You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

To paraphrase Dostoevsky, one can measure the degree of civilization in a country by traveling its roads.

I learned this the hard way on a recent reporting trip to Finland. To catch my departing flight, first I had to rent a car to drive from Wilkes-Barre, Pennsylvania, to Newark airport. Then, en route, not only did I have to deal with the usual stress of having to balance the risk of getting a speeding ticket against the risk of getting into an accident by driving too slowly, I also got to meet some deranged hooligans straight out of “Mad Max.” Perhaps 15 or 20 souped-up cars and trucks, with deafening glass packs and side-dump exhausts, appeared suddenly around Stroudsburg, driving perhaps 100 miles per hour, weaving between lanes and onto the shoulder. One of them abruptly cut me off, nearly causing me to crash into another car.

It’s a familiar experience for anyone who drives, bikes, or walks on an American street. Hyper-vigilance is the natural response to roads filled with big, heavy, powerful cars and trucks driven at high speed, and often by people with a contemptuous disregard for anything but their own convenience and kicks.

So when I got to Finland to pick up a rental car, I was still amped. It’s a foreign country, and getting to my hotel meant I had to drive through the middle of the capital city. Surely this would be difficult.

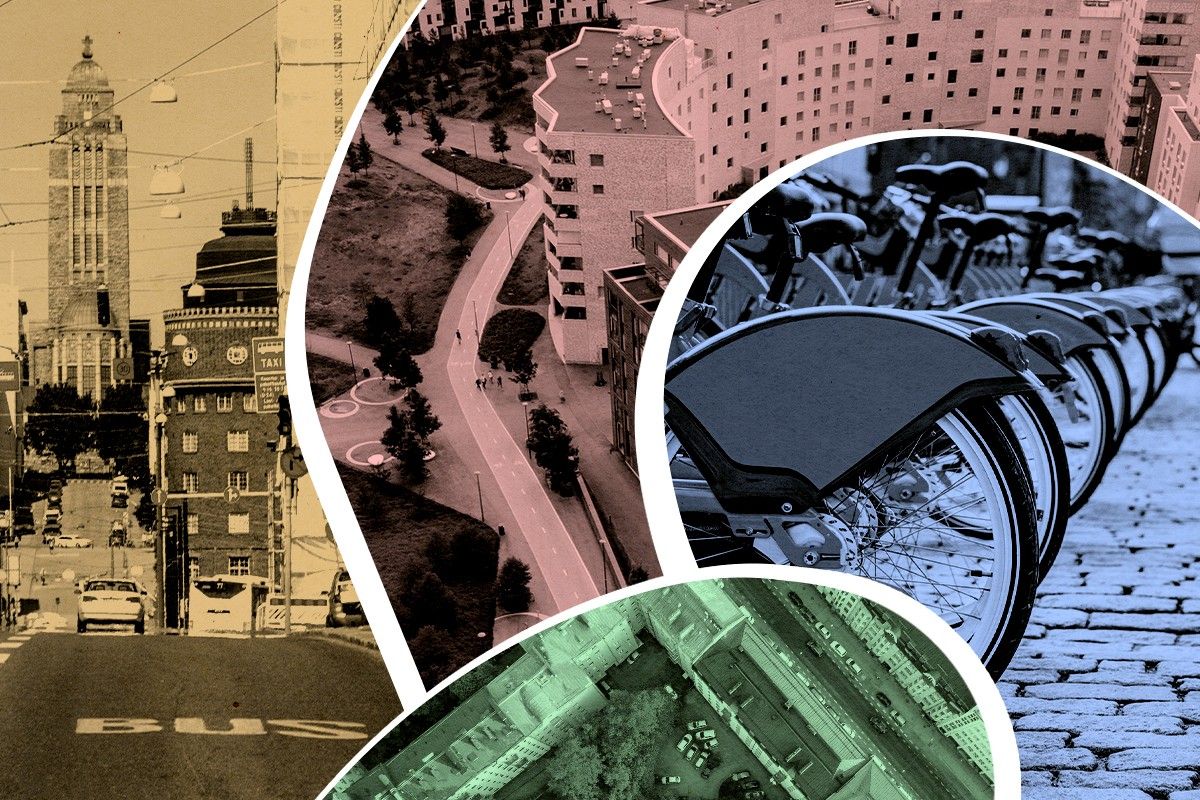

It was not. I was surprised to learn that driving in downtown Helsinki is actually quite easy and safe — and later as I walked around the city, so is walking, cycling, or riding an electric scooter. What’s more, most of the road design policies that have made it so easy and safe to move around, drastically reducing carbon emissions in the process, are relatively simple. Even a sprawling American suburb could adopt most of them, with great effect.

The first and most important policy is to slow down traffic in towns and cities. Finland does have high-speed highways, but the speed limit only hits 120 kilometers per hour (about 75 miles per hour) far outside any settlement and only during the summer. Elsewhere, limits have been progressively reduced over the years. In the Helsinki suburbs, a limit of 80 kph, or 50 mph, is enforced with speed cameras. Further into the city, as the roads pick up more traffic and become more complex, the highway speed drops to 60 kph (37 mph), or even 50 kph (31 mph). On local city streets, the limit drops to 30 kph (18 mph), and most streets are narrow and paved with rough stone that, together with raised crosswalks, effectively force people to drive even slower.

A Finnish speeding ticket, which is levied as a percentage of one’s income, is no joke. Back in June, a wealthy businessman named Anders Wiklöf was fined 121,000 euros for doing 82 kph in a 50 kph zone. “I really regret the matter,” he told a local newspaper.

Thanks to those stiff and all-but-guaranteed fines, people hardly ever speed, and as a result, driving is much easier and safer. You’ve got plenty of time to change lanes, react to other cars, and figure out where you need to go. It’s actually rather pleasant. Without the white-knuckle American road culture, you can actually relax and enjoy the driving experience, even in the big city.

Low speeds are also central to pedestrian and cyclist safety on city streets. People are driving so slowly that even if someone darts right out in front of a driver, there is still usually enough time to stop. And if a collision does happen, lower speeds are exponentially safer for everyone involved. One study estimated that the risk of severe injury for a pedestrian struck by a vehicle at 26 kph (16 mph) was about 10 percent, but that increased to 90 percent at 74 kph (46 mph).

The second policy is to provide separate dedicated space for pedestrians, bikes, and public transit. Larger Helsinki streets typically have a sidewalk divided between a pedestrian section and a bike section, a lane for cars, and then a separated tram lane. This means less conflict between pedestrians, cyclists, drivers, and trams — and critically, the trams don’t get stuck in traffic. That means they can bypass any traffic congestion, and so those who don’t need or want to drive will logically opt to take public transit instead, thus letting the car lanes breathe. On smaller side streets, low speeds mean the city can forgo controls of any kind. Many Helsinki intersections don’t have so much as a stop sign; people just have to watch each other and negotiate on the fly — and it works.

Taken together, all this helps create a culture of walking, cycling, and transit use that is safer, healthier, and more efficient. Thanks to these reforms, Helsinki cut its annual pedestrian fatalities from 84 in 1965 to zero in 2019 (though there have been a couple in the subsequent years). Nationally, last year saw the lowest number of traffic deaths ever recorded. Meanwhile, cutting down on automobile trips is part of how Finland slashed its carbon dioxide emissions per capita by about half, from 14 metric tons in 2003 to 7 tons in 2021, as compared to 15 tons in America.

It’s also just more wholesome. Once it sunk in that I was about as safe as it is possible to be on a street, and didn’t have to be looking over my shoulder every few seconds to watch out for a careening 4-ton pickup truck, I felt the sense of peace that comes from releasing a worry that has been there for so long you’d forgotten what it was like to exist without it. Rather than being perceived as some irritating interloper getting in the way of drivers, I felt that I belonged on the street as much as anyone else. Conversely, I started viewing drivers, who invariably stop when anyone approaches a crosswalk, as fellow human beings rather than probable speed-crazed maniacs bent on running me down.

This safety no doubt helps explain why compared to an American city, one sees children on the street far more frequently in Helsinki; either big packs of young schoolchildren wearing high-visibility vests, shepherded by a couple adults, or kids from about seven and up out by themselves or in groups. And that’s despite the fact that the American birthrate is substantially higher than Finland’s. No doubt part of the reason for children being absent from the street is America’s hyper-neurotic parenting culture, but that culture is also fueled by the quite rational worry that unsupervised kids will be obliterated by a speeding lunatic.

It all sounds pretty fancy. But I want to emphasize that Helsinki is not really on the urbanist cutting edge. It still has some wide “stroads” here and there, and compared to, say, Amsterdam it is still relatively car-centric. But that also means that it isn’t too far off from the American city average.

Now, of course America couldn’t simply copy-paste every one of Finland road policies. We have neither the political will nor the administrative capacity to impose six-digit fines on rich jerks speeding through school zones in their Porsche Cayennes. It’s also hard to imagine the kind of stiff taxes on vehicle ownership and gasoline (about three dollars a gallon) that also makes driving much more expensive.

But we could have automatically enforced speed limits. New York City, for example, recently turned its (very limited) collection of speed cameras on continuously, after long delays from car-brained officials. Sure enough, speeding fell sharply along with traffic injuries and deaths of all kinds. We could also reclaim some road space for bike lanes and trams — or even just buses. The average suburban arterial has more than enough space, and e-bikes make many bike trips possible even in low-density sprawl.

Studies demonstrate that a substantial and growing fraction of Americans want to be able to live car-free. Another larger fraction would simply like the option to avoid driving if they don’t want to. The reason so many don’t is the risk. Make walking and cycling safe, and millions more will do it. We wouldn’t make it all the way to Finland’s level without the rest of its policies, but we’d get fairly far.

When reformers propose Finland-style changes to American cities, drivers commonly complain that it would cut into their freedom. But you can still drive just about anywhere in Finland, if you want to. Indeed, it’s much easier and safer to do so than it is in American cities. We have about the worst of all possible worlds, where we’re so dedicated to car supremacy that we’ve made our cities a dangerous, stressful, polluted hellscape even for drivers. There’s a better way.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

It’s not perfect, but pretty soon, it’ll be available for under $30,000.

Here’s what you need to know about the rejuvenated Chevrolet Bolt: It’s back, it’s better, and it starts at under $30,000.

Although the revived 2027 Bolt doesn’t officially hit the market until January 2026, GM revealed the new version of the iconic affordable EV at a Wednesday evening event at the Universal Studios backlot in Los Angeles. The assembled Bolt owners and media members drove the new cars past Amity Island from Jaws and around the Old West and New York sets that have served as the backdrops of so many television shows and movies. It was star treatment for a car that, like its predecessor, isn’t the fanciest EV around. But given the giveaway patches that read “Chevy Bolt: Back by popular demand,” it’s clear that GM heard the cries of people who missed having the plucky electric hatchback on the market.

The Bolt died at the height of its powers. The original Bolt EV and Bolt EUV sold in big numbers in the late 2010s and early 2020s, powered by a surprisingly affordable price compared to competitor EVs and an interior that didn’t feel cramped despite its size as a smallish hatchback. In 2023, the year Chevy stopped selling it, the Bolt was the third-best-selling EV in America after Tesla’s top two models.

Yet the original had a few major deficiencies that reflected the previous era of EVs. The most egregious of which was its charging speed that topped out at around 50 kilowatts. Given that today’s high-speed chargers can reach 250 to 350 kilowatts — and an even faster future could be on the way — the Bolt’s pit stops on a road trip were a slog that didn’t live up to its peppy name.

Thankfully, Chevy fixed it. Charging speed now reaches 150 kilowatts. While that figure isn’t anywhere near the 350 kilowatts that’s possible in something like the Hyundai Ioniq 9, it’s a threefold improvement for the Bolt that lets it go from 10% to 80% charged in a respectable 26 minutes. The engineers said they drove a quartet of the new cars down old Route 66 from the Kansas City area, where the Bolt is made, to Los Angeles to demonstrate that the EV was finally ready for such an adventure.

From the outside, the 2027 Bolt is virtually indistinguishable from the old car, but what’s inside is a welcome leap forward. New Bolt has a lithium-ion-phosphate, or LFP battery that holds 65 kilowatt-hours of energy, but still delivers 255 miles of max range because of the EV’s relatively light weight. Whereas older EVs encourage drivers to stop refueling at around 80%, the LFP battery can be charged to 100% regularly without the worry of long-term damage to the battery.

The Bolt is GM’s first EV with the NACS charging standard, the former Tesla proprietary plug, which would allow the little Chevy to visit Tesla Superchargers without an adapter (though its port placement on the front of the driver’s side is backwards from the way older Supercharger stations are built). Now built on GM’s Ultium platform, the Bolt shares its 210-horsepower electric motor with the Chevy Equinox EV and gets vehicle-to-load capability, meaning you’ll be able to tap into its battery energy for other uses such as powering your home.

But it’s the price that’s the real wow factor. Bolt will launch with an RS version that gets the fancier visual accents and starts at $32,000. The Bolt LT that will be available a little later will eventually start as low as $28,995, a figure that includes the destination charge that’s typically slapped on top of a car’s price, to the tune of an extra $1,000 to $2,000 on delivery. Perhaps it’s no surprise that GM revealed this car just a week after the end of the $7,500 federal tax credit for EV purchases (and just a day after Tesla announced its budget versions of the Model Y and Model 3). Bringing in a pretty decent EV at under $30,000 without the help of a big tax break is a pretty big deal.

The car is not without compromises. Plenty of Bolt fans are aghast that Chevy abandoned the Apple CarPlay and Android Auto integrations that worked with the first Bolt in favor of GM’s own built-in infotainment system as the only option. Although the new Bolt was based on the longer, “EUV” version of the original, this is still a pretty compact car without a ton of storage space behind the back seats. Still, for those who truly need a bigger vehicle, there’s the Chevy Equinox EV.

For as much time as I’ve spent clamoring for truly affordable EVs that could compete with entry-level gas cars on prices, the Bolt’s faults are minor. At $29,000 for an electric vehicle in the U.S., there is practically zero competition until the new Nissan Leaf arrives. The biggest threats to the Bolt are America’s aversion to small cars and the rapid rates of depreciation that could allow someone to buy a much larger, gently used EV for the price of the new Chevy. But the original Bolt found a steady footing among drivers who wanted that somewhat counter-cultural car — and this one is a lot better.

“Old economy” companies like Caterpillar and Williams are cashing in by selling smaller, less-efficient turbines to impatient developers.

From the perspective of the stock market, you’re either in the AI business or you’re not. If you build the large language models pushing out the frontiers of artificial intelligence, investors love it. If you rent out the chips the large language models train on, investors love it. If you supply the servers that go in the data centers that power the large language models, investors love it. And, of course, if you design the chips themselves, investors love it.

But companies far from the software and semiconductor industry are profiting from this boom as well. One example that’s caught the market’s fancy is Caterpillar, better known for its scale-defying mining and construction equipment, which has become a “secular winner” in the AI boom, writes Bloomberg’s Joe Weisenthal.

Typically construction businesses do well when the overall economy is doing well — that is, they don’t typically take off with a major technological shift like AI. Now, however, Caterpillar has joined the ranks of the “picks and shovels” businesses capitalizing on the AI boom thanks to its gas turbine business, which is helping power OpenAI’s Stargate data center project in Abilene, Texas.

Just one link up the chain is another classic “old economy” business: Williams Companies, the natural gas infrastructure company that controls or has an interest in over 33,000 miles of pipeline and has been around in some form or another since the early 20th century.

Gas pipeline companies are not supposed to be particularly exciting, either. They build large-scale infrastructure. Their ratemaking is overseen by federal regulators. They pay dividends. The last gas pipeline company that got really into digital technology, well, uh, it was Enron.

But Williams’ shares are up around 28% in the past year — more than Caterpillar. That’s in part, due to its investing billions in powering data centers with behind the meter natural gas.

Last week, Williams announced that it would funnel over $3 billion into two data center projects, bringing its total investments in powering AI to $5 billion. This latest bet, the company said, is “to continue to deliver speed-to-market solutions in grid-constrained markets.”

If we stipulate that the turbines made by Caterpillar are powering the AI boom in a way analogous to the chips designed by Nvidia or AMD and fabricated by TSMC, then Williams, by developing behind the meter gas-fired power plants, is something more like a cloud computing provider or data center developer like CoreWeave, except that its facilities house gas turbines, not semiconductors.

The company has “seen the rapid emergence of the need for speed with respect to energy,” Williams Chief Executive Chad Zamarin said on an August earnings call.

And while Williams is not a traditional power plant developer or utility, it knows its way around natural gas. “We understand pipeline capacity,” Zamarin said on a May earnings call. “We obviously build a lot of pipeline and turbine facilities. And so, bringing all the different pieces together into a solution that is ready-made for a customer, I think, has been truly a differentiator.”

Williams is already behind the Socrates project for Meta in Ohio, described in a securities filing as a $1.6 billion project that will provide 400 megawatts of gas-fired power. That project has been “upsized” to $2 billion and 750 megawatts, according to Morgan Stanley analysts.

Meta CEO Mark Zuckerberg has said that “energy constraints” are a more pressing issue for artificial intelligence development than whether the marginal dollar invested is worth it. In other words, Zuckerberg expects to run out of energy before he runs out of projects that are worth pursuing.

That’s great news for anyone in the business of providing power to data centers quickly. The fact that developers seem to have found their answer in the Williamses and Caterpillars of the world, however, calls into question a key pillar of the renewable industry’s case for itself in a time of energy scarcity — that the fastest and cheapest way to get power for data centers is a mix of solar and batteries.

Just about every renewable developer or clean energy expert I’ve spoken to in the past year has pointed to renewables’ fast timeline and low cost to deploy compared to building new gas-fired, grid-scale generation as a reason why utilities and data centers should prefer them, even absent any concerns around greenhouse gas emissions.

“Renewables and battery storage are the lowest-cost form of power generation and capacity,” Next Era chief executive John Ketchum said on an April earnings call. “We can build these projects and get new electrons on the grid in 12 to 18 months.” Ketchum also said that the price of a gas-fired power plant had tripled, meanwhile lead times for turbines are stretching to the early 2030s.

The gas turbine shortage, however, is most severe for large turbines that are built into combined cycle systems for new power plants that serve the grid.

GE Vernova is discussing delivering turbines in 2029 and 2030. While one manufacturer of gas turbines, Mitsubishi Heavy Industries, has announced that it plans to expand its capacity, the industry overall remains capacity constrained.

But according to Morgan Stanley, Williams can set up behind the meter power plants in 18 months. xAI’s Colossus data center in Memphis, which was initially powered by on-site gas turbines, went from signing a lease to training a large language model in about six months.

These behind the meter plants often rely on cheaper, smaller, simple cycle turbines, which generate electricity just from the burning of natural gas, compared to combined cycle systems, which use the waste heat from the gas turbines to run steam turbines and generate more energy. The GE Vernova 7HA combined cycle turbines that utility Duke Energy buys, for instance, range in output from 290 to 430 megawatts. The simple cycle turbines being placed in Ohio for the Meta data center range in output from about 14 megawatts to 23 megawatts.

Simple cycle turbines also tend to be less efficient than the large combined cycle system used for grid-scale natural gas, according to energy analysts at BloombergNEF. The BNEF analysts put the emissions difference at almost 1,400 pounds of carbon per megawatt-hour for the single turbines, compared to just over 800 pounds for combined cycle.

Overall, Williams is under contract to install 6 gigawatts of behind-the-meter power, to be completed by the first half of 2027, Morgan Stanley analysts write. By comparison, a joint venture between GE Vernova, the independent power producer NRG, and the construction company Kiewit to develop combined cycle gas-fired power plants has a timeline that could stretch into 2032.

The Williams projects will pencil out on their own, the company says, but they have an obvious auxiliary benefit: more demand for natural gas.

Williams’ former chief executive, Alan Armstrong, told investors in a May earnings call that he was “encouraged” by the “indirect business we are seeing on our gas transmission systems,” i.e. how increased natural gas consumption benefits the company’s traditional pipeline business.

Wall Street has duly rewarded Williams for its aggressive moves.

Morgan Stanley analysts boosted their price target for the stock from $70 to $83 after last week’s $3 billion announcement, saying in a note to clients that the company has “shifted from an underappreciated value (impaired terminal value of existing assets) to underappreciated growth (accelerating project pipeline) story.” Mizuho Securities also boosted its price target from $67 to $72, with analyst Gabriel Moreen telling clients that Williams “continues to raise the bar on the scope and potential benefits.”

But at the same time, Moreen notes, “the announcement also likely enhances some investor skepticism around WMB pushing further into direct power generation and, to a lesser extent, prioritizing growth (and growth capex) at the expense of near-term free cash flow and balance sheet.”

In other words, the pipeline business is just like everyone else — torn between prudence in a time of vertiginous economic shifts and wanting to go all-in on the AI boom.

Williams seems to have decided on the latter. “We will be a big beneficiary of the fast rising data center power load,” Armstrong said.

On billions for clean energy, Orsted layoffs, and public housing heat pumps

Current conditions: A tropical rainstorm is forming in the Atlantic that’s forecast to barrel along the East Coast through early next week, threatening major coastal flooding and power outages • Hurricane Priscilla is weakening as it tracks northward toward California • The Caucasus region is sweltering in summer-like heat, with the nation of Georgia enduring temperatures of up to 93 degrees Fahrenheit in October.

Base Power, the Texas power company that leases batteries to homeowners and taps the energy for the grid, on Tuesday announced a $1 billion financing round. The Series C funding is set to supercharge the Austin-based company’s meteoric growth. Since starting just two years ago, Base has deployed more than 100 megawatts of residential battery capacity, making it one of the fastest growing distributed energy companies in the nation. The company now plans to build a factory in the old headquarters of the Austin American-Statesman, the leading daily newspaper in the Texan capital. The funding round included major investors who are increasing their stakes, including Valor Equity Partners, Thrive Capital, and Andreessen Horowitz, and at least nine new venture capital investors, including Lowercarbon, Avenir, and Positive Sum. “The chance to reinvent our power system comes once in a generation,” Zach Dell, chief executive and co-founder of Base Power, said in a statement. “The challenge ahead requires the best engineers and operators to solve it and we’re scaling the team to make our abundant energy future a reality.”

The deal came a day after Brookfield Asset Management, the Canadian-American private equity giant, raised a record $23.5 billion for its clean energy fund. At least $5 billion has already been spent on investments such as the renewable power operator Neoen, the energy developer Geronimo Power, and the Indian wind and solar giant Evren. “Energy demand is growing fast, driven by the growth of artificial intelligence as well as electrification in industry and transportation,” Connor Teskey, Brookfield’s president and renewable power chief, said in a press release. “Against this backdrop we need an ‘any and all’ approach to energy investment that will continue to favor low carbon resources.”

Orsted has been facing down headwinds for months. The Danish offshore wind giant has absorbed the Trump administration’s wrath as the White House deployed multiple federal agencies to thwart progress on building seaward turbines in the Northeastern U.S. Then lower-than-forecast winds this year dinged Orsted’s projected earnings for 2025. When the company issued new stock to fund its efforts to fight back against Trump, the energy giant was forced to sell the shares at a steep discount, as I wrote in this newsletter last month. Despite all that, the company has managed to raise the money it needed. On Wednesday, The Wall Street Journal reported that Orsted had raised $9.4 billion. Existing shareholders subscribed for 99.3% of the new shares on offer, but demand for the remaining shares was “extraordinarily high,” the company said.

That wasn’t enough to stave off job cuts. Early Thursday morning, the company announced plans to lay off 2,000 employees between now and 2027. The cuts represented roughly one-quarter of the company’s 8,000-person global workforce. “This is a necessary consequence of our decision to focus our business and the fact that we'll be finalizing our large construction portfolio in the coming years — which is why we'll need fewer employees,” Rasmus Errboe, Orsted’s chief executive, said in a statement published on CNBC. "At the same time, we want to create a more efficient and flexible organization and a more competitive Orsted, ready to bid on new value-accretive offshore wind projects.”

California operates the world’s largest geothermal power station, The Geysers, and generates up to 5% of its power from the Earth’s heat. But the state is far behind its neighbors on developing new plants based on next-generation technology. Most of the startups racing to commercialize novel methods are headquartered or building pilot plants in states such as Utah, Nevada, and Texas. A pair of bills to make doing business in California easier for geothermal companies was supposed to change that. Yet while Governor Gavin Newsom signed one statute into law that makes it easier for state regulators to certify geothermal plants, he vetoed a permitting reform bill to which the industry had pegged its hopes. “Every geothermal developer and energy org I talked to was excited about this bill,” Thomas Hochman, who heads the energy program at the right-leaning Foundation for American Innovation, wrote in a post on X. “The legislature did everything right, passing it unanimously. They even reworked it to accommodate certain classic California concerns, such as prevailing wage requirements.”

In a letter announcing his veto, the governor claimed that the law would have added new fees for geothermal projects. But an executive at Zanskar — the startup that, as Heatmap’s Katie Brigham reported last month, is using new technology to locate and tap into conventional geothermal resources — called the governor’s argument “weak sauce.” Far from burdening the industry, Zanskar co-founder Joel Edwards said on X, “this was a clean shot to accelerate geothermal today, and he whiffed it.”

Last month, Generate Capital trumpeted the appointment of its first new chief executive in its 11-year history as the leading infrastructure investment firm sought to realign its approach to survive a tumultuous time in clean-energy financing. Less publicly, as Katie wrote in a scoop last night, it also kicked off company-wide job cuts. In an interview with Katie, Jonah Goldman, the firm’s head of external affairs, said the company “grew quickly and made some mistakes,” and now planned to lay off 50 people.

Generate once invested in “leading-edge technologies,” according to co-founder Jigar Shah, who left the firm to serve as the head of the Biden-era DOE Loan Programs Office. That included investments in projects involving fuel cells, anaerobic digesters, and battery storage. But from the outside, he said on the Open Circuits podcast he now co-hosts, the firm appears to have moved away from taking these riskier but potentially more lucrative bets. “They ended up with 38 people in their capital markets team, and their capital markets team went out to the marketplace and said, Hey, we have all this stuff to sell. And the people that they went to said, Well, that’s interesting, but what we really would love is boring community solar.”

Three of New England’s largest public housing agencies signed deals with the heat pump manufacturer Gradient to replace aging electric heaters and air conditioners with the company’s 120-volt, two-way units that provide both heating and cooling. The Boston Housing Authority, New England’s largest public housing agency, will kick off the deal by installing 100 all-weather, two-way units that both heat and cool at the Hassan Apartments, a complex for seniors and adults with disabilities in Boston’s Mattapan neighborhood. The housing authorities in neighboring Chelsea and Lynn — two formerly industrial, working-class cities just outside Boston — will follow the same approach.

Public housing agencies have long served a vital role in helping to popularize new, more efficient appliances. The New York City Housing Authority, for example, is credited with creating the market for efficient mini fridges in the 1990s. Last year, NYCHA — the nation’s largest public housing system — signed a similar deal with Gradient for heat pumps. Months later, as Heatmap’s Emily Pontecorvo exclusively reported at the time, NYCHA picked a winner in its $32 million contest for an efficient new induction stove for its apartments.

Three chemists — Susumu Kitagawa, Richard Robson, and Omar Yaghi — won the Nobel Prize for “groundbreaking discoveries” that "may contribute to solving some of humankind’s greatest challenges, from pollution to water scarcity.” Just a few grams of the so-called molecular organic frameworks the scientists pioneered could have as much surface area as a soccer field, which can be used to lock gas molecules in place in carbon capture or harvest freshwater from the atmosphere.