You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

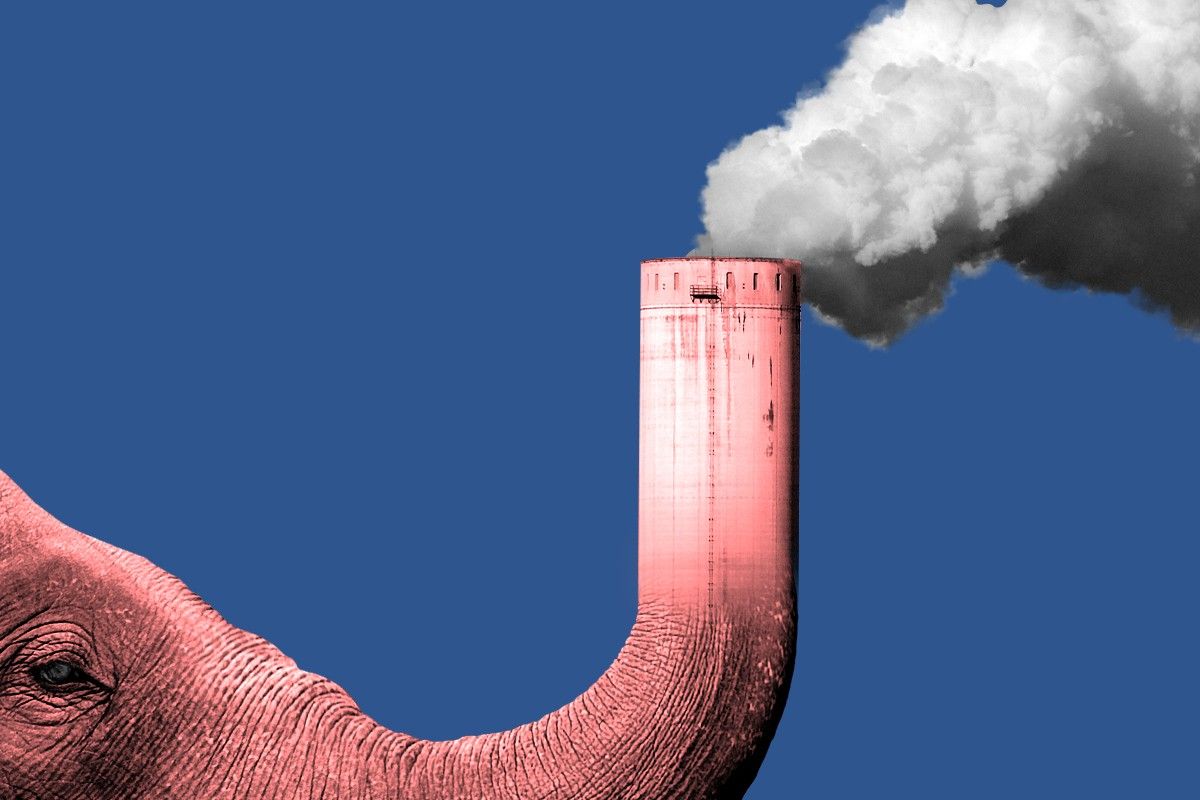

The GOP says no to the jobs and growth of the future.

The Republican-controlled House is struggling to figure out what to do with its control of the chamber. GOP representatives are sure they want to take the debt ceiling hostage, but they have thus far presented no list of demands because they can’t agree on what they want.

However, they did recently pass an energy policy bill, in the form of a repeal of several provisions of President Biden’s signature Inflation Reduction Act (IRA), plus some deregulation of environmental protections. It would delete the EPA’s $27 billion Greenhouse Gas Reduction Fund as well as a new incentive for efficient appliances, and remove new fees on oil and gas drillers. Many parts of the environmental review process would be removed (as compared to Democrats, who want to speed it up with more money and staffing).

In short, it would increase production of carbon fuels, delay the energy transition, cause more environmental damage, and harm the green energy industry. The package is dead on arrival in the Senate, and President Biden has already promised to veto it as well. But it’s still a good window into the thinking, or more specifically the incoherent oppositional defiance disorder attempting to resemble thinking, that dominates the Republican worldview.

The bill is so senseless that many of the backfilled arguments from Republicans in favor of it can be read, verbatim, as criticisms. Representative Bruce Westerman of Arkansas, chair of the Natural Resources Committee, claimed that his bill would reverse the damage of the IRA, which has caused “more dependence on the worst polluters in the world.”

Yet this is precisely what the Republican bill would accomplish. As I have previously written, the bender of oil and gas infrastructure construction under Obama and Trump got America hooked on cheap oil and natural gas — which put us all at the mercy of global market trends, even for natural gas thanks to rapid construction of liquified natural gas (LNG) export terminals. Big fossil fuel companies don’t frack Pennsylvania and Texas into Swiss cheese out of some sense of patriotic duty. If they can make a nickel shipping that gas to Europe where the price is higher, they will do it, and have done so over the past year because Putin cut back gas supplies to the continent.

If the U.S. had conducted a crash energy transition during the 2010s, accelerating the rollout of zero-carbon electricity, industrial processes, electric vehicles, and so on, today it would have a lot less dependence on foreign sources of energy controlled by insane dictators. It follows that slowing down the transition would directly benefit Vladimir Putin and Mohammad bin Salman. Europe has learned the same lesson even more painfully (though to their credit they are making up for lost time).

Then there is the international angle. “We just found that a majority of [Democrats] are so extreme that they would rather stand with China and Russia than with the American energy worker,” said Speaker of the House Kevin McCarthy. The IRA will “wreck our own economy, sending our wealth and jobs overseas,” said Westerman. But the explicit intention of the IRA is to stand up a cutting-edge clean technology and energy sector in America itself and in friendly countries. China currently dominates most of this sector thanks in part to mercantilist policies and savvy past investments. The IRA is designed to change the dynamic, so as to reduce dependency on a hostile dictatorship, create jobs in the U.S., and increase redundancy in the supply chain.

More broadly, it’s obvious that the technological frontier for the next couple decades will be all about harnessing green energy. Wind and solar are now the cheapest energy source in human history, which is opening up new innovative possibilities in core industries that were thought to be mature decades ago. We’ve got new companies combining dirt-cheap renewable energy with clever new processes to produce zero-carbon steel, sucking carbon dioxide out of the air and putting it in concrete, and revolutionizing everything from paper to food production to smelting with renewable-powered thermal batteries — and this new industrial revolution has barely gotten started.

This kind of thing is going to be where the growth and jobs of the future are created. If all goes well, the IRA will put the United States and its allies at the forefront of real technological innovation — as opposed to over-hyped Silicon Valley garbage — with attendant domestic production and jobs.

But if Republicans win power anytime soon, they’ll likely tear it all up. While this current bill doesn’t repeal the tax credits that are the core of the IRA, the GOP is clearly gunning for them. Republican Representative Andy Ogles of Tennessee has introduced a bill repealing the entire thing. “It’s the beginning of starting to roll back some of those things,” his colleague Jeff Duncan, Republican congressman of South Carolina, told E&E News. “It’s the first bite of the apple here … it’s just the beginning.”

The underlying premise of the GOP’s position here is that Biden, no doubt influenced by a Soros-led Cultural Marxism conspiracy, has strangled American oil and gas production to punish red-blooded Real Americans who have no choice but to drive MRAPs to work. The reality, once again, is the exact opposite. Under Biden, America remains the largest producer of oil and gas in the world, and he has approved drilling leases on federal land faster than Trump did — including the huge Willow project in Alaska most recently.

To be clear, this is bad for the reasons detailed above. One would think the fact that Republicans give Democrats no credit for doing what they want, and instead accuse them of doing the opposite, might prompt Democrats to stop appeasing them, but never mind.

It’s honestly a bit baffing why Republicans are so resistant to the technology of the future, given how much of the new investment is going into red states. At a guess, it’s down to Republicans’ long history of climate denial, belief that renewable energy is hippie stuff, reflexive opposition to everything Democrats do regardless of what it is, and above all their increasing lack of traditional policy goals. The party is frantic with excitement over vindictive culture war red meat like stomping on LGBT people, banning books, and installing Donald Trump as president for life, but their eyes glaze over when anyone starts talking about the electric grid.

In any case, for now the Inflation Reduction Act is secure. But Democrats shouldn’t sit on their hands. In recent poll commissioned by Heatmap, 63 percent of respondents — including 53 percent of Democrats — said they knew “not much” or “nothing” about the IRA. Forty-five percent had no idea about the clean vehicle credit, 50 percent of the residential clean energy credit, and 44 percent of the energy efficiency credit. Clean energy policies are popular, but only if people know they exist.

If more is done to publicize the IRA, in time perhaps Republicans will come to accept what’s best for the country.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

A renewable energy project can only start construction if it can get connected to the grid.

The clock is ticking for clean energy developers. With the signing of the One Big Beautiful Bill Act, wind and solar developers have to start construction (whatever that means) in the next 12 months and be operating no later than the end of 2027 to qualify for federal tax credits.

But projects can only get built if they can get connected to the grid. Those decisions are often out of the hands of state, local, or even federal policymakers, and are instead left up to utilities, independent system operators, or regional trading organizations, which then have to study things like the transmission infrastructure needed for the project before they can grant a project permission to link up.

This process, from requesting interconnection to commercial operation, used to take two years on average as of 2008; by 2023, it took almost five years, according to the National Renewable Energy Laboratory. This creates what we call the interconnection queue, where likely thousands of gigawatts of proposed projects are languishing, unable to start construction. The inability to quickly process these requests adds to the already hefty burden of state, local, and federal permitting and siting — and could mean that developers will be locked out of tax credits regardless of how quickly they move.

There’s no better example of the tension between clean energy goals and the process of getting projects into service than the Mid-Atlantic, home to the 13-state electricity market known as PJM Interconnection. Many states in the region have mandates to substantially decarbonize their electricity systems, whereas PJM is actively seeking to bring new gas-fired generation onto the grid in order to meet its skyrocketing projections of future demand.

This mismatch between current supply and present-and-future demand has led to the price for “capacity” in PJM — i.e. what the grid operator has greed to pay in exchange for the ability to call on generators when they’re most needed — jumping by over $10 billion, leading to utility bill hikes across the system.

“There is definitely tension,” Abe Silverman, a senior research scholar at Johns Hopkins University and former general counsel for New Jersey’s utility regulator, told me.

While Silverman doesn’t think that PJM is “philosophically” opposed to adding new resources, including renewables, to the grid, “they don’t have urgency you might want them to have. It’s a banal problem of administrative competency rather than an agenda to stymie new resources coming on the grid.”

PJM is in the midst of a multiyear project to overhaul its interconnection queue. According to a spokesperson, there are around 44,500 megawatts of proposed projects that have interconnection agreements and could move on to construction. Of these, I calculated that about 39,000 megawatts are solar, wind, or storage. Another 63,000 megawatts of projects are in the interconnection queue without an agreement, and will be processed by the end of next year, the spokesperson said, likely making it impossible for wind and solar projects to be “placed in service” by 2028.

Even among the projects with agreements, “there probably will be some winnowing of that down,” Mark Repsher, a partner at PA Consulting Group, told me. “My guess is, of that 44,000 megawatts that have interconnection agreements, they may have other challenges getting online in the next two years.”

PJM has attempted to place the blame for project delays largely at the feet of siting, permitting, and operations challenges.

“Some [projects] are moving to construction, but others are feeling the headwinds of siting and permitting challenges and supply chain backlogs,” PJM’s executive vice president of operations, planning, and security Aftab Khan said in a June statement giving an update on interconnection reforms.

And on high prices, PJM has been increasingly open about blaming “premature” retirements of fossil fuel power plants.

In May, PJM said in a statement in response to a Department of Energy order to keep a dual-fuel oil and natural gas plant in Pennsylvania open that it “has repeatedly documented and voiced its concerns over the growing risk of a supply and demand imbalance driven by the confluence of generator retirements and demand growth. Such an imbalance could have serious ramifications for reliability and affordability for consumers.”

Just days earlier, in a statement ahead of a Federal Energy Regulatory Commission conference, PJM CEO Manu Asthana had fretted about “growing resource adequacy concerns” based on demand growth, the cost of building new generation, and, in a direct shot at federal and state policies that encouraged renewables and discouraged fossil fuels, “premature, primarily policy-driven retirements of resources continue to outpace the development of new generation.”

The Trump administration has echoed these worries for the whole nation’s electrical grid, writing in a report issued this week that “if current retirement schedules and incremental additions remain unchanged, most regions will face unacceptable reliability risks.” So has the North American Electric Reliability Corporation, which argued in a 2024 report that most of the U.S. and Canada “faces mounting resource adequacy challenges over the next 10 years as surging demand growth continues and thermal generators announce plans for retirement.”

State officials and clean energy advocates have instead placed the blame for higher costs and impending reliability gaps on PJM’s struggles to connect projects, how the electricity market is designed, and the operator’s perceived coolness towards renewables.

Pennsylvania Governor Josh Shapiro told The New York Times in June that the state should “re-examine” its membership in PJM following last year’s steep price hikes. In February, Virginia Governor Glenn Youngkin wrote a letter calling for Asthana to be fired. (He will leave the transmission organization by the end of the year, although PJM says the decision was made before Youngkin’s letter.)

That conflict will likely only escalate as developers rush to start projects — which they can only do if they can get an interconnection services agreement from PJM.

In contrast to Silverman, Tyson Slocum, director of Public Citizen’s energy program, told me that “PJM, internally and operationally, believes that renewables are a drag on the grid and that dispatchable generation, particularly fossil fuels and nuclear, are essential.”

In May, for instance, PJM announced that it had selected 51 projects for its “Reliability Resource Initiative,” a one-time special process for adding generation to the grid over the next five to six years. The winning bids overwhelmingly involved expanding existing gas-fired plants or building new ones.

The main barrier to getting the projects built that have already worked their way through the queue, Repsher told me, is “primarily permitting.” But even with new barriers thrown up by the OBBBA, “there’s going to be appetite for these, these projects,” thanks to high demand, Repsher said. “It’s really just navigating all the logistical hurdles.”

Some leaders of PJM states are working on the permitting and deployment side of the equation while also criticizing the electricity market. Pennsylvania’s Shapiro has proposed legislation that would set up a centralized state entity to handle siting for energy projects. Maryland Governor Wes Moore signed legislation in May that would accelerate permitting for energy projects, including preempting local regulations for siting solar.

New Jersey, on the other hand, is procuring storage projects directly.

The state has a mandate stemming from its Clean Energy Act of 2018 to add 2,000 megawatts of energy storage by 2030. In June, New Jersey’s utility regulator started a process to procure at least half of that through utility-scale projects, funded through an existing utility-bill-surcharge.

New Jersey regulators described energy storage as “the most significant source of near-term capacity,” citing specifically the fact that storage makes up the “bulk” of proposed energy capacity in New Jersey with interconnection approval from PJM.

While the regulator issued its order before OBBBA passed, the focus on storage ended up being advantageous. The bill treats energy storage far more generously than wind and solar, meaning that New Jersey could potentially expand its generation capacity with projects that are more likely to pencil due to continued access to tax credits. The state is also explicitly working around the interconnection queue, not raging against it: “PJM interconnection delays do not pose a significant obstacle to a Phase 1 transmission-scale storage procurement target of 1,000 MW,” the order said.

In the end, PJM and the states may be stuck together, and their best hope could be finding some way to work together — and they may not have any other choice.

“A well-functioning RTO is the best way to achieve both low rates for consumers and carbon emissions reductions,” Evan Vaughan, the executive director of MAREC Action, a trade group representing Mid-Atlantic solar, wind, and storage developers, told me. “I think governors in PJM understand that, and I think that they’re pushing on PJM.”

“I would characterize the passage of this bill as adding fuel to the fire that was already under states and developers — and even energy offtakers — to get more projects deployed in the region.”

On Neil Jacobs’ confirmation hearing, OBBBA costs, and Saudi Aramco

Current conditions: Temperatures are climbing toward 100 degrees Fahrenheit in central and eastern Texas, complicating recovery efforts after the floods • More than 10,000 people have been evacuated in southwestern China due to flooding from the remnants of Typhoon Danas • Mebane, North Carolina, has less than two days of drinking water left after its water treatment plant sustained damage from Tropical Storm Chantal.

Neil Jacobs, President Trump’s nominee to head the National Oceanic and Atmospheric Administration, fielded questions from the Senate Commerce, Science, and Transportation Committee on Wednesday about how to prevent future catastrophes like the Texas floods, Politico reports. “If confirmed, I want to ensure that staffing weather service offices is a top priority,” Jacobs said, even as the administration has cut more than 2,000 staff positions this year. Jacobs also told senators that he supports the president’s 2026 budget, which would further cut $2.2 billion from NOAA, including funding for the maintenance of weather models that accurately forecast the Texas storms. During the hearing, Jacobs acknowledged that humans have an “influence” on the climate, and said he’d direct NOAA to embrace “new technologies” and partner with industry “to advance global observing systems.”

Jacobs previously served as the acting NOAA administrator from 2019 through the end of Trump’s first term, and is perhaps best remembered for his role in the “Sharpiegate” press conference, in which he modified a map of Hurricane Dorian’s storm track to match Trump’s mistaken claim that it would hit southern Alabama. The NOAA Science Council subsequently investigated Jacobs and found he had violated the organization’s scientific integrity policy.

The Republican budget reconciliation bill could increase household energy costs by $170 per year by 2035 and $353 per year by 2040, according to a new analysis by Evergreen Action, a climate policy group. “Biden-era provisions, now cut by the GOP spending plan, were making it more affordable for families to install solar panels to lower utility bills,” the report found. The law also cut building energy efficiency credits that had helped Americans reduce their bills by an estimated $1,250 per year. Instead, the One Big Beautiful Bill Act will increase wholesale electricity prices almost 75% by 2035, as well as eliminate 760,000 jobs by the end of the decade. Separately, an analysis by the nonpartisan think tank Center for American Progress found that the OBBBA could increase average electricity costs by $110 per household as soon as next year, and up to $200 annually in some states.

Saudi Arabia’s state-owned oil company Saudi Aramco is in talks with Commonwealth LNG in Louisiana to buy liquified natural gas, Reuters reports. The discussion is reportedly for 2 million tons per year of the facility’s 9.4 million-ton annual export capacity, which would help “cement Aramco’s push into the global LNG market as it accelerates efforts to diversify beyond crude oil exports” and be the “strongest signal yet that Aramco intends to take a material position in the U.S. LNG sector,” OilPrice.com notes. LNG demand is expected to grow 50% globally by 2030, but as my colleague Emily Pontecorvo has reported, President Trump’s tariffs could make it harder for LNG projects still in early development, like Commonwealth, to succeed. “For the moment, U.S. LNG is still interesting,” Anne-Sophie Corbeau, a research scholar focused on natural gas at Columbia University’s Center on Global Energy Policy, told Emily. “But if costs increase too much, maybe people will start to wonder.”

Ford confirmed this week that its $3 billion electric vehicle battery plant in Michigan will still qualify for federal tax credits due to eleventh-hour tweaks to the bill’s language, The New York Times reports. Though Ford had said it would build its factory regardless of what happened to the credits, the company’s executive chairman had previously called them “crucial” to the construction of the facility and the employment of the 1,700 people expected to work there. Ford’s battery plant is located in Michigan’s Calhoun County, which Trump won by a margin of 56%. The last-minute tweaks to save the credits to the benefit of Ford “suggest that at least some Republican lawmakers were aware that cuts in the bill would strike their constituents the hardest,” the Times writes.

Italy and Spain are on track to shutter their last remaining mainland coal power plants in the next several months, marking “a major milestone in Europe’s transition to a predominantly renewables-based power system by 2035,” Beyond Fossil Fuels reported Wednesday. To date, 15 European countries now have coal-free grids following Ireland’s move away from coal in 2025.

Italy is set to complete its transition from coal by the end of the summer with the closure of its last two plants, in keeping with the government’s 2017 phase-out target of 2025. Two coal plants in Sardinia will remain operational until 2028 due to complications with an undersea grid connection cable. In Spain, the nation’s largest coal plant will be entirely converted to fossil gas by the end of the year, while two smaller plants are also on track to shut down in the immediate future. Once they do, Spain’s only coal-power plant will be in the Balearic Islands, with an expected phase-out date of 2030.

“Climate change makes this a battle with a ratchet. There are some things you just can’t come back from. The ratchet has clicked, and there is no return. So it is urgent — it is time for us all to wake up and fight.” — Senator Sheldon Whitehouse of Rhode Island in his 300th climate speech on the Senate floor Wednesday night.

Some of the Loan Programs Office’s signature programs are hollowed-out shells.

With a stroke of President Trump’s Sharpie, the One Big Beautiful Bill Act is now law, stripping the Department of Energy’s Loan Programs Office of much of its lending power. The law rescinds unobligated credit subsidies for a number of the office’s key programs, including portions of the $3.6 billion allocated to the Loan Guarantee Program, $5 billion for the Energy Infrastructure Reinvestment Program, $3 billion for the Advanced Technology Vehicle Manufacturing Program, and $75 million for the Tribal Energy Loan Guarantee Program.

Just three years ago, the Inflation Reduction Act supercharged LPO, originally established in 2005 to help stand up innovative new clean energy technologies that weren’t yet considered bankable for the private sector, expanding its lending authority to roughly $400 billion. While OBBBA leaves much of the office’s theoretical lending authority intact, eliminating credit subsidies means that it no longer really has the tools to make use of those dollars.

Credit subsidies represent the expected cost to the government of providing a loan or a loan guarantee — including the possibility of a default — and thus how much money Congress must set aside to cover these potential losses. So by axing these subsidies, Congress is effectively limiting the amount of lending that the LPO can undertake, given that many third-party lenders would be reluctant to finance riskier, more novel, or larger projects in the absence of federal credit support.

“The LPO is statutorily allowed to take loans on its books to finance these projects in these categories, but it has no credit subsidy by which to take the risk required to do so,” Advait Arun, senior associate of energy finance at the Center for Public Enterprise and a Heatmap contributor, told me.

The particular programs that have been eliminated support new and improved energy technologies, clean energy infrastructure, fuel efficient vehicles, and help native communities access energy project financing. The long-running Loan Guarantee Program and the advanced vehicles program in particular are behind some of the best known LPO efforts, supporting companies such as Tesla, Ford, and NextEra Energy, and projects such as Georgia’s Vogtle nuclear reactors, the Thacker Pass lithium mine, and Shepherd’s Flat, one of the world’s largest wind farms.

The Loan Guarantees Program is “the big Kahuna,” Arun told me. “This is the longest-standing program of the LPO. So to see this defunded is like, you’re decapitating the LPO’s crown jewel.”

The program only has about $11 million left over in credit subsidies, consisting of funding that it received prior to the IRA’s appropriations. That won’t be enough to make any meaningful loans, Arun said, and is more likely to be used to “keep a skeleton crew online” for any remaining administrative tasks.

Then there’s the Energy Infrastructure Reinvestment Program, which the IRA stood up with a whopping $250 billion in lending authority to transition and transform existing fossil fuel infrastructure for clean energy purposes. Now, OBBBA has axed the program’s remaining $5 billion in credit subsidies and replaced it with $1 billion in new subsidies for projects that “retool, repower, repurpose, or replace” existing energy infrastructure, with a focus on expanding capacity and output as opposed to decarbonizing the economy. It also refashioned the program as the predictably-named “Energy Dominance Financing” initiative.

The new-old program — which the law extended through 2028 — no longer requires LPO-funded infrastructure to reduce or sequester emissions, broadening the office’s lending authority to include support for fossil fuel and critical minerals projects. It also adds language encouraging the LPO to “support or enable the provision of known or forecastable electric supply,” which Arun fears is a “backend way of penalizing the addition of renewable energy” on previously developed land.

“Under the Trump administration’s direction, [the LPO] can use that term, ‘known and forecastable,’ to actually just say, well, guess what? Renewables are not known or forecastable because they are intermittent due to the weather,” Arun told me. So while government and private industry were once excited about, say, turning sites originally developed for coal mining or coal ash disposal into solar and battery facilities, those days are probably over.

Carbon capture in particular stands to suffer from this reprogramming, Arun said, explaining that while the Biden LPO saw potential in adding carbon capture to natural gas and coal plants, its current incarnation will no longer allocate funding in any meaningful amount “because reducing emissions is no longer part of the LPO’s mandate.” Some policymakers and clean energy developers had also hoped that excess renewable energy would make it economically feasible to power the production of hydrogen fuel with renewable energy. But with this law — and really each passing day under Trump — a mass buildout of solar and wind seems less and less likely, making it doubtful that green hydrogen will move down the cost curve.

As bleak as this looks, it’s better than it could have been. There was no guarantee that Trump would keep the LPO around at all. Even in this denuded state, the office can still fund the expansion of existing nuclear projects, and perhaps even the buildout of transmission lines or battery projects on brownfield sites, Arun said, depending on how LPO’s leadership ends up interpreting what it means to “increase the capacity output of operating infrastructure.”

But in many ways, what happened with the LPO looks like another instance of the Trump administration picking winners and losers: Yes to clean, firm energy and fossil fuels, no to solar, wind, and electric vehicles.

Take the Advanced Technology Vehicle Manufacturing Program, for example. OBBBA nixed both its credit subsidies and its tens of billions of dollars in lending authority. That’s hardly a surprise, given that the Bush administration created the program in 2007 explicitly to support the domestic development and manufacture of fuel-efficient vehicles and components. But it means that unlike the LPO programs for which lending authority still stands, even if Congress wanted to, it could not redesign the advanced vehicles program to serve a more Trump-aligned purpose. Safer, I suppose, to cut off any opening for funding EVs and hybrids.

The latest LPO rescissions add to the growing list of reasons the private sector has to be wary of the consistently inconsistent landscape for federal funding, Arun told me. He worries that slashing the LPO’s authority at the same time as there’s so much uncertainty around tax credit eligibility will lead some companies to forgo federal funding opportunities altogether.

“We’ll see if private developers even want to play around with the LPO,” Arun told me, “given the uncertainty around the rest of the federal landscape here.”