You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

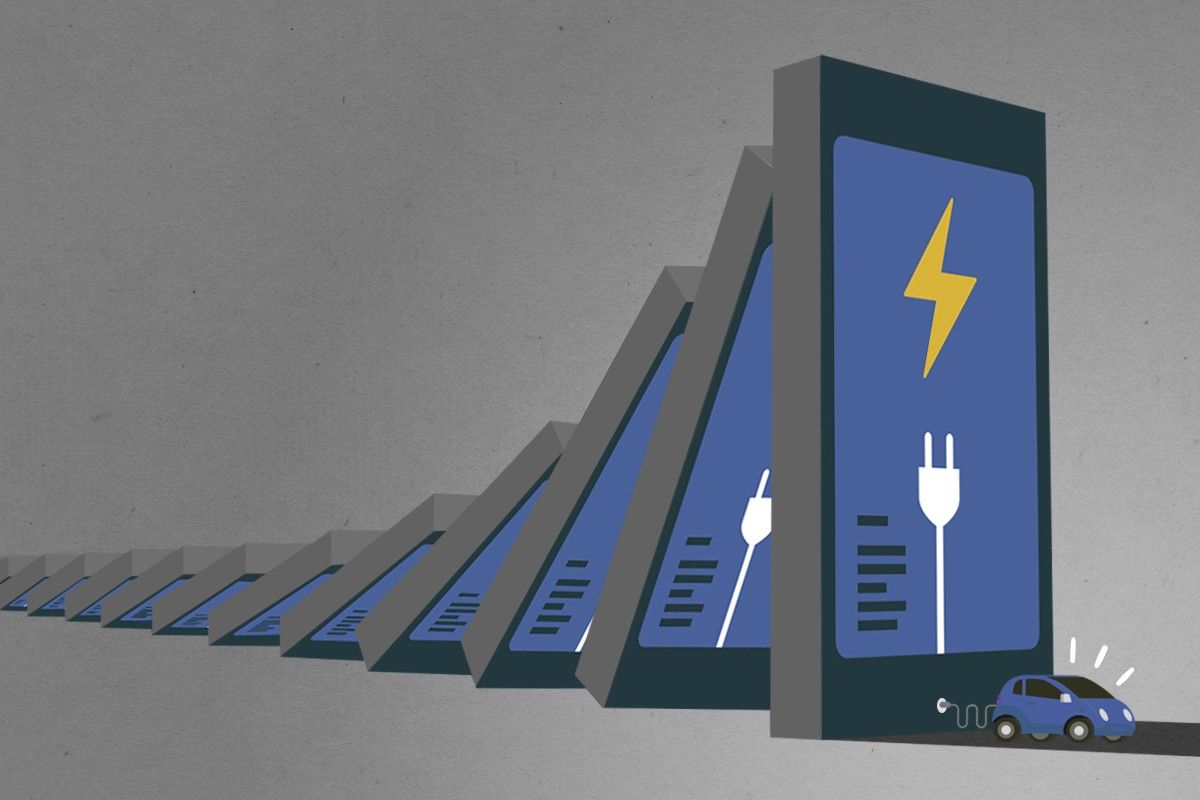

As we race to an electric future, slower charging is stuck in 2015.

Breaking news: America’s electric vehicle charging infrastructure continues to disappoint. In other news, water is wet, the sky is blue (unless it’s orange), and nine out of the 10 people who might occupy the White House in 2025 probably aren’t going to do a damn thing about climate change.

It’s been that way for years, so why is it still the case now? Besides Tesla’s excellent charging network, EV infrastructure hasn’t ever been up to snuff, but there’s a now baffling incongruency between that and the actual EV market. Despite some fits and starts, this year is expected to be a record one for EV sales. New electric cars are coming out all the time and across every part of the pricing spectrum.

Why does our charging experience feel stuck in 2015, back when EVs were few and far between on the roads and mostly driven by early adopters?

One area in particular that’s lacking is Level 2 charging. Faster than a wall outlet but slower than the DC fast chargers that can fill up a compatible vehicle in 20 to 30 minutes, Level 2 chargers can juice a car overnight or add some miles during daily errands. And they’ll be crucial to an EV future — even if drivers don’t quite think of it that way yet. (Level 2 chargers are the ones you can have in your home garage, by the way.)

DC fast charging gets the lion’s share of attention in part, I believe, because so many new EV drivers are used to the gas station model. To them, getting gas is getting gas; there’s really only one way to do it and it takes about five minutes, tops. Adding more DC fast chargers, in theory, will not only enable longer trips but also ease that charging anxiety by making EVs more convenient to own.

But the truth is, we’ll need both fast charging stations for road trips and quality Level 2 charging for when our cars are parked at the office, shopping malls, movie theaters or anywhere else we might go. For starters, a gas car can’t get energy while it’s parked, so a good Level 2 charger is an immediate upgrade in convenience from internal combustion right now — if you can find one.

Second, there’s the energy consumption issue. Besides being expensive and labor-intensive to build, DC fast chargers use a staggering amount of electricity to charge cars quickly. Matt McCaffree, the VP of Utility Marketing Development at Austin-based Level 2 charging company Flash, gave an example of a DC fast charger station with 16 ports where each offers at least 150-kilowatt charging.

“If you multiply 150 times 16, then you end up with 2.4 megawatts of energy being pulled from the grid,” he said. “That’s the equivalent of about two 14-story buildings.” Put two such stations together, McCaffree said, and you get energy use on par with some landmarks in Denver where he lives: “That's the equivalent of a stadium,” he said. “That's the equivalent of Mile High or Ball Arena downtown.”

(By the way, relying too much on fast charging is bad news for your battery, too; that’s a ton of heat that can degrade performance over time, so it’s best not to use these on a daily basis.)

Given the fact that EVs are meant to solve energy and climate concerns, you’d think someone would step up and make Level 2 chargers better by now. But you’d sadly be wrong.

A study released last week by auto industry marketing and research firm J.D. Power and must-have charging app PlugShare reveals that even with much wider EV adoption, the problems around charging aren’t getting better. According to the firm’s data, it’s actually getting worse. Customer satisfaction with public Level 2 charging in particular is at its lowest point in the three years the study has been conducted. Fast charging fared better overall. But even in California, where charging is ubiquitous for the country’s biggest EV market, a staggering 25% of respondents said they found public charging unreliable.

If California can’t get this right, what hope is there for the rest of us?

Get one great climate story in your inbox every day:

What’s going wrong here is nothing new. Many Level 2 chargers are still hard to find, shoved off to the sides of parking lots or other inconvenient places. Then you have the challenges of uptime, whether they’re actually working or not; the question of who’s responsible for fixing them, the charging company or the owner of the property where they sit; and the abundance of apps to pay for different charging networks, often through depositing money into a digital wallet before you can begin.

If gas cars were a new invention in 2023, and gas stations worked this way, we’d still be a horse-centric society.

Level 2 charging also doesn’t seem to be a huge focus of the federal government; though there is a grant program to fund such chargers in certain communities, more than twice as much funding is going toward DC fast charging. “[Federal] funding is disproportionately focused on the roadside charging and on the transportation corridors,” McCaffree said. “Again, that is an important use case that we need to have out there. But it is not the only charging solution that we should provide.”

To make matters worse, the $5 billion National Electric Vehicle Infrastructure (NEVI) program that offers grants for public chargers has rules around uptime. Specifically, grant recipients have to guarantee their chargers will be functional 97% of the time. But those only apply to the DC fast chargers — grants for Level 2 chargers are under a separate program and have no such strings. This means that while the federal government will require DC fast chargers to get better, Level 2 chargers may only do so if “the market” forces things that way via competition.

Of course, no businessman screams out for more regulation, but McCaffree thinks the whole charging industry would do well to follow those DC charging uptime rules on their own as a “baseline” for how to operate. “If the industry starts to just say, ‘Okay, we're going to stick to this,’ then I think that that will be sufficient. And that's a standard that is very reasonable.”

There’s also Tesla riding to the rescue of the whole EV industry by opening its charging network to other EVs, including its Level 2 “Destination” chargers. “It may provide a boost in fast-charging satisfaction among owners of EVs from other brands as they begin to use Tesla’s Supercharger stations,” J.D. Power’s EV chief Brent Gruber said in a statement. Then again, as great as the Supercharger network is, I question the wisdom of relying on one company to solve what’s about to be a national infrastructure challenge — especially a company run by, you know, that guy.

So it’s clear that as EVs get cheaper, faster, better and more capable of driving longer distances, public Level 2 charging needs to up its game too. I have some ideas on how to start:

National uptime requirements and pricing transparency. I’d be in favor of bringing the federal hammer down here, even if most charging companies aren’t. So far, EV charging has been a barely regulated free-for-all; if the gas station industry can thrive under such red tape, so can the electron business. I’d like to see Level 2 chargers beholden to those 97% uptime rules, with prominent displays for pricing — people often don’t even realize this.

An end to the proprietary payment apps. Whether it’s credit card point of sale, digital pay accessibility or, hell, even cash somehow, the “every charging network has its own app” madness has to go. This is another federal grant requirement for DC chargers, though it’s unclear how it’s going to be implemented.

Better education. This comes in on the part of the federal government, the charging companies, the automotive industry — really everyone involved. We cannot have EV charging exist under the gas station paradigm forever, and that means teaching drivers what types of charging they need for different situations and where to find them. Otherwise, you’ll have waves of new drivers pulling up to an “EV charger” in need of immediate juice, only to find charging will take eight hours. (I’ve done that myself in the past; the learning curve is real here and it is steep.)

An industry focus on making this work. McCaffree said much of the EV charging market was, until fairly recently, a “land grab”: getting as many chargers out there with as much brand recognition as possible, and not focusing as much on quality and customer service. Those days are over. “I think we as an industry… now, we have to focus on creating that consumer confidence in what has already been built.”

If they can’t, they won’t survive what’s coming any more than a car company that refuses to invest in electrification.

Read more about EVs:

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

On Neil Jacobs’ confirmation hearing, OBBBA costs, and Saudi Aramco

Current conditions: Temperatures are climbing toward 100 degrees Fahrenheit in central and eastern Texas, complicating recovery efforts after the floods • More than 10,000 people have been evacuated in southwestern China due to flooding from the remnants of Typhoon Danas • Mebane, North Carolina, has less than two days of drinking water left after its water treatment plant sustained damage from Tropical Storm Chantal.

Neil Jacobs, President Trump’s nominee to head the National Oceanic and Atmospheric Administration, fielded questions from the Senate Commerce, Science, and Transportation Committee on Wednesday about how to prevent future catastrophes like the Texas floods, Politico reports. “If confirmed, I want to ensure that staffing weather service offices is a top priority,” Jacobs said, even as the administration has cut more than 2,000 staff positions this year. Jacobs also told senators that he supports the president’s 2026 budget, which would further cut $2.2 billion from NOAA, including funding for the maintenance of weather models that accurately forecast the Texas storms. During the hearing, Jacobs acknowledged that humans have an “influence” on the climate, and said he’d direct NOAA to embrace “new technologies” and partner with industry “to advance global observing systems.”

Jacobs previously served as the acting NOAA administrator from 2019 through the end of Trump’s first term, and is perhaps best remembered for his role in the “Sharpiegate” press conference, in which he modified a map of Hurricane Dorian’s storm track to match Trump’s mistaken claim that it would hit southern Alabama. The NOAA Science Council subsequently investigated Jacobs and found he had violated the organization’s scientific integrity policy.

The Republican budget reconciliation bill could increase household energy costs by $170 per year by 2035 and $353 per year by 2040, according to a new analysis by Evergreen Action, a climate policy group. “Biden-era provisions, now cut by the GOP spending plan, were making it more affordable for families to install solar panels to lower utility bills,” the report found. The law also cut building energy efficiency credits that had helped Americans reduce their bills by an estimated $1,250 per year. Instead, the One Big Beautiful Bill Act will increase wholesale electricity prices almost 75% by 2035, as well as eliminate 760,000 jobs by the end of the decade. Separately, an analysis by the nonpartisan think tank Center for American Progress found that the OBBBA could increase average electricity costs by $110 per household as soon as next year, and up to $200 annually in some states.

Saudi Arabia’s state-owned oil company Saudi Aramco is in talks with Commonwealth LNG in Louisiana to buy liquified natural gas, Reuters reports. The discussion is reportedly for 2 million tons per year of the facility’s 9.4 million-ton annual export capacity, which would help “cement Aramco’s push into the global LNG market as it accelerates efforts to diversify beyond crude oil exports” and be the “strongest signal yet that Aramco intends to take a material position in the U.S. LNG sector,” OilPrice.com notes. LNG demand is expected to grow 50% globally by 2030, but as my colleague Emily Pontecorvo has reported, President Trump’s tariffs could make it harder for LNG projects still in early development, like Commonwealth, to succeed. “For the moment, U.S. LNG is still interesting,” Anne-Sophie Corbeau, a research scholar focused on natural gas at Columbia University’s Center on Global Energy Policy, told Emily. “But if costs increase too much, maybe people will start to wonder.”

Ford confirmed this week that its $3 billion electric vehicle battery plant in Michigan will still qualify for federal tax credits due to eleventh-hour tweaks to the bill’s language, The New York Times reports. Though Ford had said it would build its factory regardless of what happened to the credits, the company’s executive chairman had previously called them “crucial” to the construction of the facility and the employment of the 1,700 people expected to work there. Ford’s battery plant is located in Michigan’s Calhoun County, which Trump won by a margin of 56%. The last-minute tweaks to save the credits to the benefit of Ford “suggest that at least some Republican lawmakers were aware that cuts in the bill would strike their constituents the hardest,” the Times writes.

Italy and Spain are on track to shutter their last remaining mainland coal power plants in the next several months, marking “a major milestone in Europe’s transition to a predominantly renewables-based power system by 2035,” Beyond Fossil Fuels reported Wednesday. To date, 15 European countries now have coal-free grids following Ireland’s move away from coal in 2025.

Italy is set to complete its transition from coal by the end of the summer with the closure of its last two plants, in keeping with the government’s 2017 phase-out target of 2025. Two coal plants in Sardinia will remain operational until 2028 due to complications with an undersea grid connection cable. In Spain, the nation’s largest coal plant will be entirely converted to fossil gas by the end of the year, while two smaller plants are also on track to shut down in the immediate future. Once they do, Spain’s only coal-power plant will be in the Balearic Islands, with an expected phase-out date of 2030.

“Climate change makes this a battle with a ratchet. There are some things you just can’t come back from. The ratchet has clicked, and there is no return. So it is urgent — it is time for us all to wake up and fight.” — Senator Sheldon Whitehouse of Rhode Island in his 300th climate speech on the Senate floor Wednesday night.

Some of the Loan Programs Office’s signature programs are hollowed-out shells.

With a stroke of President Trump’s Sharpie, the One Big Beautiful Bill Act is now law, stripping the Department of Energy’s Loan Programs Office of much of its lending power. The law rescinds unobligated credit subsidies for a number of the office’s key programs, including portions of the $3.6 billion allocated to the Loan Guarantee Program, $5 billion for the Energy Infrastructure Reinvestment Program, $3 billion for the Advanced Technology Vehicle Manufacturing Program, and $75 million for the Tribal Energy Loan Guarantee Program.

Just three years ago, the Inflation Reduction Act supercharged LPO, originally established in 2005 to help stand up innovative new clean energy technologies that weren’t yet considered bankable for the private sector, expanding its lending authority to roughly $400 billion. While OBBBA leaves much of the office’s theoretical lending authority intact, eliminating credit subsidies means that it no longer really has the tools to make use of those dollars.

Credit subsidies represent the expected cost to the government of providing a loan or a loan guarantee — including the possibility of a default — and thus how much money Congress must set aside to cover these potential losses. So by axing these subsidies, Congress is effectively limiting the amount of lending that the LPO can undertake, given that many third-party lenders would be reluctant to finance riskier, more novel, or larger projects in the absence of federal credit support.

“The LPO is statutorily allowed to take loans on its books to finance these projects in these categories, but it has no credit subsidy by which to take the risk required to do so,” Advait Arun, senior associate of energy finance at the Center for Public Enterprise and a Heatmap contributor, told me.

The particular programs that have been eliminated support new and improved energy technologies, clean energy infrastructure, fuel efficient vehicles, and help native communities access energy project financing. The long-running Loan Guarantee Program and the advanced vehicles program in particular are behind some of the best known LPO efforts, supporting companies such as Tesla, Ford, and NextEra Energy, and projects such as Georgia’s Vogtle nuclear reactors, the Thacker Pass lithium mine, and Shepherd’s Flat, one of the world’s largest wind farms.

The Loan Guarantees Program is “the big Kahuna,” Arun told me. “This is the longest-standing program of the LPO. So to see this defunded is like, you’re decapitating the LPO’s crown jewel.”

The program only has about $11 million left over in credit subsidies, consisting of funding that it received prior to the IRA’s appropriations. That won’t be enough to make any meaningful loans, Arun said, and is more likely to be used to “keep a skeleton crew online” for any remaining administrative tasks.

Then there’s the Energy Infrastructure Reinvestment Program, which the IRA stood up with a whopping $250 billion in lending authority to transition and transform existing fossil fuel infrastructure for clean energy purposes. Now, OBBBA has axed the program’s remaining $5 billion in credit subsidies and replaced it with $1 billion in new subsidies for projects that “retool, repower, repurpose, or replace” existing energy infrastructure, with a focus on expanding capacity and output as opposed to decarbonizing the economy. It also refashioned the program as the predictably-named “Energy Dominance Financing” initiative.

The new-old program — which the law extended through 2028 — no longer requires LPO-funded infrastructure to reduce or sequester emissions, broadening the office’s lending authority to include support for fossil fuel and critical minerals projects. It also adds language encouraging the LPO to “support or enable the provision of known or forecastable electric supply,” which Arun fears is a “backend way of penalizing the addition of renewable energy” on previously developed land.

“Under the Trump administration’s direction, [the LPO] can use that term, ‘known and forecastable,’ to actually just say, well, guess what? Renewables are not known or forecastable because they are intermittent due to the weather,” Arun told me. So while government and private industry were once excited about, say, turning sites originally developed for coal mining or coal ash disposal into solar and battery facilities, those days are probably over.

Carbon capture in particular stands to suffer from this reprogramming, Arun said, explaining that while the Biden LPO saw potential in adding carbon capture to natural gas and coal plants, its current incarnation will no longer allocate funding in any meaningful amount “because reducing emissions is no longer part of the LPO’s mandate.” Some policymakers and clean energy developers had also hoped that excess renewable energy would make it economically feasible to power the production of hydrogen fuel with renewable energy. But with this law — and really each passing day under Trump — a mass buildout of solar and wind seems less and less likely, making it doubtful that green hydrogen will move down the cost curve.

As bleak as this looks, it’s better than it could have been. There was no guarantee that Trump would keep the LPO around at all. Even in this denuded state, the office can still fund the expansion of existing nuclear projects, and perhaps even the buildout of transmission lines or battery projects on brownfield sites, Arun said, depending on how LPO’s leadership ends up interpreting what it means to “increase the capacity output of operating infrastructure.”

But in many ways, what happened with the LPO looks like another instance of the Trump administration picking winners and losers: Yes to clean, firm energy and fossil fuels, no to solar, wind, and electric vehicles.

Take the Advanced Technology Vehicle Manufacturing Program, for example. OBBBA nixed both its credit subsidies and its tens of billions of dollars in lending authority. That’s hardly a surprise, given that the Bush administration created the program in 2007 explicitly to support the domestic development and manufacture of fuel-efficient vehicles and components. But it means that unlike the LPO programs for which lending authority still stands, even if Congress wanted to, it could not redesign the advanced vehicles program to serve a more Trump-aligned purpose. Safer, I suppose, to cut off any opening for funding EVs and hybrids.

The latest LPO rescissions add to the growing list of reasons the private sector has to be wary of the consistently inconsistent landscape for federal funding, Arun told me. He worries that slashing the LPO’s authority at the same time as there’s so much uncertainty around tax credit eligibility will lead some companies to forgo federal funding opportunities altogether.

“We’ll see if private developers even want to play around with the LPO,” Arun told me, “given the uncertainty around the rest of the federal landscape here.”

Electric vehicle batteries are more efficient at lower speeds — which, with electricity prices rising, could make us finally slow down.

The contours of a 30-year-old TV commercial linger in my head. The spot, whose production value matched that of local access programming, aired on the Armed Forces Network in the 1990s when the Air Force had stationed my father overseas. In the lo-fi video, two identical military green vehicles are given the same amount of fuel and the same course to drive. The truck traveling 10 miles per hour faster takes the lead, then sputters to a stop when it runs out of gas. The slower one eventually zips by, a mechanical tortoise triumphant over the hare. The message was clear: slow down and save energy.

That a car uses a lot more energy to go fast is nothing new. Anyone who remembers the 55 miles per hour national speed limit of the 1970s and 80s put in place to counter oil shortages knows this logic all too well. But in the time of electric vehicles, when driving too fast slashes a car’s range and burns through increasingly expensive electricity, the speed penalty is front and center again. And maybe that’s not a bad thing.

You certainly can notice the cost of lead-footedness in a gasoline-powered car. It’s simpler today, when lots of vehicles have digital displays that show the miles per gallon you’re getting, than in the old days when you had to do the math yourself. An EV puts the hard efficiency math right in front of you. Battery life is often displayed in terms of estimated miles of range remaining, and those miles evaporate before your eyes if you climb a mountain or accelerate like a drag racer.

This is no academic concern, like trying to boost one’s fuel efficiency through hypermiling techniques such as gentle acceleration, downhill coasting, and killing the AC. In six years of owning a Tesla Model 3, I’ve pushed its range limits trying to reach far-flung national parks and other destinations where fast chargers are scarce. I’ve found myself in numerous situations where I’ve set the cruise control at exactly the speed limit or slightly below to make sure the car would reach the one and only charging depot in the vicinity. For particularly close calls, I’ve puttered white-knuckled with one eye on Tesla’s in-car energy app — and felt my stomach drop when I found myself underperforming its expectations.

Fortunately, slow works. Three years ago I managed a comfortable round-trip from what was then the closest Tesla Supercharger to Crater Lake National Park by driving there down a 55-mile-per-hour two-lane highway; at freeway speed, my little battery probably wouldn’t have made it. Today, my fully charged Model 3 might make it something like 130 to 140 miles at interstate speed, depending on elevation. Go a little slower and it comes close to matching the 200 miles of supposed range.

Fear is the speed-killer, sure. The chance of being stranded with a dead battery is enough for any driver to be scared straight into observing the posted limit. But having all that data at the ready had already started to affect my driving habits even when there was no danger of stranding myself. It’s hard to watch the range drop when you slam the accelerator without thinking of the Interstellar meme about how much this little maneuver is going to cost us. With the price of electricity at the fast charger rising, I’m much more conscious of wasting a few kilowatt-hours by being in a hurry.

The difference is stunningly clear in the kind of controlled range tests that car sites and EV influencers have been conducting. For example, the State of Charge YouTube channel recently drove the Cadillac Escalade IQ, the fully electric version of the status SUV that is officially rated at 465 miles of range. Driven at exactly 70 miles per hour until it ran out of juice, the big EV exceeded that estimate by traveling 481 miles. With the speedometer held at 60 miles per hour, however, the vehicle went 607 miles — more than 100 miles more.

Granted, the Caddy’s comically large 205 kilowatt-hour battery — more than three times as big as the one in my little Tesla — does the lion’s share of the work in allowing it to go so very many miles. A peek into State of Charge’s data, though, makes it clear what 10 miles per hour can do. Dropping from 70 miles per hour to 60 caused the car’s miles per kilowatt-hour figure to rise from 2.1 to 2.6 or 2.7.

That’s not to say EV ownership turns every driver into an energy-obsessed hypermiler. One blessing of the huge batteries that go into Cadillac EVs and Rivians is freeing their drivers from some of the mental burden of range calculations. With driving ranges reaching well above 300 miles, you’re going to make it to the next plug even if you drive like a maniac.

Even so, the increased awareness of the cost of electricity might make some of us reconsider the casual speeding we all do just to take a few minutes off the trip. That’s a good thing for public safety: Big EV batteries make these vehicles heavier than other cars, on average, and thus potentially more dangerous in auto accidents. And slowing down will be especially relevant as electricity prices outpace inflation. Consumer electricity prices are up nearly 5% over last year and are poised to get worse: The budget reconciliation bill signed by President Trump last week won’t help, as one projection sees it leading to an increase in annual energy bills of up to $290 by 2035.

To be honest, the biggest problem of slowing down a little isn’t really the extra time it takes to get someplace. It’s trying to conserve in a world where 5 to 10 miles per hour over the speed limit is the expectation. I once had to cross 140 miles of wind-swept New Mexico expanse from Albuquerque to Gallup on a single charge, a task that required driving 55 miles per hour in a 65 zone of the interstate, holding on tight as semi trucks flew past me in revved aggravation. We made it. But if you really want to make your electrons go farther, then be prepared to become the target of road rage by the hasty and the aggrieved.