You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

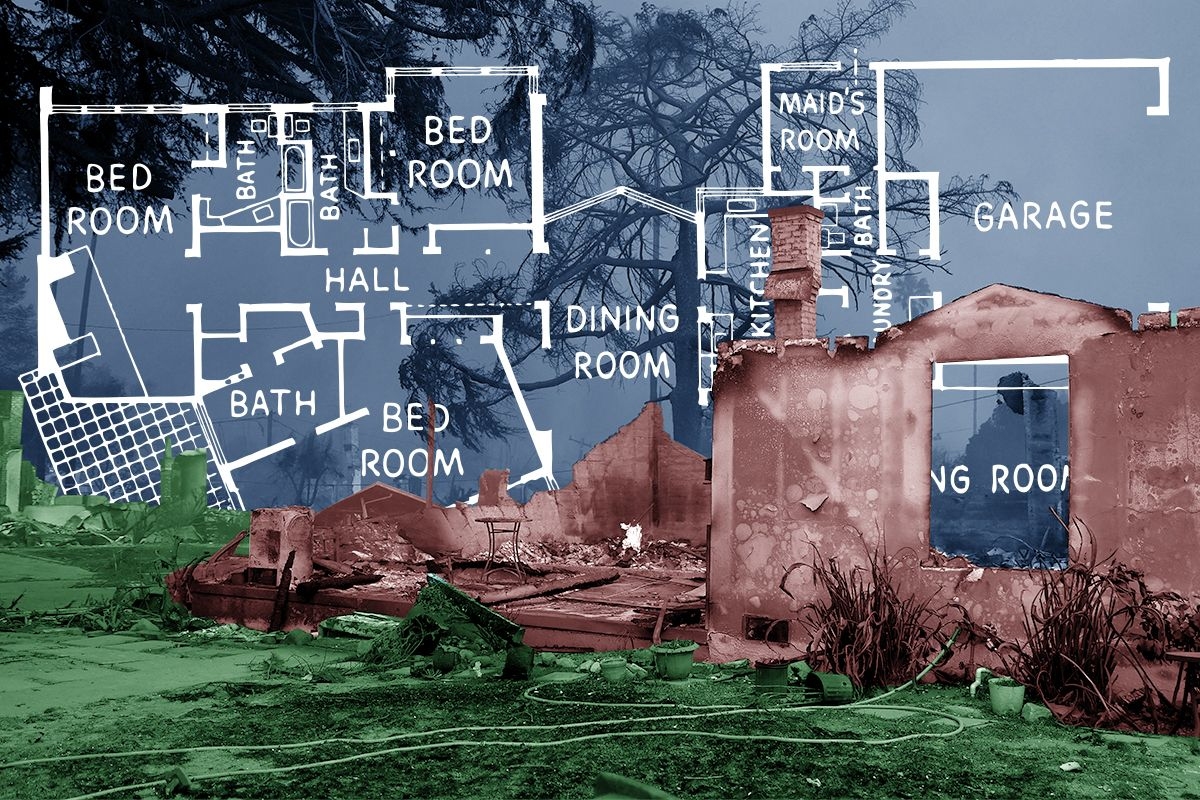

Recovering from the Los Angeles wildfires will be expensive. Really expensive. Insurance analysts and banks have already produced a wide range of estimates of both what insurance companies will pay out and overall economic loss. AccuWeather has put out an eye-catching preliminary figure of $52 billion to $57 billion for economic losses, with the service’s chief meteorologist saying that the fires have the potential to “become the worst wildfire in modern California history based on the number of structures burned and economic loss.” On Thursday, J.P. Morgan doubled its previous estimate for insured losses to $20 billion, with an economic loss figure of $50 billion — about the gross domestic product of the country of Jordan.

The startlingly high loss figures from a fire that has only lasted a few days and is (relatively) limited in scope show just how distinctly devastating an urban fire can be. Enormous wildfires that cover millions of acres like the 2023 Canadian wildfires can spew ash and particulate matter all over the globe and burn for months, darkening skies and clogging airways in other countries. And smaller — and far deadlier fires — than those still do not produce the same financial roll.

It’s in coastal Southern California where you find large population centers areas known by all to be at extreme risk of fire. And so a fire there can destroy a whole neighborhood in a few hours and put the state’s insurance system into jeopardy.

One reason why the projected economic impacts of the fires are so high is that the structures that have burned and the land those structures sit on are very valuable. Pacific Palisades, Malibu, and Santa Monica contain some of the most sought-after real estate on planet earth, with typical home prices over $2 million. Pacific Palisades itself has median home values of around $3 million, according to JPMorgan Chase.

The AccuWeather estimates put the economic damage for the Los Angeles fires at several times previous large, urban fires — the Maui wildfire in 2023 was estimated to cause around $14 billion of economic loss, for example — while the figure would be about a third or a quarter of a large hurricane, which tend to strike areas with millions of people in them across several states.

“The fires have not been contained thus far and continue to spread, implying that estimates of potential economic and insured losses are likely to increase,” the JPMorgan analysts wrote Thursday.

Get the best of Heatmap in your inbox daily.

That level of losses would make the fires costlier in economic terms than the 2018 Butte County Camp Fire, whose insured losses of $10 billion made it California’s costliest at the time. That fire was far larger than the Los Angeles fires, spreading over 150,000 acres compared to just over 17,000 acres for the Palisades Fire and over 10,000 acres for the Eaton Fire. It also led to more than 80 deaths in the town of Paradise.

So far, around 2,000 homes have been destroyed, according to the Los Angeles Times, a fraction of the more than 19,000 structures affected by the Camp Fire. The difference in estimated losses comes from the fact that homes in Pacific Palisades weigh in at more than six times those in rural Butte, according to JPMorgan.

While insured losses get the lion’s share of attention when it comes to the cost impacts of a natural disaster, the potential damages go far beyond the balance sheet of insurers.

For one, it’s likely that many affected homeowners did not even carry insurance, either because their insurers failed to renew their existing policies or the homeowners simply chose to go without due to the high cost of what insurance they could find. “A larger than usual portion of the losses caused by the wildfires will be uninsured,” according to Morningstar DBRS, which estimated total insured losses at more than $8 billion. Many homeowners carry insurance from California’s backup FAIR Plan, which may itself come under financial pressure, potentially leading to assessments from the state’s policyholders to bolster its ability to pay claims.

AccuWeather arrived at its economic impact figure by looking not just at losses from property damage but also wages that go unearned due to economic activity slowing down or halting in affected areas, infrastructure that needs to be repaired, supply chain issues, and transportation snarls. Even when homes and businesses aren’t destroyed, people may be unable to work due to evacuations; businesses may close due to the dispersal of their customers or inability of their suppliers to make deliveries. Smoke inhalation can lead to short-, medium-, and long-term health impacts that take a dent out of overall economic activity.

The high level of insured losses, meanwhile, could mean that insurers’ will see less surplus and could have to pay more for reinsurance, Nancy Watkins, an actuary and wildfire expert at Milliman, told me in an email. This may mean that they would have to shed yet more policies “in order to avoid deterioration in their financial strength ratings,” just as California has been trying to lure insurers back with reforms to its dysfunctional insurance market.

The economic costs of the fire will likely be felt for years if not decades. While it would take an act of God far stronger than a fire to keep people from building homes on the slopes of the Santa Monica Mountains or off the Pacific Coast, the city that rebuilds may be smaller, more heavily fortified, and more expensive than the one that existed at the end of last year. And that’s just before the next big fire.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

“It is difficult to imagine more arbitrary and capricious decisionmaking than that at issue here.”

A federal court shot down President Trump’s attempt to kill New York City’s congestion pricing program on Tuesday, allowing the city’s $9 toll on cars entering downtown Manhattan during peak hours to remain in effect.

Judge Lewis Liman of the U.S. District Court for the Southern District of New York ruled that the Trump administration’s termination of the program was illegal, writing, “It is difficult to imagine more arbitrary and capricious decisionmaking than that at issue here.”

So concludes a fight that began almost exactly one year ago, just after Trump returned to the White House. On February 19, 2025, the newly minted Transportation Secretary Sean Duffy sent a letter to Kathy Hochul, the governor of New York, rescinding the federal government’s approval of the congestion pricing fee. President Trump had expressed concerns about the program, Duffy said, leading his department to review its agreement with the state and determine that the program did not adhere to the federal statute under which it was approved.

Duffy argued that the city was not allowed to cordon off part of the city and not provide any toll-free options for drivers to enter it. He also asserted that the program had to be designed solely to relieve congestion — and that New York’s explicit secondary goal of raising money to improve public transit was a violation.

Trump, meanwhile, likened himself to a monarch who had risen to power just in time to rescue New Yorkers from tyranny. That same day, the White House posted an image to social media of Trump standing in front of the New York City skyline donning a gold crown, with the caption, "CONGESTION PRICING IS DEAD. Manhattan, and all of New York, is SAVED. LONG LIVE THE KING!"

New York had only just launched the tolling program a month earlier after nearly 20 years of deliberation — or, as reporter and Hell Gate cofounder Christopher Robbins put it in his account of those years for Heatmap, “procrastination.” The program was supposed to go into effect months earlier before, at the last minute, Hochul tried to delay the program indefinitely, claiming it was too much of a burden on New Yorkers’ wallets. She ultimately allowed congestion pricing to proceed with the fee reduced from $15 during peak hours to $9, and thereafter became one of its champions. The state immediately challenged Duffy’s termination order in court and defied the agency’s instruction to shut down the program, keeping the toll in place for the entirety of the court case.

In May, Judge Liman issued a preliminary injunction prohibiting the DOT from terminating the agreement, noting that New York was likely to succeed in demonstrating that Duffy had exceeded his authority in rescinding it.

After the first full year the program was operating, the state reported 27 million fewer vehicles entering lower Manhattan and a 7% boost to transit ridership. Bus speeds were also up, traffic noise complaints were down, and the program raised $550 million in net revenue.

The final court order issued Tuesday rejected Duffy’s initial arguments for terminating the program, as well as additional justifications he supplied later in the case.

“We disagree with the court’s ruling,” a spokesperson for the Transportation Department told me, adding that congestion pricing imposes a “massive tax on every New Yorker” and has “made federally funded roads inaccessible to commuters without providing a toll-free alternative.” The Department is “reviewing all legal options — including an appeal — with the Justice Department,” they said.

Current conditions: A cluster of thunderstorms is moving northeast across the middle of the United States, from San Antonio to Cincinnati • Thailand’s disaster agency has put 62 provinces, including Bangkok, on alert for severe summer storms through the end of the week • The American Samoan capital of Pago Pago is in the midst of days of intense thunderstorms.

We are only four days into the bombing campaign the United States and Israel began Saturday in a bid to topple the Islamic Republic’s regime. Oil prices closed Monday nearly 9% higher than where trading started last Friday. Natural gas prices, meanwhile, spiked by 5% in the U.S. and 45% in Europe after Qatar announced a halt to shipments of liquified natural gas through the Strait of Hormuz, which tapers at its narrowest point to just 20 miles between the shores of Iran and the United Arab Emirates. It’s a sign that the war “isn’t just an oil story,” Heatmap’s Matthew Zeitlin wrote yesterday. Like any good tale, it has some irony: “The one U.S. natural gas export project scheduled to start up soon is, of all things, a QatarEnergy-ExxonMobil joint venture.” Heatmap’s Robinson Meyer further explored the LNG angle with Eurasia Group analyst Gregory Brew on the latest episode of Shift Key.

At least for now, the bombing of Iranian nuclear enrichment sites hasn’t led to any detectable increase in radiation levels in countries bordering Iran, the International Atomic Energy Agency said Monday. That includes the Bushehr nuclear power plant, the Tehran research reactor, and other facilities. “So far, no elevation of radiation levels above the usual background levels has been detected in countries bordering Iran,” Director General Rafael Grossi said in a statement.

Financial giants are once again buying a utility in a bet on electricity growth. A consortium led by BlackRock subsidiary Global Infrastructure Partners and Swedish private equity heavyweight EQT announced a deal Monday to buy utility giant AES Corp. The acquisition was valued at more than $33 billion and is expected to close by early next year at the latest. “AES is a leader in competitive generation,” Bayo Ogunlesi, the chief executive officer of BlackRock’s Global Infrastructure Partners, said in a statement. “At a time in which there is a need for significant investments in new capacity in electricity generation, transmission, and distribution, especially in the United States of America, we look forward to utilizing GIP’s experience in energy infrastructure investing, as well as our operational capabilities to help accelerate AES’ commitment to serve the market needs for affordable, safe and reliable power.” The move comes almost exactly a year after the infrastructure divisions at Blackstone, the world’s largest alternative asset manager, bought the Albuquerque-based utility TXNM Energy in an $11.5 billion gamble on surging power demand.

China’s output of solar power surpassed that of wind for the first time last year as cheap panels flooded the market at home and abroad. The country produced nearly 1.2 million gigawatt-hours of electricity from solar power in 2025, up 40% from a year earlier, according to a Bloomberg analysis of National Bureau of Statistics data published Saturday. Wind generation increased just 13% to more than 1.1 gigawatt-hours. The solar boom comes as Beijing bolsters spending on green industry across the board. China went from spending virtually nothing on fusion energy development to investing more in one year than the entire rest of the world combined, as I have previously reported. To some, China is — despite its continued heavy use of coal — a climate hero, as Heatmap’s Katie Brigham has written.

Sign up to receive Heatmap AM in your inbox every morning:

Canada and India have a longstanding special friendship on nuclear power. Both countries — two of the juggernauts of the 56-country Commonwealth of Nations — operate fleets that rely heavily on pressurized heavy water reactors, a very different design than the light water reactors that make up the vast majority of the fleets in Europe and the United States. Ottawa helped New Delhi build its first nuclear plants. Now the two countries have renewed their atomic ties in what the BBC called a “landmark” deal Monday. As part of the pact, India signed a nine-year agreement with Canada’s largest uranium miner, Cameco, to supply fuel to New Delhi’s growing fleet of seven nuclear plants. The $1.9 billion deal opens a new market for Canada’s expanding production of uranium ore and gives India, which has long worried about its lack of domestic deposits, a stable supply of fuel.

India, meanwhile, is charging ahead with two new reactors at the Kaiga atomic power station in the southwestern state of Karnataka. The units are set to be IPHWR-700, natively designed pressurized heavy water reactors. Last week, the Nuclear Power Corporation of India poured the first concrete on the new pair of reactors, NucNet reported Monday.

The Spanish refiner Moeve has decided to move forward with an investment into building what Hydrogen Insight called “a scaled-back version” of the first phase of its giant 2-gigawatt Andalusian Green Hydrogen Valley project. Even in a less ambitious form, Reuters pegged the total value of the project at $1.2 billion. Meanwhile in the U.S., as I wrote yesterday, is losing major projects right as big production facilities planned before Trump returned to office come online.

Speaking of building, the LEGO Group is investing another $2.8 million into carbon dioxide removal. The Danish toymaker had already pumped money into carbon-removal projects overseen by Climate Impact Partners and ClimeFi. At this point, LEGO has committed $8.5 million to sucking planet-heating carbon out of the atmosphere, where it circulates for centuries. “As the program expands, it is helping to strengthen our understanding of different approaches and inform future decision-making on how carbon removal may complement our wider climate goals,” Annette Stube, LEGO’s chief sustainability officer, told Carbon Herald.

In this special edition of Shift Key, Rob talks to Eurasia Group’s Gregory Brew about how the U.S.-Israeli-led conflict will reshape global energy markets.

The United States and Israel have launched a devastating new war on Iran. What has happened so far, when could it end, and what could it mean for oil, gas, and the global energy shift?

Rob is joined by Gregory Brew, an analyst with the Eurasia Group’s energy, climate, and resources team focused on the geopolitics of oil and gas. He serves as the group’s country analyst for Iran. He’s also an historian of modern Iran, oil, and U.S. foreign policy, and the author of two books about the subject.

Shift Key is hosted by Robinson Meyer, the founding executive editor of Heatmap News.

Subscribe to “Shift Key” and find this episode on Apple Podcasts, Spotify, Amazon, or wherever you get your podcasts.

You can also add the show’s RSS feed to your podcast app to follow us directly.

Here is an excerpt from their conversation:

Robinson Meyer: I think the first place that people’s minds go when you’re talking about Iran, when you’re talking about the Strait of Hormuz, is oil. Why is the Strait of Hormuz particularly important to the global oil market? And then second of all, what have we seen as the initial effects here?

Gregory Brew: So the Strait of Hormuz matters for three reasons. One, it is a very narrow waterway. So it is quite easy, theoretically, to block it. Other waterways — even the Bab el-Mandab and the Red Sea, the Strait of Malacca, other strategic pathways through which large quantities of energy move — are not so easily disrupted as the Strait of Hormuz. That’s reason number one.

Reason number two, Iran. Iran is there. Iran frequently threatens to block the Strait of Hormuz, frequently threatens to close the Strait of Hormuz. It is a hostile actor vis-à-vis the other states in the region. We are now seeing proof of that, given that it is open fire on the GCC in a concerted way. That’s another reason why the Strait of Hormuz gets so much attention as far as the connection between the strait, the strait security and the situation in the global oil market.

The third reason — I guess there are four reasons. The third reason is the volume of energy moving through the strait. It’s close to a fifth of global oil supply. It’s 20 million barrels a day, sometimes a little more. It’s a significant portion of the global LNG supply coming from Qatar has to pass through the Strait of Hormuz. A large quantity of refined products, metal distillates, condensates, fuel oil moves through the strait. So the volume affected by the strait being closed or disrupted or affected in some way is very, very large.

Finally, fourth point, there’s nowhere else to go. You can’t go around the Strait of Hormuz. You have to go through it. Tankers that can’t transit the strait or are blocked from doing so have no other options. There’s no Africa route, as there was with the Red Sea disruption. So for those four reasons, the Strait of Hormuz gets a lot of attention. And it’s why it’s getting attention now. Although, interestingly enough, price of oil has responded, but has not moved so in a significant way, at least per some people’s expectations.

Meyer: Well, the theme of the year in oil so far has been that there’s a glut of oil. Or there’s at least a small glut of oil. We’ve kind of been dealing with that for a long time. And so I wonder if that is in some way — one hesitates to call this good for oil markets, but it is kind of solving an issue for the market. Do you think oil is the most important energy product affected by this war?

Brew: Well, it’s certainly the largest in terms of volume, given how much oil moves through the strait. However, I think this could end up being a gas story as much as an oil story.

You can find a full transcript of the episode here.

Mentioned:

From Heatmap: War With Iran Isn’t Just an Oil Story

From Heatmap: How Trump’s War Could Destabilize the Global Energy Market

This episode of Shift Key is sponsored by …

Accelerate your clean energy career with Yale’s online certificate programs. Explore the 10-month Financing and Deploying Clean Energy program or the 5-month Clean and Equitable Energy Development program. Use referral code HeatMap26 and get your application in by the priority deadline for $500 off tuition to one of Yale’s online certificate programs in clean energy. Learn more at cbey.yale.edu/online-learning-opportunities.

Music for Shift Key is by Adam Kromelow.