility narrative is shifting from ‘capex growth at all costs’ to ‘capex growth with a customer permission slip,’” Dumoulin-Smith wrote in a separate note on Thursday. “We believe it is no longer enough for utilities to say they care about affordability; regulators and investors are demanding proof of proactive behavior.”

If they can’t come up with answers that satisfy their investors, ultimately they’ll have to answer to the voters. Last fall, two Republican utility regulators in Georgia lost their reelection bids by huge margins thanks in part to a backlash over years of rate increases they’d approved.

“Especially as the November 2026 elections approach, utilities that fail to demonstrate concrete mitigants face political and reputational risk and may warrant a credibility discount in valuations, in our view,” Dumoulin wrote.

At the same time, utilities are dealing with increased demand for electricity, which almost necessarily means making more investments to better serve that new load, which can in the short turn translate to higher prices. While large technology companies and the White House are making public commitments to shield existing customers from higher costs, utility rates are determined in rate cases, not in press releases.

“As the issue of rising utility bills has become a greater economic and political concern, investors are paying attention,” Charles Hua, the founder and executive director of PowerLines, told me. “Rising utility bills are impacting the investor landscape just as they have reshaped the political landscape.”

Plus more of the week’s top fights in data centers and clean energy.

1. Osage County, Kansas – A wind project years in the making is dead — finally.

2. Franklin County, Missouri – Hundreds of Franklin County residents showed up to a public meeting this week to hear about a $16 billion data center proposed in Pacific, Missouri, only for the city’s planning commission to announce that the issue had been tabled because the developer still hadn’t finalized its funding agreement.

3. Hood County, Texas – Officials in this Texas County voted for the second time this month to reject a moratorium on data centers, citing the risk of litigation.

4. Nantucket County, Massachusetts – On the bright side, one of the nation’s most beleaguered wind projects appears ready to be completed any day now.

Talking with Climate Power senior advisor Jesse Lee.

For this week's Q&A I hopped on the phone with Jesse Lee, a senior advisor at the strategic communications organization Climate Power. Last week, his team released new polling showing that while voters oppose the construction of data centers powered by fossil fuels by a 16-point margin, that flips to a 25-point margin of support when the hypothetical data centers are powered by renewable energy sources instead.

I was eager to speak with Lee because of Heatmap’s own polling on this issue, as well as President Trump’s State of the Union this week, in which he pitched Americans on his negotiations with tech companies to provide their own power for data centers. Our conversation has been lightly edited for length and clarity.

What does your research and polling show when it comes to the tension between data centers, renewable energy development, and affordability?

The huge spike in utility bills under Trump has shaken up how people perceive clean energy and data centers. But it’s gone in two separate directions. They see data centers as a cause of high utility prices, one that’s either already taken effect or is coming to town when a new data center is being built. At the same time, we’ve seen rising support for clean energy.

As we’ve seen in our own polling, nobody is coming out looking golden with the public amidst these utility bill hikes — not Republicans, not Democrats, and certainly not oil and gas executives or data center developers. But clean energy comes out positive; it’s viewed as part of the solution here. And we’ve seen that even in recent MAGA polls — Kellyanne Conway had one; Fabrizio, Lee & Associates had one; and both showed positive support for large-scale solar even among Republicans and MAGA voters. And it’s way high once it’s established that they’d be built here in America.

A year or two ago, if you went to a town hall about a new potential solar project along the highway, it was fertile ground for astroturf folks to come in and spread flies around. There wasn’t much on the other side — maybe there was some talk about local jobs, but unemployment was really low, so it didn’t feel super salient. Now there’s an energy affordability crisis; utility bills had been stable for 20 years, but suddenly they’re not. And I think if you go to the town hall and there’s one person spewing political talking points that they've been fed, and then there’s somebody who says, “Hey, man, my utility bills are out of control, and we have to do something about it,” that’s the person who’s going to win out.

The polling you’ve released shows that 52% of people oppose data center construction altogether, but that there’s more limited local awareness: Only 45% have heard about data center construction in their own communities. What’s happening here?

There’s been a fair amount of coverage of [data center construction] in the press, but it’s definitely been playing catch-up with the electric energy the story has on social media. I think many in the press are not even aware of the fiasco in Memphis over Elon Musk’s natural gas plant. But people have seen the visuals. I mean, imagine a little farmhouse that somebody bought, and there’s a giant, 5-mile-long building full of computers next to it. It’s got an almost dystopian feel to it. And then you hear that the building is using more electricity than New York City.

The big takeaway of the poll for me is that coal and natural gas are an anchor on any data center project, and reinforce the worst fears about it. What you see is that when you attach clean energy [to a data center project], it actually brings them above the majority of support. It’s not just paranoia: We are seeing the effects on utility rates and on air pollution — there was a big study just two days ago on the effects of air pollution from data centers. This is something that people in rural, urban, or suburban communities are hearing about.

Do you see a difference in your polling between natural gas-powered and coal-powered data centers? In our own research, coal is incredibly unpopular, but voters seem more positive about natural gas. I wonder if that narrows the gap.

I think if you polled them individually, you would see some distinction there. But again, things like the Elon Musk fiasco in Memphis have circulated, and people are aware of the sheer volume of power being demanded. Coal is about the dirtiest possible way you can do it. But if it’s natural gas, and it’s next door all the time just to power these computers — that’s not going to be welcome to people.

I'm sure if you disentangle it, you’d see some distinction, but I also think it might not be that much. I’ll put it this way: If you look at the default opposition to data centers coming to town, it’s not actually that different from just the coal and gas numbers. Coal and gas reinforce the default opposition. The big difference is when you have clean energy — that bumps it up a lot. But if you say, “It’s a data center, but what if it were powered by natural gas?” I don’t think that would get anybody excited or change their opinion in a positive way.

Transparency with local communities is key when it comes to questions of renewable buildout, affordability, and powering data centers. What is the message you want to leave people with about Climate Power’s research in this area?

Contrary to this dystopian vision of power, people do have control over their own destinies here. If people speak out and demand that data centers be powered by clean energy, they can get those data centers to commit to it. In the end, there’s going to be a squeeze, and something is going to have to give in terms of Trump having his foot on the back of clean energy — I think something will give.

Demand transparency in terms of what kind of pollution to expect. Demand transparency in terms of what kind of power there’s going to be, and if it’s not going to be clean energy, people are understandably going to oppose it and make their voices heard.