You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

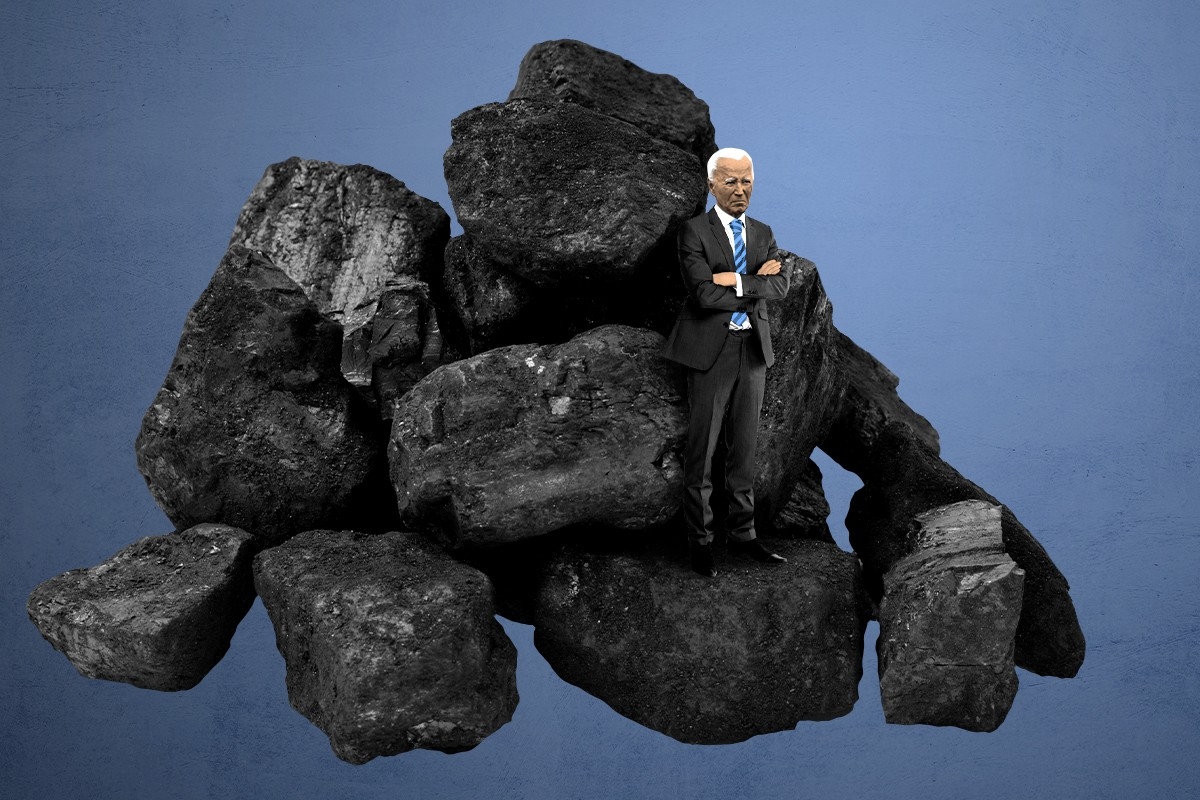

The end has been coming for a while. With the EPA’s new power plant emissions rules, though, it’s gotten a lot closer.

There’s no question that coal is on its way out in the U.S. In 2001, coal-fired power plants generated about 50% of U.S. electricity. Last year, they were down to about 15%.

On Thursday, however, the Biden administration arguably delivered a death blow. New carbon emission limits for coal plants establish a clear timeline by which America’s remaining coal generators must either invest in costly carbon capture equipment or close. With many of these plants already struggling to compete with cheaper renewables and natural gas, it’s not likely to be much of a choice. If the rule survives legal challenges, the nation’s coal fleet could be extinct by 2039.

Coal plant retirement presents a two-pronged problem: Utilities have to figure out how to replace lost power generation, and the surrounding community must reckon with the lost tax revenue and jobs from the power plants and the coal mines that supplied them.

From the beginning, Biden has promised to help revitalize the economies of the communities left in coal’s wake. “We’re never going to forget the men and women who dug the coal and built the nation,” he said when he laid out his energy transition plan just a week after entering office. “We’re going to do right by them.”

Economic revitalization doesn’t happen overnight, of course, or even in the span of a four-year term. But money is already rolling out in the form of targeted investments in new energy sources, businesses, and jobs in coal communities, and there’s more to come.

It’s the proactive planning aspect, however, that remains underresourced and scattershot.

Emily Grubert, a civil engineer and sociologist at the University of Notre Dame, told me there are few plants that are expected to make it past 2039 regardless, due to their age and the economics of operating them. The emissions rule’s real potential, then, is to bring about a more orderly — and potentially less painful — exit.

A Heatmap analysis of Energy Information Administration data found that of the nation’s roughly 230 remaining coal plants, 38 are scheduled to fully shut down by 2032. These plants won’t have to make any changes under the new rule. An additional five will shutter by 2039. These will be required to reduce their emissions in the interim, beginning in 2030, by replacing some of the coal they burn with natural gas. That leaves about 190 plants with either partial retirement plans or no plans at all that will be forced to make a decision between carbon capture and shutting down.

Grubert told me that many of these plants have, in fact, communicated informal plans to shut down that are not recorded in the federal data. That aside, she called it “amazing” how many have no retirement plans at all.

For surrounding communities, an impending coal transition can look really different in different places, depending on geography and how diverse the local economy is. Still, the first step should be the same everywhere. “What you need to do, really practically, is figure out what that plant is supporting,” Grubert told me. “What needs to be replaced, for whom, and by when?

It’s a lot more concrete than it seems: It’s some specific number of people, it’s some specific amount of tax revenue. It’s much easier to move forward once you actually know what those are.”

How much of that work has been done so far depends, in part, on the state. Some, like Colorado, New Mexico, and Illinois, have established new positions or entirely new offices dedicated to helping communities transition off fossil fuels. But other states, like Wyoming and Ohio, have advanced measures to keep coal plants open as long as possible.

Successful planning also depends on how clearly a retirement date is articulated and stuck to, Jeffrey Jacquet, an associate professor of rural sociology at Ohio State University who leads a multidisciplinary research project on coal communities there, told me. Some communities have been told one date and then been blindsided when a plant has been forced to shut down years earlier for economic reasons. He noted one success story in Shadyside, Ohio, where the local school board was able to negotiate a deal to slowly step down its tax collections over four years after learning the RE Burger coal plant was going to close. “Had they not weaned us off losing that tax revenue, we would have been in terrible shape,” a school board administrator told a student on Jacquet’s project. “Fiscally we’re pretty good on solid ground now, but at one point it was an extremely bleak time.”

The new power plant rule could help address some of these problems by putting the entire country on the same set timeline, forcing plant operators to put retirement dates in writing. There’s still a risk some will fail early, in unforeseen ways, but at least communities will have been put on notice.

Those who go looking for help will find ample resources. When I started looking into all of the programs that exist to bring investment into coal communities, or otherwise help them diversify their economies, I was surprised at how much investment in coal communities had already been set in motion:

This list is far from comprehensive. In fact, there are so many programs, it’s kind of a problem.

“So much of it comes down to the local capacity to take advantage of these opportunities,” Jacquet told me. “A lot of these communities are losing population, they’re facing out-migration. Community leaders are already overworked and overstressed.” (Possible case in point: I reached out to several local groups doing coal transition work in West Virginia and Kentucky for this story, and wasn’t able to get anyone on the phone.)

This isn’t a new problem, per se. The federal government had dozens of programs and pots of money set aside for rural economic development before the Biden administration came into the White House, but they were scattered across different agencies and departments within those agencies, making it difficult for any overworked, overstressed town manager to know where to start.

Jeremy Richardson, a manager of the carbon-free electricity program at the think tank RMI, told me he was involved in a group that pitched policies to the incoming president that would help ease the process. “It shouldn’t be on the community to navigate the entire federal bureaucracy to figure out what they qualify for,” he said.

Biden took the note. In his first climate executive order, he established the Interagency Working Group on Coal and Power Plant Communities and Economic Revitalization, which is building tools to help companies and local governments identify funding opportunities. Its “getting started guide,” which Richardson called a “fantastic piece of work,” walks communities and workers through 10 concrete steps, from identifying needs to developing a transition strategy to finding funding and implementing a project, with curated resources for each step. The group also established four “rapid response” teams to provide more targeted assistance to communities in areas with the highest loss of coal assets.

Jacquet summed up the group’s work as “hand holding,” stressing that it still required people at the local level that were willing and able to take advantage of these services. “I think we’re sort of seeing this phenomenon where the communities that are already best positioned to take advantage of these are going to be the ones that take advantage of it,” he said.

There are other limitations to the broader suite of federal assistance programs. For instance, even if a community is able to attract a big manufacturing project, there may be a several-years gap between the coal plant closing and the new job opportunities and local tax revenue manifesting.

That’s why the coordination efforts in states like Colorado, which was the first to establish an Office of Just Transition in 2019, are so promising. The office has a small staff of six, and a meager budget of $15 million, but is making progress by focusing on highly targeted assistance. In the town of Craig, two nearby coal-fired power plants are scheduled to retire over the next four years and four coal mines will shutter by 2030, taking with them 900 jobs and about 45% of the county’s tax revenue. A new “transition navigator” hired in January will help match the town’s needs with federal and state funding opportunities and serve as a central point of contact for coal workers and their families seeking connection to services.

“I think it’s been really helpful,” said Richardson. “They’ve had long conversations — several years of conversations — with those communities in northwest Colorado that are facing closures soon.” The office was controversial at first. Republicans called it “Orwellian” and unanimously opposed it. But in the years since, some of its staunchest critics have become its biggest champions. “To me that says that they’re doing some good work and they’re making some inroads.”

There’s progress on the energy side, too. RMI is pushing a model called “clean repowering,” enabled by a suite of IRA incentives that offer tax credits and loan guarantees for clean energy projects in fossil fuel communities. The idea is that renewable energy projects can get around the yearslong bottleneck of connecting to the grid by building in close proximity to existing fossil fuel plants. A lot of these plants have “spare” interconnection rights that a solar or wind farm could use to connect a lot sooner.

RMI found 250 gigawatts of spare rights available — which is more than the capacity of the entire existing coal fleet. “If you can build a renewable facility alongside where that fossil plant is, maybe you use the fossil plant a little less because it’s cheaper to generate from the renewables, but you know, you don’t have to close it immediately,” said Richardson.

As Daniel Raimi, a fellow at Resources for the Future, told me, even though the coal transition has been in motion for decades, it’s still early. There hasn’t been enough research. Much of the funding and programs are new. No one really knows yet what’s working, or what could work better.

The only thing that’s clear, he said, is that if these communities are going to develop alternative economic futures, they really need to begin that process now.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

The administration has yet to publish formal documentation of its decision, leaving several big questions unanswered.

President Trump announced on Thursday that he was repealing the Environmental Protection Agency’s scientific determination that greenhouse gases are dangerous to human health and the natural world.

The signal move would hobble the EPA’s ability to limit heat-trapping pollution from cars, trucks, power plants, and other industrial facilities. It is the most aggressive attack on environmental regulation that the president and his officials have yet attempted.

The move, which was first proposed last summer, has major legal implications. But its importance is also symbolic: It brings the EPA’s official view of climate change much closer to President Trump’s false but long-held claim that anthropogenic global warming — which scientists have long affirmed as a major threat to public health and the environment — is in fact a “con job,” “a hoax,” and a “scam.”

While officials in the first Trump administration frequently sought to undermine climate regulation, arguing that the government’s climate rules were unnecessary or a waste of time and money, they did not formally try to undo the agency’s scientific determination that heat-trapping pollution was dangerous.

The move is only the most recent of a long list of attacks on environmental protections — including the partial rollback of the country’s first climate law, the Inflation Reduction Act, enacted last summer — that Trump and congressional Republicans have overseen since taking office last January.

Several environmental and public health organizations, including the American Lung Association and the Environmental Defense Fund, have vowed to challenge the move in court. The EPA has not yet published the legal documents formalizing the repeal.

Here is what we know — and don’t know — about the repeal for now:

Startups Airloom and Radia looked at the same set of problems and came up with very different solutions.

You’d be forgiven for assuming that wind energy is a technologically stagnant field. After all, the sleek, three-blade turbine has defined the industry for nearly half a century. But even with over 1,000 gigawatts of wind generating capacity installed worldwide, there’s a group of innovators who still see substantial room for improvement.

The problems are myriad. There are places in the world where the conditions are too windy and too volatile for conventional turbines to handle. Wind farms must be sited near existing transportation networks, accessible to the trucks delivering the massive components, leaving vast areas with fantastic wind resources underdeveloped. Today’s turbines have around 1,500 unique parts, and the infrastructure needed to assemble and stand up a turbine’s multi-hundred-foot tower and blades is expensive— giant cranes don’t come cheap.

“We’ve only really ever tried one type of technology,” Neil Rickner, the CEO of the wind power startup Airloom Energy, told me. Now, he’s one of a few entrepreneurs trying a new approach.

Airloom’s system uses much-shorter vertical blades attached to an oval track that resembles a flat rollercoaster — no climbs or drops, just a horizontal loop composed of 58 unique parts. Wind propels the blades around the track, turning a vertical shaft that’s connected to an electricity-producing generator. That differs from conventional turbines, which spin on a vertical plane around a horizontal shaft, like a ferris wheel.

The system is significantly lower to the ground than today’s turbines and has the ability to capture wind from any direction, unlike conventional turbines, allowing for deployment in areas with shifting wind patterns. It promises to be mass manufacturable, cheap, and simple to transport and install, opening up the potential to build systems in a wider variety of geographies — everywhere from airports to remote or even mountainous regions.

Airloom’s CTO, Andrew Street, brings a background in drone tech that Rickner said helped shape the architecture of Airloom’s blades. “It’s all known tech. And it’s not completely off the shelf, but Andrew’s done it on 17 other platforms,” he told me. Rickner himself spent years at GoogleX working on Makani, a now-defunct wind energy project that attempted to commercialize an airborne wind energy system. The concept involved attaching rotors to autonomous kites, which flew in high-altitude loops to capture wind energy.

That system ultimately proved too complicated, something Airloom’s founder Robert Lumley warned Rickner about a decade ago at an industry conference. As Rickner recalls, he essentially told him, “all of that flying stuff is too complicated. Put all that physics — which is great — put it on the ground, on a rail.” Rickner took the lesson to heart, and when Lumley recruited him to join Airloom’s team a few years ago, he said it felt like an ideal chance to apply all the knowledge he’d accumulated “around what it takes to bring a novel wind technology to a very stodgy market.”

Indeed, the industry has proven difficult to disrupt. While Airloom was founded in 2014, the startup is still in its early stages, though it’s attracted backing from some climate sector heavyweights. Lowercarbon Capital led its $7.5 million seed round in 2024, which also included participation from Breakthrough Energy Ventures. The company also secured $5 million in matching funds from the state of Wyoming, where it’s based, and a $1.25 million contract with the Department of Defense.

Things are moving now. In the coming months, Airloom is preparing to bring its pilot plant online in Wyoming, closely followed by a commercial demo. Rickner told me the plan is to begin construction on a commercial facility by July 4, the deadline for wind to receive federal tax credits.

“If you could just build wind without gigantic or heavy industrial infrastructure — cranes and the like —- you will open up huge parts of the world,” Rickner told me, citing both the Global South and vast stretches of rural America as places where the roads, bridges, cranes, and port infrastructure may be insufficient for transporting and assembling conventional turbines. While modern onshore installations can exceed 600 feet from the tower’s base to the blade’s tip, Airloom’s system is about a fifth that height. Its nimble assembly would also allow turbines to be sited farther from highways, potentially enabling a more “out of sight, out of mind” attitude among residents and passersby who might otherwise resist such developments.

The company expects some of its first installations to be co-located with — you guessed it — data centers, as tech giants are increasingly looking to circumvent lengthy grid interconnection queues by sourcing power directly from onsite renewables, an option Rickner said wasn’t seriously discussed until recently.

Even considering Trump’s cuts to federal incentives for wind, “I’d much rather be doing Airloom today than even a year ago,” Rickner told me. “Now, with behind-the-meter, you’ve got different financing options. You’ve got faster buildout timelines that actually meet a venture company, like Airloom. You can see it’s still a tough road, don’t get me wrong. But a year ago, if you said we’re just going to wait around seven years for the interconnection queue, no venture company is going to survive that.”

It’s certainly not the only company in the sector looking to benefit from the data center boom. But I was still surprised when Rickner pointed out that Airloom’s fundamental value proposition — enabling wind energy in more geographies — is similar to a company that at first glance appears to be in a different category altogether: Radia.

Valued at $1 billion, this startup plans to make a plane as long as a football field to carry blades roughly 30% to 40% longer than today’s largest onshore models. Because larger blades mean more power, Radia’s strategy could make wind energy feasible in low-wind regions or simply boost output where winds are strong. And while the company isn’t looking to become a wind developer itself, “if you look at their pitch, it is the Airloom pitch,” Rickner told me.

Will Athol, Radia’s director of business development, told me that by the time the company was founded in 2016, “it was becoming clear that ground-based infrastructure — bridges, tunnels, roads, that kind of thing — was increasingly limiting where you can deploy the best turbines,” echoing Airloom’s sentiments. So competitors in the wind industry teamed up, requesting logistics input from the aviation industry. Radia responded, and has since raised over $100 million as it works to achieve its first flight by 2030.

Hopefully by that point, the federal war on wind will be a thing of the past. “We see ourselves and wind energy as a longer term play,” Athol told me. Though he acknowledged that these have certainly been “eventful times for the wind industry” in the U.S., there’s also a global market eager for this tech. He sees potential in regions such as India and North Africa, where infrastructure challenges have made it tough to deploy large-scale turbines.

Neither Radia nor Airloom thinks its approach will render today’s turbines obsolete, or that other renewable resources will be completely displaced. “I think if you look at most utilities, they want a mix,” Rickner said. But he’s still pretty confident in Airloom’s potential to seriously alter an industry that’s long been considered mature and constrained to incremental gains.

“When Airloom is 100% successful,” he told me, “we will take a huge chunk of market share.”

On electrolyzers’ decline, Anthropic’s pledge, and Syria’s oil and gas

Current conditions: Warmer air from down south is pushing the cold front in Northeast back up to Canada • Tropical Cyclone Gezani has killed at least 31 in Madagascar • The U.S. Virgin Islands are poised for two days of intense thunderstorms that threaten its grid after a major outage just days ago.

Back in November, Democrats swept to victory in Georgia’s Public Service Commission races, ousting two Republican regulators in what one expert called a sign of a “seismic shift” in the body. Now Alabama is considering legislation that would end all future elections for that state’s utility regulator. A GOP-backed bill introduced in the Alabama House Transportation, Utilities, and Infrastructure Committee would end popular voting for the commissioners and instead authorize the governor, the Alabama House speaker, and the Alabama Senate president pro tempore to appoint members of the panel. The bill, according to AL.com, states that the current regulatory approach “was established over 100 years ago and is not the best model for ensuring that Alabamians are best-served and well-positioned for future challenges,” noting that “there are dozens of regulatory bodies and agencies in Alabama and none of them are elected.”

The Tennessee Valley Authority, meanwhile, announced plans to keep two coal-fired plants operating beyond their planned retirement dates. In a move that seems laser-targeted at the White House, the federally-owned utility’s board of directors — or at least those that are left after President Donald Trump fired most of them last year — voted Wednesday — voted Wednesday to keep the Kingston and Cumberland coal stations open for longer. “TVA is building America’s energy future while keeping the lights on today,” TVA CEO Don Moul said in a statement. “Taking steps to continue operations at Cumberland and Kingston and completing new generation under construction are essential to meet surging demand and power our region’s growing economy.”

Secretary of the Interior Doug Burgum said the Trump administration plans to appeal a series of court rulings that blocked federal efforts to halt construction on offshore wind farms. “Absolutely we are,” the agency chief said Wednesday on Bloomberg TV. “There will be further discussion on this.” The statement comes a week after Burgum suggested on Fox Business News that the Supreme Court would break offshore wind developers’ perfect winning streak and overturn federal judges’ decisions invalidating the Trump administration’s orders to stop work on turbines off the East Coast on hotly-contested national security, environmental, and public health grounds. It’s worth reviewing my colleague Jael Holzman’s explanation of how the administration lost its highest profile case against the Danish wind giant Orsted.

Thyssenkrupp Nucera’s sales of electrolyzers for green hydrogen projects halved in the first quarter of 2026 compared to the same period last year. It’s part of what Hydrogen Insight referred to as a “continued slowdown.” Several major projects to generate the zero-carbon fuel with renewable electricity went under last year in Europe, Australia, and the United States. The Trump administration emphasized the U.S. turn away from green hydrogen by canceling the two regional hubs on the West Coast that were supposed to establish nascent supply chains for producing and using green hydrogen — more on that from Heatmap’s Emily Pontecorvo. Another potential drag on the German manufacturer’s sales: China’s rise as the world’s preeminent manufacturer of electrolyzers.

Sign up to receive Heatmap AM in your inbox every morning:

The artificial intelligence giant Anthropic said Wednesday it would work with utilities to figure out how much its data centers were driving up electricity prices and pay a rate high enough to avoid passing the costs onto ratepayers. The announcement came as part of a multi-pronged energy strategy to ease public concerns over its data centers at a moment when the server farms’ effect on power prices and local water supplies is driving a political backlash. As part of the plan, Anthropic would cover 100% of the costs of upgrading the grid to bring data centers online, and said it would “work to bring net-new power generation online to match our data centers’ electricity needs.” Where that isn’t possible, the company said it would “work with utilities and external experts to estimate and cover demand-driven price effects from our data centers.” The maker of ChatGPT rival Claude also said it would establish demand response programs to power down its data centers when demand on the grid is high, and deploy other “grid optimization” tools.

“Of course, company-level action isn’t enough. Keeping electricity affordable also requires systemic change,” the company said in a blog post. “We support federal policies — including permitting reform and efforts to speed up transmission development and grid interconnection — that make it faster and cheaper to bring new energy online for everyone.”

Syria’s oil reserves are opening to business, and Western oil giants are in line for exploration contracts. In an interview with the Financial Times, the head of the state-owned Syrian Petroleum Company listed France’s TotalEnergies, Italy’s Eni, and the American Chevron and ConocoPhillips as oil majors poised to receive exploration licenses. “Maybe more than a quarter, or less than a third, has been explored,” said Youssef Qablawi, chief executive of the Syrian Petroleum Company. “There is a lot of land in the country that has not been touched yet. There are trillions of cubic meters of gas.” Chevron and Qatar’s Power International Holding inked a deal just last week to explore an offshore block in the Mediterranean. Work is expected to begin “within two months.”

At the same time, Indonesia is showing the world just how important it’s become for a key metal. Nickel prices surged to $17,900 per ton this week after Indonesia ordered steep cuts to protection at the world’s biggest mine, highlighting the fast-growing Southeast Asian nation’s grip over the global supply of a metal needed for making batteries, chemicals, and stainless steel. The spike followed Jakarta’s order to cut production in the world’s biggest nickel mine, Weda Bay, to 12 million metric tons this year from 42 million metric tons in 2025. The government slashed the nationwide quota by 100 million metric tons to between 260 million and 270 million metric tons this year from 376 million metric tons in 2025. The effect on the global price average showed how dominant Indonesia has become in the nickel trade over the past decade. According to another Financial Times story, the country now accounts for two-thirds of global output.

The small-scale solar industry is singing a Peter Tosh tune: Legalize it. Twenty-four states — funny enough, the same number that now allow the legal purchase of marijuana — are currently considering legislation that would allow people to hook up small solar systems on balconies, porches, and backyards. Stringent permitting rules already drive up the cost of rooftop solar in the U.S. But systems small enough for an apartment to generate some power from a balcony have largely been barred in key markets. Utah became the first state to vote unanimously last year to pass a law allowing residents to plug small solar systems straight into wall sockets, providing enough electricity to power a laptop or small refrigerator, according to The New York Times.