You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

The raw material of America’s energy transition is poised for another boom.

In the town of Superior, Arizona, there is a hotel. In the hotel, there is a room. And in the room, there is a ghost.

Henry Muñoz’s father owned the building in the early 1980s, back when it was still a boarding house and the “Magma” in its name, Hotel Magma, referred to the copper mine up the hill. One night, a boarder from Nogales, Mexico, awoke to a phantom trying to pin her to the wall with the mattress; naturally, she demanded a new room. When Muñoz, then in his fearless early 20s, heard this story from his father, he became curious. Following his swing shift at the mine, Muñoz posted himself to the room with a six-pack of beer and passed the hours until dawn drinking and waiting for the spirit to make itself known.

Muñoz didn’t see a ghost that night, but he has since become well acquainted with others in town. There is the Mexican bakery, which used to sell pink cookies but now opens only when the late owner’s granddaughter feels up to it. There’s the old Magma Club, its once-segregated swimming pool — available one day a week to Hispanics — long since filled in. Muñoz can still point out where all the former bars were on Main Street, the ones that drew crowds of carousing miners in the good years before copper prices plunged in 1981 and Magma boarded up and left town. Now their dusty windows are what give out-of-towners from nearby Phoenix reason to write off Superior as “dead.”

“What happens when a mine closes, the hardship that brings to people — today’s generation has never experienced that,” Muñoz told me.

Superior is home to about 2,400 people, less than half its population when the mine was booming. To tourists zipping past on U.S. 60 to visit the Wild West sites in the Superstition Mountains, it might look half a step away from becoming a ghost town, itself. As recently as 2018, pictures of Main Street were used as stock photos to illustrate things like “America’s worsening geographic inequality.”

But if you take the exit into town, it’s clear something in Superior is changing. The once-haunted boarding house has undergone a multi-million-dollar renovation into a boutique hotel, charging staycationers that make the hour drive south from Scottsdale $200 a night. Across the street, Bellas Cafe whips up terrific sandwiches in a gleaming, retro-chic kitchen. The Chamber of Commerce building, a little further down the block, has been painted an inviting shade of purple. And propped in the window of some of the storefronts with their lights on, you might even see a sign: WE SUPPORT RESOLUTION COPPER.

Resolution Copper’s offices are located in the former Magma Hospital, where Muñoz was born and where his mother died. People in hard hats and safety vests mill about the parking lot, miners without a mine, which is not an unusual sight in Superior these days — no copper has been sold out of the immediate area in over two decades. And yet just a nine-minute drive further up the hill and another 15-minute elevator ride down the deepest mine shaft in the country lies one of the world’s largest remaining copper deposits. It’s estimated to be 40 billion pounds, enough to meet a quarter of U.S. demand, according to the company’s analysis.

That’s “huge,” Adam Simon, an Earth and environmental sciences professor at the University of Michigan, told me, and not just in terms of sheer size.

“Copper is the most important metal for all technologies we think of as part of the energy transition: battery electric vehicles, grid-scale battery storage, wind turbines, solar panels,” Simon said. In May, he published a study with Lawrence Cathles, an Earth and atmospheric sciences researcher at Cornell University, which looked at 120 years of copper-mining data and found that just to meet the demands of “business as usual,” the world will need 115% more of the material between 2018 and 2050 than has been previously mined in all of human history, even with recycling rates taken into account.

Aluminum, used in high-voltage lines, is sometimes floated as a potential substitute, but it’s not as good of a conductor, and copper is almost always the preferred metal in batteries and electricity generation. Renewables are particularly copper-intensive; one offshore wind turbine can require up to 29 tons. What lies in the hills behind Superior, then, represents “millions of electric vehicles, millions of wind turbines, millions of solar panels. And it’s also lots of jobs, from top to bottom — jobs for people with bachelor’s degrees in engineering, mining, geology, and environmental science, all the way down to security officers and truck drivers,” Simon said. He added: “The world will need more copper year over year for both socioeconomic improvement in the Global South and also the energy transition, and neither of those can happen without increasing the amount of copper that we produce.”

Muñoz insisted to me that the promises of jobs and a robust local economy are a kind of Trojan horse. “Everybody’s getting drunk and having a good time: ‘Oh, look at the gift they brought us!’” he said of Superior’s support for Resolution Copper. “But at night, they’re going to sneak out of that horse, and they’re going to leave an environmental disaster.”

For now, though, the copper has just one catch: Resolution isn’t allowed to touch it.

If not for a painted sign declaring the ground HOLY LAND, there would be nothing visible to suggest the 16 oak-shaded tent sites over Resolution Copper’s ore body were anything particularly special. The Oak Flat campground is less than five miles past Superior, but at an elevation of nearly 4,000 feet, it can feel almost 10 degrees Fahrenheit cooler. On the late June day that I visited with Muñoz, Sylvia Delgado, and Orlando “Marro” Perea — the leaders of the Concerned Citizens and Retired Miners Coalition — the floor of the East Valley was 113 degrees Fahrenheit, and the altitude offered only limited relief.

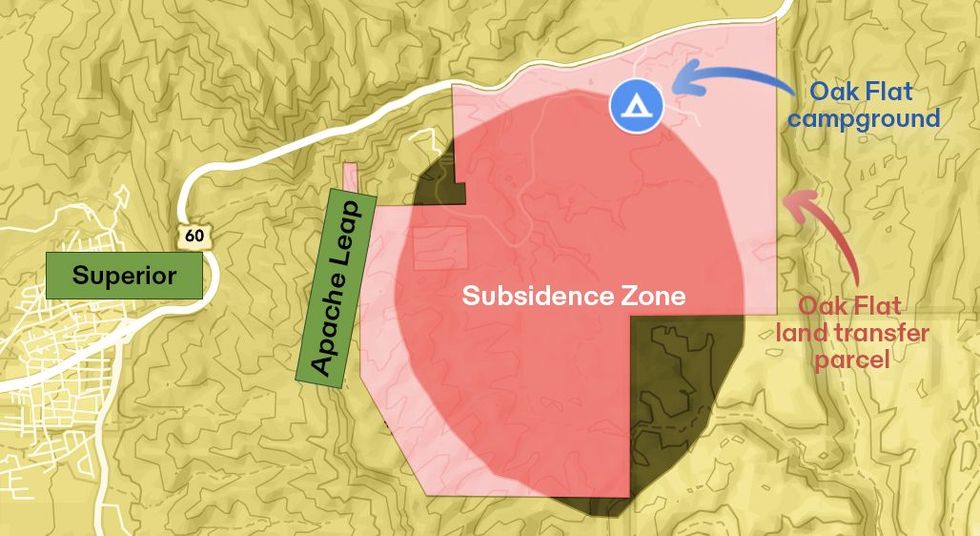

Directly below us and to the east of the campground, beneath a bouldery, yucca-studded desert, lies the copper deposit. At 7,000 or so feet deep, extracting it would require an advanced mining process called block caving, in which ore is collected from below through what is essentially a controlled cave-in, like sand slipping through the neck of an hourglass.

Muñoz, a fifth-generation miner, prefers the metaphor of going to the dentist. “They drill out your tooth and refill it: that’s basically traditional cut-and-fill mining,” he told me. “Block cave, on the other hand, would be going to the dentist and having them pull out the whole molar. It just leaves a vacant hole.” In this case, the resulting cavity would be almost two miles wide and over 1,000 feet deep by the time the ore was exhausted sometime in the 2060s.

Even four decades is just a blink of an eye for Oak Flat, though, where human history goes back at least 1,500 years; anthropologists say the mine’s sinkhole would swallow countless Indigenous burial locations and archeological sites, including petroglyphs depicting antlered animals that Muñoz and Perea showed me hidden deep in the rocks. Even more alarmingly, the subsidence would obliterate Chí'chil Biłdagoteel, the Western Apache’s name for the lands around Oak Flat, which are sacred to at least 10 federally recognized tribes. The members of the San Carlos Apache who are leading the opposition effort, and use the location for a four-day-long girlhood coming-of-age ceremony, say it is the only place where their prayers can reach the Creator directly.

Mining and Indigenous sovereignty have been at odds in Arizona for over a century. “The Apache is as near the lobo, or wolf of the country, as any human being can be to a beast,” The New York Times wrote in 1859, claiming the tribe was “the greatest obstacle to the operations of the mining companies” in the area. Three years later, the U.S. Army’s departmental commander ordered Apache men killed “wherever found,” the social archaeologist John Welch writes in his eye-opening historical survey of the region, in which he also advocates for using the term “genocide” to describe the government’s policies. That violence still casts a shadow in Superior: Apache Leap, an astonishing escarpment that looms over the town and backs up against Oak Flat, is named for a legend that cornered Apache warriors jumped to their deaths from its cliffs rather than surrender to the U.S. Cavalry.

As the Apache were being forced onto reservations and into residential boarding schools during the late 1890s, a treaty with the government set aside Oak Flat for protection. The land was later fortified against mining by President Dwight D. Eisenhower, with the federal protections reconfirmed by the Nixon administration in the 1960s. (The defunct Magma Mine that fueled the first copper boom in Superior is located just off this 760-acre “Oak Flat Withdrawal Area.”)

In 1995, the enormity of the Oak Flat ore body — and the billions it would be worth if it could be accessed — started to become apparent. The British and Australian mining companies Rio Tinto and BHP Billiton formed a U.S. subsidiary, Resolution Copper, which bought the old Magma mine and began to lobby Arizona politicians to sign over the neighboring parcel of Oak Flat. Between 2004 and 2013, lawmakers from the state introduced 11 different land transfer bills into Congress, none of which managed to earn broad support.

Then, in December 2014, President Barack Obama signed a must-pass defense spending bill. On page 1,103 was a midnight rider, inserted by Arizona Republican Senators John McCain and Jeff Flake, which authorized a land transfer of 2,400 acres of Tonto National Forest, including Oak Flat, to Resolution Copper in exchange for private land the company had bought in other parts of the state. (Flake previously worked as a paid lobbyist for a Rio Tinto uranium mine, and the company contributed to McCain’s 2014 Senate campaign.)

The senators’ rider also included an odd little twist. While the National Environmental Policy Act requires the Forest Service to conduct an environmental impact statement for a potential mine, the bill stipulated that the land transfer to Resolution Copper had to be completed within a 60-day window of the final environmental impact statement’s release, regardless of what the FEIS found.

After six years of study, the FEIS was rushed to publication by President Donald Trump in the final five days of his term, triggering that 60-day countdown. President Biden rescinded Trump’s FEIS once he took office in 2021, pending further consultation with the tribes, but the clock will begin anew once a revised FEIS is released, potentially later this year. (The new FEIS was expected last summer, but the Forest Service has since reported there is no timeline for its release. The agency declined to comment to Heatmap for this story, citing ongoing litigation.)

A spokesperson for Resolution Copper told me that the company is “committed to being a good steward of the land, air, and water throughout the entirety of this project,” and described programs to restore the local ecology and preserve certain natural features, including Apache Leap. “At each step,” the spokesperson said, “we have taken great care to solicit and act upon the input of our Native American and other neighbors. We have made many changes to the project scope to accommodate those concerns and will continue those efforts over the life of the project.”

Meanwhile, Apache Stronghold — the San Carlos Apache-led religious nonprofit opposing the mine — filed a lawsuit to block the land transfer, arguing that the destruction of Oak Flat infringes on their First Amendment right to practice their religion. The lower courts haven’t agreed, citing a controversial 1988 decision against tribes who made a similar argument in defense of a sacred grove of trees in California. Apache Stronghold, joined by the religious liberty group Becket, is now asking the U.S. Supreme Court to hear its case, a decision that is expected any day now. Nearly everyone I spoke with for this story, however, was pessimistic that the Justices would agree to hear the battle over Oak Flat, meaning the lower court’s ruling against Apache Stronghold would stand.

If Mila Besich could have it her way, Biden would visit Superior. He’d marvel at Apache Leap and Picketpost Mountain, visit the impressive new Superior Enterprise Center — paid for partially with money from his 2021 American Rescue Plan Act — and maybe wrap up the day with a purple scoop of prickly pear ice cream from Felicia’s Ice Cream Shop. And, most importantly, he’d hear her pitch: that “Superior and the state of Arizona have a once-in-a-generation opportunity to be the leader in advancing your green energy strategy.” She says Superior — and America — needs this mine.

Superior is a blue town, and Besich, its mayor, is a Democrat, which means she has found herself in the awkward position of defending Resolution Copper against colleagues like Congressman Raúl Grijalva of Tucson and Senator Bernie Sanders of Vermont, who have introduced unsuccessful bills in Congress to prevent the land transfer. There is something of a bitter irony, too, in seeing her party tout the economic upsides of the energy transition while standing in the way of Superior’s mine, which would employ an average of 1,434 workers per year and add over $1 billion annually to Arizona’s economy during its lifespan, according to the FEIS.

“Every mayor wants more jobs in their community,” Besich told me simply. But, she also pointed out, “Copper is critical to the green economy, so if we want the green economy, we should want to be mining American copper.”

Superior, of course, isn’t just any town. “Everybody here either worked in the mines or had family that worked in the mines,” James Schenck, a former employee of Resolution Copper who supports the mine and serves as the treasurer for Rebuild Superior, a nonprofit working to diversify the local economy, told me. “They understand the downsides, and some of them, for a while, were having a hard time understanding how this is different than what went on before.”

Though everyone seems to be on cordial terms — at one point during my visit, I was having lunch with Muñoz and Delgado when Besich walked in, and everyone smiled politely at one another — there are still clear factions. A Facebook group for locals warns against “posts concerning DRAMA, POLITICS, RELIGION, and MINING,” presumably the same topics to be avoided at family Thanksgivings.

The critical mineral experts I talked to for this story, though, said Schenck is largely right on that point. “Mining in 2024 is radically different than mining in 1954 or in 1904,” Simon told me. “It is really surgical.”

Muñoz is one of those in town who still isn’t buying it, and has converted his garage into an interpretive center for exposing the perceived infiltrators. As soft classic rock played over the speakers and a fan whirred to keep us cool, he showed me the 3D model he had commissioned of the Oak Flat sinkhole, with a miniature Eiffel Tower subsumed in its crater for scale. Laid out on a table on the other side of the room was a row of six dictionary-thick, spiral-bound sections of the FEIS, their most pertinent sections bookmarked. On the walls, Muñoz had hung pictures of comparable tailings sites in other parts of the world — cautionary tales of the hazards posed during the long lifespan of mines. (Including the water demands, no small concern in a place like Arizona, which opens a whole other can of worms).

“I use my experience to educate the people,” Muñoz said. “This isn’t what it’s made out to be. They’re going to play you.”

Muñoz was employed at the Magma Copper mine until 1982, when he was 27. “One day they said, ‘We’re shutting down.’ They folded up just like a carnival does on Monday morning,” he recalled. The abrupt departure devastated Superior: In These Times described the following years as an “economic cataclysm” for the town. By 1989, the median household income was just $16,118 compared to $36,806 in Queen Creek, the nearest Phoenix suburb just a 45-minute drive away.

“I witnessed grown men cry,” Muñoz said. “Men who’d been in the mines pretty close to 30 years — they never knew nothing else.” His father, the former boarding house owner, was among them: “He had limited writing abilities and what have you. He was 58. People lost their homes here. They lost their cars. There were divorces. Some people committed suicide. The drinking, the drugs. It was a bad time.”

Muñoz went on food stamps and unemployment. “This generation that is coming up, they’ve never experienced that,” he said. “They’ve never experienced a repossession note in the mail from the bank. They’ve never experienced a disconnection notice hanging from your front door knob. And they’ve never experienced calling up the utilities and saying, ‘Hey, can you wait until Friday when my unemployment check comes in?’”

Superior’s story isn’t unique; Arizona’s Copper Triangle is a constellation of hollowed-out company towns. Like many other out-of-work Magma miners, Muñoz eventually found a job at San Manuel, a BHP-owned block cave mine about an hour south of Superior. Then, in 1999, copper prices stuttered again, and by 2003, it shut down, too.

Muñoz had just returned from a car show in San Manuel when we met in his garage, and he reported it was still a sorry sight. “The main grocery store is closed, the Subway, all the buildings are boarded up, and the schools are shut down,” he said. The mine “just abandoned that town.”

Even as Muñoz and the Concerned Citizens and Retired Miners Coalition work with Apache Stronghold and national environmentalist groups like HECHO, the Sierra Club, and the National Wildlife Federation try to block Resolution Copper’s mine, there is a distinct feeling in Superior of its inevitability. Schenck, the treasurer for Rebuild Superior, told me he suspects just “10% or 15%” of people in town are “against the project.”

“My personal belief is this copper deposit is going to be developed at some point,” Schenck said. “It’s too important.”

Besich, the mayor, gave this impression too. “What people need to understand is, this ore body is not going anywhere,” she said. “Someone will mine it in the future.” She views Superior and the copper industry as partners in an “arranged marriage,” and her job as mayor is helping them “figure out how to get along.”

From the outside, though, Resolution Copper looks more like a sugar daddy. To date, Rio Tinto and BHP have spent more than $2 billion combined pursuing the Oak Flat mine, including pumping money into the Chamber of Commerce building, the Enterprise Center, and the fire department. When the town of Kearny, downstream of the mine’s proposed tailings site, needed a new ambulance, Resolution Copper offered to help foot the bill. Local high schoolers and tribal members can even apply for Resolution Copper scholarships.

Critics say Resolution Copper is buying political and social influence in the Copper Corridor, a modern-day iteration of the propaganda tactics that swept aside the Apache in the late 1800s. Rio Tinto and BHP “remain committed to influencing U.S. government decisions about the use of public lands and minerals, regardless of additional harms to those lands, to Native Americans, or to National Register historic sites and sacred places,” the archaeologist Welch wrote in his Oak Flat study.

Rio Tinto is infamous even in the mining industry for its poor history of handling community- and heritage-related concerns. To pick a recent example, the company drew international condemnation for its 2020 destruction of the Juukan Gorge cave in Western Australia, a sacred site to the Aboriginal people that had evidence of continuous human occupation going back to the Ice Age. Though Rio Tinto had the legal right to destroy the 45,000-year-old caves, “it is hard to believe community engagement is being taken seriously” by the company, Glynn Cochrane, a former Rio Tinto senior advisor, said in a testimony in the aftermath. Archaeologists and sympathetic politicians have warned that the cultural and spiritual loss caused by mining Oak Flat would be like a second Juukan Gorge.

The San Carlos Apache are not a monolith, however, and the community has differing beliefs about the cultural importance of Oak Flat. Tribal members who support the mine or work for Resolution Copper are often cited by non-Native supporters as proof of Apache Stronghold’s supposedly arbitrary defense of Oak Flat. (Apache Stronghold, which is on a prayer journey to petition the Supreme Court, did not return Heatmap’s request for comment.)

Muñoz and his team are specifically worried about how Superior, the town, will make out. U.S. copper smelters are already at capacity, meaning Resolution Copper would likely send much if not all of the raw copper extracted at Oak Flat to China for processing. (Rio Tinto’s largest shareholder is the Aluminum Corporation of China.) The spokesperson for Resolution Copper told me that it’s the company’s priority to process the ore domestically, and Rio Tinto does have its own facility in the U.S., the Kennecott copper smelting facility in Utah. Yet it hasn’t committed publicly to processing the Arizona ore there, and it’s far from clear that it even has the capacity to do so.

For Simon, the University of Michigan professor, that shouldn’t be a deterrent: “If we mine more copper here and it just means we have to export it — who cares?” he pushed back. “If it has to go to China and they smelt it, then you send it to China and they smelt it. Climate is the prize, and if we want to mitigate our impact, we’ve got to do it. There are no ifs, ands, or buts.”

Oak Flat is also located outside of Superior’s town limits, meaning the community would only recoup about $500,000 in tax revenue, on the high end, from the mine annually, according to the 2021 FEIS — Schenek told me the town’s budget is around $3 million, so it’s hardly insignificant, though it is peanuts compared to the $38 million the state would reap. The FEIS additionally estimated that only about a quarter of the mine’s eventual employees would actually “seek to live in or near Superior;” many would choose instead to commute the hour or so from Phoenix’s Maricopa County.

Because of technological advances in mining and robotics, the mine also won’t bring back the physical jobs locals remember from the 1970s — by Resolution Copper’s own admission. Besich, at least, isn’t bothered by this detail: “In all reality, I don’t see my children and their peers wanting to do the manual physical labor that my grandfather, my father, and certainly my great-grandfather did,” she told me. “So the change in technique is good, and I think that it’s actually better for the environment in the long term.” She added that Resolution Copper’s investment in things like local infrastructure and worker training programs will compensate for the comparably insignificant tax revenue the town will otherwise receive, ensuring Superior gets a fair cut of the bonanza.

What supporters and opponents of the mine can agree on is that Superior must avoid the devastation of the 1980s if or when the Oak Flat mine is exhausted in 40 or more years. Besich and Schenck told me their vision is for Superior to be a town with a mine, not a mining town. But is such a thing even possible? In recent years, Superior has tried to position itself as an outdoor recreation gateway to the many climbing routes and hiking trails in the area. Yet I struggle to imagine anyone would want to vacation or recreate so close to a massive mining operation.

Muñoz believes Superior should throw itself entirely into tourism, which brings in three times as much revenue as the copper industry in Arizona. He dismissed arguments that losing the mine this far into negotiations and preparations would set the town back two decades, telling me about a conversation he had with Vicky Peacey, the president of Resolution Copper. “She said, ‘How do I tell my 300-plus employees that they don’t have a job?’” he recalled. “I said, ‘The same way BHP told the 3,300 in San Manuel they didn’t have a job. Magma Copper didn’t have a problem telling us we didn’t have a job in ‘82.”

Whatever gets decided about Oak Flat will reverberate far beyond Superior, though. “We’ve got to keep our eyes on the prize,” Simon told me. “And if the prize is mitigating human impacts on climate, and that requires the energy transition, and that requires copper, and we have a potential mine in Arizona that would provide 500,000 tons of copper every year for decades — we need to do that.”

At the end of my day in Superior, I went with Muñoz and Delgado, another former miner, to visit the haunted boarding house.

The renovated interior was surprisingly beautiful, decorated with period-appropriate details like iron bed frames, clawfoot bathtubs, and lace curtains that softened the harshness of the mid-afternoon light. Though even the FEIS warns that “mining in Arizona has followed a ‘boom and bust’ cycle, which potentially leads to great economic uncertainty,” it was with a pang that I imagined the building one day falling back into disrepair. It, and the town, had survived too much.

After peeking into Room 103, where Muñoz had passed his tipsy night all those decades ago, we asked the friendly woman working the front desk if she’d had any supernatural experiences herself — surely she’d seen the mattress-flipping phantom, or swinging chandeliers, or perhaps a white-boot miner who’d come down from the hills?

To our disappointment, she shook her head. For now, whatever ghosts there once might have been in Superior had gone.

Editor’s note: This story has been updated to include comment from Resolution Copper.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

On the NRC, energy in Pennsylvania, and Meta AI

Current conditions: Air quality alerts will remain in place in Chicago through Tuesday evening due to smoke from Canadian wildfires • There is a high risk of a tropical depression forming in the Gulf this week • The rain is clearing on the eastern seaboard after 2.64 inches fell in New York’s Central Park on Monday, breaking the record for July 14 set in 1908.

The Trump administration is putting pressure on the Nuclear Regulatory Commission to “rubber stamp” all new reactors, Politico reports based on conversations with three people at the May meeting where the expectation was relayed. The directive to the NRC’s top staff came from Adam Blake, a representative of the Department of Government Efficiency, who apparently used the term “rubber stamp” specifically to describe the function of the independent agency. NRC’s “secondary assessment” of the safety of new nuclear projects would be a “foregone conclusion” following approval by the Department of Energy or the Pentagon, NRC officials were made to believe, per Politico.

A spokesperson for the NRC pointed to President Trump’s recent executive order aiming to quadruple U.S. nuclear power by 2050 in response to Politico’s reporting. Skeptics, however, have expressed concern over the White House’s influence on the NRC, which is meant to operate independently, as well as potential safety lapses that might result from the 18-month deadline for reviewing new reactors established in the order.

President Trump and Republican Senator Dave McCormick of Pennsylvania will announce a $70 million “AI and energy investment” in the Keystone State at the inaugural Pennsylvania Energy and Innovation Summit today in Pittsburgh. The event is meant to focus on the development of emerging energy technologies. Organizers said that more than 60 CEOs, including executives from ExxonMobil, Chevron, BlackRock, and Palantir, will be in attendance at the event hosted by Carnegie Mellon University. BlackRock is expected to announce a $25 billion investment in a “data-center and energy infrastructure development in Northeast Pennsylvania, along with a joint venture for increased power generation” at the event, Axios reports.

Ahead of the summit, critics slammed the event as a “moral failure,” with student protests expected throughout the day. Paulina Jaramillo, a professor of engineering and public policy at Carnegie Mellon, wrote on Bluesky that the summit was a “slap in the face to real clean energy researchers,” and that there is “nothing innovative about propping up the fossil fuel industry.” “History will judge institutions that chose short-term gain over moral clarity during this critical moment for climate action and scientific integrity,” she went on.

On Monday, Meta founder and CEO Mark Zuckerberg confirmed on Threads that the company aims to become “the first lab to bring a 1GW+ supercluster online” — an ambitious goal that will require the extensive development of new gas infrastructure, my colleague Matthew Zeitlin reports. The first gigawatt-level project, an Ohio data center called Prometheus, will be powered by Meta’s own natural gas infrastructure, with the natural gas company Williams reportedly building two 200-megawatt facilities for the project in Ohio. The buildout for Prometheus is in addition to another Meta project in Northeast Louisiana, Hyperion, that Zuckerberg said Monday could eventually be as large as 5 gigawatts. “To get a sense of the scale we’re talking about, a new, large nuclear reactor has about a gigawatt of capacity, while a newly built natural gas plant could supply only around 500 megawatts,” Matthew writes. Read his full report here.

Electric vehicle sales are currently on track to outpace gasoline car sales in China this year, Bloomberg reports. In the first six months of 2025, new battery-electric, plug-in hybrid, and extended-range electric cars accounted for 5.5 million vehicles sold in the country (compared to 5.4 million sales of new gasoline cars), and are projected to top 16 million before the end of December — both of which put EVs a hair over their combustion-powered competitors.

By contrast, battery-electric cars only accounted for 28% of new-car sales in China last year, per the nation’s Passenger Car Association. But “sales this year have been spurred by the extension of a trade-in subsidy” as well as the nation’s expansive electrified lineup, including “several budget options” like BYD’s Seagull, Bloomberg writes. “China is the only large market where EVs are on average cheaper to buy than comparable combustion cars,” BloombergNEF reported last month.

Window heat pumps are an extremely promising answer to the conundrum of decarbonizing large apartment buildings, a new report by the nonprofit American Council for an Energy-Efficient Economy has found. Previously, research on heat pumps had primarily focused on their advantages for single-family homes, while the process of retrofitting larger steam- and hot-water-heated apartment buildings remained difficult and expensive, my colleague Emily Pontecorvo explains. But while apartment residents used to have to wait for their building to either install a large central heat pump system for the whole structure, or else rely on a more involved “mini-split” system, newer technologies like window heat pumps proved to be one of the most cost-effective solutions in ACEEE’s report with an average installation cost of $9,300 per apartment. “That’s significantly higher than the estimated $1,200 per apartment cost of a new boiler, but much lower than the $14,000 to $20,000 per apartment price tag of the other heat pump variations,” Emily writes, adding that the report also found window heat pumps may be “the cheapest to operate, with a life cycle cost of about $14,500, compared to $22,000 to $30,000 for boilers using biodiesel or biogas or other heat pump options.” Read Emily’s full report here.

California was powered by two-thirds clean energy in 2023 — the latest year data is available — making it the “largest economy in the world to achieve this milestone,” Governor Gavin Newsom’s office announced this week.

CEO Mark Zuckerberg confirmed the company’s expanding ambitions in a Threads post on Monday.

Meta is going big to power its ever-expanding artificial intelligence ambitions. It’s not just spending hundreds of millions of dollars luring engineers and executives from other top AI labs (including reportedly hundreds of millions of dollars for one engineer alone), but also investing hundreds of billions of dollars for data centers at the multi-gigawatt scale.

“Meta is on track to be the first lab to bring a 1GW+ supercluster online,” Meta founder and chief executive Mark Zuckerberg wrote on the company’s Threads platform Monday, confirming a recent report by the semiconductor and artificial intelligence research service Semianalysis that

That first gigawatt-level project, Semianalysis wrote, will be a data center in New Albany, Ohio, called Prometheus, due to be online in 2026, Ashley Settle, a Meta spokesperson, confirmed to me. Ohio — and New Albany specifically — is the home of several large data center projects, including an existing Meta facility.

At the end of last year, Zuckerberg said that a datacenter project in Northeast Louisiana, now publicly known as Hyperion, would take 2 gigawatts of electricity; in his post on Monday, he said it could eventually be as large as 5 gigawatts. To get a sense of the scale we’re talking about, a new, large nuclear reactor has about a gigawatt of capacity, while a newly built natural gas plant could supply only around 500 megawatts.

As one could perhaps infer from the fact that their size is quoted in gigawatts instead of square feet or number of GPUs, whether or not these data centers get built comes down to the ability to power them.

Citing information from the natural gas company Williams, Semianalysis reported that Meta “went full Elon mode” for the New Albany datacenter, i.e. is installed its own natural gas infrastructure. Specifically, Williams is building two 200-megawatt facilities, according to the gas developer and Semianalysis, for the Ohio project. (Williams did not immediately respond to a Heatmap request for comment.)

Does this mean Meta is violating its commitments to reach net zero? While the data center buildout may make those goals more difficult to achieve, Meta is still investing in new renewables even as it’s also bringing new gas online. Late last month, the company announced that it was procuring almost 800 new megawatts of renewables from projects to be built by Invenergy, including over 400 megawatts of solar in Ohio, roughly matching the on-site generation from the Prometheus project.

But there’s more to a data center’s climate footprint than what a big tech company does — or does not — build on site.

The Louisiana project, Hyperion, will also be served by new natural gas and renewables added to the grid. Entergy, the local utility, has proposed 1.5 gigawatts of natural gas generation near the Meta site and over 2 gigawatts of new natural gas in total, with another plant in the southern part of the state to help balance the addition of significant new load. In December, when the data center was announced, Meta said that it planned to “bring at least 1,500 megawatts of new renewable energy to the grid.” Entergy did not immediately respond to a Heatmap request for comment on its plans for the Hyperion project.

“Meta Superintelligence Labs will have industry-leading levels of compute and by far the greatest compute per researcher. I'm looking forward to working with the top researchers to advance the frontier!” Zuckerberg wrote.

A new report from the American Council for an Energy-Efficient Economy has some exciting data for anyone attempting to retrofit a multifamily building.

By now there’s plenty of evidence showing why heat pumps are such a promising solution for getting buildings off fossil fuels. But most of that research has focused on single-family homes. Larger apartment buildings with steam or hot water heating systems — i.e. most of the apartment buildings in the Northeast — are more difficult and expensive to retrofit.

A new report from the nonprofit American Council for an Energy-Efficient Economy, however, assesses a handful of new technologies designed to make that transition easier and finds they have the potential to significantly lower the cost of decarbonizing large buildings.

“Several new options make decarbonizing existing commercial and multifamily buildings much more feasible than a few years ago,” Steven Nadel, ACEEE’s executive director and one of the authors, told me. “The best option may vary from building to building, but there are some exciting new options.”

To date, big, multifamily buildings have generally had two flavors of heat pumps to consider. They can install a large central heat pump system that delivers heating and cooling throughout the structure, or they can go with a series of “mini-split” systems designed to serve each apartment individually. (Yes, there are geothermal heat pumps, too, but those are often even more expensive and complicated to install, especially in urban areas.)

While these options have proven to work, they often require a fair amount of construction work, including upgrading electrical systems, mounting equipment on interior and exterior walls, and running new refrigerant lines throughout the building. That means they cost a lot more than a simple boiler replacement, and that the retrofit process can be disruptive to residents.

In 2022, the New York City Housing Authority launched a contest to try and solve these problems by challenging manufacturers to develop heat pumps that can sit in a window just like an air conditioner. New designs from the two winners, Gradient Comfort and Midea, are just starting to come to market. But another emerging solution, central air-to-water heat pumps, also presents an appealing alternative. These systems avoid major construction because they can integrate with existing radiators or baseboard heaters in buildings that currently use hot water boilers. Instead of burning natural gas or oil to produce hot water, the heat pump warms the water using electricity.

The ACEEE report takes the cost and performance data for these emerging solutions and compares it to results from mini-splits, central heat pumps, geothermal heat pumps, packaged terminal heat pumps — all-in-one devices that sit inside a sleeve in the wall, commonly used in hotels — and traditional boilers fed by biogas or biodiesel.

While data on the newer technologies is limited, so far the results are extremely promising. The report found that window heat pumps are the most cost-effective of the bunch to fully decarbonize large apartment buildings, with an average installation cost of $9,300 per apartment. That’s significantly higher than the estimated $1,200 per apartment cost of a new boiler, but much lower than the $14,000 to $20,000 per apartment price tag of the other heat pump variations, although air-to-water heat pumps came in second. The report also found that window heat pumps could turn out to be the cheapest to operate, with a life cycle cost of about $14,500, compared to $22,000 to $30,000 for boilers using biodiesel or biogas or other heat pump options.

As someone who has followed this industry for several years with a keen interest in new solutions for boiler-heated buildings in the Northeast — where I grew up and currently reside — I was especially wowed by how well the new window heat pumps have performed. New York City installed units from both Midea and Gradient in 24 public housing apartments, placing one in each bedroom and living room, and monitored the results for a full heating season.

Preliminary data shows the units performed swimmingly on every metric.

On ease of installation: It took a total of eight days for maintenance workers to install the units in all 24 apartments, compared to about 10 days per apartment when the Housing Authority put split heat pump systems in another building.

On performance: During the winter, while other apartments in the building were baking in 90-degree Fahrenheit heat from the steam system, the window unit-heated apartments maintained a comfortable 75 to 80 degree range, even as outdoor temperatures dropped to as low as 20 degrees.

On energy and cost: The window unit-heated apartments used a whopping 87% less energy than the rest of the building’s steam-heated apartments did, cutting energy costs per household in half.

On customer satisfaction: A survey of 72 residents returned overwhelmingly positive feedback, with 93% reporting that the temperature was “just right” and 100% reporting they were either “neutral” or “satisfied” with the new units.

The Housing Authority found that the units also lowered energy used for cooling in peak summer since they were more efficient than the older window ACs residents had been using. Next, the agency plans to expand the pilot to two full buildings before deploying the units across its portfolio. The pilot was so successful that utilities in Massachusetts, Vermont, and elsewhere are purchasing units to do their own testing.

The ACEEE report looked at a handful of air-to-water heat pump projects in New York and Massachusetts, as well, only two of which have been completed. The average installation cost per apartment was around $13,500, with each of the buildings retaining a natural gas boiler as a backup, but none had published performance data yet.

Air-to-water heat pumps have only recently come to market in the U.S. after having taken off in Europe, and they don’t yet fit seamlessly into the housing stock here. Existing technology can only heat water to 130 to 140 degrees, which is hot enough for the more efficient hot water radiators common in Europe but too cold for the U.S. market, where hot water systems are designed to carry 160- to 180-degree water, or even steam.

These heat pumps can still work in U.S. buildings, but they require either new radiators to be installed or supplemental heat from a conventional boiler or electric resistance unit. The other downside to an air-to-water system is that it can’t provide cooling unless the building is already equipped with compatible air conditioning units.

One strength of these systems over the window units, however, is that they don’t push costs onto tenants in buildings where the landlord has historically paid for heat. They also may be cheaper to operate than more traditional heat pump options, although data is still extremely limited and depends on the use of supplemental heat.

It’s probably too soon to draw any major conclusions about air-to-water systems, anyway, because new, potentially more effective options are on the way. In 2023, New York State launched a contest challenging manufacturers to develop new decarbonized heating solutions for large buildings. Among the finalists announced last year, six companies were developing heat pumps that could generate higher-temperature hot water and/or steam. One of them is now installing its first demonstration system in an apartment building in Harlem, and two others have similar demonstrations in the works.

The ACEEE report also mentions a few other promising new heat pump formats, such as an all-in-one wall-mounted heat pump from Italian company Ephoca. It’s similar to the window heat pump in that it’s contained in a single device rather than split into an indoor and outdoor unit, so it doesn’t require mounting anything to the outside of the building or worrying about refrigerant lines, although it does require drilling two six-inch holes in the wall for vents. These may be a good option for those whose windows won’t accommodate a window heat pump or who don’t like the aesthetics. New York State is also funding product development for better packaged terminal heat pumps that could slot into wall cavities occupied by less-efficient packaged terminal air conditioners and heat pumps today.

Gradient and Midea are not yet selling their cold-climate window heat pumps directly to consumers. Gradient brought a version of its technology for more moderate climates to market in 2023, which was only suitable for heating at outdoor temperatures of 40 degrees and higher. But the company has discontinued that model and is focusing on an “all-weather” version designed for cold climates, which is the one that has been installed in the New York City apartments. Gradient told me it is currently selling that model in bulk to multi-family building owners, utilities, and schools. Midea did not respond to my inquiry.

One big takeaway is that even the new school heat pumps designed to be easier and cheaper to install have higher capital costs than buying a boiler and air conditioners — a stubborn facet of many climate solutions, even when they save money in the long run. Canary Media previously reported that the Gradient product would start at $3,800 per unit and the Midea at $3,000. Experts expect the cost to come down as adoption and demand pick up, but the ACEEE report recommends that states develop incentives and financing to help with up-front costs.

“These are not just going to happen on their own. We do need some policy support for them,” Nadel said. In addition to incentives and building decarbonization standards, Nadel raised the idea of discounted electric rates for heat pump users, an idea that has started to gain traction among climate advocates that a few utilities have piloted.

“To oversimplify,” Nadel said, “in many jurisdictions, heat pumps subsidize other customers, and that probably needs to change if this is going to be viable.”

Editor’s note: This story has been updated to include comment from Gradient.