You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

U.S. manufacturers are racing to get into the game while they still can.

In the weird, wide world of energy storage, lithium-ion batteries may appear to be an unshakeably dominant technology. Costs have declined about 97% over the past three decades, grid-scale battery storage is forecast to grow faster than wind or solar in the U.S. in the coming decade, and the global lithium-ion supply chain is far outpacing demand, according to BloombergNEF.

That supply chain, however, is dominated by Chinese manufacturing. According to the International Energy Agency, China controls well over half the world’s lithium processing, nearly 85% of global battery cell production capacity, and the lion’s share of actual lithium-ion battery production. Any country creating products using lithium-ion batteries, including the U.S., is at this point dependent on Chinese imports.

This has, understandably, sent U.S. manufactures searching for alternatives, and lately they have struck on one that has the industry all excited: sodium-ion batteries. As global interest ramps up, domestic manufacturers have at least a prayer of building out their own sodium-ion supply chains before China completely takes over. Research and consulting firm Benchmark Mineral Intelligence expects to see a 350% jump in announced sodium-ion battery manufacturing capacity this year alone. And while the supply of these batteries is only in the tens of gigawatts today, Benchmark forecasts that it will be in the hundreds of gigawatts by 2030.

Sodium-ion technology itself isn’t particularly disruptive — it’s not new, nor does it serve a new market, exactly. It performs roughly the same as lithium-ion in energy storage systems, providing around four hours of power for either grid-scale or residential applications. But sodium-ion chemistries have a handful of key advantages — perhaps most critically that sodium is significantly more abundant in the U.S. than lithium, and is thus far cheaper. China has unsurprisingly taken an early lead in the sodium-ion market anyway, reportedly opening its first sodium-ion battery storage station in May. But because the industry is still so nascent, domestic manufacturers say there’s still time for them to get in the game.

“We’re focused on catching up to China in lithium-ion batteries, where in our view, we should be leapfrogging to what’s next,” Cam Dales, co-founder and chief commercial officer at Peak Energy, a Bay Area-based sodium-ion battery storage startup, told me. “There’s no CATL of the United States. That’s ultimately our ambition, is to become that.”

As political tensions between China and the U.S. mount, relying on a Chinese-dominated battery supply chain is geopolitically risky. Last month, the Biden administration announced a steep increase in tariffs on a wide array of Chinese imports, including a 25% tariff on lithium-ion non-electric vehicle batteries starting in 2026, and another 25% tariff on battery parts and certain critical minerals starting this year.

Because sodium is so plentiful and cheap, companies in the space estimate that sodium-ion storage systems could eventually be around 40% less expensive than lithium-ion systems, once manufacturing scales. This lower price point could eventually make sodium-ion economically viable for storage applications “up to eight, 10, maybe even 12 hours,” Dales told me.

Sodium-ion also has a leg up on lithium-ion when it comes to safety. While this is an ongoing area of research, so far sodium-ion batteries appear less likely to catch fire, at least in part because of their lower energy density and the fact that their electrolytes generally have a higher flashpoint, the temperature at which the liquid is capable of igniting. This could make them safer to install indoors or pack close together. It’s also possible to discharge sodium-ion batteries down to zero volts, completely eliminating the possibility of battery fires during transit, whereas lithium-ion can’t be completely discharged without ruining the battery. Finally, sodium-ion performs better in the cold than lithium-ion batteries, which notoriously struggle to charge and discharge as efficiently at low temperatures.

“When we saw announcements coming out of China about very large investments in large capacity sodium projects, that was really an eye opener for us,” Dales told me. He and co-founder Landon Mossburg launched Peak Energy last year with $10 million in funding. The company is currently importing sodium-ion cells and assembling battery packs domestically, but by 2027, Dales said he hopes to produce both cells and packs in the U.S., with an eye toward opening a gigafactory and onshoring the entirety of the supply chain.

He’s not alone in this ambition. Natron Energy, another Silicon Valley-based sodium-ion company, has been at this for more than a decade. The startup, founded in 2012, recently opened the first commercial-scale sodium-ion battery manufacturing facility in the U.S. When fully ramped, the plant will have the capacity to produce 600 megawatts of batteries annually, paving the way for future gigawatt-scale facilities.

It cost Natron over $40 million to upgrade the Michigan-based plant, which formerly produced lithium-ion batteries, into a sodium-ion facility, and while the first shipments were expected to begin in June, none have yet been announced. The company’s backers include Khosla Ventures as well as strategic investors such as Chevron, which is interested in using this tech at EV charging stations; United Airlines, which hopes to use it for charging motorized ground equipment; and Nabor Industries, one of the world’s largest oil and gas drilling companies, which is interested in using sodium-ion batteries to power drilling rigs. It also received nearly $20 million from ARPA-E to fund the conversion of the Michigan facility.

Beyond the U.S. and China, France-based sodium-ion cell developer Tiamat is planning to build out a massive 5-gigawatt facility, while Sweden-based Northvolt and UK-based Faradion are also hoping to bring sodium-ion battery manufacturing to the European market.

Sodium-ion isn’t a magic bullet technology, though, and it certainly won’t make sense for all applications. The main reason there hasn’t been much interest up until now is because these batteries are about 30% less energy-dense than their lithium-ion counterparts. That likely doesn’t matter too much for grid-scale or even residential storage systems, where there’s usually enough open land, garage, or exterior wall space to install a sufficiently-sized system. But it is the reason why sodium-ion wasn’t commercialized sooner, as lithium-ion’s space efficiency is better suited to the portable electronics and electric vehicle markets.

“It’s only in the last two years probably, that the stationary storage market has gotten big enough where it alone can drive specific chemistries and the investment required to scale them,” Dales told me.

Catherine Peake, an analyst at Benchmark Mineral Intelligence, also told me that lithium iron phosphate batteries — the specific flavor of lithium-ion that’s generally favored for energy storage systems — usually have a longer cycle life than sodium-ion batteries, meaning they can charge and discharge more times before performance degrades. “That cycle life is actually a pretty key metric for [energy storage system] applications,” she said, though she acknowledged that Natron is an outlier in this regard, as the company claims to have a longer cycle life than standard lithium-ion batteries.

Lithium is also a volatile market. Though prices have bottomed out recently, less than two years ago the world was facing the opposite scenario, as China saw the price for battery-grade lithium carbonate hit an all-time high, Kevin Shang, a senior research analyst at the energy consultancy WoodMackenzie, told me. “So this catalyzed a soaring interest in sodium-ion batteries,” he said.

Although Shang and Peake agree that the U.S. could seize this moment to build a domestic sodium-ion supply chain, both also said that scaling production up to the level of China or other battery giants like South Korea or Japan is a longshot. “After all, they have been doing this battery-related business for over 10 years. They have more experience in scaling up these materials, in scaling up these technologies,” Shang told me.

These countries are home to the world’s largest battery manufacturers, with CATL and BYD in China and LG Energy in South Korea. But Natron and Peak Energy are both startups, lacking the billions that would allow for massive scale-up, at least in the short term.

“It shouldn't be underestimated how hard it is to make anything in large volume,” Matt Stock, a product director at Benchmark, told me. Largely due to the maturity of lithium-ion battery supply chains, the research firm doesn’t see sodium-ion becoming the dominant energy storage tech anytime soon. Rather, by 2030, Benchmark forecasts that sodium-ion batteries will comprise 5% of the battery energy storage market, increasing to over 10% by 2040. BloombergNEF is somewhat more optimistic, predicting sodium-ion will make up 12% of the stationary energy storage market by 2030.

And while storage may be the most obvious near-term use case for sodium-ion batteries, it’s certainly not the only industry that stands to benefit. China is experimenting with using these batteries in two- and three-wheeled vehicles such as electric scooters, bikes, and motorcycles. And as the tech improves, Stock said it’s possible that sodium-ion batteries could become a viable option for longer-range EVs as well.

Ultimately, Dales thinks these batteries will follow a similar technological trajectory to lithium iron phosphate, a chemistry that many in the west thought would never be suitable for use in electric vehicle batteries. “Over time, our view is that sodium-ion will continue to increase its energy density just like [lithium iron phosphate] did,” Dales told me. Now, lithium iron phosphate is the dominant battery chemistry for Chinese-made EVs. “But what actually happened was it was so cheap and they made it better and better and better than now it’s taking over the world. We see this playing out again with sodium-ion.”

Benchmark, on the other hand, is more circumspect regarding sodium-ion’s world dominating potential. Stock said he sees the technology more as a supplement to lithium-ion, which can swoop in when lithium prices boom or critical minerals shortages hit. “When that happens, something like sodium-ion can fill the space. And that’s really where it’s a complementary technology rather than a replacement,” he told me. “If there were other technologies as mature as sodium-ion, we’d also see those being scaled alongside it, but sodium-ion is kind of next in line.”

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

This week is light on the funding, heavy on the deals.

This week’s Funding Friday is light on the funding but heavy on the deals. In the past few days, electric carmaker Rivian and virtual power plant platform EnergyHub teamed up to integrate EV charging into EnergyHub’s distributed energy management platform; the power company AES signed 20-year power purchase agreements with Google to bring a Texas data center online; and microgrid company Scale acquired Reload, a startup that helps get data centers — and the energy infrastructure they require — up and running as quickly as possible. Even with venture funding taking a backseat this week, there’s never a dull moment.

Ahead of the Rivian R2’s launch later this year, the EV-maker has partnered with EnergyHub, a company that aggregates distributed energy resources into virtual power plants, to give drivers the opportunity to participate in utility-managed charging programs. These programs coordinate the timing and rate of EV charging to match local grid conditions, enabling drivers to charge when prices are low and clean energy is abundant while avoiding periods of peak demand that would stress the distribution grid.

As Seth Frader-Thompson, EnergyHub’s president, said in a statement, “Every new EV on the road is a win for drivers and the environment, and by managing charging effectively, we ensure this growth remains a benefit for the grid as well.”

The partnership will fold Rivian into EnergyHub’s VPP ecosystem, giving the more than 150 utilities on its platform the ability to control when and how participating Rivian drivers charge. This managed approach helps alleviate grid stress, thus deferring the need for costly upgrades to grid infrastructure such as substations or transformers. Extending the lifespan of existing grid assets means lower electricity costs for ratepayers and more capacity to interconnect new large loads — such as data centers.

Google seems to be leaning hard into the “bring-your-own-power” model of data center development as it looks to gain an edge in the AI race.

The latest evidence came on Tuesday, when the power company and utility operator AES announced a partnership with the hyperscaler to provide on-site power for a new data center in Texas. signing 20-year power purchase agreements. AES will develop, own, and operate the generation assets, as well as all necessary electricity infrastructure, having already secured the land and interconnection agreements to bring this new power online. The data center is set to begin operations in 2027.

As of yet, neither company has disclosed the exact type of energy infrastructure that AES will be building, although Amanda Peterson Corio, Google’s head of data center energy, said in a press release that it will be “clean.”

“In partnership with AES, we are bringing new clean generation online directly alongside the data center to minimize local grid impact and protect energy affordability,” she said.

This announcement came the same day the hyperscaler touted a separate agreement with the utility Xcel Energy to power another data center in Minnesota with 1.6 gigawatts of solar and wind generation and 300 megawatts of long-duration energy storage from the iron-air battery startup Form Energy.

The microgrid developer Scale has acquired Reload, a “powered land” startup founded in 2024, for an undisclosed sum. What is “powered land”? Essentially, it’s land that Reload has secured and prepared for large data centers customers, obtaining permits and planning for onsite energy infrastructure such that sites can be energized immediately. This approach helps developers circumvent the years-long utility interconnection queue and builds on Scale’s growing focus on off-grid data center projects, as the company aims to deliver gigawatts of power for hyperscalers in the coming years powered by a diverse mix of sources, from solar and battery storage to natural gas and fuel cells.

Early last year, the Swedish infrastructure investor EQT acquired Scale. The goal, EQT said, was to enable the company “to own and operate billions of dollars in distributed generation assets.” At the time of the acquisition, Scale had 2.5 gigawatts of projects in its pipeline. In its latest press release the company announced it has secured a multi-hundred-megawatt contract with a leading hyperscaler, though it did not name names.

As Jan Vesely, a partner at EQT said in a statement, “By bringing together Reload’s campus development capabilities, Scale’s proven islanded power operating platform, and EQT’s deep expertise across energy, digital infrastructure and technology, we are supporting a more integrated approach to delivering power for next-generation digital infrastructure today.”

Not to say there’s been no funding news to speak of!

As my colleague Alexander C. Kaufman reported in an exclusive on Thursday, fusion company Shine Technologies raised $240 million in a Series E round, the majority of which came from biotech billionaire Patrick Soon-Shiong. Unlike most of its peers, Shine isn’t gunning to build electricity-generating reactors anytime soon. Instead, its initial focus is producing valuable medical isotopes — currently made at high cost via fission — which it can sell to customers such as hospitals, healthcare organizations, or biopharmaceutical companies. The next step, Shine says, is to scale into recycling radioactive waste from spent fission fuel.

“The basic premise of our business is fusion is expensive today, so we’re starting by selling it to the highest-paying customers first,” the company’s CEO, Greg Piefer told Kaufman, calling electricity customers the “lowest-paying customer of significance for fusion today.”

On the solar siege, New York’s climate law, and radioactive data center

Current conditions: A rain storm set to dump 2 inches of rain across Alabama, Tennessee, Georgia, and the Carolinas will quench drought-parched woodlands, tempering mounting wildfire risk • The soil on New Zealand’s North Island is facing what the national forecast called a “significant moisture deficit” after a prolonged drought • Temperatures in Odessa, Texas, are as much as 20 degrees Fahrenheit hotter than average.

For all its willingness to share in the hype around as-yet-unbuilt small modular reactors and microreactors, the Trump administration has long endorsed what I like to call reactor realism. By that, I mean it embraces the need to keep building more of the same kind of large-scale pressurized water reactors we know how to construct and operate while supporting the development and deployment of new technologies. In his flurry of executive orders on nuclear power last May, President Donald Trump directed the Department of Energy to “prioritize work with the nuclear energy industry to facilitate” 5 gigawatts of power uprates to existing reactors “and have 10 new large reactors with complete designs under construction by 2030.” The record $26 billion loan the agency’s in-house lender — the Loan Programs Office, recently renamed the Office of Energy Dominance Financing — gave to Southern Company this week to cover uprates will fulfill the first part of the order. Now the second part is getting real. In a scoop on Thursday, Heatmap’s Robinson Meyer reported that the Energy Department has started taking meetings with utilities and developers of what he said “would almost certainly be AP1000s, a third-generation reactor produced by Westinghouse capable of producing up to 1.1 gigawatts of electricity per unit.”

Reactor realism includes keeping existing plants running, so notch this as yet more progress: Diablo Canyon, the last nuclear station left in California, just cleared the final state permitting hurdle to staying open until 2030, and possibly longer. The Central Coast Water Board voted unanimously on Thursday to give the state’s last nuclear plant a discharge permit and water quality certification. In a post on LinkedIn, Paris Ortiz-Wines, a pro-nuclear campaigner who helped pass a 2022 law that averted the planned 2025 closure of Diablo Canyon, said “70% of public comments were in full support — from Central Valley agricultural associations, the local Chamber of Commerce, Dignity Health, the IBEW union, district supervisors, marine meteorologists, and local pro-nuclear organizations.” Starting in 2021, she said, she attended every hearing on the bill that saved the plant. “Back then, I knew every single pro-nuclear voice testifying,” she wrote. “Now? I’m meeting new ones every hearing.”

It was the best of times, it was the worst of times. It was a year of record solar deployments, it was a year of canceled solar megaprojects, choked-off permits, and desperate industry pleas to Congress for help. But the solar industry’s political clouds may be parting. The Department of the Interior is reviewing at least 20 commercial-scale projects that E&E News reported had “languished in the permitting pipeline” since Trump returned to office. “That includes a package of six utility-scale projects given the green light Friday by Interior Secretary Doug Burgum to resume active reviews, such as the massive Esmeralda Energy Center in Nevada,” the newswire reported, citing three anonymous career officials at the agency.

Heatmap’s Jael Holzman broke the news that the project, also known as Esmeralda 7, had been canceled in October. At the time, NextEra, one of the project’s developers, told her that it was “committed to pursuing our project’s comprehensive environmental analysis by working closely with the Bureau of Land Management.” That persistence has apparently paid off. In a post on X linking to the article, Morgan Lyons, the senior spokesperson at the Solar Energy Industries Association, called the change “quite a tone shift” with the eyes emoji. GOP voters overwhelmingly support solar power, a recent poll commissioned by the panel manufacturer First Solar found. The MAGA coalition has some increasingly prominent fans. As I have covered in the newsletter, Katie Miller, the right-wing influencer and wife of Trump consigliere Stephen Miller, has become a vocal proponent of competing with China on solar and batteries.

Get Heatmap AM directly in your inbox every morning:

MP Materials operates the only active rare earths mine in the United States at California’s Mountain Pass. Now the company, of which the federal government became the largest shareholder in a landmark deal Trump brokered earlier this year, is planning a move downstream in the rare earths pipeline. As part of its partnership with the Department of Defense, MP Materials plans to invest more than $1 billion into a manufacturing campus in Northlake, Texas, dedicated to making the rare earth magnets needed for modern military hardware and electric vehicles. Dubbed 10X, the campus is expected to come online in 2028, according to The Wall Street Journal.

Sign up to receive Heatmap AM in your inbox every morning:

New York’s rural-urban divide already maps onto energy politics as tensions mount between the places with enough land to build solar and wind farms and the metropolis with rising demand for power from those panels and turbines. Keeping the state’s landmark climate law in place and requiring New York to generate the vast majority of its power from renewables by 2040 may only widen the split. That’s the obvious takeaway from data from the New York State Energy Research and Development Authority. In a memo sent Thursday to Governor Kathy Hochul on the “likely costs of” complying with the law as it stands, NYSERDA warned that the statute will increase the cost of heating oil and natural gas. Upstate households that depend on fossil fuels could face hikes “in excess of $4,000 a year,” while New York City residents would see annual costs spike by $2,300. “Only a portion of these costs could be offset by current policy design,” read the memo, a copy of which City & State reporter Rebecca C. Lewis posted on X.

Last fall, this publication’s energy intelligence unit Heatmap Pro commissioned a nationwide survey asking thousands of American voters: “Would you support or oppose a data center being built near where you live?” Net support came out to +2%, with 44% in support and 42% opposed. Earlier this month, the pollster Embold Research ran the exact same question by another 2,091 registered voters across the country. The shift in the results, which I wrote about here, is staggering. This time just 28% said they would support or strongly support a data center that houses “servers that power the internet, apps, and artificial intelligence” in their neighborhood, while 52% said they would oppose or strongly oppose it. That’s a net support of -24% — a 26-point drop in just a few months.

Among the more interesting results was the fact that the biggest partisan gap was between rural and urban Republicans, with the latter showing greater support than any other faction. When I asked Emmet Penney at the right-leaning Foundation for American Innovation to make sense of that for me, he said data centers stoke a “fear of bigness” in a way that compares to past public attitudes on nuclear power.

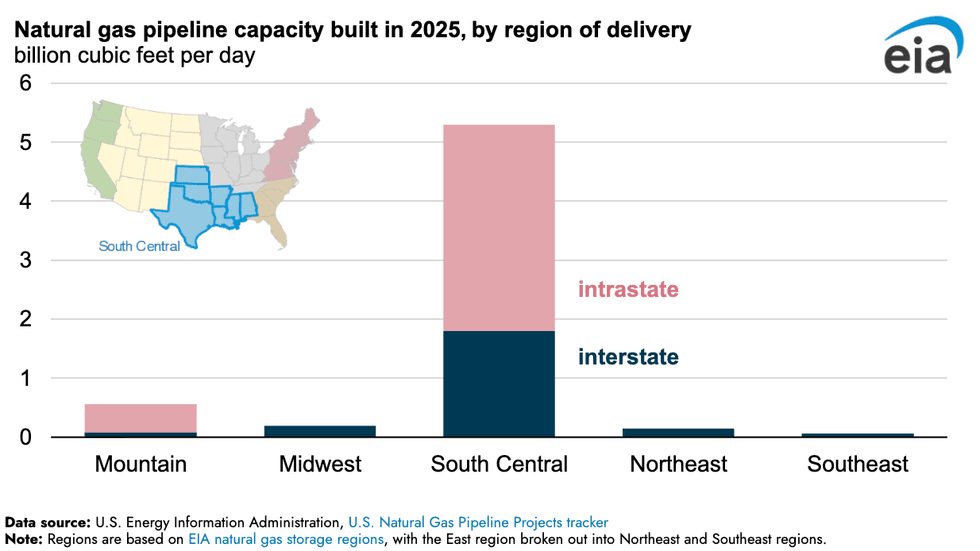

Gas pipeline construction absolutely boomed last year in one specific region of the U.S. Spanning Texas, Oklahoma, Kansas, Arkansas, Louisiana, Mississippi, and Alabama, the so-called South Central bloc saw a dramatic spike in intrastate natural gas pipelines, more than all other regions combined, per new Energy Information Administration data. It’s no mystery as to why. The buildout of liquified natural gas export terminals along the Gulf coast needs conduits to carry fuel from the fracking fields as far west as the Texas Permian.

Rob sits down with Jane Flegal, an expert on all things emissions policy, to dissect the new electricity price agenda.

As electricity affordability has risen in the public consciousness, so too has it gone up the priority list for climate groups — although many of their proposals are merely repackaged talking points from past political cycles. But are there risks of talking about affordability so much, and could it distract us from the real issues with the power system?

Rob is joined by Jane Flegal, a senior fellow at the Searchlight Institute and the States Forum. Flegal was the former senior director for industrial emissions at the White House Office of Domestic Climate Policy, and she has worked on climate policy at Stripe. She was recently executive director of the Blue Horizons Foundation.

Shift Key is hosted by Robinson Meyer, the founding executive editor of Heatmap News.

Subscribe to “Shift Key” and find this episode on Apple Podcasts, Spotify, Amazon, or wherever you get your podcasts.

You can also add the show’s RSS feed to your podcast app to follow us directly.

Here is an excerpt from their conversation:

Robinson Meyer: What’s interesting is the scarcity model is driven by the fact that ultimately rate payers that is utility customers are where the buck stops, and so state regulators don’t want utilities to overbuild for a given moment because ultimately it is utility customers — it’s people who pay their power bills — who will bear the burden of a utility overbuilding. In some ways, the entire restructured electricity market system, the entire shift to electricity markets in the 90s and aughts, was because of this belief that utilities were overbuilding.

And what’s been funny is that, what, we started restructuring markets around the year 2000. For about five or six or seven years. Wall Street was willing to finance new electricity. I mean, I hear two stories here — basically it’s another place where I hear two stories, and I think where there’s a lot of disagreement about the path forward on electricity policy, in that I’ve heard a story that, basically, electricity restructuring starts in the late 90s you know year 2000, and for five years, Wall Street is willing to finance new power investment based entirely on price risk based entirely on the idea that market prices for electricity will go up. Then three things happen: The Great Recession, number one, wipes out investment, wipes out some future demand.

Number two, fracking. Power prices tumble, and a bunch of plays that people had invested in, including then advanced nuclear, are totally out of the money suddenly. Number three, we get electricity demand growth plateaus, right? So for 15 years, electricity demand plateaus. We don’t need to finance investments into the power grid anymore. This whole question of, can you do it on the back of price risk? goes away because electricity demand is basically flat, and different kinds of generation are competing over shares and gas is so cheap that it’s just whittling away.

Jane Flegal: But this is why that paradigm needs to change yet again. Like ,we need to pivot to like a growth model where, and I’m not, again —

Meyer: I think what’s interesting, though, is that Texas is the other counterexample here. Because Texas has had robust load growth for years, and a lot of investment in power production in Texas is financed off price risk, is financed off the assumption that prices will go up. Now, it’s also financed off the back of the fact that in Texas, there are a lot of rules and it’s a very clear structure around finding firm offtake for your powers. You can find a customer who’s going to buy 50% of your power, and that means that you feel confident in your investment. And then the other 50% of your generation capacity feeds into ERCOT. But in some ways, the transition that feels disruptive right now is not only a transition like market structure, but also like the assumptions of market participants about what electricity prices will be in the future.

Flegal: Yeah, and we may need some like backstop. I hear the concerns about the risks of laying early capital risks basically on rate payers in the frame of growth rather than scarcity. But I guess my argument is just there’s ways to deal with that. Like we could come up with creative ways to think about dealing with that. And I’m not seeing enough ideation in that space, which — I would like, again, a call for papers, I guess — that I would really like to get a better handle on.

The other thing that we haven’t talked about, but that I do think, you know, the States Forum, where I’m now a senior fellow, I wrote a piece for them on electricity affordability several months ago now. But one of the things that doesn’t get that much attention is just like getting BS off of bills, basically. So there’s like the rate question, but then there’s the like, what’s in a bill? And like, what, what should or should not be in a bill? And in truth, you know, we’ve got a lot of social programs basically that are being funded by the rate base and not the tax base. And I think there are just like open questions about this — whether it’s, you know, wildfire in California, which I think everyone recognizes is a big challenge, or it’s efficiency or electrification or renewable mandates in blue states. There are a bunch of these things and it’s sort of like there are so few things you can do in the very near term to constrain rate increases for the reasons we’ve discussed.

You can find a full transcript of the episode here.

Mentioned:

Cheap and Abundant Electricity Is Good, by Jane Flegal

From Heatmap: Will Virtual Power Plants Ever Really Be a Thing?

Previously on Shift Key: How California Broke Its Electricity Bills and How Texas Could Destroy Its Electricity Market

This episode of Shift Key is sponsored by …

Accelerate your clean energy career with Yale’s online certificate programs. Explore the 10-month Financing and Deploying Clean Energy program or the 5-month Clean and Equitable Energy Development program. Use referral code HeatMap26 and get your application in by the priority deadline for $500 off tuition to one of Yale’s online certificate programs in clean energy. Learn more at cbey.yale.edu/online-learning-opportunities.

Music for Shift Key is by Adam Kromelow.