You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

Unpriced risk undermined the global economy during the financial crisis of 2008. Today, researchers say unpriced physical climate risk will lead to rapid declines in property values — and point out that this is already happening in some Florida markets. They often compare what’s happening now to the run-up to 2008. If the analogy holds, we will likely see disruption in other related financial structures. In particular, as the physical reality of climate change begins to have an effect on the attractiveness of bonds in risky areas, the ability of local governments to raise money to adapt to rapidly changing climate conditions may be undercut.

But comparing the effect of the 2008 unpriced risk on the municipal bond market with the potential effects of physical climate risk shows the suffering will likely be much greater this time. Today, there’s a direct, rather than indirect, connection between risk and public finance markets.

The solution? Last week, Tom Doe, CEO and founder of Municipal Market Analytics, said cities should act now to raise as much money as possible for adaptation before the municipal bond market starts pricing in physical climate risk. It’s only going to get more expensive later, in his view.

During the 2008 collapse, issuers of municipal bonds suffered. According to the final report on the crisis, New York State was stuck making suddenly skyrocketing interest payments to investors — the rate went from about 3.5% to more than 14% — on $4 billion of its debt. The Port Authority of New York and New Jersey’s interest rate went from 4.3% to 20% in a single week. Investors who had bought municipal bonds in auctions suffered too, because the pool of new buyers dried up very quickly in early 2008.

Since then, the muni market has bounced back in a big way, with professional investment managers urging tax-avoidant retail investors to buy individual bonds through separately managed accounts rather than through a mutual bond fund or an exchange-traded fund. Most people think $500 billion in bond issues is likely in 2025, and the group of buyers has a seemingly unending appetite for what they perceive to be safe and highly liquid investments — essentially the equivalent of money market accounts that promise federal tax-free interest payments.

But the risks now posed by physical climate change to municipal bond issuers and investors are different and likely greater than they were in 2008. The last time around, the municipal bond market suffered because of a domino effect — the insurance companies the issuers were using were exposed to mortgage risk.

According to the Financial Crisis Inquiry Report, so-called “monoline” insurers (writing policies for single financial structures rather than a broad array of products) had gotten into the mortgage-backed securities business, issuing a boatload of guarantees covering more than $250 billion of these structured products. The CEO of one of these monoline businesses, Alan Roseman of ACA, said, “We never expected losses. ... We were providing hedges on market volatility to institutional counterparties.” In other words, ACA believed its risk was limited because it wasn’t directly investing in the underlying assets — that its risk was limited to ups and downs in the market value of the mortgage-backed securities. But when the value of huge numbers of mortgage-backed securities plunged as the credit rating agencies woke up and repriced the risk of the subprime mortgages buried within them, ACA and other insurers were faced with stunning losses.

Those same insurers (MBIA, ACA, Ambac) were then substantially downgraded. And they hadn’t been insuring only mortgage-backed securities — they were also insuring municipal bonds and “auction rate securities” based on those bonds, structures that allowed local governments to borrow money at variable interest rates. When the insurance companies froze up because of the sudden repricing of mortgage-backed securities and their guarantees became worthless, the auction markets froze, as well. As a result, issuers of muni bonds (and investors in them) suffered.

In other words, in 2008, it was risk in a different financial arena — mortgage-backed securities guaranteed by insurance companies — that slopped over and caused problems for municipal bonds. By contrast, when it comes to physical climate change today, the municipal bond market is directly exposed to the central risk: Will the communities that effectively guarantee these bonds continue to be viable? Will these communities be insurable? Will community property values and thus property taxes suddenly decline?

Not only that, the 2008 risk was different because it could be eventually unwound. Property markets could get going again, as they have in spades. This time, deterioration of the underlying asset — the communities themselves — will likely be irreversible. Chronic flooding will not cease on any human-relevant time scale.

Issuers are not being penalized — yet — for the physical climate risk facing their communities, according to Tom Doe’s conversation with Will Compernolle on the latter’s Simply Put podcast last week. “This risk is not being priced in,” Doe said. “There’s no evidence of that right now. And in addition, the rating agencies have not reflected [physical risk] in their letter scoring of credit risk … so there is not a ratings penalty right now. There’s not a pricing penalty.”

Doe’s suggestion is that local governments may want to get out there and raise as much money as they can for adaptation. “State and local governments who are in harm’s way that need to do this can go to the market right now, and investors are not penalizing them. The market is not. So this is essentially cheap money if they issue [bonds] for these projects today,” Doe said.

That’s one way of looking at the situation. Public money for adaptation is cheap, there’s a lot of it potentially available, and it is much less expensive to raise that money now than it will be once the credit rating agencies and the investors start pricing in physical risk and demanding higher interest payments in exchange for the use of their cash.

It’s a race against time: Eventually, as in 2008, the mispriced risk will be correctly assessed. This time, unlike the last crisis, the harm to the underlying assets will be permanent.

A version of this article originally appeared in the author’s newsletter, Moving Day, and has been repurposed for Heatmap.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

This week is light on the funding, heavy on the deals.

This week’s Funding Friday is light on the funding but heavy on the deals. In the past few days, electric carmaker Rivian and virtual power plant platform EnergyHub teamed up to integrate EV charging into EnergyHub’s distributed energy management platform; the power company AES signed 20-year power purchase agreements with Google to bring a Texas data center online; and microgrid company Scale acquired Reload, a startup that helps get data centers — and the energy infrastructure they require — up and running as quickly as possible. Even with venture funding taking a backseat this week, there’s never a dull moment.

Ahead of the Rivian R2’s launch later this year, the EV-maker has partnered with EnergyHub, a company that aggregates distributed energy resources into virtual power plants, to give drivers the opportunity to participate in utility-managed charging programs. These programs coordinate the timing and rate of EV charging to match local grid conditions, enabling drivers to charge when prices are low and clean energy is abundant while avoiding periods of peak demand that would stress the distribution grid.

As Seth Frader-Thompson, EnergyHub’s president, said in a statement, “Every new EV on the road is a win for drivers and the environment, and by managing charging effectively, we ensure this growth remains a benefit for the grid as well.”

The partnership will fold Rivian into EnergyHub’s VPP ecosystem, giving the more than 150 utilities on its platform the ability to control when and how participating Rivian drivers charge. This managed approach helps alleviate grid stress, thus deferring the need for costly upgrades to grid infrastructure such as substations or transformers. Extending the lifespan of existing grid assets means lower electricity costs for ratepayers and more capacity to interconnect new large loads — such as data centers.

Google seems to be leaning hard into the “bring-your-own-power” model of data center development as it looks to gain an edge in the AI race.

The latest evidence came on Tuesday, when the power company and utility operator AES announced a partnership with the hyperscaler to provide on-site power for a new data center in Texas. signing 20-year power purchase agreements. AES will develop, own, and operate the generation assets, as well as all necessary electricity infrastructure, having already secured the land and interconnection agreements to bring this new power online. The data center is set to begin operations in 2027.

As of yet, neither company has disclosed the exact type of energy infrastructure that AES will be building, although Amanda Peterson Corio, Google’s head of data center energy, said in a press release that it will be “clean.”

“In partnership with AES, we are bringing new clean generation online directly alongside the data center to minimize local grid impact and protect energy affordability,” she said.

This announcement came the same day the hyperscaler touted a separate agreement with the utility Xcel Energy to power another data center in Minnesota with 1.6 gigawatts of solar and wind generation and 300 megawatts of long-duration energy storage from the iron-air battery startup Form Energy.

The microgrid developer Scale has acquired Reload, a “powered land” startup founded in 2024, for an undisclosed sum. What is “powered land”? Essentially, it’s land that Reload has secured and prepared for large data centers customers, obtaining permits and planning for onsite energy infrastructure such that sites can be energized immediately. This approach helps developers circumvent the years-long utility interconnection queue and builds on Scale’s growing focus on off-grid data center projects, as the company aims to deliver gigawatts of power for hyperscalers in the coming years powered by a diverse mix of sources, from solar and battery storage to natural gas and fuel cells.

Early last year, the Swedish infrastructure investor EQT acquired Scale. The goal, EQT said, was to enable the company “to own and operate billions of dollars in distributed generation assets.” At the time of the acquisition, Scale had 2.5 gigawatts of projects in its pipeline. In its latest press release the company announced it has secured a multi-hundred-megawatt contract with a leading hyperscaler, though it did not name names.

As Jan Vesely, a partner at EQT said in a statement, “By bringing together Reload’s campus development capabilities, Scale’s proven islanded power operating platform, and EQT’s deep expertise across energy, digital infrastructure and technology, we are supporting a more integrated approach to delivering power for next-generation digital infrastructure today.”

Not to say there’s been no funding news to speak of!

As my colleague Alexander C. Kaufman reported in an exclusive on Thursday, fusion company Shine Technologies raised $240 million in a Series E round, the majority of which came from biotech billionaire Patrick Soon-Shiong. Unlike most of its peers, Shine isn’t gunning to build electricity-generating reactors anytime soon. Instead, its initial focus is producing valuable medical isotopes — currently made at high cost via fission — which it can sell to customers such as hospitals, healthcare organizations, or biopharmaceutical companies. The next step, Shine says, is to scale into recycling radioactive waste from spent fission fuel.

“The basic premise of our business is fusion is expensive today, so we’re starting by selling it to the highest-paying customers first,” the company’s CEO, Greg Piefer told Kaufman, calling electricity customers the “lowest-paying customer of significance for fusion today.”

On the solar siege, New York’s climate law, and radioactive data center

Current conditions: A rain storm set to dump 2 inches of rain across Alabama, Tennessee, Georgia, and the Carolinas will quench drought-parched woodlands, tempering mounting wildfire risk • The soil on New Zealand’s North Island is facing what the national forecast called a “significant moisture deficit” after a prolonged drought • Temperatures in Odessa, Texas, are as much as 20 degrees Fahrenheit hotter than average.

For all its willingness to share in the hype around as-yet-unbuilt small modular reactors and microreactors, the Trump administration has long endorsed what I like to call reactor realism. By that, I mean it embraces the need to keep building more of the same kind of large-scale pressurized water reactors we know how to construct and operate while supporting the development and deployment of new technologies. In his flurry of executive orders on nuclear power last May, President Donald Trump directed the Department of Energy to “prioritize work with the nuclear energy industry to facilitate” 5 gigawatts of power uprates to existing reactors “and have 10 new large reactors with complete designs under construction by 2030.” The record $26 billion loan the agency’s in-house lender — the Loan Programs Office, recently renamed the Office of Energy Dominance Financing — gave to Southern Company this week to cover uprates will fulfill the first part of the order. Now the second part is getting real. In a scoop on Thursday, Heatmap’s Robinson Meyer reported that the Energy Department has started taking meetings with utilities and developers of what he said “would almost certainly be AP1000s, a third-generation reactor produced by Westinghouse capable of producing up to 1.1 gigawatts of electricity per unit.”

Reactor realism includes keeping existing plants running, so notch this as yet more progress: Diablo Canyon, the last nuclear station left in California, just cleared the final state permitting hurdle to staying open until 2030, and possibly longer. The Central Coast Water Board voted unanimously on Thursday to give the state’s last nuclear plant a discharge permit and water quality certification. In a post on LinkedIn, Paris Ortiz-Wines, a pro-nuclear campaigner who helped pass a 2022 law that averted the planned 2025 closure of Diablo Canyon, said “70% of public comments were in full support — from Central Valley agricultural associations, the local Chamber of Commerce, Dignity Health, the IBEW union, district supervisors, marine meteorologists, and local pro-nuclear organizations.” Starting in 2021, she said, she attended every hearing on the bill that saved the plant. “Back then, I knew every single pro-nuclear voice testifying,” she wrote. “Now? I’m meeting new ones every hearing.”

It was the best of times, it was the worst of times. It was a year of record solar deployments, it was a year of canceled solar megaprojects, choked-off permits, and desperate industry pleas to Congress for help. But the solar industry’s political clouds may be parting. The Department of the Interior is reviewing at least 20 commercial-scale projects that E&E News reported had “languished in the permitting pipeline” since Trump returned to office. “That includes a package of six utility-scale projects given the green light Friday by Interior Secretary Doug Burgum to resume active reviews, such as the massive Esmeralda Energy Center in Nevada,” the newswire reported, citing three anonymous career officials at the agency.

Heatmap’s Jael Holzman broke the news that the project, also known as Esmeralda 7, had been canceled in October. At the time, NextEra, one of the project’s developers, told her that it was “committed to pursuing our project’s comprehensive environmental analysis by working closely with the Bureau of Land Management.” That persistence has apparently paid off. In a post on X linking to the article, Morgan Lyons, the senior spokesperson at the Solar Energy Industries Association, called the change “quite a tone shift” with the eyes emoji. GOP voters overwhelmingly support solar power, a recent poll commissioned by the panel manufacturer First Solar found. The MAGA coalition has some increasingly prominent fans. As I have covered in the newsletter, Katie Miller, the right-wing influencer and wife of Trump consigliere Stephen Miller, has become a vocal proponent of competing with China on solar and batteries.

Get Heatmap AM directly in your inbox every morning:

MP Materials operates the only active rare earths mine in the United States at California’s Mountain Pass. Now the company, of which the federal government became the largest shareholder in a landmark deal Trump brokered earlier this year, is planning a move downstream in the rare earths pipeline. As part of its partnership with the Department of Defense, MP Materials plans to invest more than $1 billion into a manufacturing campus in Northlake, Texas, dedicated to making the rare earth magnets needed for modern military hardware and electric vehicles. Dubbed 10X, the campus is expected to come online in 2028, according to The Wall Street Journal.

Sign up to receive Heatmap AM in your inbox every morning:

New York’s rural-urban divide already maps onto energy politics as tensions mount between the places with enough land to build solar and wind farms and the metropolis with rising demand for power from those panels and turbines. Keeping the state’s landmark climate law in place and requiring New York to generate the vast majority of its power from renewables by 2040 may only widen the split. That’s the obvious takeaway from data from the New York State Energy Research and Development Authority. In a memo sent Thursday to Governor Kathy Hochul on the “likely costs of” complying with the law as it stands, NYSERDA warned that the statute will increase the cost of heating oil and natural gas. Upstate households that depend on fossil fuels could face hikes “in excess of $4,000 a year,” while New York City residents would see annual costs spike by $2,300. “Only a portion of these costs could be offset by current policy design,” read the memo, a copy of which City & State reporter Rebecca C. Lewis posted on X.

Last fall, this publication’s energy intelligence unit Heatmap Pro commissioned a nationwide survey asking thousands of American voters: “Would you support or oppose a data center being built near where you live?” Net support came out to +2%, with 44% in support and 42% opposed. Earlier this month, the pollster Embold Research ran the exact same question by another 2,091 registered voters across the country. The shift in the results, which I wrote about here, is staggering. This time just 28% said they would support or strongly support a data center that houses “servers that power the internet, apps, and artificial intelligence” in their neighborhood, while 52% said they would oppose or strongly oppose it. That’s a net support of -24% — a 26-point drop in just a few months.

Among the more interesting results was the fact that the biggest partisan gap was between rural and urban Republicans, with the latter showing greater support than any other faction. When I asked Emmet Penney at the right-leaning Foundation for American Innovation to make sense of that for me, he said data centers stoke a “fear of bigness” in a way that compares to past public attitudes on nuclear power.

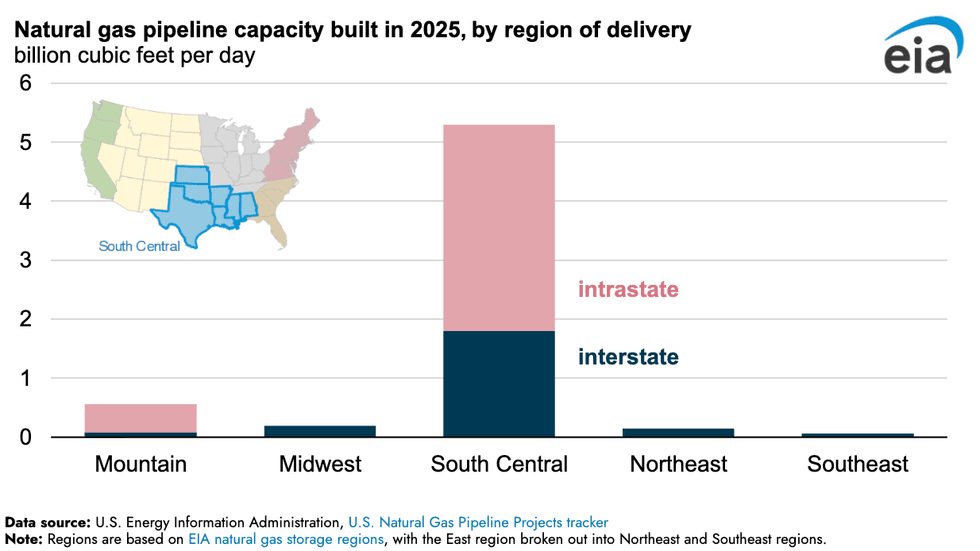

Gas pipeline construction absolutely boomed last year in one specific region of the U.S. Spanning Texas, Oklahoma, Kansas, Arkansas, Louisiana, Mississippi, and Alabama, the so-called South Central bloc saw a dramatic spike in intrastate natural gas pipelines, more than all other regions combined, per new Energy Information Administration data. It’s no mystery as to why. The buildout of liquified natural gas export terminals along the Gulf coast needs conduits to carry fuel from the fracking fields as far west as the Texas Permian.

Rob sits down with Jane Flegal, an expert on all things emissions policy, to dissect the new electricity price agenda.

As electricity affordability has risen in the public consciousness, so too has it gone up the priority list for climate groups — although many of their proposals are merely repackaged talking points from past political cycles. But are there risks of talking about affordability so much, and could it distract us from the real issues with the power system?

Rob is joined by Jane Flegal, a senior fellow at the Searchlight Institute and the States Forum. Flegal was the former senior director for industrial emissions at the White House Office of Domestic Climate Policy, and she has worked on climate policy at Stripe. She was recently executive director of the Blue Horizons Foundation.

Shift Key is hosted by Robinson Meyer, the founding executive editor of Heatmap News.

Subscribe to “Shift Key” and find this episode on Apple Podcasts, Spotify, Amazon, or wherever you get your podcasts.

You can also add the show’s RSS feed to your podcast app to follow us directly.

Here is an excerpt from their conversation:

Robinson Meyer: What’s interesting is the scarcity model is driven by the fact that ultimately rate payers that is utility customers are where the buck stops, and so state regulators don’t want utilities to overbuild for a given moment because ultimately it is utility customers — it’s people who pay their power bills — who will bear the burden of a utility overbuilding. In some ways, the entire restructured electricity market system, the entire shift to electricity markets in the 90s and aughts, was because of this belief that utilities were overbuilding.

And what’s been funny is that, what, we started restructuring markets around the year 2000. For about five or six or seven years. Wall Street was willing to finance new electricity. I mean, I hear two stories here — basically it’s another place where I hear two stories, and I think where there’s a lot of disagreement about the path forward on electricity policy, in that I’ve heard a story that, basically, electricity restructuring starts in the late 90s you know year 2000, and for five years, Wall Street is willing to finance new power investment based entirely on price risk based entirely on the idea that market prices for electricity will go up. Then three things happen: The Great Recession, number one, wipes out investment, wipes out some future demand.

Number two, fracking. Power prices tumble, and a bunch of plays that people had invested in, including then advanced nuclear, are totally out of the money suddenly. Number three, we get electricity demand growth plateaus, right? So for 15 years, electricity demand plateaus. We don’t need to finance investments into the power grid anymore. This whole question of, can you do it on the back of price risk? goes away because electricity demand is basically flat, and different kinds of generation are competing over shares and gas is so cheap that it’s just whittling away.

Jane Flegal: But this is why that paradigm needs to change yet again. Like ,we need to pivot to like a growth model where, and I’m not, again —

Meyer: I think what’s interesting, though, is that Texas is the other counterexample here. Because Texas has had robust load growth for years, and a lot of investment in power production in Texas is financed off price risk, is financed off the assumption that prices will go up. Now, it’s also financed off the back of the fact that in Texas, there are a lot of rules and it’s a very clear structure around finding firm offtake for your powers. You can find a customer who’s going to buy 50% of your power, and that means that you feel confident in your investment. And then the other 50% of your generation capacity feeds into ERCOT. But in some ways, the transition that feels disruptive right now is not only a transition like market structure, but also like the assumptions of market participants about what electricity prices will be in the future.

Flegal: Yeah, and we may need some like backstop. I hear the concerns about the risks of laying early capital risks basically on rate payers in the frame of growth rather than scarcity. But I guess my argument is just there’s ways to deal with that. Like we could come up with creative ways to think about dealing with that. And I’m not seeing enough ideation in that space, which — I would like, again, a call for papers, I guess — that I would really like to get a better handle on.

The other thing that we haven’t talked about, but that I do think, you know, the States Forum, where I’m now a senior fellow, I wrote a piece for them on electricity affordability several months ago now. But one of the things that doesn’t get that much attention is just like getting BS off of bills, basically. So there’s like the rate question, but then there’s the like, what’s in a bill? And like, what, what should or should not be in a bill? And in truth, you know, we’ve got a lot of social programs basically that are being funded by the rate base and not the tax base. And I think there are just like open questions about this — whether it’s, you know, wildfire in California, which I think everyone recognizes is a big challenge, or it’s efficiency or electrification or renewable mandates in blue states. There are a bunch of these things and it’s sort of like there are so few things you can do in the very near term to constrain rate increases for the reasons we’ve discussed.

You can find a full transcript of the episode here.

Mentioned:

Cheap and Abundant Electricity Is Good, by Jane Flegal

From Heatmap: Will Virtual Power Plants Ever Really Be a Thing?

Previously on Shift Key: How California Broke Its Electricity Bills and How Texas Could Destroy Its Electricity Market

This episode of Shift Key is sponsored by …

Accelerate your clean energy career with Yale’s online certificate programs. Explore the 10-month Financing and Deploying Clean Energy program or the 5-month Clean and Equitable Energy Development program. Use referral code HeatMap26 and get your application in by the priority deadline for $500 off tuition to one of Yale’s online certificate programs in clean energy. Learn more at cbey.yale.edu/online-learning-opportunities.

Music for Shift Key is by Adam Kromelow.