You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

Carbon removal would seem to have a pretty clear definition. It’s the reverse of carbon emissions. It means taking carbon out of the atmosphere and putting it somewhere else — underground, into products, into the ocean — where it won’t warm the planet. But a new kind of carbon removal project shows how this formula can conceal consequential differences between approaches.

A few months ago, Puro.earth, a carbon removal registry, certified a small ethanol refinery in North Dakota to sell carbon removal credits — the first ethanol plant to earn this privilege. Red Trail Energy, which owns the facility, captures the CO2 released from the plant when corn is fermented into ethanol, and injects it into a porous section of rock more than 6,000 feet underground. Since Red Trail started doing this in June of 2022, it’s prevented some 300,000 metric tons of CO2 from entering the atmosphere, according to data published by the North Dakota Department of Mineral Resources.

There are two ways to look at what’s happening here.

If you just follow the carbon, it started in the atmosphere and ended up underground. In between, the corn sucked up carbon through photosynthesis; when it was processed into ethanol, about a third of that carbon went into the fuel, a third was left behind as dried grain, and the remainder was captured as it wafted out of the fermentation tank and stashed underground. “That is, in a broad sense, how that looks like carbon removal,” Daniel Sanchez, an assistant professor at the University of California, Berkeley who studies biomass carbon removal, told me.

But if you zoom out, the picture changes. For the carbon to get from the atmosphere to the ground, a few other things had to happen. The corn had to be grown, harvested, and transported in trucks to the plant. It had to be put through a mill, cooked, and then liquified using heat from a natural gas boiler. And this was all in service, first and foremost, of producing ethanol to be burned, ultimately, in a car engine. If you account for the CO2 emitted during these other steps, the process as a whole is putting more into the atmosphere than it’s taking out.

So, is Red Trail Energy really doing carbon removal?

Puro.earth takes the first view — the registry’s rules essentially draw a box around the carbon capture and storage, or CCS, part of the process. Red Trail has to count the emissions from the energy it took to capture and liquify and inject the carbon, but not from anything else that happened before that. So far, Puro has issued just over 157,000 carbon removal credits for Red Trail to sell.

This is, essentially, industry consensus. Other carbon market registries including Gold Standard, Verra, and Isometric more or less take the same approach for any projects involving biomass, though they haven’t certified any ethanol projects yet. (Isometric’s current rules disqualify ethanol plants because they only allow projects that use waste biomass.)

But the nonprofit CarbonPlan, a watchdog for the carbon removal industry, argues that it’s a mistake to call this carbon removal. In a blog post published in December, program lead Freya Chay wrote that because the carbon storage is “contingent upon the continued production of ethanol,” it’s wrong to separate the two processes. The project reduces the facility’s overall emissions, Chay argued, but it’s not “carbon removal.”

This debate may sound semantic, and to some extent, it is. As long as an action results in less pollution warming the planet, does it matter whether we label it “carbon removal” or “emission reduction”?

The point of carbon credits is that they are paying for an intervention that wouldn’t have happened otherwise. “You have to look at, what part of the project is being built because they receive carbon removal credits?” Marianne Tikkanen, the co-founder and head of standard at Puro told me. “In this case, it was the capture part.” Previously, the emissions from the fermentation tank were considered to be zero, since the carbon started in the atmosphere and ended up back in the atmosphere. If you just look at the change that the sale of credits supported, those emissions are now negative.

But the logic of carbon credits may not be totally aligned with the point of carbon removal. Scientists generally see three roles for technologies that remove carbon from the atmosphere. The first is to reduce net emissions in the near term — Red Trail’s project checks that box. In the medium term, carbon removal can counteract any remaining emissions that we don’t know how to eliminate. That’s how we’ll “achieve net-zero” and stop the planet from warming.

But those who say these labels really matter are thinking of the third role. In the distant future, if we achieve net-zero emissions, but global average temperatures have reached dangerous heights, doing additional carbon removal — and lowering the total concentration of CO2 in the atmosphere — will be our only hope of cooling the planet. If this is the long term goal, there is a “clear conceptual problem” with calling a holistic process that emits more than it removes “carbon removal,” Chay told me.

“I think the point of definitions is to help us navigate the world,” she said. “It will be kind of a miracle if we get there, but that is the lighthouse.”

Red Trail may have been the first ethanol company to get certified to sell carbon removal credits, but others are looking to follow in its footsteps. Chay’s blog post, written in December, was responding to news of another project: Summit Carbon Solutions, a company trying to build a major pipeline through the midwest that will transport CO2 captured from ethanol refineries and deliver it to an underground well in North Dakota, announced a deal to pre-sell $30 million worth of carbon removal credits from the project; it plans to certify the credits through Gold Standard. In May, Summit announced it planned to sell more than 160 million tons of carbon removal credits over the next decade.

Decarbonization experts often refer to the emissions from ethanol plants as low-hanging fruit. Out of all the polluting industries that we could be capturing carbon from, ethanol is one of the easiest. The CO2 released when corn sugar is fermented is nearly 100% pure, whereas the CO2 that comes from fossil fuel combustion is filled with all kinds of chemicals that need to be scrubbed out first.

Even if it’s relatively easy, though, it’s not free, and the ethanol industry has historically ignored the opportunity. But in the past few years, federal tax credits and carbon markets have made the idea more attractive.

Red Trail’s CCS project has been a long time in the making. The company began looking into CCS in 2016, partnering with the Energy and Environmental Research Center, the North Dakota Industrial Commission Renewable Energy Council, and the U.S. Department of Energy on a five-year feasibility study. Jodi Johnson, Red Trail’s CEO, answered questions about the project by email. “Building a first-of-its-kind CCS project involved significant financial, technical, and regulatory risks,” she told me. “The technology, while promising, required substantial upfront investment and a commitment to navigating uncharted regulatory frameworks.”

The primary motivation for the project was the company’s “commitment to environmental stewardship and sustainability,” Johnson said, but low-carbon fuel markets in California and Oregon were also a “strategic incentive.” Ethanol companies that sell into those states earn carbon credits based on how much cleaner their fuel is than gasoline. They can sell those credits to dirtier-fuel makers who need to comply with state laws. The carbon capture project would enable Red Trail to earn more credits — a revenue stream that at first, looked good enough to justify the cost. A 2017 economic assessment of the project found that it “may be economically viable,” depending on the specific requirements in the two states.

But today, two years after Red Trail began capturing carbon, the company’s application to participate in California’s low-carbon fuel market is still pending. Though the company does sell some ethanol into the Oregon market, it decided to try and sell carbon removal credits through Puro to support “broader decarbonization and sequestration efforts while awaiting regulatory approvals,” Johnson said. Red Trail had already built its carbon capture system prior to working with Puro, but it may not have operated the equipment unless it had an incentive to do so.

Puro didn’t just take Red Trail’s word for it. The project underwent a “financial additionality test” including an evaluation of other incentives for Red Trail to sequester carbon. For example, the company can earn up to $50 in tax credits for each ton of CO2 it puts underground. (The Inflation Reduction Act increased this subsidy to $85 per ton, but Red Trail is not eligible for the higher amount because it started building the project before the law went into effect.) In theory, this tax credit alone could be enough to finance the project. A recent report from the Energy Futures Initiative concluded that a first-of-a-kind CCS project at an ethanol plant should cost between $36 and $41 per ton of CO2 captured and stored.

Johnson told me Red Trail does not pay income tax at the corporate level, however — it is taxed as a partnership. That means individual investors can take advantage of the credit, but it’s not a big enough benefit to secure project finance. The project “requires significant capital expenditure, operating expense, regulatory, and long-term monitoring for compliance,” she said. “Access to the carbon market was the needed incentive to secure the investment and the continuous project operation.”

Ultimately, after an independent audit of Red Trail’s claims, Puro concluded that the company did, in fact, need to sell carbon removal credits to justify operating the CCS project. (Red Trail is currently also earning carbon credits for fuel sold in Oregon, but Puro is accounting for these and deducting credits from its registry accordingly.)

All this helps make the case that it’s reasonable to support projects like Red Trail’s through the sale of carbon credits. But it doesn’t explain why we should call it carbon removal.

When I put the question to Tikkanen, she said that the project interrupts the “short cycle” of carbon: The CO2 is captured during photosynthesis, it’s transferred into food or fuel, and then it’s released back into the air in a continuous loop — all in a matter of months. Red Trail is turning that loop into a one-way street from the atmosphere to the ground, taking more and more carbon out of the air over time. That’s different from capturing carbon at a fossil fuel plant, where the carbon in question had previously been trapped underground for millennia.

Robert Hoglund, a carbon removal advisor who co-founded the database CDR.fyi, had a similar explanation. He told me that it didn’t make sense to categorize this project as “reducing emissions” from the plant because the fossil fuel-burning trucks that deliver the corn and the natural gas boilers cooking it are still releasing the same amount of carbon into the atmosphere. “If we say only processes that, if they're scaled up, lead to lower emissions in the atmosphere are carbon removal, that's looking at it from a system perspective,” he said. “I can understand where they come from, but I think it does add some confusion.”

Red Trail Energy and Summit Carbon Solutions defended the label, noting that this is the way carbon market registries have decided to treat biomass-based carbon sequestration projects. “The fact that emissions remain from the lifecycle of the corn itself is not the focus of the removal activity,” Johnson told me. “The biogenic CO2 is clearly removed from the atmosphere permanently.”

Sanchez, the Berkeley professor, argued that Puro’s rules are adequate because there’s a path for ethanol plants to eventually achieve net-negative emissions. They will have to capture emissions from the boiler, in addition to the fermentation process, and make a few other tweaks, like using renewable natural gas, according to a recent peer-reviewed study Sanchez authored. “That's not what's happening here,” he told me, “but I view that as indicative that this is part of the basket of technologies that we use to reach net-zero and to suck CO2 out of the air.”

(Red Trail is working on reducing its emissions even more, Johnson told me. The company is finishing engineering on a new combined heat and power system that will improve efficiency at the plant.)

In addition to teaching at Berkeley, Sanchez is a principal scientist for the firm Carbon Direct, which helps corporate buyers find “high quality” carbon removal credits. He added that he felt the project was “worthy" of the dollars companies are designating for carbon removal because of the risk it involved, and the fact that it would blaze a trail for others to follow. Ethanol CCS projects will help build up carbon storage infrastructure and expertise, enabling other carbon removal projects in the future.

Though there is seeming consensus among carbon market participants that this is carbon removal, scientists outside the industry are more skeptical. Katherine Maher, an Earth systems scientist who studies the carbon cycle at Stanford University, said she understood the argument for calling ethanol with CCS carbon removal, but she also couldn’t ignore the fact that capturing the carbon requires energy to grow the corn, transport it, and so on. “You really need to be conscious about, what are the other emissions in the project, and are those being accounted for in the calculation of the CO2 removed?”

Carbon180, a nonprofit that advocates for carbon removal policy, shares that perspective. “When it comes to ethanol with CCS, we want to see the actual net negativity,” Sifang Chen, the group’s managing science and innovation advisor, told me.

In the U.S. Department of Energy’s Road to Removals report, a 221-page document that highlights all of the opportunities for carbon removal in the United States, the agency specifically chose not to analyze ethanol with CCS “due largely to its inability to achieve a negative [carbon intensity] without substantial retrofitting of existing corn-ethanol facilities.”

It’s possible to say that both views are correct. Each follows a clear logic — one more rooted in creating practical rules for a market in order to drive innovation, the other in the uncompromising math of atmospheric science.

At times throughout writing this, I wondered if I was making something out of nothing. But the debate has significance beyond ethanol. Sanchez pointed out to me that you could ask the same question about any so-called carbon removal process that’s tied to an existing industry. Take enhanced rock weathering, for example, which involves crushing up special kinds of rocks that are especially good at absorbing carbon from the air. A lot of the companies trying to do this get their rocks from mining waste, but they don’t include all the emissions from mining in their carbon removal calculation.

Similarly, Summit Carbon Solutions noted that CarbonPlan supports claims of carbon removal by Charm Industrial, a company that takes the biomass left behind in corn fields, turns it into oil, and sequesters the oil underground. In that case, the company is not counting emissions from corn production or the downstream uses of corn.

Chay admitted that she didn’t have a great answer for why she drew the boundaries differently for one versus the other. “We don’t claim to have all the answers, and this back-and-forth illustrates just how much ambiguity there is and why it’s important to work through these issues,” she told me in an email. But she suggested that one point of comparison is to look at how dependent the carbon removal activity is on “the ongoing operation of a net emitting industry, and how one thinks about the role of that emitting industry in a net-zero world.” There is no apparent version of the future where we no longer have mining as an industry, or no longer grow corn for food. But there is a path to eliminating the use of ethanol by electrifying transportation.

It’s worth mentioning that this niche debate about carbon removal is taking place within a much larger and longer controversy about whether ethanol belongs in a low-carbon future at all.

Red Trail told me the company sees the adoption of electric vehicles as an opportunity to diversify into making fuels for aviation and heavy-duty transportation, which are more difficult to electrify. But some environmental groups, like the World Resources Institute, argue that a more sustainable approach would be to develop synthetic fuels from captured carbon and hydrogen. I should note that experts from both sides of this debate told me that carbon credit sales should not justify keeping an ethanol plant open or building a new one if the economics of the fuel don’t work on their own.

In Chay’s blog post, she presented real stakes for this rhetorical debate. If we call net-emitting processes carbon removal, we could develop an inflated sense of how much progress we’ve made toward our overall capacity to remove carbon from the atmosphere, which in turn could warp perceptions of how quickly we need to reduce emissions.

Peter Minor, the former director of science and innovation at Carbon180 who is starting a company focused on measurement and verification, raised the same concern. “When the definition of what it means to remove a ton of CO2 from the air is subjective, what happens is you get a bunch of projects that might have quite different climate impacts,” he told me. “And you may or may not realize it until after the fact.”

There’s also a risk of diverting funding that could go toward scaling up more challenging, more expensive, but truly net-negative solutions such as direct air capture. This risk is compounded by the growing pressure on carbon market players like Puro and Carbon Direct to identify new, more affordable carbon removal projects. Over the past several years, influential groups like the Science Based Targets initiative and corporate sustainability thought leaders like Stripe and Microsoft have decided that old-school carbon credits — the cheaper so-called “offsets” that represent emissions reductions — are not good enough. Now companies are expected to buy carbon removal credits to fulfill their climate promises to customers, lest they be accused of greenwashing.

As a result, the industry has backed itself into a corner, Minor told me. “We have come out as a society and said, the only thing that is worth it, the only thing that is allowed to be used is carbon removal,” he said. “So if that's the only thing with economics behind it, then yeah, like, magic! Everything is now all of a sudden carbon removal! Who would have predicted that this could have happened?”

The success of carbon removal depends, ultimately, on integrity — the industry’s favorite word these days. From the companies trying to remove carbon, to the carbon credit registries validating those efforts, to the nonprofits, brokers, and buyers that want to see the market scale, everyone is talking about developing transparent and trustworthy processes for measuring how much carbon is removed from the atmosphere by a given intervention. But how good is good measurement if experts don’t agree on what should be measured?

“There hasn't been a way to standardize the climate impacts that are being promised,” said Minor. “And so I think unless we solve that problem, I just don't see how we're going to build the trust we need, to create the economics that we need and justify an industry that can’t really exist outside of the millions or billions of tons scale.”

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Europeans have been “snow farming” for ages. Now the U.S. is finally starting to catch on.

February 2015 was the snowiest month in Boston’s history. Over 28 days, the city received a debilitating 64.8 inches of snow; plows ran around the clock, eventually covering a distance equivalent to “almost 12 trips around the Equator.” Much of that plowed snow ended up in the city’s Seaport District, piled into a massive 75-foot-tall mountain that didn’t melt until July.

The Seaport District slush pile was one of 11 such “snow farms” established around Boston that winter, a cutesy term for a place that is essentially a dumpsite for snow plows. But though Bostonians reviled the pile — “Our nightmare is finally over!” the Massachusetts governor tweeted once it melted, an event that occasioned multiple headlines — the science behind snow farming might be the key to the continuation of the Winter Olympics in a warming world.

The number of cities capable of hosting the Winter Games is shrinking due to climate change. Of 93 currently viable host locations, only 52 will still have reliable winter conditions by the 2050s, researchers found back in 2024. In fact, over the 70 years since Cortina d’Ampezzo first hosted the Olympic Games in 1956, February temperatures in the Dolomites have warmed by 6.4 degrees Fahrenheit, according to Climate Central, a nonprofit climate research and communications group. Italian organizers are expected to produce more than 3 million cubic yards of artificial snow this year to make up for Mother Nature’s shortfall.

But just a few miles down the road from Bormio — the Olympic venue for the men’s Alpine skiing events as well as the debut of ski mountaineering next week — is the satellite venue of Santa Caterina di Valfurva, which hasn’t struggled nearly as much this year when it comes to usable snow. That’s because it is one of several European ski areas that have begun using snow farming to their advantage.

Like Ruka in Finland and Saas-Fee in Switzerland, Santa Caterina plows its snow each spring into what is essentially a more intentional version of the Great Boston Snow Pile. Using patented tarps and siding created by a Finnish company called Snow Secure, the facilities cover the snow … and then wait. As spring turns to summer, the pile shrinks, not because it’s melting but because it’s becoming denser, reducing the air between the individual snowflakes. In combination with the pile’s reduced surface area, this makes the snow cold and insulated enough that not even a sunny day will cause significant melt-off. (Neil DeGrasse Tyson once likened the phenomenon to trying to cook an entire potato with a lighter; successfully raising the inner temperature of a dense snowball, much less a gigantic snow pile, requires more heat.)

Shockingly little snow melts during storage. Snow Secure reports a melt rate of 8% to 20% on piles that can be 50,000 cubic meters in size, or the equivalent of about 20 Olympic swimming pools. When autumn eventually returns, ski areas can uncover their piles of farmed snow and spread it across a desired slope or trail using snowcats, specialized groomers that break up and evenly distribute the surface. For Santa Caterina, the goal was to store enough to make a nearly 2-mile-long cross-country trail — no need to wait for the first significant snowfall of the season, which creeps later and later every year.

“In many places, November used to be more like a winter month,” Antti Lauslahti, the CEO of Snow Secure, told me. “Now it’s more like a late-autumn month; it’s quite warm and unpredictable. Having that extra few weeks is significant. When you cannot open by Thanksgiving or Christmas, you can lose 20% to 30% of the annual turnover.”

Though the concept of snow farming is not new — Lauslahti told me the idea stems from the Finnish tradition of storing snow over the summer beneath wood chips, once a cheap byproduct of the local logging industry — the company's polystyrene mat technology, which helps to reduce summer melt, is. Now that the technique is patented, Snow Secure has begun expanding into North America with a small team. The venture could prove lucrative: Researchers expect that by the end of the century, as many as 80% of the downhill ski areas in the U.S. will be forced to wait until after Christmas to open, potentially resulting in economic losses of up to $2 billion.

While there have been a few early adopters of snow farming in Wisconsin, Utah, and Idaho, the number of ski areas in the United States using the technique remains surprisingly low, especially given its many other upsides. In the States, the most common snow management system is the creation of artificial snow, which is typically water- and energy-intensive. Snow farming not only avoids those costs — which can also have large environmental tolls, particularly in the water-strapped West — but the super-dense snow farming produces is “really ideal” for something like the Race Centre at Canada’s Sun Peaks Resort, where top athletes train. Downhill racers “want that packed, harder, faster snow,” Christina Antoniak, the area’s director of brand and communications, told me of the success of the inaugural season of snow farming at Sun Peaks. “That’s exactly what stored snow produced for that facility.”

The returns are greatest for small ski areas, which are also the most vulnerable to climate change. While the technology is an investment — Antoniak ballparked that Sun Peaks spent around $185,000 on Snow Secure’s siding — the money goes further at a smaller park. At somewhere like Park City Mountain in Utah, stored snow would cover only a small portion of the area’s 140 miles of skiable routes. But it can make a major difference for an area down the road like the Soldier Hollow Nordic Center, which has a more modest 20 miles of cross-country trails.

In fact, the 2025-2026 winter season will be the Nordic Center’s first using Snow Secure’s technology. Luke Bodensteiner, the area’s general manager and chief of sport, told me that alpine ski areas are “all very curious to see how our project goes. There is a lot of attention on what we do, and if it works out satisfactorily, we might see them move into it.”

Ensuring a reliable start to the ski season is no small thing for a local economy; jobs and travel plans rely on an area being open when it says it will be. But for the Soldier Hollow Nordic Center, the stakes are even higher: The area is one of the planned host venues of the 2034 Salt Lake City Winter Games. “Based on historical weather patterns, our goal is to be able to make all the snow that we need for the entire Olympic trail system in two weeks,” Bodensteiner said, adding, “We envision having four or five of these snow piles around the venue in the summer before the Olympic Games, just to guarantee — in a worst case scenario — that we’ve got snow on the venue.”

Antoniak, at Canada’s Sun Peaks, also told me that their area has been a bit of a “guinea pig” when it comes to snow farming. “A lot of ski areas have had their eyes on Sun Peaks and how [snow farming is] working here,” she told me. “And we’re happy to have those conversations with them, because this is something that gives the entire industry some more resiliency.”

Of course, the physics behind snow farming has a downside, too. The same science saving winter sports is also why that giant, dirty pile of plowed snow outside your building isn’t going anywhere anytime soon.

Current conditions: A train of three storms is set to pummel Southern California with flooding rain and up to 9 inches mountain snow • Cyclone Gezani just killed at least four people in Mozambique after leaving close to 60 dead in Madagascar • Temperatures in the southern Indian state of Kerala are on track to eclipse 100 degrees Fahrenheit.

What a difference two years makes. In April 2024, New York announced plans to open a fifth offshore wind solicitation, this time with a faster timeline and $200 million from the state to support the establishment of a turbine supply chain. Seven months later, at least four developers, including Germany’s RWE and the Danish wind giant Orsted, submitted bids. But as the Trump administration launched a war against offshore wind, developers withdrew their bids. On Friday, Albany formally canceled the auction. In a statement, the state government said the reversal was due to “federal actions disrupting the offshore wind market and instilling significant uncertainty into offshore wind project development.” That doesn’t mean offshore wind is kaput. As I wrote last week, Orsted’s projects are back on track after its most recent court victory against the White House’s stop-work orders. Equinor's Empire Wind, as Heatmap’s Jael Holzman wrote last month, is cruising to completion. If numbers developers shared with Canary Media are to be believed, the few offshore wind turbines already spinning on the East Coast actually churned out power more than half the time during the recent cold snap, reaching capacity factors typically associated with natural gas plants. That would be a big success. But that success may need the political winds to shift before it can be translated into more projects.

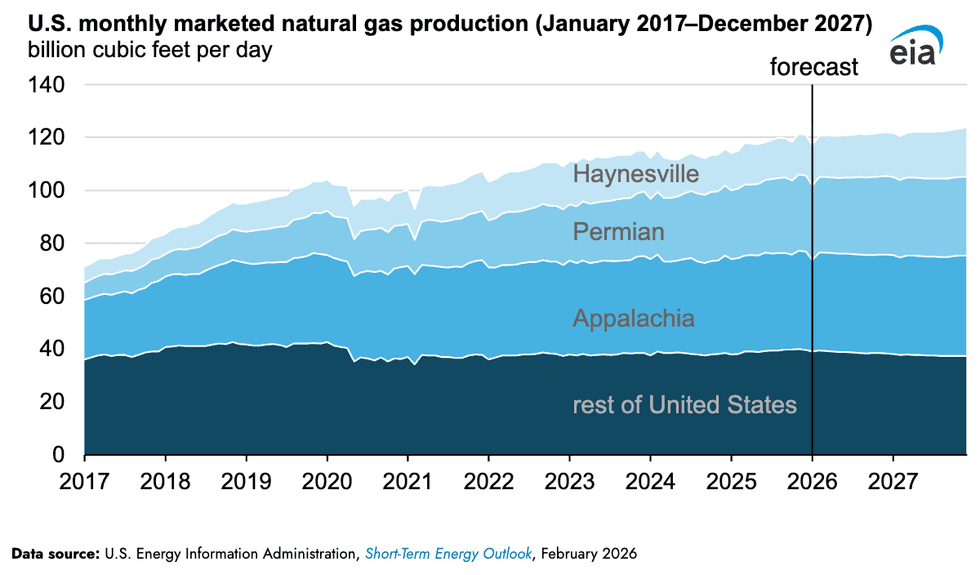

President Donald Trump’s “drill, baby, drill” isn’t moving American oil extractors, whose output is set to contract this year amid a global glut keeping prices low. But production of natural gas is set to hit a record high in 2026, and continue upward next year. The Energy Information Administration’s latest short-term energy outlook expects natural gas production to surge 2% this year to 120.8 billion cubic feet per day, from 118 billion in 2025 — then surge again next year to 122.3 billion cubic feet. Roughly 69% of the increased output is set to come from Appalachia, Louisiana’s Haynesville area, and the Texas Permian regions. Still, a lot of that gas is flowing to liquified natural gas exports, which Heatmap’s Matthew Zeitlin explained could raise prices.

The U.S. nuclear industry has yet to prove that microreactors can pencil out without the economies of scale that a big traditional reactor achieves. But two of the leading contenders in the race to commercialize the technology just crossed major milestones. On Friday, Amazon-backed X-energy received a license from the Nuclear Regulatory Commission to begin commercial production of reactor fuel high-assay low-enriched uranium, the rare but potent material that’s enriched up to four times higher than traditional reactor fuel. Due to its higher enrichment levels, HALEU, pronounced HAY-loo, requires facilities rated to the NRC’s Category II levels. While the U.S. has Category I facilities that handle low-enriched uranium and Category III facilities that manage the high-grade stuff made for the military, the country has not had a Category II site in operation. Once completed, the X-energy facility will be the first, in addition to being the first new commercial fuel producer licensed by the NRC in more than half a century.

On Sunday, the U.S. government airlifted a reactor for the first time. The Department of Defense transported one of Valar Atomics’ 5-megawatt microreactors via a C-17 from March Air Reserve Base in California to Hill Air Force Base in Utah. From there, the California-based startup’s reactor will go to the Utah Rafael Energy Lab in Orangeville, Utah, for testing. In a series of posts on X, Isaiah Taylor, Valar’s founder, called the event “a groundbreaking unlock for the American warfighters.” His company’s reactor, he said, “can power 5,000 homes or sustain a brigade-scale” forward operating base.

Sign up to receive Heatmap AM in your inbox every morning:

After years of attempting to sort out new allocations from the dwindling Colorado River, negotiators from states and the federal government disbanded Friday without a plan for supplying the 40 million people who depend on its waters. Upper-basin states Colorado, Utah, Wyoming, and New Mexico have so far resisted cutting water usage when lower-basin states California, Arizona, and Nevada are, as The Guardian put it, “responsible for creating the deficit” between supply and demand. But the lower-basin states said they had already agreed to substantial cuts and wanted the northern states to share in the burden. The disagreement has created an impasse for months; negotiators blew through deadlines in November and January to come up with a solution. Calling for “unprecedented cuts” that he himself described as “unbelievably harsh,” Brad Udall, senior water and climate research scientist at Colorado State University’s Colorado Water Center, said: “Mother Nature is not going to bail us out.”

In a statement Friday, Secretary of the Interior Doug Burgum described “negotiations efforts” as “productive” and said his agency would step in to provide guidelines to the states by October.

Europe’s “regulatory rigidity risks undermining the momentum of the hydrogen economy. That, at least, is the assessment of French President Emmanuel Macron, whose government has pumped tens of billions of euros into the clean-burning fuel and promoted the concept of “pink hydrogen” made with nuclear electricity as the solution that will make energy technology take off. Speaking at what Hydrogen Insight called “a high-level gathering of CEOs and European political leaders,” Macron, who is term-limited in next year’s presidential election, said European rules are “a crazy thing.” Green hydrogen, the version of the fuel made with renewable electricity, remains dogged by high prices that the chief executive of the Spanish oil company Repsol said recently will only come down once electricity rates decrease. The Dutch government, meanwhile, just announced plans to pump 8 billion euros, roughly $9.4 billion, into green hydrogen.

Kazakhstan is bringing back its tigers. The vast Central Asian nation’s tiger reintroduction program achieved record results in reforesting an area across the Ili River Delta and Southern Balkhash region, planting more than 37,000 seedlings and cuttings on an area spanning nearly 24 acres. The government planted roughly 30,000 narrow-leaf oleaster seedlings, 5,000 willow cuttings, and about 2,000 turanga trees, once called a “relic” of the Kazakh desert. Once the forests come back, the government plans to eventually reintroduce tigers, which died out in the 1950s.

In this special episode, Rob goes over the repeal of the “endangerment finding” for greenhouse gases with Harvard Law School’s Jody Freeman.

President Trump has opened a new and aggressive war on the Environmental Protection Agency’s ability to limit climate pollution. Last week, the EPA formally repealed its scientific determination that greenhouse gases endanger human health and the environment.

On this week’s episode of Shift Key, we find out what happens next.

Rob is joined by Jody Freeman, the director of the Environmental and Energy Law Program at Harvard Law School, to discuss the Trump administration’s war on the endangerment finding. They chat about how the Trump administration has already changed its argument since last summer, whether the Supreme Court will buy what it’s selling, and what it all means for the future of climate law.

They also talk about whether the Clean Air Act has ever been an effective tool to fight greenhouse gas pollution — and whether the repeal could bring any upside for states and cities.

Shift Key is hosted by Robinson Meyer, the founding executive editor of Heatmap News.

Subscribe to “Shift Key” and find this episode on Apple Podcasts, Spotify, Amazon, or wherever you get your podcasts.

You can also add the show’s RSS feed to your podcast app to follow us directly.

Here is an excerpt from our conversation:

Jody Freeman: The scientific community, you know, filed comments on this proposal and just knocked all of the claims in the report out of the box, and made clear how much evidence not only there was in 2009, for the endangerment finding, but much more now. And they made this very clear. And the National Academies of Science report was excellent on this. So they did their job. They reflected the state of the science and EPA has dropped any frontal attack on the science underlying the endangerment finding.

Now, it’s funny. My reaction to that is like twofold. One, like, yay science, right? Go science. But two is, okay, well, now the proposal seems a little less crazy, right? Or the rule seems a little less crazy. But I still think they had to fight back on this sort of abuse of the scientific record. And now it is the statutory arguments based on the meaning of these words in the law. And they think that they can get the Supreme Court to bite on their interpretation.

And they’re throwing all of these recent decisions that the Supreme Court made into the argument to say, look what you’ve done here. Look what you’ve done there. You’ve said that agencies need explicit authority to do big things. Well, this is a really big thing. And they characterize regulating transportation sector emissions as forcing a transition to EVs. And so to characterize it as this transition unheralded, you know, and they need explicit authority, they’re trying to get the court to bite. And, you know, they might succeed, but I still think some of these arguments are a real stretch.

Robinson Meyer: One thing I would call out about this is that while they’ve taken the climate denialism out of the legal argument, they cannot actually take it out of the political argument. And even yesterday, as the president was announcing this action — which, I would add, they described strictly in deregulatory terms. In fact, they seemed eager to describe it not as an environmental action, not as something that had anything to do with air and water, not even as a place where they were. They mentioned the Green New Scam, quote-unquote, a few times. But mostly this was about, oh, this is the biggest deregulatory action in American history.

It’s all about deregulation, not about like something about the environment, you know, or something about like we’re pushing back on those radicals. It was ideological in tone. But even in this case, the president couldn’t help himself but describe climate change as, I think the term he used is a giant scam. You know, like even though they’ve taken, surgically removed the climate denialism from the legal argument, it has remained in the carapace that surrounds the actual ...

Freeman: And I understand what they say publicly is, you know, deeply ideological sounding and all about climate is a hoax and all that stuff. But I think we make a mistake … You know, we all get upset about the extent to which the administration will not admit physics is a reality, you know, and science is real and so on. But, you know, we shouldn’t get distracted into jumping up and down about that. We should worry about their legal arguments here and take them seriously.

You can find a full transcript of the episode here.

Mentioned:

From Heatmap: The 3 Arguments Trump Used to Gut Greenhouse Gas Regulations

Previously on Shift Key: Trump’s Move to Kill the Clean Air Act’s Climate Authority Forever

Rob on the Loper Bright case and other Supreme Court attacks on the EPAThis episode of Shift Key is sponsored by ...

This episode of Shift Key is sponsored by ...

Accelerate your clean energy career with Yale’s online certificate programs. Explore the 10-month Financing and Deploying Clean Energy program or the 5-month Clean and Equitable Energy Development program. Use referral code HeatMap26 and get your application in by the priority deadline for $500 off tuition to one of Yale’s online certificate programs in clean energy. Learn more at cbey.yale.edu/online-learning-opportunities.

Music for Shift Key is by Adam Kromelow.