You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

Goodhart’s Law tells us that “when a measure becomes a target, it ceases to be a good measure.” The disagreements climate diplomats were having last week highlight why.

Last week, climate negotiators sparred in Bonn, Germany, over a New Collective Quantified Goal on climate finance. The NCQG, as it’s labeled, is a new target for how much money governments must mobilize to meet global climate investment needs consistent with goals set down in the United Nations’ landmark 2015 Paris Agreement. Reaching a consensus on the NCQG is the biggest item on negotiators’ plates between Bonn and COP29, the annual United Nations-led conference on climate change, happening this fall in Baku, Azerbaijan. But, true to Goodhart, the global climate targets negotiators are deadlocked over are not good measurements of progress, let alone ones that developed countries measured up to.

In 2009, at COP15 in Copenhagen, developed countries set a goal of mobilizing $100 billion annually for climate investments in developing countries by 2020. In 2015, as part of the Paris Agreement, the world’s climate diplomats agreed to set an updated goal — the NCQG — before 2025. In the interim, developed countries achieved their original goal, although years later than planned and amidst allegations that some of their grants and loans were merely existing sources of development financing dressed up as climate finance. That there is no fixed definition of the term “climate finance” makes the $100 billion target doubly fuzzy: Upon closer inspection, some spending classified as climate finance doesn’t really seem like it should count, while other spending seems to have circled back to donor country governments, consultants, and nonprofits.

Despite these measurement issues, negotiators at Bonn pressed for an ambitious updated target. There was consensus that the NCQG could not be less than $100 billion annually — but that is where agreement ended. While negotiators from developing countries ― particularly those from African and Asian governments ― called for an NCQG as high as $1.4 trillion annually over the next five years, developed country negotiators refused to commit to a figure, choosing instead to argue over which countries should be expected to pay. Held up over this disagreement, Bonn ended without a resolution even on what a range of possible NCQGs could look like.

Whatever its size, this target means nothing without a plan to deliver it. What’s more, the back-and-forth over the size of the bill and who foots it took up so much time last week that two other long-standing debates were neglected: The first over what type of financing the NCQG should prioritize ― a measurement issue ― and the second about the obstacles (or “disenablers,” as negotiators called them) in the way of achieving that level of financing — a target issue.

As to the type of financing, the share of total official development assistance sent from G7 governments and the European Union to African countries is at its lowest in 50 years, making it possible to conclude, as did an EU negotiator at Bonn, that “public resources alone will not suffice” to meet the NCQG. The growing scale of the climate challenge, weighed against this apparent (if arguably self-imposed) inadequate public spending by developed countries, has prompted policymakers to advocate for greater private-sector involvement in meeting global climate finance targets. The United States in particular has placed heavy emphasis on the need to “mobilize private capital.” This agenda has prompted Global North governments and the World Bank to attract private investors to decarbonization projects in developing countries.

Developing country negotiators and civil society advocates, meanwhile, have long criticized the fact that the majority of the climate financing we know about has come in the form of loans and not grants, and that most of the loans ― some of the ones from the public sector and all of the private loans ― are issued on market-rate rather than “concessional” terms. In other words, all this so-called help places an undue burden on the balance sheets of developing countries, especially as global interest rates stay high.

Some negotiators are looking to incorporate these arguments into the NCQG as a measure of the quality of the financing developing countries receive. And this is where the conversation around the obstacles begins.

One can argue that loans of any kind are better than nothing at all; long-term investments require long-term debt financing. But market-rate loans in the Global South carry prohibitively high interest rates, reflecting the greater risks that private investors think they face when investing. The International Energy Agency confirms that “the cost of capital for a typical solar PV plant in 2021 was between two‐ and three‐times higher in emerging and developing economies than in advanced economies and China.” While policymakers, particularly at the World Bank, are developing tools to “derisk” these investments such that they can be profitable at market interest rates, it’s still not clear that private sector creditors will respond with enthusiasm. Under these conditions, many climate-vulnerable communities are liable to be locked out of capital markets.

Debt, after all, is not inherently bad. High debt-to-GDP ratios don’t mean anything in and of themselves — indeed, taking on debt to finance crucial investments can (and should!) be prosperity-enhancing and increase a country’s future borrowing capacity.

But today’s global economic system is structured in such a way that debt places a needlessly heavy burden on developing countries, contributing to a “crowding out of crucial development spending,” per findings of the UN Development Programme. Almost 40% of developing countries are setting aside over 10% of their governments’ total revenues to cover interest payments; 62% of developing countries’ external public debt is owed to private creditors (again, at market rates). And these figures don’t include the debt that individual firms take on to finance, say, energy infrastructure. Even that requires the governments of developing countries and development banks to derisk low-return projects across much of the Global South, a process which can plant “budgetary time bombs” on those governments’ balance sheets. Where decarbonization is concerned, private balance sheets are also public liabilities.

Developing country governments and firms also face interest rate and foreign exchange shocks, as higher U.S. interest rates and the concomitant threat of currency depreciation strain their abilities to service external debts. The perverse effect is to prioritize hoarding dollars earned through exports as potential shock absorbers rather than channel them toward domestic investment goals. Loans become a millstone around a government’s policy goals, rather than a measurement of its ambitions.

These liquidity risks loom over climate-vulnerable countries. Take Egypt, where this summer is expected to be brutally hot enough to force its government to import more grain and more gas ― putting increased pressure on the already-volatile Egyptian pound ― and to seriously threaten labor productivity. Egypt’s latest Nationally Determined Contribution, its national climate plan, states that it needs approximately $35 billion per year between now and 2030 to meet its climate targets. Yet the International Monetary Fund expects Egypt to spend $50 billion a year on interest payments in that same period, all while Egypt’s recent bailout agreement with the IMF commits to “put debt firmly on a downward path.”

This debt-climate nexus or climate risk doom loop, exemplifies why developing country negotiators and civil society advocates have hesitated to embrace loan-based climate finance. Debt today need not “crowd out” debt-financed climate spending tomorrow. But that’s exactly what’s happening.

So where does that leave us? For all diplomats’ focus on the NCQG target, how they measure it does matter. As it stands, $100 million of climate finance in the form of market-rate loans to developing countries might seriously threaten their debt sustainability. But developed countries, the multilateral development banks, and the International Monetary Fund can change the nature of debt finance. They can commit to making debt easier to bear by offering lower interest rates and extending loan terms. They can issue more of this concessional debt, of course, displacing the panoply of private lenders that currently play in sovereign bond markets. They can reform their lending standards such that they no longer penalize borrowers for carrying high debt-to-GDP ratios when huge debt-financed investment is precisely what staving off climate change requires. And they can set up dollar swap lines to provide developing countries with the resources to manage interest rate and currency value shocks.

These strategies, if fleshed out in practical detail, can sidestep fickle private investors, contribute to an investment-friendly reform of the global macroeconomic architecture, and kickstart a virtuous cycle of green development around the world. That’s the target. Can we measure up to it?

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

On power plant emissions, Fervo, and a UK nuclear plant

Current conditions: A week into Atlantic hurricane season, development in the basin looks “unfavorable through June” • Canadian wildfires have already burned more land than the annual average, at over 3.1 million hectares so far• Rescue efforts resumed Wednesday in the search for a school bus swept away by flash floods in the Eastern Cape province of South Africa.

The Environmental Protection Agency plans to announce on Wednesday the rollback of two major Biden-era power plant regulations, administration insiders told Bloomberg and Politico. The EPA will reportedly argue that the prior administration’s rules curbing carbon dioxide emissions at coal and gas plants were misplaced because the emissions “do not contribute significantly to dangerous pollution,” per The Guardian, despite research showing that the U.S. power sector has contributed 5% of all planet-warming pollution since 1990. The government will also reportedly argue that the carbon capture technology proposed by the prior administration to curb CO2 emissions at power plants is unproven and costly.

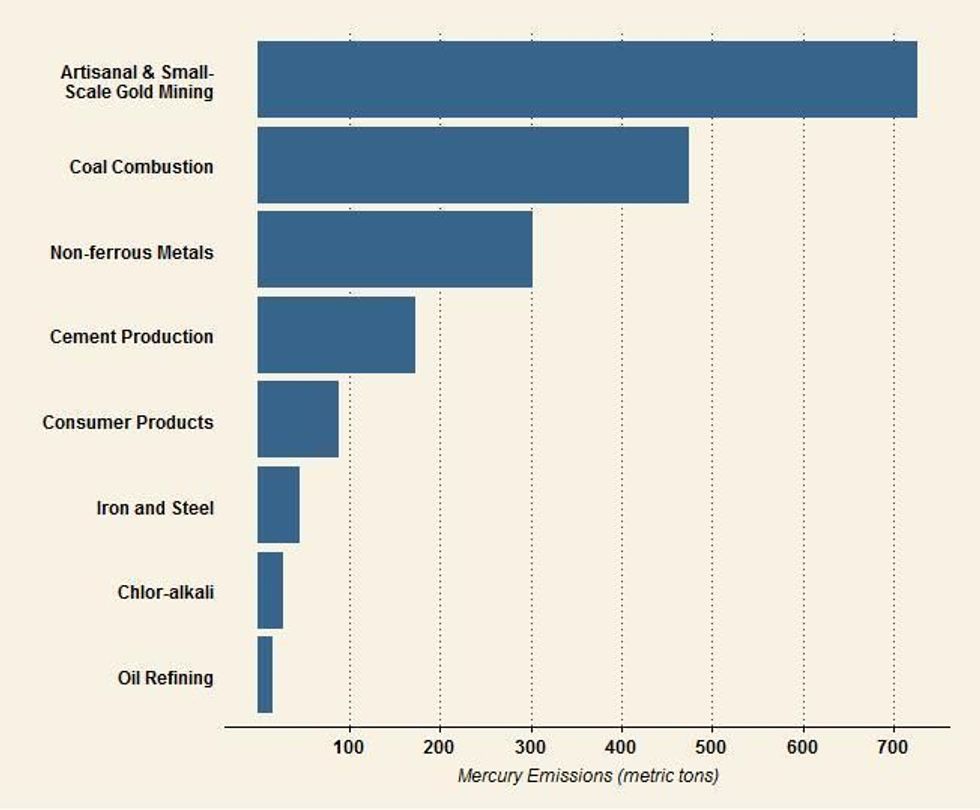

Similarly, the administration plans to soften limits on mercury emissions, which are released by burning coal, arguing that the Biden administration “improperly targeted coal-fire power plants” when it strengthened existing regulations in 2024. Per a document reviewed by The New York Times, the EPA’s proposal will “loosen emissions limits for toxic substances such as lead, nickel, and arsenic by 67%,” and for mercury at some coal power plants by as much as 70%. “Reversing these protections will take lives, drive up costs, and worsen the climate crisis,” Climate Action Campaign Director Margie Alt said in a statement. “Instead of protecting American families, [President] Trump and [EPA Administrator Lee] Zeldin are turning their backs on science and the public to side with big polluters.”

Fervo Energy announced Wednesday morning that it has secured $206 million in financing for its 400-megawatt Cape Station geothermal project in southwest Utah. The bulk of the new funding, $100 million, comes from the Breakthrough Energy Catalyst program.

Fervo’s announcement follows on the heels of the company’s Tuesday announcement that it had drilled its hottest and deepest well yet — at 15,000 feet and 500 degrees Fahrenheit — in just 16 days. As my colleague Katie Brigham reports, Fervo’s progress represents “an all too rare phenomenon: A first-of-a-kind clean energy project that has remained on track to hit its deadlines while securing the trust of institutional investors, who are often wary of betting on novel infrastructure projects.” Read her full report on the clean energy startup’s news here.

The United Kingdom said Tuesday that it will move forward with plans to construct a $19 billion nuclear power station in southwest England. Sizewell C, planned for coastal Suffolk, is expected to create 10,000 jobs and power 6 million homes, The New York Times reports. Sizewell would be only the second nuclear power plant to be built in the UK in over two decades; the country generates approximately 14% of its total electricity supply through nuclear energy. Critics, however, have pointed unfavorably to the other nuclear plant under construction in the UK, Hinkley Point C, which has experienced multiple delays and escalating costs throughout its development. “For those who have followed Sizewell’s progress over the years, there was a glaring omission in the announcement,” one columnist wrote for The Guardian. “What will consumers pay for Sizewell’s electricity? Will it still be substantially cheaper in real terms than the juice that will be generated at Hinkley Point C in Somerset?” The UK additionally announced this week that it has chosen Rolls-Royce as the “preferred bidder” to build the country’s first three small modular nuclear reactors.

The European Union on Tuesday proposed a ban on transactions with Nord Stream 1 and 2 as part of a new package of sanctions aimed at Russia, Bloomberg reports. “We want peace for Ukraine,” the president of the European Commission, Ursula von der Leyen, said at a news conference in Brussels. “Therefore, we are ramping up pressure on Russia, because strength is the only language that Russia will understand.” The package would also lower the price cap on Russian oil to $45 a barrel, down from $60 a barrel, von der Leyen said, as well as crack down on Moscow’s “shadow fleet” of vessels used to transport sanctioned products like crude oil. The EU’s 27 member states need to unanimously agree to the package for it to be adopted; their next meeting is on June 23.

The world’s oceans hit their second-highest temperature ever in May, according to the European Union’s Earth observation program Copernicus. The average sea surface temperature for the month was 20.79 degrees Celsius, just 0.14 degrees below May 2024’s record. Last year’s marine heat had been partly driven by El Niño in the Pacific, so the fact that the oceans remain warm in 2025 is alarming, Copernicus senior scientist Julien Nicolas told the Financial Times. “As sea surface temperatures rise, the ocean’s capacity to absorb carbon diminishes, potentially accelerating the build-up of greenhouse gases in the atmosphere and intensifying future climate warming,” he said. In some areas around the UK and Ireland, the sea surface temperature is as high as 4 degrees Celsius above average.

The Pacific Island nation of Tonga is poised to become the first country to recognize whales as legal persons — including by appointing them (human) representatives in court. “The time has come to recognize whales not merely as resources but as sentient beings with inherent rights,” Tongan Princess Angelika Lātūfuipeka Tukuʻaho said in comments delivered ahead of the U.N. Ocean Conference in Nice, France.

Microsoft, Amazon, Google, and the rest only have so much political capital to spend.

When Donald Trump first became a serious Presidential candidate in 2015, many big tech leaders sounded the alarm. When the U.S. threatened to exit the Paris Agreement for the first time, companies including Google, Microsoft, Apple, and Facebook (now Meta) took out full page ads in The New York Times and The Wall Street Journal urging Trump to stay in. He didn’t — and Elon Musk, in particular, was incensed.

But by the time specific climate legislation — namely the Inflation Reduction Act — was up for debate in 2022, these companies had largely clammed up. When Trump exited Paris once more, the response was markedly muted.

Now that the IRA’s tax credits face clear and present threats, this same story is playing out again. As the Senate makes its changes to the House’s proposed budget bill, tech giants such as Microsoft, Google, Meta, and Amazon are keeping quiet, at least publicly, about their lobbying efforts. Most did not respond to my request for an interview or a statement clarifying their position, except to say they had “nothing to share on this topic,” as Microsoft did.

That’s not to say they have no opinion about the fate of clean energy tax credits. Microsoft, Google, Meta, and Amazon have all voluntarily set ambitious net-zero emissions targets that they’re struggling to meet, largely due to booming data center electricity demand. They’re some of the biggest buyers of solar and wind energy, and are investing heavily in nuclear and geothermal. (On Wednesday morning, Pennsylvania’s Talen Energy announced an expanded power purchase agreement with Amazon, for nearly 2 gigawatts of power through 2042.) All of these energy sources are a whole lot more accessible with tax credits than without.

There’s little doubt the tech companies would prefer an abundant supply of cheap, clean energy. Exactly how much they’re willing to fight for it is the real question.

The answer may come down to priorities. “It’s hard to overstate how much this race for AI has just completely changed the business models and the way that these big tech companies are thinking about investment,” Jeff Navin, co-founder of the climate-focused government affairs firm Boundary Stone Partners, told me. “While they’re obviously going to be impacted by the price of energy, I think they’re even more interested and concerned about how quickly they can get energy built so that they can build these data centers.”

The tech industry has shown much more reluctance to stand up to Trump, period, this time around. As the president has moved from a political outsider to the central figure in the Republican party, hyperscalers have increasingly curried his favor as they advocate against actions that could pose an existential risk to their business — think tighter regulations on the tech sector or AI, or tariffs on key supplies made in Asia.

As Navin put it to me, “When you have a president who has very strong opinions on wind turbines and randomly throws companies’ names in tweets in the middle of the night, do you really want to stick your neck out and take on something that the president views as unpopular if you’ve got other business in front of him that could be more impactful for your bottom line?”

It is undeniably true that the AI-driven data center boom is pushing these companies to look for new sources of clean power. Last week Meta signed a major nuclear deal with Constellation Energy. Microsoft is also partnering with Constellation to reopen Three Mile Island, while Google and Amazon have both announced investments in companies developing small modular reactors. Meta, Google, and Microsoft are also investing in next-generation geothermal energy startups.

But while the companies are eager to tout these partnerships, Navin suspects most of their energy lobbying is now being directed towards efforts such as permitting reform and building out transmission infrastructure. Publicly available lobbying records confirm that these are indeed focus areas, as they’re critical to bringing data centers online quickly, regardless of how they’re powered and whether that power is subsidized. “They’re not going to stop construction on an energy project that has access to electricity just because that electricity is marginally more expensive,” Navin told me. “There’s just too much at stake.”

Tech companies have lobbied on numerous budget, tax, sustainability, and clean energy issues thus far this year. Amazon’s lobbying report is the only one to specifically call out efforts on “renewable energy tax credits,” while Meta cites “renewable energy policy” and Microsoft name-drops the IRA. But there’s no hard and fast standard for how companies describe the issues they’re lobbying on or what they’re looking to achieve. And perhaps most importantly, the reports don’t disclose how much money they allot to each issue, which would illuminate their priorities.

Lobbying can also happen indirectly, via industry groups such as the Clean Energy Buyers Association and the Data Center Coalition. Both have been vocal advocates for preserving the tax credits. The Wall Street Journal recently detailed a lobbying push by the latter — which counts Microsoft, Amazon, Meta, and Google among its most prominent members — that involved meetings with about 30 Republican senators and a letter to Senate Majority Leader John Thune.

DCC didn’t respond to my request for an interview. But CEBA CEO Rich Powell told me, “If we take away these incentives right now, just as we’re getting the rust off the gears and getting back into growth mode for the electricity economy, we’re really concerned about price spikes.”

The leader of another industry group, Advanced Energy United, shared Powell’s concern that passing the bill would mean higher electricity prices. Taking away clean energy incentives would ”fundamentally undercut the financing structure for — let’s be frank — the vast majority of projects in the interconnection queue today,” Harry Godfrey, the managing director of AEU, told me.

Being part of an industry association is by no means a guarantee of political alignment on every issue. Microsoft, Google, Meta, and Amazon are also members of the U.S. Chamber of Commerce — by far the largest lobbying group in the U.S. — which has a long history of opposing climate action and the IRA itself. Apple even left the Chamber in 2009 due to its climate policy stances.

But Powell and Godfrey implied that the tech giants' views are — or at least ought to be — in alignment with theirs. “Many of our members are lobbying independently. Many of them are lobbying alongside us. And then many of them are supporting CEBA to go and lobby on this,” Powell told me, though he wouldn’t reveal what actions any specific hyperscalers were taking.

Godfrey said that AEU’s positions are “certainly reflective of what large energy consumers, notably tech companies, have been working to pursue across a variety of technologies and with applicability to a couple of different types of credits.”

And yet hyperscalers may have already spent a good deal of their political capital fighting for a niche provision in the House’s version of the budget bill, which bans state-level AI regulation for a decade. That would make the AI boom infinitely easier for tech companies, who don’t want to deal with a patchwork of varying regulations, or really most regulations at all.

On top of everything else, big tech in particular is dealing with government-led anti-trust lawsuits, both at home and abroad. Google recently lost two major cases to the Department of Justice, related to its search and advertising business. A final decision is pending regarding the Federal Trade Commission’s antitrust lawsuit against Meta, regarding the company’s acquisition of Instagram and WhatsApp. Not to be outdone, Amazon will also be fighting an antitrust case brought by the FTC next year.

As these companies work to convince the public, politicians, and the courts that they’re not monopolistic rule-breakers, and that AI is a benevolent technology that the U.S. must develop before China, they certainly seem to be relinquishing the clean energy mantle they once sought to carry, at least rhetorically. We’ll know more once all these data centers come online. But if the present is any indication, speed, not green electrons, is the North Star.

Editor’s note: This story has been updated to reflect Amazon’s power purchase agreement with Talen Energy.

The new funding comes as tax credits for geothermal hang in the balance.

The good news is pouring in for the next-generation geothermal developer Fervo Energy. On Tuesday the company reported that it was able to drill its deepest and hottest geothermal well to date in a mere 16 days. Now on Wednesday, the company is announcing an additional $206 million in financing for its Cape Station project in Utah.

With this latest tranche of funding, the firm’s 500-megawatt development in rural Beaver County is on track to deliver 24/7 clean power to the grid beginning in 2026, reaching full operation in 2028. The development is shaping up to be an all-too-rare phenomenon: A first-of-a-kind clean energy project that has remained on track to hit its deadlines while securing the trust of institutional investors, who are often wary of betting on novel infrastructure projects.

The bulk of this latest financing comes from the Bill Gates-backed Breakthrough Energy Catalyst program, which provided $100 million in project-level equity funding. The energy and commodity trading company Mercuria provided $60 million in corporate loans, increasing its existing fixed-term loan from $40 million to $100 million. An additional $45.6 million in short-term debt financing came from XRL-ALC, an affiliate of X-Caliber Rural Capital, which provides loans to infrastructure projects in rural areas. That comes on top of a previous $100 million loan from the firm.

The plan is for Cape Station to deliver 100 megawatts of grid power in 2026, with the additional 400 megawatts by 2028. The facility has the necessary permitting to expand production to two gigawatts — twice the size of a standard nuclear reactor. And on Monday, the company announced that an independent report from the consulting firm DeGolyer & MacNaughton confirms that the project could expand further still — eventually supporting over 5 gigawatts of clean power at depths of up to 13,000 feet. The company’s latest drilling results, which reached 15,765 feet at 520 degrees Fahrenheit, could push the project’s potential power output even higher.

Traditional geothermal wells normally max out at around 10,000 feet, and must be built in locations where a lucky confluence of geological features come together: high temperatures, porous rock, and naturally occurring water or steam. But because Fervo can drill thousands of feet deeper, it’s able to access hot rocks in locations that weren’t previously suitable for geothermal development, pumping high-pressure water down into the wells to fracture rocks and thus create its own geothermal reservoirs.

The primary customer for Fervo’s Cape Station project is Southern California Edison, which signed a 320-megawatt power purchase agreement with the company last year, advertised as the largest geothermal PPA ever. Shell was also announced as a customer this year. Fervo is already providing 3.5 megawatts of power to Google via a pilot project in Nevada, which it’s seeking to expand, entering into a 115 megawatt PPA with NV Energy and the tech giant to further build out production at this location.

Fervo’s latest funding comes on top of last February’s $244 million Series D round led by Devon Energy, as well as an additional $255 million in corporate equity and debt financing that it announced last December. On top of investments from well known climate tech venture firms such as Breakthrough Energy Ventures and Galvanize Climate Solutions, the company has secured institutional investment from Liberty Mutual as well as public pension funds such as the California State Teachers’ Retirement System and the Canada Pension Plan Investment Board.

Fervo, like all clean energy startups, also stands to benefit greatly from the Inflation Reduction Act’s clean energy tax credits, which are now in jeopardy as President Trump’s One Big, Beautiful Bill works its way through the Senate. While Secretary of Energy Chris Wright has traditionally been a booster of geothermal energy and is advocating to keep tax incentives for the technology in place through 2031, the bill as it stands would essentially erase incentives for all geothermal projects that start construction more than 60 days after the bill’s passage.

Fervo broke ground on Cape Station in 2023, so that project will make the cut. For future Fervo developments, it’s much less clear. But for now, the company seems to be flush with cash and potential in a climate tech world awash in ill omens.