You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

Ice melt is creating many geopolitical dangers, thanks largely to a familiar foe.

The Arctic is becoming dangerously destabilized.

This is true in a literal sense. The north’s precipitous loss in glacial ice sheets, permafrost, and sea ice will have global ripple effects. Should the “Earth’s air conditioner” become perennially iceless, as scientists fear could happen as early as 2050, the fallout has the power to trigger worst-case scenarios around the world: Sea levels could rise in New York City, monsoon rains could swamp Lagos, Nigeria, and precious forest cover in Puerto Maldonado, Peru, could dwindle to nubs. Each glacier that collapses is another tick of the time-bomb.

But it’s also true in a more metaphorical sense: Arctic ice melt is creating many geopolitical dangers, thanks largely to a familiar foe: Russia.

The Kremlin controls 50 percent of the Arctic coastline. But isolated from the other countries encircling the North Pole due to its war of aggression in Ukraine, Russia has retreated from any sort of Arctic cooperation. That has left experts fearful not only of scientists’ ability to stay on top of the impacts of climate change, but also that the warming region might give Russian President Vladimir Putin a pretext to break more international rules.

For the last 15 years, Russia has jockeyed for Arctic control — from aggressively building its military capabilities, to scaling up its shipping capacity, to even unlawfully planting a flag along the North Pole seabed and claiming the land as its own. But it was still hemmed in by the Arctic’s web of laws and accords.

These laws, unfortunately, are quite vulnerable to ice melt.

Maritime claims, upheld by entities like the International Maritime Organization, for example, are one way for states to protest rule-breaking in the region. But melting sea ice has opened up previously frozen zones, threatening to undermine laws like Article 234 of the United Nations Convention on the Law of the Sea, which gives coastal states special rights to ice covered areas. “If the ice melts, do you still have that legal basis?” said Rebecca Pincus, the director of the Polar Institute at the Wilson Center.

Valuable shipping lanes are also emerging in the north, encouraging Russia to further engage in a two-fold strategy: mass resource extraction to underpin its national wealth and taking “the most extreme position possible on its right to control all foreign navigation through the internal waters of the [Northern Sea Route],” as Cornell Overfield wrote recently in Foreign Policy. However, this state of affairs might not last long. “As sea ice continues to retreat in the Arctic, it will become possible for ships to navigate outside of the Russian zone through the central Arctic Ocean and bypass the Russian coastline entirely,” Pincus said. “That will shift the balance of the, I guess you could say, ‘power’ to a certain extent.”

These central Arctic Ocean shipping routes will not be open for decades and pose a number of operational challenges along the way, she explained. But when they do, it would allow ships to navigate outside Russian waters, reducing the potency of Russia’s de facto control along the Northern Sea Route, further isolating a country that sees the icy region as a part of its power projection.

Meanwhile, Russia is essentially alone among its neighbors.

Mathieu Boulègue, a consulting fellow in the Russia and Eurasia Programme at Chatham House, told me a bifurcation is emerging in the north, where a singled-out Russia has recused itself from the Nordic-North American camp — a once-staid Arctic 8 now made into an awkward, asterisked Arctic 7. With Finland having joined NATO this month, and Sweden close behind, Russia might see itself as not just alone, but surrounded. Experts fear that spells trouble.

“More human activity and more military activity will lead to more accidents, more incidents, more miscalculation, and therefore more tension,” said Boulègue. “Now that the signs are on the wall, we can't really ignore them anymore.”

The United States and other countries rimming the Arctic are carefully initiating exploratory military exercises in the region to see how they can navigate safely and effectively in newly-melted territories. Because of how remote the Arctic is, accidents and emergencies are exponentially harder and more expensive to triage. The latest U.S. Arctic strategy promises to increase its military presence there, too, in order to keep pace with the Russian military presence. But experts warn that neither technology nor policy in a territorially hostile area could keep up with the speed of these melting passages. Indeed, they say it would take the West at least 10 years to catch up with Russia’s military in the region. This opens up dangers for Russia to do just about anything it’d like to, including seizing new territory and setting up military bases in contested areas.

“We're seeing some pretty aggressive, unprofessional, and unsafe behavior by the Russian military in regards to American military assets [in the Arctic],” said the Wilson Center’s Pincus. “Think about that level of risk-taking and aggression on the part of the Russian military and now extrapolate that to, for example, a naval exercise that is contesting Russian claims to waters in the Arctic. That gives me pause and argues for great care.”

Beyond the threat of Russia’s mounting military capabilities in the region, Arctic cooperation has also suffered more generally from Russia’s absence. The Arctic Council is a Nobel Prize-nominated diplomatic forum that convenes the Arctic 8, six non-Arctic states, and a cadre of non-governmental observers which include Arctic Indigenous communities. This preeminent intergovernmental venue had to suspend all of its programming after the start of the war in Ukraine. It has only picked up projects since June of last year that do not require cooperation with Russia. Norway is set to assume the chair of this forum come May, but will have to tread delicately if it means to keep Russia within the Council’s orbit.

“The accession by Finland and Sweden to NATO will strengthen security and stability in Northern Europe, including in the Arctic. While security related aspects will understandably become more important, we must ensure that we do not lose sight of the broader issues in Arctic cooperation,” said Finnish Ambassadors Petteri Vuorimäki and Anne Mutanen in a statement to Heatmap.

These so-called broader issues not only impact high-level powers in the Arctic, but also those who are native to the region. Today, six Arctic Indigenous NGOs hold a non-voting status in the Arctic Council, making it one of the world’s only multilateral forums where national government officials sit at the same table as Native leaders.

Many of the six Arctic Indigenous communities who participate in the Arctic Council have ancestral lands that extend into Russia. Leaders among the Indigenous Saami people, for instance, fear that while Arctic states are busy ironing out tension spurred by Russia and its war, their priorities — from phasing out ecologically harmful heavy fuel oil, to prioritizing climate-resilient infrastructure, to recognizing land rights agreements which enable important climate science research, to triaging the potential displacement of Indigenous communities amid coastal erosion and sea ice melt — may take a back seat. “It's not said straight; it's a feeling underlying there that they have more important things to deal with,” said Gunn Britt-Retter, head of the Arctic Environment Unit of the Saami Council, which represents the Saami people spread across Norway, Sweden, Finland, and parts of Russia.

And then there’s another way Russian isolation is punishing the world: science. The world’s leading scientists desperately need access to this corner of the world to establish what they call a “ground truthing,” — basically an up-close understanding of what they’re only seeing now via satellites.

As Tim Lydon warned in The Atlantic last April, “cooperation with Russian scientists has ground to a halt.” Things haven’t improved over the past year. In February, French scientist Jérôme Chappellaz told the Arctic Institute that Russia’s absence from the international scientific community has led to an “environmental emergency.” Field sites have been cut off, data can’t be shared among climate experts based elsewhere, and scientific endeavors have been significantly scaled down.

Russian isolation is being felt everywhere in the Arctic. With global shipping, climate science, international cooperation, and adversarial militaries involved, the rest of the world might also feel the repercussions if something doesn’t change soon.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

1. Marion County, Indiana — State legislators made a U-turn this week in Indiana.

2. Baldwin County, Alabama — Alabamians are fighting a solar project they say was dropped into their laps without adequate warning.

3. Orleans Parish, Louisiana — The Crescent City has closed its doors to data centers, at least until next year.

A conversation with Emily Pritzkow of Wisconsin Building Trades

This week’s conversation is with Emily Pritzkow, executive director for the Wisconsin Building Trades, which represents over 40,000 workers at 15 unions, including the International Brotherhood of Electrical Workers, the International Union of Operating Engineers, and the Wisconsin Pipe Trades Association. I wanted to speak with her about the kinds of jobs needed to build and maintain data centers and whether they have a big impact on how communities view a project. Our conversation was edited for length and clarity.

So first of all, how do data centers actually drive employment for your members?

From an infrastructure perspective, these are massive hyperscale projects. They require extensive electrical infrastructure and really sophisticated cooling systems, work that will sustain our building trades workforce for years – and beyond, because as you probably see, these facilities often expand. Within the building trades, we see the most work on these projects. Our electricians and almost every other skilled trade you can think of, they’re on site not only building facilities but maintaining them after the fact.

We also view it through the lens of requiring our skilled trades to be there for ongoing maintenance, system upgrades, and emergency repairs.

What’s the access level for these jobs?

If you have a union signatory employer and you work for them, you will need to complete an apprenticeship to get the skills you need, or it can be through the union directly. It’s folks from all ranges of life, whether they’re just graduating from high school or, well, I was recently talking to an office manager who had a 50-year-old apprentice.

These apprenticeship programs are done at our training centers. They’re funded through contributions from our journey workers and from our signatory contractors. We have programs without taxpayer dollars and use our existing workforce to bring on the next generation.

Where’s the interest in these jobs at the moment? I’m trying to understand the extent to which potential employment benefits are welcomed by communities with data center development.

This is a hot topic right now. And it’s a complicated topic and an issue that’s evolving – technology is evolving. But what we do find is engagement from the trades is a huge benefit to these projects when they come to a community because we are the community. We have operated in Wisconsin for 130 years. Our partnership with our building trades unions is often viewed by local stakeholders as the first step of building trust, frankly; they know that when we’re on a project, it’s their neighbors getting good jobs and their kids being able to perhaps train in their own backyard. And local officials know our track record. We’re accountable to stakeholders.

We are a valuable player when we are engaged and involved in these sting decisions.

When do you get engaged and to what extent?

Everyone operates differently but we often get engaged pretty early on because, obviously, our workforce is necessary to build the project. They need the manpower, they need to talk to us early on about what pipeline we have for the work. We need to talk about build-out expectations and timelines and apprenticeship recruitment, so we’re involved early on. We’ve had notable partnerships, like Microsoft in southeast Wisconsin. They’re now the single largest taxpayer in Racine County. That project is now looking to expand.

When we are involved early on, it really shows what can happen. And there are incredible stories coming out of that job site every day about what that work has meant for our union members.

To what extent are some of these communities taking in the labor piece when it comes to data centers?

I think that’s a challenging question to answer because it varies on the individual person, on what their priority is as a member of a community. What they know, what they prioritize.

Across the board, again, we’re a known entity. We are not an external player; we live in these communities and often have training centers in them. They know the value that comes from our workers and the careers we provide.

I don’t think I’ve seen anyone who says that is a bad thing. But I do think there are other factors people are weighing when they’re considering these projects and they’re incredibly personal.

How do you reckon with the personal nature of this issue, given the employment of your members is also at stake? How do you grapple with that?

Well, look, we respect, over anything else, local decision-making. That’s how this should work.

We’re not here to push through something that is not embraced by communities. We are there to answer questions and good actors and provide information about our workforce, what it can mean. But these are decisions individual communities need to make together.

What sorts of communities are welcoming these projects, from your perspective?

That’s another challenging question because I think we only have a few to go off of here.

I would say more information earlier on the better. That’s true in any case, but especially with this. For us, when we go about our day-to-day activities, that is how our most successful projects work. Good communication. Time to think things through. It is very early days, so we have some great success stories we can point to but definitely more to come.

The number of data centers opposed in Republican-voting areas has risen 330% over the past six months.

It’s probably an exaggeration to say that there are more alligators than people in Colleton County, South Carolina, but it’s close. A rural swath of the Lowcountry that went for Trump by almost 20%, the “alligator alley” is nearly 10% coastal marshes and wetlands, and is home to one of the largest undeveloped watersheds in the nation. Only 38,600 people — about the population of New York’s Kew Gardens neighborhood — call the county home.

Colleton County could soon have a new landmark, though: South Carolina’s first gigawatt data center project, proposed by Eagle Rock Partners.

That’s if it overcomes mounting local opposition, however. Although the White House has drummed up data centers as the key to beating China in the race for AI dominance, Heatmap Pro data indicate that a backlash is growing from deep within President Donald Trump’s strongholds in rural America.

According to Heatmap Pro data, there are 129 embattled data centers located in Republican-voting areas. The vast majority of these counties are rural; just six occurred in counties with more than 1,000 people per square mile. That’s compared with 93 projects opposed in Democratic areas, which are much more evenly distributed across rural and more urban areas.

Most of this opposition is fairly recent. Six months ago, only 28 data centers proposed in low-density, Trump-friendly countries faced community opposition. In the past six months, that number has jumped by 95 projects. Heatmap’s data “shows there is a split, especially if you look at where data centers have been opposed over the past six months or so,” says Charlie Clynes, a data analyst with Heatmap Pro. “Most of the data centers facing new fights are in Republican places that are relatively sparsely populated, and so you’re seeing more conflict there than in Democratic areas, especially in Democratic areas that are sparsely populated.”

All in all, the number of data centers that have faced opposition in Republican areas has risen 330% over the past six months.

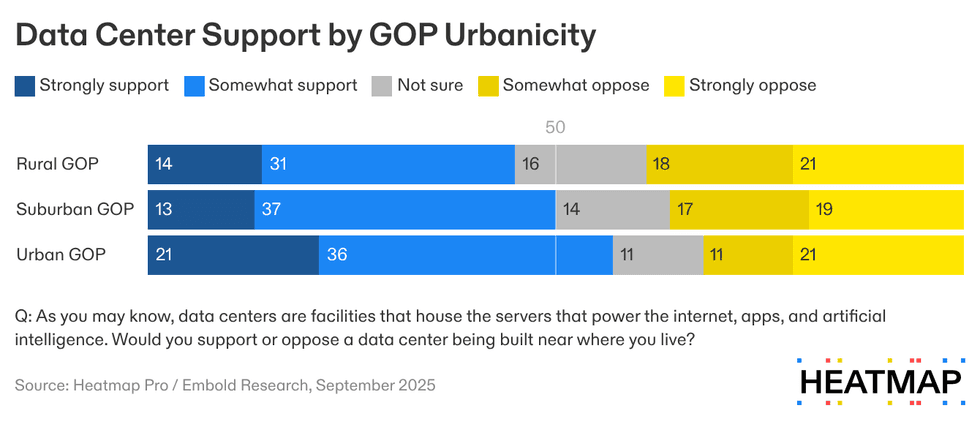

Our polling reflects the breakdown in the GOP: Rural Republicans exhibit greater resistance to hypothetical data center projects in their communities than urban Republicans: only 45% of GOP voters in rural areas support data centers being built nearby, compared with nearly 60% of urban Republicans.

Such a pattern recently played out in Livingston County, Michigan, a farming area that went 61% for President Donald Trump, and “is known for being friendly to businesses.” Like Colleton County, the Michigan county has low population density; last fall, hundreds of the residents of Howell Township attended public meetings to oppose Meta’s proposed 1,000-acre, $1 billion AI training data center in their community. Ultimately, the uprising was successful, and the developer withdrew the Livingston County project.

Across the five case studies I looked at today for The Fight — in addition to Colleton and Livingston Counties, Carson County, Texas; Tucker County, West Virginia; and Columbia County, Georgia, are three other red, rural examples of communities that opposed data centers, albeit without success — opposition tended to be rooted in concerns about water consumption, noise pollution, and environmental degradation. Returning to South Carolina for a moment: One of the two Colleton residents suing the county for its data center-friendly zoning ordinance wrote in a press release that he is doing so because “we cannot allow” a data center “to threaten our star-filled night skies, natural quiet, and enjoyment of landscapes with light, water, and noise pollution.” (In general, our polling has found that people who strongly oppose clean energy are also most likely to oppose data centers.)

Rural Republicans’ recent turn on data centers is significant. Of 222 data centers that have faced or are currently facing opposition, the majority — 55% —are located in red low-population-density areas. Developers take note: Contrary to their sleepy outside appearances, counties like South Carolina’s alligator alley clearly have teeth.