You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

On China’s export pause, BrightDrop demand, and fighting wildfires

Current conditions: More than 28 million people in the Ohio Valley are at risk of severe thunderstorms today • Intense heat in Vietnam’s Ho Chi Minh City may be behind dozens of cases of food poisoning linked to street vendors • Parts of Michigan’s Upper Peninsula could see up to 10 inches of snow by late Tuesday.

Manufacturers dependent on critical minerals and magnets are bracing for shortages and production delays after China suspended exports last week, in apparent retaliation for tariffs imposed by the Trump administration. The pause comes as China implements a new regulatory system, although it is expected to cut off shipments to some U.S. companies indefinitely, The New York Times reports.

China produces nearly all of the world’s heavy rare earth metals and rare earth magnets, which are crucial components for electric car motors, as well as drones, missiles, and spacecraft. But while rare earth magnets make up a small portion of China’s exports and the pause will cause “minimal economic pain” to Beijing, there is “potential for big effects in the United States and elsewhere,” the Times writes. Emergency stockpiles of heavy rare earth metals and magnets vary by company, but many American manufacturers have historically kept little to no extra inventory on hand.

GM announced Friday that it is pausing production of its electric Chevrolet BrightDrop delivery van through October, citing “market demand and rebalancing inventory.” The decision will see the automaker temporarily lay off 1,200 workers at its assembly plant in Ontario, Canada, with a permanent reduction of 450 workers expected when production resumes at lower levels in the fall. “This is a crushing blow,” Lana Payne, the president of Unifor, Canada’s largest private sector union, said in a statement. Last year, the Ontario plant produced 3,500 BrightDrop vans, of which GM sold 1,529; this year, it has sold just 247. The Detroit Free Press cites the vehicle’s $74,000 price tag as a reason for lagging sales, while Electrek points to the uncertainty of Trump’s tariffs for “causing companies like GM to expect more pain in the near term.”

The Trump administration is reportedly considering an executive order calling for creating a new wildland fire agency focused on the “immediate” suppression of wildfires. While many organizations and industry insiders have long awaited reforms in how the federal government combats wildfires — including pushing for the creation of a National Wildland Fire Service — the news was also met by concerns that the order could loosen certain requirements, especially for aerial firefighting.

Washington State’s Commissioner of Public Lands Dave Upthegrove warned The Spokesman-Review in a statement that “If the draft is implemented as currently written it will, among other things, eliminate critical safety measures that protect aerial firefighters,” including independent inspections of tankers and planes that perform surveillance by the Forest Service. The Trump administration has responded to speculation over the EO by saying, “The media should stop reporting on ‘drafts’ with unknown origins.”

Michele Della Vigna, the head of natural resources research at Goldman Sachs, told CNBC that investors should consider including oil and gas stocks as a “cornerstone” of their ESG portfolios. While fossil fuel companies have traditionally been excluded from investments focused on “environmental, social, and governance” factors, Della Vigna likened a reappraisal of oil and gas to the way that some ESG funds have started to shift to include defense stocks. “This energy transition will be much longer than expected,” he said, adding that fossil fuel companies are major investors in low-carbon technologies and “we will not have affordable energy” otherwise.

The White House has singled out law firms with a focus on ESG and promoted support of coal and oil, but despite the pressures, others who spoke to CNBC remained skeptical of Della Vigna’s argument. “We can see the negative impacts of oil and gas,” Ida Kassa Johannesen, the head of commercial ESG at Saxo Bank, said, adding, “I mean, why would we want to see more fossil fuels? Most ESG investors would not.”

Center-right President Daniel Noboa won reelection in Ecuador on Sunday, earning a full four-year term after taking power in snap elections in November 2023. While Ecuador has been an international leader on environmental issues, famously recognizing the legal rights of nature in its 2008 constitution, Noboa has a more mixed record, with critics claiming he has prioritized the nation’s economy over proposals for emissions reductions. Noboa notably has welcomed an anticipated $42 billion in foreign investment in oil production over the next five years, even as a 2024 national referendum blocked the government’s plan to restart drilling in Yasuní National Park. (Noboa has said he’s considering a moratorium on that referendum.) The impacts of a warmer climate have been immediately felt in Ecuador, however; the nation endured blackouts last year due to the impacts of a drought on the nation’s hydroelectric plants, and Noboa has pledged rainwater harvesting and storage projects during his second term.

On Friday, 63 nations — including China, Brazil, and much of Europe, but excluding the United States — voted to approve a first-of-its-kind tax on greenhouse gas emissions by ships in the shipping industry.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Wildfires are moving east.

There were 77,850 wildfires in the United States in 2025, and nearly half of those — 49% — ignited east of the Mississippi River, according to statistics released last week by the National Interagency Fire Center. That might come as a surprise to some in the West, who tend to believe they hold the monopoly on conflagrations (along with earthquakes, tsunamis, and megalomaniac tech billionaires).

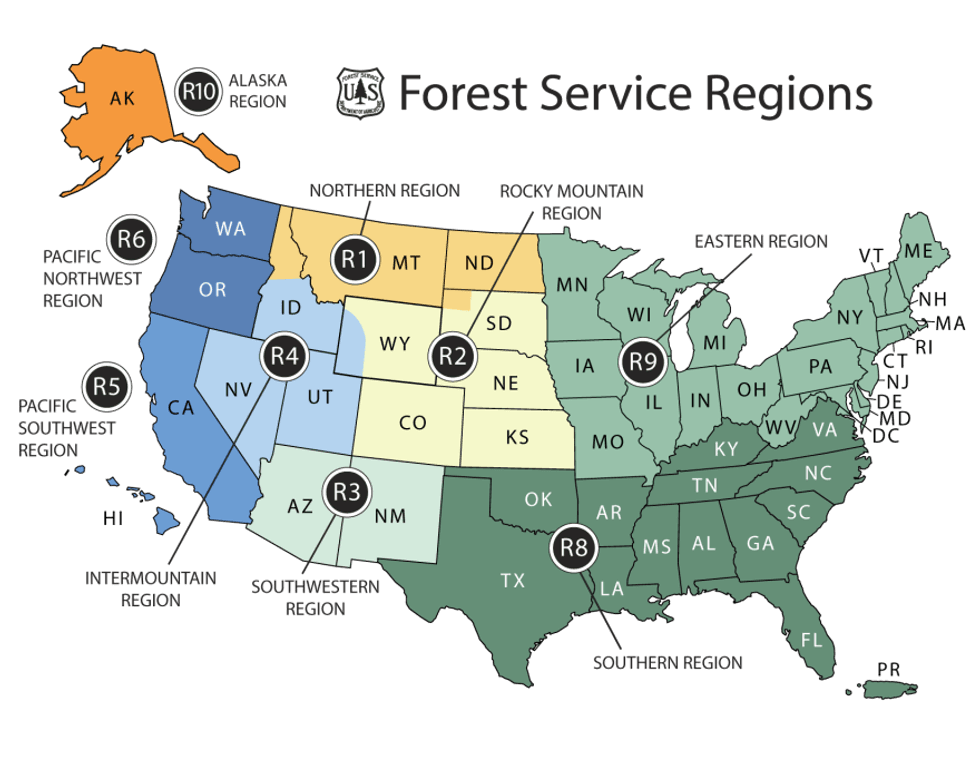

But if you lump the Central Plains and Midwest states of Minnesota, Iowa, Missouri, Arkansas, Oklahoma, and Texas along with everything to their east — the swath of the nation collectively designated as the Eastern and Southern Regions by the U.S. Forest Service — the wildfires in the area made up more than two-thirds of total ignitions last year.

Like fires in the West, wildfires in the eastern and southeastern U.S. are increasing. Over the past 40 years, the region has seen a 10-fold jump in the frequency of large burns. (Many risk factors contribute to wildfires, including but not limited to climate change.)

What’s exciting to wildfire researchers and managers, though, is the idea that they could catch changes to the Eastern fire regime early, before the situation spirals into a feedback loop or results in a major tragedy. “We have the opportunity to get ahead of the wildfire problem in the East and to learn some of the lessons that we see in the West,” Donovan said.

Now that effort has an organizing body: the Eastern Fire Network. Headed by Erica Smithwick, a professor in Penn State’s geography department, the research group formed late last year with the help of a $1.7 million, three-year grant from the Gordon and Betty Moore Foundation, a partner with the U.S. National Science Foundation, with the goal of creating an informed research agenda for studying fire in the East. “It was a very easy thing to have people buy into because the research questions are still wide open here,” Smithwick told me.

Though the Eastern U.S. is finally exiting a three-week block of sub-freezing temperatures, the hot, dry days of summer are still far from most people’s minds. But the wildland-urban interface — that is, the high-fire-risk communities that abut tracts of undeveloped land — is more extensive in the East than in the West, with up to 72% of the land in some states qualifying as WUI. The region is also much more densely populated, meaning practically every wildfire that ignites has the potential to threaten human property and life.

It’s this density combined with the prevalent WUI that most significantly distinguishes Eastern fires from those in the comparatively rural West. One fire manager warned Smithwick that a worst-case-scenario wildfire could run across the entirety of New Jersey, the most populous state in the nation, in just 48 hours.

Generally speaking, though, wildfires in the East are much smaller than those in the West. The last megafire in the Forest Service’s Southern Region was as far west in its boundaries as you can get: the 2024 Smokehouse Creek fire in Texas and Oklahoma, which burned more than a million acres. The Eastern Region hasn’t had a megafire exceeding 100,000 acres in the modern era. For research purposes, a “large” wildfire in the East is typically defined as being 200 hectares or more in size, the equivalent of about 280 football fields; in the West, a “large” wildfire is twice that, 400 hectares or more.

But what the eastern half of the country lacks in total acres burned (for that statistic, Alaska edges out the Southern Region), it makes up for in the total number of reported ignitions. In 2025, for example, the state of Maine alone recorded 250 fires in August, more than doubling its previous record of just over 100 fires. “The East is highly fragmented,” Donovan, who is contributing to the Eastern Fire Network’s research, told me. “We have a lot of development here compared to the West, and so it’s much more challenging for fires to spread.”

Fires in the West tend to be long-duration events, burning for weeks or even months; fires in the East are often contained within 48 hours. In New Jersey, for example, “smaller, fragmented forests, which are broken up by numerous roads and the built environment, [allow] firefighters to move ahead of a wildfire to improve firebreaks and begin backfiring operations to help slow the forward progression,” a spokesperson for the New Jersey Forest Fire Service told me.

The parcelized nature of the eastern states is also reflected in who is responding to the fires. It is more common for state agencies and local departments — including many volunteer firefighting departments — to be the ones on the scene, Debbie Miley, the executive director of the National Wildfire Suppression Association, a trade group representing private wildland fire service contractors, told me by email. On the one hand, the local response makes sense; smaller fires require smaller teams to fight them. But the lack of a joint effort, even within a single state, means broader takeaways about mitigation and adaptation can be lost.

“Many eastern states have strong state forestry agencies and local departments that handle wildfire as part of an ‘all hazards’ portfolio,” Miley said. “In the West, there’s often a deeper bench of personnel and systems oriented around long-duration wildfire campaigns (though that varies by state).”

All of this feeds into why Smithwick believes the Eastern Fire Network is necessary: because of this “intermingling, at a very fine scale, of different jurisdictional boundaries,” conversations about fire management and the changing regimes in the region happen in parallel, rather than with meaningful coordination. Even within a single state, fire management might be divided between different agencies — such as the Game Commission and the Bureau of Forestry, which share fire management responsibilities in Pennsylvania. Fighting fires also often involves working with private landowners in the East; in the West, on the other hand, roughly two-thirds of wildfires burn on public land, which a single agency — e.g. the Bureau of Land Management, Forest Service, or Park Service — manages.

But “wildfire risk is going to be different than in the West, and maybe more variable,” Smithwick told me. Identifying the appropriate research questions about that risk is one of the most important objectives of the Eastern Fire Network.

Bad wildfires are the result of fuel and weather conditions aligning. “We generally know what the fuels are [in the East] and how well they burn,” Smithwick said. But weather conditions and their variability are a greater question mark.

Nationally, fire and emergency managers rely on indices to predict fire-weather risk based on humidity, temperature, and wind. But while those indices are dialed in for the Western states, they’re less well understood in the East. “We hope to look at case studies of recent fires that have occurred in the 2024 and 2025 window to look at the antecedent conditions and to use those as case studies for better understanding the mechanisms that led to that wildfire,” Smithwick said.

Learning more about the climatological mechanisms driving dry spells in the region is another explicit goal. Knowing how dry spells evolve, and where, will help researchers and eventually policymakers to identify mitigation strategies for locations most at risk. Smithwick also expects to learn that some areas might not be at high risk: “We can tell you that this is not something your community needs to invest in right now,” she told me.

Different management practices, jurisdictions, terrains, and fuel types mean solutions in the East will look different from those in the West, too. As Donovan’s research has found, the unmanaged regrowth of forests in the northeast in particular after centuries of deforestation has led to an increase in trees and shrubs that are prone to wildfires. Due to the smaller forest tracts in the area, mechanical thinning is a more realistic solution in eastern forests than on large, sprawling, remote western lands.

Prescribed burns tend to be more common and more readily accepted practices in the East, too. Florida leads the nation in preventative fires, and the New Jersey Forest Fire Service aims to treat 25,000 acres of forest, grasslands, and marshlands with prescribed fire annually.

The winter storms that swept across the Eastern and Southern regions of the United States last month have the potential to queue up a bad fire season once the land starts to thaw and eventually dry out. Though the picture in the Eastern Region is still coming into focus depending on what happens this spring, in the Southern region the storms have created “potential compaction of the abundant grasses across the Plains, in addition to ice damage in pine-dominant areas farther east,” the National Interagency Fire Center wrote in last Monday’s update to its nationwide fire outlook. (The nearly million-acre Pinelands of New Jersey are similarly a fire-adapted ecosystem and are “comparable in volatility to the chaparral shrublands found in California and southern Oregon,” the spokesperson told me.)

The compaction of grasses is significant because, although they will take longer to dry and become a fuel source, it will ultimately leave the Southern region covered with a dense, flammable fuel when summer is in full swing. Beyond the Plains, in the Southeast’s pine forests, the winter-damaged trees could cast “abundant” pine needles and “other fine debris” that could dry out and become flammable as soon as a few weeks from now. “Increased debris burning will also amplify ignitions and potential escapes, enhancing significant fire potential during warmer and drier weather that will return in short order,” NIFC goes on to warn.

Though the historically wet Northeast and humid Southeast seem like unlikely places to worry about large wildfires, as conditions change, nothing is certain. “If we learned anything from fire science over the past few decades, it’s that anywhere can burn under the right conditions,” Smithwick said. “We are burning in the tundra; we are burning in Canada; we are burning in all of these places that may not have been used to extreme wildfire situations.”

“These fires could have a large economic and social cost,” Smithwick added, “and we have not prepared for them.”

New guidelines for the clean fuel tax credit reward sustainable agriculture practices — but could lead to greater emissions anyway.

The Treasury Department published proposed guidance last week for claiming the clean fuel tax credit — one of the few energy subsidies that was expanded, rather than diminished, by Trump’s One Big Beautiful Bill Act. There was little of note in the proposal, since many of the higher-stakes climate-related decisions about the tax credit were made by Congress in the statute itself. But it did clear up one point of uncertainty: The guidance indicates that the administration will reward biofuel crops cultivated using “climate-smart agriculture” practices.

On the one hand, it’s a somewhat surprising development simply because of Trump’s record of cutting anything with climate in the title. Last April, the U.S. Department of Agriculture terminated grants from a Biden-era “Climate-Smart Commodities” program, calling it a “slush fund,” and refashioned it into the “Advancing Markets for Producers” initiative.

On the other hand, depending on how the Trump administration implements it, integrating climate-smart agriculture into the clean fuel tax credit could become its own kind of slush fund, paying out billions in taxpayer dollars for questionable benefits and with little accountability.

The clean fuel tax credit, known by its section of the tax code as 45Z, subsidizes the production of low-carbon transportation fuels for vehicles and aviation. Companies can earn up to $1 per gallon depending on the carbon intensity of the production process.

Sourcing corn and soy from farms that use climate-smart agriculture practices is one potential way for biofuel producers to claim more of the credit. “Climate-smart agriculture” can refer to a wide variety of techniques that increase the amount of soil stored in carbon or otherwise reduce emissions, such as reducing soil disturbance, planting cover crops, or implementing nutrient management practices that reduce nitrous oxide emissions. But to date, the federal government has not issued guidance for how to account for these practices.

The Biden administration put out proposed rules just before leaving office that were quite controversial, Nikita Pavlenko, the fuels and aviation program director at the International Council on Clean Transportation, told me. The methodology relied entirely on modeling and did not require farmers to take any real-life measurements of soil carbon before or after adopting the climate-smart practice. The rules also assume that these climate-smart practices would be implemented anew, when in reality many farms have been practicing some of them for years without subsidies. That means ethanol producers could potentially get free money to buy corn from farms that adopted no-till practices long ago, with no additional benefit for the climate.

“These climate-smart ag practices are a rare example of bipartisanship, for what it’s worth, and there’s a lot of money to be made in it,” Pavlenko told me. “But I’m not sure exactly how much actual greenhouse gas reduction or sequestration.”

According to estimates by Pavlenko’s group, the lack of an additionality requirement could lead to the government paying $2.1 billion in subsidies for farms to keep doing what they were already doing, with no new benefits for the climate.

I should note that the climate integrity of the clean fuel tax credit, also known as 45Z, was already compromised by changes made in the OBBBA. Subsidies for crop-based biofuels can indirectly drive deforestation. Prior to Trump’s tax law, producers would have had to take into account emissions related to land use changes when they calculated the carbon intensity of their fuel. Now they don’t. The change will make it much easier for a fuel like ethanol, which is already heavily subsidized through other programs, to qualify.

That, in turn, could cost taxpayers an estimated five times as much per year. When the subsidy was first created in the Inflation Reduction Act, the Joint Committee on Taxation estimated that it would cost taxpayers $2.9 billion over three years. After the OBBBA passed, extending the credit by two years, the committee’s estimate was $25.7 billion.

The existing proposal for incorporating climate-smart agriculture practices into the tax credit calculation would likely push that estimate even higher. After the Biden administration released its proposal last January, groups like Pavlenko’s submitted comments critiquing the methods and suggesting changes. But after the Trump administration took over, it was unclear what would happen with it, he said.

Last week’s guidance was still somewhat vague about what’s next for the climate-smart agriculture calculations, saying only that the proposal published in January is still “undergoing testing, peer review, and public comment,” and that the Treasury expects it to be ready some time in 2026. In the meantime, the Treasury will be taking public comments on the broader 45Z guidance through April 6 and hold a public hearing on May 28.

On Tesla’s sunny picture, Chinese nuclear, and Bad Bunny’s electric halftime show

Current conditions: The Seattle Seahawks returned home to a classically rainy, overcast city from their win in last night’s Super Bowl, though the sun is expected to come out for Wednesday's victory parade • Severe Tropical Cyclone Mitchell is pummeling Western Australia with as much as 8 inches of rain • Flash floods from Storm Marta have killed at least four in Morocco.

Orsted’s two major offshore wind projects in the United States are back on track to be completed on schedule, its chief executive said. Rasmus Errboe told the Financial Times that the Revolution Wind and Sunrise Wind projects in New England would come online in the latter half of this year and in 2027, respectively. “We are fully back to work and construction on both projects is moving forward according to plan,” Errboe said. The U.S. has lost upward of $34 billion worth of clean energy projects since President Donald Trump returned to office, as I wrote last week. A new bipartisan bill introduced in the House last week to reform the federal permitting process would bar the White House from yanking back already granted permits. For now, however, the Trump administration has signaled its plans to appeal federal courts’ decisions to rule against its actions to halt construction on offshore turbines.

The fight over the billions in federal funding the White House is holding up for the Gateway rail project between New Jersey and New York, meanwhile, heated up over the weekend. On Friday night, a federal judge ordered the Trump administration to unfreeze the nearly $16 billion to the project, just hours after construction ground to a halt as funding ran dry. In her ruling, U.S. District Judge Jeannette Vargas of the Southern District of New York wrote that “plaintiffs have adequately shown that the public interest would be harmed by a delay in a critical infrastructure project.” Trump had his own idea in mind. Over the weekend, the White House proposed releasing the money only if Senate Minority Leader Chuck Schumer of New York agreed to rename Penn Station after Trump.

Tesla has started hiring staff to ramp up production of solar panels as the company looks to build 100 gigawatts of panel-manufacturing capacity supplied with raw materials produced in America. In a job posting on LinkedIn, Seth Winger, Tesla’s senior manager for solar products engineering, wrote that the panel-producing buildout was “an audacious, ambitious project.” For that, he wrote, “we need audacious, ambitious engineers and scientists to help us grow to massive scale. If you want to solve tough manufacturing problems at breakneck speed and help the U.S. breakthrough on renewable energy generation, come join us.” One of the listings indicated that the target date for bringing the new factories online was the “end of 2028,” giving an indication of timing that Reuters noted had been previously absent from Elon Musk’s public statements. Bloomberg reported last week that Tesla is already looking at sites in New York, Arizona, and Idaho for its manufacturing expansion.

The Trump administration tried to yank permits from the offshore wind projects off New England on the grounds that the towering turbines caused more ecological destruction than the electricity is worth. On Friday, however, Trump signed a proclamation reopening a giant marine preserve in the Atlantic Ocean to commercial fishing. First established at the end of the Obama administration, the Northeast Canyons and Seamounts Marine National Monument lies 130 miles off the coast of Cape Cod, encompassing what The New York Times described as “an area the size of Connecticut that is home to dolphins, endangered whales, sea turtles, and ancient deep-sea corals.” While Trump lifted the ban on commercial fishing in the zone during his first administration, President Joe Biden reinstated the restrictions. But this isn’t the first time Trump reopened a national marine national monument to fishing. In April, he ended protections for the Pacific Islands Heritage Marine National Monument located 750 miles west of Hawaii and designated by President George W. Bush in 2009.

Sign up to receive Heatmap AM in your inbox every morning:

Connecitcut’s Department of Insurance has launched a website that displays extensive information about the climate risk of every property in the state in what E&E News called “an unprecedented move to alert residents and to promote flood insurance.” The details include each property’s history of damage from floods and other events predicted to get worse as the planet warms. “A single risk score does not fully convey flood and climate risk,” department spokesperson Mary Quinn said. The department plans a marketing campaign this year with ads on radio, TV, and social media, and workshops for insurance agents on how to use the website. Nationwide, climate change is already raising household costs by $900 per year, as Heatmap’s Matthew Zeitlin reported last year. Wildfires have already “destroyed California’s insurance market,” according to an interview with Heatmap's Shift Key podcast last year with an expert at the University of Pennsylvania’s Wharton School.

Unit 1 of the Taipingling nuclear power station in China’s Guangdong has reached criticality seven years after construction began on the gigawatt-sized Hualong One reactor. The debut atom-splitting means the newest reactor is months, if not weeks, from entering into commercial operation. If that enticingly single-digit number of years to build a piece of infrastructure that takes the U.S. more than a decade wasn’t enough of a sign of China’s nuclear strengths, the country this week hit another milestone on a separate atomic station. At the Zhangzhou-3 nuclear reactor, workers last week installed the inner steel dome of the containment building.

Nearly a decade after Puerto Rico’s power grid collapsed and plunged America’s most populous territory into the second-longest blackout in world history, the island’s biggest musical star performed a Super Bowl halftime show that included linemen working on transformers. Bad Bunny’s performance, a revue of his reggaeton hits, served as an ode to what he called “my motherland, my homeland, Puerto Rico.” The grid still suffers regular outages. When it’s working, the power system sends occasional surges through wires that fry appliances. Electricity rates are higher than almost any state, despite Puerto Rico suffering worse poverty rates than Mississippi. At one point, Bad Bunny climbed a utility pole on stage waving a light-blue Puerto Rican flag, a symbol of the movement to establish the island territory as its own independent nation. It was a powerful political statement at America’s most-watched sporting event. For energy nerds, it was a rare opportunity to reflect on one of the worst, most prolonged infrastructure disasters in modern American history.