You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

Ten years ago, if you were a hotshot senior advisor in the Obama administration, odds are good you exited the revolving door of the White House straight into a job in Big Tech. But there’s a new career trajectory that’s looking pretty good these days: federal government to climate tech. Since the latter Obama years and increasingly with the passage of the Inflation Reduction Act two years ago, former government employees are popping up at some of the most important companies and venture capital firms in the climate ecosystem.

That’s a testament to how far we’ve come since clean tech 1.0 in the 2010s, when Solyndra’s bankruptcy was blowing up headlines and the shale revolution was starting to derail renewable energy investment. As a more durable market started to rise from the ashes, a growing number of industry experts jumped into government to help fuel the revival — and then often back into industry to take advantage of a more favorable policy environment and an increased focus on corporate sustainability.

Alfred Johnson, co-founder and CEO of the tax credit marketplace Crux, told me that after growing up in D.C. but moving to Stanford for college, he was surprised to hear folks in Silicon Valley talking about government and private industry as if they had completely “mismatched objectives.” Prior to starting Crux, Johnson served as deputy chief of staff at the Department of the Treasury, his second stint at the agency during a career that’s taken him from campaigning for Obama to Blackrock, to founding his first startup, Mobilize, a platform that used to recruit volunteers for Democratic Party campaign events and progressive causes.

“The perspective that I’ve always had is that government and the private sector are fundamentally intertwined, and always have been,” Johnson told me. Crux itself demonstrates this public-private synergy: Not only did the IRA unleash an abundance of clean energy tax credits, it also made them much easier to trade — transactions Crux facilitates.

“If our goal is to mobilize trillions of dollars of investment into the clean energy transition,” Varun Sivaram, a senior fellow for energy and climate at the Council on Foreign Relations, told me, “the people holding the reins of power should absolutely not be the people who have never been in an investment committee room making a financial decision on a project.” Prior to his latest gig, Sivaram worked as an executive at Orsted, which he joined after a stint in the White House as the managing director for clean energy and innovation and a senior advisor to John Kerry, the administration’s climate envoy.

“After the IRA, I said, look, we’ve passed this extraordinary legislation. I would now love to help be at a company that can use this amazing public policy and build clean energy as fast as possible,” he told me. At Orsted he helped lead the internal R&D and artificial intelligence teams and founded Orsted Ventures, which has invested in Crux. Sivaram was also on the committee that decided to pull out of two offshore wind projects in New Jersey, resulting in a $4 billion impairment for the company. “I sometimes feel like Forrest Gump. I have had this front row seat to a lot of very important things,” Sivaram told me.

A lot of the recent revolving door activity can also be traced to the renewed vigor of the once-nearly-dormant Loan Programs Office, part of the Department of Energy, which the IRA imbued with $400 billion to guarantee loans to emerging energy technologies. LPO became a political football thanks to Solyndra, which received a loan guarantee from the office of more than $500 million. After Jigar Shah took the helm in 2021, he tripled the agency’s staff, bringing with him a cohort of private industry experts and advisors, many of whom held contract positions for about a year or two before moving back into industry to pursue other ventures in the climate tech and energy world.

Climate tech investment firms have also become a popular landing spot for former government talent. David Danielson, now a managing director at Breakthrough Energy Ventures, co-founded ARPA-E and worked in the Department of Energy in the second Obama administration. Jenny Gao, a vice president at Energy Impact Partners, went there fresh off a position in the DOE’s Office of Technology Transitions. And Clay Dumas, a partner at Lowercarbon Capital, worked in the Obama White House as the chief of staff and a senior advisor for the White House Office of Digital Strategy.

And then there’s Overture, a climate tech VC founded by former Obama staffers, which aims to help climate tech founders take advantage of government programs and navigate regulatory complexity. “In some ways, campaigns are startups — you start small with a big idea,” Michael O’Neil, one of Overture’s co-founders and partners, told me. “We used to say in the White House, How do you make the room bigger? How do you get more minds and more talent involved to make better decisions?” Now they ask the same questions to help founders build out their technologies. Overture announced the close of its first $60 million fund earlier this year.

It’s not just climate-specific companies and investors who are benefiting — big tech companies still attract plenty of former government employees, although the locus of that energy is now concentrated on corporate sustainability and decarbonization efforts. Lisa Jackson, VP of environment, policy, and social initiatives at Apple, served as the Administrator of the Environmental Protection Agency under Obama. Melanie Nakagawa, the chief sustainability officer at Microsoft, previously worked as a climate advisor to Biden’s National Security Council, while Google’s director of climate and energy research, Ali Douraghy, came straight from the DOE.

Tech industry efforts to run operations with clean energy and back emerging climate solutions have also had an undeniably positive impact — most notably Frontier’s commitment to purchasing over $1 billion of carbon removal credits has catalyzed demand in the nascent industry. This initiative, led by the payments platform Stripe and co-founded by Alphabet, Meta, Shopify, and McKinsey, is also powered by a former government employee, Jane Flegal, who worked in the Biden White House as the senior director for industrial emissions.

While it’s true that the traditional off ramps for former government employees remain — the financial sector also still looms large, Sivaram told me — what’s new is that “there’s now actual money in starting your own company, in working at a venture fund,” he said And this, he believes, is how it should be.

“You want people who understand the nuances of the federal government and the IRA in order to effectively run companies that take advantage of the IRA. It is no secret that the government wanted companies to basically take this money. So many of us made this move.”

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Plus a pair of venture capital firms close their second funds.

It’s been a big few weeks for both minerals recycling and venture capital fundraising. As I wrote about earlier this week, battery recycling powerhouse Redwood Materials just closed a $475 million Series E round, fueled by its pivot to repurposing used electric vehicle batteries for data center energy storage. But it’s not the only recycling startup making headlines, as Cyclic Materials also announced a Series C and unveiled plans for a new facility. And despite a challenging fundraising environment, two venture firms announced fresh capital this week — some welcome news, hopefully, to help you weather the winter storms.

Toronto-based rare earth elements recycling company Cyclic Materials announced a $75 million Series C funding round last Friday, which it will use to accelerate the commercialization of its rare earth recycling tech in North America and support expansion into Europe and Asia. The round was led by investment management firm T. Rowe Price, with participation from Microsoft, Amazon, and Energy Impact Partners, among others.

Building on this news, today the startup revealed plans for a new $82 million recycling facility in South Carolina — its largest to date. The plant is expected to begin operations in 2028, and Cyclic says its eventual output would be enough to supply the magnets for six million hybrid-electric vehicle motors annually.

The rare earth supply chain is heavily concentrated in China, where these materials have traditionally been extracted through environmentally intensive mining operations. They’re critical components of high-performance permanent magnets, which are used in a wide range of technologies, from electric vehicles and wind turbines to data center electronics and MRI machines. Cyclic’s proprietary recycling system recovers these magnets from end-of-life products and converts them into a powdered mixture of rare earth oxides that can be used to make new magnets. According to the company, its process reduces carbon emissions by 61% while using just 5% of the water required for conventional mining.

The London-based urban sustainability firm 2150 announced on Monday that it had closed its second fund, raising €210 million from 34 limited partners — about $250 million. This brings the firm’s total assets under management to nearly $600 million as it doubles down on its thesis that cities — and the industries behind them — offer the greatest opportunity for sustainability wins. Thus far the firm has invested in companies spanning the gamut from cooling and industrial heat to low-carbon cement and urban mobility.

2150 has already invested in seven companies from its new fund, including the industrial heat pump startup AtmosZero, the refurbished electronics marketplace Getmobil, and the direct air capture company MissionZero. According to TechCrunch, the firm plans to back a total of 20 companies from this fund, typically at the Series A stage. Checks will range from about $6 million to $7 million with roughly half of the fund’s capital reserved for follow-on investments.

It was also a big week for second fund closes. The firm Voyager Ventures raised $275 million for “technologies that modernize the base layer of the economy,” from energy efficiency to AI and carbon removal. According to The Wall Street Journal, the firm is dropping its formerly advertised “climate tech” label to avoid any association with government subsidies or green premiums, focusing instead on advancing the Trump administration’s national security, energy independence, and domestic manufacturing agenda. The strategy appears to be working: Voyager co-founder Sierra Peterson told the Journal that five of its portfolio companies have secured federal contracts during the second Trump administration.

In an announcement letter posted to its website on Tuesday, the firm wrote, “Abundance is not automatic, but it is technologically favored,” going on to explain that it will focus its investments on three areas that it considers the “fundamental drivers of growth” — electrification, critical materials and resources such as AI computing infrastructure and minerals, and advanced manufacturing. “As energy, compute, and production scale in tandem, systems become more durable and scarcity recedes,” the letter went on to state.

The firm has already begun investing out of this second fund, which held its first close in October 2024. Its investments include backing for the EV charging platform ENAPI, a company called Electroflow Technologies that’s pursuing a novel approach to lithium extraction, and the advanced industrial materials startup Leeta Materials.

Axios reported on Wednesday that “a source familiar” with Form Energy’s plans says the long-duration battery storage startup is seeking to raise between $300 million and $500 million, in what’s likely to be its last equity round before targeting an IPO in 2027. The company, which is developing 100-plus-hour grid-scale storage using its iron-air technology, last raised a $405 Series F funding round in October 2024, bringing its total funding to over $1.2 billion.

The company is now deploying its very first commercial batteries in Minnesota. Form has yet to release a public statement about either its fundraising or IPO plans, so watch this space for further developments.

Current conditions: The bomb cyclone barrelling toward the East Coast is set to dump up to 6 inches of snow on North Carolina in one of the state’s heaviest snowfalls in decades • The Arctic cold and heavy snow that came last weekend has already left more than 50 people dead across the United States • Heavy rain in the Central African Republic is worsening flooding and escalating tensions on the country’s border with war-ravaged Sudan.

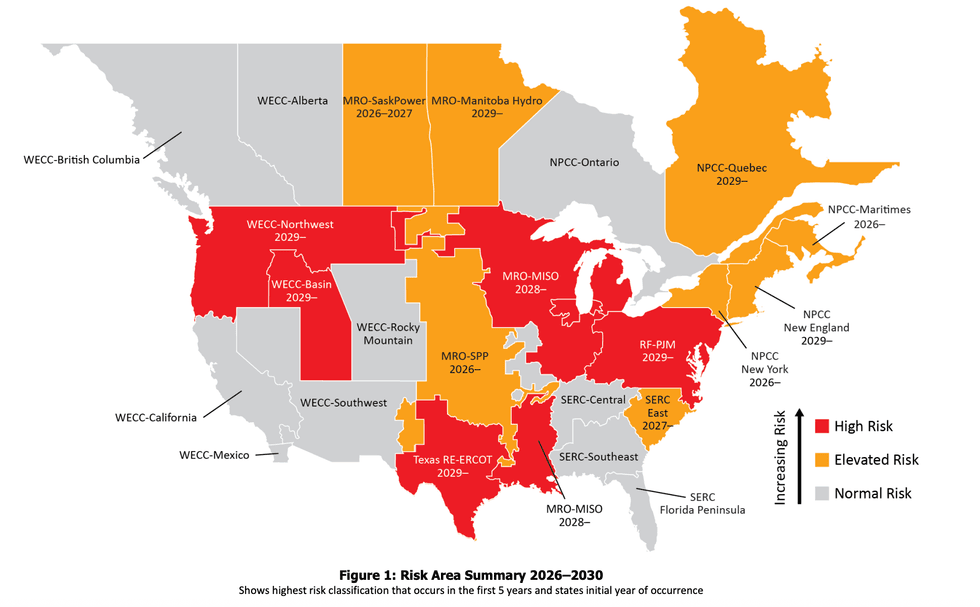

Every year, the North American Electric Reliability Corporation — a quasi-governmental watchdog group that monitors the health of the power grids in the United States and Canada — publishes its analysis of where things are headed. The 2025 report just came out, and America is bathed in a sea of red. The short of it: Electricity demand is on track to outpace supply throughout much of the country. The grids that span the Midwest, Texas, the Northwest, and the Mid-Atlantic face high risks — code red for reliability. The systems in the Northeast, the Carolinas, the Great Plains, and broad swaths of Canada all face elevated risk over the next four years. The failure to build power plants quickly enough to meet surging demand is just one issue. NERC warned that some grids, such as those in the Pacific Northwest, the Mountain West, and Great Basin states, are staring down potential instability from the addition of primarily weather-dependent renewables such as solar panels and wind turbines that, absent batteries and grid-forming technologies, make managing systems built around firm sources such as coal and hydroelectricity harder to balance.

There’s irony there. Solar and wind are among the fastest new generating sources to build. They’re among the cheapest, too, when you consider how expensive turbines for gas plants have grown as manufacturers’ backlogs stretch to the end of the decade. But they’re up against a Trump administration that’s phasing out tax credits and refusing to permit projects — even canceling solar megaprojects that would have matched the capacity of large nuclear stations. The latest tactic, as my colleague Jael Holzman described in a scoop last night, involves challenging the aesthetic value of wind and solar installations.

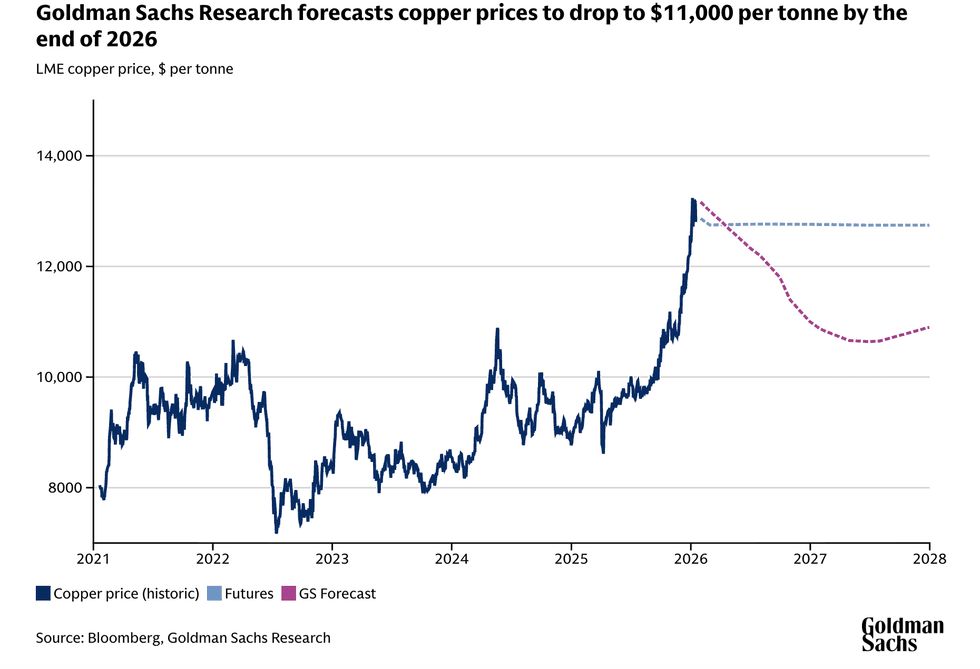

Copper prices just surged by the most in more than 16 years after what Bloomberg pegged to a “wave of buying from Chinese investors” that “triggered one of the most dramatic moves in the market’s history.” Prices surged as much as 11% to above $14,500 per ton for the first time before falling somewhat. It was enough to earn headlines about “metals mania” and “absolutely bonkers” pricing. The metal is used in virtually every electrical application. Between China commencing its march toward becoming the world’s first “electrostate” and U.S. Federal Reserve Chairman Jerome Powell signaling a stronger American economy than previously thought, investors are betting on demand for copper to keep growing. For now, however, the prices on copper futures contracts are already leveling off, and Goldman Sachs forecasts the price to fall before stabilizing at a level still well above the average over the last four years.

Amid the volatility, the Trump administration may be shying away from a key tool used to make investments in new mines less risky. On Thursday, Reuters reported that two senior Trump officials told U.S. minerals executives that their projects would need to prove financial independence without the federal government guaranteeing a minimum price for what they mine. “We’re not here to prop you guys up,” Audrey Robertson, assistant secretary of the Department of Energy and head of its Office of Critical Minerals and Energy Innovation, reportedly told the executives gathered at a closed-door meeting hosted by a Washington think tank earlier this month. “Don’t come to us expecting that.” The Energy Department said that Reuters’ reporting is “false and relies on unnamed sources that are either misinformed or deliberately misleading.” At least one mining startup, United States Antimony Corporation, and a mining economist have echoed the administration’s criticism. One tool the Trump administration certainly isn’t wavering on is quasi nationalization. Just two days ago I was telling you about the latest company, USA Rare Earth, to give the government an equity stake in exchange for federal financing.

Get Heatmap AM directly in your inbox every morning:

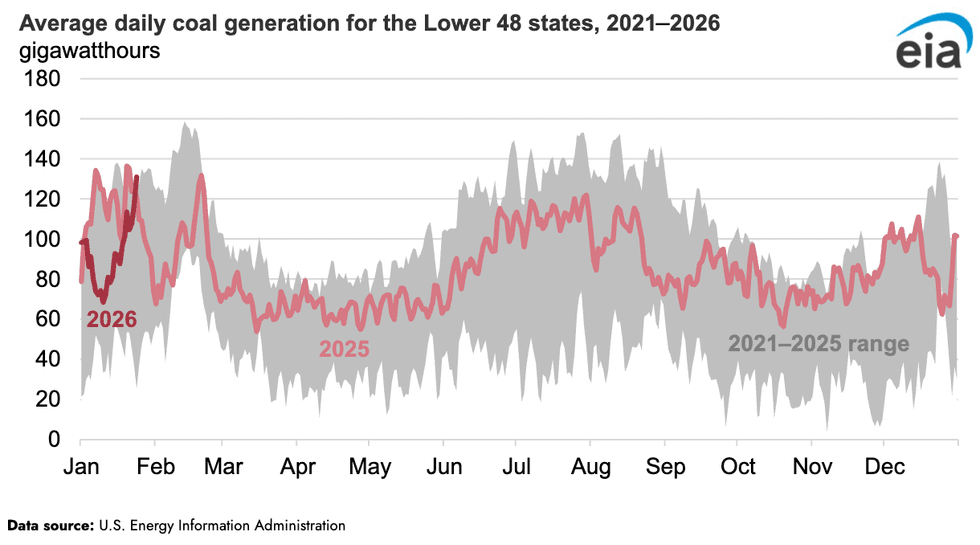

Coal-fired electricity generation in the Lower 48 states soared 31% last week compared to the previous week amid Winter Storm Fern’s Arctic temperatures, according to a new analysis by the Energy Information Administration. It’s a stark contrast from the start of the month, when milder temperatures led to lower coal-fired power production versus the same period in 2025. Natural gas generation also surged 14% compared to the previous week. Solar, wind, and hydropower all declined. Nuclear generation remained nearly unchanged.

Sign up to receive Heatmap AM in your inbox every morning:

The specter of an incident known as “whoops” haunts the nuclear industry. Back in the 1980s, the Washington Public Power Supply System attempted to build several different types of reactors all at once, and ended up making history with the biggest municipal bond default in U.S. history at that point. The lesson? Stick to one design, and build it over and over again in fleets so you can benefit from the same supply chain and workforce and bring down costs. That, after all, is how China, Russia, and South Korea successfully build reactors on time and on budget. Now Jeff Bezos’ climate group is backing an effort to get the Americans to adopt that approach. On Thursday, the Bezos Earth Fund gave a $3.5 million grant to the Nuclear Scaling Initiative, a partnership between the Clean Air Task Force, the EFI Foundation, and the Nuclear Threat Initiative. In a statement, the philanthropy’s chief executive, Tom Taylor, called the grant “a targeted bet that smart coordination can unlock much larger public and private investment and turn this first reactor package into a model for many more.” Steve Comello, the executive director at the Nuclear Scaling Initiative, said the “United States needs repeat nuclear energy builds — not one off projects — to bolster energy security, improve grid reliability, and drive economic competitiveness.”

The Netherlands must write stricter emissions-cutting targets into its laws to align with the Paris Agreement in the name of protecting Bonaire, one of its Caribbean island territories, from the effects of climate change. That’s according to a Wednesday ruling by the District Court of The Hague in a case brought by Greenpeace. The decision also found that Amsterdam was discriminating against residents of the island by failing to do enough to help the island adapt to the existing effects of global warming, including sea-level rise, flooding, and extreme weather. Bonaire is the largest and most populous of the trio of islands that form the Dutch Caribbean territory and includes Sint Eustatius and Saba. The lawsuit, the Financial Times noted, was “one of the first to test climate obligations on a national level.”

The least ecologically destructive minerals to harvest for batteries and other technologies come not from the ground but from old batteries and materials that can be recycled. Recyclers can also get supply up and running faster than a mine can open. With the U.S. aggressively seeking supplies of rare earths that don’t come from China, the recycling startup Cyclic Materials sees an opportunity. The company is investing $82 million to build its second and largest plant. At full capacity, the first phase of the new facility in South Carolina will process 2,000 metric tons of magnet material per year. But the firm plans to eventually expand to 6,000 tons.

Pennsylvania is out, Virginia wants in, and New Jersey is treating it like a piggybank.

The Regional Greenhouse Gas Initiative has been quietly accelerating the energy transition in the Mid-Atlantic and Northeast since 2005. Lately, however, the noise around the carbon market has gotten louder as many of the compact’s member states have seen rising energy prices dominate their local politics.

What is RGGI, exactly? How does it work? And what does it have to do with the race for the 2028 Democratic presidential nomination?

Read on:

The Regional Greenhouse Gas Initiative is a cap and trade market with roots in a multistate compact formed in 2005 involving Connecticut, Delaware, Maine, New Hampshire, New Jersey, New York, and Vermont.

The goal was to reduce emissions, and the mechanism would be regular auctions for emissions “allowances,” which large carbon-emitting electricity generators would have to purchase at auction. Over time, the total number of allowances in circulation would shrink, making each one more expensive and encouraging companies to reduce their emissions. The cap started at 188 million short tons of carbon and has been dropping steadily ever since, with an eventual target of under 10 million by 2037.

By the time of the first auction in 2008, six states were fully participating — Delaware, New Hampshire, New Jersey, and New York were out; Maryland, Massachusetts, and Rhode Island were in — and together they raised almost $39 million. By the second auction later that year, 10 states — the six from the previous auction, plus New York, New Jersey, New Hampshire, and Delaware — were fully participating.

Membership has grown and shrunk over the years (for reasons we’ll cover below) but the current makeup is the same as it was at the end of 2008.

When carbon pricing schemes were first dreamt up by economists, the basic thinking was that by taxing something bad (carbon emissions) you could reduce taxes on something good (like wages or income). Real existing carbon pricing schemes, however, have tended to put their proceeds toward further decarbonization rather than reducing taxes or other costs.

In the case of the RGGI, the bulk of revenue goes to fund state climate programs. About two-thirds of investments from RGGI revenues in 2023 went to energy efficiency programs, which have received 56% of the system’s cumulative investments. By contrast, 15% of the 2023 investments (and 15% of the all-time investments) went to “direct bill assistance,” i.e. lowering utility bills.

Carbon dioxide emissions from the power sector have fallen by 40% to 50% in the RGGI territory since the program began — faster than in the U.S. as a whole.

That’s in part because the areas covered by RGGI have seen some of the sharpest transitions away from coal-fired power. New England, for instance, saw its last coal plant shut down late last year.

But it’s not always easy to figure out what was the effect of RGGI versus broader shifts in the energy industry. In the emissions-trading system’s early years, allowance prices were very low, and actual emissions fell well below the cap. That was largely due to factors affecting the country as a whole, including sluggish demand growth for electricity. The fracking boom also sent natural gas prices plunging, accelerating the switch from coal to gas and decelerating carbon dioxide emissions from the power sector (although this effect may have been more limited in the RGGI region, much of which has insufficient natural gas pipeline capacity).

That said, RGGI still might have helped tip the scales, Dallas Burtraw, a senior fellow at Resources for the Future, told me.

“It takes only a modest carbon price to really push out coal,” he said, pointing to the experience of RGGI and arguing that it could be replicated in other states. A 2016 paper by Man-Kuen Kim and Taehoo kim published in Energy Economics found “strong evidence that coal to gas switching has been actually accelerated by RGGI implementation.”

That trick doesn’t work as well now as it used to, though. “For the first 10 years or so, the primary margin for achieving emission reductions was substitution from coal to gas,” Burtraw told me. Then renewables prices began to drop “precipitously” in the early 2010s, opening up the opportunity for more thoroughgoing decarbonization beyond just getting rid of coal. “Going forward, I think program advocates would say that now you’re seeing the move from gas to renewables with storage,” he said.

When RGGI went through its regular program review in 2012 (these happen every few years; the third was completed last year), the target had to be wrenched downward to account for the actual path of emissions, which had dropped far more quickly than the cap.

“Soon after the start of RGGI, it became apparent that the number of allowances in the emissions budget was higher than actual emissions. Allowance prices consequently dropped, making it particularly inexpensive to purchase allowances and bank them for use in later periods,” a case study published by the Environmental Defense Fund found. In other words, because there was such a gap between the proscribed cap and actual emissions, generators had been able to squirrel away enough allowances to make future caps ineffective.

The arguments against the RGGI have been relatively constant and will be familiar to anyone following debates over energy and climate policy: RGGI raises prices for consumers, its opponents say. It pushes out reliable and cheaper energy sources, and thereby threatens jobs in fossil fuel generation and infrastructure. Also the particulars of how a state joins or exits the group have often come up for debate.

Three states have proved troublesome, including one original member and two later joiners: New Jersey, Virginia, and Pennsylvania. All three states are sizable energy consumers, and Virginia and Pennsylvania have substantial fossil fuel infrastructure and production.

New Jersey quickly expressed its discontent. In 2011, New Jersey’s Republican Governor Chris Christie decided to take the state out of the market, saying that it was unnecessary and costly. Democrat Phil Murphy, Christie’s successor, brought it back in 2020 as part of a broader agenda to decarbonize New Jersey’s economy.

Pennsylvania attempted to join next, in 2019, but ran into legal hurdles almost immediately. Governor Tom Wolf, a Democrat, issued an executive order in 2019 to set up carbon trading in the state, and state regulators got to work drawing up rules to allow Pennsylvania to link up with RGGI, formally joining in 2022.

But the following year, a Pennsylvania court ruled that the state was not able to participate because the regulatory work ordered by Wolf had been approved by the legislature. The case worked its way up to the state’s highest court last spring, but got tossed in January after Governor Josh Shapiro, a Democrat, made a budget deal with the state legislature late last year removing Pennsylvania from RGGI once and for all — more on that below.

Virginia was the last new state to join in 2020, under Democratic Governor Ralph Northam, who said that by joining, Virginia was “sending a powerful signal that our commonwealth is committed to fighting climate change and securing a clean energy future.” A year later, however, Northam lost the governorship to Republican Glenn Youngkin, who removed Virginia from RGGI at the end of 2023.

Youngkin described the exit — technically a choice made by state regulators — as a “commonsense decision by the Air Board to repeal RGGI protects Virginians from the failed program that is not only a regressive tax on families and businesses across the Commonwealth, but also does nothing to reduce pollution.”

Pennsylvania fits uneasily into the Northeastern–blue hue of the RGGI’s core states. It’s larger than any state in the system besides New York, right down the center politically, and is a substantial producer and exporter of electricity, much of it coming from fossil fuels (and nuclear power). It also has lower electricity costs than its neighbors to the east.

Pennsylvania’s governor, Josh Shapiro, is widely expected to run for the Democratic presidential nomination in 2028, and has put reining in electricity costs at the center of his messaging of late. He sued PJM, the mid-Atlantic electricity market at the end of 2024, and won a settlement to cap costs in the system’s capacity auctions. He also helped negotiate a “statement of principles” with the White House in order to potentially get those caps extended. And earlier this month, he met with utility executives “to discuss steps they can take to lower utility costs and protect consumers,” Will Simons, a spokesperson for the governor, said.

Pennsylvania’s permanent and undisputed inclusion in the RGGI system would be a coup. Unlike its neighbor RGGI states, including Maryland, Delaware, New Jersey, and New York, Pennsylvania still has a meaningful coal industry, meaning that its emissions could potentially fall substantially with a modest carbon price. It would also provide some relief to the rest of the system by notching significant emissions reductions at lower cost, meaning that electricity prices would likely be minimally affected or even go down, according to research done in 2023 by Burtraw, Angela Pachon, and Maya Domeshek.

“Pennsylvania is the source of a lot of low-cost emission reductions precisely because it still retains that coal-to-gas margin,” Burtraw said. “It looks the way the Northeastern states looked 15 years ago.”

But alas, it won’t happen. As part of a budget deal with Republicans reached late last year, Pennsylvania exited RGGI. That Shapiro would be willing to sacrifice RGGI isn’t shocking considering his record — when he ran for governor in 2021, he often put more emphasis on investing in clean energy than restricting fossil fuels. As governor, he has pushed for regulatory reforms, and even a Pennsylvania-specific cap and trade program, but Senate Republicans made RGGI exit the price of any energy policy talks.

Virginia may be ready to return to the fold.

“For me, this is about cost savings,” newly installed governor Abigail Spanberger said in her inaugural address. “RGGI generated hundreds of millions of dollars for Virginia — dollars that went directly to flood mitigation, energy efficiency programs, and lowering bills for families who need help most.” Furthermore, “withdrawing from RGGI did not lower energy costs,” she said. “In fact, the opposite happened — it just took money out of Virginia’s pocket,” referring to lost gains from RGGI auctions. (Research by Burtraw, Maya Domeshek, and Karen Palmer found that RGGI participation was the “lowest-cost way” of achieving the state’s statutory emissions reductions goals and that the funded investments in efficiency will likely drive down household costs.)

Virginia’s newly elected Attorney General Jay Jones also reversed the position of his Republican predecessor, signing on to litigation against Youngkin’s withdrawal from the program, arguing that the governor lacked the legal authority to withdraw from the program in the first place —the inverse of Pennsylvania’s legal tangle over RGGI.

New Jersey, too, has a new governor, Democrat Mikie Sherrill. In a set of executive orders, signed before she had even finished her inaugural address, Sherrill directed New Jersey economic, environment, and utility regulatory officials to “confer about the use of Regional Greenhouse Gas Initiative … proceeds for ratepayer relief,” and “include an explanation of how they intend to address ratepayer relief in the 2026-2028 RGGI Strategic Funding Plan.”

Ratepayers are already due to receive RGGI funding under New Jersey’s current strategic funding plan, as are environmental protection and energy efficiency programs, renewable and transmission investments, and a grab-bag of other climate related projects. New Jersey utility regulators last fall made a $430 million distribution to ratepayers in the form of two $50 bill credits, with additional $25 a month credits for low-income ratepayers.

The evolution of RGGI — and its use by New Jersey to reduce electricity bills in particular — shows how carbon mitigation programs have had to adapt to political realities.

“In the political context of the moment, I think it’s totally fair,” Burtraw told me of Sherrill’s plan. “It’s the worst good idea of what you can do with the carbon proceeds. Everybody in the room can come up with better ideas: Oh, we should be doing this investment, or we should be doing energy efficiency, or we should subsidize renewables. Show me that those ideas are a higher value use for that money and I’m all in. But we could at least be doing this.”

What remains to be seen is whether other states pick up the torch from Sherrill and start using RGGI as a way to more directly combat electricity price hikes. Her actions “could create ripple effects for other states that may face similar concerns,” Olivia Windorf, U.S. policy fellow at the Center for Climate and Energy Solutions, told me.

While RGGI tends to be in the news in the individual states only when there’s some controversy about entering or exiting the program, “the focus on electricity prices and affordability is putting a new spotlight on it,” Windorf said.

More aggressive or creative uses of the proceeds would put RGGI closer to the center of debates around affordability. “I think it will help address affordability concerns in a way that's really tangible,” Windorf said. “So it’s not abstract how carbon markets and RGGI can help through this time of load growth and energy transition. It can be a tool rather than a burden.”