You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

Shares in Sunrun, SolarEdge, and Enphase are collapsing on the Senate’s new mega-bill draft.

The residential solar rescue never happened. Shares in several residential solar companies plummeted Tuesday as the market reacted to the Senate Finance Committee’s reconciliation language, which maintains the House bill’s restriction on investment tax credits for residential solar installers and its scrapping of the tax credit for homeowners who buy their own systems.

The Solar Energy Industries Association, a solar trade group, criticized the Senate text, saying that it had only “modest improvements on several provisions” and would “pull the plug on homegrown solar energy and decimate the American manufacturing renaissance.”

Sunrun shares fell 40% Tuesday, bringing the company’s market cap down by almost $900 million to $1.3 billion, a comparable loss in value to what it sustained the day after the passage of the House reconciliation bill. The stock price had jumped up late last week due to optimism that the Senate Finance bill might include friendlier language for its business model.

Instead the Finance Committee proposal would terminate the residential clean energy tax credit for any systems, including residential solar, six months after the bill is signed. The text also zeroes out investment and production tax credits for residential solar when “the taxpayer rents or leases such property to a third party,” a common arrangement in the industry pioneered by Sunrun.

Sunrun’s third party ownership model well predates the Inflation Reduction Act and is about as old as the company itself, which was founded in 2007. The company had been claiming investment tax credits for solar before the IRA made them tech neutral. The company began securitizing solar deals in 2015 and in a 2016 securities filling, the company said that it had six deals where investors would be able to garner the lease payments and investment tax credits.

“Ain’t no sunshine for resi,” Jefferies analyst Julien Dumoulin-Smith wrote in a note to clients on Tuesday. “Overall, we view Senate's version as a negative” for Sunrun, as well as SolarEdge and Enphase, the residential solar equipment companies, whose shares are down by about 33% and 24% respectively.

“If this language is not adjusted before the bill passes the Senate floor,” Morgan Stanley analyst Andrew Perocco wrote in a note to clients, “we believe Sunrun, SolarEdge, and Enphase will trade towards our bear cases.”

Morgan Stanley had earlier estimated that cutting off home solar from tax credits would lead to a “85% contraction in residential solar volumes” due, in many cases, to solar products no longer resulting in savings on electricity bills.

That’s because the ability to lease solar equipment (or have homeowners sign power purchase agreements) and then claim tax credits sits at the core of the contemporary residential solar model.

“Our core solar service offerings are provided through our lease and power purchase agreements,” the company said in its 2024 annual report. “While customers have the option to purchase a solar energy system outright from us, most of our customers choose to buy solar as a service from us through our Customer Agreements without the significant upfront investment of purchasing a solar energy system.”

This means that to claim tax credits for the projects, they have to be investment tax credits, not home energy credits. These credits play a role in Sunrun’s extensive business raising money from investors to finance solar projects, which can then be partially monetized via tax credits.

Fund investors “can receive attractive after-tax returns from our investment funds due to their ability to utilize Commercial ITCs,” the company said in its report. The financing then “enables us to offer attractive pricing to our customers for the energy generated by the solar energy system on their homes.”

Without the ability to claim investment tax credits, Sunrun could be left having to charge higher prices to homeowners and face a higher cost of capital to raise money from investors.

“Last night’s draft text confirms the Senate intends to abruptly repeal tax credits available to homeowners who want to go solar – effectively increasing costs and limiting choice for countless Americans,” Chris Hopper, chief executive of Aurora Solar, said in an emailed statement.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

On China’s rare earths, Bill Gates’ nuclear dream, and Texas renewables

Current conditions: Hurricane Melissa exploded in intensity over the warm Caribbean waters and has now strengthened into a major storm, potentially slamming into Cuba, the Dominican Republic, Haiti, and Jamaica as a Category 5 in the coming days • The Northeast is bracing for a potential nor’easter, which will be followed by a plunge in temperatures of as much as 15 degrees Fahrenheit lower than average • The northern Australian town of Julia Creek saw temperatures soar as high as 106 degrees.

Exxon Mobil filed a lawsuit against California late Friday on the grounds that two landmark new climate laws violate the oil giant’s free speech rights, The New York Times reported. The two laws would require thousands of large companies doing business in the state to calculate and report the greenhouse gas pollution created by the use of their products, so-called Scope 3 emissions. “The statutes compel Exxon Mobil to trumpet California’s preferred message even though Exxon Mobil believes the speech is misleading and misguided,” Exxon complained through its lawyers. California Governor Gavin Newsom’s office said the statutes “have already been upheld in court and we continue to have confidence in them.” He condemned the lawsuit, calling it “truly shocking that one of the biggest polluters on the planet would be opposed to transparency.”

China will delay introducing export controls on rare earths, an unnamed U.S. official told the Financial Times following two days of talks in Malaysia. For years, Beijing has been ratcheting up trade restrictions on the global supply of metals its industry dominates. But this month, China slapped the harshest controls yet on rare earths. In response, stocks in rare earth mining and refining companies soared. Despite what Heatmap’s Matthew Zeitlin called the “paradox of Trump’s critical mineral crusade” to mine even as he reduced demand from electric vehicle factories, “everybody wants to invest in critical minerals startups,” Heatmap’s Katie Brigham wrote. That — as frequent readers of this newsletter will recall — includes the federal government, which under the Trump administration has been taking equity stakes in major projects as part of deals for federal funding.

The Nuclear Regulatory Commission rewarded Bill Gates’ next-generation reactor company, TerraPower, with its final environment impact statement last week. The next step in the construction permit process is a final safety evaluation that the company expects to receive by the end of this year. If everything goes according to plan, TerraPower could end up winning the race to build the nation’s first commercial reactor to use a coolant other than water, and do so at a former coal-fired plant in the country’s top coal-producing state. “The Natrium plant in Wyoming, Kemmerer Unit 1, is now the first advanced reactor technology to successfully complete an environmental impact statement for the NRC, bringing us another step closer to delivering America’s next nuclear power plant,” said TerraPower president and CEO Chris Levesque.

A judge gave New York Governor Kathy Hochul’s administration until February 6 to issue rules for its long-delayed cap-and-invest program, the Albany Times-Union reported. The government was supposed to issue the guidelines that would launch the program as early as 2024, but continuously pushed back the release. “Early outlines of New York’s cap and invest program indicate that regulators were considering a relatively low price ceiling on pollution, making it easier for companies to buy their way out of compliance with the cap,” Heatmap’s Emily Pontecorvo wrote in January.

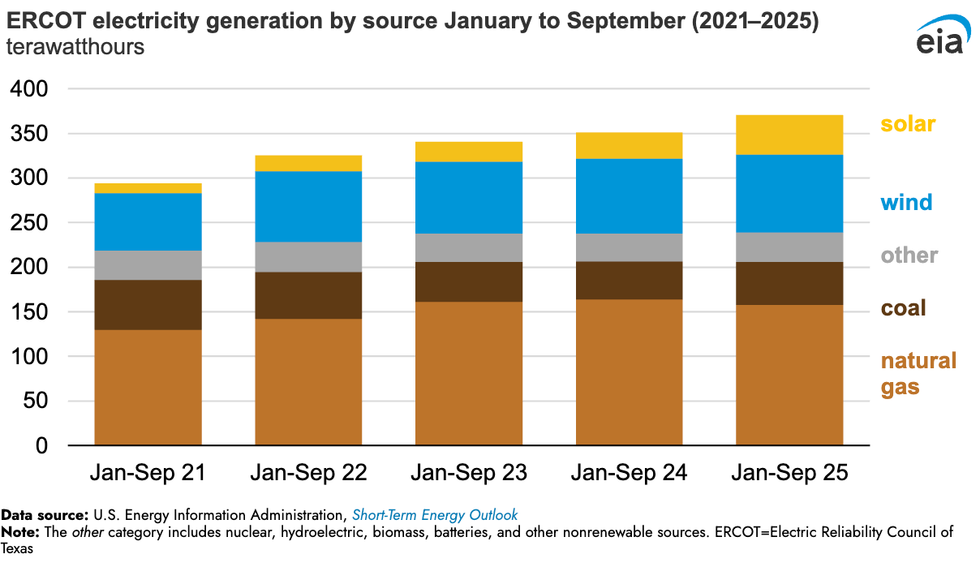

The Texas data center boom is being powered primarily with new wind, solar, and batteries, according to new analysis by the Energy Information Administration. Since 2021, electricity demand on the independent statewide grid operated by the Electric Reliability Council of Texas has soared. Over the past year, wind, solar, and batteries have been supplying that rising demand. Utility-scale solar generated 45 terawatt-hours of electricity in the first nine months of 2025. That’s 50% more than the same period in 2024 and nearly four times more than the same period in 2021. Wind generation, meanwhile, totaled 87 terawatt-hours for the first nine months of this year, up 4% from last year and 36% since 2021. “Together,” the analysis stated, “wind and solar generation met 36% of ERCOT’s electricity demand in the first nine months of 2025.”

The question isn’t whether the flames will come — it’s when, and what it will take to recover.

In the two decades following the turn of the millennium, wildfires came within three miles of an estimated 21.8 million Americans’ homes. That number — which has no doubt grown substantially in the five years since — represents about 6% of the nation’s population, including the survivors of some of the deadliest and most destructive fires in the country’s history. But it also includes millions of stories that never made headlines.

For every Paradise, California, and Lahaina, Hawaii, there were also dozens of uneventful evacuations, in which regular people attempted to navigate the confusing jargon of government notices and warnings. Others lost their homes in fires that were too insignificant to meet the thresholds for federal aid. And there are countless others who have decided, after too many close calls, to move somewhere else.

By any metric, costly, catastrophic, and increasingly urban wildfires are on the rise. Nearly a third of the U.S. population, however, lives in a county with a high or very high risk of wildfire, including over 60% of the counties in the West. But the shape of the recovery from those disasters in the weeks and months that follow is often that of a maze, featuring heart-rending decisions and forced hands. Understanding wildfire recovery is critical, though, for when the next disaster follows — which is why we’ve set out to explore the topic in depth.

The most immediate concerns for many in the weeks following a wildfire are financial. Homeowners are still required to pay the mortgage on homes that are nothing more than piles of ash — one study by the Federal Reserve Bank of Philadelphia found that 90-day delinquencies rose 4% and prepayments rose 16% on properties that were damaged by wildfires. Because properties destroyed in fires often receive insurance settlements that are lower than the cost to fully replace their home, “households face strong incentives to apply insurance funds toward the mortgage balance instead of rebuilding, and the observed increase in prepayment represents a symptom of broader frictions in insurance markets that leave households with large financial losses in the aftermath of a natural disaster,” the researchers explain.

Indeed, many people who believed they had adequate insurance only discover after a fire that their coverage limits are lower than 75% of their home’s actual replacement costs, putting them in the category of the underinsured. Homeowners still grappling with the loss of their residence and possessions are also left to navigate reams of required paperwork to get their money, a project one fire victim likened to having a “part-time job.” It’s not uncommon for fire survivors to wait months or even years for payouts, or to find that necessary steps to rebuilding, such as asbestos testing and dead tree removals, aren’t covered. Just last week, California Governor Gavin Newsom signed a new law requiring insurers to pay at least 60% of a homeowner’s personal property coverage on a total loss without a detailed inventory, up to $350,000. The original proposal called for a 100% payout, but faced intense insurance industry blowback .

Even if your home doesn’t burn to the ground, you might be affected by the aftermath of a nearby fire. In California, a fifth of homes in the highest-risk wildfire areas have lost insurance coverage since 2019, while premiums in those same regions have increased by 42%. Insurers’ jitters have overflowedspilled over into other Western states like Washington, where there are fewer at-risk properties than in California — 16% compared to 41% — but premiums have similarly doubled in some cases due to the perceived hazardrisks.

Some experts argue that people should be priced out of the wildland-urban interface and that managed retreat will help prevent future tragedies. But as I report in my story on fire victims who’ve decided not to rebuild, that’s easier said than done. There are only three states where insured homeowners have the legal right to replace a wildfire-destroyed home by buying a new property instead of rebuilding, meaning many survivors end up shackled to a property that is likely to burn again.

The financial maze, of course, is only one aspect of recovery — the physical and mental health repercussions can also reverberate for years. A study that followed survivors of Australia’s Black Saturday bush fires in 2009, which killed over 170 people, found that five years after the disaster, a fifth of survivors still suffered from “serious mental health challenges” like post-traumatic stress disorder. In Lahaina, two years after the fire, nearly half of the children aged 10 to 17 who survived are suspected of coping with PTSD.

Federal firefighting practices continue to focus on containing fires as quickly as possible, to the detriment of less showy but possibly more effective solutions such as prescribed burns and limits on development in fire-prone areas. Some of this is due to the long history of fire suppression in the West, but it persists due to ongoing political and public pressure. Still, you can find small and promising steps forward for forest management in places like Paradise, where the recreation and park district director has scraped together funds to begin to build a buffer between an ecosystem that is meant to burn and survivors of one of the worst fires in California’s history.

In the four pieces that follow, I’ve attempted to explore the challenges of wildfire recovery in the weeks and months after the disaster itself. In doing so, I’ve spoken to firefighters, victims, researchers, and many others to learn more about what can be done to make future recoveries easier and more effective.

The bottom line, though, is that there is no way to fully prevent wildfires. We have to learn to live alongside them, and that means recovering smarter, too. It’s not the kind of glamorous work that attracts TV cameras and headlines; often, the real work of recovery occurs in the many months after the fire is extinguished. But it also might just make the difference.

Wildfire evacuation notices are notoriously confusing, and the stakes are life or death. But how to make them better is far from obvious.

How many different ways are there to say “go”? In the emergency management world, it can seem at times like there are dozens.

Does a “level 2” alert during a wildfire, for example, mean it’s time to get out? How about a “level II” alert? Most people understand that an “evacuation order” means “you better leave now,” but how is an “evacuation warning” any different? And does a text warning that “these zones should EVACUATE NOW: SIS-5111, SIS-5108, SIS-5117…” even apply to you?

As someone who covers wildfires, I’ve been baffled not only by how difficult evacuation notices can be to parse, but also by the extent to which they vary in form and content across the United States. There is no centralized place to look up evacuation information, and even trying to follow how a single fire develops can require hopping among jargon-filled fire management websites, regional Facebook pages, and emergency department X accounts — with some anxious looking-out-the-window-at-the-approaching-pillar-of-smoke mixed in.

Google and Apple Maps don’t incorporate evacuation zone data. Third-party emergency alert programs have low subscriber rates, and official government-issued Wireless Emergency Alerts, or WEAs — messages that trigger a loud tone and vibration to all enabled phones in a specific geographic region — are often delayed, faulty, or contain bad information, none of which is ideal in a scenario where people are making life-or-death decisions. The difficulty in accessing reliable information during fast-moving disasters like wildfires is especially aggravating when you consider that nearly everyone in America owns a smartphone, i.e. a portal to all the information in the world.

So why is it still so hard to learn when and where specific evacuation notices are in place, or if they even apply to you? The answer comes down to the decentralized nature of emergency management in the United States.

A downed power line sparks a fire on a day with a Red Flag Warning. A family driving nearby notices the column of smoke and calls to report it to 911. The first responders on the scene realize that the winds are fanning the flames toward a neighborhood, and the sheriff decides to issue a wildfire warning, communicating to the residents that they should be ready to leave at a moment’s notice. She radios her office — which is now fielding multiple calls asking for information about the smoke column — and asks for the one person in the office that day with training on the alert system to compose the message.

Scenarios like these are all too common. “The people who are put in the position of issuing the messages are doing 20 other things at the same time,” Jeannette Sutton, a researcher at the University at Albany’s Emergency and Risk Communication Message Testing Lab, told me. “They might have limited training and may not have had the opportunity to think about what the messages might contain — and then they’re told by an incident commander, Send this, and they’re like, Oh my God, what do I do?”

The primary way of issuing wildfire alerts is through WEAs, with 78,000 messages sent since 2012. Although partnerships between local emergency management officials, the Federal Emergency Management Agency, the Federal Communications Commission, and cellular and internet providers facilitate the technology, it’s local departments that determine the actual content of the message. Messaging limits force some departments to condense the details of complicated and evolving fire events into 90 characters or fewer. Typos, confusing wording, and jargon inevitably abound.

Emergency management teams often prefer to err on the side of sending too few messages rather than too many for fear of inducing information overload. “We’re so attached to our devices, whether it’s Instagram or Facebook or text messages, that it’s hard to separate the wheat from the chaff, so to speak — to make sure that we are getting the right information out there,” John Rabin, the vice president of disaster management at the consulting firm ICF International and a former assistant administrator at the Federal Emergency Management Agency, told me. “One of the challenges for local and state governments is how to bring [pertinent information] up and out, so that when they send those really important notifications for evacuations, they really resonate.”

But while writing an emergency alert is a bit of an art, active prose alone doesn’t ensure an effective evacuation message.

California’s Cal Fire has found success with the “Ready, Set, Go” program, designed by the International Association of Fire Chiefs, which uses an intuitive traffic light framework — “ready” is the prep work of putting together a go-bag and waiting for more news if a fire is in the vicinity, escalating to the “go” of the actual evacuation order. Parts of Washington and Oregon use similar three-tiered systems of evacuation “levels” ranging from 1 to 3. Other places, like Montana, rely on two-step “evacuation warnings” and “evacuation orders.”

Watch Duty, a website and app that surged in popularity during the Los Angeles fires earlier this year, doesn’t worry about oversharing. Most information on Watch Duty comes from volunteers, who monitor radio scanners, check wildfire cameras, and review official law enforcement announcements, then funnel the information to the organization’s small staff, who vet it before posting. Though WatchDuty volunteers and staff — many of whom are former emergency managers or fire personnel themselves — actively review and curate the information on the app, the organization still publishes far more frequent and iterative updates than most people are used to seeing and interpreting. As a result, some users and emergency managers have criticized Watch Duty for having too much information available, as a result.

The fact that Watch Duty was downloaded more than 2 million times during the L.A. fires, though, would seem to testify to the fact that people really are hungry for information in one easy-to-locate place. The app is now available in 22 states, with more than 250 volunteers working around the clock to keep wildfire information on the app up to date. John Clarke Mills, the app’s CEO and co-founder, has said he created the app out of “spite” over the fact that the government doesn’t have a better system in place for keeping people informed on wildfires.

“I’ve not known too many situations where not having information makes it better,” Katlyn Cummings, the community manager at Watch Duty, told me. But while the app’s philosophy is “rooted in transparency and trust with our users,” Cummings stressed to me that the app’s volunteers only use official and public sources of information for their updates and never include hearsay, separating it from other crowd-sourced community apps that have proved to be less than reliable.

Still, it takes an army of a dozen full-time staff and over 200 part-time volunteers, plus an obsessively orchestrated Slack channel to centralize the wildfire and evacuation updates — which might suggest why a more official version doesn’t exist yet, either from the government or a major tech company. Google Maps currently uses AI to visualize the boundaries of wildfires, but stops short of showing users the borders of local evacuation zones (though it will route you around known road closures). A spokesperson for Google also pointed me toward a feature in Maps that shares news articles, information from local authorities, and emergency numbers when users are in “the immediate vicinity” of an actively unfolding natural disaster — a kind of do-it-yourself Watch Duty. The company declined to comment on the record about why Maps specifically excludes evacuation zones. Apple did not respond to a request for comment.

There is, of course, a major caveat to the usefulness of Watch Duty.

Users of the app tend to be a self-selecting group of hyper-plugged-in digital natives who are savvy enough to download it or otherwise know to visit the website during an unfolding emergency. As Rabin, the former FEMA official, pointed out, Watch Duty users aren’t the population that first responders are most concerned about — they’re like “Boy Scouts,” he said, because they’re “always prepared.” They’re the ones who already know what’s going on. “It’s reaching the folks that aren’t paying attention that is the big challenge,” he told me.

The older adult population is the most vulnerable in cases of wildfire. Death tolls often skew disproportionately toward the elderly; of the 30 people who died in the Los Angeles fires in January, for example, all but two were over 60 or disabled, with the average age of the deceased 77, the San Francisco Chronicle reported. Part of that is because adults 65 and older are more likely to have physical impairments that make quick or unplanned evacuations challenging. Social and technological isolation are also factors — yes, almost everyone in America has a smartphone, but that includes just 80% of those 65 and older, and only 26% of the older adult population feels “very confident” using computers or smartphones. According to an extensive 2024 report on how extreme weather impacts older adults by CNA, an independent, nonprofit research organization, “Evacuation information, including orders, is not uniformly communicated in ways and via media that are accessible to older adults or those with access and functional needs.”

Sutton, the emergency warning researcher, also cautioned that more information isn’t always better. Similar to the way scary medical test results might appear in a health portal before a doctor has a chance to review them with you (and calm you down), wildfire information shared without context or interpretation from emergency management officials means the public is “making assumptions based upon what they see on Watch Duty without actually having those official messages coming from the public officials who are responsible for issuing those messages,” she said. One role of emergency managers is to translate the raw, on-the-ground information into actionable guidance. Absent that filter, panic is probable, which could lead to uncontrollable evacuation traffic or exacerbate alert fatigue. Alternatively, people might choose to opt out of future alerts or stop checking for updates.

Sutton, though she’s a strong advocate of creating standardized language for emergency alerts — “It would be wonderful if we had consistent language that was agreed upon” between departments, she told me — was ultimately skeptical of centralizing the emergency alert system under a large agency like FEMA. “The movement of wildfires is so fast, and it requires knowledge of the local communities and the local terrain as well as meteorological knowledge,” she said. “Alerts and warnings really should be local.”

The greater emphasis, Sutton stressed, should be on providing emergency managers with the training they need to communicate quickly, concisely, and effectively with the tools they already have.

The high wire act of emergency communications, though, is that while clear and regionally informed messages are critical during life-or-death situations, it also falls on residents in fire-risk areas to be ready to receive them. California first adopted the “Ready, Set, Go” framework in 2009, and it has spent an undisclosed amount of money over the years on a sustained messaging blitz to the public. (Cal Fire’s “land use planning and public education budget is estimated at $16 million, and funds things like the updated ad spots it released as recently as this August.) Still, there is evidence that even that has not been enough — and Cal Fire is the best-resourced firefighting agency in the country, setting the gold standard for an evacuation messaging campaign.

Drills and test messages are one way to bring residents up to speed, but participation is typically very low. Many communities and residents living in wildfire-risk areas continue to treat the threat with low urgency — something to get around to one day. But whether they’re coming from your local emergency management department or the White House itself, emergency notices are only as effective as the public is willing and able to heed them.