You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

Inside Climeworks’ big experiment to wrest carbon from the air

In the spring of 2021, the world’s leading authority on energy published a “roadmap” for preventing the most catastrophic climate change scenarios. One of its conclusions was particularly daunting. Getting energy-related emissions down to net zero by 2050, the International Energy Agency said, would require “huge leaps in innovation.”

Existing technologies would be mostly sufficient to carry us down the carbon curve over the next decade. But after that, nearly half of the remaining work would have to come from solutions that, for all intents and purposes, did not exist yet. Some would only require retooling existing industries, like developing electric long-haul trucks and carbon-free steel. But others would have to be built from almost nothing and brought to market in record time.

What will it take to rapidly develop new solutions, especially those that involve costly physical infrastructure and which have essentially no commercial value today?

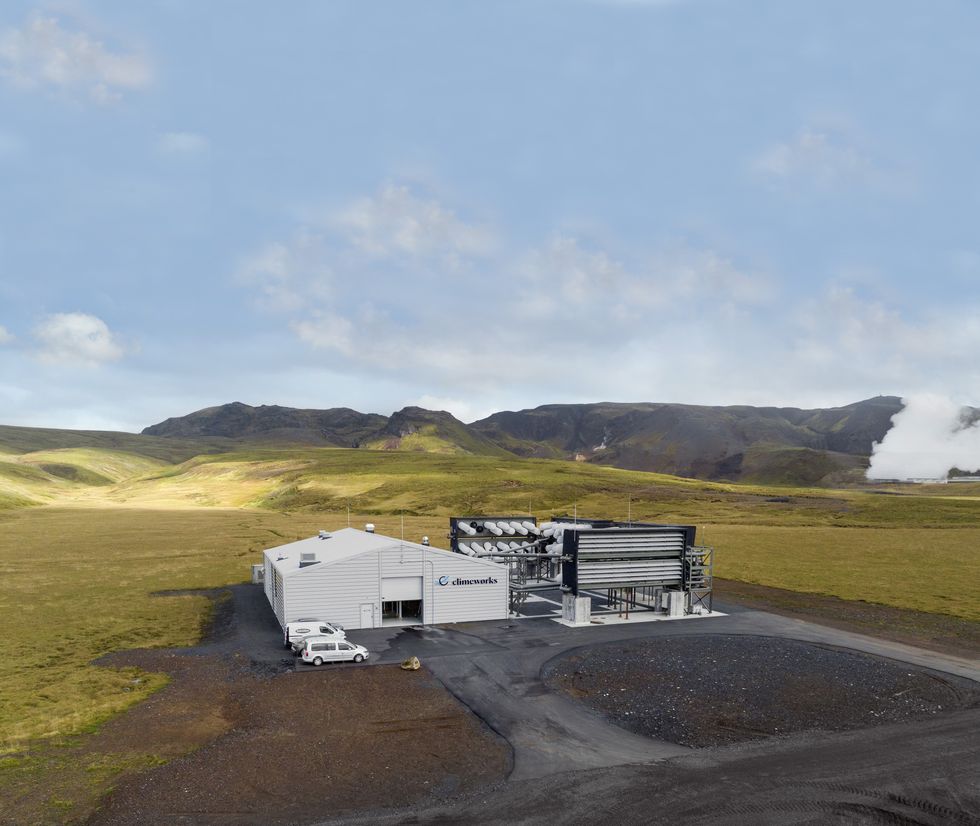

That’s the challenge facing Climeworks, the Swiss company developing machines to wrest carbon dioxide molecules directly from the air. In September 2021, a few months after the IEA’s landmark report came out, Climeworks switched on its first commercial-scale “direct air capture” facility, a feat of engineering it dubbed “Orca,” in Iceland.

The technology behind Orca is one of the top candidates to clean up the carbon already blanketing the Earth. It could also be used to balance out any stubborn, residual sources of greenhouse gases in the future, such as from agriculture or air travel, providing the “net” in net-zero. If we manage to scale up technologies like Orca to the point where we remove more carbon than we release, we could even begin cooling the planet.

As the largest carbon removal plant operating in the world, Orca is either trivial or one of the most important climate projects built in the last decade, depending on how you look at it. It was designed to capture approximately 4,000 metric tons of carbon from the air per year, which, as one climate scientist, David Ho, put it, is the equivalent of rolling back the clock on just 3 seconds of global emissions. But the learnings gleaned from Orca could surpass any quantitative assessment of its impact. How well do these “direct air capture” machines work in the real world? How much does it really cost to run them? And can they get better?

The company — and its funders — are betting they can. Climeworks has made major deals with banks, insurers, and other companies trying to go green to eventually remove carbon from the atmosphere on their behalf. Last year, the company raised $650 million in equity that will “unlock the next phase of its growth,” scaling the technology “up to multi-million-ton capacity … as carbon removal becomes a trillion-dollar market.” And just last month, the U.S. Department of Energy selected Climeworks, along with another carbon removal company, Heirloom, to receive up to $600 million to build a direct air capture “hub” in Louisiana, with the goal of removing one million tons of carbon annually.

Two years after powering up Orca, Climeworks has yet to reveal how effective the technology has proven to be. But in extensive interviews, top executives painted a picture of innovation in progress.

Chief marketing officer Julie Gosalvez told me that Orca is small and climatically insignificant on purpose. The goal is not to make a dent in climate change — yet — but to maximize learning at minimal cost. “You want to learn when you're small, right?” Gosalvez said. “It’s really de-risking the technology. It’s not like Tesla doing EVs when we have been building cars for 70 years and the margin of learning and risk is much smaller. It’s completely new.”

From the ground, Orca looks sort of like a warehouse or a server farm with a massive air conditioning system out back. The plant consists of eight shipping container-sized boxes arranged in a U-shape around a central building, each one equipped with an array of fans. When the plant is running, which is more or less all the time, the fans suck air into the containers where it makes contact with a porous filter known as a “sorbent” which attracts CO2 molecules.

When the filters become totally saturated with CO2, the vents on the containers snap shut, and the containers are heated to more than 212 degrees Fahrenheit. This releases the CO2, which is then delivered through a pipe to a secondary process called “liquefaction,” where it is compressed into a liquid. Finally, the liquid CO2 is piped into basalt rock formations underground, where it slowly mineralizes into stone. The process requires a little bit of electricity and a lot of heat, all of which comes from a carbon-free source — a geothermal power plant nearby.

A day at Orca begins with the morning huddle. The total number on the team is often in flux, but it typically has a staff of about 15 people, Climeworks’ head of operations Benjamin Keusch told me. Ten work in a virtual control room 1,600 miles away in Zurich, taking turns monitoring the plant on a laptop and managing its operations remotely. The remainder work on site, taking orders from the control room, repairing equipment, and helping to run tests.

During the huddle, the team discusses any maintenance that needs to be done. If there’s an issue, the control room will shut down part of the plant while the on-site workers investigate. So far, they’ve dealt with snow piling up around the plant that had to be shoveled, broken and corroded equipment that had to be replaced, and sediment build-up that had to be removed.

The air is more humid and sulfurous at the site in Iceland than in Switzerland, where Climeworks had built an earlier, smaller-scale model, so the team is also learning how to optimize the technology for different weather. Within all this troubleshooting, there’s additional trade-offs to explore and lessons to learn. If a part keeps breaking, does it make more sense to plan to replace it periodically, or to redesign it? How do supply chain constraints play into that calculus?

The company is also performing tests regularly, said Keusch. For example, the team has tested new component designs at Orca that it now plans to incorporate into Climeworks’ next project from the start. (Last year, the company began construction on “Mammoth,” a new plant that will be nine times larger than Orca, on a neighboring site.) At a summit that Climeworks hosted in June, co-founder Jan Wurzbacher said the company believes that over the next decade, it will be able to make its direct air capture system twice as small and cut its energy consumption in half.

“In innovation lingo, the jargon is we haven’t converged on a dominant design,” Gregory Nemet, a professor at the University of Wisconsin who studies technological development, told me. For example, in the wind industry, turbines with three blades, upwind design, and a horizontal axis, are now standard. “There were lots of other experiments before that convergence happened in the late 1980s,” he said. “So that’s kind of where we are with direct air capture. There’s lots of different ways that are being tried right now, even within a company like Climeworks."

Although Climeworks was willing to tell me about the goings-on at Orca over the last two years, the company declined to share how much carbon it has captured or how much energy, on average, the process has used.

Gosalvez told me that the plant’s performance has improved month after month, and that more detailed information was shared with investors. But she was hesitant to make the data public, concerned that it could be misinterpreted, because tests and maintenance at Orca require the plant to shut down regularly.

“Expectations are not in line with the stage of the technology development we are at. People expect this to be turnkey,” she said. “What does success look like? Is it the absolute numbers, or the learnings and ability to scale?”

Danny Cullenward, a climate economist and consultant who has studied the integrity of various carbon removal methods, did not find the company’s reluctance to share data especially concerning. “For these earliest demonstration facilities, you might expect people to hit roadblocks or to have to shut the plant down for a couple of weeks, or do all sorts of things that are going to make it hard to transparently report the efficiency of your process, the number of tons you’re getting at different times,” he told me.

But he acknowledged that there was an inherent tension to the stance, because ultimately, Climeworks’ business model — and the technology’s effectiveness as a climate solution — depend entirely on the ability to make precise, transparent, carbon accounting claims.

Nemet was also of two minds about it. Carbon removal needs to go from almost nothing today to something like a billion tons of carbon removed per year in just three decades, he said. That’s a pace on the upper end of what’s been observed historically with other technologies, like solar panels. So it’s important to understand whether Climeworks’ tech has any chance of meeting the moment. Especially since the company faces competition from a number of others developing direct air capture technologies, like Heirloom and Occidental Petroleum, that may be able to do it cheaper, or faster.

However, Nemet was also sympathetic to the position the company was in. “It’s relatively incremental how these technologies develop,” he said. “I have heard this criticism that this is not a real technology because we haven’t built it at scale, so we shouldn’t depend on it. Or that one of these plants not doing the removal that it said it would do shows that it doesn’t work and that we therefore shouldn’t plan on having it available. To me, that’s a pretty high bar to cross with a climate mitigation technology that could be really useful.”

More data on Orca is coming. Climeworks recently announced that it will work with the company Puro.Earth to certify every ton of CO2 that it removes from the atmosphere and stores underground, in order to sell carbon credits based on this service. The credits will be listed on a public registry.

But even if Orca eventually runs at full capacity, Climeworks will never be able to sell 4,000 carbon credits per year from the plant. Gosalvez clarified that 4,000 tons is the amount of carbon the plant is designed to suck up annually, but the more important number is the amount of “net” carbon removal it can produce. “That might be the first bit of education you need to get out there,” she said, “because it really invites everyone to look at what are the key drivers to be paid attention to.”

She walked me through a chart that illustrated the various ways in which some of Orca’s potential to remove carbon can be lost. First, there’s the question of availability — how often does the plant have to shut down due to maintenance or power shortages? Climeworks aims to limit those losses to 10%. Next, there’s the recovery stage, where the CO2 is separated from the sorbent, purified, and liquified. Gosalvez said it’s basically impossible to do this without losing some CO2. At best, the company hopes to limit that to 5%.

Finally, the company also takes into account “gray emissions,” or the carbon footprint associated with the business, like the materials, the construction, and the eventual decommissioning of the plant and restoration of the site to its former state. If one of Climeworks’ plants ever uses energy from fossil fuels (which the company has said it does not plan to do) it would incorporate any emissions from that energy. Climeworks aims to limit gray emissions to 15%.

In the end, Orca’s net annual carbon removal capacity — the amount Climeworks can sell to customers — is really closer to 3,000 tons. Gosalvez hopes other carbon removal companies adopt the same approach. “Ultimately what counts is your net impact on the planet and the atmosphere,” she said.

Get one great climate story in your inbox every day:

Despite being a first-of-its-kind demonstration plant — and an active research site — Orca is also a commercial project. In fact, Gosalvez told me that Orca’s entire estimated capacity for carbon removal, over the 12 years that the plant is expected to run, sold out shortly after it began operating. The company is now selling carbon removal services from its yet-to-be-built Mammoth plant.

In January, Climeworks announced that Orca had officially fulfilled orders from Microsoft, Stripe, and Shopify. Those companies have collectively asked Climeworks to remove more than 16,000 tons of carbon, according to the deal-tracking site cdr.fyi, but it’s unclear what portion of that was delivered. The achievement was verified by a third party, but the total amount removed was not made public.

Climeworks has also not disclosed how much it has charged companies per ton of carbon, a metric that will eventually be an important indicator of whether the technology can scale to a climate-relevant level. But it has provided rough estimates of how much it expects each ton of carbon removal to cost as the technology scales — expectations which seem to have shifted after two years of operating Orca.

In 2021, Climeworks co-founder Jan Wurzbacher said the company aimed to get the cost down to $200 to $300 per ton removed by the end of the decade, with steeper declines in subsequent years. But at the summit in June, he presented a new cost curve chart showing that the price was currently more than $1,000, and that by the end of the decade, it would fall to somewhere between $400 to $700. The range was so large because the cost of labor, energy, and storing the CO2 varied widely by location, he said. The company aims to get the price down to $100 to $300 per ton by 2050, when the technology has significantly matured.

Critics of carbon removal technologies often point to the vast sums flowing into direct air capture tech like Orca, which are unlikely to make a meaningful difference in climate change for decades to come. During a time when worsening disasters make action feel increasingly urgent, many are skeptical of the value of investing limited funds and political energy into these future solutions. Carbon removal won’t make much of a difference if the world doesn’t deploy the tools already available to reduce emissions as rapidly as possible — and there’s certainly not enough money or effort going into that yet.

But we’ll never have the option to fully halt climate change, let alone begin reversing it, if we don’t develop solutions like Orca. In September, the International Energy Agency released an update to its seminal net-zero report. The new analysis said that in the last two years, the world had, in fact, made significant progress on innovation. Now, some 65% of emission reductions after 2030 could be accounted for with technologies that had reached market uptake. It even included a line about the launch of Orca, noting that Climeworks’ direct air capture technology had moved from the prototype to the demonstration stage.

But it cautioned that DAC needs “to be scaled up dramatically to play the role envisaged,” in the net zero scenario. Climeworks’ experience with Orca offers a glimpse of how much work is yet to be done.

Read more about carbon removal:

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

And more on the week’s biggest conflicts around renewable energy projects.

1. Jackson County, Kansas – A judge has rejected a Hail Mary lawsuit to kill a single solar farm over it benefiting from the Inflation Reduction Act, siding with arguments from a somewhat unexpected source — the Trump administration’s Justice Department — which argued that projects qualifying for tax credits do not require federal environmental reviews.

2. Portage County, Wisconsin – The largest solar project in the Badger State is now one step closer to construction after settling with environmentalists concerned about impacts to the Greater Prairie Chicken, an imperiled bird species beloved in wildlife conservation circles.

3. Imperial County, California – The board of directors for the agriculture-saturated Imperial Irrigation District in southern California has approved a resolution opposing solar projects on farmland.

4. New England – Offshore wind opponents are starting to win big in state negotiations with developers, as officials once committed to the energy sources delay final decisions on maintaining contracts.

5. Barren County, Kentucky – Remember the National Park fighting the solar farm? We may see a resolution to that conflict later this month.

6. Washington County, Arkansas – It seems that RES’ efforts to build a wind farm here are leading the county to face calls for a blanket moratorium.

7. Westchester County, New York – Yet another resort town in New York may be saying “no” to battery storage over fire risks.

Solar and wind projects are getting swept up in the blowback to data center construction, presenting a risk to renewable energy companies who are hoping to ride the rise of AI in an otherwise difficult moment for the industry.

The American data center boom is going to demand an enormous amount of electricity and renewables developers believe much of it will come from solar and wind. But while these types of energy generation may be more easily constructed than, say, a fossil power plant, it doesn’t necessarily mean a connection to a data center will make a renewable project more popular. Not to mention data centers in rural areas face complaints that overlap with prominent arguments against solar and wind – like noise and impacts to water and farmland – which is leading to unfavorable outcomes for renewable energy developers more broadly when a community turns against a data center.

“This is something that we’re just starting to see,” said Matthew Eisenson, a senior fellow with the Renewable Energy Legal Defense Initiative at the Columbia University Sabin Center for Climate Change Law. “It’s one thing for environmentalists to support wind and solar projects if the idea is that those projects will eventually replace coal power plants. But it’s another thing if those projects are purely being built to meet incremental demand from data centers.”

We’ve started to see evidence of this backlash in certain resort towns fearful of a new tech industry presence and the conflicts over transmission lines in Maryland. But it is most prominent in Virginia, ground zero for American hyperscaler data centers. As we’ve previously discussed in The Fight, rural Virginia is increasingly one of the hardest places to get approval for a solar farm in the U.S., and while there are many reasons the industry is facing issues there, a significant one is the state’s data center boom.

I spent weeks digging into the example of Mecklenburg County, where the local Board of Supervisors in May indefinitely banned new solar projects and is rejecting those that were in the middle of permitting when the decision came down. It’s also the site of a growing data center footprint. Microsoft, which already had a base of operations in the county’s town of Boydton, is in the process of building a giant data center hub with three buildings and an enormous amount of energy demand. It’s this sudden buildup of tech industry infrastructure that is by all appearances driving a backlash to renewable energy in the county, a place that already had a pre-existing high opposition risk in the Heatmap Pro database.

It’s not just data centers causing the ban in Mecklenburg, but it’s worth paying attention to how the fight over Big Tech and solar has overlapped in the county, where Sierra Club’s Virginia Chapter has worked locally to fight data center growth with a grassroots citizens group, Friends of the Meherrin River, that was a key supporter of the solar moratorium, too.

In a conversation with me this week, Tim Cywinski, communications director for the state’s Sierra Club chapter, told me municipal leaders like those in Mecklenburg are starting to group together renewables and data centers because, simply put, rural communities enter into conversations with these outsider business segments with a heavy dose of skepticism. This distrust can then be compounded when errors are made, such as when one utility-scale solar farm – Geenex’s Grasshopper project – apparently polluted a nearby creek after soil erosion issues during construction, a problem project operator Dominion Energy later acknowledged and has continued to be a pain point for renewables developers in the county.

“I don’t think the planning that has been presented to rural America has been adequate enough,” the Richmond-based advocate said. “Has solar kind of messed up in a lot of areas in rural America? Yeah, and that’s given those communities an excuse to roll them in with a lot of other bad stuff.”

Cywinski – who describes himself as “not your typical environmentalist” – says the data center space has done a worse job at community engagement than renewables developers in Virginia, and that the opposition against data center projects in places like Chesapeake and Fauquier is more intense, widespread, and popular than the opposition to renewables he’s seeing play out across the Commonwealth.

But, he added, he doesn’t believe the fight against data centers is “mutually exclusive” from conflicts over solar. “I’m not going to tout the gospel of solar while I’m trying to fight a data center for these people because it’s about listening to them, hearing their concerns, and then not telling them what to say but trying to help them elevate their perspective and their concerns,” Cywinski said.

As someone who spends a lot of time speaking with communities resisting solar and trying to best understand their concerns, I agree with Cywinksi: the conflict over data centers speaks to the heart of the rural vs. renewables divide, and it offers a warning shot to anyone thinking AI will help make solar and wind more popular.

The One Big Beautiful Bill Act is one signature away from becoming law and drastically changing the economics of renewables development in the U.S. That doesn’t mean decarbonization is over, experts told Heatmap, but it certainly doesn’t help.

What do we do now?

That’s the question people across the climate change and clean energy communities are asking themselves now that Congress has passed the One Big Beautiful Bill Act, which would slash most of the tax credits and subsidies for clean energy established under the Inflation Reduction Act.

Preliminary data from Princeton University’s REPEAT Project (led by Heatmap contributor Jesse Jenkins) forecasts that said bill will have a dramatic effect on the deployment of clean energy in the U.S., including reducing new solar and wind capacity additions by almost over 40 gigawatts over the next five years, and by about 300 gigawatts over the next 10. That would be enough to power 150 of Meta’s largest planned data centers by 2035.

But clean energy development will hardly grind to a halt. While much of the bill’s implementation is in question, the bill as written allows for several more years of tax credit eligibility for wind and solar projects and another year to qualify for them by starting construction. Nuclear, geothermal, and batteries can claim tax credits into the 2030s.

Shares in NextEra, which has one of the largest clean energy development businesses, have risen slightly this year and are down just 6% since the 2024 election. Shares in First Solar, the American solar manufacturer, are up substantially Thursday from a day prior and are about flat for the year, which may be a sign of investors’ belief that buyer demand for solar panels will persist — or optimism that the OBBBA’s punishing foreign entity of concern requirements will drive developers into the company’s arms.

Partisan reversals are hardly new to climate policy. The first Trump administration gleefully pulled the rug from under the Obama administration’s power plant emissions rules, and the second has been thorough so far in its assault on Biden’s attempt to replace them, along with tailpipe emissions standards and mileage standards for vehicles, and of course, the IRA.

Even so, there are ways the U.S. can reduce the volatility for businesses that are caught in the undertow. “Over the past 10 to 20 years, climate advocates have focused very heavily on D.C. as the driver of climate action and, to a lesser extent, California as a back-stop,” Hannah Safford, who was director for transportation and resilience in the Biden White House and is now associate director of climate and environment at the Federation of American Scientists, told Heatmap. “Pursuing a top down approach — some of that has worked, a lot of it hasn’t.”

In today’s environment, especially, where recognition of the need for action on climate change is so politically one-sided, it “makes sense for subnational, non-regulatory forces and market forces to drive progress,” Safford said. As an example, she pointed to the fall in emissions from the power sector since the late 2000s, despite no power plant emissions rule ever actually being in force.

“That tells you something about the capacity to deliver progress on outcomes you want,” she said.

Still, industry groups worry that after the wild swing between the 2022 IRA and the 2025 OBBA, the U.S. has done permanent damage to its reputation as a business-friendly environment. Since continued swings at the federal level may be inevitable, building back that trust and creating certainty is “about finding ballasts,” Harry Godfrey, the managing director for Advanced Energy United’s federal priorities team, told Heatmap.

The first ballast groups like AEU will be looking to shore up is state policy. “States have to step up and take a leadership role,” he said, particularly in the areas that were gutted by Trump’s tax bill — residential energy efficiency and electrification, transportation and electric vehicles, and transmission.

State support could come in the form of tax credits, but that’s not the only tool that would create more certainty for businesses — considering the budget cuts states will face as a result of Trump’s tax bill, it also might not be an option. But a lot can be accomplished through legislative action, executive action, regulatory reform, and utility ratemaking, Godfrey said. He cited new virtual power plant pilot programs in Virginia and Colorado, which will require further regulatory work to “to get that market right.”

A lot of work can be done within states, as well, to make their deployment of clean energy more efficient and faster. Tyler Norris, a fellow at Duke University's Nicholas School of the Environment, pointed to Texas’ “connect and manage” model for connecting renewables to the grid, which allows projects to come online much more quickly than in the rest of the country. That’s because the state’s electricity market, ERCOT, does a much more limited study of what grid upgrades are needed to connect a project to the grid, and is generally more tolerant of curtailing generation (i.e. not letting power get to the grid at certain times) than other markets.

“As Texas continues to outpace other markets in generator and load interconnections, even in the absence of renewable tax credits, it seems increasingly plausible that developers and policymakers may conclude that deeper reform is needed to the non-ERCOT electricity markets,” Norris told Heatmap in an email.

At the federal level, there’s still a chance for, yes, bipartisan permitting reform, which could accelerate the buildout of all kinds of energy projects by shortening their development timelines and helping bring down costs, Xan Fishman, senior managing director of the energy program at the Bipartisan Policy Center, told Heatmap. “Whether you care about energy and costs and affordability and reliability or you care about emissions, the next priority should be permitting reform,” he said.

And Godfrey hasn’t given up on tax credits as a viable tool at the federal level, either. “If you told me in mid-November what this bill would look like today, while I’d still be like, Ugh, that hurts, and that hurts, and that hurts, I would say I would have expected more rollbacks. I would have expected deeper cuts,” he told Heatmap. Ultimately, many of the Inflation Reduction Act’s tax credits will stick around in some form, although we’ve yet to see how hard the new foreign sourcing requirements will hit prospective projects.

While many observers ruefully predicted that the letter-writing moderate Republicans in the House and Senate would fold and support whatever their respective majorities came up with — which they did, with the sole exception of Pennsylvania Republican Brian Fitzpatrick — the bill also evolved over time with input from those in the GOP who are not openly hostile to the clean energy industry.

“You are already seeing people take real risk on the Republican side pushing for clean energy,” Safford said, pointing to Alaska Republican Senator Lisa Murkowski, who opposed the new excise tax on wind and solar added to the Senate bill, which earned her vote after it was removed.

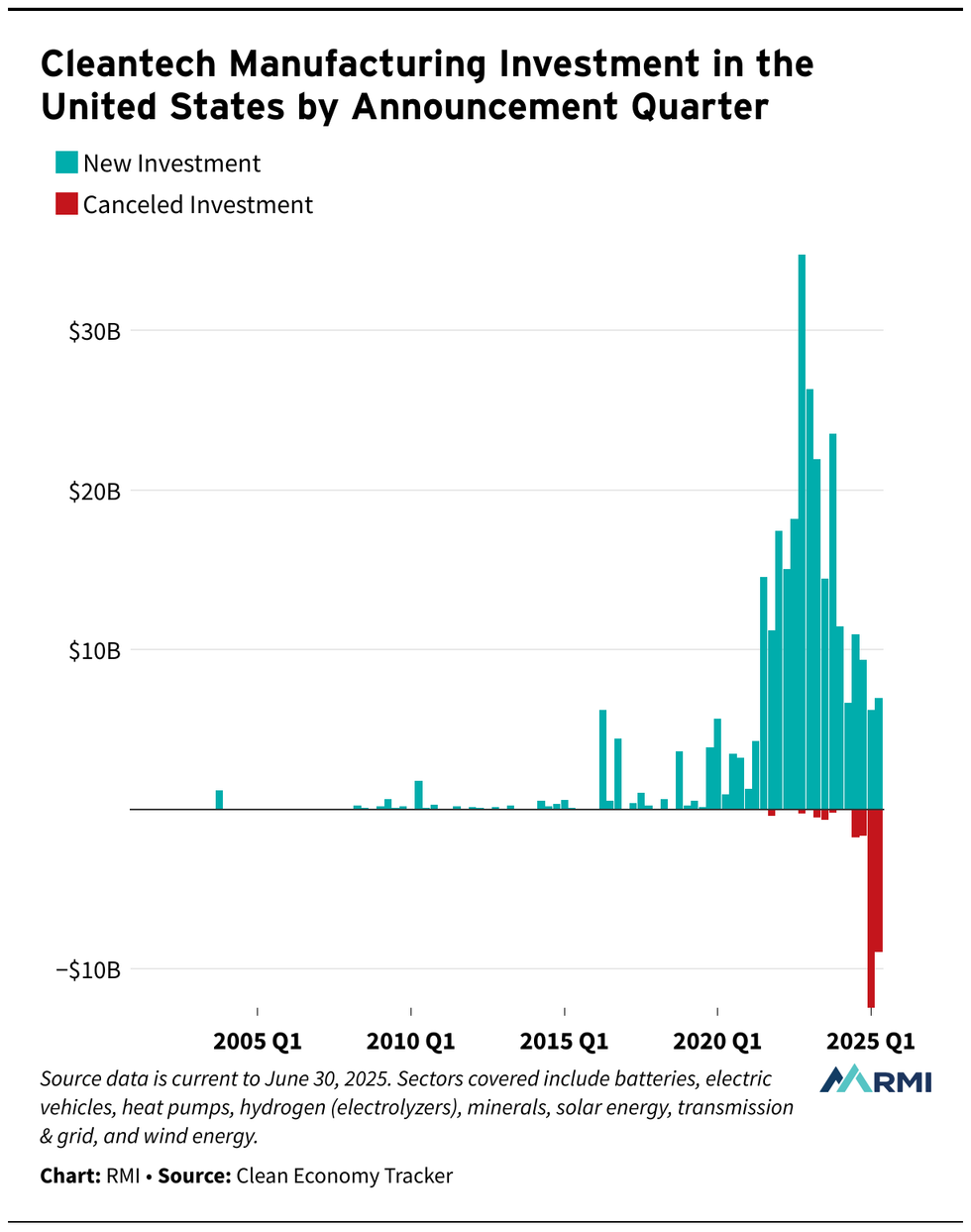

Some damage has already been done, however. Canceled clean energy investments adds up to $23 billion so far this year, compared to just $3 billion in all of 2024, according to the decarbonization think tank RMI. And that’s before OBBBA hits Trump’s desk.

The start-and-stop nature of the Inflation Reduction Act may lead some companies, states, local government and nonprofits to become leery of engaging with a big federal government climate policy again.

“People are going to be nervous about it for sure,” Safford said. “The climate policy of the future has to be polycentric. Even if you have the political opportunity to make a big swing again, people will be pretty gun shy. You will need to pursue a polycentric approach.”

But to Godfrey, all the back and forth over the tax credits, plus the fact that Republicans stood up to defend them in the 11th hour, indicates that there is a broader bipartisan consensus emerging around using them as a tool for certain energy and domestic manufacturing goals. A future administration should think about refinements that will create more enduring policy but not set out in a totally new direction, he said.

Albert Gore, the executive director of the Zero Emissions Transportation Association, was similarly optimistic that tax credits or similar incentives could work again in the future — especially as more people gain experience with electric vehicles, batteries, and other advanced clean energy technologies in their daily lives. “The question is, how do you generate sufficient political will to implement that and defend it?” he told Heatmap. “And that depends on how big of an economic impact does it have, and what does it mean to the American people?”

Ultimately, Fishman said, the subsidy on-off switch is the risk that comes with doing major policy on a strictly partisan basis.

“There was a lot of value in these 10-year timelines [for tax credits in the IRA] in terms of business certainty, instead of one- or two- year extensions,” Fishman told Heatmap. “The downside that came with that is that it became affiliated with one party. It was seen as a partisan effort, and it took something that was bipartisan and put a partisan sheen on it.”

The fight for tax credits may also not be over yet. Before passage of the IRA, tax credits for wind and solar were often extended in a herky-jerky bipartisan fashion, where Democrats who supported clean energy in general and Republicans who supported it in their districts could team up to extend them.

“You can see a world where we have more action on clean energy tax credits to enhance, extend and expand them in a future congress,” Fishman told Heatmap. “The starting point for Republican leadership, it seemed, was completely eliminating the tax credits in this bill. That’s not what they ended up doing.”