You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

The week’s buzziest real estate listings, ranked by climate risk.

Glued to real estate posts on The New York Times, The Wall Street Journal, Dwell, or Architectural Digest and wondering how those gorgeous homes will hold up in the next decades? I have you covered.

Heatmap has partnered with my new climate risk platform, Habitable. Every Friday, we add a climate risk score to the real estate listings featured in the news this week and ask: Could you live here as the climate changes?

Using a model developed by a team of Berkeley data scientists at Climate Check, Habitable scores each property for heat, flood, drought, and fire risk on a scale of 1-10. One represents the lowest risk and 10 is the highest. Our rating for each hazard is based on climate change projections through 2050. (You can check your own home’s climate risk here.)

For today’s edition, I apply the Habitable Index to check the climate risk of houses that are local heroes — star listings in locations on the outskirts of major cities. What’s interesting is that across the country buyers are still spending big for risky properties although there are some surprises and exceptions.

Controversial quarterback Aaron Rodgers will have nothing to get riled up about in his new Montclair, New Jersey, home during his first season with the New York Jets. The brand new house listed for $11 million (he bought it for $9.5 million) has an overall low climate risk with nothing to worry about besides moderate drought and heat.

Featured in The Daily Mail and sold for $9,500,000

Savannah

The newly renovated childhood home of U.S. Poet Laureate and Pulitzer Prize-winning author Conrad Aiken in a historic Savannah neighborhood is picture perfect and recently listed for $4.9 million. Brand new interior upgrades highlight the historic details. The climate risk is focused on the high heat typical to southern Georgia, which is not bad, all things considered.

Featured in Home Stratosphere and listed for $12,300,000

This house and location is spectacular! On a private peninsula on Lake Minnetonka in Minnesota, there are views from every room in the house and also from the lighthouse.

But habitable it is not. Not only will the long private driveway leading to the beautiful stone home likely be underwater, it’s probable the multiple decks, porches, and patios that maximize outdoor living will be too.

Featured on CBS News and listed for $14,750,000

A record-breaking sale makes Copper Beech Farm in Greenwich the most expensive home ever sold in Connecticut. On 50 acres, the land includes a mile of uninterrupted beach on the Long Island Sound. The historic mansion has nine fireplaces and gorgeous old trees which may contribute to the low heat risk. But with a 9/10 extreme risk for flooding, it’s a high price to pay.

Featured in the New York Post and sold for $138,000,000.

Texas’ highest priced residential home was just listed outside Houston for $65 million. "The Lodge in Hunters Creek" is Texas-sized (22,000 square feet) and includes a personal 24-hour guard house. I have to admit, the house and the setting and landscaping is stunning. But gosh that is a lot of money to pay to live with the most extreme heat and flood risk with a little drought and fire risk thrown in.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

On aluminum smelting, Korean nuclear, and a geoengineering database

Current conditions: Winter Storm Fern may have caused up to $115 billion in economic losses and triggered the longest stretch of subzero temperatures in New York City’s history • Temperatures across the American South plunged up to 30 degrees Fahrenheit below historical averages • South Africa’s Northern Cape is roasting in temperatures as high as 104 degrees.

President Donald Trump has been on quite a shopping spree since taking an equity stake in MP Materials, the only active rare earths miner in the U.S., in a deal Heatmap’s Matthew Zeitlin noted made former Biden administration officials “jealous.” The latest stake the administration has taken for the American taxpayer is in USA Rare Earth, a would-be miner that has focused its attention establishing a domestic manufacturing base for the rare earth-based magnets China dominates. On Monday, the Department of Commerce announced a deal to inject $1.6 billion into the company in exchange for shares. “USA Rare Earth’s heavy critical minerals project is essential to restoring U.S. critical mineral independence,” Secretary of Commerce Howard Lutnick said in a statement. “This investment ensures our supply chains are resilient and no longer reliant on foreign nations.” In a call with analysts Monday, USA Rare Earth CEO Barbara Humpton called the deal “a watershed moment in our work to secure and grow a resilient and independent rare earth value chain based in this country.”

After two years of searching for a site to build the United States’ first new aluminum smelter in half a century, Century Aluminum has abandoned its original plan and opted instead to go into business with a Dubai-based rival developing a plant in Oklahoma. Emirates Global Aluminum announced plans last year to construct a smelter near Tulsa. Under the new plan, Century Aluminum would take a 40% stake in the venture, with Emirates Global Aluminum holding the other 60%. At peak capacity, the smelter would produce 750,000 tons of aluminum per year, a volume The Wall Street Journal noted would make it the largest smelter in the U.S. Emirates Global Aluminum has not yet announced a long-term contract to power the facility. Century Aluminum’s original plan was to use 100% of its power from renewables or nuclear, Canary Media reported, and received $500 million from the Biden administration to support the project.

The federal Mine Safety and Health Administration has stopped publishing data tied to inspections of sites with repeated violations, E&E News reported. At a hearing before the House Education & the Workforce Subcommittee on Workforce Protections last week, Wayne Palmer, the assistant secretary of labor for mine safety and health, said the data would no longer be made public. “To the best of my knowledge, we do not publish those under the current administration,” Palmer said. He said the decision to not make public results of “targeted inspections” predated his time at the agency. The move comes as the Trump administration is pushing to ramp up mining in the U.S. to compete with China’s near monopoly over key metals such as rare earths, and lithium. As Heatmap’s Katie Brigham wrote in September, “everybody wants to invest in critical minerals.”

Sign up to receive Heatmap AM in your inbox every morning:

South Korea’s center-left Democratic Party has historically been staunchly anti-nuclear. So when the country’s nuclear regulator licensed a new plant earlier this month — its first under a new Democratic president — I counted it as a win for the industry. Now President Lee Jae-myung’s administration is going all in all on atomic energy. On Monday, NucNet reported that the state-owned Korea Hydro & Nuclear Power plans to open bidding for sites for two new large reactors. The site selection is set to take up to six months. The country then plans to begin construction in the early 2030s and bring the reactors online in 2037 and 2038. Kim Sung-whan, the country’s climate minister, said the Lee administration would stick to the nuclear buildout plan authored in February 2025 under former President Yoon Suk Yeol, a right-wing leader who strongly supported the atomic power industry before being ousted from power after attempting to declare martial law.

Reflective, a nonprofit group that bills itself as “aiming to radically accelerate the pace of sunlight reflection research,” launched its Uncertainty Database on Monday, with the aim of providing scientists, funders, and policymakers with “an initial foundation to create a transparent, prioritized, stage-gated” roadmap of different technologies to spray aerosols in the atmosphere to artificially cool the planet. “SAI research is currently fragmented and underpowered, with no shared view of which uncertainties actually matter for real-world decisions,” Dakota Gruener, the chief executive of Reflective, said in a statement. “We need a shared, strategic view of what we know, what we don’t, and where research can make the biggest difference. The Uncertainty Database helps the field prioritize the uncertainties and research that matter most for informed decisions about SAI.” The database comes as the push to research geoengineering technologies goes mainstream. As Heatmap’s Robinson Meyer reported in October, Stardust Solutions, a U.S. firm run by former Israeli government physicists, has already raised $60 million in private capital to commercialize technology that many climate activists and scientists still see as taboo to even study.

Often we hear of the carbon-absorbing potential of towering forest trees or fast-growing algae. But nary a word on the humble shrub. New research out of China suggests the bush deserves another look. An experiment in planting shrubs along the edges of western China’s Taklamakan Desert over the past four decades has not only kept desertification at bay, it’s made a dent in carbon emissions from the area. “This is not a rainforest,” King-Fai Li, a physicist at the University of California at Riverside, said in a statement. “It’s a shrubland like Southern California’s chaparral. But the fact that it’s drawing down CO2 at all, and doing it consistently, is something positive we can measure and verify from space.” The study provides a rare, long-term case study of desert greening, since this effort has endured for decades whereas one launched in the Sahara Desert by the United Nations crumbled.

With historic lows projected for the next two weeks — and more snow potentially on the way — the big strain may be yet to come.

Winter Storm Fern made the final stand of its 2,300-mile arc across the United States on Monday as it finished dumping 17 inches of “light, fluffy” snow over parts of Maine. In its wake, the storm has left hundreds of thousands without power, killed more than a dozen people, and driven temperatures to historic lows.

The grid largely held up over the weekend, but the bigger challenge may still be to come. That’s because prolonged low temperatures are forecasted across much of the country this week and next, piling strain onto heating and electricity systems already operating at or close to their limits.

What issues there have been were largely due to damage in the transmission and distribution system, i.e. power lines freezing or being brought down by errant branches.

The outages or blackouts that have occurred have been the result of either operational issues with plants, scheduled maintenance, or issues specifically with snow affecting the distribution system. As yet there’s been no need for rolling blackouts to relieve grid congestion and preserve the system as a whole. Speaking about the country’s largest electrical grid, Jon Gordon, a director at Advanced Energy United, told Heatmap: “So far, so good.”

But this is all assuming we just get more cold weather. We could be in for another storm. Since late last week, the forecasting model maintained by the European Centre for Medium-Range Weather Forecasts — one of the two primary computer forecasting models, and generally considered more accurate than its analogue, the American model — has suggested there could be another major winter storm headed toward the Eastern U.S. next weekend. Whether it hits the Eastern Seaboard, clips it, or stays offshore, it’s still early to say with any confidence.

Should that storm hit, here’s what it’ll be barreling into.

Temperatures will likely remain below 0 degrees Fahrenheit across swaths of PJM Interconnection — the country’s largest regional transmission organization, covering the Mid-Atlantic through portions of the Midwest — with parts of Pennsylvania and Ohio not expected to see a day above freezing for the next two weeks.

Put simply, cold temperatures stress the grid. That’s because cold can affect the performance of electricity generators as well as the distribution and production of natural gas, the most commonly used grid fuel. And the longer the grid has to operate under these difficult conditions, the more fragile it gets. And this is all happening while demand for electricity and natural gas is rising.

Forced outages — which happen when power is pulled offline due to some kind of unexpected event or emergency — peaked on Sunday in PJM at just over 17,000 megawatts, while total outages were over 22 gigawatts on Monday, according to Grid Status’s Tim Ennis, who said some of them may have been due to ice “ice accumulation across Virginia.”

The market has also been serving more than its own 13-state territory. Already on Saturday — after the fierce cold had set in across its territory but before snow arrived — PJM noted to the Department of Energy that it had been asked to provide up to 3,000 megawatts to neighboring grids, and that it had already seen outages of around 20,000 megawatts — enough to serve 16 million people.

Kentucky, Virginia, and West Virginia reported the highest number of customers without power in the PJM region as of Monday afternoon, largely due to ice and snow that brought down tree branches on power lines or toppled utility poles.

Meanwhile, snow was still falling across New England on Monday afternoon, where parts of Massachusetts have received up to 20 inches. Another 8 inches could still accumulate on the Atlantic coast due to the ongoing lake effect, a common winter pattern in which cold Canadian air picks up moisture over the warmer Great Lakes, resulting in heavy snow downwind.

Though there were minimal blackouts in New England’s electricity market as of Monday morning, natural gas has fallen to just 30% of the grid’s fuel supply, from more than half at the same time a week earlier, with nearly 40% of its electricity output coming from oil-fired plants, Reuters reports. Solar generation peaked at less than a gigawatt on Sunday due to cloud cover, compared to over 4 gigawatts on Saturday and over 3 gigawatts on Friday. During the summer, ISO-NE’s combined behind-the-meter and utility-scale solar production can get as high as eight gigawatts.

The Department of Energy granted ISO New England, emergency permission to operate generators at maximum capacity, regardless of air quality and environmental standards. (It also granted the same dispensation to PJM and Texas’ grid operator, ERCOT.)

The most widespread outages in the country were concentrated in Tennessee, with some 230,000 customers in Nashville Electric Service’s area without power at one point. The disruptions were largely caused not by grid demands, but rather by nearly 100 broken utility poles and more than 70 distribution circuits taken down by the snow and ice, Utility Dive reported.

Mississippi and Louisiana also had outages, with around 4% of Energy customers offline according to Jefferies data, and around 10% of Entergy customers in Mississippi being affected by blackouts. By contrast, Jefferies data shows, less than 1% of Texas electricity customers were offline.

Typically, cold weather means higher natural gas prices, as the demand for home heating goes up alongside demand for electricity. The 44.2 billion cubic feet of natural gas forecast to be burned today would be the fifth highest January burn of all time in the U.S., according to Matthew Palmer, executive director at S&P Global Energy, in an email. The extended cold weather is expected to push natural gas stockpiles to their lowest since the winter of 2021 to 2022, according to S&P data.

Benchmark natural gas prices have shot up to $6.50 per million British thermal units, up from $5.28 on Friday. Crude oil prices by contrast were down slightly today, while heating oil prices were up around 5%.

High natural prices means that power markets are also expecting higher prices. Day-ahead average wholesale prices in Texas for 9 a.m. were almost $1,500 per megawatt-hour, compared to just $100 in the real-time market. In PJM, average real-time prices were around $270 at 9 a.m. compared to $482 in the day-ahead market.

“The worst is over, but we are expecting bitterly cold temperatures throughout the week. Please continue to avoid unnecessary travel and be vigilant about ice.” New Jersey Governor Mikie Sherrill, who had made electricity prices the centerpoint of her election campaign as well as her early days in office, said in a statement.

“While the worst of the snow is over, prolonged cold is still expected,” Jefferies analyst Julien Dumoulin-Smith wrote in a note to clients Monday. That can lead to “resource adequacy events,” i.e. blackouts, “as fuel supplies get strained and plants face operational strains from more significant run-time.”

There’s particular pressure and attention during this cold snap on ERCOT, the Texas grid operator, after 2021’s Winter Storm Uri, which brought ice, snow, and below-0 temperatures to much of the state. Natural gas wellheads froze up as much of the system for pumping and distributing natural gas lost power. Power plants were “unprepared for cold weather,” a report from the Federal Energy Regulatory Commission found, “and thus failed in large numbers.” ERCOT had to order power plants to shut down for several days in order to protect the system as a whole from falling perilously out of frequency, which would have risked a complete blackout. Around 60% of the state’s households rely on electricity for heating, and the long freeze-out left 4 million homes and businesses without power. More than 200 people died.

In the intervening years, Texas has introduced new capacity and reforms meant to prevent a similar tragedy. While ERCOT “does not anticipate any reliability issues on the statewide electric grid,” per a spokesperson, the operator flagged for the DOE that low temperatures in the week ahead could raise demand to an “extreme level” that poses “significant risk of emergency conditions that could jeopardize electric reliability and public safety.” So far, though, it’s been holding up, with peak demand expected Monday morning and outages mostly limited to East Texas due to downed power lines.

The Tennessee Valley Authority, which operates a vertically integrated grid centered in Tennessee and spanning several neighboring states, warned of “extreme cold” in the coming days, but said that its generation fleet — which includes coal, natural gas, and nuclear power plants — was “positioned to meet rising demand.” As of Monday morning, TVA said that 12 of the 153 power companies it serves had “distribution issues” related to the storm.

One Mississippi power company in the TVA system said that it had “suffered catastrophic damage” to its distribution system, specifically a 161 kilovolt transmission line operated by the TVA. The cold weather has dealt a double blow to the system, with TVA officials reporting ice on transmission and distribution lines as well as icy conditions making it difficult to service lines in need of repair.

Currently, TVA is forecasting that demand will peak Tuesday at just over 33,000 megawatts, according to EIA data. The system’s all-time winter peak is 35,430 megawatts.

PJM also expects several more days of tight conditions on the grid thanks to forecasted cold weather. The grid operator issued a “maximum generation emergency/load management alert” on Monday morning through at least the end of the day Tuesday, indicating that it needed to maintain high levels of generation throughout the system. It also asked generators for specifics on when any scheduled maintenance would be over in order to more carefully schedule operations to maintain reliability.

Over the weekend, PJM told the Energy Department that peak demand could exceed 130,000 megawatts “for seven straight days, a winter streak that PJM has never experienced.” The grid operator expects project peak demand over 147,000 megawatts on Tuesday, exceeding the previous record of 143,700 megawatts set last January. Demand peaked at 135,000 megawatts on Saturday and 129,000 megawatts on Sunday.

Current conditions: Winter Storm Fern buried broad swaths of the country, from Oklahoma City to Boston • Intense flooding in Zimbabwe and Mozambique have killed more than 100 people • South Australia’s heat wave is raging on, raising temperatures as high as 113 degrees Fahrenheit.

The United States’ aging grid infrastructure faces a test every time the weather intensifies, whether that’s heat domes, hurricanes, or snow storms. The good news is that pipeline winterization efforts that followed the deadly blackouts in 2021’s Winter Storm Uri made some progress in keeping everything running in the cold. The bad news is that nearly a million American households still lost power amid the storm. Tennessee, Mississippi, and Louisiana were the worst hit, with hundreds of thousands of households left in the dark, according to live data on the Power Outage tracker website. Georgia and Texas followed close behind, with roughly 75,000 customers facing blackouts. Kentucky had the next-most outages, with more than 50,000 households disconnected from the grid, followed by South Carolina, West Virginia, North Carolina, Virginia, and Alabama. Given the prevalence of electric heating in the typically-warmer Southeast, the outages risked leaving the blackout region without heat. Gas wasn’t entirely reliable, however. The deep freeze in Texas halted operations at roughly 10% of the Gulf Coast’s petrochemical facilities and refineries, Bloomberg reported.

On Saturday, right before Winter Storm Fern began, the Department of Energy issued its first emergency order of the year to deploy backup generation in Texas in hopes of avoiding a repeat of Uri. As of Sunday evening, data from Electric Reliability Council of Texas, the state’s grid operator, showed natural gas providing nearly 60% of the electricity on the wires, with coal and wind neck-and-neck for second place and solar in a close fourth. It’s a relief that the grid is holding. But the overreliance on fossil fuels isn’t a good long-term strategy. While “climate change deniers love to use major winter storms as ‘proof’ that global warming isn’t real,” my colleague Jeva Lange wrote last week, “in the case of this weekend’s polar vortex, there is evidence that Arctic warming is responsible for the record cold temperature projections across the United States.”

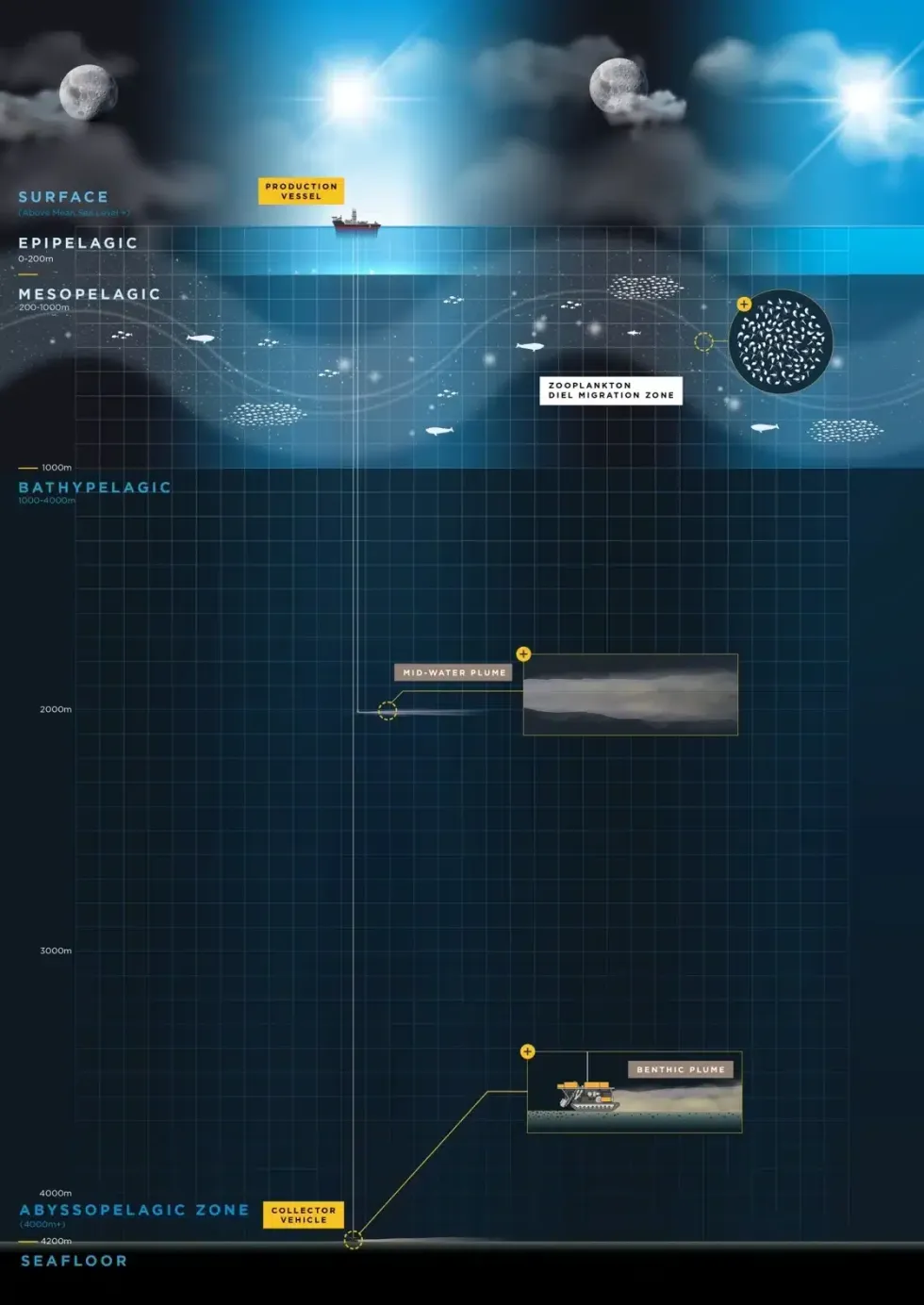

The National Oceanic and Atmospheric Administration finalized a rule last week clearing the way for companies to apply for the right to mine the deep ocean floor. Under the new rules, applications for commercial and exploratory licenses are streamlined into a single process, cutting the number of required environmental assessments and public comment hearings in half. The day after the final rule came out, The Metals Company, the leading startup racing to collect mineral-rich nodules from largely unexplored depths of international waters, submitted an application to mine an area roughly twice the size of its original plans. “Nearly 50 years after this industry took shape, it’s ready to move forward,” the company told The New York Times. But opposition to deep-sea mining is mounting as environmentalists highlight the risk the industry poses to a scarcely understood and still remarkably untouched ecosystem. A corporate campaign to oppose deep sea mining just added the solar giant Sunrun to its petition, as I told you last week.

Tesla has officially discontinued Autopilot, its basic self-driving software, in the U.S. and Canada. All new car purchases now come with standard Traffic-Aware Cruise Control, Sawyer Merritt, a self-described Tesla investor with a prolific social media presence, wrote in a post on X. The move, according to TechCrunch, is designed to boost adoption of Tesla’s more advanced Full Self-Driving setting. But it’s also in response to a courtroom loss in the company’s biggest market. Last month, a judge in California ruled that Tesla engaged in deceptive marketing by overstaying the capabilities of both Autopilot and FSD for years. The California Department of Motor Vehicles, which originally brought the case, gave Tesla two months to comply with the ruling by dropping the Autopilot name.

Sign up to receive Heatmap AM in your inbox every morning:

New York Governor Kathy Hochul is going all in on nuclear power. She started off last year at the helm of a new multi-state alliance working on building more reactors. Over the summer, she directed the state-owned power authority to oversee construction of New York’s first new reactor since the 1980s. More recently, she inked a deal with Ontario to work together on building new plants and expanded her target fivefold to 5 gigawatts of new atomic energy in the state. Now she’s backed something a little more traditional but no less important. Last week, the state’s utility regulators extended subsidies for existing nuclear plants by another two decades in hopes of keeping aging reactors open until at least 2049.

In Denmark, meanwhile, the government has officially started considering building small modular reactors and lifting the nuclear ban the parliament put into effect 40 years ago. “Green energy from solar and wind is now and will continue to be the backbone of the Danish energy supply, but we can also see that it cannot stand alone,” Lars Aagaard, Denmark’s climate, energy and utilities minister, said in a statement. “We must be open to examining whether other technologies can provide us with green energy in the future. Small modular nuclear reactors may be an option.”

Standard Nuclear, a startup producing TRISO atomic fuel required by several of the nation’s leading small modular reactor designs, has raised $140 million in Series A funding. The investment round was led by Decisive Point, with first-time backing from Chevron Technology Ventures, StepStone Group, and XTX Ventures. Several existing investors, including Fundomo, Andreessen Horowitz, and Crucible Capital, increased their stakes. The financing will support Standard Nuclear’s plans to expand TRISO production to over 2 metric tons per year at multiple sites across the country. The timeline, the company said, is “rapid” and will take place by mid-2026. “With this funding, we are positioned to accelerate our roadmap, scale operations, and deliver on the promise to fuel the next generation of reactors powering industry, defense, and space,” Kurt Terrani, Standard Nuclear’s chief executive, said in a statement.

While TRISO was invented decades ago, the fuel — which has extra layers of ceramic coating that are meant to make a meltdown virtually impossible — is making a comeback as the go-to material for next-generation reactors designed to reach higher temperatures by using coolants other than water. Standard Nuclear has also inked a deal with the nuclear recycling company SHINE Technologies to work on reprocessing radioactive waste into fresh fuel.

Years ago, at a lecture about the spread of Lyme disease in the New York area, I learned that opossums eat thousands of ticks every season. That information totally changed my perception of a rodent that previously creeped me out. Well, it turns out kestrels — colorful, predatory birds — serve a similar function on fruit farms. New research in the Journal of Applied Ecology suggests kestrels keep harmful pathogens off fruit by eating and scaring off small birds that carry those diseases. Orchards that housed the birds in nest boxes saw fewer cherry-eating birds than orchards without, translating to what Inside Climate News described as a 81% reduction in crop damage.