You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

The electric vehicle maker has delivered another 15,500 cars since June. Yet trouble is brewing.

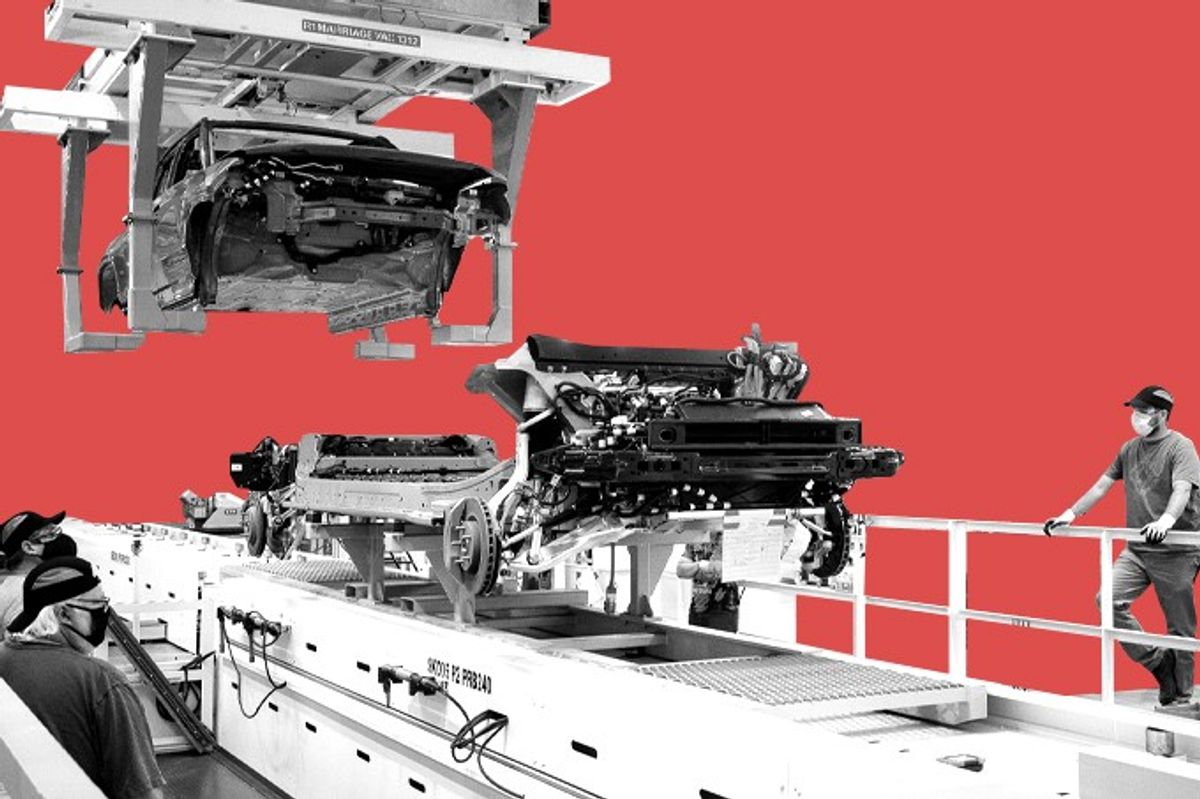

After a slow start, production at the electric truck maker Rivian is revving up. The company announced today that it made 16,304 new vehicles in the third quarter of 2023 and delivered about 15,500 of them.

That’s about 2,000 vehicles better than Wall Street analysts were expecting, according to CNBC, and it puts Rivian on target to beat its goal of shipping 52,000 vehicles this year. Rivian’s consumer vehicles — the R1T, a pickup, and R1, a three-row SUV — go for about $80,000 a pop. The company also makes delivery vehicles for Amazon. This quarter, Rivian made all its vehicles in its factory in Normal, Illinois, although it’s received the go-ahead to build a second facility in Georgia.

We won’t learn more about the company’s financials until next month, when it unveils its full quarterly earnings. But just because Rivian is shipping expensive trucks doesn’t mean that it’s making money off them. From April to June, the company lost $30,000 for every vehicle that it sold, The Wall Street Journal reported today, and R.J. Scaringe, its CEO, is now “rushing to slash expenses and slim down operations.” The company made nearly 14,000 vehicles in the second quarter and lost $1.19 billion.

Earlier this year, Scaringe told me that Rivian was still trying to rebound from rolling out its production vehicles amid the pandemic. “I don’t think you could have designed a more complex environment to do that in,” he said. “The supply chain catastrophe that was 2022 was our launching ramp here. And then managing the build-out of a large, 5,000-plus person workforce to produce vehicles in our first plant, in the middle of a pandemic, was also really hard.”

Rivian’s stock fell 2.55% in trading today, while the S&P 500 was essentially flat.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

The state’s senior senator, Thom Tillis, has been vocal about the need to maintain clean energy tax credits.

The majority of voters in North Carolina want Congress to leave the Inflation Reduction Act well enough alone, a new poll from Data for Progress finds.

The survey, which asked North Carolina voters specifically about the clean energy and climate provisions in the bill, presented respondents with a choice between two statements: “The IRA should be repealed by Congress” and “The IRA should be kept in place by Congress.” (“Don’t know” was also an option.)

The responses from voters broke down predictably along party lines, with 71% of Democrats preferring to keep the IRA in place compared to just 31% of Republicans, with half of independent voters in favor of keeping the climate law. Overall, half of North Carolina voters surveyed wanted the IRA to stick around, compared to 37% who’d rather see it go — a significant spread for a state that, prior to the passage of the climate law, was home to little in the way of clean energy development.

But North Carolina now has a lot to lose with the potential repeal of the Inflation Reduction Act, as my colleague Emily Pontecorvo has pointed out. The IRA brought more than 17,000 jobs to the state, per Climate Power, along with $20 billion in investment spread out over 34 clean energy projects. Electric vehicle and charging manufacturers in particular have flocked to the state, with Toyota investing $13.9 billion in its Liberty EV battery manufacturing facility, which opened this past April.

North Carolina Senator Thom Tillis was one of the four co-authors of a letter sent to Majority Leader John Thune in April advocating for the preservation of the law. Together, they wrote that gutting the IRA’s tax credits “would create uncertainty, jeopardizing capital allocation, long-term project planning, and job creation in the energy sector and across our broader economy.” It seems that the majority of North Carolina voters are aligned with their senator — which is lucky for him, as he’s up for reelection in 2026.

SpaceX has also now been dragged into the fight.

The value of Tesla shares went into freefall Thursday as its chief executive Elon Musk traded insults with President Donald Trump. The war of tweets (and Truths) began with Musk’s criticism of the budget reconciliation bill passed by the House of Representatives and has escalated to Musk accusing Trump of being “in the Epstein files,” a reference to the well-connected financier Jeffrey Epstein, who died in federal detention in 2019 while awaiting trial on sex trafficking charges.

The conflict had been escalating steadily in the week since Musk formally departed the Trump administration with what was essentially a goodbye party in the Oval Office, during which Musk was given a “key” to the White House.

Musk has since criticized the reconciliation bill for not cutting spending enough, and for slashing credits for electric vehicles and renewable energy while not touching subsidies for oil and gas. “Keep the EV/solar incentive cuts in the bill, even though no oil & gas subsidies are touched (very unfair!!), but ditch the MOUNTAIN of DISGUSTING PORK in the bill,” Musk wrote on X Thursday afternoon. He later posted a poll asking “Is it time to create a new political party in America that actually represents the 80% in the middle?”

Tesla shares were down around 5% early in the day but recovered somewhat by noon, only to nosedive again when Trump criticized Musk during a media availability. The shares had fallen a total of 14% from the previous day’s close by the end of trading on Thursday, evaporating some $150 billion worth of Tesla’s market capitalization.

As Musk has criticized Trump’s bill, Trump and his allies have accused him of being sore over the removal of tax credits for the purchase of electric vehicles. On Tuesday, Speaker of the House Mike Johnson described Musk’s criticism of the bill as “very disappointing,” and said the electric vehicle policies were “very important to him.”

“I know that has an effect on his business, and I lament that,” Johnson said.

Trump echoed that criticism Thursday afternoon on Truth Social, writing, “Elon was ‘wearing thin,’ I asked him to leave, I took away his EV Mandate that forced everyone to buy Electric Cars that nobody else wanted (that he knew for months I was going to do!), and he just went CRAZY!” He added, “The easiest way to save money in our Budget, Billions and Billions of Dollars, is to terminate Elon’s Governmental Subsidies and Contracts. I was always surprised that Biden didn’t do it!”

“In light of the President’s statement about cancellation of my government contracts, @SpaceX will begin decommissioning its Dragon spacecraft immediately,” Musk replied, referring to the vehicles NASA uses to ferry personnel and supplies to and from the International Space Station.

The company will use the seed funding to bring on more engineers — and customers.

As extreme weather becomes the norm, utilities are scrambling to improve the grid’s resilience, aiming to prevent the types of outages and infrastructure damage that often magnify the impact of already disastrous weather events. Those events cost the U.S. $182 billion in damages last year alone.

With the intensity of storms, heat waves, droughts, and wildfires growing every year, some utilities are now turning to artificial intelligence in their quest to adapt to new climate realities. Rhizome, which just announced a $6.5 million seed round, uses AI to help assess and prevent climate change-induced grid infrastructure vulnerabilities. It’s already working with utilities such as Avangrid, Seattle City Light, and Vermont Electric Power Company to do so.

“With a combination of utility system data and historical weather and hazard information, and then climate projection information, we can build a full profile of likelihood and consequence of failure at a very high resolution,” Rhizome co-founder and CEO Mish Thadani told me.

While utilities often have lots of data about the history of their assets and the surrounding landscape, there’s no real holistic system to bring together these disparate datasets and provide a simple overview of systemic risk across a range of different scenarios. Utilities usually rely on historical data to make decisions about their assets — a practice that’s increasingly unhelpful as climate change makes previously rare extreme weather events more likely.

Rhizome aims to solve both problems, serving as an integrated platform for risk assessment and mitigation that incorporates forward-looking climate modeling into its projections. The company measures its success against modeled counterfactuals that determine avoided power outages and the economic losses associated with these hypothetical blackouts. “So we can say the anticipated failure rate across the system for a Category 1 hurricane was X, and after you invest in the system, it will be Y,” Thadani told me. “Or if you’ve made a bunch of investments in the system, and you do experience a Category 1 hurricane, what would have been the failure rate had those investments not been made?”

This allows utilities to provide regulators with much more robust data to back up their funding requests. So while Thadani expects electricity prices to continue to rise and ratepayers to bear the burden, he told me that Rhizome can ultimately help regulators and utilities keep costs in check by making sure that every dollar spent on risk mitigation goes as far as possible.

Rhizome’s seed round, which came in oversubscribed, was led by the early-stage tech-focused venture firm Base10 Partners, which aims to automate traditional sectors of the economy. Additional funders include climate investors MCJ and CLAI, as well as the wildfire-focused venture firm Convective Capital. In addition to its standard risk assessment system, Rhizome has also developed a wildfire-specific risk mitigation tool. This quantifies not only how likely a hazard is to occur and its potential impact on utility infrastructure, but also the probability that an equipment failure would spark a wildfire, based on the geography of the area and historical ignition data.

Thadani told me that he considers evaluating wildfire risk “to be the next step in a sequence” as a utility evaluates the threats to its system overall. So while customers can choose to adopt either the standard product or the wildfire-specific product, many could gain utility from both, he said. The company has also developed a third offering specifically tailored for municipal and cooperative utilities. This more affordable system doesn’t provide the same machine learning-powered cost-benefit metrics, but can still help these smaller entities evaluate their infrastructure’s vulnerability.

Right now, Rhizome has a “lean and mighty” team of just 11 people, Thadani told me. With this latest raise, he said that the company will immediately hire five or six engineers, primarily to do further research and development. As Rhizome looks to onboard more and larger customers, it’s planning to incorporate more advanced modeling features into its platform and operate it increasingly autonomously, such that the model can retrain itself as new weather, climate, and utility data becomes available.

The company is out of the pilot phase with most of its customers, Thadani said, having signed multiple enterprise software contracts. That’s big, as utilities have gained a reputation for showing an initial appetite for testing innovative technologies, only to balk at the cost of full-scale deployment. Thadani told me Rhizome has been able to avoid this so-called “pilot purgatory” by making a point to engage with senior-level stakeholders at utilities — not just the innovation teams — to “graduate from that pilot ecosystem more quickly.”