You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

A new report from Carbon Brief shows how accounting for empires tips the historic emissions balance.

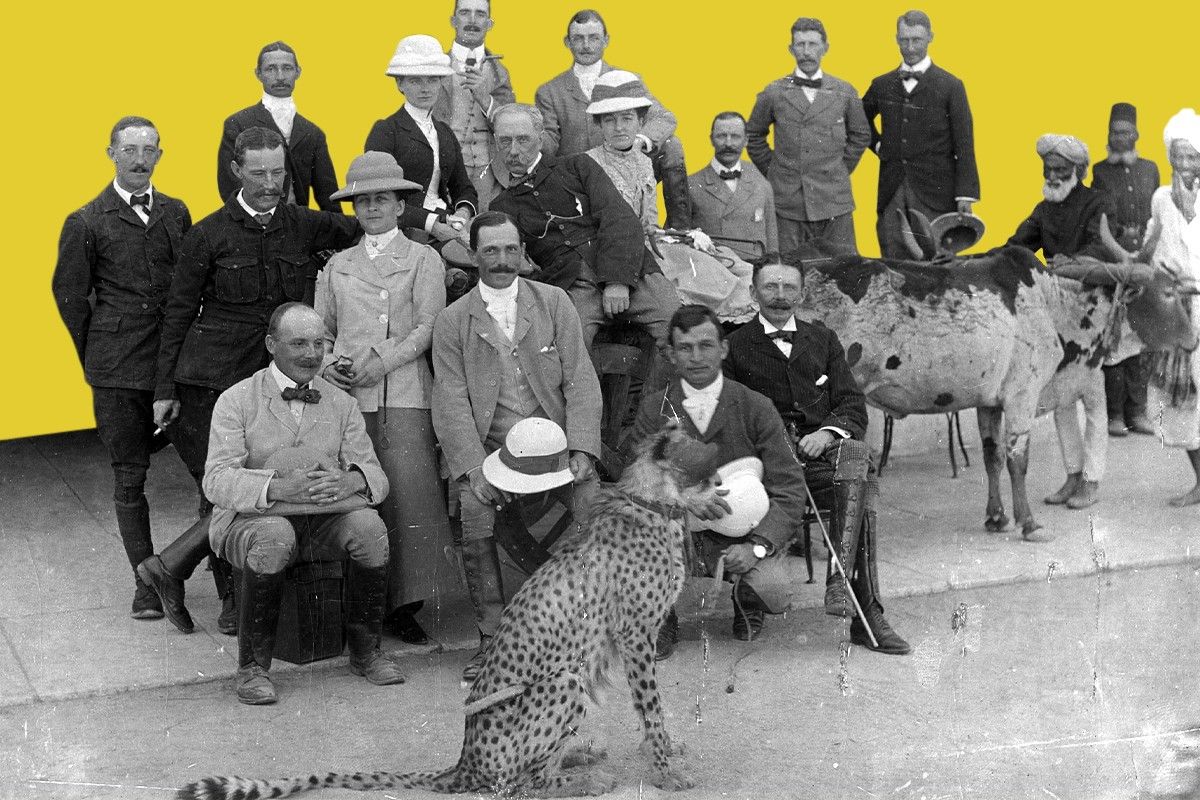

The British pose in India.

At the height of Britain’s power, it was said that the sun never set on its empire. The crown’s tendrils stretched around the world, with colonies on every continent but Antarctica — though I’m sure if there had been anybody around to subjugate on the ice, the crown would have happily set up shop there, too.

The British were not, of course, the only colonial power; many of their European brethren had empires of their own. All that colonization takes energy, and the days of empire were also, for the most part, the days of coal. But as countries around the world gained their independence, they also found themselves responsible for the historic emissions that came from their colonizers burning fossil fuels within their borders.

A new analysis from Carbon Brief aims to correct that record. Using the same methodology as an analysis of historic emissions conducted in 2021, researchers found that accounting for colonial rule dramatically shifts the responsibility for climate change towards the historic European powers. My home country of India, for example, sees its share of historical responsibility fall by 15%, while the UK, its former ruler, sees its share nearly double. The Netherlands’ share, meanwhile, nearly triples.

This is a rare kind of post-colonial accountability, and it thoroughly reshuffles the ranking table of biggest historic polluters. The UK, for example, rises from 9th place on the emissions chart to 5th — above India, which sits steady at 8th — while the Netherlands goes from 35th to 13th:

For years, developing nations have been pushing for wealthy countries — many of which are former colonial powers, their riches built through pillage — to pay for a loss and damage fund that some argue should have its contributions decided based on each country’s historic emissions. It’s unlikely this Carbon Brief analysis will affect discussions at COP28 in Dubai, where the loss and damage fund will no doubt be a point of negotiation yet again, but it’s a striking report regardless. The colonial powers have tried their best to wash their hands of their violent legacy; soot stains, it seems, are a bit harder to erase from the record.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

A letter from the Solar Energy Industries Association describes the administration’s “nearly complete moratorium on permitting.”

A major solar energy trade group now says the Trump administration is refusing to do even routine work to permit solar projects on private lands — and that the situation has become so dire for the industry, lawmakers discussing permitting reform in Congress should intervene.

The Solar Energy Industries Association on Thursday published a letter it sent to top congressional leaders of both parties asserting that a July memo from Interior Secretary Doug Burgum mandating “elevated” review for renewables project decisions instead resulted in “a nearly complete moratorium on permitting for any project in which the Department of Interior may play a role, on both federal and private land, no matter how minor.” The letter was signed by more than 140 solar companies, including large players EDF Power Solutions, RES, and VDE Americas.

The letter reinforces a theme underlying much of Heatmap’s coverage since the memo’s release — that the bureaucratic freeze against solar decision-making has stretched far beyond final permits to processes once considered ancillary. It also confirms that the enhanced review has jammed up offices outside Burgum’s purview, such as the Army Corps of Engineers, which oversees wetlands, water crossings, and tree removals, and requires Interior to sign off on actions through the interagency consultation process.

SEIA’s letter asserts that the impacts of Burgum’s memo stretch even to projects on private lands seeking Interior’s assistance to determine whether federally protected species are even present — meaning that regardless of whether endangered animals or flowers are there, companies are now taking on an outsized legal risk by moving forward with any kind of development.

After listing out these impacts in its letter, SEIA asked Congress to pressure Interior into revoking the July memo in its entirety. The trade group added there may be things Interior could do besides revoking the memo that would amount to “reasonable steps” in the “short-term to prevent unnecessary delays in energy development that is currently poised to help meet the growing energy demands of AI and other industries.” SEIA did not elaborate on what those actions would look like in its letter.

“Businesses need certainty in order to continue making investments in the United States to build out much-needed energy projects,” SEIA’s letter reads. “Certainty must include a review process that does not discriminate by energy source.” It concludes: “We urge Congress to keep fairness and certainty at the center of permitting negotiations.”

Notably, the letter arrived after American Clean Power — another major trade group representing renewable energy companies — backed a major GOP-authored permitting bill called the SPEED Act that is moving through the House. Although the bill has some bipartisan support from the most moderate wing of the House Democratic caucus, it has yet to win support from Democrats involved in bipartisan permitting talks, including Representative Scott Peters, who told me he’d back the bill only if Trump were prevented from stalling federal decision-making for renewable energy projects.

SEIA has deliberately set itself apart from ACP in this regard, telling me last week that it was neutral on the legislation as it stands. In a statement released with the letter to Congress, the trade group’s CEO, Abigail Ross Hopper, said that while “the solar industry values the continued bipartisan engagement on permitting reform, the SPEED Act, as passed out of committee, falls short of addressing this core problem: the ongoing permitting moratorium.”

“To be clear, there is no question we need permitting reform,” Hopper stated. “There is an agreement to be reached, and SEIA and our 1,200 member companies will continue our months-long effort to advocate for a deal that ensures equal treatment of all energy sources, because the current status of this blockade is unsustainable.”

In a statement to Heatmap News, Interior spokesperson Alyse Sharpe confirmed the agency is using its “current review process” on “federal resources, permits or consultations” related to solar projects on “federal, state or private lands.” “This policy strengthens accountability, prevents misuse of taxpayer-funded subsidies and upholds our commitment to restoring balance in energy development.” The agency declined to comment on SEIA’s request to Congress, though. “We don’t provide comment on correspondence to Congress regarding Interior issues via the media,” Sharpe said.

The senator spoke at a Heatmap event in Washington, D.C. last week about the state of U.S. manufacturing.

At Heatmap’s event, “Onshoring the Electric Revolution,” held last week in Washington, D.C. every guest agreed: The U.S. is falling behind in the race to build the technologies of the future.

Senator Catherine Cortez Masto of Nevada, a Democrat who sits on the Senate’s energy and natural resources committee, expressed frustration with the Trump administration rolling back policies in the Inflation Reduction Act and Infrastructure Investment and Jobs Act meant to support critical minerals companies. “If we want to, in this country, lead in 21st century technology, why aren’t we starting with the extraction of the critical minerals that we need for that technology?” she asked.

At the same time, Cortez Masto also seemed hopeful that the Senate would move forward on both permitting and critical minerals legislation. “After we get back from the Thanksgiving holiday, there is going to be a number of bills that we’re looking at marking up and moving through the committee,” Cortez Masto said. That may well include the SPEED Act, a permitting bill with bipartisan support that passed the House Natural Resources Committee late last week.

Friction in the permitting of new energy and transmission projects is one of the key factors slowing down the transition to clean energy — though fossil fuel companies also have an interest in the process.

Thomas Hochman, the Foundation of American Innovation’s director of infrastructure policy, talked about how legislation could protect energy projects of all stripes from executive branch interference.

“The oil and gas industry is really, really interested in seeing tech-neutral language on this front because they’re worried that the same tools that have been uncovered to block wind and solar will then come back and block oil and gas,” Hochman said.

While permitting dominated the conversation, it was not the only topic on panelists’ minds.

“There’s a lot of talk about permitting,” said Michael Tubman, the senior director of federal affairs at Lucid Motors. “It’s not just about permits. There’s a lot more to be done. And one of those important things is those mines have to have the funding available.”

Michael Bruce, a partner at the venture capital firm Emerson Collective, thinks that other government actions, such as supporting domestic demand, would help businesses in the critical minerals space.

“You need to have demand,” he said. “And if you don’t have demand, you don’t have a business.”

Like Cortez Masto, Bruce lamented the decline of U.S. mining in the face of China’s supply chain dominance.

“We do [mining] better than anyone else in the world,” said Bruce. “But we’ve got to give [mining companies] permission to return. We have a few [projects] that have been waiting for permits for upwards of 25 years.”

Flames have erupted in the “Blue Zone” at the United Nations Climate Conference in Brazil.

A literal fire has erupted in the middle of the United Nations conference devoted to stopping the planet from burning.

The timing couldn’t be worse. Today is the second to last day of the annual climate meeting known as COP30, taking place on the edge of the Amazon rainforest in Belém, Brazil. Delegates are in the midst of heated negotiations over a final decision text on the points of agreement this session.

A number of big questions remain up in the air, including how countries will address the fact that their national plans to cut emissions will fail to keep warming “well under 2 degrees Celsius,” the target they supported in the 2015 Paris Agreement. They are striving to reach agreement on a list of “indicators,” or metrics by which to measure progress on adaptation. Brazil has led a push for the conference to mandate the creation of a global roadmap off of fossil fuels. Some 80 countries support the idea, but it’s still highly uncertain whether or how it will make its way into the final text.

Just after 2:00 p.m. Belém time, 12 p.m. Eastern, I was in the middle of arranging an interview with a source at the conference when I got the following message:

“We've been evacuated due to a fire- not exactly sure how the day is going to continue.”

The fire is in the conference’s “Blue Zone,” an area restricted to delegates, world leaders, accredited media, and officially designated “observers” of the negotiations. This is where all of the official negotiations, side events, and meetings take place, as opposed to the “Green Zone,” which is open to the public, and houses pavilions and events for non-governmental organizations, business groups, and civil society groups.

It is not yet clear what the cause of the fire was or how it will affect the home sprint of the conference.

Outside of the venue, a light rain was falling.