You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

The answer depends on where it’s going and what it’s replacing.

President Biden’s decision to pause approving liquified natural gas export terminals until it can better study their climate effects — functionally delaying or even outright preventing their construction — got real political, real fast. Almost immediately, West Virginia Senator Joe Manchin called for a hearing on the president’s decision-making.

“If the Administration has the facts to prove that additional LNG export capacity would hurt Americans, they must make that information public and clear,” he said in a statement last week. “But if this pause is just another political ploy to pander to keep-it-in-the-ground climate activists at the expense of American workers, businesses and our allies in need, I will do everything in my power to end this pause immediately.”

While Senator Manchin is not exactly the administration’s biggest fan lately, he’s also asking some pretty interesting questions. One of the animating ideas of the past few months in climate politics has been the argument that LNG (and maybe even pipeline gas) are in fact far worse for the global climate even than coal, which has long been assumed to be the dirtiest, most carbon-intensive fossil fuel around. That view is based on research by Cornell University scientist Robert Howarth and has been expounded by climate advocates and elected officials alike.

But that research has not yet passed through peer review. Even if it had, Howarth’s past research has gotten criticism from other climate scientists for using some idiosyncratic assumptions that yield more dramatic results.

Make no mistake, meeting the goals of the Paris Agreement and holding global warming to 1.5 degrees Celsius over pre-industrial levels requires winding down our use of fossil fuels as quickly as possible. If we meet those goals, the natural gas export terminals delayed by the Biden administration’s decision will likely go dormant well before the end of their expected lifespans. But it’s not the case that in all possible worlds, continuing or even expanding natural gas production and exports would actually be worse for the climate.

The basic physics of coal emissions versus LNG emissions are just part of the equation. When it’s burned, natural gas releases carbon dioxide, the primary source of human-caused climate change, albeit less carbon dioxide than coal. But natural gas is itself mostly methane, CH4, which traps far more heat than CO2 when it leaks from wells, pipelines, and production facilities. (LNG is also much more energy-intensive to extract, produce, and store than regular natural gas, since it has to be cooled to -260 degrees Fahrenheit, sailed across the ocean and then “regasified” and shipped via pipeline on the other side.) While CH4 is more potent than CO2 from a warming perspective, it also breaks down much more quickly in the atmosphere, which means the warming effect doesn’t last as long.

How to think about LNG’s effect on overall emissions, then, largely depends on how much you think each of these factors matters. “Only if we assume high methane leakage rates and a 20-year global warming potential is natural gas worse than coal, and such assumptions are likely unrealistic,” wrote Carnegie Mellon energy systems researcher Paulina Jaramillo in an essay titled, aptly, “Navigating the LNG Dilemma.”

Absolute emissions aren’t even what we should be asking about, Arvind Ravikumar, a professor at the University of Texas and a leading scholar on natural gas and energy policy, told me. “The climate impact of U.S. LNG depends on what it replaces in countries — whether those alternatives have more or less emissions than U.S. LNG.”

When the United States stepped in to replace much of the gas the European Union would otherwise buy from Russia with LNG, Ravikumar explained, it likely reduced overall emissions because of lower methane emissions from the U.S. gas industry. Before the invasion of Ukraine, Russia supplied about 155 billion cubic meters of natural gas to Europe; by 2022, that was down to around 80 billion cubic meters. That’s a lot of energy to replace. In that time, the U.S. more than doubled its LNG exports to Europe, which has guaranteed demand of at least 50 billion cubic meters from the U.S. through 2030.

Had the U.S. not ramped up its LNG exports, boosters argue, these countries might not have had a viable alternative and might have turned to coal, instead. But that won’t be the case in every single possible future scenario. “There’s no right answer,” Ravikumar told me. “It depends on who buys, what time frame, which country, and how are they using LNG.”

There’s at least one clear case study of the coal-to-gas switch working to lower emissions: the United States itself.

In 2007, the U.S. was consuming just over 1 billion tons of coal for electricity; by 2016 that had declined to 679 million, and by 2022 to just under 500 million — in other words, by more than half. In that same time, natural gas use for electricity grew from 7 trillion cubic feet in 2007 to 10 trillion cubic feet in 2016 to 12 trillion cubic feet in 2022.

U.S. greenhouse gas emissions have dropped more than 15% since 2007 to even below their 1992 levels, according to the Environmental Protection Agency and the Rhodium Group. The drop in emissions has been going on since 2010, which the EPA attributes, in part, to "the growing use of natural gas and renewables to generate electricity in place of more carbon-intensive fuels.”

As climatologist Zeke Hausfather put it in an earlier commentary on an earlier Howarth paper, “While it isn’t responsible for the majority of emissions reductions, natural gas replacing coal is the largest single driver.”

Much of the conceptual infrastructure on which climate policy operates relies on estimating what the world will be like in the future — not just figuring out the effects of different levels of greenhouse gas concentrations in the atmosphere, but also figuring out different likely pathways for the evolution of those emissions over time.

This works in both directions — asking how specific projects either reduce or lower emissions, and asking about what an energy system would look like in a world where emissions have been reduced enough to avoid certain levels of temperature increases. And that’s really where the rubber meets the road.

In a scenario where the world hits its Paris Agreement goals, there would not be the coal-to-gas switching envisioned by LNG advocates precisely because there would be very little coal still being used to generate electricity. The fear, then, is that LNG terminals would either become stranded assets, capital investments that wind up becoming liabilities; or that, once they’re in operation, the companies behind them would use their political and economic leverage — not to mention just the power of inertia — to keep enough natural gas in the global energy system to be profitable.

“Either you’re building and planning to shut it down early,” Hausfather told me, “or you’re building something that’s going to be inconsistent with the world we’re aiming to have under our climate targets.”

In a Paris-compliant world, almost 90% of the world’s coal reserves and over half of the natural gas and oil reserves will stay in the ground, according to researchers from University College London. They estimate that in order to meet the Paris targets, gas production would “see rapid decline” from 2020 to 2050 and would be eliminated as a fuel for electricity generation by 2040, with accompanying “low utilization rates of infrastructure, and limited prospect for future additional liquefaction capacity” for exports.

In other words, in a world that comes in under 1.5 degrees of warming, the emissions reductions from coal-to-gas switching peter out after 2035; with 2 degrees of warming it’s around 2040 to 2045 — in any case, beyond the planned life of the export terminals that the Biden administration’s decision affects.

But how much LNG export capacity the United States builds up in the next decade is only a tiny part of the overall emissions picture now, in 2035, or in 2050. “This is the issue with regulating at a project level in general,” energy consultant Sean Smillie told me. “The decision of any given project in the scheme of global emissions is small. For me, that points to the fact that we’re trying to regulate climate change — which is a systemic issue — at the project level, and that’s a very hard thing to do.”

The biggest question is just how energy systems overseas evolve — and what role LNG exports play in that determination. The European Union is about to decide whether to reduce its net collective emissions 90% from 1990 levels by 2040, on their way to zero by 2050, which would signal a sharp reduction in demand coming from that part of the world. Meanwhile, for U.S. LNG export projects currently in the permitting pipeline, Asian countries are contracted to receive a much bigger share, according to a Public Citizen analysis. Bloomberg reports that those buyers have started looking elsewhere — including to Russia.

But what if we don’t hit our Paris Agreement targets, as the United Nations and Bill Gates agree we’re increasingly unlikely to do? What if developing countries prioritize cheap, available energy (like India’s growing coal production) over climate goals? In that case, Ravikumar argues, then LNG export capacity turns from a potential “stranded asset” into an insurance policy.

“The way to think about LNG in the longer term is the insurance against a 3 [degrees of warming] world,” Ravikumar told me. If we fail at taking quick action to change our systems from carbon-polluting to zero-carbon energy, we might still be doing some coal-to-gas switching by 2050.

“It’s hard to say for certain that we will or not need the LNG export terminals by 2050 and 2060,” Elan Sykes, an energy policy analyst at the Progressive Policy Institute and an opponent of the Biden administration’s decision, told me. “Absent aggressive foreign policy measures [like] a Green Marshall Plan for worldwide clean energy, it’s hard to imagine a world where LNG doesn’t provide” some value, whether from continuing to help reduce emissions or simply maintaining a reliable supply of energy, he said.

Modelers are good at figuring out what the energy mix of a 1.5, 2, or 3-degree world would look like. They’re less good at predicting how that energy mix will evolve over time in the world we actually live in — and it’s in that world that the Biden administration will have to decide whether more LNG exports will serve the public interest.

The job isn’t just to make decisions for an ideal world. As Hausfather told me, it’s “aiming at the best versus mitigating the worst.”

With reporting by Emily Pontecorvo.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

And more on the week’s biggest conflicts around renewable energy projects.

1. Jackson County, Kansas – A judge has rejected a Hail Mary lawsuit to kill a single solar farm over it benefiting from the Inflation Reduction Act, siding with arguments from a somewhat unexpected source — the Trump administration’s Justice Department — which argued that projects qualifying for tax credits do not require federal environmental reviews.

2. Portage County, Wisconsin – The largest solar project in the Badger State is now one step closer to construction after settling with environmentalists concerned about impacts to the Greater Prairie Chicken, an imperiled bird species beloved in wildlife conservation circles.

3. Imperial County, California – The board of directors for the agriculture-saturated Imperial Irrigation District in southern California has approved a resolution opposing solar projects on farmland.

4. New England – Offshore wind opponents are starting to win big in state negotiations with developers, as officials once committed to the energy sources delay final decisions on maintaining contracts.

5. Barren County, Kentucky – Remember the National Park fighting the solar farm? We may see a resolution to that conflict later this month.

6. Washington County, Arkansas – It seems that RES’ efforts to build a wind farm here are leading the county to face calls for a blanket moratorium.

7. Westchester County, New York – Yet another resort town in New York may be saying “no” to battery storage over fire risks.

Solar and wind projects are getting swept up in the blowback to data center construction, presenting a risk to renewable energy companies who are hoping to ride the rise of AI in an otherwise difficult moment for the industry.

The American data center boom is going to demand an enormous amount of electricity and renewables developers believe much of it will come from solar and wind. But while these types of energy generation may be more easily constructed than, say, a fossil power plant, it doesn’t necessarily mean a connection to a data center will make a renewable project more popular. Not to mention data centers in rural areas face complaints that overlap with prominent arguments against solar and wind – like noise and impacts to water and farmland – which is leading to unfavorable outcomes for renewable energy developers more broadly when a community turns against a data center.

“This is something that we’re just starting to see,” said Matthew Eisenson, a senior fellow with the Renewable Energy Legal Defense Initiative at the Columbia University Sabin Center for Climate Change Law. “It’s one thing for environmentalists to support wind and solar projects if the idea is that those projects will eventually replace coal power plants. But it’s another thing if those projects are purely being built to meet incremental demand from data centers.”

We’ve started to see evidence of this backlash in certain resort towns fearful of a new tech industry presence and the conflicts over transmission lines in Maryland. But it is most prominent in Virginia, ground zero for American hyperscaler data centers. As we’ve previously discussed in The Fight, rural Virginia is increasingly one of the hardest places to get approval for a solar farm in the U.S., and while there are many reasons the industry is facing issues there, a significant one is the state’s data center boom.

I spent weeks digging into the example of Mecklenburg County, where the local Board of Supervisors in May indefinitely banned new solar projects and is rejecting those that were in the middle of permitting when the decision came down. It’s also the site of a growing data center footprint. Microsoft, which already had a base of operations in the county’s town of Boydton, is in the process of building a giant data center hub with three buildings and an enormous amount of energy demand. It’s this sudden buildup of tech industry infrastructure that is by all appearances driving a backlash to renewable energy in the county, a place that already had a pre-existing high opposition risk in the Heatmap Pro database.

It’s not just data centers causing the ban in Mecklenburg, but it’s worth paying attention to how the fight over Big Tech and solar has overlapped in the county, where Sierra Club’s Virginia Chapter has worked locally to fight data center growth with a grassroots citizens group, Friends of the Meherrin River, that was a key supporter of the solar moratorium, too.

In a conversation with me this week, Tim Cywinski, communications director for the state’s Sierra Club chapter, told me municipal leaders like those in Mecklenburg are starting to group together renewables and data centers because, simply put, rural communities enter into conversations with these outsider business segments with a heavy dose of skepticism. This distrust can then be compounded when errors are made, such as when one utility-scale solar farm – Geenex’s Grasshopper project – apparently polluted a nearby creek after soil erosion issues during construction, a problem project operator Dominion Energy later acknowledged and has continued to be a pain point for renewables developers in the county.

“I don’t think the planning that has been presented to rural America has been adequate enough,” the Richmond-based advocate said. “Has solar kind of messed up in a lot of areas in rural America? Yeah, and that’s given those communities an excuse to roll them in with a lot of other bad stuff.”

Cywinski – who describes himself as “not your typical environmentalist” – says the data center space has done a worse job at community engagement than renewables developers in Virginia, and that the opposition against data center projects in places like Chesapeake and Fauquier is more intense, widespread, and popular than the opposition to renewables he’s seeing play out across the Commonwealth.

But, he added, he doesn’t believe the fight against data centers is “mutually exclusive” from conflicts over solar. “I’m not going to tout the gospel of solar while I’m trying to fight a data center for these people because it’s about listening to them, hearing their concerns, and then not telling them what to say but trying to help them elevate their perspective and their concerns,” Cywinski said.

As someone who spends a lot of time speaking with communities resisting solar and trying to best understand their concerns, I agree with Cywinksi: the conflict over data centers speaks to the heart of the rural vs. renewables divide, and it offers a warning shot to anyone thinking AI will help make solar and wind more popular.

The One Big Beautiful Bill Act is one signature away from becoming law and drastically changing the economics of renewables development in the U.S. That doesn’t mean decarbonization is over, experts told Heatmap, but it certainly doesn’t help.

What do we do now?

That’s the question people across the climate change and clean energy communities are asking themselves now that Congress has passed the One Big Beautiful Bill Act, which would slash most of the tax credits and subsidies for clean energy established under the Inflation Reduction Act.

Preliminary data from Princeton University’s REPEAT Project (led by Heatmap contributor Jesse Jenkins) forecasts that said bill will have a dramatic effect on the deployment of clean energy in the U.S., including reducing new solar and wind capacity additions by almost over 40 gigawatts over the next five years, and by about 300 gigawatts over the next 10. That would be enough to power 150 of Meta’s largest planned data centers by 2035.

But clean energy development will hardly grind to a halt. While much of the bill’s implementation is in question, the bill as written allows for several more years of tax credit eligibility for wind and solar projects and another year to qualify for them by starting construction. Nuclear, geothermal, and batteries can claim tax credits into the 2030s.

Shares in NextEra, which has one of the largest clean energy development businesses, have risen slightly this year and are down just 6% since the 2024 election. Shares in First Solar, the American solar manufacturer, are up substantially Thursday from a day prior and are about flat for the year, which may be a sign of investors’ belief that buyer demand for solar panels will persist — or optimism that the OBBBA’s punishing foreign entity of concern requirements will drive developers into the company’s arms.

Partisan reversals are hardly new to climate policy. The first Trump administration gleefully pulled the rug from under the Obama administration’s power plant emissions rules, and the second has been thorough so far in its assault on Biden’s attempt to replace them, along with tailpipe emissions standards and mileage standards for vehicles, and of course, the IRA.

Even so, there are ways the U.S. can reduce the volatility for businesses that are caught in the undertow. “Over the past 10 to 20 years, climate advocates have focused very heavily on D.C. as the driver of climate action and, to a lesser extent, California as a back-stop,” Hannah Safford, who was director for transportation and resilience in the Biden White House and is now associate director of climate and environment at the Federation of American Scientists, told Heatmap. “Pursuing a top down approach — some of that has worked, a lot of it hasn’t.”

In today’s environment, especially, where recognition of the need for action on climate change is so politically one-sided, it “makes sense for subnational, non-regulatory forces and market forces to drive progress,” Safford said. As an example, she pointed to the fall in emissions from the power sector since the late 2000s, despite no power plant emissions rule ever actually being in force.

“That tells you something about the capacity to deliver progress on outcomes you want,” she said.

Still, industry groups worry that after the wild swing between the 2022 IRA and the 2025 OBBBA, the U.S. has done permanent damage to its reputation as a business-friendly environment. Since continued swings at the federal level may be inevitable, building back that trust and creating certainty is “about finding ballasts,” Harry Godfrey, the managing director for Advanced Energy United’s federal priorities team, told Heatmap.

The first ballast groups like AEU will be looking to shore up is state policy. “States have to step up and take a leadership role,” he said, particularly in the areas that were gutted by Trump’s tax bill — residential energy efficiency and electrification, transportation and electric vehicles, and transmission.

State support could come in the form of tax credits, but that’s not the only tool that would create more certainty for businesses — considering the budget cuts states will face as a result of Trump’s tax bill, it also might not be an option. But a lot can be accomplished through legislative action, executive action, regulatory reform, and utility ratemaking, Godfrey said. He cited new virtual power plant pilot programs in Virginia and Colorado, which will require further regulatory work to “to get that market right.”

A lot of work can be done within states, as well, to make their deployment of clean energy more efficient and faster. Tyler Norris, a fellow at Duke University's Nicholas School of the Environment, pointed to Texas’ “connect and manage” model for connecting renewables to the grid, which allows projects to come online much more quickly than in the rest of the country. That’s because the state’s electricity market, ERCOT, does a much more limited study of what grid upgrades are needed to connect a project to the grid, and is generally more tolerant of curtailing generation (i.e. not letting power get to the grid at certain times) than other markets.

“As Texas continues to outpace other markets in generator and load interconnections, even in the absence of renewable tax credits, it seems increasingly plausible that developers and policymakers may conclude that deeper reform is needed to the non-ERCOT electricity markets,” Norris told Heatmap in an email.

At the federal level, there’s still a chance for, yes, bipartisan permitting reform, which could accelerate the buildout of all kinds of energy projects by shortening their development timelines and helping bring down costs, Xan Fishman, senior managing director of the energy program at the Bipartisan Policy Center, told Heatmap. “Whether you care about energy and costs and affordability and reliability or you care about emissions, the next priority should be permitting reform,” he said.

And Godfrey hasn’t given up on tax credits as a viable tool at the federal level, either. “If you told me in mid-November what this bill would look like today, while I’d still be like, Ugh, that hurts, and that hurts, and that hurts, I would say I would have expected more rollbacks. I would have expected deeper cuts,” he told Heatmap. Ultimately, many of the Inflation Reduction Act’s tax credits will stick around in some form, although we’ve yet to see how hard the new foreign sourcing requirements will hit prospective projects.

While many observers ruefully predicted that the letter-writing moderate Republicans in the House and Senate would fold and support whatever their respective majorities came up with — which they did, with the sole exception of Pennsylvania Republican Brian Fitzpatrick — the bill also evolved over time with input from those in the GOP who are not openly hostile to the clean energy industry.

“You are already seeing people take real risk on the Republican side pushing for clean energy,” Safford said, pointing to Alaska Republican Senator Lisa Murkowski, who opposed the new excise tax on wind and solar added to the Senate bill, which earned her vote after it was removed.

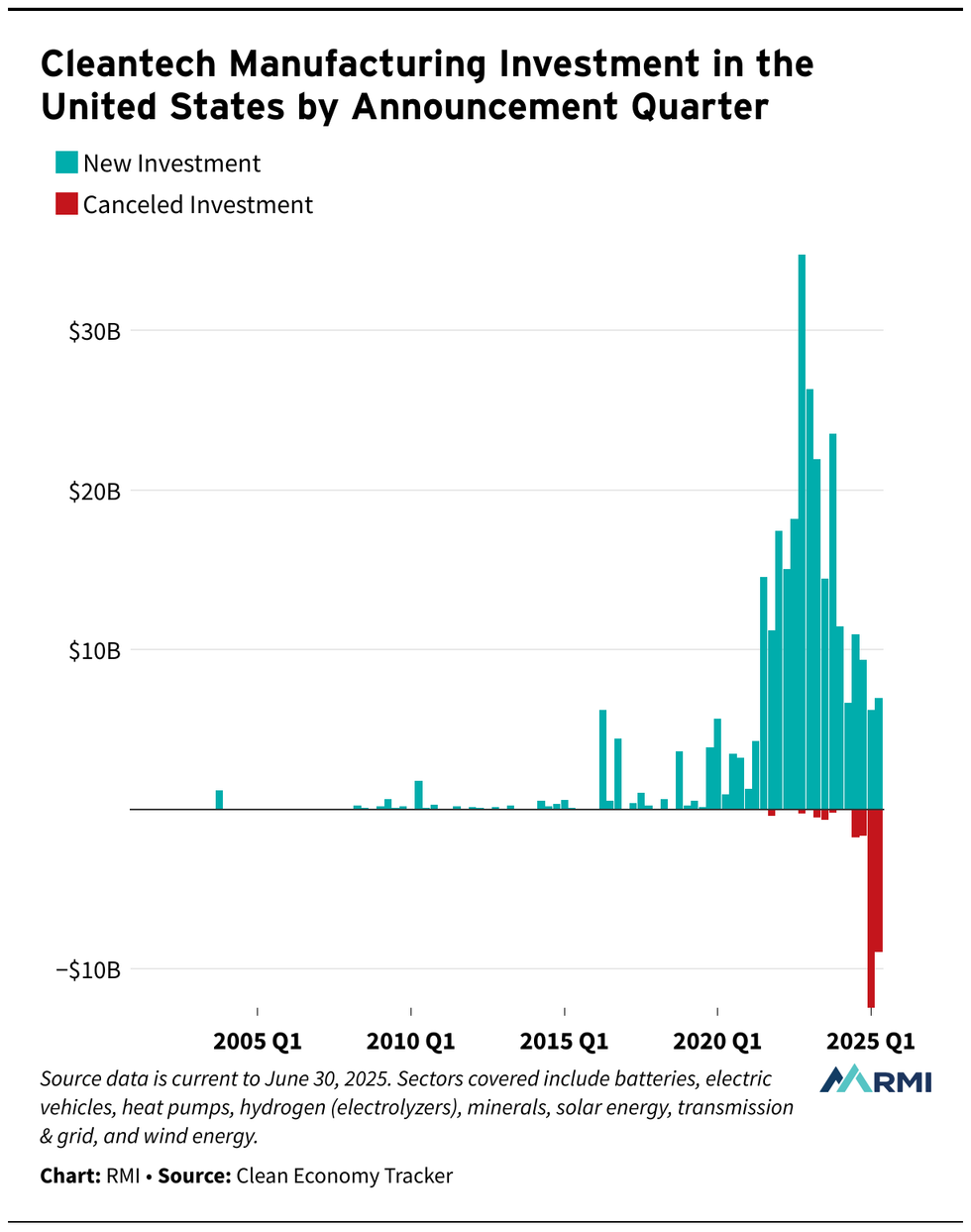

Some damage has already been done, however. Canceled clean energy investments adds up to $23 billion so far this year, compared to just $3 billion in all of 2024, according to the decarbonization think tank RMI. And that’s before OBBBA hits Trump’s desk.

The start-and-stop nature of the Inflation Reduction Act may lead some companies, states, local government and nonprofits to become leery of engaging with a big federal government climate policy again.

“People are going to be nervous about it for sure,” Safford said. “The climate policy of the future has to be polycentric. Even if you have the political opportunity to make a big swing again, people will be pretty gun shy. You will need to pursue a polycentric approach.”

But to Godfrey, all the back and forth over the tax credits, plus the fact that Republicans stood up to defend them in the 11th hour, indicates that there is a broader bipartisan consensus emerging around using them as a tool for certain energy and domestic manufacturing goals. A future administration should think about refinements that will create more enduring policy but not set out in a totally new direction, he said.

Albert Gore, the executive director of the Zero Emissions Transportation Association, was similarly optimistic that tax credits or similar incentives could work again in the future — especially as more people gain experience with electric vehicles, batteries, and other advanced clean energy technologies in their daily lives. “The question is, how do you generate sufficient political will to implement that and defend it?” he told Heatmap. “And that depends on how big of an economic impact does it have, and what does it mean to the American people?”

Ultimately, Fishman said, the subsidy on-off switch is the risk that comes with doing major policy on a strictly partisan basis.

“There was a lot of value in these 10-year timelines [for tax credits in the IRA] in terms of business certainty, instead of one- or two- year extensions,” Fishman told Heatmap. “The downside that came with that is that it became affiliated with one party. It was seen as a partisan effort, and it took something that was bipartisan and put a partisan sheen on it.”

The fight for tax credits may also not be over yet. Before passage of the IRA, tax credits for wind and solar were often extended in a herky-jerky bipartisan fashion, where Democrats who supported clean energy in general and Republicans who supported it in their districts could team up to extend them.

“You can see a world where we have more action on clean energy tax credits to enhance, extend and expand them in a future congress,” Fishman told Heatmap. “The starting point for Republican leadership, it seemed, was completely eliminating the tax credits in this bill. That’s not what they ended up doing.”