You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

Where climate hawks meet China hawks.

Why are relations between China and the United States deteriorating? Why does the global outlook feel like it’s darkening? A few weeks ago, Brian Deese, President Biden’s former top economic aide, offered a theory on Shift Key, the podcast I cohost with Princeton engineering professor Jesse Jenkins.

We started by asking Deese whether the U.S. should import the cheap electric cars that Chinese companies are beginning to churn out by the millions.

He began by politely disputing the premise of our question. It was wrong to assume, he said, that China is a “market-based economy and a market-based actor.” It would even be wrong to assume we’re in “a balanced and sustainable global trading” system.

He continued:

In terms of the global trading system, we have this enormous imbalance because China has this enormous excess savings. And what they’re trying to do to try to solve the acute economic challenges that they face is to plow that into manufacturing with the explicit goal of trying to dominate — not just try to gain competitive edge, but dominate particular industries. And when they do that … they flood markets with cheap goods.

These “excess savings” impose their own burden on the United States, he said, so we can’t just accept the cheaper consumer goods and move on. “We, the recipient countries, end up paying a lot of the cost of those Chinese subsidies and those Chinese policies,” Deese said. “We end up paying by our own industries, our own capabilities being diminished and derogated in a way that they wouldn’t have that imbalance not existed.”

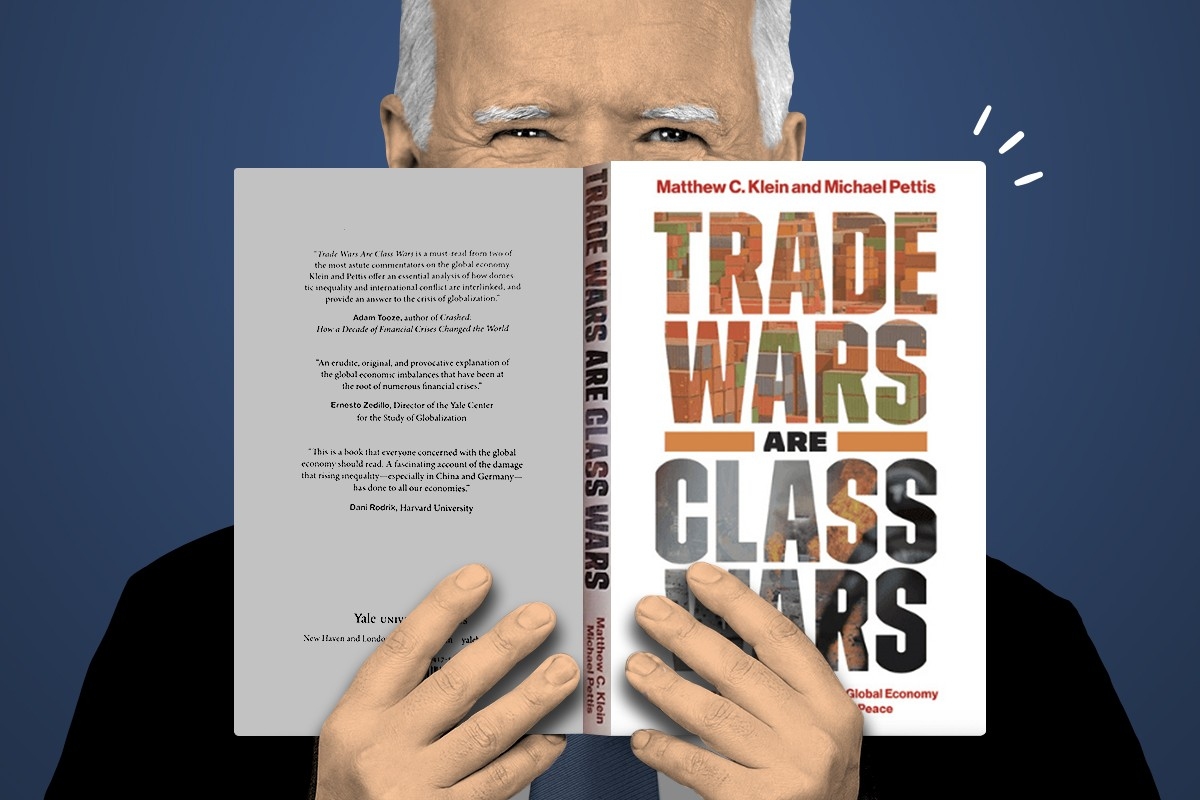

If these ideas seem to you to be coming out of nowhere, you are probably not alone. What could Chinese financial savings have to do with the success of its EV industry? But for people who have followed left-ish-wing arguments about trade and geopolitics over the past few years, what Deese is saying is immediately familiar. He is glossing a set of ideas argued most famously by the 2020 book Trade Wars Are Class Wars, by the finance professor Michael Pettis and the financial journalist Matthew C. Klein.

These ideas are widely understood in the world of heterodox economists who resist neoclassical approaches to the field but have received little airing in the broader press. Yet they are increasingly important to understanding how the Biden administration sees the world. As Dylan Matthews of Vox has noted, the Biden administration can sometimes seem like a perplexing alliance of left-wing economic thinkers and China hawks. The Klein-Pettis book is the intellectual mortar fusing those two camps.

The book’s argument is nuanced and wide-ranging, but here is a brief summary. The global economy, Klein and Pettis argue, suffers from a destabilizing and dangerous imbalance, which, if left unchecked, could spiral into a global war. The cause of this imbalance is that since 1991, a handful of countries — notably China and Germany — have passed policies that depress their workers’ wages. These actions have included higher taxes, welfare cuts, lower environmental standards, and sometimes open graft, but they all achieve the same end: They impose great costs on the working class, artificially suppressing citizens’ income and reducing their quality of life, to the benefit of each country’s industrial leaders.

This, the “class war” of the book’s title, has rippled across the global economy in several ways. It has, first, allowed China and some European countries to build up a disproportionately large share of the world’s manufacturing industries. Since workers there are paid so much less than they would be elsewhere, companies are happy to relocate their factories to profit from cheap costs and (in China) low environmental standards. But because Chinese and German workers are systematically underpaid, they cannot afford what they are producing, thus forcing other countries to buy their artificially cheap finished goods. These are the titular “trade wars.”

This is not the end of the story. According to Klein and Pettis, China’s “class war” policies — such as its hukou system, which has created a roving migrant class within the country who lack access to welfare benefits — has artificially enriched its wealthy elite. These industrialists, executives, and officials cannot spend their money as fast as they earn it, meaning that they must save it. Specifically, they seek to save it in U.S. dollars, the world’s reserve currency, snapping up dollar-denominated bonds, stocks, and mortgages. This, in turn, drives up asset prices and generates artificial credit bubbles in the United States and its ally countries, as the world’s extra cash seeks a productive outlet somewhere in the American economy. And because global demand for U.S. financial products pushes up the cost of a U.S. dollar, it makes any goods produced in America more expensive, which further dings the competitiveness of American manufacturers versus their Chinese or German peers.

In short, over the past few decades, “the world’s rich were able to benefit at the expense of the world’s workers and retirees because the interests of American financiers were complementary to the interests of Chinese and German industrialists,” Klein and Pettis write. But note that there is a destabilizing cyclical mechanic to this story too: As China takes more global manufacturing, its excess savings build up further, which slosh around the global economy and generate larger and larger credit bubbles.

This is what Deese was referring to when he condemned China’s “enormous excess savings,” and this is why he identifies those savings as a key driver of China’s manufacturing boom. In the Klein-Pettis worldview, the underlying cause of the destructive tendency in the global economy is the way that its economy systematically steals from the poor and enriches the wealthy. As Deese told us:

China needs to decide if it loves this unsustainable, unbalanced, in many cases, illegal manufacturing strategy more than it hates the kind of domestic reforms it would actually need to take to boost domestic consumption, produce more balanced growth as it becomes a more mature economy.

This intellectual strain has long been present in the Biden administration’s thinking, but recently it has taken on a new prominence. On Wednesday, Treasury Secretary Janet Yellen warned China against flooding global markets with cheap green technology exports while speaking at a Georgia solar factory. “China’s overcapacity distorts global prices and production patterns and hurts American firms and workers, as well as firms and workers around the world,” she said.

Biden himself has even begun to sound this note. You can see the soft influence of Trade Wars thinking in his promise that Chinese electric vehicles will not overwhelm American automakers. “China is determined to dominate the future of the auto market, including by using unfair practices,” he said in a statement last month. “I’m not going to let that happen on my watch.”

For Klein and Pettis, and presumably for the Biden administration, these “unfair practices” can be relieved only by China allowing the consumption share of its economy to rise. They argue that China must stop plowing money into unsustainable investment projects and instead allow its economy to be piloted by consumers, not party officials.

That this would require revising the country’s political system, which concentrates power in the hands of the economic elite, is what makes it so unlikely. On the other hand, if China fails to reform its system, then the consequences could be even more painful: Klein and Pettis suggest that a similar dynamic among the late-19th century Great Powers led to World War I.

Ultimately, Trade Wars Are Class Wars does not predict what will happen. The authors are clear that America’s and China’s economic growth are not necessarily in conflict; only the current dynamic makes it seem so. But the book also suggests a few ideas that it does not fully articulate — presumably because Pettis, who is a professor at Peking University, lives in Beijing.

The biggest of these is that China’s political economy could metastasize into far more malign forms than it holds today. If you think about a country’s politics and economy as necessarily growing and changing together — its politics taking a form that its economics can tolerate, and vice versa — then China’s politics and economy are not necessarily destined to grow along a consumer-friendly path. Today, China produces more solar panels and electric cars than it can consume, and it must find a way to get rid of them. But there are other lines of business — and political styles — that have a demonically self-disposing tendency.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

On the real copper gap, Illinois’ atomic mojo, and offshore headwinds

Current conditions: The deadliest avalanche in modern California history killed at least eight skiers near Lake Tahoe • Strong winds are raising the wildfire risk across vast swaths of the northern Plains, from Montana to the Dakotas, and the Southwest, especially New Mexico, Texas, and Oklahoma • Nairobi is bracing for days more of rain as the Kenyan capital battles severe flooding.

Last week, the Environmental Protection Agency repealed the “endangerment finding” that undergirds all federal greenhouse gas regulations, effectively eliminating the justification for curbs on carbon dioxide from tailpipes or smokestacks. That was great news for the nation’s shrinking fleet of coal-fired power plants. Now there’s even more help on the way from the Trump administration. The agency plans to curb rules on how much hazard pollutants, including mercury, coal plants are allowed to emit, The New York Times reported Wednesday, citing leaked internal documents. Senior EPA officials are reportedly expected to announce the regulatory change during a trip to Louisville, Kentucky on Friday. While coal plant owners will no doubt welcome less restrictive regulations, the effort may not do much to keep some of the nation’s dirtiest stations running. Despite the Trump administration’s orders to keep coal generators open past retirement, as Heatmap’s Matthew Zeitlin wrote in November, the plants keep breaking down.

At the same time, the blowback to the so-called climate killshot the EPA took by rescinding the endangerment finding has just begun. Environmental groups just filed a lawsuit challenging the agency’s interpretation of the Clean Air Act to cover only the effects of regional pollution, not global emissions, according to Landmark, a newsletter tracking climate litigation.

Copper prices — as readers of this newsletter are surely well aware — are booming as demand for the metal needed for virtually every electrical application skyrockets. Just last month, Amazon inked a deal with Rio Tinto to buy America’s first new copper output for its data center buildout. But new research from a leading mineral supply chain analyst suggests the U.S. can meet 145% of its annual demand using raw copper from overseas and domestic mines and from scrap. By contrast, China — the world’s largest consumer — can source just 40% of its copper that way. What the U.S. lacks, according to Benchmark Mineral Intelligence, is the downstream processing capacity to turn raw copper into the copper cathode manufacturers need. “The U.S. is producing more copper than it uses, and is far more self-reliant than China in terms of raw materials,” Benchmark analyst Albert Mackenzie told the Financial Times. The research calls into question the Trump administration’s mineral policy, which includes stockpiling copper from jointly-owned ventures in the Democratic Republic of the Congo and domestically. “Stockpiling metal ores doesn’t help if you don’t have midstream processing,” Stephen Empedocles, chief executive of US lobbying firm Clark Street Associates, told the newspaper.

Illinois generates more of its power from nuclear energy than any other state. Yet for years the state has banned construction of new reactors. Governor JB Pritzker, a Democrat, partially lifted the prohibition in 2023, allowing for development of as-yet-nonexistent small modular reactors. With excitement about deploying large reactors with time-tested designs now building, Pritzker last month signed legislation fully repealing the ban. In his state of the state address on Wednesday, the governor listed the expansion of atomic energy among his administration’s top priorities. “Illinois is already No. 1 in clean nuclear energy production,” he said. “That is a leadership mantle that we must hold onto.” Shortly afterward, he issued an executive order directing state agencies to help speed up siting and construction of new reactors. Asked what he thought of the governor’s move, Emmet Penney, a native Chicagoan and nuclear expert at the right-leaning Foundation for American Innovation, told me the state’s nuclear lead is “an advantage that Pritzker wisely wants to maintain.” He pointed out that the policy change seems to be copying New York Governor Kathy Hochul’s playbook. “The governor’s nuclear leadership in the Land of Lincoln — first repealing the moratorium and now this Hochul-inspired executive order — signal that the nuclear renaissance is a new bipartisan commitment.”

The U.S. is even taking an interest in building nuclear reactors in the nation that, until 1946, was the nascent American empire’s largest overseas territory. The Philippines built an American-made nuclear reactor in the 1980s, but abandoned the single-reactor project on the Bataan peninsula after the Chernobyl accident and the fall of the Ferdinand Marcos dictatorship that considered the plant a key state project. For years now, there’s been a growing push in Manila to meet the country’s soaring electricity needs by restarting work on the plant or building new reactors. But Washington has largely ignored those efforts, even as the Russians, Canadians, and Koreans eyed taking on the project. Now the Trump administration is lending its hand for deploying small modular reactors. The U.S. Trade and Development Agency just announced funding to help the utility MGEN conduct a technical review of U.S. SMR designs, NucNet reported Wednesday.

Sign up to receive Heatmap AM in your inbox every morning:

Despite the American government’s crusade against the sector, Europe is going all in on offshore wind. For a glimpse of what an industry not thrust into legal turmoil by the federal government looks like, consider that just on Wednesday the homepage of the trade publication OffshoreWIND.biz featured stories about major advancements on at least three projects totaling nearly 5 gigawatts:

That’s not to say everything is — forgive me — breezy for the industry. Germany currently gives renewables priority when connecting to the grid, but a new draft law would give grid operators more discretion when it comes to offshore wind, according to a leaked document seen by Windpower Monthly.

American clean energy manufacturing is in retreat as the Trump administration’s attacks on consumer incentives have forced companies to reorient their strategies. But there is at least one company setting up its factories in the U.S. The sodium-ion battery startup Syntropic Power announced plans to build 2 gigawatts of storage projects in 2026. While the North Carolina-based company “does not reveal where it manufactures its battery systems,” Solar Power World reported, it “does say” it’s establishing manufacturing capacity in the U.S. “We’re making this move now because the U.S. market needs storage that can be deployed with confidence, supported by certification, insurance acceptance, and a secure domestic supply chain,” said Phillip Martin, Syntropic’s chief executive.

For years now, U.S. manufacturers have touted sodium-ion batteries as the next big thing, given that the minerals needed to store energy are more abundant and don’t afford China the same supply-chain advantage that lithium-ion packs do. But as my colleague Katie Brigham covered last April, it’s been difficult building a business around dethroning lithium. New entrants are trying proprietary chemistries to avoid the mistakes other companies made, as Katie wrote in October when the startup Alsym launched a new stationary battery product.

Last spring, Heron Power, the next-generation transformer manufacturer led by a former Tesla executive, raised $38 million in a Series A round. Weeks later, Spain’s entire grid collapsed from voltage fluctuations spurred by a shortage of thermal power and not enough inverters to handle the country’s vast output of solar power — the exact kind of problem Heron Power’s equipment is meant to solve. That real-life evidence, coupled with the general boom in electrical equipment, has clearly helped the sales pitch. On Wednesday, the company closed a $140 million Series B round co-led by the venture giants Andreessen Horowitz and Breakthrough Energy Ventures. “We need new, more capable solutions to keep pace with accelerating energy demand and the rapid growth of gigascale compute,” Drew Baglino, Heron’s founder and chief executive, said in a statement. “Too much of today’s electrical infrastructure is passive, clunky equipment designed decades ago. At Heron we are manifesting an alternative future, where modern power electronics enable projects to come online faster, the grid to operate more reliably, and scale affordably.”

A senior scholar at Columbia University’s Center on Global Energy Policy on what Trump has lost by dismantling Biden’s energy resilience strategy.

A fossil fuel superpower cannot sustain deep emissions reductions if doing so drives up costs for vulnerable consumers, undercuts strategic domestic industries, or threatens the survival of communities that depend on fossil fuel production. That makes America’s climate problem an economic problem.

Or at least that was the theory behind Biden-era climate policy. The agenda embedded in major legislation — including the Infrastructure Investment and Jobs Act and the Inflation Reduction Act — combined direct emissions-reduction tools like clean energy tax credits with a broader set of policies aimed at reshaping the U.S. economy to support long-term decarbonization. At a minimum, this mix of emissions-reducing and transformation-inducing policies promised a valuable test of political economy: whether sustained investments in both clean energy industries and in the most vulnerable households and communities could help build the economic and institutional foundations for a faster and less disruptive energy transition.

Sweeping policy reversals have cut these efforts short. Abandoning the strategy makes the U.S. economy less resilient to the decline of fossil fuels. It also risks sowing distrust among communities and firms that were poised to benefit, complicating future efforts to recommit to the economic policies needed to sustain an energy transition.

This agenda rested on the idea that sustaining decarbonization would require structural changes across the economy, not just cleaner sources of energy. First, in a country that derives substantial economic and geopolitical power from carbon-intensive industries, a durable energy transition would require the United States to become a clean energy superpower in its own right. Only then could the domestic economy plausibly gain, rather than lose, from a shift away from fossil fuels.

Second, with millions of households struggling to afford basic energy services and fossil fuels often providing relatively cheap energy, climate policy would need to ensure that clean energy deployment reduces household energy burdens rather than exacerbates them.

Third, policies would need to strengthen the economic resilience of communities that rely heavily on fossil fuel industries so the energy transition does not translate into shrinking tax bases, school closures, and lost economic opportunity in places that have powered the country for generations.

This strategy to reshape the economy for the energy transition has largely been dismantled under President Trump.

My recent research examines federal support for fossil fuel-reliant communities, assessing President Biden’s stated goal of “revitalizing the economies of coal, oil, gas, and power plant communities.” Federal spending data provides little evidence that these at-risk communities have been effectively targeted. One reason is timing: While legislation authorized unprecedented support, actual disbursements lagged far behind those commitments.

Many of the key policies — including $4 billion in manufacturing tax credits reserved for communities affected by coal closures — took years to move from statutory language to implementation guidance and final project selection. As a result, aside from certain pandemic-era programs, fossil fuel-reliant communities had received limited support by the time Trump took office last year.

Since then, the Trump administration and Congress have canceled projects intended to benefit fossil fuel-reliant regions, including carbon capture and clean hydrogen demonstrations, and discontinued programs designed to help communities access and implement federal funding.

Other elements of the strategy to reduce the country’s vulnerability to fossil fuel decline have fared even worse under the Trump administration. Programs intended to help households access and afford clean energy — most notably the $27 billion Greenhouse Gas Reduction Fund — were effectively canceled last year, including attempts to claw back previously awarded funds. More broadly, the rollback of IRA programs with an explicit equity or justice focus leaves lower-income households more exposed to the economic disruptions that can accompany an energy transition.

By contrast, subsidies and grant programs aimed at strengthening the country’s energy manufacturing base have largely survived, including tax credits supporting domestic production of batteries, solar components, and other key technologies. Even so, the investment environment has weakened. Automakers have scaled back planned U.S. battery manufacturing expansions. Clean Investment Monitor data shows annual clean energy manufacturing investments on pace to decline in 2025, after rising sharply from 2022 to 2024. Whatever one believed about the potential to build globally competitive domestic supply chains for the technologies that will power clean energy systems, those prospects have dimmed amid slowing investment and the Trump administration’s prioritization of fossil fuels.

Perhaps these outcomes were unavoidable. Building a strong domestic solar industry was always uncertain, and place-based economic development programs have a mixed track record even under favorable conditions. Still, the Biden-era approach reflected a coherent theory of climate politics that warranted a real-world test.

Over the past year, debates in climate policy circles have centered on whether clean energy progress can continue under less supportive federal policies, with plausible cases made on both sides. The fate of Biden’s broader economic strategy to sustain the energy transition, however, is less ambiguous. The underlying dependence of the United States on fossil fuels across industries, households, and many local communities remains largely unchanged.

New data from the Clean Investment Monitor shows the first year-over-year quarterly decline since the project began.

Investment in the clean economy is flagging — and the electric vehicle supply chain is taking the biggest hit.

The Clean Investment Monitor, a project by the Rhodium Group and the Massachusetts Institute of Technology’s Center for Energy and Environmental Policy Research that tracks spending on the energy transition, found that total investment in clean technology in the last three months of 2025 was $60 billion. That compares to $68 billion in the fourth quarter of 2024 and $79 billion in the third quarter of last year. While total clean investment in 2025 was $277 billion — the highest the group has ever recorded — the fourth quarter of 2025 was the first time since the Clean Investment Monitor began tracking that the numbers fell compared to the same quarter the year before.

“Since 2019, quarterly investment has surpassed the level observed in the same period of the previous year — even when quarter-on-quarter declines occurred,” the report says. “That trend ended in Q4 2025, when investment declined 11% from the level observed in Q4 2024.”

It starts downstream, with consumer purchases of clean energy technology once favored by federal tax policy: electric vehicles, heat pumps, and home electricity generation. Consumer purchases fell 36% from the third quarter to the fourth quarter, after the $7,500 federal EV credit expired on September 30.

With a consumer market for EVs being undercut, car companies responded by canceling projects and redirecting investment.

“There were a lot of big, multi-billion dollar cancellations coming from Ford specifically,” Harold Tavarez, a research analyst at Rhodium, told me. There’s been a lot of pivots from having fully electric vehicles to doing more hybrids, more internal combustion, and even extended range EVs.”

Ford alone took an almost $20 billion hit on its EV investments in 2025. The company suspended production of its all-electric F-150 Lightning late last year, despite its status as the best-selling electric pickup in the country for 2025, and announced a pivot into hybrids and extended-range EVs (which have gasoline-powered boosters onboard), including a revamped Lightning. It has also announced plans to convert some manufacturing facilities designed to produce EVs back into internal combustion plants, but it hasn’t abandoned electricity entirely. Other decommissioned EV factories will instead produce battery electric storage systems, and the company has announced a pivot to smaller, cheaper EVs.

Ford is far from alone in its EV-related pain, however. Rival Big Three automaker GM also booked $6 billion in losses for 2025, while Stellantis, the European parent company of the Chrysler, Dodge, and Jeep brands, will take as much as $26 billion in charges. EV sales fell some 46% in the fourth quarter of last year compared to the third quarter, and 36% compared to the fourth quarter of 2024, according to Cox Automotive.

Looking at the investment data holistically, the true dramatic decline was in forward-looking announcements, again heavily concentrated in the EV supply chain. The $3 billion in clean manufacturing announced in the fourth quarter of last year was an almost 50% drop from the previous quarter, “marking this quarter as the lowest period of announcements since Q4 2020,” the report says. Announcements were down about 25% for the year as a whole compared to 2024. Of the $29 billion of canceled projects Clean Investment Monitor tracked from 2018 through the end of last year, almost three quarters — some $23 billion — happened in 2025.

“Collectively, we estimate around 27,000 operational jobs in the manufacturing segment were affected by cancellations,” the report says, “two-thirds (68%) of which were tied to projects canceled in 2025.”

“One of the most frustrating parts of watching Trump wage war on all things clean energy is the apparent lack of understanding — or care — of how it impacts his stated goals,” Alex Jacquez, a former Biden economic policy official who is chief of policy and advocacy at the Groundwork Collective, told me. “The IRA built a real, competitive manufacturing base in the U.S. in a new sector for the first time in decades. Administration priorities are being hampered by blind opposition to anything Biden, IRA, or clean energy.”