This article is exclusively

for Heatmap Plus subscribers.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

And more of the week’s news around renewable energy conflicts.

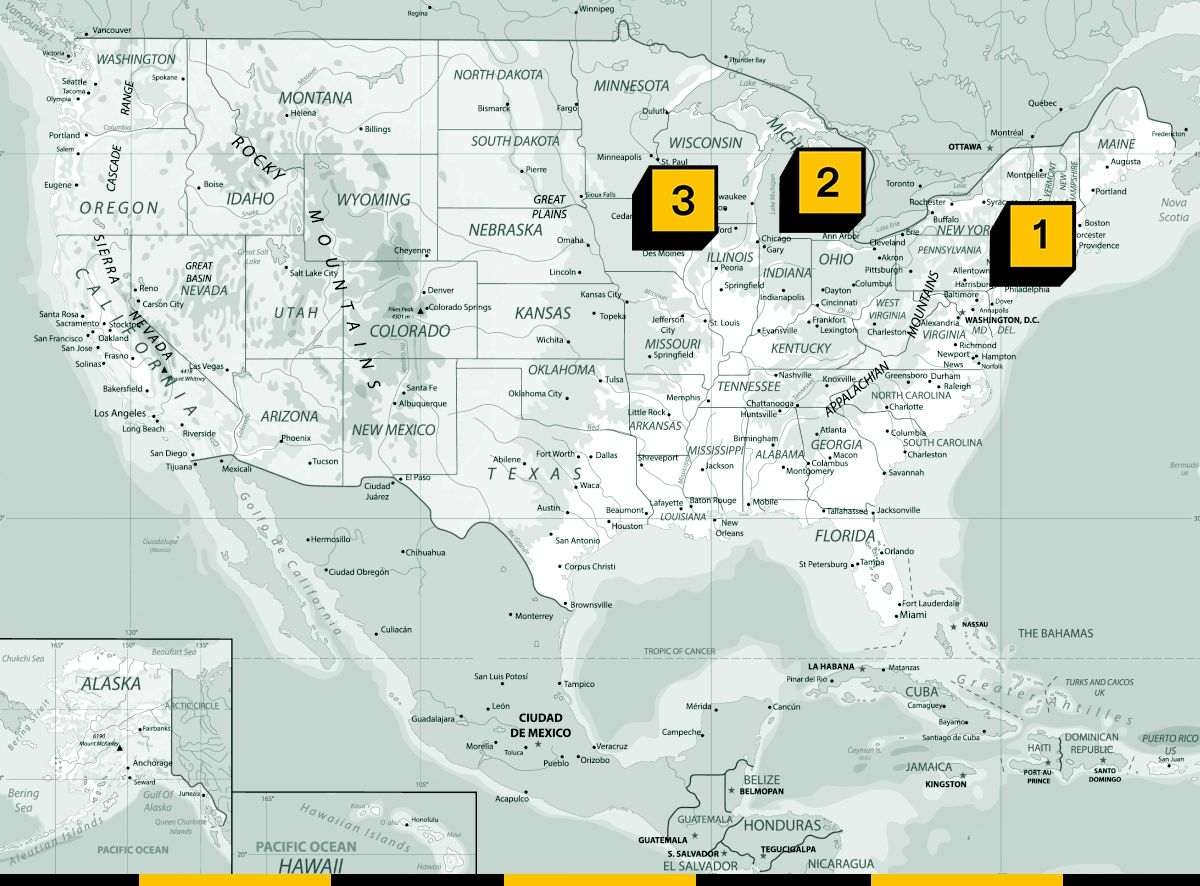

Queens County, New York – TotalEnergies’ first Attentive Energy offshore wind project might be the canary in the Trumpy renewables coal mine.

Clinton County, Michigan – EV manufacturing news in Michigan is showing that fallout from Trump’s election may not be limited to offshore wind, and could creep into other projects facing grassroots opposition.

Linn County, Iowa – Even carbon pipelines facing opposition are getting canceled right now, after Wolf Carbon Solutions rescinded its project application to the Iowa Utilities Board.

Here’s what else we’re watching right now …

In California, the city of Escondido has extended its moratorium against the Seguro battery storage project. (Consider us shocked.)

In Illinois, an Acconia Energy solar farm’s application with the Will County government is being delayed over local opposition.

In Nebraska, NextEra is facing resistance to a new 2,400 acre solar farm in Lancaster County.

In Oklahoma, momentum for a moratorium is building in Lincoln County, an area once friendly to wind development.

In New York, the small town of Glenville rejected a small solar project proposed by a Nexamp subsidiary.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Plus more of the week’s top fights in data centers and clean energy.

1. Osage County, Kansas – A wind project years in the making is dead — finally.

2. Franklin County, Missouri – Hundreds of Franklin County residents showed up to a public meeting this week to hear about a $16 billion data center proposed in Pacific, Missouri, only for the city’s planning commission to announce that the issue had been tabled because the developer still hadn’t finalized its funding agreement.

3. Hood County, Texas – Officials in this Texas County voted for the second time this month to reject a moratorium on data centers, citing the risk of litigation.

4. Nantucket County, Massachusetts – On the bright side, one of the nation’s most beleaguered wind projects appears ready to be completed any day now.

Talking with Climate Power senior advisor Jesse Lee.

For this week's Q&A I hopped on the phone with Jesse Lee, a senior advisor at the strategic communications organization Climate Power. Last week, his team released new polling showing that while voters oppose the construction of data centers powered by fossil fuels by a 16-point margin, that flips to a 25-point margin of support when the hypothetical data centers are powered by renewable energy sources instead.

I was eager to speak with Lee because of Heatmap’s own polling on this issue, as well as President Trump’s State of the Union this week, in which he pitched Americans on his negotiations with tech companies to provide their own power for data centers. Our conversation has been lightly edited for length and clarity.

What does your research and polling show when it comes to the tension between data centers, renewable energy development, and affordability?

The huge spike in utility bills under Trump has shaken up how people perceive clean energy and data centers. But it’s gone in two separate directions. They see data centers as a cause of high utility prices, one that’s either already taken effect or is coming to town when a new data center is being built. At the same time, we’ve seen rising support for clean energy.

As we’ve seen in our own polling, nobody is coming out looking golden with the public amidst these utility bill hikes — not Republicans, not Democrats, and certainly not oil and gas executives or data center developers. But clean energy comes out positive; it’s viewed as part of the solution here. And we’ve seen that even in recent MAGA polls — Kellyanne Conway had one; Fabrizio, Lee & Associates had one; and both showed positive support for large-scale solar even among Republicans and MAGA voters. And it’s way high once it’s established that they’d be built here in America.

A year or two ago, if you went to a town hall about a new potential solar project along the highway, it was fertile ground for astroturf folks to come in and spread flies around. There wasn’t much on the other side — maybe there was some talk about local jobs, but unemployment was really low, so it didn’t feel super salient. Now there’s an energy affordability crisis; utility bills had been stable for 20 years, but suddenly they’re not. And I think if you go to the town hall and there’s one person spewing political talking points that they've been fed, and then there’s somebody who says, “Hey, man, my utility bills are out of control, and we have to do something about it,” that’s the person who’s going to win out.

The polling you’ve released shows that 52% of people oppose data center construction altogether, but that there’s more limited local awareness: Only 45% have heard about data center construction in their own communities. What’s happening here?

There’s been a fair amount of coverage of [data center construction] in the press, but it’s definitely been playing catch-up with the electric energy the story has on social media. I think many in the press are not even aware of the fiasco in Memphis over Elon Musk’s natural gas plant. But people have seen the visuals. I mean, imagine a little farmhouse that somebody bought, and there’s a giant, 5-mile-long building full of computers next to it. It’s got an almost dystopian feel to it. And then you hear that the building is using more electricity than New York City.

The big takeaway of the poll for me is that coal and natural gas are an anchor on any data center project, and reinforce the worst fears about it. What you see is that when you attach clean energy [to a data center project], it actually brings them above the majority of support. It’s not just paranoia: We are seeing the effects on utility rates and on air pollution — there was a big study just two days ago on the effects of air pollution from data centers. This is something that people in rural, urban, or suburban communities are hearing about.

Do you see a difference in your polling between natural gas-powered and coal-powered data centers? In our own research, coal is incredibly unpopular, but voters seem more positive about natural gas. I wonder if that narrows the gap.

I think if you polled them individually, you would see some distinction there. But again, things like the Elon Musk fiasco in Memphis have circulated, and people are aware of the sheer volume of power being demanded. Coal is about the dirtiest possible way you can do it. But if it’s natural gas, and it’s next door all the time just to power these computers — that’s not going to be welcome to people.

I'm sure if you disentangle it, you’d see some distinction, but I also think it might not be that much. I’ll put it this way: If you look at the default opposition to data centers coming to town, it’s not actually that different from just the coal and gas numbers. Coal and gas reinforce the default opposition. The big difference is when you have clean energy — that bumps it up a lot. But if you say, “It’s a data center, but what if it were powered by natural gas?” I don’t think that would get anybody excited or change their opinion in a positive way.

Transparency with local communities is key when it comes to questions of renewable buildout, affordability, and powering data centers. What is the message you want to leave people with about Climate Power’s research in this area?

Contrary to this dystopian vision of power, people do have control over their own destinies here. If people speak out and demand that data centers be powered by clean energy, they can get those data centers to commit to it. In the end, there’s going to be a squeeze, and something is going to have to give in terms of Trump having his foot on the back of clean energy — I think something will give.

Demand transparency in terms of what kind of pollution to expect. Demand transparency in terms of what kind of power there’s going to be, and if it’s not going to be clean energy, people are understandably going to oppose it and make their voices heard.

The proportion of voters who strongly oppose development grew by nearly 50%.

During his State of the Union address Tuesday night, President Donald Trump attempted to stanch the public’s bleeding support for building the data centers his administration says are necessary to beat China in the artificial intelligence race. With “many Americans” now “concerned that energy demand from AI data centers could unfairly drive up their electricity bills,” Trump said, he pledged to make major tech companies pay for new power plants to supply electricity to data centers.

New polling from energy intelligence platform Heatmap Pro shows just how dramatically and swiftly American voters are turning against data centers.

Earlier this month, the survey, conducted by Embold Research, reached out to 2,091 registered voters across the country, explaining that “data centers are facilities that house the servers that power the internet, apps, and artificial intelligence” and asking them, “Would you support or oppose a data center being built near where you live?” Just 28% said they would support or strongly support such a facility in their neighborhood, while 52% said they would oppose or strongly oppose it. That’s a net support of -24%.

When Heatmap Pro asked a national sample of voters the same question last fall, net support came out to +2%, with 44% in support and 42% opposed.

The steep drop highlights a phenomenon Heatmap’s Jael Holzman described last fall — that data centers are "swallowing American politics,” as she put it, uniting conservation-minded factions of the left with anti-renewables activists on the right in opposing a common enemy.

The results of this latest Heatmap Pro poll aren’t an outlier, either. Poll after poll shows surging public antipathy toward data centers as populists at both ends of the political spectrum stoke outrage over rising electricity prices and tech giants struggle to coalesce around a single explanation of their impacts on the grid.

“The hyperscalers have fumbled the comms game here,” Emmet Penney, an energy researcher and senior fellow at the right-leaning Foundation for American Innovation, told me.

A historian of the nuclear power sector, Penney sees parallels between the grassroots pushback to data centers and the 20th century movement to stymie construction of atomic power stations across the Western world. In both cases, opponents fixated on and popularized environmental criticisms that were ultimately deemed minor relative to the benefits of the technology — production of radioactive waste in the case of nuclear plants, and as seems increasingly clear, water usage in the case of data centers.

Likewise, opponents to nuclear power saw urgent efforts to build out the technology in the face of Cold War competition with the Soviet Union as more reason for skepticism about safety. Ditto the current rhetoric on China.

Penney said that both data centers and nuclear power stoke a “fear of bigness.”

“Data centers represent a loss of control over everyday life because artificial intelligence means change,” he said. “The same is true about nuclear,” which reached its peak of expansion right as electric appliances such as dishwashers and washing machines were revolutionizing domestic life in American households.

One of the more fascinating findings of the Heatmap Pro poll is a stark urban-rural divide within the Republican Party. Net support for data centers among GOP voters who live in suburbs or cities came out to -8%. Opposition among rural Republicans was twice as deep, at -20%. While rural Democrats and independents showed more skepticism of data centers than their urbanite fellow partisans, the gap was far smaller.

That could represent a challenge for the Trump administration.

“People in the city are used to a certain level of dynamism baked into their lives just by sheer population density,” Penney said. “If you’re in a rural place, any change stands out.”

Senator Bernie Sanders, the democratic socialist from Vermont, has championed legislation to place a temporary ban on new data centers. Such a move would not be without precedent; Ireland, transformed by tax-haven policies over the past two decades into a hub for Silicon Valley’s giants, only just ended its de facto three-year moratorium on hooking up data centers to the grid.

Senator Josh Hawley, the Missouri Republican firebrand, proposed his own bill that would force data centers off the grid by requiring the complexes to build their own power plants, much as Trump is now promoting.

On the opposite end of the spectrum, you have Republicans such as Mississippi Governor Tate Reeves, who on Tuesday compared halting construction of data centers to “civilizational suicide.”

“I am tempted to sit back and let other states fritter away the generational chance to build. To laugh at their short-sightedness,” he wrote in a post on X. “But the best path for all of us would be to see America dominate, because our foes are not like us. They don’t believe in order, except brutal order under their heels. They don’t believe in prosperity, except for that gained through fraud and plunder. They don’t think or act in a way I can respect as an American.”

Then you have the actual hyperscalers taking opposite tacks. Amazon Web Services, for example, is playing offense, promoting research that shows its data centers are not increasing electricity rates. Claude-maker Anthropic, meanwhile, issued a de facto mea culpa, pledging earlier this month to offset all its electricity use.

Amid that scattershot messaging, the critical rhetoric appears to be striking its targets. Whether Trump’s efforts to curb data centers’ impact on the grid or Reeves’ stirring call to patriotic sacrifice can reverse cratering support for the buildout remains to be seen. The clock is ticking. There are just 36 weeks until the midterm Election Day.