You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

European elites have been annoyed or worse by the U.S. Inflation Reduction Act. Its name is misleading; this is the largest American industrial policy since the New Deal — one that intends not only to drastically reduce greenhouse gas emissions, but also to stand up a whole new industrial supply chain for green energy and manufacturing located in the U.S. and North America.

That project doesn’t sound great to many Europeans. French President Emmanuel Macron complained it was “super aggressive.” The French and German economic ministers traveled to Washington in February to lobby the Biden administration for exemptions from IRA rules (and actually got a receptive hearing). More recently Europe seems to have softened on the law; Bloomberg reports that elites are making their piece with EU businesses setting up shop in North America to be eligible for IRA subsidies. But this is still not ideal.

In the abstract, one can sympathize with European complaints over the U.S. flexing its still-unparalleled economic might to direct a greater share of cutting-edge economic production towards itself. But this isn’t merely a question of economics. As the recent IPCC report details, the world is still careening towards catastrophic global warming even given the fairly extensive climate policies most countries have enacted. Fighting that crisis trumps any possible complaint about economic unfairness.

But there’s a deeper problem here. The European Union taken together has economic heft not far off from the United States, with a population of 450 million and a price parity GDP of about $24 trillion. It absolutely has the capacity to enact an IRA-style industrial policy scheme — indeed, the continent has been crying out for one for over a decade. The IRA is a perfect opportunity to clear away the irrational and deeply harmful budget rules that have hamstrung the EU economy, return prosperity to the continent, and fight climate change to boot.

For the last 15 years most of the European Union, and especially the eurozone currency area, has been suffering a largely self-inflicted crisis of economic stagnation.

When the 2008 financial crisis hit, Europe barely avoided a galloping economic collapse, but it still faced a serious recession, particularly in the eurozone periphery of Greece, Spain, Italy, and Portugal. These countries were confronted with classic debt problems as revenues fell while spending on social benefits rose — a situation made worse because those nations did not control the European Central Bank and thus couldn’t rely on it to print money to prevent a self-perpetuating debt crisis. The EU eventually responded by essentially bailing out the banks that had lent to the ailing countries, but they disguised it as broader economic relief and then demanded punishing austerity measures in the rescued countries.

The austerity binge after 2010 pummeled the broader EU economy, and created a Great Depression-scale catastrophe in Greece and Spain. In the eurozone, unemployment had peaked and started to come down by mid 2010, but once the debt crisis and austerity poison took hold, it soared again to over 12 percent by 2012, where it remained for two years, and came down only with agonizing slowness. In Spain unemployment peaked at 26 percent, in Greece 28 percent.

Since 2009, eurozone growth has been dismal compared to America — which itself suffered a growth disaster during the 2010s, as I have previously argued. Yet the U.S. still managed inflation-adjusted growth per person of 19 percent between 2009 and 2021; the eurozone figure is 11 percent. In France the figure is just 8 percent; in Spain 1 percent, and in Greece negative 17 percent. Italy has not grown at all for more than 20 years. Adding insult to injury, all that austerity didn’t even help with Greece’s debt-to-GDP burden, because its economy shrank just as fast as the debt total.

This was a disaster for climate change and European energy security. European investment in renewable energy plummeted during the 2010s, from a high of about $30 billion in 2011 to just $10 billion in 2018. In sunny Spain and Italy investment virtually ceased during this period. Instead many European countries, particularly Germany, came to rely on cheap Russian natural gas for their core energy needs. That made them greatly vulnerable to Russia pressure when Vladimir Putin cut down gas supplies in an attempt to force Europe to stop supporting Ukraine’s effort to fight off Russian aggression.

To be fair, as I previously wrote here at Heatmap, Europe has been conducting a crash renewable investment program in response to Putin’s war that has been an amazing success, all things considered. But if it had spent the 2010s building out green energy, it would have been far less vulnerable to Russia coercion, its emissions would be much lower, European inflation today (driven by skyrocketing energy costs) would be considerably less, and Putin might even have thought twice about the invasion.

What is called for is a Europe-wide spending, borrowing, and investment policy to add to existing EU renewable subsidies. Rather than just decarbonization, the goal should be to restore full employment and production, and create a green energy and technology supply chain in Europe itself.

In other words, Europe needs its own Inflation Reduction Act. But still one hears austerity dogmatism from the highest European quarters. The EU is currently renegotiating its budget policies and German Finance Minister Christian Lindner recently published an article in the Financial Times arguing that “[s]ound public finances are a prerequisite for enabling economic growth in the EU,” and therefore the old strict rules about deficits and debt “must remain untouched.”

It would be hard to imagine a better disproof of this argument than the evidence cited above. The result of the old rules was the Greek crisis that threatened the structure of the EU itself. Europe’s lousy economic performance undoubtedly contributed to the decision of British voters to leave the EU in 2016. Yet Lindner has learned nothing.

The actual proposed reforms to the pact were released this week, and while they are a step in the right direction, they are mainly a loosening of the austerity straitjacket, not a removal of it — allowing countries more leeway as to how they will cut debt and deficits. That’s far short of what’s needed.

European commentators who aren’t austerity addicts often point to the political obstacles to doing Europe-wide industrial policy. But America has its own obstacles that are nearly as difficult to overcome. Thanks to our anachronistic Constitution, we had to get our climate bill past Joe Manchin, a literal coal baron. It’s frankly shocking that Democrats managed to pass anything with a zero-seat majority in the Senate, let alone the largest climate bill in history.

So for any Europeans who can see sense, the IRA should be seen as a golden opportunity. As noted above, the EU’s lunatic budget rules are most vulnerable in a crisis, and this can be such a crisis.

It may seem presumptuous for an American — coming from the land of suburban sprawl, four-ton SUVs that get eight miles to the gallon, and 3,000 square foot desert McMansions — to be lecturing Europe about what it needs to do about climate and economics. But I’m coming from a place of deep affection for the continent. I have been inspired by Europe’s welfare states, its city infrastructure, and even its tax authorities. America’s institutions in these areas are humiliating, pathetic failures by comparison.

That’s precisely why I want to see Europe strong, prosperous, and confident once more — so it can be the best version of itself, and provide an even better example for the rest of the world.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

On power plant emissions, Fervo, and a UK nuclear plant

Current conditions: A week into Atlantic hurricane season, development in the basin looks “unfavorable through June” • Canadian wildfires have already burned more land than the annual average, at over 3.1 million hectares so far• Rescue efforts resumed Wednesday in the search for a school bus swept away by flash floods in the Eastern Cape province of South Africa.

The Environmental Protection Agency plans to announce on Wednesday the rollback of two major Biden-era power plant regulations, administration insiders told Bloomberg and Politico. The EPA will reportedly argue that the prior administration’s rules curbing carbon dioxide emissions at coal and gas plants were misplaced because the emissions “do not contribute significantly to dangerous pollution,” per The Guardian, despite research showing that the U.S. power sector has contributed 5% of all planet-warming pollution since 1990. The government will also reportedly argue that the carbon capture technology proposed by the prior administration to curb CO2 emissions at power plants is unproven and costly.

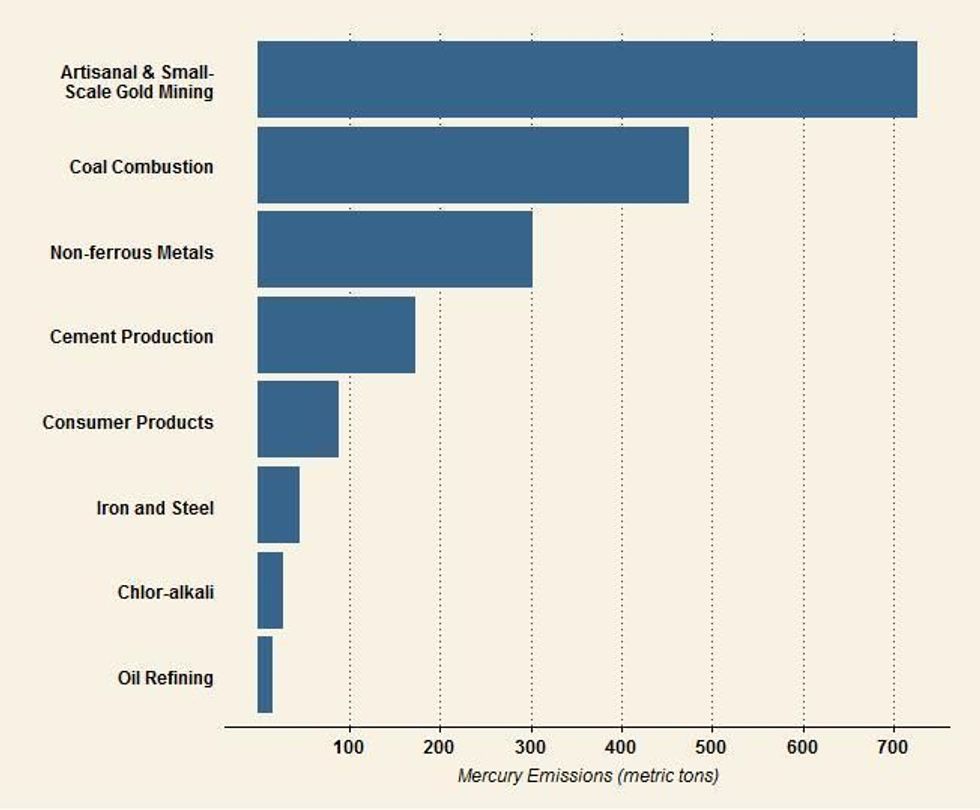

Similarly, the administration plans to soften limits on mercury emissions, which are released by burning coal, arguing that the Biden administration “improperly targeted coal-fire power plants” when it strengthened existing regulations in 2024. Per a document reviewed by The New York Times, the EPA’s proposal will “loosen emissions limits for toxic substances such as lead, nickel, and arsenic by 67%,” and for mercury at some coal power plants by as much as 70%. “Reversing these protections will take lives, drive up costs, and worsen the climate crisis,” Climate Action Campaign Director Margie Alt said in a statement. “Instead of protecting American families, [President] Trump and [EPA Administrator Lee] Zeldin are turning their backs on science and the public to side with big polluters.”

Fervo Energy announced Wednesday morning that it has secured $206 million in financing for its 400-megawatt Cape Station geothermal project in southwest Utah. The bulk of the new funding, $100 million, comes from the Breakthrough Energy Catalyst program.

Fervo’s announcement follows on the heels of the company’s Tuesday announcement that it had drilled its hottest and deepest well yet — at 15,000 feet and 500 degrees Fahrenheit — in just 16 days. As my colleague Katie Brigham reports, Fervo’s progress represents “an all too rare phenomenon: A first-of-a-kind clean energy project that has remained on track to hit its deadlines while securing the trust of institutional investors, who are often wary of betting on novel infrastructure projects.” Read her full report on the clean energy startup’s news here.

The United Kingdom said Tuesday that it will move forward with plans to construct a $19 billion nuclear power station in southwest England. Sizewell C, planned for coastal Suffolk, is expected to create 10,000 jobs and power 6 million homes, The New York Times reports. Sizewell would be only the second nuclear power plant to be built in the UK in over two decades; the country generates approximately 14% of its total electricity supply through nuclear energy. Critics, however, have pointed unfavorably to the other nuclear plant under construction in the UK, Hinkley Point C, which has experienced multiple delays and escalating costs throughout its development. “For those who have followed Sizewell’s progress over the years, there was a glaring omission in the announcement,” one columnist wrote for The Guardian. “What will consumers pay for Sizewell’s electricity? Will it still be substantially cheaper in real terms than the juice that will be generated at Hinkley Point C in Somerset?” The UK additionally announced this week that it has chosen Rolls-Royce as the “preferred bidder” to build the country’s first three small modular nuclear reactors.

The European Union on Tuesday proposed a ban on transactions with Nord Stream 1 and 2 as part of a new package of sanctions aimed at Russia, Bloomberg reports. “We want peace for Ukraine,” the president of the European Commission, Ursula von der Leyen, said at a news conference in Brussels. “Therefore, we are ramping up pressure on Russia, because strength is the only language that Russia will understand.” The package would also lower the price cap on Russian oil to $45 a barrel, down from $60 a barrel, von der Leyen said, as well as crack down on Moscow’s “shadow fleet” of vessels used to transport sanctioned products like crude oil. The EU’s 27 member states need to unanimously agree to the package for it to be adopted; their next meeting is on June 23.

The world’s oceans hit their second-highest temperature ever in May, according to the European Union’s Earth observation program Copernicus. The average sea surface temperature for the month was 20.79 degrees Celsius, just 0.14 degrees below May 2024’s record. Last year’s marine heat had been partly driven by El Niño in the Pacific, so the fact that the oceans remain warm in 2025 is alarming, Copernicus senior scientist Julien Nicolas told the Financial Times. “As sea surface temperatures rise, the ocean’s capacity to absorb carbon diminishes, potentially accelerating the build-up of greenhouse gases in the atmosphere and intensifying future climate warming,” he said. In some areas around the UK and Ireland, the sea surface temperature is as high as 4 degrees Celsius above average.

The Pacific Island nation of Tonga is poised to become the first country to recognize whales as legal persons — including by appointing them (human) representatives in court. “The time has come to recognize whales not merely as resources but as sentient beings with inherent rights,” Tongan Princess Angelika Lātūfuipeka Tukuʻaho said in comments delivered ahead of the U.N. Ocean Conference in Nice, France.

Microsoft, Amazon, Google, and the rest only have so much political capital to spend.

When Donald Trump first became a serious Presidential candidate in 2015, many big tech leaders sounded the alarm. When the U.S. threatened to exit the Paris Agreement for the first time, companies including Google, Microsoft, Apple, and Facebook (now Meta) took out full page ads in The New York Times and The Wall Street Journal urging Trump to stay in. He didn’t — and Elon Musk, in particular, was incensed.

But by the time specific climate legislation — namely the Inflation Reduction Act — was up for debate in 2022, these companies had largely clammed up. When Trump exited Paris once more, the response was markedly muted.

Now that the IRA’s tax credits face clear and present threats, this same story is playing out again. As the Senate makes its changes to the House’s proposed budget bill, tech giants such as Microsoft, Google, Meta, and Amazon are keeping quiet, at least publicly, about their lobbying efforts. Most did not respond to my request for an interview or a statement clarifying their position, except to say they had “nothing to share on this topic,” as Microsoft did.

That’s not to say they have no opinion about the fate of clean energy tax credits. Microsoft, Google, Meta, and Amazon have all voluntarily set ambitious net-zero emissions targets that they’re struggling to meet, largely due to booming data center electricity demand. They’re some of the biggest buyers of solar and wind energy, and are investing heavily in nuclear and geothermal. (On Wednesday morning, Pennsylvania’s Talen Energy announced an expanded power purchase agreement with Amazon, for nearly 2 gigawatts of power through 2042.) All of these energy sources are a whole lot more accessible with tax credits than without.

There’s little doubt the tech companies would prefer an abundant supply of cheap, clean energy. Exactly how much they’re willing to fight for it is the real question.

The answer may come down to priorities. “It’s hard to overstate how much this race for AI has just completely changed the business models and the way that these big tech companies are thinking about investment,” Jeff Navin, co-founder of the climate-focused government affairs firm Boundary Stone Partners, told me. “While they’re obviously going to be impacted by the price of energy, I think they’re even more interested and concerned about how quickly they can get energy built so that they can build these data centers.”

The tech industry has shown much more reluctance to stand up to Trump, period, this time around. As the president has moved from a political outsider to the central figure in the Republican party, hyperscalers have increasingly curried his favor as they advocate against actions that could pose an existential risk to their business — think tighter regulations on the tech sector or AI, or tariffs on key supplies made in Asia.

As Navin put it to me, “When you have a president who has very strong opinions on wind turbines and randomly throws companies’ names in tweets in the middle of the night, do you really want to stick your neck out and take on something that the president views as unpopular if you’ve got other business in front of him that could be more impactful for your bottom line?”

It is undeniably true that the AI-driven data center boom is pushing these companies to look for new sources of clean power. Last week Meta signed a major nuclear deal with Constellation Energy. Microsoft is also partnering with Constellation to reopen Three Mile Island, while Google and Amazon have both announced investments in companies developing small modular reactors. Meta, Google, and Microsoft are also investing in next-generation geothermal energy startups.

But while the companies are eager to tout these partnerships, Navin suspects most of their energy lobbying is now being directed towards efforts such as permitting reform and building out transmission infrastructure. Publicly available lobbying records confirm that these are indeed focus areas, as they’re critical to bringing data centers online quickly, regardless of how they’re powered and whether that power is subsidized. “They’re not going to stop construction on an energy project that has access to electricity just because that electricity is marginally more expensive,” Navin told me. “There’s just too much at stake.”

Tech companies have lobbied on numerous budget, tax, sustainability, and clean energy issues thus far this year. Amazon’s lobbying report is the only one to specifically call out efforts on “renewable energy tax credits,” while Meta cites “renewable energy policy” and Microsoft name-drops the IRA. But there’s no hard and fast standard for how companies describe the issues they’re lobbying on or what they’re looking to achieve. And perhaps most importantly, the reports don’t disclose how much money they allot to each issue, which would illuminate their priorities.

Lobbying can also happen indirectly, via industry groups such as the Clean Energy Buyers Association and the Data Center Coalition. Both have been vocal advocates for preserving the tax credits. The Wall Street Journal recently detailed a lobbying push by the latter — which counts Microsoft, Amazon, Meta, and Google among its most prominent members — that involved meetings with about 30 Republican senators and a letter to Senate Majority Leader John Thune.

DCC didn’t respond to my request for an interview. But CEBA CEO Rich Powell told me, “If we take away these incentives right now, just as we’re getting the rust off the gears and getting back into growth mode for the electricity economy, we’re really concerned about price spikes.”

The leader of another industry group, Advanced Energy United, shared Powell’s concern that passing the bill would mean higher electricity prices. Taking away clean energy incentives would ”fundamentally undercut the financing structure for — let’s be frank — the vast majority of projects in the interconnection queue today,” Harry Godfrey, the managing director of AEU, told me.

Being part of an industry association is by no means a guarantee of political alignment on every issue. Microsoft, Google, Meta, and Amazon are also members of the U.S. Chamber of Commerce — by far the largest lobbying group in the U.S. — which has a long history of opposing climate action and the IRA itself. Apple even left the Chamber in 2009 due to its climate policy stances.

But Powell and Godfrey implied that the tech giants' views are — or at least ought to be — in alignment with theirs. “Many of our members are lobbying independently. Many of them are lobbying alongside us. And then many of them are supporting CEBA to go and lobby on this,” Powell told me, though he wouldn’t reveal what actions any specific hyperscalers were taking.

Godfrey said that AEU’s positions are “certainly reflective of what large energy consumers, notably tech companies, have been working to pursue across a variety of technologies and with applicability to a couple of different types of credits.”

And yet hyperscalers may have already spent a good deal of their political capital fighting for a niche provision in the House’s version of the budget bill, which bans state-level AI regulation for a decade. That would make the AI boom infinitely easier for tech companies, who don’t want to deal with a patchwork of varying regulations, or really most regulations at all.

On top of everything else, big tech in particular is dealing with government-led anti-trust lawsuits, both at home and abroad. Google recently lost two major cases to the Department of Justice, related to its search and advertising business. A final decision is pending regarding the Federal Trade Commission’s antitrust lawsuit against Meta, regarding the company’s acquisition of Instagram and WhatsApp. Not to be outdone, Amazon will also be fighting an antitrust case brought by the FTC next year.

As these companies work to convince the public, politicians, and the courts that they’re not monopolistic rule-breakers, and that AI is a benevolent technology that the U.S. must develop before China, they certainly seem to be relinquishing the clean energy mantle they once sought to carry, at least rhetorically. We’ll know more once all these data centers come online. But if the present is any indication, speed, not green electrons, is the North Star.

Editor’s note: This story has been updated to reflect Amazon’s power purchase agreement with Talen Energy.

The new funding comes as tax credits for geothermal hang in the balance.

The good news is pouring in for the next-generation geothermal developer Fervo Energy. On Tuesday the company reported that it was able to drill its deepest and hottest geothermal well to date in a mere 16 days. Now on Wednesday, the company is announcing an additional $206 million in financing for its Cape Station project in Utah.

With this latest tranche of funding, the firm’s 500-megawatt development in rural Beaver County is on track to deliver 24/7 clean power to the grid beginning in 2026, reaching full operation in 2028. The development is shaping up to be an all-too-rare phenomenon: A first-of-a-kind clean energy project that has remained on track to hit its deadlines while securing the trust of institutional investors, who are often wary of betting on novel infrastructure projects.

The bulk of this latest financing comes from the Bill Gates-backed Breakthrough Energy Catalyst program, which provided $100 million in project-level equity funding. The energy and commodity trading company Mercuria provided $60 million in corporate loans, increasing its existing fixed-term loan from $40 million to $100 million. An additional $45.6 million in short-term debt financing came from XRL-ALC, an affiliate of X-Caliber Rural Capital, which provides loans to infrastructure projects in rural areas. That comes on top of a previous $100 million loan from the firm.

The plan is for Cape Station to deliver 100 megawatts of grid power in 2026, with the additional 400 megawatts by 2028. The facility has the necessary permitting to expand production to two gigawatts — twice the size of a standard nuclear reactor. And on Monday, the company announced that an independent report from the consulting firm DeGolyer & MacNaughton confirms that the project could expand further still — eventually supporting over 5 gigawatts of clean power at depths of up to 13,000 feet. The company’s latest drilling results, which reached 15,765 feet at 520 degrees Fahrenheit, could push the project’s potential power output even higher.

Traditional geothermal wells normally max out at around 10,000 feet, and must be built in locations where a lucky confluence of geological features come together: high temperatures, porous rock, and naturally occurring water or steam. But because Fervo can drill thousands of feet deeper, it’s able to access hot rocks in locations that weren’t previously suitable for geothermal development, pumping high-pressure water down into the wells to fracture rocks and thus create its own geothermal reservoirs.

The primary customer for Fervo’s Cape Station project is Southern California Edison, which signed a 320-megawatt power purchase agreement with the company last year, advertised as the largest geothermal PPA ever. Shell was also announced as a customer this year. Fervo is already providing 3.5 megawatts of power to Google via a pilot project in Nevada, which it’s seeking to expand, entering into a 115 megawatt PPA with NV Energy and the tech giant to further build out production at this location.

Fervo’s latest funding comes on top of last February’s $244 million Series D round led by Devon Energy, as well as an additional $255 million in corporate equity and debt financing that it announced last December. On top of investments from well known climate tech venture firms such as Breakthrough Energy Ventures and Galvanize Climate Solutions, the company has secured institutional investment from Liberty Mutual as well as public pension funds such as the California State Teachers’ Retirement System and the Canada Pension Plan Investment Board.

Fervo, like all clean energy startups, also stands to benefit greatly from the Inflation Reduction Act’s clean energy tax credits, which are now in jeopardy as President Trump’s One Big, Beautiful Bill works its way through the Senate. While Secretary of Energy Chris Wright has traditionally been a booster of geothermal energy and is advocating to keep tax incentives for the technology in place through 2031, the bill as it stands would essentially erase incentives for all geothermal projects that start construction more than 60 days after the bill’s passage.

Fervo broke ground on Cape Station in 2023, so that project will make the cut. For future Fervo developments, it’s much less clear. But for now, the company seems to be flush with cash and potential in a climate tech world awash in ill omens.