You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

Renewable energy isn’t the only big beneficiary of Biden’s announcement in Pennsylvania.

Seven regions of the country are about to become laboratories for a whole new system of producing and using energy. If all goes according to the Biden administration’s plans, by the end of the decade, clean hydrogen, which can be produced and used without greenhouse gas emissions, will replace fossil fuels across a variety of industries that can’t easily run on renewable energy.

President Biden announced the seven regions that will be eligible for up to $7 billion to build “hydrogen hubs” while visiting Pennsylvania on Friday. The selected hubs are made up of coalitions of governments, companies, labor groups, and universities that will use a combination of private and public funding to build new infrastructure to test the production, transport, and use of hydrogen.

The hubs have not yet been awarded any funding and will now move into a negotiation phase where they will refine their community benefits plans and other aspects of their proposals before being awarded an initial grant to move forward. In the coming weeks, the Department of Energy will begin hosting virtual community briefings with the project teams and local stakeholders in their regions, which may be used to inform the negotiation process.

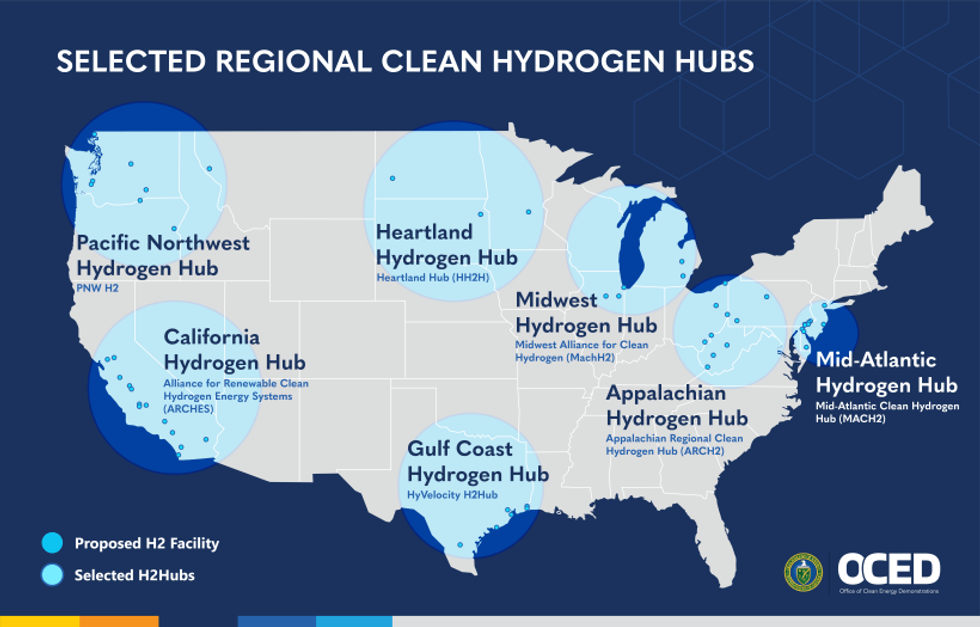

Friday’s announcement included the names of the seven hubs that are eligible for funding and a few paragraphs explaining the general outline of what they plan to do. The Department of Energy provided the following map which offers a rough sense of the number of projects within each hub and where they will be located. But there’s still very little information about what these projects are.

Based on what we do know, here are three big takeaways from the announcement today.

At least some of the dots on that map will be production facilities. The main benefit of hydrogen is that it doesn’t release emissions when burned, but the challenge is that it isn’t readily available in the environment like coal or gas or renewable energy. It has to be produced. And it will only help tackle climate change if it can be produced without emissions.

Three of the hubs — in California, the Pacific Northwest, and the Mid-Atlantic — plan to make hydrogen using only renewable energy, nuclear power, or biomass. But at least three of the hubs — in the Gulf Coast, Appalachia, and the Midwest — plan to make it from natural gas and capture the carbon released in the process. (The Department of Energy did not specify what resources the Heartland hub plans to use.)

A lot of climate advocates and researchers are skeptical if not outright against schemes to make hydrogen from natural gas with carbon capture. One risk is that not all of the carbon will be captured. Another is that it takes additional natural gas to run the capture equipment, so the overall effect could be increased natural gas production. That could perpetuate pollution in communities living near wells and processing facilities. Depending on how much methane leaks from natural gas infrastructure, it could also cancel out any benefits from using hydrogen.

The scale of these risks will become clearer after the projects move to the awards phase, at which point they will have to “submit detailed risk assessments and risk management plans outlining potential risks and impacts, and how they will mitigate those impacts.”

Hydrogen has the potential to be used in basically any application that we use fossil fuels in today. But because it takes so much energy to make, it won’t necessarily make sense to use it everywhere. One of the main purposes of the hydrogen hubs program is to determine the cases where hydrogen will be an efficient, economical way to cut emissions.

The hubs outline a variety of ways they will use hydrogen, from steelmaking to fertilizer production to power generation. But there’s one area that at least six out of the seven hubs all see a future in: heavy duty transportation. All of the regions except the Heartland hub describe building networks of hydrogen fueling stations for long-haul trucks, buses, municipal waste, drayage, and other heavy duty vehicles.

Truck manufacturers are mixed on whether hydrogen will ultimately be the best solution to replace diesel. Equipping trucks with rechargeable batteries could turn out to be cheaper. But powering trucks with hydrogen fuel cells may be a lighter, space-saving option, and offer the ability to refuel more quickly. If the hubs program establishes a national network of hydrogen fueling stations, that could help tip the scales in favor of fuel cell trucks. The question is whether it will be built in time to beat the pace of battery innovation.

However, there are two other types of transport where many experts agree hydrogen will be useful: aviation and shipping. The Midwest and Pacific hubs also plan to produce aviation fuel, and the Gulf Coast aims to produce fuel for ships.

While hydrogen hubs certainly come with risks, they also have the potential to deliver big economic benefits to communities. The research firm Rhodium Group estimates that a commercial-scale hydrogen production facility that uses electricity is associated with an average of 330 jobs during the construction phase and 45 permanent jobs when the plant becomes operational.

The hubs are expected to create more than 200,000 jobs during the construction phase, and more than 100,000 permanent jobs. The question, as always, is whether these will be “good” jobs. But at least three of the hubs — in California, the Mid-Atlantic, and the Pacific Northwest — say they will require labor agreements for all projects connected to their hubs. If the job estimates provided by the hubs are accurate, some 86% of the permanent positions created by the hubs will be in these three regions.

By definition, these kinds of deals are hashed out between developers and local unions prior to any hiring and establish wages and benefits for the workers involved in a project. They don’t guarantee that union workers will be hired, but they do level the playing field for union contractors to compete with non-union shops — and set clear standards for whoever is ultimately hired.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

The attacks on Iran have not redounded to renewables’ benefit. Here are three reasons why.

The fragility of the global fossil fuel complex has been put on full display. The Strait of Hormuz has been effectively closed, causing a shock to oil and natural gas prices, putting fuel supplies from Incheon to Karachi at risk. American drivers are already paying more at the pump, despite the United States’s much-vaunted energy independence. Never has the case for a transition to renewable energy been more urgent, clear, and necessary.

So despite the stock market overall being down, clean energy companies’ shares are soaring, right?

Wrong.

First Solar: down over 1% on the day. Enphase: down over 3%. Sunrun: down almost 8%; Tesla: down around 2.5%.

Why the slump? There are a few big reasons:

Several analysts described the market action today as “risk-off,” where traders sell almost anything to raise cash. Even safe haven assets like U.S. Treasuries sold off earlier today while the U.S. dollar strengthened.

“A lot of things that worked well recently, they’re taking a big beating,” Gautam Jain, a senior research scholar at the Columbia University Center on Global Energy Policy, told me. “It’s mostly risk aversion.”

Several trackers of clean energy stocks, including the S&P Global Clean Energy Transition Index (down 3% today) or the iShares Global Clean Energy ETF (down over 3%) have actually outperformed the broader market so far this year, making them potentially attractive to sell off for cash.

And some clean energy stocks are just volatile and tend to magnify broader market movements. The iShares Global Clean Energy ETF has a beta — a measure of how a stock’s movements compare with the overall market — higher than 1, which means it has tended to move more than the market up or down.

Then there’s the actual news. After President Trump announced Tuesday afternoon that the United States Development Finance Corporation would be insuring maritime trade “for a very reasonable price,” and that “if necessary” the U.S. would escort ships through the Strait of Hormuz, the overall market picked up slightly and oil prices dropped.

It’s often said that what makes renewables so special is that they don’t rely on fuel. The sun or the wind can’t be trapped in a Middle Eastern strait because insurers refuse to cover the boats it arrives on.

But what renewables do need is cash. The overwhelming share of the lifetime expense of a renewable project is upfront capital expenditure, not ongoing operational expenditures like fuel. This makes renewables very sensitive to interest rates because they rely on borrowed money to get built. If snarled supply chains translate to higher inflation, that could send interest rates higher, or at the very least delay expected interest rate cuts from central banks.

Sustained inflation due to high energy prices “likely pushes interest rate cuts out,” Jain told me, which means higher costs for renewables projects.

While in the long run it may make sense to respond to an oil or natural gas supply shock by diversifying your energy supply into renewables, political leaders often opt to try to maintain stability, even if it’s very expensive.

“The moment you start thinking about energy security, renewables jump up as a priority,” Jain said. “Most countries realize how important it is to be independent of the global supply chain. In the long term it works in favor of renewables. The problem is the short term.”

In the short term, governments often try to mitigate spiking fuel prices by subsidizing fossil fuels and locking in supply contracts to reinforce their countries’ energy supplies. Renewables may thereby lose out on investment that might more logically flow their way.

The other issue is that the same fractured supply chain that drives up oil and gas prices also affects renewables, which are still often dependent on imports for components. “Freight costs go up,” Jain said. “That impacts clean energy industry more.”

As for the Strait of Hormuz, Trump said the Navy would start escorting ships “as soon as possible.”

“It is difficult to imagine more arbitrary and capricious decisionmaking than that at issue here.”

A federal court shot down President Trump’s attempt to kill New York City’s congestion pricing program on Tuesday, allowing the city’s $9 toll on cars entering downtown Manhattan during peak hours to remain in effect.

Judge Lewis Liman of the U.S. District Court for the Southern District of New York ruled that the Trump administration’s termination of the program was illegal, writing, “It is difficult to imagine more arbitrary and capricious decisionmaking than that at issue here.”

So concludes a fight that began almost exactly one year ago, just after Trump returned to the White House. On February 19, 2025, the newly minted Transportation Secretary Sean Duffy sent a letter to Kathy Hochul, the governor of New York, rescinding the federal government’s approval of the congestion pricing fee. President Trump had expressed concerns about the program, Duffy said, leading his department to review its agreement with the state and determine that the program did not adhere to the federal statute under which it was approved.

Duffy argued that the city was not allowed to cordon off part of the city and not provide any toll-free options for drivers to enter it. He also asserted that the program had to be designed solely to relieve congestion — and that New York’s explicit secondary goal of raising money to improve public transit was a violation.

Trump, meanwhile, likened himself to a monarch who had risen to power just in time to rescue New Yorkers from tyranny. That same day, the White House posted an image to social media of Trump standing in front of the New York City skyline donning a gold crown, with the caption, "CONGESTION PRICING IS DEAD. Manhattan, and all of New York, is SAVED. LONG LIVE THE KING!"

New York had only just launched the tolling program a month earlier after nearly 20 years of deliberation — or, as reporter and Hell Gate cofounder Christopher Robbins put it in his account of those years for Heatmap, “procrastination.” The program was supposed to go into effect months earlier before, at the last minute, Hochul tried to delay the program indefinitely, claiming it was too much of a burden on New Yorkers’ wallets. She ultimately allowed congestion pricing to proceed with the fee reduced from $15 during peak hours to $9, and thereafter became one of its champions. The state immediately challenged Duffy’s termination order in court and defied the agency’s instruction to shut down the program, keeping the toll in place for the entirety of the court case.

In May, Judge Liman issued a preliminary injunction prohibiting the DOT from terminating the agreement, noting that New York was likely to succeed in demonstrating that Duffy had exceeded his authority in rescinding it.

After the first full year the program was operating, the state reported 27 million fewer vehicles entering lower Manhattan and a 7% boost to transit ridership. Bus speeds were also up, traffic noise complaints were down, and the program raised $550 million in net revenue.

The final court order issued Tuesday rejected Duffy’s initial arguments for terminating the program, as well as additional justifications he supplied later in the case.

“We disagree with the court’s ruling,” a spokesperson for the Transportation Department told me, adding that congestion pricing imposes a “massive tax on every New Yorker” and has “made federally funded roads inaccessible to commuters without providing a toll-free alternative.” The Department is “reviewing all legal options — including an appeal — with the Justice Department,” they said.

Current conditions: A cluster of thunderstorms is moving northeast across the middle of the United States, from San Antonio to Cincinnati • Thailand’s disaster agency has put 62 provinces, including Bangkok, on alert for severe summer storms through the end of the week • The American Samoan capital of Pago Pago is in the midst of days of intense thunderstorms.

We are only four days into the bombing campaign the United States and Israel began Saturday in a bid to topple the Islamic Republic’s regime. Oil prices closed Monday nearly 9% higher than where trading started last Friday. Natural gas prices, meanwhile, spiked by 5% in the U.S. and 45% in Europe after Qatar announced a halt to shipments of liquified natural gas through the Strait of Hormuz, which tapers at its narrowest point to just 20 miles between the shores of Iran and the United Arab Emirates. It’s a sign that the war “isn’t just an oil story,” Heatmap’s Matthew Zeitlin wrote yesterday. Like any good tale, it has some irony: “The one U.S. natural gas export project scheduled to start up soon is, of all things, a QatarEnergy-ExxonMobil joint venture.” Heatmap’s Robinson Meyer further explored the LNG angle with Eurasia Group analyst Gregory Brew on the latest episode of Shift Key.

At least for now, the bombing of Iranian nuclear enrichment sites hasn’t led to any detectable increase in radiation levels in countries bordering Iran, the International Atomic Energy Agency said Monday. That includes the Bushehr nuclear power plant, the Tehran research reactor, and other facilities. “So far, no elevation of radiation levels above the usual background levels has been detected in countries bordering Iran,” Director General Rafael Grossi said in a statement.

Financial giants are once again buying a utility in a bet on electricity growth. A consortium led by BlackRock subsidiary Global Infrastructure Partners and Swedish private equity heavyweight EQT announced a deal Monday to buy utility giant AES Corp. The acquisition was valued at more than $33 billion and is expected to close by early next year at the latest. “AES is a leader in competitive generation,” Bayo Ogunlesi, the chief executive officer of BlackRock’s Global Infrastructure Partners, said in a statement. “At a time in which there is a need for significant investments in new capacity in electricity generation, transmission, and distribution, especially in the United States of America, we look forward to utilizing GIP’s experience in energy infrastructure investing, as well as our operational capabilities to help accelerate AES’ commitment to serve the market needs for affordable, safe and reliable power.” The move comes almost exactly a year after the infrastructure divisions at Blackstone, the world’s largest alternative asset manager, bought the Albuquerque-based utility TXNM Energy in an $11.5 billion gamble on surging power demand.

China’s output of solar power surpassed that of wind for the first time last year as cheap panels flooded the market at home and abroad. The country produced nearly 1.2 million gigawatt-hours of electricity from solar power in 2025, up 40% from a year earlier, according to a Bloomberg analysis of National Bureau of Statistics data published Saturday. Wind generation increased just 13% to more than 1.1 gigawatt-hours. The solar boom comes as Beijing bolsters spending on green industry across the board. China went from spending virtually nothing on fusion energy development to investing more in one year than the entire rest of the world combined, as I have previously reported. To some, China is — despite its continued heavy use of coal — a climate hero, as Heatmap’s Katie Brigham has written.

Sign up to receive Heatmap AM in your inbox every morning:

Canada and India have a longstanding special friendship on nuclear power. Both countries — two of the juggernauts of the 56-country Commonwealth of Nations — operate fleets that rely heavily on pressurized heavy water reactors, a very different design than the light water reactors that make up the vast majority of the fleets in Europe and the United States. Ottawa helped New Delhi build its first nuclear plants. Now the two countries have renewed their atomic ties in what the BBC called a “landmark” deal Monday. As part of the pact, India signed a nine-year agreement with Canada’s largest uranium miner, Cameco, to supply fuel to New Delhi’s growing fleet of seven nuclear plants. The $1.9 billion deal opens a new market for Canada’s expanding production of uranium ore and gives India, which has long worried about its lack of domestic deposits, a stable supply of fuel.

India, meanwhile, is charging ahead with two new reactors at the Kaiga atomic power station in the southwestern state of Karnataka. The units are set to be IPHWR-700, natively designed pressurized heavy water reactors. Last week, the Nuclear Power Corporation of India poured the first concrete on the new pair of reactors, NucNet reported Monday.

The Spanish refiner Moeve has decided to move forward with an investment into building what Hydrogen Insight called “a scaled-back version” of the first phase of its giant 2-gigawatt Andalusian Green Hydrogen Valley project. Even in a less ambitious form, Reuters pegged the total value of the project at $1.2 billion. Meanwhile in the U.S., as I wrote yesterday, is losing major projects right as big production facilities planned before Trump returned to office come online.

Speaking of building, the LEGO Group is investing another $2.8 million into carbon dioxide removal. The Danish toymaker had already pumped money into carbon-removal projects overseen by Climate Impact Partners and ClimeFi. At this point, LEGO has committed $8.5 million to sucking planet-heating carbon out of the atmosphere, where it circulates for centuries. “As the program expands, it is helping to strengthen our understanding of different approaches and inform future decision-making on how carbon removal may complement our wider climate goals,” Annette Stube, LEGO’s chief sustainability officer, told Carbon Herald.