You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

The electric vehicle maker has delivered another 15,500 cars since June. Yet trouble is brewing.

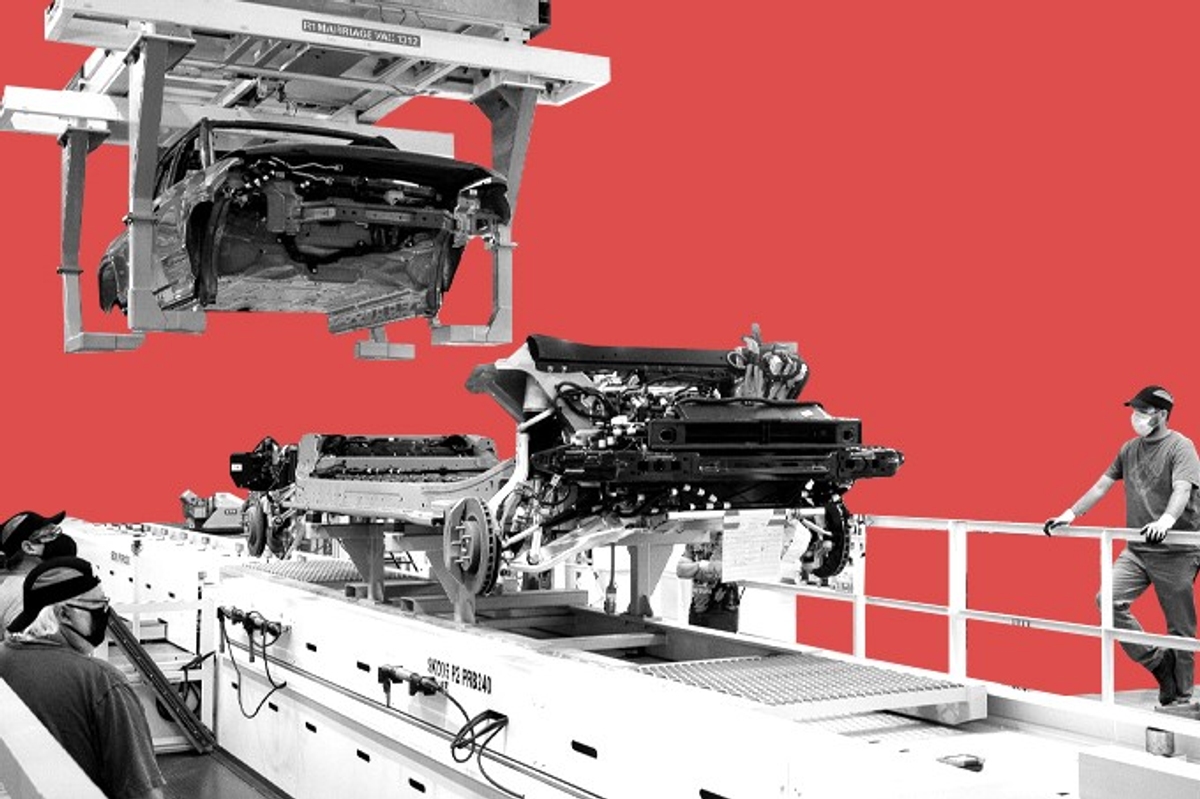

After a slow start, production at the electric truck maker Rivian is revving up. The company announced today that it made 16,304 new vehicles in the third quarter of 2023 and delivered about 15,500 of them.

That’s about 2,000 vehicles better than Wall Street analysts were expecting, according to CNBC, and it puts Rivian on target to beat its goal of shipping 52,000 vehicles this year. Rivian’s consumer vehicles — the R1T, a pickup, and R1, a three-row SUV — go for about $80,000 a pop. The company also makes delivery vehicles for Amazon. This quarter, Rivian made all its vehicles in its factory in Normal, Illinois, although it’s received the go-ahead to build a second facility in Georgia.

We won’t learn more about the company’s financials until next month, when it unveils its full quarterly earnings. But just because Rivian is shipping expensive trucks doesn’t mean that it’s making money off them. From April to June, the company lost $30,000 for every vehicle that it sold, The Wall Street Journal reported today, and R.J. Scaringe, its CEO, is now “rushing to slash expenses and slim down operations.” The company made nearly 14,000 vehicles in the second quarter and lost $1.19 billion.

Earlier this year, Scaringe told me that Rivian was still trying to rebound from rolling out its production vehicles amid the pandemic. “I don’t think you could have designed a more complex environment to do that in,” he said. “The supply chain catastrophe that was 2022 was our launching ramp here. And then managing the build-out of a large, 5,000-plus person workforce to produce vehicles in our first plant, in the middle of a pandemic, was also really hard.”

Rivian’s stock fell 2.55% in trading today, while the S&P 500 was essentially flat.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Alphabet and Amazon each plan to spend a small-country-GDP’s worth of money this year.

Big tech is spending big on data centers — which means it’s also spending big on power.

Alphabet, the parent company of Google, announced Wednesday that it expects to spend $175 billion to $185 billion on capital expenditures this year. That estimate is about double what it spent in 2025, far north of Wall Street’s expected $121 billion, and somewhere between the gross domestic products of Ecuador and Morocco.

This is a “a massive investment in absolute terms,” Jefferies analyst Brent Thill wrote in a note to clients Thursday. “Jarringly large,” Guggenheim analyst Michael Morris wrote. With this announcement, total expected capital expenditures by Alphabet, Microsoft and Meta for 2026 are at $459 billion, according to Jefferies calculations — roughly the GDP of South Africa. If Alphabet’s spending comes in at the top end of its projected range, that would be a third larger than the “total data center spend across the 6 largest players only 3 years ago,” according to Brian Nowak, an analyst at Morgan Stanley.

And that was before Thursday, when Amazon told investors that it expects to spend “about $200 billion” on capital expenditures this year.

For Alphabet, this growth in capital expenditure will fund data center development to serve AI demand, just as it did last year. In 2025, “the vast majority of our capex was invested in technical infrastructure, approximately 60% of that investment in servers, and 40% in data centers and networking equipment,” chief financial officer Anat Ashkenazi said on the company’s earnings call.

The ramp up in data center capacity planned by the tech giants necessarily means more power demand. Google previewed its immense power needs late last year when it acquired the renewable developer Intersect for almost $5 billion.

When asked by an analyst during the company’s Wednesday earnings call “what keeps you up at night,” Alphabet chief executive Sundar Pichai said, “I think specifically at this moment, maybe the top question is definitely around capacity — all constraints, be it power, land, supply chain constraints. How do you ramp up to meet this extraordinary demand for this moment?”

One answer is to contract with utilities to build. The utility and renewable developer NextEra said during the company’s earnings call last week that it plans to bring on 15 gigawatts worth of power to serve datacenters over the next decade, “but I'll be disappointed if we don't double our goal and deliver at least 30 gigawatts through this channel by 2035,” NextEra chief executive John Ketchum said. (A single gigawatt can power about 800,000 homes).

The largest and most well-established technology companies — the Microsofts, the Alphabets, the Metas, and the Amazons — have various sustainability and clean energy commitments, meaning that all sorts of clean power (as well as a fair amount of natural gas) are likely to get even more investment as data center investment ramps up.

Jefferies analyst Julien Dumoulin-Smith described the Alphabet capex figure as “a utility tailwind,” specifically calling out NextEra, renewable developer Clearway Energy (which struck a $2.4 billion deal with Google for 1.2 gigawatts worth of projects earlier this year), utility Entergy (which is Google’s partner for $4 billion worth of projects in Arkansas), Kansas-based utility Evergy (which is working on a data center project in Kansas City with Google), and Wisconsin-based utility Alliant (which is working on data center projects with Google in Iowa).

If getting power for its data centers keeps Pichai up at night, there’s no lack of utility executives willing to answer his calls.

The offshore wind industry is now five-for-five against Trump’s orders to halt construction.

District Judge Royce Lamberth ruled Monday morning that Orsted could resume construction of the Sunrise Wind project off the coast of New England. This wasn’t a surprise considering Lamberth has previously ruled not once but twice in favor of Orsted continuing work on a separate offshore energy project, Revolution Wind, and the legal arguments were the same. It also comes after the Trump administration lost three other cases over these stop work orders, which were issued without warning shortly before Christmas on questionable national security grounds.

The stakes in this case couldn’t be more clear. If the government were to somehow prevail in one or more of these cases, it would potentially allow agencies to shut down any construction project underway using even the vaguest of national security claims. But as I have previously explained, that behavior is often a textbook violation of federal administrative procedure law.

Whether the Trump administration will appeal any of these rulings is now the most urgent question. There have been no indications that the administration intends to do so, and a review of the federal dockets indicates nothing has been filed yet.

The Department of Justice declined to comment on whether it would seek to appeal any or all of the rulings.

Editor’s note: This story has been updated to reflect that the administration declined to comment.

A new PowerLines report puts the total requested increases at $31 billion — more than double the number from 2024.

Utilities asked regulators for permission to extract a lot more money from ratepayers last year.

Electric and gas utilities requested almost $31 billion worth of rate increases in 2025, according to an analysis by the energy policy nonprofit PowerLines released Thursday morning, compared to $15 billion worth of rate increases in 2024. In case you haven’t already done the math: That’s more than double what utilities asked for just a year earlier.

Utilities go to state regulators with its spending and investment plans, and those regulators decide how much of a return the utility is allowed to glean from its ratepayers on those investments. (Costs for fuel — like natural gas for a power plant — are typically passed through to customers without utilities earning a profit.) Just because a utility requests a certain level of spending does not mean that regulators will approve it. But the volume and magnitude of the increases likely means that many ratepayers will see higher bills in the coming year.

“These increases, a lot of them have not actually hit people's wallets yet,” PowerLines executive director Charles Hua told a group of reporters Wednesday afternoon. “So that shows that in 2026, the utility bills are likely to continue to rise, barring some major, sweeping action.” Those could affect some 81 million consumers, he said.

Electricity prices have gone up 6.7% in the past year, according to the Bureau of Labor Statistics, outpacing overall prices, which have risen 2.7%. Electricity is 37% more expensive today than it was just five years ago, a trend researchers have attributed to geographically specific factors such as costs arising from wildfires attributed to faulty utility equipment, as well as rising costs for maintaining and building out the grid itself.

These rising costs have become increasingly politically contentious, with state and local politicians using electricity markets and utilities as punching bags. Newly elected New Jersey Governor Mikie Sherrill’s first two actions in office, for instance, were both aimed at effecting a rate freeze proposal that was at the center of her campaign.

But some of the biggest rate increase requests from last year were not in the markets best known for high and rising prices: the Northeast and California. The Florida utility Florida Power and Light received permission from state regulators for $7 billion worth of rate increases, the largest such increase among the group PowerLines tracked. That figure was negotiated down from about $10 billion.

The PowerLines data is telling many consumers something they already know. Electricity is getting more expensive, and they’re not happy about it.

“In a moment where affordability concerns and pocketbook concerns remain top of mind for American consumers, electricity and gas are the two fastest drivers,” Hua said. “That is creating this sense of public and consumer frustration that we're seeing.”