You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

A practical guide to using the climate law to get cheaper solar panels, heat pumps, and more.

Today marks the one year anniversary of the Inflation Reduction Act, the biggest investment in tackling climate change the United States has ever made. The law consists of dozens of subsidies to help individuals, households, and businesses adopt clean energy technologies. Many of these solutions will also help people save money on their energy bills, reduce pollution, and improve their resilience to disasters.

But understanding how much funding is available for what, and how to get it, can be pretty confusing. Many Americans are not even aware that these programs exist. A poll conducted by The Washington Post and the University of Maryland in late July found that about 66% of Americans say they have heard “little” or “nothing at all” about the law’s incentives for installing rooftop solar panels, and 77% have heard little or nothing about subsidies for heat pumps. This tracks similar polling that Heatmap conducted last winter, suggesting not much has changed since then.

Below is Heatmap’s guide to the IRA’s incentives for cutting your carbon footprint at home. If you haven’t heard much about how the IRA can help you decarbonize your life, this guide is for you. If you have heard about the available subsidies, but aren’t sure how much they are worth or where to begin, I’ll walk you through it. (And if you’re looking for information about the electric vehicle tax credit, my colleague at Heatmap Robinson Meyer has you covered with this buyer’s guide.)

Get one great climate story in your inbox every day:

There’s funding for almost every solution you can think of to make your home more energy efficient and reduce your fossil fuel use, whether you want to install solar panels, insulate your attic, replace your windows, or buy electric appliances. If you need new wiring or an electrical panel upgrade before you can get heat pumps or solar panels, there’s some money available for that, too.

The IRA created two types of incentives for home energy efficiency improvements: Unlimited tax credits that will lower the amount you owe when you file your taxes, and $8.8 billion in rebates that function as up-front discounts or post-installation refunds on equipment and services.

The tax credits are available now, but the rebates are not. The latter will be administered by states, which must apply for funding and create programs before the money can go out. The Biden administration began accepting applications at the end of July and expects states to begin rolling out their programs later this year or early next.

The home tax credits are available to everyone that owes taxes. The rebates, however, will have income restrictions (more on this later).

“The Inflation Reduction Act is not a limited time offer,” according to Ari Matusiak, the CEO of the nonprofit advocacy group Rewiring America. The rebate programs will only be available until the money runs out, but, again, none of them have started yet. Meanwhile, there’s no limit on how many people can claim the tax credits, and they’ll be available for at least the next decade. That means you don’t need to rush and replace your hot water heater if you have one that works fine. But when it does break down, you’ll have help paying for a replacement.

You might want to hold off on buying new appliances or getting insulation — basically any improvements inside your house. There are tax credits available for a lot of this stuff right now, but you’ll likely be able to stack them with rebates in the future.

However, if you’re thinking of installing solar panels on your roof or getting a backup battery system, there’s no need to wait. The rebates will not cover those technologies.

A few other caveats: There’s a good chance your state, city, or utility already offers rebates or other incentives for many of these solutions. Check with your state’s energy office or your utility to find out what’s available. Also, it can take months to get quotes and line up contractors to get this kind of work done. If you want to be ready when the rebates hit, it’s probably a good idea to do some of the legwork now.

If you do nothing else this year, consider getting a professional home energy audit. This will cost several hundred dollars, depending on where you live, but you’ll be able to get 30% off or up to $150 back under the IRA’s home improvement tax credit. Doing an audit will help you figure out which solutions will give you the biggest bang for your buck, and how to prioritize them once more funding becomes available. The auditor might even be able to explain all of the existing local rebate programs you’re eligible for.

The Internal Revenue Service will allow you to work with any home energy auditor until the end of this year, but beginning in 2024, you must hire an auditor with specific qualifications in order to claim the credit.

Let’s start with what’s inside your home. In addition to an energy audit, the Energy Efficiency Home Improvement Credit offers consumers 30% off the cost (after any other subsidies, and excluding labor) of Energy Star-rated windows and doors, insulation, and air sealing.

There’s a maximum amount you can claim for each type of equipment each year:

$600 for windows

$500 for doors

$1,200 for air sealing and insulation

The Energy Efficiency Home Improvement Credit also covers heat pumps, heat pump water heaters, and electrical panel upgrades, including the cost of installation for those systems. You can get:

$2,000 for heat pumps

$600 for a new electrical panel

Yes, homeowners can only claim up to $3,200 per year under this program until 2032.

Also, one downside to the Energy Efficiency Home Improvement Credit is that it does not carry over. If you spend enough on efficiency to qualify for the full $3,200 in a given year, but you only owe the federal government $2,000 for the year, your bill will go to zero and you will miss out on the remaining $1,200 credit. So it could be worth your while to spread the work out.

The other big consumer-oriented tax credit, the Residential Clean Energy Credit, offers homeowners 30% off the cost of solar panels and solar water heaters. It also covers battery systems, which store energy from the grid or from your solar panels that you can use when there’s a blackout, or sell back to your utility when the grid needs more power.

The subsidy has no limits, so if you spend $35,000 on solar panels and battery storage, including labor, you’ll be eligible for the full 30% refund, or $10,500. The credit can also be rolled over, so if your tax liability that year is only $5,000, you’ll be able to claim more of it the following year, and continue doing so until you’ve received the full value.

Geothermal heating systems are also covered under this credit. (Geothermal heat pumps work similarly to regular heat pumps, but they use the ground as a source and sink for heat, rather than the ambient air.)

Here’s what we know right now. The IRA funded two rebate programs. One, known as the Home Energy Performance-Based Whole House Rebates, will provide discounts to homeowners and landlords based on the amount of energy a home upgrade is predicted to save.

Congress did not specify which energy-saving measures qualify — that’s something state energy offices will decide when they design their programs. But it did cap the total amount each household could receive, based on income. For example, if your household earns under 80% of the area median income, and you make improvements that cut your energy use by 35%, you’ll be eligible for up to $8,000. If your household earns more than that, you can get up to $4,000.

There’s also the High-Efficiency Electric Home Rebate Program, which will provide discounts on specific electric appliances like heat pumps, an induction stove, and an electric clothes dryer, as well as a new electrical panel and wiring. Individual households can get up to $14,000 in discounts under this program, although there are caps on how much is available for each piece of equipment. This money will only be available to low- and moderate-income households, or those earning under 150% of the area median income.

Renters with a household income below 150% of the area median income qualify for rebates on appliances that they should be able to install without permission from their landlords, and that they can take with them if they move. For example, portable appliances like tabletop induction burners, clothes dryers, and window-unit heat pumps are all eligible for rebates.

It’s also worth noting that there is a lot of funding available for multifamily building owners. If you have a good relationship with your landlord, you might want to talk to them about the opportunity to make lasting investments in their property. Under the performance-based rebates program, apartment building owners can get up to $400,000 for energy efficiency projects.

For the most part, yes. But the calculus gets tricky when it comes to heat pumps.

Experts generally agree that no matter where you live, switching from an oil or propane-burning heating system or electric resistance heaters to heat pumps will lower your energy bills. Not so if you’re switching over from natural gas.

Electric heat pumps are three to four times more efficient than natural gas heating systems, but electricity is so much more expensive than gas in some parts of the country that switching from gas to a heat pump can increase your overall bills a bit. Especially if you also electrify your water heater, stove, and clothes dryer.

That being said, Rewiring America estimates that switching from gas to a heat pump will lower bills for about 60% of households. Many utilities offer tools that will help you calculate your bills if you make the switch.

The good news is that all the measures I’ve discussed in this article are expected to cut carbon emissions and pollution, even if most of your region’s electricity still comes from fossil fuels. For some, that might be worth the monthly premium.

Tax Credit #1 offers 30% off the cost of energy audits, windows, doors, insulation, air sealing, heat pumps, electrical panels, with a $3200-per-year allowance and individual item limits.

Tax Credit #2 offers 30% off the cost of solar panels, solar water heaters, batteries, and geothermal heating systems.

Rebate Program #1 will offer discounts on whole-home efficiency upgrades depending on how much they reduce your energy use, with an $8,000 cap for lower-income families and a $4,000 cap for everyone else.

Rebate Program #2 is only for low- and moderate- income households, and will offer discounts on specific electric appliances, with a $14,000 cap.

Read more about the Inflation Reduction Act:

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

The interior secretary and former North Dakota governor used to praise liberty. Now he is betraying it.

One thing has long stood out about U.S. Interior Secretary Doug Burgum: Even before he ran for office, he talked a lot about freedom. It’s really striking, even for a Republican.

Perhaps you don’t know Burgum’s story. He grew up a shaggy-haired boy in tiny Arthur, North Dakota. In 1983, he mortgaged a part of his family farm to fund a software company, Great Plains Software. The company was a success, and it made him wealthy as a young man.

Burgum talked about the startup — and the new technology industry to which it belonged — as something nobler and higher than just a hustle. The software industry, he told lawmakers in 1998, helped make the people who participated in it free because it helped them flourish. “Part of the appeal of this industry is the freedom to succeed or fail based solely on one’s own abilities,” he said. He was known as a good boss.

Microsoft bought his company, making Burgum a billionaire. He stayed there for a few years, then became an investor and a real estate developer. In 2016, he ran to be North Dakota’s governor and won by a landslide.

Observing Burgum for a few years now, I’ve seen him talk about freedom in a few ways. He is a federalist. Although he praised the First Amendment’s liberties, which he describes as inherent and God-given, he speaks often about the Tenth Amendment, too — the part of the Bill of Rights that says powers not delegated to the federal government are retained by the states and the people.

That idea, he said while running for the Republican presidential nomination in 2023, was something national Republicans too often forgot. “When I see the Republican Party try to get into things where we’re also overreaching, it also goes against this principle. There isn’t a one-size-fits-all federal rule — it should be returned to the states,” Burgum said.

Even his criticism of President Joe Biden’s “green fantasy energy policies” was rooted in this understanding of freedom. It wasn’t just that Biden’s policies limited consumer choice, he said, but that they empowered freedom’s enemies. They kept U.S. oil in the ground while encouraging Americans to buy electric vehicles and critical minerals from China.

“To defeat those adversaries, we must have a leader who understands the power of free societies and free markets,” he said.

Burgum didn’t win the 2024 nomination, and he wasn’t — as some hoped — picked for vice president on the ticket, either. But he won control of Trump’s energy agenda. Today, Burgum not only runs the Interior Department, but also chairs the National Energy Dominance Council, an ad hoc body that oversees energy and environment policy.

He’s kept talking about freedom in his new role — and he connects liberty to the eternal human struggle to flourish. “Human flourishing in this world has always been dependent on affordable and reliable energy,” he told Stanford students last year.

Which is why I was astounded to see this post last week:

Now, Burgum is a light-hearted guy, and obviously, we’re meant to chuckle. It’s a joke. Alaska and Washington, D.C., are part of the “old interior,” but Greenland’s capital, Nuuk, is the “new interior” — future American territory.

Burgum defended himself on Fox News last Thursday. “Who knew that posting a factual map of Alaska and Greenland would be triggering to those folks who do not fully understand the importance of Greenland and the strategic nature of protecting the United States of America?” he said.

Burgum is wrong. His map was not factual: Greenland is not part of the American interior; it is part of Denmark. To describe it as the “interior” of America should humiliate Burgum’s liberty-loving soul. But what we can tell from this tweet is that Burgum is mentally preparing himself for a terrible betrayal of the values and ideas he once celebrated.

What would that betrayal be? Nothing less than the open theft of Greenlanders’ most fundamental freedoms. On Fox, Burgum said that Trump wanted to “buy” Greenland — but this is such a twisting and abrasing of the truth as to make a patriot yelp. Trump desires Greenland by any means, and he is willing to use the military to bully Denmark and the Greenlandic people into selling their sovereignty.

This is not friendly commerce between two equals, as a free market requires, but rather petty and corrupt gangsterism. Trump is shoving a gun in Denmark’s face, muttering, We can do this the easy way or the hard way. Burgum claims to see nothing wrong with this degeneracy.

He should. Less than two years ago, Burgum praised the Constitution and “the historic and aspirational vision presented by our Founding Fathers.” That cohort’s insight — the reason we remember its members now, despite their flaws — was that the most fundamental political freedom is political self-determination. “All men are, by nature, equal and free,” wrote James Wilson, one of only six men to sign both the Declaration and the Constitution. “No one has a right to any authority over another without his consent: all lawful government is founded on the consent of those who are subject to it.”

Yet Burgum would help establish Trump’s authority over more than 55,000 Greenlanders without their consent and over their objections — a government that would reek of illegality from its birthpangs. And Burgum would be its midwife. The Office of Insular Affairs, which he oversees as part of the Interior Department, manages America’s territories and freely associated states, such as Puerto Rico and Palau. Greenland could soon fall under its purview, too. Burgum could easily become Greenland’s colonial governor, its federal subjugator.

All lawful government is founded on the consent of those who are subject to it. I have been to Greenland. It is an austere and beautiful country, home to a population of independent and freedom-loving people who want to prosper, raise their families, farm, hunt, thrive, and flourish. It should sound familiar: Greenlanders are not so far from Burgum’s old North Dakota constituents.

Either Burgum will now see the resemblance and desist from Trump’s corrupt attack on liberty, democracy, and the principle of self-government itself — either he will block it, delay it, never defend it in public or in private, and never joke about the wicked betrayal of an ally again — either he will review and revise the resignation letter in his desk drawer — either he will, in other words, act as a free man, or he should stop lying to Americans about his love of freedom and admit that he now believes instead that might makes right — that Donald Trump’s word is law, or close enough to it — and clarify for us, at last, that he has already become one of the president’s moral degenerates.

“Ronald Reagan famously told us, ‘Freedom is never more than one generation away from extinction,’” an earlier version of Doug Burgum once told us. It was 2024, and he was running for president, addressing Republicans in Florida. His political prospects had never looked better.

Burgum paused for a second. He wanted the audience to think about the quote — to stick with Reagan’s words.

“Sometimes people remember that [line],” he said, “but they forget the second part of the quote, and I think it’s the most important: ‘Freedom must be fought for and protected, or we’ll spend our later years telling our grandchildren what it was like when America was free.’”

To fight and protect freedom — what would such an act demand of Doug Burgum in this moment, when a president is threatening America’s neighbors and trying to impose the very definition of unfreedom on its friends? Burgum was a thoughtful politician once: an independent and heterodox leader who loved liberty and wanted to see Americans flourish. Will he now do his duty to America and the world? Or will he push the country and its imperial subjects — no longer free citizens — into an unfreedom that will aggrieve and impoverish us well into our grandchildren’s lives. The choice is his. He has his freedom, now let him use it.

Mikie Sherrill used her inaugural address to sign two executive orders on energy.

Mikie Sherill, a former Navy helicopter pilot, was best known during her tenure in the House of Representatives as a prominent Democratic voice on national security issues. But by the time she ran for governor of New Jersey, utility bills were spiking up to 20% in the state, putting energy at the top of her campaign agenda. Sherrill’s oft-repeated promise to freeze electricity rates took what could have been a vulnerability and turned it into an electoral advantage.

“I hope, New Jersey, you'll remember me when you open up your electric bill and it hasn't gone up by 20%,” Sherrill said Tuesday in her inauguration address.

Before she even finished her speech, Sherrill signed a series of executive orders aimed at constraining utility costs and expanding energy production in the state. One was her promised emergency declaration giving utility regulators the authority to freeze rate hikes. Another was aimed at fostering new generation, ordering the New Jersey Board of Public Utilities “to open solicitations for new solar and storage power generation, to modernize gas and nuclear generation so we can lower utility costs over the long term.”

Now all that’s left is the follow-through. But with strict deadlines to claim tax credits for renewable energy development looming, that will be trickier than it sounds.

The One Big Beautiful Bill Act from last summer put strict deadlines on when wind and solar projects must start construction (July 2026), or else be placed in service (the end of 2027) in order to qualify for the remaining federal clean energy tax credits.

Sherrill’s belt-and-suspenders approach of freezing rates and boosting supply was one she previewed during the campaign, during which she made a point of talking not just about solar and battery storage, but also about nuclear power.

The utility rate freeze has a few moving parts, including direct payments to offset bill hikes that are due to hit this summer and giving New Jersey regulators the authority “to pause or modify utility actions that could further increase bills.” The order also instructs regulators to “review utility business models to ensure alignment with delivering cost reductions to ratepayers,” which could mean utilities wind up extracting less return from ratepayers on capital investments in the grid.

The second executive order declares a second state of emergency and “expands multiple, expedited state programs to develop massive amounts of new power generation in New Jersey,” the governor’s office said. It also instructs the state to “identify permit reforms” to more quickly bring new projects online, requests that regulators instruct utilities to more accurately report energy usage from potential data center projects, and sets up a “Nuclear Power Task Force to position the state to lead on building new nuclear power generation.”

This combination of direct intervention to contain costs with new investments in supply, tough language aimed at utilities and PJM, the electricity market New Jersey is in, along with some potential deregulation to help bring new generation online more quickly, is essentially throwing every broadly left-of-center idea around energy at the wall and seeing what sticks.

Not surprisingly, the orders won immediate plaudits from green groups, with Justin Balik, the vice president of action for Evergreen States, saying in a statement, “It is refreshing to see a governor not only correctly diagnose what’s wrong with our energy system, but also demonstrate the clear political will to fix it.”

On Greenland jockeying, Brazilian rare earth, and atomic British sea power

Current conditions: A geomagnetic storm triggered by what’s known as a coronal mass ejection in space could hit severe levels and disrupt critical infrastructure from southern Alabama to northern California • After weekend storms blanketed the Northeast in snow, Arctic air is pushing more snow into the region by midweek • Extreme heat in South America is fueling wildfires that have already killed 19 people in Chile.

Over the weekend, President Donald Trump once again ratcheted up pressure on Denmark and the European Union to consider his bid to seize Greenland. In a post on Truth Social, the president announced punitive 10% tariffs on Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland starting on February 1, with plans to raise the levies to 25% by June. “We have subsidized Denmark, and all of the Countries of the European Union, and others, for many years by not charging them Tariffs, or any other forms of remuneration,” he wrote. “Now, after Centuries, it is time for Denmark to give back — World Peace is at stake!” In response, the EU has threatened to deploy its economic “big bazooka.” Known formally as the anti-coercion instrument, the policy came into force in 2023 to counter China’s attacks on Lithuania, and involves the imposition of sweeping trade sanctions, ousting the aggressor nation’s companies from the world’s second-largest market, and ending intellectual property protections. Economists told the Financial Times that a trade war over Greenland would risk sparking the worst financial crisis since the Great Recession.

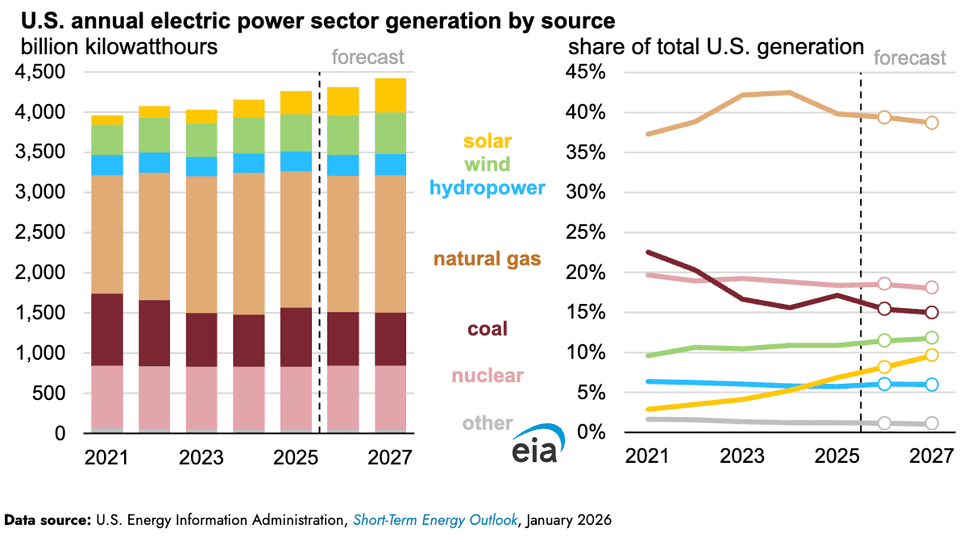

Electricity generation is set to grow 1.1% this year and 2.6% in 2027, according to the latest short-term energy outlook report from the federal Energy Information Administration. Despite the Trump administration’s attacks on the industry, solar power will provide the bulk of that growth. The U.S. is set to add 70 gigawatts of new utility-scale solar in 2026 and 2027, representing a 49% increase in operating solar capacity compared to the end of 2025. While natural gas, coal, and nuclear combined accounted for 75% of all generation last year, the trio’s share of power output in 2027 is on track to slip to 72%. Solar power and wind energy, meanwhile, are set to rise from about 18% in 2025 to 21% in 2027.

Still, the solar industry is struggling to fend off the Trump administration’s efforts to curb deployments of what its top energy officials call unreliable forms of renewable power. As Heatmap’s Jael Holzman wrote last month, the leading solar trade association is pleading with Congress for help fending off a “near complete moratorium on permitting.”

Everybody wants to invest in critical minerals — including the Western Hemisphere’s second center of power. Brazil is angling for a trade deal with the U.S. to mine what the Financial Times called its “abundant but largely untapped rare earth deposits.” With tensions thawing between Trump and the government of leftwinger Luiz Inácio Lula da Silva, officials in the Brazilian administration see a chance to broker an agreement on the metals Washington needs for modern energy and defense technologies. “There’s nothing but opportunity here,” one official told the newspaper. “Brazil’s government is open to a deal on critical minerals.”

Northwest of Brazil, in Bolivia, the new center-right government is stepping up efforts to court foreign investors to develop its lithium resources. The country’s famous salt flats comprise the world’s largest known reserve of the key battery metal. But the leftist administration that ruled the Andean nation for much of the past two decades made little progress toward exploiting the resource under state-owned companies. The new pro-Washington government that took power after the October election has vowed to bring in the private sector. In what Energy Minister Mauricio Medinaceli last week called the government’s “first message to investors,” the administration vowed to honor all existing deals with Chinese and Russian companies, according to Mining.com.

Sign up to receive Heatmap AM in your inbox every morning:

Last month, I told you about how swapping bunker fuel-burning engines for nuclear propulsion units in container ships could shave $68 million off annual shipping costs. That’s got real appeal to the British. Five industrial giants in the United Kingdom — Rolls-Royce, Babcock International Group, Global Nuclear Security Partners, Stephenson Harwood, and NorthStandard — have formed a new group called the Maritime Nuclear Consortium to boost British efforts to commercialize nuclear-powered cargo ships. “Without coordinated U.K. action, the chance to define the rules, create high-skilled jobs and anchor a global supply chain could be lost to faster competitors,” Lloyd's Register, a professional services company in London that provides maritime certifications, said in a statement to World Nuclear News. “Acting now would give the U.K. first-mover advantage, and ensure those standards, jobs and supply chains are built here.”

On the more standard atomic power front, the U.S. has officially inked its nuclear partnership deal with Slovakia, which I wrote about last week.

Sunrun has come out against the nascent effort to harvest the minerals needed for panels and batteries from metal-rich nodules in the pristine depths of the ocean. Last week, America’s largest residential solar and storage company signed onto a petition calling for a moratorium on deep-sea mining. The San Francisco-based giant joins Google, Apple, Samsung, BMW, Volvo, Salesforce, and nearly 70 other corporations in calling for a halt to the ongoing push at a little-known United Nations maritime regulator to establish permitting rules for mining in international waters. As Heatmap’s Jeva Lange has written, there are real questions about whether the potential damage to one of the few ecosystems on Earth left untouched by human development is really worth it. Trump has vowed to go it alone on deep-sea mining if global regulators can’t come to agreement, as I wrote last year. But it’s unclear how quickly the biggest developer in the space, The Metals Company, could get the industry started. As You Sow, the advocacy group promoting the moratorium, said Sunrun’s signature “brings an important voice from the clean energy sector.”

The home electrification company Jetson, which makes smart thermostats and heat pumps, has raised $50 million in a Series A round. Founded less than two years ago, the company pulled in first-time funding from venture firms including Eclipse, 8VC, and Activate Capital, and saw at least two existing investors put in more money. “Heat pumps have worked for decades, but their cost and complexity have put them out of reach of most homeowners,” Stephen Lake, Jetson’s co-founder and chief executive, said in a statement. “We’re removing the friction by making the process digital, fast, and affordable while fully managing the purchase from start to finish. This funding will help us quickly bring this experience to more homeowners across the U.S. and Canada.”