You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

Struggling developers will likely be able to write off subsea cables, as a treat.

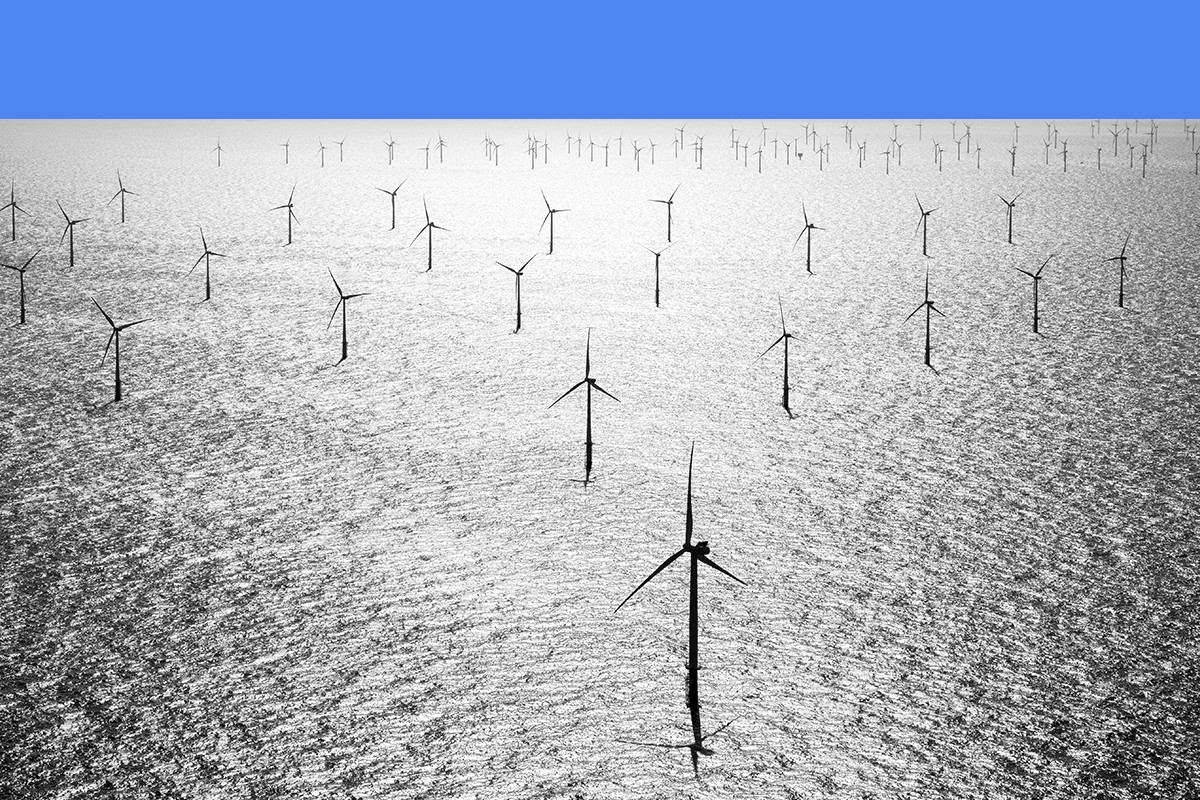

The beleaguered offshore wind industry got a small boost from the Biden administration on Friday in the form of a proposal that would expand the definition of what qualifies for a 30% clean energy investment tax credit.

Offshore wind farms have many different components beyond just the turbines, and developers have been seeking clarity on where the dividing line was between the equipment that would qualify for the tax credit, and any interdependent infrastructure like transformers and transmission lines. Under the new rules, developers would be able to include the cost of subsea cables that bring the power to shore, as well as onshore substations — not just the towers and blades or the platforms they sit on.

The proposal is part of the Treasury’s ongoing role in overseeing a range of expanded tax credits for clean energy that were in the Inflation Reduction Act. It provides similar clarity for a new tax credit for standalone, utility-scale energy storage projects, which can store power from wind and solar farms and dispatch it when needed.

“Given the new and expanded incentives created by the Inflation Reduction Act, clarity around the underlying rules for long-standing investment credits is critical as projects move from the announcement, to groundbreaking, and eventual ribbon-cutting stage,” said Wally Adeyomo, deputy secretary of the Treasury, during a call with reporters on Thursday.

John Podesta, senior advisor to Biden for clean energy innovation and implementation, who was also on the call, said that developers were hearing from their lenders that they were waiting to see the final tax credit guidance, particularly in regard to underwater cabling. Offshore wind projects have been plagued by rising costs due to inflation, supply chain disruptions, and rising interest rates. Many have asked the future buyers of their power to approve higher rates, and two projects in New Jersey were recently canceled altogether.

In July, a utility in Rhode Island decided not to move forward on a contract to buy power from a proposed offshore wind farm called Revolution II, a joint venture between Orsted and Eversource, putting the project in limbo. In a press release, the utility pointed to “uncertainty of federal tax credits” as one of the factors that likely contributed to the higher-than-expected proposed contract.

Adeyomo said the clarity provided by the tax credit rules will “allow these offshore wind companies to price their offerings going forward with the certainty to know what types of incentives they will receive from the government.”

“We appreciate the clarification from the Treasury Department that recognizes the integral nature of all components of an offshore wind project,” a spokesperson for Orsted told me.

Considering the broader economic headwinds these projects face, this expansion of the tax credit eligibility is unlikely to be enough to put the ailing industry on solid ground. Offshore wind developers are also still waiting for clarity on another Inflation Reduction Act program that could prove essential — the energy community bonus credit. The subsidy gives projects an additional 10% tax credit if they build in communities that have been host to fossil fuel plants or extractive activities. It will apply to the location of onshore substations, but developers want to see it also apply to port infrastructure.

Clean energy trade groups welcomed the proposal on Friday.

“Thanks to the IRA, clean energy businesses now have access to a stable tax platform like the one enjoyed by the fossil fuel sector for more than a century,” said Gregory Wetstone, President and CEO of the American Council on Renewable Energy in a statement. “But to fully take advantage of these benefits, they need to understand how the provisions work. The tax guidance released today provides important clarity to developers and investors looking to further America’s energy transition.”

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Clean energy stocks were up after the court ruled that the president lacked legal authority to impose the trade barriers.

The Supreme Court struck down several of Donald Trump’s tariffs — the “fentanyl” tariffs on Canada, Mexico, and China and the worldwide “reciprocal” tariffs ostensibly designed to cure the trade deficit — on Friday morning, ruling that they are illegal under the International Emergency Economic Powers Act.

The actual details of refunding tariffs will have to be addressed by lower courts. Meanwhile, the White House has previewed plans to quickly reimpose tariffs under other, better-established authorities.

The tariffs have weighed heavily on clean energy manufacturers, with several companies’ share prices falling dramatically in the wake of the initial announcements in April and tariff discussion dominating subsequent earnings calls. Now there’s been a sigh of relief, although many analysts expected the Court to be extremely skeptical of the Trump administration’s legal arguments for the tariffs.

The iShares Global Clean Energy ETF was up almost 1%, and shares in the solar manufacturer First Solar and the inverter company Enphase were up over 5% and 3%, respectively.

First Solar initially seemed like a winner of the trade barriers, however the company said during its first quarter earnings call last year that the high tariff rate and uncertainty about future policy negatively affected investments it had made in Asia for the U.S. market. Enphase, the inverter and battery company, reported that its gross margins included five percentage points of negative impact from reciprocal tariffs.

Trump unveiled the reciprocal tariffs on April 2, a.k.a. “liberation day,” and they have dominated decisionmaking and investor sentiment for clean energy companies. Despite extensive efforts to build an American supply chain, many U.S. clean energy companies — especially if they deal with batteries or solar — are still often dependent on imports, especially from Asia and specifically China.

In an April earnings call, Tesla’s chief financial officer said that the impact of tariffs on the company’s energy business would be “outsized.” The turbine manufacturer GE Vernova predicted hundreds of millions of dollars of new costs.

Companies scrambled and accelerated their efforts to source products and supplies from the United States, or at least anywhere other than China.

Even though the tariffs were quickly dialed back following a brutal market reaction, costs that were still being felt through the end of last year. Tesla said during its January earnings call that it expected margins to shrink in its energy business due to “policy uncertainty” and the “cost of tariffs.”

Alphabet and Amazon each plan to spend a small-country-GDP’s worth of money this year.

Big tech is spending big on data centers — which means it’s also spending big on power.

Alphabet, the parent company of Google, announced Wednesday that it expects to spend $175 billion to $185 billion on capital expenditures this year. That estimate is about double what it spent in 2025, far north of Wall Street’s expected $121 billion, and somewhere between the gross domestic products of Ecuador and Morocco.

This is a “a massive investment in absolute terms,” Jefferies analyst Brent Thill wrote in a note to clients Thursday. “Jarringly large,” Guggenheim analyst Michael Morris wrote. With this announcement, total expected capital expenditures by Alphabet, Microsoft and Meta for 2026 are at $459 billion, according to Jefferies calculations — roughly the GDP of South Africa. If Alphabet’s spending comes in at the top end of its projected range, that would be a third larger than the “total data center spend across the 6 largest players only 3 years ago,” according to Brian Nowak, an analyst at Morgan Stanley.

And that was before Thursday, when Amazon told investors that it expects to spend “about $200 billion” on capital expenditures this year.

For Alphabet, this growth in capital expenditure will fund data center development to serve AI demand, just as it did last year. In 2025, “the vast majority of our capex was invested in technical infrastructure, approximately 60% of that investment in servers, and 40% in data centers and networking equipment,” chief financial officer Anat Ashkenazi said on the company’s earnings call.

The ramp up in data center capacity planned by the tech giants necessarily means more power demand. Google previewed its immense power needs late last year when it acquired the renewable developer Intersect for almost $5 billion.

When asked by an analyst during the company’s Wednesday earnings call “what keeps you up at night,” Alphabet chief executive Sundar Pichai said, “I think specifically at this moment, maybe the top question is definitely around capacity — all constraints, be it power, land, supply chain constraints. How do you ramp up to meet this extraordinary demand for this moment?”

One answer is to contract with utilities to build. The utility and renewable developer NextEra said during the company’s earnings call last week that it plans to bring on 15 gigawatts worth of power to serve datacenters over the next decade, “but I'll be disappointed if we don't double our goal and deliver at least 30 gigawatts through this channel by 2035,” NextEra chief executive John Ketchum said. (A single gigawatt can power about 800,000 homes).

The largest and most well-established technology companies — the Microsofts, the Alphabets, the Metas, and the Amazons — have various sustainability and clean energy commitments, meaning that all sorts of clean power (as well as a fair amount of natural gas) are likely to get even more investment as data center investment ramps up.

Jefferies analyst Julien Dumoulin-Smith described the Alphabet capex figure as “a utility tailwind,” specifically calling out NextEra, renewable developer Clearway Energy (which struck a $2.4 billion deal with Google for 1.2 gigawatts worth of projects earlier this year), utility Entergy (which is Google’s partner for $4 billion worth of projects in Arkansas), Kansas-based utility Evergy (which is working on a data center project in Kansas City with Google), and Wisconsin-based utility Alliant (which is working on data center projects with Google in Iowa).

If getting power for its data centers keeps Pichai up at night, there’s no lack of utility executives willing to answer his calls.

The offshore wind industry is now five-for-five against Trump’s orders to halt construction.

District Judge Royce Lamberth ruled Monday morning that Orsted could resume construction of the Sunrise Wind project off the coast of New England. This wasn’t a surprise considering Lamberth has previously ruled not once but twice in favor of Orsted continuing work on a separate offshore energy project, Revolution Wind, and the legal arguments were the same. It also comes after the Trump administration lost three other cases over these stop work orders, which were issued without warning shortly before Christmas on questionable national security grounds.

The stakes in this case couldn’t be more clear. If the government were to somehow prevail in one or more of these cases, it would potentially allow agencies to shut down any construction project underway using even the vaguest of national security claims. But as I have previously explained, that behavior is often a textbook violation of federal administrative procedure law.

Whether the Trump administration will appeal any of these rulings is now the most urgent question. There have been no indications that the administration intends to do so, and a review of the federal dockets indicates nothing has been filed yet.

The Department of Justice declined to comment on whether it would seek to appeal any or all of the rulings.

Editor’s note: This story has been updated to reflect that the administration declined to comment.